Perception is a precursor technology of the Internet of Things (IoT). To ensure the stable operation of IoT, it relies on numerous perception technologies, among which one of the most critical technologies is the sensor. As the “tentacles” of IoT, sensors play a crucial role in today’s information age, having penetrated into various industries and fields such as industrial production, environmental protection, bioengineering, and medical testing, increasingly trending towards intelligence, miniaturization, and digitalization.

In the current rapid development of IoT, understanding the IoT industry first requires an understanding of the sensor industry. This article introduces the new technologies of sensors, application scenarios, industry standards, and the development of the industrial chain, helping relevant personnel quickly understand the sensor industry. The following is the main content of the text.

01

New Products Launched

Today, the view that “without sensors, there is no modern science and technology” has become a globally recognized perspective. Countries have elevated sensors to a high position, and no one wants to fall behind in the development of the sensor industry.

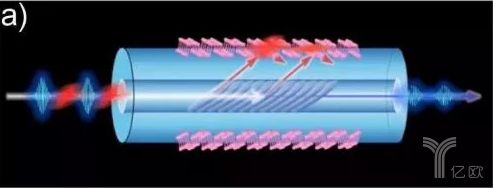

The Shenzhen Institute of Advanced Technology, Chinese Academy of Sciences collaborated with Bangor University in the UK to successfully develop the first fiber-optic chemical sensor based on black phosphorus, achieving ultra-sensitive detection of heavy metal ions. It is reported that this is the first time the research team has combined black phosphorus with tilted fiber grating, leading to the birth of a new type of ultra-sensitive chemical sensor. The successful development of the black phosphorus fiber sensor will provide an excellent optical detection platform for chemical and biological sensing, thus promoting the application research process of black phosphorus chemical biological sensors.

While the research results from the Chinese Academy of Sciences were made public, the Korea Institute of Science and Technology also made new gains. The Korea Institute of Science and Technology, in collaboration with Yonsei University, developed a photodiode device that can sense light from ultraviolet to near-infrared using a mixed-dimensional dual-layer structure of two-dimensional tungsten diselenide nanosheets and one-dimensional zinc oxide semiconductor nanowires.

The research results were published in the international academic journal “Advanced Functional Materials”. The two-dimensional components used by the research group have strong optical response performance and high hole mobility, making them P-type semiconductor components. One-dimensional zinc oxide nanowires are currently one of the best one-dimensional nanosemiconductors, with high electron mobility characteristics, making them promising for application in high-performance electronic components N-type semiconductor components. The mixed-dimensional dual-layer structure (PN type) was formed by mixing one-dimensional and two-dimensional materials to develop the photodiode components.

The research team stated that this study successfully achieved two-dimensional imaging, which is expected to be widely used in next-generation imaging sensor components in the future.

Researchers at the University of Manchester have recently designed a graphene sensor embedded with a radio frequency identification system (RFIDs), which could potentially revolutionize IoT. This new development can provide various applications, such as battery-free smart wireless monitoring for manufacturing processes that are very sensitive to humidity, food safety, healthcare, and nuclear waste.

In addition, institutions like the University of Oxford have developed new smart MOF photonic sensors; Germany has developed a quantum sensor that can be used in micro magnetic fields.

02

Main Applications

Smart sensors are widely used in various fields such as aerospace, aviation, national defense, technology, and industrial and agricultural production. For example, they have broad application prospects in the robotics field, where smart sensors enable robots to possess human-like sensory and cognitive functions, allowing them to perceive various phenomena and perform various actions.

In industrial production, traditional sensors cannot quickly and directly measure and control certain product quality indicators (such as viscosity, hardness, surface smoothness, composition, color, and taste) online. However, smart sensors can directly measure certain quantities in the production process that have a functional relationship with product quality indicators (such as temperature, pressure, flow, etc.), using mathematical models established with neural networks or expert systems to infer product quality.

As sensor products and technologies continue to develop and break through, the sensor application market is deepening. Among them, fingerprint recognition and autonomous driving have always been viewed favorably by the industry, while robots and the medical industry may become new fertile ground for the future development of sensors.

Specifically, in the autonomous driving field, due to the limited space of the car body itself, ordinary sensors are obviously difficult to meet the new demands posed by the times, at which point the advantages of smart sensors become prominent. Compared to traditional sensors, smart sensors can not only achieve precise data collection but also keep costs under control. Additionally, their automation capabilities and diverse functions also add to the advantages of smart sensors.

For example, Google’s car uses sensors not only for laser scanners but also for components/systems such as cameras, radar, and inertial systems. Currently, common sensors used in autonomous vehicles include LiDAR, image sensors, and millimeter-wave radar.

Autonomous driving is just one of the application scenarios for sensors; another highly regarded application market is fingerprint recognition. In recent years, the development speed of smartphones has been very rapid, and fingerprint recognition has become an essential feature of many smart smartphone brands. Relevant data shows that in 2016, the number of fingerprint sensors approached 700 million, with a compound annual growth rate exceeding 133%.

With the continued development of smart products equipped with fingerprint recognition, such as smartphones, wearable devices, and smart locks, the fingerprint sensor market will usher in a brighter development prospect.

03

Multiple Industry Standards

Regulating market order is an important guarantee for the healthy development of the industry, and the sensor market is no exception. Based on existing resources such as talent, market, and technology, accelerating the development of sensors requires favorable policies and the establishment of industry standards.

In recent years, there have been numerous policies related to the development of the sensor industry. For example, in 2011, the China Electronic Components Association released the “12th Five-Year Plan for Electronic Components in China”; in 2012, the Ministry of Industry and Information Technology also emphasized the development of micro and smart sensors and wireless sensor networks in the “12th Five-Year Plan for the Internet of Things”.

In 2015, the “Made in China 2025” strategy also reiterated the direction for the development of the sensor industry; later, in July 2016, the “13th Five-Year National Science and Technology Innovation Plan” was introduced, emphasizing the research and innovation of new sensors.

Entering 2018, the implementation of a series of industry standards will continue to “protect” the sensor industry. In 2017, the State Administration for Market Regulation and the National Standardization Administration approved 203 national standards and 10 foreign language versions of national standards. It is reported that these new standards will be implemented in 2018, involving multiple instrument and meter standards, including smart sensors, smart recording instruments, and smart flow instruments.

With the introduction of multiple new national standards, the sensor industry will usher in a new era of growth. In addition to trends such as intelligence and digitalization, standardization may become one of the labels for the development of sensors.

Breakthroughs in products/technologies, continuous deepening of application scenarios, successive introduction of industry standards, and continuous enhancement of upstream and downstream market demand are all driving the sensor industry towards maturity, which may be why smart sensors are referred to as one of the most influential high-tech innovations of the 21st century.

04

Industrial Chain

Smart sensors are sensors with information processing capabilities. Their greatest value is the organic integration of the signal detection function of sensors and the signal processing function of microprocessors.

In the domestic smart sensor market, local companies have relatively weak competitiveness, with multinational companies occupying 87% of the market share. However, the ecological system of the Chinese smart sensor industry is also becoming complete, with key links such as design, manufacturing, and packaging testing having backbone enterprises laid out.

Research and Development

Domestic smart sensor technology research and development has begun to take shape. Domestic universities such as Peking University, Southeast University, and the 214 Institute have conducted in-depth technical research. At the same time, research institutions represented by the Shanghai Institute of Microsystem and Information Technology and Suzhou Micro-Nano Center have established smart sensor pilot service platforms to promote domestic industrial innovation and development.

Abroad: AT&T Bell Laboratories, IBM, IMEC Microelectronics Research Center, Microelectronics Research Institute, University of Virginia, University of Maryland, University of Michigan, University of California, Berkeley, MIT, National University of Singapore, Nanyang Technological University

Domestic: Shanghai Institute of Microsystem and Information Technology, China Electronics Technology Group Corporation, Industrial Technology Research Institute (Taiwan), Peking University, Southeast University, China Weapon Industry Group 214 Institute, Tianjin University, Institute of Microelectronics, Chinese Academy of Sciences, Institute of Electronics, Chinese Academy of Sciences, Tsinghua University, Huazhong University of Science and Technology, Harbin Institute of Technology

Design

Abroad: Analog Devices, Texas Instruments, Maradin, MicroVision, Qualtre, Maxim, Cirrus Logic, Murata Manufacturing, STMicroelectronics, Sony, Bosch, Broadcom, Qualcomm, Omron, Asahi Kasei Microdevices, ADI, NXP, Infineon, Apacer, Honeywell.

Domestic: Maxlinear, Shendi Semiconductor, Goertek, Minghao Sensors, AAC Technologies, Chipone, Minxun Microelectronics, Consensys Technology, Multi-Dimensional Technology, OmniVision Technology, Geke Microelectronics, Spico, Goodix Technology, Meitai Technology, Silan Microelectronics, Gode Infrared.

Manufacturing

Abroad: GlobalFoundries, Teledyne DALSA, Epson, Semefab, Silex, Sony, Fraunhofer ISIT, Tronics, Bosch, ST, Asahi Kasei Microdevices, ADI, NXP, Infineon, Apacer, Honeywell.

Domestic: TSMC (Taiwan), SMIC, UMC (Taiwan), China Resources Microelectronics, Shanghai Advanced Semiconductor, Huahong Group, Meena Technology, Silan Microelectronics, Hanwang Microelectronics, National High Microelectronics, Lide Infrared.

Packaging

Abroad: Amkor, Casio, Hana Microelectronics, Star Technology, Unisen, UTAC, Boschman, Texas Instruments

Domestic: ASE (Taiwan), AAC Technologies, Changdian Technology, Weisheng Company (Taiwan), Tongxin Electronics (Taiwan), SPIL, Huatian Technology, Jingfang Technology, Nanto Fujitsu, Licheng Technology (Taiwan), Namo Technology (Taiwan), Xindong Technology (Taiwan), Goertek, Gude Electronics, Hongguang Co., Ltd.

Testing

Abroad: Acutronic, ADI, Apacer, NXP, Analog Devices, Maxim, Murata Manufacturing, ST, Sony, Texas Instruments, Bosch, Omron

Domestic: JY Electronics (Taiwan), Shanghai Hualing, Goertek, Maxlinear, AAC Technologies, Shendi Semiconductor, Meitai Technology, Chipone, Gongda Electronics, Silan Technology

In terms of supporting software and chips, there is local layout, but compared to IDM sensor companies like Bosch and Analog Devices that come with software algorithms, as well as traditional embedded chip companies like Qualcomm and Marvell, there is still a large gap.

Software

Abroad: Asahi Kasei Microdevices, Analog Devices, Bosch, NXP, Kionix, Hillcrest Labs, Murata Manufacturing, PNI Sensor, ST

Domestic: Noyiteng, Dingyi Digital Technology, Feizhi, Suwei Technology, Aisung Technology, Minxun Microelectronics, Minghao Sensors, Shendi Semiconductor, Silan Technology

Chips

Abroad: Qualcomm, Broadcom, NVIDIA, Intel, Marvell, Apple, Samsung

Domestic: Spreadtrum, MediaTek (Taiwan), Lianxin Technology, Ruidico Microelectronics, HiSilicon, Unisoc, Zhuhai Junlian, Xiaomi

>>>>

System/Application

In the downstream of the industrial chain, the Chinese market, especially the consumer electronics market, is extremely broad. At the same time, companies such as Huawei, ZTE, and Xiaomi have strong innovation capabilities and possess strong system integration and innovation capabilities.

Abroad: Apple, Samsung, Google, LG, Nokia, Sony, Facebook, Dell, Microsoft, GoPro, Philips.

Domestic: Huawei, ZTE, OPPO, vivo, Xiaomi, HTC (Taiwan), Lenovo, Coolpad, 360, OnePlus, TCL, Gionee, LeEco.

This article is reproduced from Yiou Network and does not represent the position of the association.