Display technology is a key support for electronic products such as televisions, computers, and mobile phones. Display technology has evolved from the initial cathode ray tube (CRT) technology to the current flat panel display (FPD) technology, which has branched out into technologies such as plasma display (PDP), liquid crystal display (LCD), and organic light-emitting diode display (OLED), leading to the upgrade of electronic products.

According to the information released at the 2021 World Display Industry Conference, the revenue of China’s new display industry reached 446 billion yuan in 2020, accounting for 40.3% of the global market, making it the largest in the world. In the current market landscape, OLED panels are gradually occupying the mid-to-high-end home appliance and consumer electronics markets, while LCD panels still hold a certain market share in the large-sized home appliance and mid-to-low-end consumer electronics markets. In the next 3-5 years, although there will be competition between the two, both will continue to coexist and develop.

This article compares the upstream material patent situation of LCD and OLED, analyzing the competitive development of the two technologies.

1. Global Development Trend – OLED Takes Over LCD Technology Development

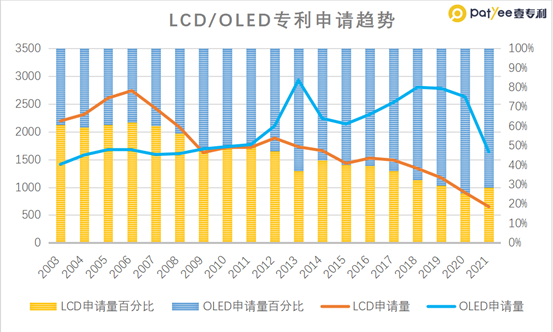

Globally, looking at the patent application trends for LCD and OLED materials, LCD material technology has matured after a long period of development and application, and the number of patent applications has been slowly declining since 2006.

OLED material technology has been on the rise for nearly twenty years, from 2005 to 2009, companies like Samsung and Sony vigorously promoted OLED technology, widely applying it in Samsung’s high-end mobile phones. In 2009, the number of OLED patent applications began to exceed that of LCD and reached its first peak in 2013; it then experienced a brief decline over the next two years, but with the rise of OLED flat/curved TVs, it ushered in a second growth in patent applications.

From the percentage stacked chart of patent applications for LCD and OLED, over twenty years, the percentage of patent applications for LCD materials has decreased from 60% to 30%. Through twenty years of competition, the development trend of OLED material patents has already surpassed that of LCD, reflecting that the current research and development hotspot in the display field is OLED panels applied in high-end home appliances and consumer markets.

Although the patent application intensity for LCD is gradually decreasing due to its technological maturity, LCD still has a significant cost advantage and remains indispensable in the large-sized home appliance and mid-to-low-end consumer electronics markets. Moreover, LCD screens can integrate the advantageous characteristics of OLED screens through optimization, such as BOE’s use of a dual-layer Cell design with black-and-white and color, as well as pixel partitioning technology and micron-level ultra-fine light control technology, allowing BD Cell screens (TFT-LCD) to provide richer details in low-gray-scale images, with a contrast ratio reaching millions, while power consumption can be 40% lower than that of OLED. Due to technological improvements, the product lifecycle of LCD has been extended, and related patent applications will continue in the future.

2. Global LCD/OLED Regional Development Direction – Transfer from Japan and South Korea to Mainland China

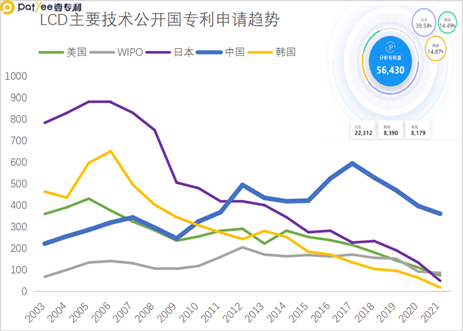

Regarding LCD materials, Japan, South Korea, and the United States occupy the top three positions in total applications, with China ranking fourth. In terms of application trends, although China has not entered the top three in LCD material patent applications, the current patent application volumes from Japan, South Korea, and the United States are all on a downward trend, with Japan’s application volume declining particularly significantly.

Since 2007, China’s LCD material application volume has gradually exceeded that of the US, South Korea, and Japan, and currently, China’s LCD material applications are still showing slight growth. This is partly related to the global new display market shifting from Japan and South Korea to China, and on the other hand, China has vigorously supported independent innovation in recent years, leading to an increase in patent applications across various industries, and domestic panel companies have not abandoned the continuous development and updating of LCD display technology.

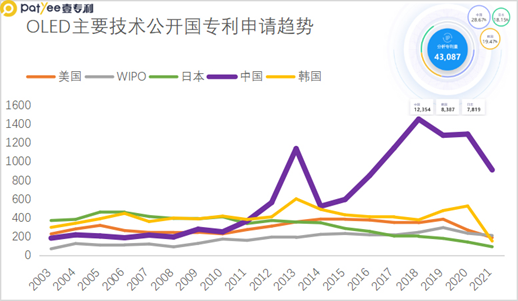

For OLED materials, similarly, before 2010, China’s patent application volume did not enter the top three, but after that, China’s annual patent application volume began to exceed that of the US, Japan, and South Korea, and after 2012, China ranked first in the world in annual patent applications for OLED materials.

Currently, Japan’s application volume shows a slight downward trend, while other countries are experiencing growth, with China’s growth being particularly remarkable. China’s patent application volume peaked for the first time in 2013, and the second peak in 2018 exceeded the previous application volume, making OLED display technology a development trend for smartphones and large-sized television screens, with China becoming the largest OLED application market in the world.

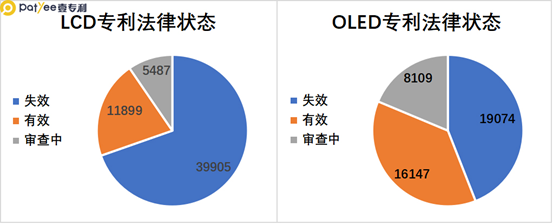

3. Comparison of Patent Application Quality – OLED Dominates Valid Patents

Although the total number of patent applications for LCD materials still exceeds that of OLED materials, Japan and South Korea have significant advantages in the LCD field, from the perspective of patent legal status, most patents for LCD materials have expired, and the number of valid patents is less than that of OLED. The situation where China’s LCD raw materials are constrained by Japan, South Korea, and the United States will eventually be broken as these countries’ LCD material patents expire.

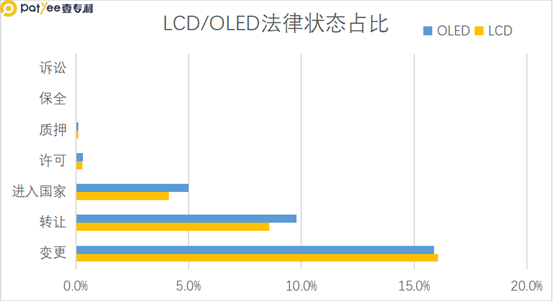

From the perspective of legal events, the proportion of OLED material patents in terms of transfer, licensing, and entering countries is higher than that of LCD, reflecting that the current patent value of OLED materials is higher, and intellectual property protection is utilized more fully.

4. Sources of Global Patent Applications: Global Leading Innovators

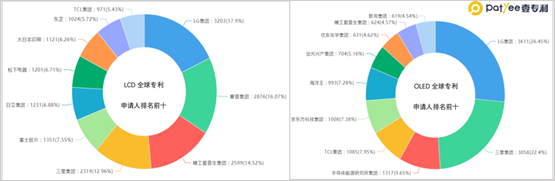

In the global patent applicant rankings, whether for LCD or OLED, Japanese and South Korean companies dominate most positions. In the LCD field, large Japanese multinational companies hold an advantage, with only TCL Group ranking tenth; in the OLED field, South Korea’s LG and Samsung have impressive achievements, with the number of patents held by these two global screen display giants almost equaling the combined number of applicants ranked third to tenth, and their leading position in high-end screens remains unshakable; Chinese companies TCL, BOE, and Ocean King rank fourth to sixth.

5. Domestic Development Regional Distribution: Which Provinces Have Technological Advantages

Guangdong Province ranks first in the number of patent applications for both LCD and OLED materials, holding a significant advantage; Beijing and Jiangsu Province are not far behind, ranking second and third respectively. Guangdong, Jiangsu, Beijing, and Shanghai have strong research capabilities and strengths in the new display industry, undoubtedly allowing them to dominate in patent applications for LCD and OLED. For inland cities, there is generally a focus on introducing related industries, with Sichuan Province focusing on the development of LCD materials, while Jilin and Shaanxi focus on the development of OLED materials.

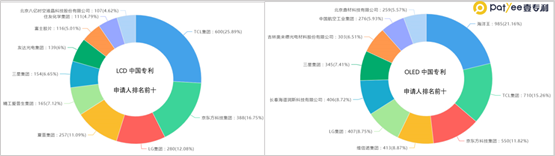

6. Sources of Innovation in Chinese Patent Applications: Advantageous Innovators in Domestic Layouts

In the ranking of Chinese patent applicants, in the field of LCD materials, TCL Group and BOE clearly occupy the top two positions, while foreign companies still hold a significant position, with the third to ninth rankings being Japanese and South Korean companies; in the OLED materials field, the situation is quite different, with domestic companies occupying eight seats, Ocean King, focusing on organic light-emitting materials, ranking first, followed by major panel shippers TCL Group, BOE, and Visionox; global leaders LG and Samsung rank fifth and seventh respectively.

Changchun Haipurun focuses on the research and development, production, sales, and technical services of OLED terminal materials and is one of the advanced OLED terminal material companies in China; Jilin Aolai De, with a presence in Shanghai and Changchun, is a company specializing in organic electroluminescent materials and has been selected as one of the first batch of manufacturing single champions in China, receiving the Special Contribution Award for the New Display Industry Chain in China. Due to the innovative contributions of these two companies, Jilin Province ranks fourth in the number of Chinese patent applications in the field of OLED materials.

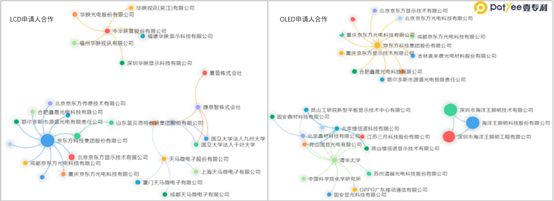

In terms of applicant cooperation, domestic patent applicants mainly collaborate within group companies and subsidiaries, such as BOE and its various subsidiaries; however, there are also many foreign applicants engaging in industry-academia-research cooperation in the LCD materials field, such as Sharp and Chiba University.

From the perspective of patent analysis, LCD materials have undergone a long period of technological development and have now entered a mature technological phase, and there will be some technological improvements in the future; OLED materials are like a rising star, even giants in the LCD field, are actively laying out OLED technology routes.

Key Focus Countries and Technology Fields: Japan – LCD; South Korea – OLED.

Domestic Advantage Enterprises: TCL, BOE, Visionox – full panel chain; Ocean King, Changchun Haipurun, Jilin Aolai De – organic light-emitting materials.

Domestic Advantage Universities: Tsinghua University.

Scan to Apply for Free New Material Industry Database Account