Winds are rising, and the road ahead is long.

Written by | Ru Qing, Xiao FenImage Source | IC photo

History is often surprisingly similar.

In the 1980s, during the peak of the Japanese semiconductor industry, it first surpassed the United States in market share, becoming the world’s largest semiconductor producer, which led to restrictions from the United States.

In 1985, the United States brought Japan to the negotiation table over unfair competition in the semiconductor industry, igniting the “Chip War” between the US and Japan. The following year, Japan’s Ministry of International Trade and Industry was forced to sign the “US-Japan Semiconductor Agreement” with the US Department of Commerce, limiting Japanese semiconductor exports to the US and expanding the US semiconductor market in Japan, but the results were not satisfactory. In 1989, the US signed the “US-Japan Semiconductor Trade Agreement” again, opening up Japan’s semiconductor industry’s intellectual property and patents. After that, the Japanese semiconductor industry declined, ultimately losing its advantage and retreating to the fields of semiconductor equipment and materials, while the US continued to dominate the high-value areas of the semiconductor industry.

Now, the US seems to want to replay this scene in China, placing companies related to semiconductors such as Huawei, SMIC, Hikvision, and Dahua on the “Entity List” to implement export controls, aiming to restrict the development of China’s semiconductor industry.

But China is not Japan.

Mainland China has already accounted for 35% of the global semiconductor consumption. Behind the rapid development of new technologies and products such as mobile internet, smart devices, new energy vehicles, and 5G is a booming emerging semiconductor application market; as the third semiconductor industry transfer takes place, China has already developed the capability to participate in global competition in packaging, testing, and mid-to-low-end chip design, securing a place in the global semiconductor supply chain. China has the confidence and ability to establish a self-controlled semiconductor industry system.

The US restrictions have stimulated the national security nerves, and seemingly overnight, “chips” have become linked to “national destiny.” Who would have thought that chips—these precision components integrating hundreds of millions of transistors in a tiny space, the silent heart and brain of machines working in hidden corners—would become one of the most discussed topics among the public in 2020.

Hundreds of millions of citizens are concerned, thousands of companies are involved, hundreds of billions of funds are entering, and nearly a hundred investment institutions are betting… A construction boom in the semiconductor industry has emerged under the black swan of the pandemic. More and more overseas semiconductor experts and engineers are returning to participate in this wave, leading to an increase in innovation within the semiconductor industry, and more “bottlenecks” are gradually being broken. China is slowly finding its place on the global semiconductor map.

It can be boldly predicted that in the next decade, China is likely to gradually establish a semiconductor industry system that is both independent and open, anchored by emerging technologies such as AI, 5G, and the Internet of Things, fueled by enormous market demand, and driven by technology giants.

This tumultuous year of 2020 may just be the beginning of it all.

Capital Paves the Way, Investment Booms

“Hot” is the most intuitive feeling of Wang Huadong, a partner at Matrix Partners China, regarding the semiconductor investment situation in 2020. Li Wei, a partner at Xiangfeng Investment, shares a similar experience, describing it as “frenzy.”

Over the past decade, the industry has rapidly expanded. According to Tianyancha statistics, the number of registered chip companies was 53,238 in 2019, and 59,793 in 2020, nearly five times that of 2014, and nearly 100 times more than ten years ago.

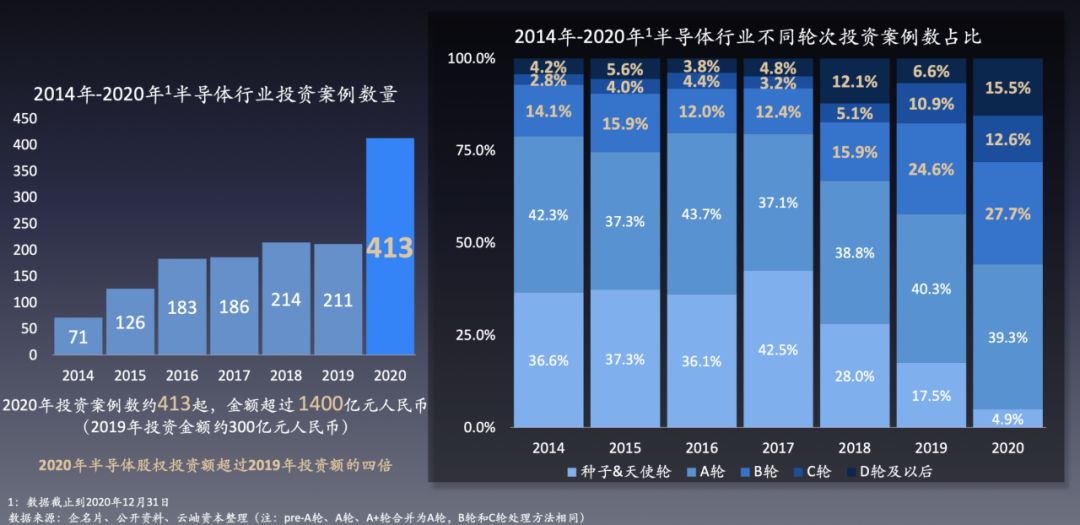

According to Yunxiu Capital’s “2020 China Semiconductor Industry Investment Interpretation,” there were 413 equity investment cases in the semiconductor industry in 2020, with an investment amount exceeding 140 billion RMB, a nearly fourfold increase compared to the approximately 30 billion RMB invested in 2019, making it the highest investment year in the history of China’s semiconductor primary market.

Number of Investment Cases and Proportions in the Semiconductor Industry

Source: Yunxiu Capital’s “2020 China Semiconductor Industry Investment Interpretation”

Not only has the total amount of investment cases increased exponentially, but the amount of single financing has also seen significant breakthroughs. According to incomplete statistics from 36Kr, there were at least 11 investments exceeding 1 billion RMB in 2020, with the largest being 15.6 billion RMB raised by Ruili Integrated. In 2019, investments exceeding 100 million RMB were relatively rare.

Companies with Financing Exceeding 1 Billion RMB in 2020 36Kr compiled based on public data

Companies with Financing Exceeding 1 Billion RMB in 2020 36Kr compiled based on public data

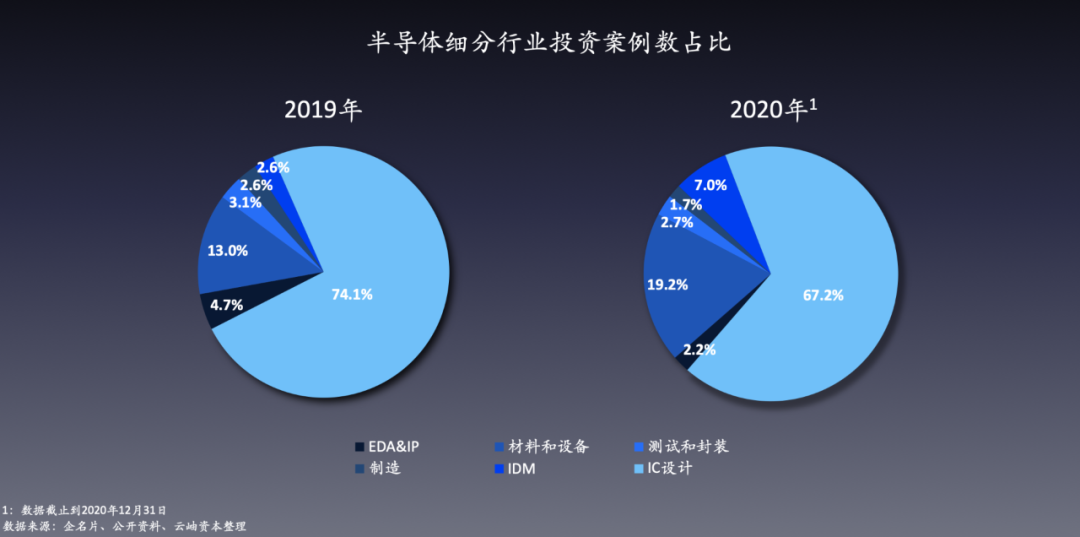

From a segmentation perspective, semiconductor design remains the focus of investment, accounting for 67.2% of investment cases in the IC design field. Additionally, upstream industries such as materials and equipment have also attracted more capital attention, with the investment proportion in materials and equipment rising from 13% in 2019 to 19.2% in 2020.

It is worth mentioning that in 2020, more startups began to create “chips that were previously considered too risky,” such as CPU, GPU, AI chips, automotive chips, and EDA, with several leading companies receiving substantial financing. For example, GPU design company Birun Technology, established in September 2019, raised 1.1 billion RMB in Series A funding; similarly, EDA intelligent industrial software system developer Xinhua Zhang, founded in March 2020, completed over 400 million RMB in financing within seven months of establishment. Companies like Coreda, Zhikai Semiconductor, and Chengdu Shishi Technology also secured financing within six months of their establishment.

“We have found that more and more chip manufacturers are entering high-barrier, low-domestic-replacement-rate semiconductor segments, indicating that the domestic semiconductor industry has entered a ‘deep water zone,'” said Zhao Zhanxiang, partner and CTO of Yunxiu Capital.

Proportion of Investment Cases in Semiconductor Sub-sectors

Source: Yunxiu Capital’s “2020 China Semiconductor Industry Investment Interpretation”

From the distribution of financing rounds, over 45% of investments occurred in Series A and earlier, indicating that China’s semiconductor startups are still in the early development stage. Additionally, the proportion of investments in Series D and later has increased by nearly 10% compared to 2019. This is closely related to the maturity of the Sci-Tech Innovation Board, where the probability of chip companies successfully listing in later stages is high, and the Sci-Tech Innovation Board provides relatively reasonable and attractive valuations for semiconductor companies, making established semiconductor firms with stable revenues in the millions a more prudent choice for many investment institutions entering the semiconductor industry.

In the secondary market, the semiconductor industry has also attracted significant attention on the Sci-Tech Innovation Board. As of December 31, 2020, among the 216 listed companies on the Sci-Tech Innovation Board, 36 are semiconductor companies, accounting for 16%, including 16 design companies, 9 materials companies, and 5 equipment companies. Moreover, semiconductor companies occupy a significant portion of the top ten companies by market capitalization on the Sci-Tech Innovation Board, with semiconductor market capitalization accounting for 30% of the total market capitalization. In 2020, the average market capitalization increase of semiconductor companies was approximately 40% to 50%.

In terms of price-to-earnings ratios, according to “Global Semiconductor Watch,” the rolling price-to-earnings ratios of 75 listed semiconductor companies in the country show that Amlogic ranks first with a price-to-earnings ratio of 2453.56, followed by Beijing Junzheng with 2387.41. The average price-to-earnings ratio of the remaining 68 companies is 118.66, while the average price-to-earnings ratio of newly listed stocks on the Sci-Tech Innovation Board is 54 times, and the average price-to-earnings ratio of eight giants including Qualcomm, Broadcom, Intel, AMD, and Texas Instruments is 54.38.

From the perspective of investors, not only traditional financial investment institutions and industrial investors that have long invested in the semiconductor industry, but also an increasing number of leading institutions have entered the semiconductor investment market in 2020, such as Sequoia Capital, Hillhouse Capital, Shenzhen Capital Group, Northern Light Venture Capital, IDG, Xiangfeng Investment, Qiming Venture Partners, Matrix Partners China, and Source Code Capital, and they have acted decisively.

“Five years ago, there were only a handful of GPs investing in semiconductors; now it seems that there is hardly a GP that does not invest in semiconductors,” lamented Kong Lingguo, founder and managing partner of Helix Capital, at the “14th China Fund Partners Summit 2020.”

Additionally, industrial investors have also been important participants in the semiconductor investment market in 2020, including SMIC’s Juyuan Capital, Huawei’s Hubble Investment, Xiaomi’s Yangtze River Fund, BOE’s Xindong Energy, Hikvision’s Zhongdian Hikvision, and OPPO and Intel, all of which have made investments in the semiconductor field. They each focus on different areas based on their respective industrial backgrounds, such as Juyuan Capital focusing more on upstream materials and equipment, while Xindong Energy focuses on display drivers, manufacturing packaging, and the Internet of Things; OPPO focuses on optoelectronic chips, the Internet of Things, and 5G RF.

Among industrial capital, Huawei’s Hubble Investment and Xiaomi’s Yangtze River Fund have garnered significant attention, both adopting a “buying spree” approach in 2020. According to rough statistics from 36Kr, since its establishment in April 2019, Huawei’s Hubble has publicly invested in over 20 projects, covering various aspects such as semiconductor design, materials, EDA tools, and testing instruments, including material suppliers like Xinyao Semiconductor, analog chip specialists like SIRU, and automotive communication chip developers like Yutai Microelectronics.

Despite the challenges faced in developing its own chips, Xiaomi is compensating for its shortcomings through investments. In terms of the number of investments, Xiaomi’s Yangtze River Fund is not inferior to Huawei’s Hubble, having publicly invested in as many as 19 semiconductor companies in 2020, involving FPGA, Wi-Fi/RF chips, and acquiring stakes in semiconductor companies like Xinyuan Microelectronics and Yunying Valley Technology.

According to Xu Yinchuan, executive director and head of the technology group at Light Source Capital, the investment logic behind industrial investors, including Xiaomi and Huawei, is twofold: to maintain supply chain stability and to leverage their industry knowledge advantages. Industrial investors are often the application parties of semiconductor products, and they have a deep understanding of the specific application scenarios for chips. For startups, securing funding from industrial investors not only provides capital but also brings product orders and collaborative development contracts. Chip product development is a long-term process, and the development of new products relies heavily on close cooperation with application customers, making industrial investors a highly beneficial choice for entrepreneurs. “More and more startups will introduce industrial investors in the early stages,” Xu Yinchuan said.

Foreign Giants Mergers and Acquisitions, Competition Intensifies

On the other side of the ocean, the semiconductor industry is witnessing a series of mergers and acquisitions.

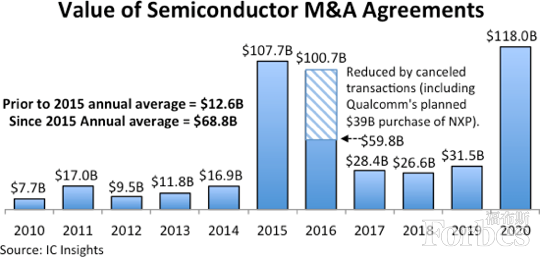

Following 2015, 2020 has also been a significant year for semiconductor mergers and acquisitions. According to IC Insights, the total value of global semiconductor acquisitions and mergers reached $118 billion this year, surpassing the $107.7 billion in 2015, setting a new historical record.

Statistics of Semiconductor Acquisition and Merger Values Over the Past DecadeData from Forbes

Statistics of Semiconductor Acquisition and Merger Values Over the Past DecadeData from Forbes

It is noteworthy that past semiconductor mergers and acquisitions mostly involved large companies acquiring smaller ones, but this year has seen many cases of large companies acquiring other large companies. The largest and most typical case this year was in July when US analog chip giant Analog Devices (ADI) acquired Maxim for $21 billion; in September, NVIDIA acquired ARM for $40 billion, marking the largest acquisition in the semiconductor industry in recent years.

October was the most active month for mergers and acquisitions, with AMD acquiring the world’s largest FPGA chip manufacturer Xilinx for $35 billion in an all-stock deal; Marvell announced it would acquire chip manufacturer Inphi for $10 billion in a “cash + stock” deal; and South Korea’s SK Hynix acquired Intel’s NAND flash memory business for $9 billion.

Mergers and acquisitions are not new in the semiconductor industry; for well-capitalized chip giants, the speed of self-research is too slow, and acquisitions are a shortcut to quickly consolidate technology in the short term. However, the concentration of large merger cases this year can be attributed to several factors: many chip manufacturers have seen significant stock price increases this year, making the acquisition targets more valuable, and the frequent actions of major US chip giants are also related to the Federal Reserve’s continued loose monetary policy following the outbreak of the pandemic.

From NVIDIA’s acquisition of ARM, AMD’s acquisition of Xilinx, and Marvell’s acquisition of Inphi, it is evident that with the explosion of high-performance computing and edge computing scenarios, heterogeneous computing through various chips has become mainstream, targeting rapidly growing markets such as data centers (IDC) and 5G infrastructure.

This poses a certain threat to Intel. However, the “king of chips” Intel appears to be quite quiet in 2020. In the processor sector, the ARM camp has gained support from Apple, while AMD and NVIDIA frequently release new products, leaving Intel struggling to keep up; in chip manufacturing, Intel is no longer focused on showcasing its capabilities, with reports suggesting it may outsource some advanced process tasks to TSMC, signaling a potential shift away from Intel’s IDM model; at the same time, Intel has been aggressively cutting unprofitable businesses, such as selling its NAND flash business to Hynix. The adjustments made by Intel, the giant, are all aimed at concentrating its efforts on transitioning from PCs to data centers.

Amidst the fervent wave of mergers and acquisitions, the global semiconductor industry’s landscape is undergoing a reshuffle. Under resource integration, we have already seen major players targeting the foundational aspects of new applications such as high-performance computing, edge computing, heterogeneous computing, AI, 5G, and autonomous driving. It can be predicted that after 2021, the cases of chip mergers and acquisitions will not cease, and the competition among foreign chip giants will intensify.

Foreign chip giants are accelerating mergers and acquisitions to grow into massive aircraft carriers, and for a long time, the global semiconductor industry will continue to be characterized by the strong getting stronger, while most small and medium-sized companies in the domestic chip sector are growing wildly under the benefits of domestic substitution. The expansion of large upstream manufacturers is also deepening their influence over downstream players. From a competitive perspective, this intense wave of mergers and acquisitions may not bode well for the domestic chip industry.

Moreover, the large-scale mergers and acquisitions that occurred in 2020 primarily came from general fields such as FPGA, processor IP, and high-end analog chips, which are all weak links in the domestic industry. In the face of the rapid industrial consolidation pushed by developed countries, the future of these specific sub-sectors may become more monopolized, and the risks of domestic companies being “choked” still exist.

Overall Price Increase, Capacity Adjustment

“Price increase” is another main theme of the chip market in the second half of 2020. The increasing demand from emerging applications such as smart electronics, automated vehicles, and 5G has already impacted the prices in the semiconductor supply chain.

The tightening capacity of 8-inch wafers has led to price increases, triggering a domino effect that gradually spread to materials, PCB boards, packaging and testing, as well as terminal chip manufacturers like MOSFET, IGBT, and MCU chips. By the beginning of 2021, according to incomplete statistics, at least 25 chip manufacturers had issued price increase announcements.

According to rough statistics from publicly available market information, the foundry price of 8-inch wafers has increased by 20%, packaging prices have risen by about 10%, and the delivery of various terminal chips such as driver chips, Wi-Fi chips, and MOSFETs has been delayed, with prices increasing by 10% to 20% to varying degrees.

The price increase reflects the imbalance between supply and demand in the semiconductor industry.

On the supply side, the demand for 8-inch wafers has been tight for several years, and total production capacity has remained stagnant. This is partly due to insufficient supply of second-hand equipment, which has limited the expansion progress of related manufacturers; on the other hand, the cost of adding new 8-inch capacity through new construction and expansion has increased, with recent costs being comparable to those at the beginning of this century. According to SEMI data, global spending on equipment for 8-inch wafer manufacturing was $2.682 billion in 2014, and spending related to 8-inch wafer manufacturing has declined year by year since then.

Demand and Supply Trends for 8-inch Silicon Wafers

Source: Dongfang Securities Research Institute

On the demand side, automotive, industrial, and smartphones are the main downstream applications for 8-inch wafers. The development of 5G, electric vehicles, and smart manufacturing has led to strong demand for non-advanced (mid-to-low-end) chips in areas such as FPGA, driver chips, fingerprint recognition, power management, MOSFETs, and microcontrollers (MCUs), resulting in a surge in demand for 8-inch wafers, leading to a supply shortage.

This imbalance in supply and demand has become particularly evident in the significant changes of 2020. In the first half of 2020, the COVID-19 pandemic imposed many restrictions on wafer capacity and logistics, while the global shift to remote work and online education significantly increased the shipment of laptops and tablets, driving up demand for mid-to-large-sized panel display driver ICs. By the second half of 2020, as the pandemic was brought under control, the automotive market, especially the new energy vehicle market, gradually recovered, leading to a substantial increase in the use of IGBTs and MOSFETs, which brought new increments to 8-inch wafer manufacturing. Additionally, orders that had been backlogged in the first half of the year were pushed into the second half, exacerbating the supply shortage and causing price increases to gradually transmit from upstream to downstream.

On the other hand, US sanctions have prompted domestic consumer electronics giants such as Huawei, OPPO, vivo, and Xiaomi to stockpile extensively, further squeezing production capacity.

8-inch wafer foundries have begun to screen new orders and adjust product mixes, prioritizing the production of high-margin products, while products with relatively low margins are at a disadvantage in the scramble for orders, and chip capacity is skewed towards large customers, putting smaller manufacturers under greater pressure in the competition for capacity.

“A new round of demand growth is gradually emerging, coupled with supply constraints caused by the pandemic, leading to a clear imbalance between supply and demand. We believe that shortages and price increases will persist at least until the first half of 2022,” said Wang Huadong, a partner at Matrix Partners China, in an interview with 36Kr.

Overall, the market conditions are unfavorable for the industry in the short term. Due to constraints on the semiconductor supply side, the pace of innovation at the terminal will inevitably slow down, impacting both demand release and consumer interests.

For startups, securing production capacity is a test for them, while for design companies that have already entered mass production, securing supply chain guarantees will provide opportunities for more procurement orders; without that, the impact will be significant.

For primary market investors, Wang Huadong stated: “The current market environment adds a layer of challenge to investments; compared to usual, we need to understand the changes happening in the industry more deeply.” Both Kong Lingguo, founder and managing partner of Helix Capital, and Li Wei, partner at Xiangfeng Investment, also expressed that they are paying more attention to whether companies can guarantee production capacity when evaluating projects.

In the long term, the growth and changes in downstream demand will ultimately transmit to upstream, prompting upstream manufacturers such as material suppliers, equipment manufacturers, wafer fabs, and packaging and testing companies to adjust their supply capabilities to adapt to demand changes, and even prepare in advance to meet future high-growth demands. These new adjustments also present opportunities for Chinese companies.

Policy Benefits, Moving Towards Rationality

In 2020, national support for the semiconductor industry has reached a new level, including the introduction of more comprehensive and detailed policies and the continued increase of the National Fund Phase II.

In August last year, the State Council issued the “Policies for Promoting High-Quality Development of the Integrated Circuit Industry and Software Industry in the New Era” (hereinafter referred to as the “Policy”). It is noteworthy that this policy, compared to previous policies, features more detailed provisions, broader coverage, a longer time span, and greater alignment with current integrated circuit regulations.

Domestic semiconductor companies have long faced difficulties such as financing challenges and a shortage of advanced talent; industry issues include insufficient software ecosystems, advanced processes lagging by 2-3 generations, and bottlenecks in advanced foundational software like EDA. The “Policy” provides policy guidance for these pain points. For example, the “Policy” mentions tax exemptions for companies producing 28nm-130nm processes for varying years, with more advanced processes receiving greater tax exemptions; it supports integrated circuit companies and foundational software companies to reorganize and merge according to market principles; encourages local government investment funds to invest and encourages such companies to broaden financing channels through pledging intellectual property; and promotes the establishment of integrated circuit primary disciplines.

If the above are all policy guidance and support that require cooperation from companies, industries, schools, enterprises, and local governments, then in 2020, the central government has once again launched the National Fund Phase II plan, providing real financial support for key projects.

The fundraising amount for the second phase of the National Fund exceeds 200 billion RMB, and since its launch in April, publicly invested projects include Unisoc, SMIC, Changxin Memory, Changchuan Technology, and Zhixin Micro, among others. The selection of the National Fund also serves as a barometer for various private and industrial capital investments, jointly driving the investment enthusiasm in the industry.

The clear stance and capital injection from national policies have led to a true explosive year for the semiconductor industry in 2020. However, amidst the excitement, many bubbles have also emerged in the industry.

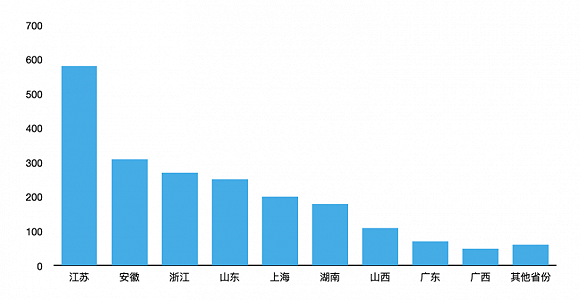

Various regions have shown great enthusiasm for integrated circuit companies, with numerous semiconductor projects being signed. According to incomplete statistics from Jiemian News, in the first half of 2020, over 140 semiconductor projects were launched across 21 provinces, with the total investment amount exceeding 307 billion RMB for projects that disclosed investment amounts. However, due to insufficient understanding of industry regulations, lack of top-level planning, and inadequate patent protection, many projects in the chip manufacturing industry faced abandonment in 2020.

Investment Amount of Semiconductor Projects Signed in Various Provinces in the First Half of 2020Statistics from CB Insights

Investment Amount of Semiconductor Projects Signed in Various Provinces in the First Half of 2020Statistics from CB Insights

The largest abandoned project in the chip manufacturing industry in 2020 was Wuhan Hongxin. This project initially claimed an investment of 100 billion RMB and even attracted TSMC’s second-in-command, Jiang Shangyi, to join, enjoying a moment of glory. However, in July, the local government revealed that the project faced a risk of funding collapse and has since been taken over by the government, causing an uproar in the industry.

At the national level, efforts are also being made to cool down local chip manufacturing enthusiasm. In October 2020, Meng Wei, spokesperson for the National Development and Reform Commission, proposed four directions to address the chip abandonment wave: strengthen planning and layout, improve the policy system, establish prevention mechanisms, and hold all parties accountable. Following the principle of “who supports, who is responsible,” local chip manufacturing fervor has received policy guidance for the first time.

This series of events indicates that the top-level design at the national level is becoming increasingly planned, and the entire industry is moving towards greater rationality, with heightened awareness of potential “bubbles.”

Future Focus: Demand and Domestic Substitution

Behind the heated surface, the gap between China’s semiconductor industry and the world’s leading level remains significant.

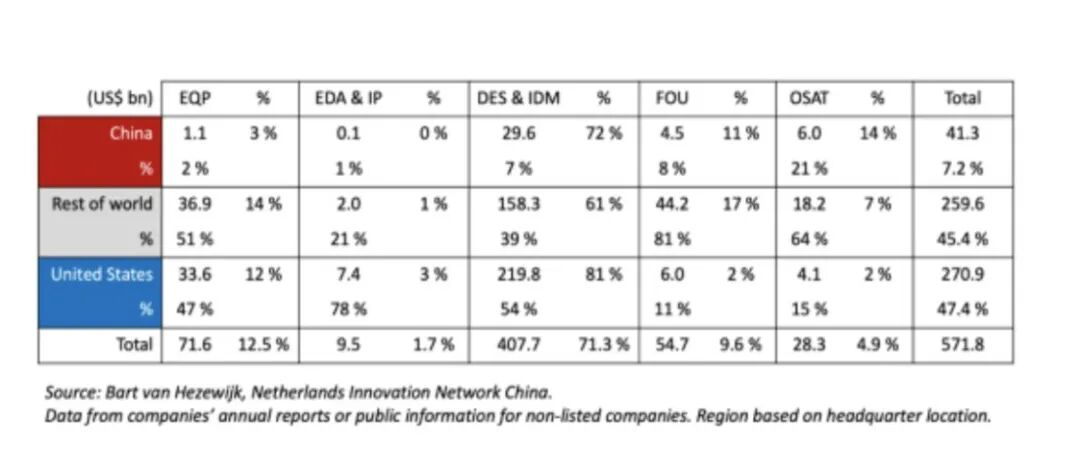

“Electronic Engineering World” has previously analyzed the differences between China and the US and other countries in five different parts of the semiconductor value chain: Equipment (EQP), Electronic Design Automation Software and Core Intellectual Property (EDA & IP), Design/Process & Integrated Device Manufacturers (DES and IDM), Wafer Foundry, and Outsourced Semiconductor Assembly and Testing (OSAT). The overall sales can reflect the strengths and weaknesses of China’s semiconductors in different segments.

From the data, US companies account for 47% of sales in all five sub-markets, companies from other parts of the world account for 45%, and Chinese companies account for only 7%. Among these five sub-markets, Design/Process & Integrated Device Manufacturers account for the highest sales, reaching 71%, while the sales share of Chinese companies is only 7%. In contrast, China has relatively strong capabilities in wafer foundry and outsourced semiconductor assembly and testing (OSAT), with a share of 21%.

Sales of Semiconductors by Segment and Region

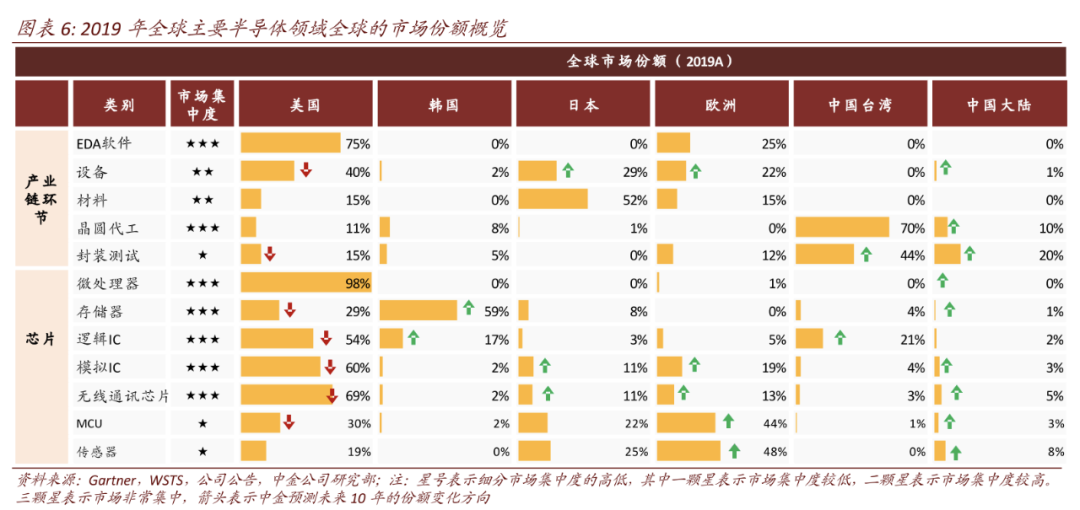

Sales of Semiconductors by Segment and Region Overview of Global Market Shares in Major Semiconductor Fields in 2019

Overview of Global Market Shares in Major Semiconductor Fields in 2019

It is evident that achieving the goal of “China’s chips must no longer rely on imports, and by 2025, the self-sufficiency rate of Chinese chips will reach 70%” remains a long and arduous journey.

There is a consensus in the industry: the global value chain of the semiconductor industry spans multiple fields, including equipment, materials, software, design, manufacturing, assembly, and testing, and has formed a relatively segmented and mature industry division of labor. It is impossible for a single country to achieve everything independently; identifying differential advantages and achieving self-controllable key technologies is the main theme of China’s semiconductor development.

Where are these opportunities? How to find them? These are two major questions facing participants in the semiconductor industry.

Based on interviews and research conducted by 36Kr in 2020 with startups and investment institutions, two approaches are provided here:

From the demand perspective, there are two major directions: one is to find significant growth points in demand, and the other is to identify spaces for domestic substitution.

Firstly, in terms of demand growth, there are already typical trends emerging, such as the intelligentization of automobiles, the proliferation of 5G leading to 4K/8K video, autonomous driving/vehicle networking, cloud gaming/VR/AR, remote collaboration, and the growing demand for wearable devices and high-precision positioning. As chips serve as the foundational infrastructure, they will experience substantial growth. Additionally, the semiconductor equipment and materials industry remains prosperous; according to SEMI data, the global semiconductor materials market grew by 2.2% from 2019 to 2020, while the global semiconductor equipment market grew by 16%, and this trend is expected to continue in the future.

The other key core lies in “domestic substitution.” “Domestic substitution” is the core strategy to address the “bottleneck” issue, emphasizing self-control to achieve supply chain security.

In 2020, we have already observed two new trends in “domestic substitution”: one is that the direction of domestic substitution is extending from specific chips in downstream applications to upstream foundational software tools, equipment, and materials; the other is that domestic substitution is no longer limited to “pin to pin” (i.e., complete IC replacement), but is leveraging advantages of being more familiar with and closer to Chinese customers to innovate and iterate faster, creating products that are more competitive than traditional manufacturers, thus beginning to replace in incremental markets.

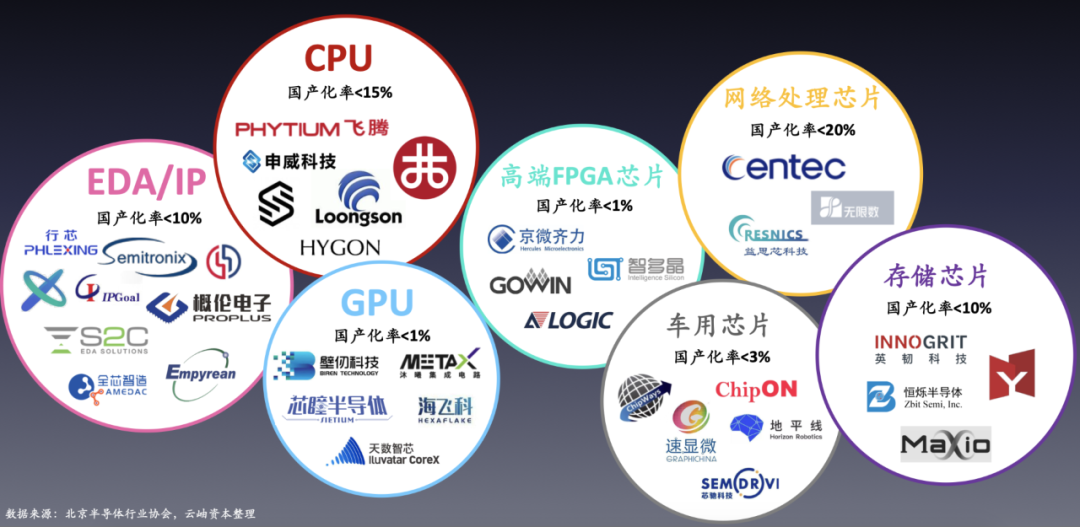

As the US gradually intensifies its restrictions, extending technology blockades upstream to areas such as EDA, semiconductor materials, and equipment, the demand for “domestic substitution” is also beginning to expand upstream and midstream, where the semiconductor upstream industry, often characterized by high barriers and heavy assets, is receiving significant attention and investment from capital and industry. Investors in the semiconductor industry are gradually reaching a consensus that “the lower the domestic substitution rate in the weak links, the greater the investment value.” Of course, this also implies higher investment risks and larger investment amounts.

Moreover, domestic substitution includes not only the replacement of existing markets but also the replacement of emerging incremental markets. Focusing on areas with low domestic substitution rates and major chips, such as EDA, IP, CPU, GPU, AI chips, automotive chips, storage chips, and FPGA, is a consensus among many investment institutions. Yunxiu Capital has compiled information on chip fields with low domestic substitution rates and representative companies for reference.

Source: Yunxiu Capital’s “2020 China Semiconductor Industry Investment Interpretation”

The second major approach is to focus on all potentially disruptive new technologies and the movement of high-level chip talent.

Disruptive technologies are often more likely to emerge in areas that are still in early development. For example, third-generation semiconductor materials, optical chips, storage-computing integrated chips, and quantum computing. Additionally, as the semiconductor industry faces increasing challenges in adhering to Moore’s Law, innovations that can break Moore’s Law are becoming increasingly important.

Furthermore, talent movement is also a barometer for the semiconductor industry. Talents in design, research and development, production, and application are often the first to sense and grasp the trends of industry innovation, and good semiconductor talent teams are also scarce, requiring investors and entrepreneurs to be vigilant in seeking them out.

Conclusion

“The high attention to the semiconductor industry in 2020 has also allowed us, who originally planned to work quietly, to feel the wind of the times,” said Kong Lingguo. In summary, the reasons for the hot investment in the semiconductor industry in 2020 can be attributed to the combination of “timing, location, and human harmony”:

Firstly, the various restrictions imposed by the US on China’s semiconductors have made the entire nation, from leadership to ordinary citizens, realize that the semiconductor industry is a “strategic weapon” that all countries must compete for, a strategic high ground in international competition that concerns national security and the lifeblood of the economy, making “domestic substitution” a necessity, and semiconductor entrepreneurs have received unprecedented support and opportunities.

Secondly, the rapidly growing demand for chip applications has also provided opportunities for the growth of domestic semiconductor companies. “Opportunities and demand growth” is also the keyword for semiconductor investment in 2020 given by Wang Huadong of Matrix Partners China, who cited the automotive market as an example, where the upgrade to intelligent/electric vehicles will transform a market of nearly $3 trillion, increasing semiconductor demand from $30 billion to $80-100 billion. Coupled with the development of 5G, the Internet of Things, and artificial intelligence, the semiconductor market is expected to grow rapidly. Kong Lingguo also predicts that in the coming years, the semiconductor industry will enter a super cycle, with the market size exceeding $1 trillion.

On the human side, not only has the domestic semiconductor industry developed over more than 40 years, cultivating a group of excellent engineers and establishing a certain industrial foundation, but also an increasing number of overseas talents have seen opportunities in the domestic market, bringing advanced technologies and experiences back to start their own businesses, providing more quality investment targets for the capital market. Additionally, the launch of the Sci-Tech Innovation Board has also provided a closed loop for semiconductor investment exits. At the same time, every segment of the semiconductor industry has high technical barriers, and in the future, there will also be numerous opportunities for mergers and acquisitions in the industry consolidation, which gives capital investing in the semiconductor industry more confidence.

The hot scene of 2020 may not necessarily continue for the long term, but it is certain that the profound changes in China’s semiconductor industry chain will continue. The development of this transformation will inevitably be rooted in future demand and based on self-control, continuously improving and comprehensively. As the third industrial specialization takes place, coupled with the rapid iteration of technology and the unavoidable impact of geopolitical factors, China’s semiconductor industry is bound to have a profound impact on the global semiconductor landscape, potentially forming a unique industrial cluster with Chinese characteristics.

However, “the road ahead is long and winding.” Looking back at history, TSMC took 40 years to break the IDM model and achieve the highest market value globally; Samsung’s lead in memory chips is the result of over 20 years of collaboration among 3,500 specialized engineers. Technological breakthroughs are not easy, talent cultivation takes time, and application validation is increasingly stringent. The semiconductor industry involves many links, has high barriers, requires significant investment, and offers slow returns; the gaps and shortcomings cannot be ignored. The development of China’s semiconductor industry requires patience and persistence.

Looking ahead, demand-driven, capital-supported, policy-encouraged, and talent returning will all push China’s semiconductor industry to a new level. The year 2020 will undoubtedly be a significant turning point in this process.

Share, Like, and Follow 👇Turning Point Year