Solana is set to undergo two significant upgrades aimed at enhancing network stability and adjusting the inflation mechanism, but these changes may drastically reduce validator earnings, particularly impacting smaller node operators, sparking discussions within the community.

VanEck: Lowering Inflation Aids Long-Term Development, but Small Validators May Be Impacted

According to analysis from asset management giant VanEck, which issues multiple cryptocurrency ETFs, these changes may benefit Solana’s long-term sustainable development, but validator earnings could face a reduction of up to 95%.

Matthew Sigel, Head of Digital Asset Research at VanEck, tweeted on March 4:

Add V: JMRF18QQ: 3289966740Join the community group without barriers, no fees, no promotion of exchanges, no referral links

Some estimates suggest that validator income could decrease by as much as 95%, making operations unsustainable for smaller validators.

Running a SOLANA validator incurs fixed costs, including approximately 1.1 SOL in voting fees per day and about $6,000 in hardware costs annually. Currently, Solana has 1,323 validators, but only 458 have sufficient stakes to exceed the basic profitability threshold.

If smaller validators shut down, the network may become more centralized around large institutional entities (such as Coinbase and Binance). Some community members have proposed lowering voting costs as a potential solution to assist validators while remaining financially viable. However, determining the optimal number of validators to maintain a decentralized network is complex, and these decisions will ultimately be left to market dynamics.

While these changes may reduce rewards, we believe that lowering inflation is a worthwhile goal to enhance Solana’s long-term sustainability. Maintaining a predictable low inflation rate can support the value of SOL by reducing dilution and selling pressure.

We support the team’s willingness to experiment with different economic models and adjust course as necessary to balance incentives and network health.

The two core proposals of this upgrade, SIMD-0123 and SIMD-0228, will be voted on March 6 and may have profound impacts on Solana’s economic model.

Priority Fee Distribution Adjustment: Stakers Will Receive More Rewards

The first proposal, SIMD-0123, will change the distribution of Solana’s priority fees, allocating this revenue to stakers.

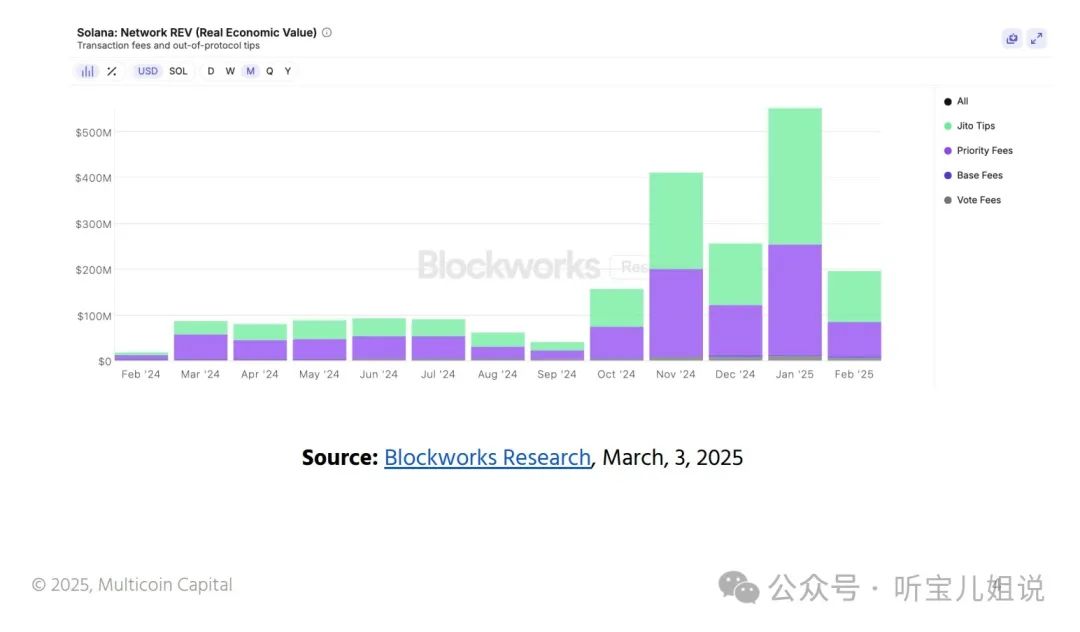

Currently, traders can pay additional fees to have validators prioritize their transactions, but validators are not required to share these priority fees with stakers. According to Sigel, these fees account for 40% of Solana’s network revenue, yet stakers do not participate in the profit-sharing.

The goal of SIMD-0123 is to ensure that these fees benefit SOL stakers, further enhancing staking rewards and reducing off-chain agreements between traders and validators, making value distribution within the network fairer and more transparent.

Adjusting Inflation Rate: Reducing Token Dilution, but Impacting Staking Rewards

The second proposal, SIMD-0228, may be the most significant change in this upgrade. Its core goal is to dynamically adjust the inflation rate based on the staking ratio of SOL, creating an inverse relationship between inflation and the level of token staking.

According to data from Coin Metrics, Solana’s current inflation rate is 4%, which has decreased from the initial 8%, but is still above the final target of 1.5%. Currently, Solana’s inflation rate decreases at a fixed rate of 15% per year.

Dynamic Inflation Rate Adjustment

The proposal suggests that MEV income has become the primary source of income for validators within the Solana network, and reducing staking yields will not significantly impact revenue. “Simply put, it is foolish issuance. Given Solana’s vibrant economic activity, it makes sense to develop a monetary policy for the network to achieve intelligent issuance.”

The proposal introduces a threshold, initially assumed to be 50%, meaning that when the staking ratio exceeds 50%, the inflation rate will decrease, reducing staking rewards. When the staking ratio is below 50%, the inflation rate will increase, expanding rewards to incentivize more funds to stake.

Subsequently, forum users questioned the lack of rigorous calculations behind the 50% threshold, arguing that the setting was too hasty. The proposer then provided a new algorithm curve, establishing a staking ratio of 33% as a threshold, where if the staking ratio exceeds 33%, the annual inflation rate will be lower than the current inflation rate.

If SIMD-0228 is approved, the inflation rate of SOL will be dynamically adjusted based on the staking ratio, which may reduce staking rewards and subsequently lessen selling pressure in the market. The main drafter of this proposal is Vishal Kankani from Multicoin Capital, which is also a major holder of Solana’s largest staking pool, Jito.

Opposition Voices

This proposal was initiated by investor Vishal Kankani from Multicoin Capital, an early investor in Solana that led a $20 million Series A funding round in 2019 and holds a significant amount of SOL tokens. Overall, this proposal represents the interests of large SOL holders, who prefer to lower inflation to achieve value stability.

At the same time, the proposal argues that a decrease in staking yields will stimulate these validators to invest their tokens more into the DeFi ecosystem, further enhancing the prosperity of Solana’s DeFi ecosystem.

If DeFi can absorb billions of idle liquidity, Solana may experience explosive innovation similar to Uniswap and Aave; however, if the market sells off due to declining yields, the massive issuance at a 25% staking ratio may drag the network into a “inflation – selling pressure – more inflation” death spiral.

During the bull market, many people hope to create a free group chat. If you really can’t navigate the crypto space, understand the latest information, layout, embrace the bull market, and improve your winning rate, say goodbye to being trapped at high positions.

Join the group chat to discuss and learn professional knowledge about the crypto space, so as not to be the chives under the sickle (you can receive a position allocation strategy, teaching you how to make money in a bull market and earn coins in a bear market.