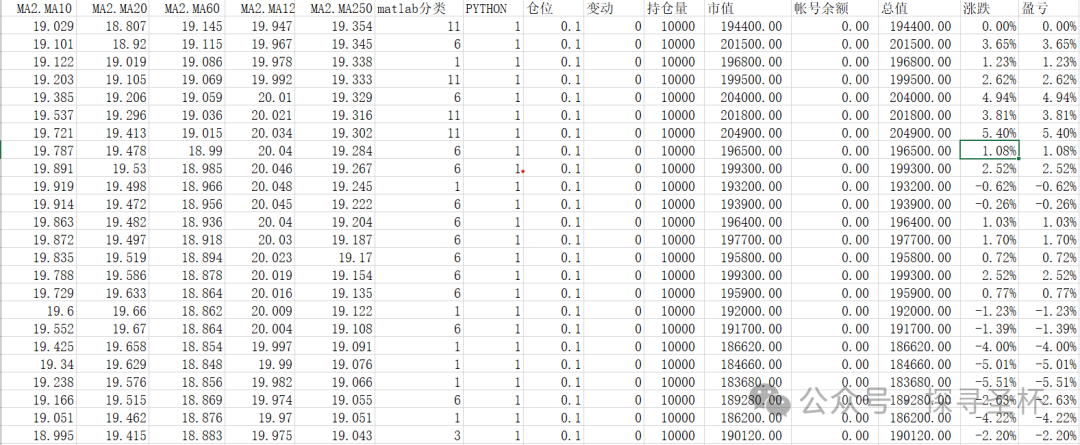

A clustering analysis is performed on a vector composed of the closing prices of stocks and several important moving average prices, attempting to identify trend characteristic classifications, which can serve as a basis for position management. The following code has been debugged using Spyder, but the classification results are not ideal, and different parameters need to be tried. For practice, here is the record:

# -*- coding: utf-8 -*-

“””

Spyder Editor

This is a temporary script file.

“””

from minisom import MiniSom

import numpy as np

import pandas as pd

data = np.loadtxt(‘D:\Programming Practice\gpfx.csv’, delimiter=’,’, skiprows=1, usecols=(1,2,3,4,5,6,7), unpack=False)

# data normalization

data = (data – np.mean(data, axis=0)) / np.std(data, axis=0)

# Initialization and training

som_shape = (3, 4)

som = MiniSom(som_shape[0], som_shape[1], data.shape[1], sigma=0.6, learning_rate=.5,

neighborhood_function=’gaussian’, random_seed=10)

som.train_batch(data, 2000, verbose=True)

# each neuron represents a cluster

winner_coordinates = np.array([som.winner(x) for x in data]).T

# with np.ravel_multi_index we convert the bidimensional

# coordinates to a monodimensional index

cluster_index = np.ravel_multi_index(winner_coordinates, som_shape)

import matplotlib.pyplot as plt

# plotting the clusters using the first 2 dimensions of the data

for c in np.unique(cluster_index):

plt.scatter(data[cluster_index == c, 0],

data[cluster_index == c, 1], label=’cluster=’+str(c), alpha=.7)

# plotting centroids

for centroid in som.get_weights():

plt.scatter(centroid[:, 0], centroid[:, 1], marker=’x’,

s=80, linewidths=35, color=’k’, label=’centroid’)

plt.legend();