Printed Circuit Boards (PCBs) refer to boards that use printing technology to form conductive circuit patterns or functional boards with printed components on insulating substrates, used to achieve interconnection and relay transmission between electronic components. They are essential basic components of electronic information products. There are various types of PCBs, which can be classified based on the flexibility of the substrate into rigid boards (R-PCB), flexible boards (FPC), and rigid-flex boards; based on the number of conductive layers, they can be divided into single-sided boards, double-sided boards, and multilayer boards. Additionally, there are special product classifications such as high-speed and high-frequency boards, high-density interconnect (HDI) boards, and packaging substrates.

1. Structure of Global PCB Downstream Application Fields

Printed circuit boards serve as a bridge that carries electronic components and connects circuits, forming a module or finished product with specific functions. They are irreplaceable in electronic products and are known as the “mother of electronic products.” PCBs are widely used in communications electronics, consumer electronics, computers, new energy vehicle electronics, industrial control, medical devices, defense, and aerospace. They are indispensable electronic components in modern electronic information products. In 2021, the largest application field for global PCBs was communications, accounting for 32%; followed by the computer industry at 24%; consumer electronics at 15%; the server industry at 10%; industrial control at 4%; military aviation at 4%; and the medical industry at 2%.

Data Source: Prismark, Organized by Guanzhi Hai Nei Consulting

2. Global PCB Output Value Scale and Growth

The PCB industry is a foundational industry in the manufacturing of electronic information products and is closely related to macroeconomic cycles. Currently, global PCB manufacturing enterprises are mainly distributed in mainland China, Taiwan, Japan, South Korea, Southeast Asia, the United States, and Europe. In 2021, the global pandemic fluctuated, and the economy saw ups and downs, but the explosion of markets such as 5G communications and terminals, new energy vehicles, and consumer electronics drove the PCB industry to grow against the trend. According to statistics, the global PCB industry’s output value reached $80.9 billion in 2021, a year-on-year increase of 24.08%.

Data Source: Prismark, Organized by Guanzhi Hai Nei Consulting

2. Global PCB Output Value Scale and Growth

The PCB industry is a foundational industry in the manufacturing of electronic information products and is closely related to macroeconomic cycles. Currently, global PCB manufacturing enterprises are mainly distributed in mainland China, Taiwan, Japan, South Korea, Southeast Asia, the United States, and Europe. In 2021, the global pandemic fluctuated, and the economy saw ups and downs, but the explosion of markets such as 5G communications and terminals, new energy vehicles, and consumer electronics drove the PCB industry to grow against the trend. According to statistics, the global PCB industry’s output value reached $80.9 billion in 2021, a year-on-year increase of 24.08%.

Data Source: Prismark, Organized by Guanzhi Hai Nei Consulting

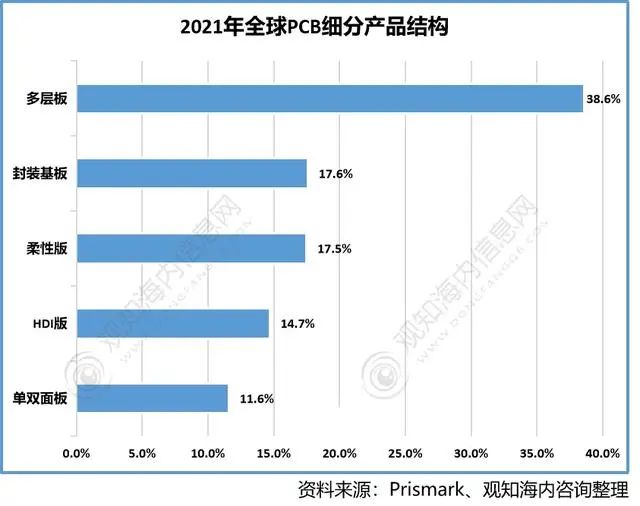

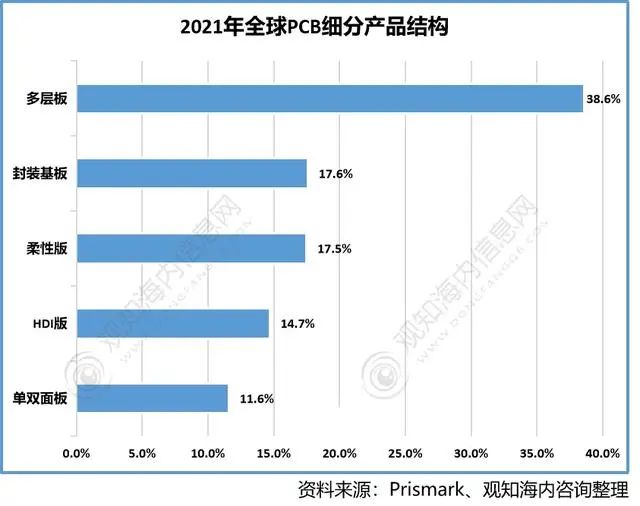

3. Structure of Global PCB Segmented Products

With the rapid development of technology in the global electronic circuit industry, the miniaturization and integration of components are becoming increasingly widespread. The demand for high-density PCBs in electronic products is becoming more prominent. In the future, the demand for high-end PCB products such as multilayer boards, HDI boards, and IC substrates will significantly increase. Electronic products will continue to develop towards “integration, automation, miniaturization, lightweight, and low energy consumption,” which will promote PCBs to continue to evolve towards high density, high integration, high-speed and high-frequency, high heat dissipation, thinness, and miniaturization. The demand for multilayer boards, rigid-flex boards, HDI boards, substrate-like boards, and packaging substrates will continue to rise. In terms of the segmented structure of PCB products, multilayer boards accounted for 38.6% of global PCB segmented products in 2021, packaging substrates accounted for 17.6%, flexible boards accounted for 17.5%, HDI boards accounted for 14.7%, and single-sided and double-sided boards accounted for 11.6%.

Data Source: Prismark, Organized by Guanzhi Hai Nei Consulting

3. Structure of Global PCB Segmented Products

With the rapid development of technology in the global electronic circuit industry, the miniaturization and integration of components are becoming increasingly widespread. The demand for high-density PCBs in electronic products is becoming more prominent. In the future, the demand for high-end PCB products such as multilayer boards, HDI boards, and IC substrates will significantly increase. Electronic products will continue to develop towards “integration, automation, miniaturization, lightweight, and low energy consumption,” which will promote PCBs to continue to evolve towards high density, high integration, high-speed and high-frequency, high heat dissipation, thinness, and miniaturization. The demand for multilayer boards, rigid-flex boards, HDI boards, substrate-like boards, and packaging substrates will continue to rise. In terms of the segmented structure of PCB products, multilayer boards accounted for 38.6% of global PCB segmented products in 2021, packaging substrates accounted for 17.6%, flexible boards accounted for 17.5%, HDI boards accounted for 14.7%, and single-sided and double-sided boards accounted for 11.6%.

Data Source: Prismark, Organized by Guanzhi Hai Nei Consulting

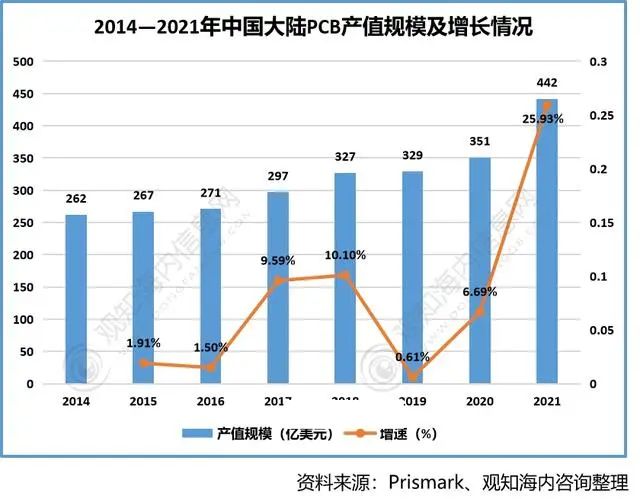

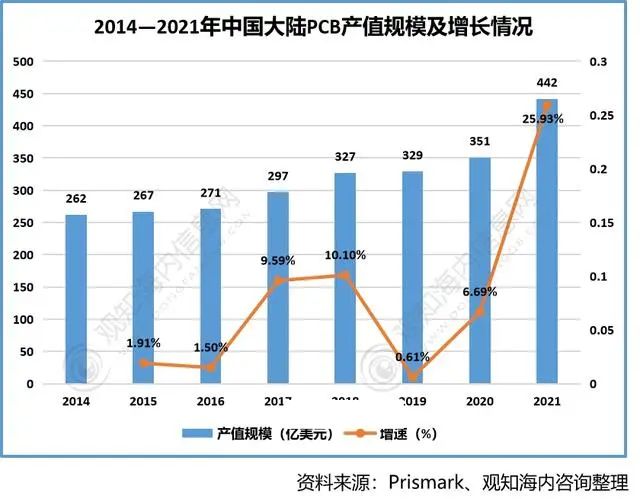

4. Scale and Growth of China’s PCB Output Value

The output value of mainland China’s PCB industry has increased from $26.2 billion in 2014 to $44.2 billion in 2021. Since 2014, the output value of mainland China’s PCB industry has been in a growth state, with a year-on-year growth of 25.93% in 2021. As the transfer of the PCB industry deepens, the proportion of China’s PCB output value will further increase.

Data Source: Prismark, Organized by Guanzhi Hai Nei Consulting

4. Scale and Growth of China’s PCB Output Value

The output value of mainland China’s PCB industry has increased from $26.2 billion in 2014 to $44.2 billion in 2021. Since 2014, the output value of mainland China’s PCB industry has been in a growth state, with a year-on-year growth of 25.93% in 2021. As the transfer of the PCB industry deepens, the proportion of China’s PCB output value will further increase.

Data Source: Prismark, Organized by Guanzhi Hai Nei Consulting

The “2023-2028 China PCB Industry Competitive Landscape and Development Trend Forecast Report” published by Guanzhi Hai Nei Information Network covers the latest industry data, market hotspots, policy planning, competitive intelligence, market outlook forecasts, investment strategies, and more. The report provides detailed analysis of PCB industry product classification, applications, industry policies, industrial chains, production models, business models, favorable and unfavorable factors for industry development, and entry barriers.

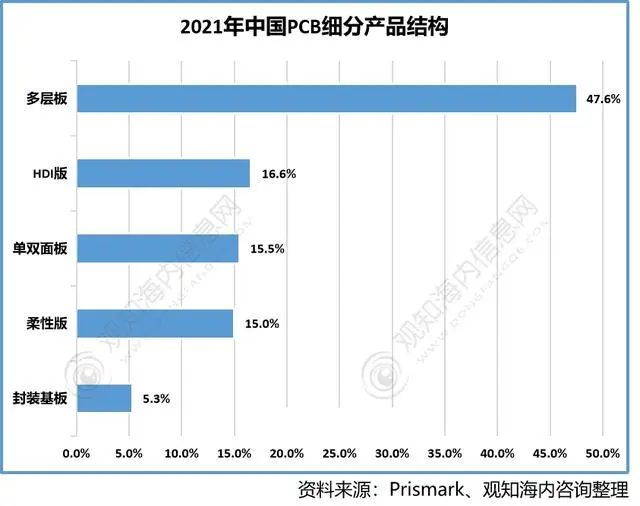

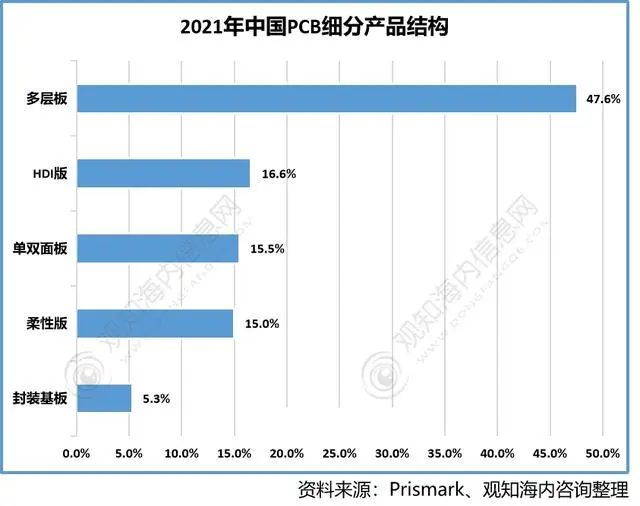

5. Structure of China’s PCB Segmented Products

As a core foundational component of the electronic information industry, the development of the PCB industry is closely tied to the development of the electronic information industry and the macroeconomic climate. Especially with the increasing internationalization of the electronic information industry market, future PCB demand will be deeply influenced by both domestic and international markets. From the current economic development momentum, the domestic economy still faces significant pressure for growth slowdown due to the impact of the COVID-19 pandemic and international trade frictions. The international economic situation is complex and changeable. If there are adverse changes or adjustments in the macroeconomic situation and national fiscal, monetary, and trade policies, it may adversely affect the operating performance of domestic enterprises. In terms of product segmentation, multilayer boards account for 47.6% of China’s PCB products, HDI boards account for 16.6%, single-sided and double-sided boards account for 15.5%, flexible boards account for 15%, and packaging substrates account for 5.3%.

Data Source: Prismark, Organized by Guanzhi Hai Nei Consulting

The “2023-2028 China PCB Industry Competitive Landscape and Development Trend Forecast Report” published by Guanzhi Hai Nei Information Network covers the latest industry data, market hotspots, policy planning, competitive intelligence, market outlook forecasts, investment strategies, and more. The report provides detailed analysis of PCB industry product classification, applications, industry policies, industrial chains, production models, business models, favorable and unfavorable factors for industry development, and entry barriers.

5. Structure of China’s PCB Segmented Products

As a core foundational component of the electronic information industry, the development of the PCB industry is closely tied to the development of the electronic information industry and the macroeconomic climate. Especially with the increasing internationalization of the electronic information industry market, future PCB demand will be deeply influenced by both domestic and international markets. From the current economic development momentum, the domestic economy still faces significant pressure for growth slowdown due to the impact of the COVID-19 pandemic and international trade frictions. The international economic situation is complex and changeable. If there are adverse changes or adjustments in the macroeconomic situation and national fiscal, monetary, and trade policies, it may adversely affect the operating performance of domestic enterprises. In terms of product segmentation, multilayer boards account for 47.6% of China’s PCB products, HDI boards account for 16.6%, single-sided and double-sided boards account for 15.5%, flexible boards account for 15%, and packaging substrates account for 5.3%.

Data Source: Prismark, Organized by Guanzhi Hai Nei Consulting

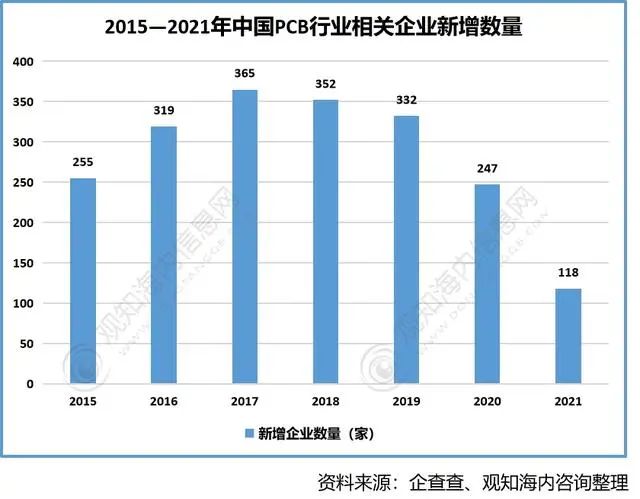

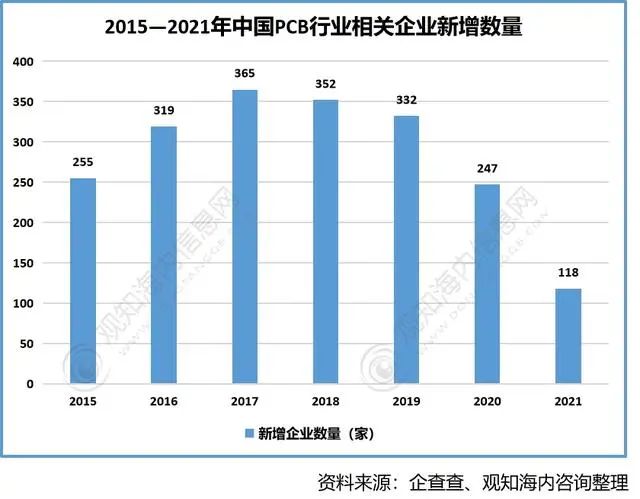

6. New Number of Related Enterprises in China’s PCB Industry

The global PCB industry’s focus is gradually shifting from Europe and America to Asia, with a new pattern emerging dominated by Asia (especially mainland China). There are numerous types of production enterprises in the PCB industry, and market competition is quite fierce, but there is an increasing trend towards “large-scale and concentration.” If companies cannot fully seize market opportunities and timely adapt to market demands and competitive conditions in product development and marketing strategies, their market competitive advantages may be weakened, facing the risk of market share decline or being surpassed by competitors. From 2015 to 2021, the number of new related enterprises in China’s PCB industry showed a trend of first rising and then declining. In 2021, the number of new related enterprises in the industry was 118.

Data Source: Prismark, Organized by Guanzhi Hai Nei Consulting

6. New Number of Related Enterprises in China’s PCB Industry

The global PCB industry’s focus is gradually shifting from Europe and America to Asia, with a new pattern emerging dominated by Asia (especially mainland China). There are numerous types of production enterprises in the PCB industry, and market competition is quite fierce, but there is an increasing trend towards “large-scale and concentration.” If companies cannot fully seize market opportunities and timely adapt to market demands and competitive conditions in product development and marketing strategies, their market competitive advantages may be weakened, facing the risk of market share decline or being surpassed by competitors. From 2015 to 2021, the number of new related enterprises in China’s PCB industry showed a trend of first rising and then declining. In 2021, the number of new related enterprises in the industry was 118.

Copyright Statement:This article is copyrighted by the original author and does not represent the views of the association.The articles promoted by the “Jiangxi Province Electronic Circuit Industry Association” are for sharing purposes only and do not represent the stance of this account. If there are copyright issues, please contact us for deletion.

Data Source: Prismark, Organized by Guanzhi Hai Nei Consulting

Data Source: Prismark, Organized by Guanzhi Hai Nei Consulting Data Source: Prismark, Organized by Guanzhi Hai Nei Consulting

Data Source: Prismark, Organized by Guanzhi Hai Nei Consulting Data Source: Prismark, Organized by Guanzhi Hai Nei Consulting

Data Source: Prismark, Organized by Guanzhi Hai Nei Consulting Data Source: Prismark, Organized by Guanzhi Hai Nei Consulting

Data Source: Prismark, Organized by Guanzhi Hai Nei Consulting Data Source: Prismark, Organized by Guanzhi Hai Nei Consulting

Data Source: Prismark, Organized by Guanzhi Hai Nei Consulting