Last night, the explosive good news regarding integrated circuits and software flooded the market, and everyone had high expectations for the performance of chip stocks today.

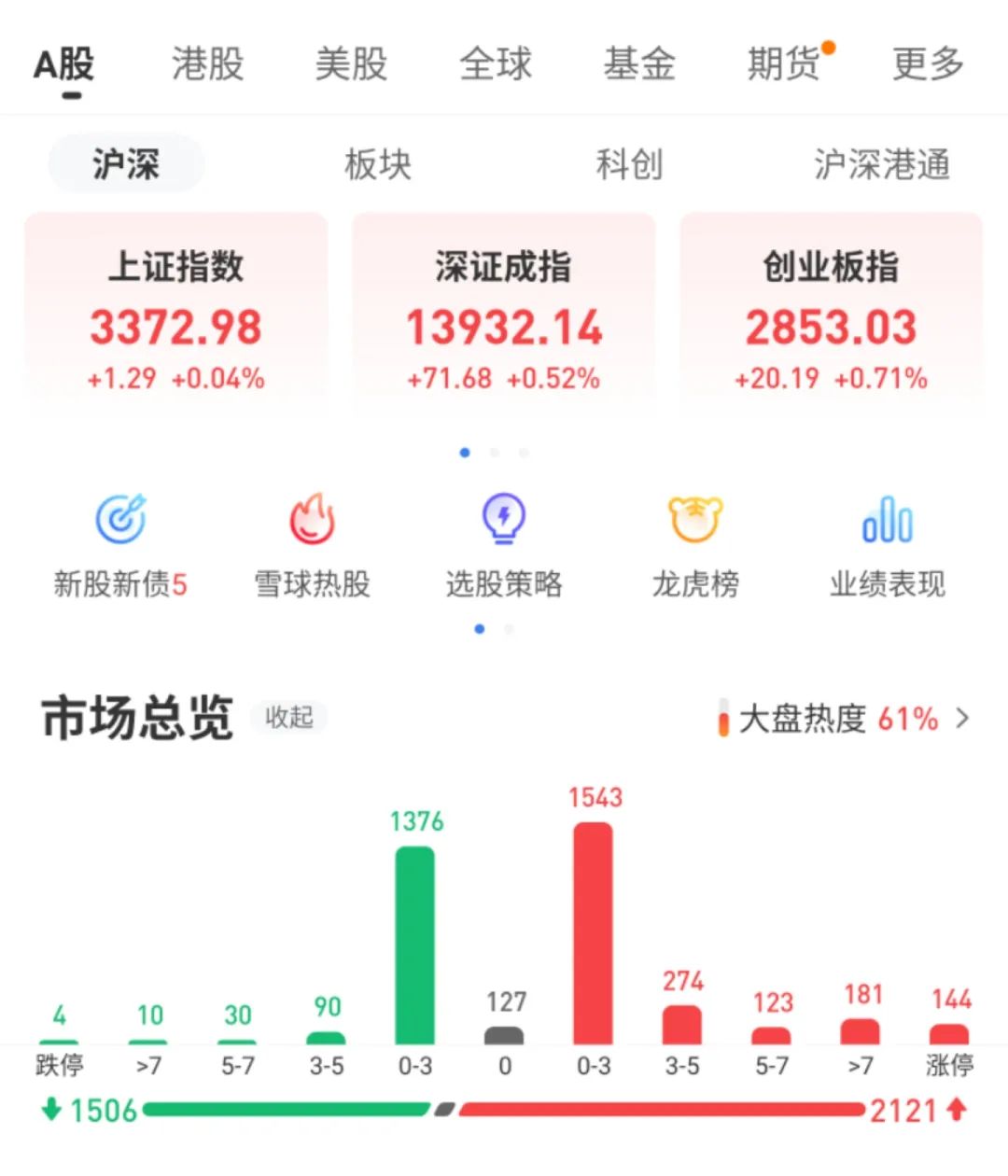

After the market opened today, the semiconductor sector opened significantly higher, but faced heavy selling pressure, falling back after the initial surge, ultimately closing up 1.95%, with the integrated circuit sector rising 2.46%.

On the market, the focus was mainly on military, agriculture, and rare earth sectors, while precious metals, food and beverage, and pork sectors performed strongly. The large financial sector corrected, overall, the hot sectors were mainly defensive, with rapid rotation and a clear seesaw effect. By the close, all three major indices were in the green, with 2,121 stocks rising and 1,506 falling, over 160 stocks hitting the daily limit.

01

Integrated Circuits Welcome Major Good News

Summary of 20 Key Points

After yesterday’s close, the State Council issued “Several Policies for Promoting High-Quality Development of the Integrated Circuit and Software Industries in the New Era,” which contains 20 key points:

Regarding Tax Policies

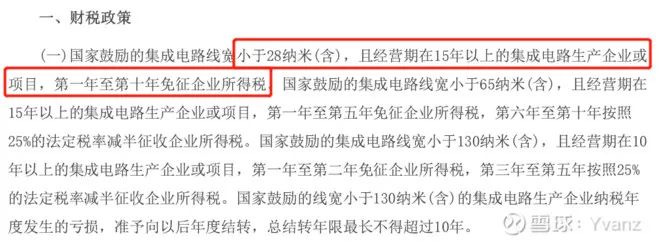

1. Integrated circuit production enterprises or projects with a line width of less than 28 nanometers (inclusive) and an operating period of more than 15 years are exempt from corporate income tax for the first ten years.

2. Integrated circuit production enterprises or projects with a line width of less than 65 nanometers (inclusive) and an operating period of more than 15 years are exempt from corporate income tax for the first five years, and the corporate income tax is halved at the statutory rate of 25% for the sixth to tenth years.

3. Integrated circuit production enterprises or projects with a line width of less than 130 nanometers (inclusive) and an operating period of more than 10 years are exempt from corporate income tax for the first two years, and the corporate income tax is halved at the statutory rate of 25% for the third to fifth years.

4. Losses incurred by integrated circuit production enterprises with a line width of less than 130 nanometers (inclusive) in the tax year are allowed to be carried forward to future years, with a maximum carryover period of no more than 10 years.

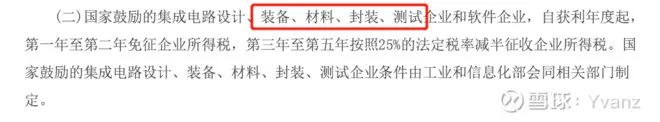

5. Integrated circuit design, equipment, materials, packaging, testing enterprises, and software enterprises encouraged by the state are exempt from corporate income tax for the first two years from the year of profitability, and the corporate income tax is halved at the statutory rate of 25% for the third to fifth years.

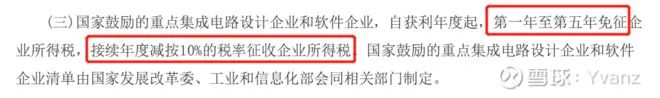

6. Key integrated circuit design enterprises and software enterprises encouraged by the state are exempt from corporate income tax for the first five years from the year of profitability, and subsequent years are taxed at a reduced rate of 10%.

7. Corporate income tax for integrated circuit design enterprises and software enterprises in the years prior to the implementation of this policy will be executed according to the “Two Exemptions and Three Reductions” preferential policy specified in Document No. 4 [2011] of the State Council.

8. Continue to implement VAT preferential policies for integrated circuit and software enterprises.

Regarding Investment and Financing Policies

9. Encourage and support integrated circuit and software enterprises to strengthen resource integration. The relevant departments of the State Council and local governments should actively support and guide mergers and acquisitions conducted by enterprises according to market principles, without setting various forms of restrictions beyond laws and regulations.

10. Fully utilize existing government investment funds at the national and local levels to support the development of the integrated circuit and software industries, encouraging social capital to raise funds through multiple channels according to market principles, and establish investment funds to improve the marketization level of funds.

11. Under the premise of controllable risks and sustainable business, increase financial support for major projects; guide insurance funds to engage in equity investment; support banks, wealth management companies, insurance, trusts, and other non-bank financial institutions to initiate specialized asset management products.

12. Encourage qualified enterprises to list and raise funds on the Sci-Tech Innovation Board and the Growth Enterprise Market, smooth the exit channels for original shareholders of related enterprises, and provide equity financing, equity transfer, and other services for integrated circuit and software enterprises at different development stages through different levels of capital markets, expanding direct financing channels and increasing the proportion of direct financing.

Research and Development Policies

13. Focus on the research and development of key core technologies in high-end chips, integrated circuit equipment and process technology, key materials for integrated circuits, integrated circuit design tools, basic software, industrial software, and application software, continuously exploring the establishment of a new national system for tackling key core technologies under the conditions of a socialist market economy.

Talent Policies

14. Further strengthen the construction of integrated circuit and software majors in universities, accelerate the promotion of the establishment of integrated circuit first-level disciplines, closely combine curriculum settings, teaching plans, and teaching methods with industrial development needs, and strive to cultivate high-level, versatile, and practical talents.

15. Encourage qualified universities to cooperate with integrated circuit enterprises to accelerate the construction of demonstrative microelectronics colleges.

Intellectual Property Policies

16. Encourage enterprises to register proprietary rights for integrated circuit layout designs and software copyrights. Support integrated circuit and software enterprises to apply for intellectual property rights in accordance with the law, and provide relevant support for those that meet the relevant regulations. Vigorously develop intellectual property services related to integrated circuits and software.

Market Application Policies

17. Through policy guidance, driven by market applications, increase the promotion of innovative products in integrated circuits and software, driving continuous technological and industrial upgrades.

International Cooperation Policies

18. Deepen global cooperation in the integrated circuit and software industries, actively create a favorable environment for international enterprises to invest and develop in China. Encourage domestic universities and research institutions to strengthen cooperation with high-level overseas universities and research institutions, and encourage international enterprises to establish R&D centers in China. Strengthen communication and exchange between domestic industry associations and international industry organizations, support domestic enterprises to cooperate with international enterprises both domestically and abroad, and deeply participate in international market division of labor and international standard formulation.

19. Promote the “going out” of the integrated circuit and software industries. Facilitate domestic enterprises to jointly build R&D centers abroad, better utilize international innovation resources to enhance the level of industrial development. The National Development and Reform Commission, the Ministry of Commerce, and other relevant departments should improve service levels to create a favorable environment for enterprises to carry out investment and cooperation.

20. All qualified integrated circuit enterprises (including design, production, packaging, testing, equipment, and materials enterprises) and software enterprises established in China, regardless of ownership nature, can enjoy this policy.

02

Huawei Launches the Nanniwan Tactics

Huawei’s New Products Will Not Contain Any US Technology

In addition to the State Council’s policy, Huawei also officially launched the significant backup plan “Nanniwan” yesterday, aimed at avoiding products containing US technology.

Reports indicate that Huawei is accelerating the advancement of its laptop and smart screen businesses, both of which do not include US technology. A new laptop product will be released in mid-August.

It is still unknown what the CPU chip process of Huawei’s new laptop is, but industry insiders have confirmed that the new laptop does not contain any components that use US technology.

Ren Zhengfei stated at the 2020 World Economic Forum that Huawei spent hundreds of billions to create a “backup plan” in response to US attacks.

The “Nanniwan” production movement refers to the large-scale production activities carried out by the army in Nanniwan during the Anti-Japanese War, aimed at overcoming economic difficulties and achieving self-sufficiency to maintain a prolonged resistance.

Reports quote insiders as saying that the project named “Nanniwan” by Huawei means “achieving self-sufficiency during difficult times.” In this process, products such as laptops, smart screens, and IoT smart home products that are “completely unaffected by the US” are included in the “Nanniwan” project.

03

Founder of SMIC:

The US’s Restrictive Power Over China Is Not That Strong, We Can Catch Up

On August 4, Zhang Ruijing, founder and CEO of SMIC, general manager of Shanghai Xinxing, and current founder and chairman of ChipOn (Qingdao), made a significant statement during an online live broadcast of the Wind 3C conference organized by CITIC Securities and Jinao Capital.

He stated, “If China maintains its lead in 5G technology, in the future, in communications, artificial intelligence, cloud services, etc., China will be significantly ahead because China is very strong in high-tech applications.”

“If the US cannot win through fair competition, it will resort to administrative means. It did this in the 1980s with Japan, and since 2018, it has started to impose restrictions on 5G, but this time its opponent is no longer Japan. The US’s ability to restrict China is not that strong, but we must not be complacent.”

“The third-generation semiconductors have a characteristic; they are not governed by Moore’s Law, but rather by the post-Moore’s Law. Their line widths are not very small, and the equipment is not particularly expensive, but the materials are not easy to produce, and there must be advantages in design.” “For third-generation semiconductors, IDM is currently the mainstream, but Foundry still has opportunities, but design companies need to find a Foundry they can cooperate with long-term.”

“In some areas, China is very strong, such as packaging and testing. As for equipment, especially optical technology, we have a significant gap. If we specifically look at the materials, production, and design of third-generation semiconductors, I personally believe that the gap in materials is not very large anymore.”

“We need to consider the talent base in the short term, which is our weakness. The foundation may have been laid, but there is a gap between the foundation and application. How do we bridge that gap? European and American companies do a better job in this regard, and we should learn from their strengths.”

“Personally, I believe that in the third stage, if we only have materials and epitaxial wafers to make this device, if we use a 6-inch wafer, the investment depends on how large you want to make it, at least over 2 billion, and at a scale of 6 to 7 billion, it can be profitable. This is for the third stage. If the second stage is to make Epi (epitaxial wafers), the investment is not large, and the corresponding Epi factory investment is about less than 1 billion to get started.”

04

Why Did Chip Stocks Open High and Close Low?

Regarding why the integrated circuit-related sectors experienced a high open and low close today, a private equity researcher stated that the market had already anticipated the policy benefits, and it is not ruled out that some institutions saw the sector open significantly higher and engaged in some profit-taking behavior.

Ball friend @Yvanz also made his interpretation of the policy last night: After the market closed, a significant policy for integrated circuit and software enterprises was released, many influencers started promoting stocks without carefully reading the policy, and they blindly pushed stocks related to 28nm equipment and packaging, which is quite absurd.

Overall, the policy has some unexpected elements, which can be considered a relatively substantial benefit, as tax reductions can directly reflect on net profits. However, the impact of tax reduction policies on different links of the industry chain still varies. After a rough read, I would like to provide a personal interpretation for reference:

First, the most significant 10-year tax exemption policy, of course, has relatively strict conditions. First, it must be a production enterprise or project, which means it targets our weakest link, the chip manufacturing sector, and is unrelated to design, equipment, materials, or packaging.Moreover, the operating period needs to be more than 15 years, and the line width must be less than 28nm. Currently, there are only two companies in China with capabilities below 28nm, and among those listed on the A-share market, only one meets the requirements—SMIC.It can be said that this first and most significant preferential policy is essentially a special favor for SMIC and Huahong Semiconductor, while other companies can basically stand aside.

Of course, for other companies with 28nm threading capabilities in design, equipment, materials, and packaging, there may be some emotional driving force. After all, many influencers see 28nm and start promoting Northern Huachuang and Changdian Technology, and retail investors are also eager to follow, regardless of whether this first policy directly benefits them.

Next, the second point is the direct benefit to all industry chain stocks, as this implements two exemptions and three reductions across the entire industry chain, while previous policies only implemented two exemptions and three reductions for “integrated circuit design and software enterprises,” thus directly benefiting equipment, materials, and packaging enterprises that were previously not covered by the two exemptions and three reductions.

The third point is the benefit to integrated circuit design enterprises and software enterprises. Previously, it was two exemptions and three reductions, but now it is five exemptions plus a subsequent tax rate of 10%, which further reduces the tax burden on chip design enterprises and software enterprises.

In summary, the biggest beneficiaries of this new policy should be SMIC, Huahong Semiconductor, and other high-end integrated circuit production enterprises, which also reflects the national level’s high attention to the shortcomings in high-end chip manufacturing. Meanwhile, integrated circuit design, equipment, materials, and packaging enterprises will also see further improvements and enhancements in profitability due to additional policy benefits.

The semiconductor boom cycle continues, and although high valuations pose risks, the state has injected new momentum into the development of the integrated circuit industry at both strategic and operational levels. This means that the semiconductor industry is highly likely to digest high valuations through rapid growth in the future, providing more certainty for semiconductor design enterprises with high-end design capabilities, high-end equipment manufacturing enterprises, high-end materials enterprises, and high-end packaging enterprises for their future sustainable development.

Recommended Reading

What Should You Do If You Can’t Time the Market? Statistics Can Give You the Answer!

For ordinary people, it is difficult to make money by copying others’ investment strategies; only by choosing a suitable fund portfolio can you achieve optimal results.

Xueqiu has selected ten funds with distinct styles and made clear distinctions in their characteristics, such as:Established fund companies managing Short-term financial essentials Employee co-investment Essential for beginners’ regular investmentsetc. Click to read the original text for detailed understanding and direct purchase.