If there were no MCU, we would not deserve to be called “modern people”.

MCU is not the Marvel Cinematic Universe. As a necessity for modern life, MCU (Microcontroller Unit, 微控制单元, also known as single-chip microcontroller) has long been integrated into human production and life, and is ubiquitous. Air conditioners, remote controls, smart chargers… basically any electronic product that requires automation will be equipped with an MCU. Various household appliances usually require at least one, while complex industrial equipment or cars may use dozens to hundreds of them. They carry the small functions you take for granted: adjusting temperature, remote locking, selecting washing machine modes, and so on. Without the MCU, electronic products would lack a “heart”, making them impossible to produce or sell.

This article is the first in the “Domestic Replacement” series planned by “Guokel Hard Technology”, focusing on the domestic replacement of MCUs. In this article, you will learn about: the classification and market overview of MCUs; the opportunities and challenges faced by Chinese manufacturers during the chip shortage.

Fu Bin | Author

Li Tuo, Liu Dongyu | Editors

Guokel Hard Technology Team | Planner

“Chip shortage” has been a hot topic since the pandemic, and MCUs are not only a “hard-hit area” for shortages but also have seen the most outrageous price increases.

For example, starting in October 2020, the STM32F103RET6, which normally costs about 10 yuan per piece, skyrocketed, reaching a peak price of 400 yuan per piece in July 2021, an increase of nearly 40 times. This model of MCU was used in a certain brand of shared bicycles and was even dismantled by vendors and sold at a low price of 40 yuan per piece.[1] We found that most distributors currently have zero inventory, and those with stock are still quoting around 200 yuan per piece.

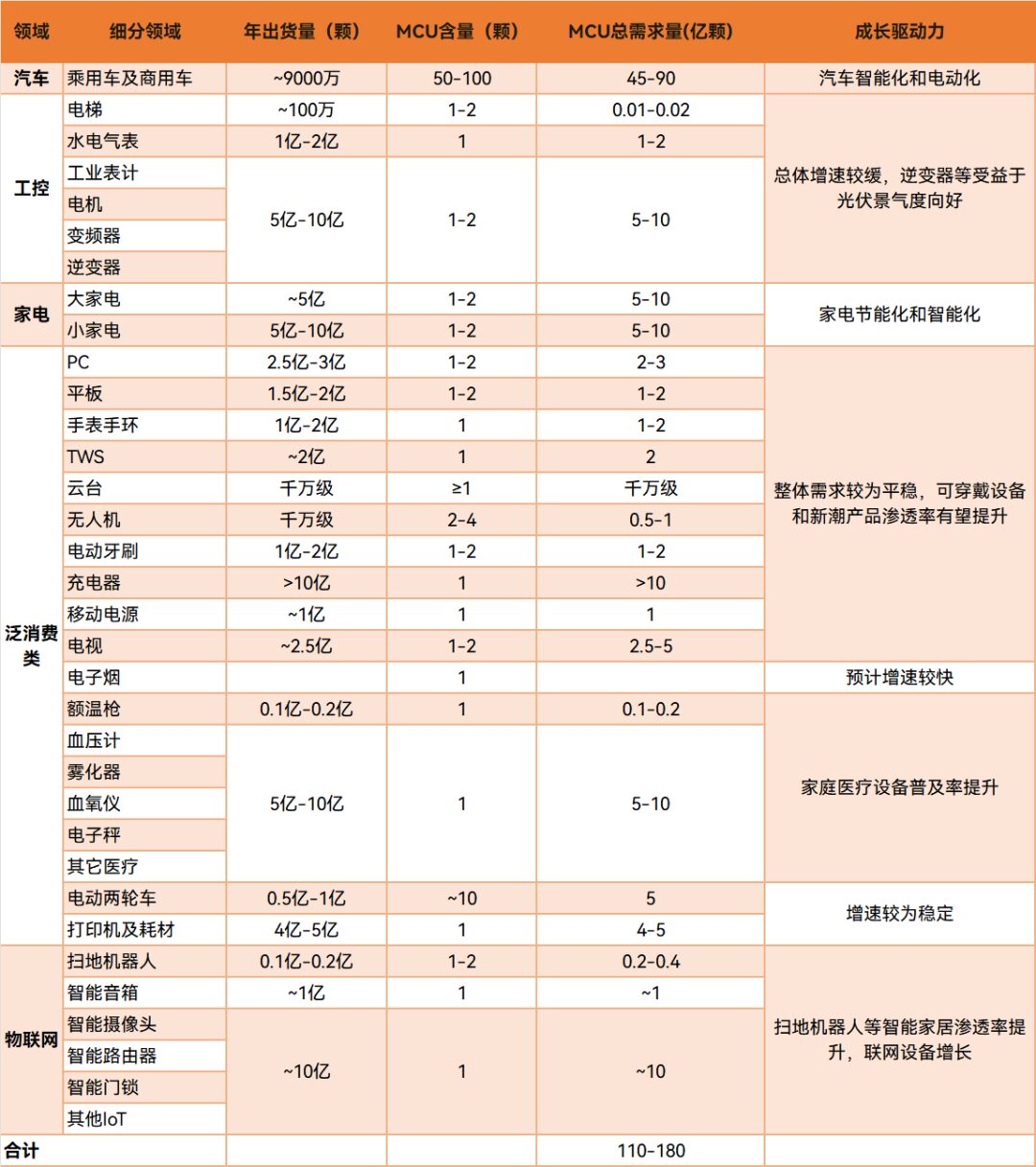

Global MCU application area shipment volume breakdown and market overview

Table created by | Guokel Hard Technology

Image source | Company websites, China Merchants Securities, AI Electric Hall

According to Deloitte’s forecast, many types of chips will still face shortages during 2022, and the shortage will last for 24 months before easing, similar to the chip shortage situation from 2008 to 2009.[2] However, amid the shortages, the demand for MCUs has increased rather than decreased. According to industry research firm ResearchAndMarkets, global MCU shipments exceeded 28 billion pieces in 2020.[3]

Now is the right time to introduce domestic MCUs. Amid shortages and price increases, where are the opportunities for domestic MCUs?

Opportunities in the “Window Period” for Domestic MCUs

An MCU chip integrates a central processing unit, random access memory, read-only memory, and other functions, equivalent to a microcomputer. It is fully functional, has strong control capabilities, strong anti-interference, small size, low power consumption, and low cost, making it a “darling” of the electronic age.[4] Through software control, MCUs can replace complex electronic circuit control systems, achieving intelligent and lightweight control. In addition, MCUs are also one of the typical processors in embedded systems.

Therefore, MCUs can be widely used in various electronic products,[5] industrial control, motor control, smart cities, smart metering, smart home appliances, smart locks/access control, medical, battery and energy management, biometric recognition, optical communication, sensor control, and robotics… It can be said that MCUs are the “universal key” for all scenarios requiring control, with downstream applications permeating various industries.

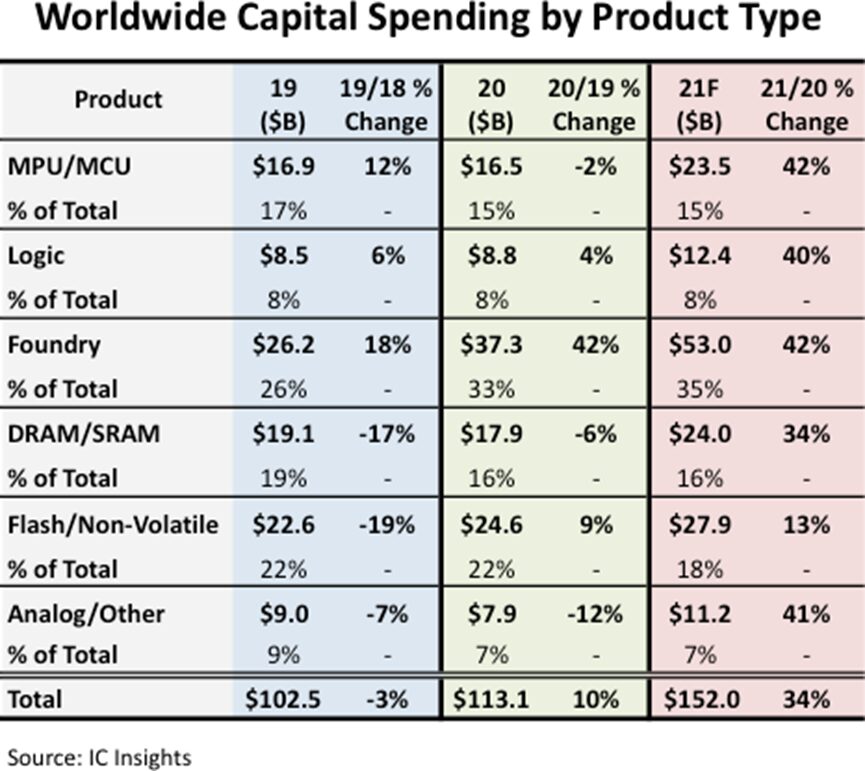

With the rise of the Internet of Things, vehicle networking, 5G, and new types of office under the pandemic, the MCU market that can be applied in various scenarios is gradually expanding. IC Insights’ latest forecast shows that global semiconductor capital expenditure is expected to reach $152 billion in 2021, a 34% increase, the largest percentage increase since a 41% growth in 2017. Among them, the spending in the foundry and MPU/MCU sectors saw the largest year-on-year increase of 42%.[6] Senior consultant Chi Xian Nian from the IC Consulting Center predicts that MCUs will see significant growth in 2021, with the global market size expected to reach $22.9 billion by 2025, with a compound annual growth rate of 8% from 2020 to 2025.[7]

2021 Semiconductor Capital Expenditure, Image source | IC Insights

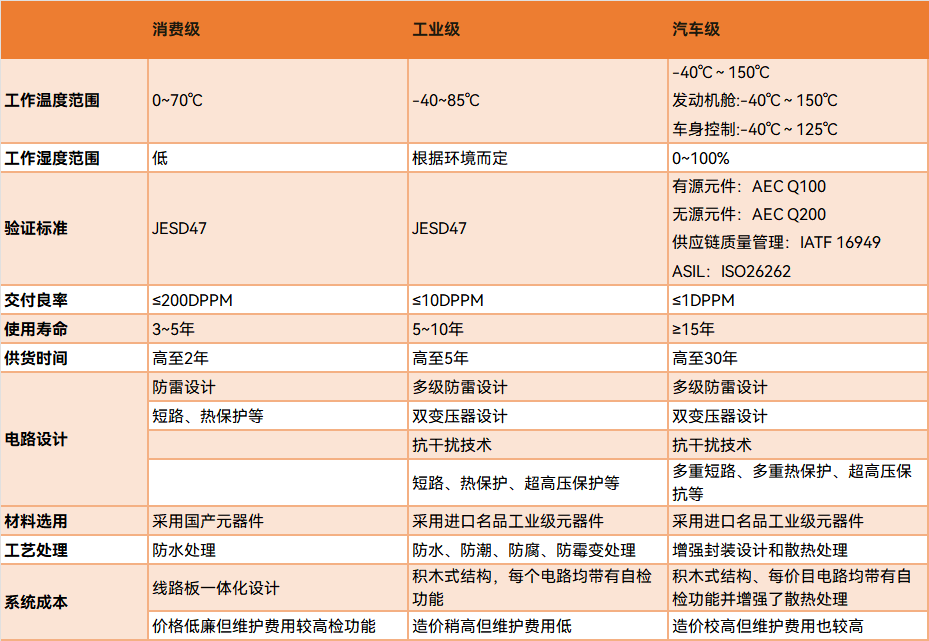

Currently, MCUs are divided into consumer-grade MCUs, industrial-grade MCUs, and automotive-grade MCUs based on different indicators. The yield requirements for different MCUs vary. Among them, consumer-grade MCUs focus on power consumption and cost, industrial-grade MCUs focus on balancing performance, power consumption, cost, and reliability, while automotive-grade MCUs emphasize safety and reliability.

The requirements for MCUs become increasingly strict from consumer to industrial to automotive fields, and the production lines are becoming more advanced, which is a key reason why automotive MCUs are the hardest to produce.

The delivery yield of consumer-grade MCUs is generally ≤200 DPPM (DPPM: defects per million), while the delivery yield of automotive-grade MCUs needs to reach ≤1 DPPM, meaning that at most one defective product can be found among a million devices, and the lifespan of automotive MCUs often exceeds 15 years, with extremely high reliability requirements. In addition, automotive-grade MCUs operate in harsh environments, usually requiring the ability to withstand operating temperatures of -40℃ to 125℃, and in engine compartments, temperature resistance capabilities may need to reach as high as 150℃.

Comparison of evaluation indicators for consumer, industrial, and automotive-grade chips

Table created by | Guokel Hard Technology

Data source | Xilinx Communication, Electronic Enthusiast Network, Zhihu, Minsheng Securities Research Institute, Chip Domestic Replacement

Therefore, many domestic companies start from consumer-grade and industrial-grade MCUs, gradually moving into automotive-grade MCUs. A person from the MCU division of Huada Semiconductor (now “Xiao Hua Semiconductor”) once told the author that the company will build four major product lines: ultra-low power consumption, general control, motor control, and automotive electronics, gradually deepening, with automotive MCUs as the company’s “highest step” to achieve “full bloom”.

According to a report from Minsheng Securities, the MCU market has long been dominated by seven overseas MCU giants: ST, NXP, Microchip, Renesas, Infineon, TI, and Cypress, which account for more than 75% of the market share, while China’s MCU market accounts for about 23% of the global market, with particularly low self-sufficiency in the high-end market.[8]

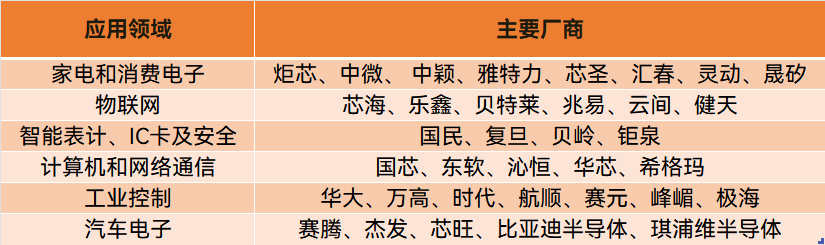

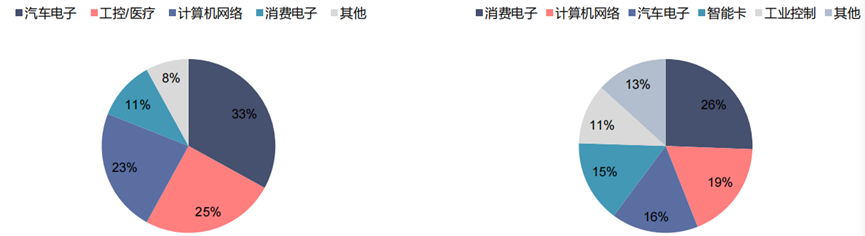

Domestic MCUs are the industry’s followers, which is also reflected in the distribution of applications between domestic and foreign MCUs. In the global MCU market, automotive electronics account for 33%, making it the largest market, followed by industrial control/medical, computer networks, and consumer electronics. In contrast, the consumer electronics sector accounts for the highest proportion in China’s MCU market, reaching 26%, with automotive and industrial MCUs ranking second and third.[9]

Global MCU downstream market application share & China MCU application market share

Image source | Cinda Securities Research Center

Main manufacturers of domestic MCUs in various fields

Image source | ASPENCORE

However, it is worth noting that in recent years, the domestic market has seen significant growth. Data shows that from 2013 to 2018, the domestic MCU market had a CAGR of 10.9%, far exceeding the global growth rate of 4.5% during the same period. According to IHS data, the scale of China’s MCU market is expected to reach 26.88 billion yuan in 2020, with a CAGR of 8.99% from 2020 to 2022.

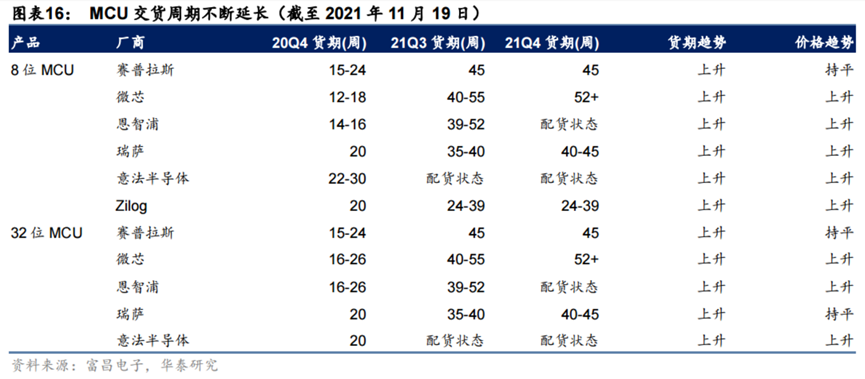

During the chip shortage, the delivery cycles of the seven major overseas giants have all shown an upward trend, and some companies face a long-term lack of goods, which has become a “window period” for introducing domestic products. Industry insiders have told the author that although a small chip may seem insignificant, it affects the entire product delivery schedule. Some car manufacturers are unable to deliver complete vehicles due to the lack of the “micro brain” MCU.

The delivery cycles of MCUs continue to extend, Image source | Huatai Research Institute[10]

Many engineers have also told the author that their companies had long relied on foreign products and had no motivation to switch, but during this round of chip shortages, companies began to encourage engineers to implement parallel replacements for MCU products.

During the “window period,” there is a large market for consumer-grade, industrial-grade, and automotive-grade MCUs, and opportunities for domestic MCU manufacturers have arrived.

Domestic MCU’s “Siege”

In the second half of 2021, the “MCU shortage” became increasingly severe, but demand did not decrease. Silicon Labs’ CTO Daniel Cooley recently stated that by 2023, global MCU shipments are expected to reach 30 billion pieces, with no signs of slowing down.

Domestic manufacturers realized the huge entry opportunity early on, accelerating R&D and investment from consumer-grade to industrial and automotive-grade MCUs. This has given rise to many emerging enterprises, while long-established companies in the market have begun to use investment and financing to consolidate their positions, creating a “market rush” atmosphere.

In this wave, different companies have different strategies; some specialize in the automotive field, some shout “I want it all,” and some take alternative paths by adopting RISC-V or developing proprietary IP. From the perspective of downstream application markets, consumer-grade, industrial-grade, and automotive-grade MCUs all have different “breakthrough” focuses.

MCU-related companies’ investment and financing situation in the second half of 2021;

Table created by | Guokel Hard Technology, Data source | Official public information

Consumer-grade MCUs: Market Driven by Smart Devices

Domestic MCUs mainly started in consumer electronics, and the consumer market share is also quite considerable. However, according to multiple media reports and company statements, domestic consumer-grade MCUs are currently competing on price to gain customers.

With the rise of the Internet of Things, smart home appliances and wearable devices have become the key to the growth of the consumer-grade MCU market, and the diversification of functions will inevitably lead to an increase in the number of MCUs used.

Smart home appliances are divided into major appliances and small appliances. Major appliances include air conditioners, refrigerators, washing machines, and other white goods, as well as speakers and home theaters, while small appliances mainly refer to household appliances aimed at home and kitchen applications, including soy milk makers, blenders, induction cookers, fans, hair dryers, and other daily appliances.

White goods and small appliances are the key to the consumer market’s MCU breakthrough. According to China Merchants Securities, the overall scale of household appliance MCUs in China is about 5 billion yuan, of which white goods MCUs account for about 2.5 to 3 billion yuan, while small appliance MCUs account for about 2 billion yuan. The shipment volume of major appliances is expected to grow relatively limited in the future, but the upgrade to smart and variable frequency is expected to increase MCU demand; the small appliance market scale continues to grow, with smartization bringing about an increase in both volume and price for small appliance MCUs.[11]

For example, Midea’s data shows that the number of MCUs required for smart variable-frequency refrigerators has increased by more than five. The addition of advanced features such as temperature control, Wi-Fi connectivity, and smart displays increases the number of MCUs in appliances, driving the upgrade of consumer-grade MCUs from 8-bit to 32-bit. However, faced with clear market expectations and cost control requirements, white goods manufacturers often choose to develop their own MCUs. According to statistics from “Aijimi”, brands such as Midea, Gree, Haier, and Galanz all have MCUs or chips in production or under research.[12]#It is not necessarily high-end 5nm SoCs to say chip production#

In addition, fields such as smartphones, tablets, computers, and wearable devices also provide space for the growth of the domestic MCU market. For example, Apple phones are equipped with an STM32 to support NFC functionality, smartwatches and smart bands typically come with a low-power MCU for communication and sensing, and the rapidly increasing penetration of true wireless earbuds requires their charging cases to be equipped with an MCU as the main control chip.[13]

Industrial-grade MCUs: A Relatively “Grinding” Path

Industrial-grade MCUs have always held an important position. The extensive application of industrial robots, stepper motors, robotic arms, instruments, industrial motors, industrial diesel engines, ventilator systems, energy gateways, motor drives, and meters has made the industrial-grade MCU market vast.

MCUs in industry mainly achieve variable speed control, collect signals, transmit data, and execute complex high-speed calculations. Driven by the industrial Internet of Things, many domestic companies have begun to expand their production lines, continuously launching low-power new products or specialized products.

However, industrial-grade MCUs are a difficult and slow path. On the one hand, they require higher anti-static capabilities, surge voltage, surge current capabilities, working temperature range, and lifespan; on the other hand, they require higher real-time processing capabilities and functional safety. Various pressures lead to a very “grinding” chip R&D process, testing the technical accumulation of the team.

Liang Lei, Technical Market Director of Fudan Microelectronics’ Power Electronics Division, explained that industrial MCU chips generally have a lifecycle of 10 to 15 years, and iterations are not as rapid as consumer-grade MCUs, and they are very cautious in core component replacements. The slow-track business is not easy to operate; product introduction takes longer than consumer-grade MCUs, and relatively higher R&D investment requires companies to “be patient” and focus on R&D.

According to data from the Qianzhan Industry Research Institute, since 2015, the market for industrial control MCUs has shown a fluctuating upward trend, with demand for MCU products in industrial control reaching 2.6 billion yuan in 2020, and the Chinese industrial control MCU market size is expected to reach about 3.5 billion yuan by 2026.[14]

Automotive-grade MCUs: Gradually Transitioning from Low-end to Mid-to-High-end

Recently, there has been a strong “rush to get on board” in the entire MCU circle. Due to supply-demand relationships, the shortage of automotive-grade MCUs will not be significantly alleviated in the short term, while the demand for automotive-grade MCUs continues to rise, making it a good time for domestic manufacturers to enter. JW Insights predicts that due to the increasing application ratio of higher-priced 32-bit MCUs, the automotive MCU market size will continue to grow, expected to rise from the current $5.916 billion to $8.878 billion by 2024.[15]

“Whoever gets the automotive-grade MCUs will dominate the world” seems to have become the motto of enterprises. Products that can meet the high safety standards of automotive applications must have extremely high safety and reliability. However, it is regrettable that high-end automotive MCUs are still dominated by overseas giants, with a market share exceeding 95%. In the global automotive MCU market in 2020, the combined market share of the five major manufacturers Renesas, NXP, Infineon, TI, and Microchip reached 86.6%.[16] Currently, only a few domestic manufacturers have automotive-grade MCUs, but this also means greater development space.

“Automotive-grade MCUs have extremely high barriers in product definition, design, and technical thresholds, not only needing to meet the complex indicator requirements of stability, safety, and reliability in ISO 26262 certification but also requiring substantial investment, making it difficult to achieve profitability in the short term.” Wang Chao, Technical Market Manager of Fudan Microelectronics’ Power Electronics Division, stated that in 2021, many automotive manufacturers or component manufacturers provided window periods for MCU companies, which presents both challenges and opportunities for domestic MCU manufacturers. How to smoothly push products to complete vehicles during the “window period” and improve future market share are both worthy of consideration.

Public information shows that there are 10 domestic manufacturers (including 5 listed companies and 5 unlisted) that have entered the automotive MCU field, including BYD Electronics, Jiefa Technology, Chipone Technology, Guoxin Technology, Chipsea Technology, GigaDevice, Beijing Junzheng, Unisoc, Zhongying Electronics, and Fudan Microelectronics. Among them, BYD Semiconductor, Saiteng Microelectronics, and Fudan Microelectronics have already mass-produced automotive-grade MCUs, while GigaDevice, Guoxin Technology, and Chipsea Technology are in the customer introduction period.

On December 8, 2021, Fudan Microelectronics released its first MCU chip that passed the AEC-Q assessment; on December 24, 2021, Chipsea Technology announced its refinancing layout for automotive MCU chips; on December 27, 2021, automotive chip company Qixin Microelectronics announced the completion of a new round of financing, with Xiaomi and SAIC entering the scene; on December 28, 2021, automotive electronic MCU company Chipone Microelectronics announced the completion of several hundred million yuan in Series C financing.

Different types of automotive MCUs are generally initiated by new domestic players in areas related to body and interior environment control, gradually moving into battery management systems, automotive lighting, and advanced driver assistance systems. For example, Fudan Microelectronics’ latest released FM33 LG0xxA is primarily used for ETC, windows, car lights, steering wheels, alarms, and window lifts.

“We hope that every car we drive in the future is equipped with domestic chips; this is our goal. We find that domestic chips are not inferior at all; it’s just that everyone has not truly explored them yet,” said Zhai Jingang, Senior Engineer and Assistant General Manager of the Power Electronics Division at Fudan Microelectronics.

Domestic MCU’s “Involution”

As more and more entrants emerge, competition in the domestic MCU market is becoming increasingly fierce, and the “involution” phenomenon is gradually taking shape, with each having its own characteristics…

Full Production Line is Necessary: Can Do Without, But Cannot Be Lacking

In terms of bit size, MCUs include 4-bit, 8-bit, 16-bit, and 32-bit. Currently, 62% of products use 32-bit products, 23% use 16-bit products, and 15% use 4/8-bit products. As system tasks become increasingly complex, the demand for computing power is rising, prompting MCUs to fully enter the 32-bit era. However, for applications that require simple functions and lower code volumes, products with “8 legs” or “16 legs” are still needed.

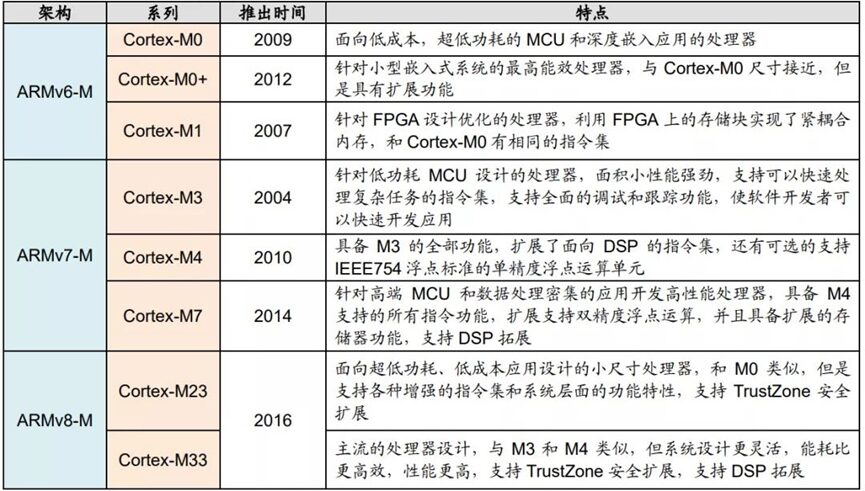

In terms of kernels, the current landscape is divided among Arm, RISC-V, and domestically developed IP. Currently, Arm cores are mainstream, with most being from the Cortex-M series. After visiting companies like Guomin Technology, Hangshun, GigaDevice, Huada Semiconductor, and Qinheng Microelectronics, it was found that domestic MCU companies have a complete product line of Cortex-M0/M0+/M3/M4/M7/M23/M33, allowing users to choose flexibly. The core directly determines the MCU’s performance, power consumption, storage size, etc., and a more complete core can correspond to different solutions.

Introduction to Arm Cortex-M series, Image source | Arm official website, China Merchants Securities

In order to meet more differentiated demands in segmented fields, manufacturers are increasingly investing in new architectures. Currently, Hangshun, GigaDevice, and Qinheng Microelectronics have all laid out RISC-V architecture, realizing RISC-V single-core or RISC-V + Arm dual-core product lines; Chipone’s self-developed kernel KungFu is a leader in self-developed architecture, with no chip IP authorization issues, which is one of its main advantages.

In terms of application fields, domestic manufacturers pursue more generality, striving for broader application fields. “As a general MCU, our market goal is ‘full bloom’, able to perform best in any field,” Guomin Technology has stated.

To “slice” different markets, domestic manufacturers’ strategic layout has been continuously expanding. Since MCUs can be used everywhere, they need to have “tall, short, fat, and thin” varieties. Coupled with the “market rush” phenomenon, companies must constantly broaden their production lines, gradually penetrating the mid-to-low-end market after establishing a good reputation in the low-end market.

Low Power Consumption is Essential: The Foundation of Design, the Pattern is Opened

In the consumer electronics field, wearable devices, smart home appliances, and other battery-powered IoT terminals have strict power consumption requirements. Only with longer standby times can they capture consumers’ hearts, while the number of functions that products need to achieve is increasing, leaving little power for MCUs to use.

In fact, the power consumption of MCUs also has rankings similar to mobile phone scores. The Embedded Microprocessor Benchmark Consortium (EEMBC) proposed two versions of the ULPMark standard to provide developers with reliable and reasonable methods for measuring microcontroller efficiency, and the corresponding scores are also uploaded to EEMBC’s ULPMark score list.

Generally speaking, the core directly determines the overall power consumption, and in the MCU field, “sub-threshold circuit” designs are also adopted to reduce power consumption. This design lowers the chip’s operating voltage to near the transistor threshold, thereby reducing static leakage and dynamic power consumption.

MCU power consumption is divided into static leakage and dynamic power consumption. To reduce leakage, power supply voltage can be lowered, and low-leakage standard cell designs can be used; for dynamic power consumption, power supply voltage can be lowered or unnecessary circuit transitions can be reduced to lower power consumption.

Integration and main frequency are also major ways for MCU manufacturers to control power consumption. Domestic manufacturers are “doing everything possible” to minimize power consumption, and this data still needs to be improved.

Strong Compatibility is a Must: Plug and Play, Easier to Replace

Under the enormous market attractiveness, domestic manufacturers generally adopt a Pin to Pin (pin-to-pin) approach to facilitate downstream users to switch from foreign products to their own products more quickly. Compatibility directly affects whether customers can quickly replace foreign products; different manufacturers have different choices.

Here, “compatibility” means the more similar the substitute is to mature foreign MCUs, the easier it is to replace. Domestic MCUs have four types of compatibility: fully compatible, hardware compatible, basically compatible, and incompatible.

To quickly onboard customers, the market may see some products that are fully compatible with hardware and registers, requiring no code changes, and directly allowing source code to work after burning, but these fully compatible products have neither thresholds nor characteristics, and “register-level” imitation also carries risks of infringing on others’ intellectual property; hardware compatibility means that power, clock, and reset are basically consistent, but registers are slightly adjusted; basic compatibility means that registers are not compatible, with some pins of clock, reset, and power being inconsistent, requiring customers to redesign the circuit board; incompatibility means that the MCU has distinctive features overall, but user design difficulty is high.

In the favorable market situation, media outlets have pointed out that in order to quickly penetrate the market and make quick profits, some companies produce fully compatible register products, using price advantages to survive. This has led to “price involution,” causing the prices of MCUs in the market to continue to decline, resulting in no profits for anyone.

However, regardless, the compatibility with foreign products is bound to be the first factor customers consider; whether to maintain individuality or follow the trend is a question.[17]

Problems with Domestic MCUs

Many first-line embedded engineers have revealed to the author that as soon as signs of chip shortages appear, their companies launch domestic replacement plans, requiring engineers to test the replacement effects of various MCUs; some companies only “scramble for solutions” when their products run out.

Regardless of the situation, after extensive testing, many replacement MCUs still have certain issues, leading to the domestic replacement plans being shelved or even abandoned.

Replacement Has Costs, Loving You Is Very Difficult

An embedded engineer who has been on the front line for many years stated that company performance is directly linked to projects, and the actual time given to engineers to find replacement MCUs is very short. For a domestic MCU to be “picked”, factors such as the developers’ familiarity, ease of development, and development duration need to be considered. “Product managers will consider whether developers can quickly complete development during the product selection phase. If the development cycle is too long, even if the MCU is abundant and cost-effective, it will face the fate of being passed over,” he explained.

Although many domestic MCUs were designed with the goal of replacement and compatibility from the outset, often engineers report issues during program execution, such as failing to run, running incorrectly, or being rigid.

During the development process, engineers encounter many complex issues, which greatly affect the development progress; at the same time, the costs of replacement rise sharply.

After-sales Resistance, I Love You, You Don’t Love Me

-

“After-sales calls are always unreachable; even if they are connected, they will always attribute the problem to the engineers themselves.”

-

“Domestic MCUs only emphasize promotion, but after-sales service is lagging, and even simple technical support is lacking.”

-

“Some bugs are not known how to solve even by technical support.”

-

“The richness of materials is quite different from that of foreign giants, but fortunately, the essentials are there, and what is lacking can often be supplemented if mentioned.”

Some engineers have listed a series of after-sales problems with domestic MCU manufacturers.

Of course, some engineers hold different views, believing that domestic products are of very good quality and that they have never encountered after-sales issues. Moreover, foreign brands do not necessarily guarantee humane after-sales service.

“The attitude of after-sales service may also relate to how much the customer is willing to purchase; if a large customer can purchase thousands at once, the service will undoubtedly be smooth, but if it is an individual developer or small-batch user, it may not be the case,” said a senior MCU designer.

Development Difficulties, Problems with No Documentation

The issue of development documentation is the most serious problem reported by engineers. “For brands like ST, even if after-sales does not respond, we can find a lot of resources online, including development documentation and experiences from predecessors. However, domestic MCUs are still relatively ‘young’, and many issues cannot be found online. Being squeezed by foreign brands for a long time, the available resources are limited, greatly increasing our development difficulty,” some engineers have stated.

Some engineers also indicated that the existing documentation for domestic MCUs often contains errors in labeling and unclear explanations, greatly increasing development difficulty and indirectly affecting development cycles; many engineers have thus missed the opportunity to “develop a long-term relationship” with domestic MCUs.

“Foreign giants like ST have been deeply rooted in China for many years, with some embedded educators including foreign products in their teaching materials or books, even translating English manuals into Chinese to help beginners quickly learn during the learning phase and achieve a sense of accomplishment. This undoubtedly creates a positive cycle.” This practitioner emphasized that domestic MCU products do not even have Chinese manuals, let alone video tutorials.

Market Fluctuations, Supply-Demand Conflicts, and Price Differences

Although the chip shortage has become an important “window period” for domestic products, domestic manufacturers cannot escape the fate of being affected by upstream fluctuations. Geopolitical friction, the pandemic, and natural disasters have led to international logistics disruptions, affecting raw material supply and packaging testing capacities, which will impact MCU deliveries.

Amid the chip shortage, panic stocking by terminals has led to a severe shortage of 8-inch wafer capacity, exacerbating the extension of MCU manufacturers’ delivery times. Currently, the MCU shortage situation in the consumer market has slightly eased, but industry insiders remain pessimistic about the market, indicating that the MCU shortage in the automotive market may continue until the second half of 2022, all of which directly lead to significant market fluctuations.

Previously, some spot traders and merchants hoarded goods and raised prices, causing some popular products’ prices to increase by more than ten times, creating extremely negative impacts on the market. As the market rises, domestic manufacturers once exhibited “low-price order grabbing,” leading to increased price fluctuations.

The chip shortage is both a crisis and an opportunity. Numerous MCU companies have emerged, and in this wave, the industry will undoubtedly witness a new round of survival of the fittest and reshuffling.

References:

[1] Xinshi Xiang. “If it keeps rising, ST may be cutting off its own path!” 2021.11.19.

https://mp.weixin.qq.com/s/MFxfCYZm0HLhPn784YowcQ

[2] Deloitte. “A Chip is Hard to Find: Semiconductor Shortages Will Continue in 2022.” 2021.12.16.

https://www2.deloitte.com/cn/zh/pages/technology-media-and-telecommunications/articles/tmt-predictions-2022-my-kingdom-for-a-chip.html.

[3] Researchandmarkets: Global Microcontroller Market Size, Share & Trends Analysis Report 2021-2028 – ResearchAndMarkets.com. 2021.10.13

https://www.businesswire.com/news/home/20211013005793/en/Global-Microcontroller-Market-Size-Share-Trends-Analysis-Report-2021-2028—ResearchAndMarkets.com

[4] Tong Yan, Zhou Yuanchao, Guo Jian, Liu Xiaohai, Chi Yahui. “Applications of Microcontrollers in Electronic Technology” [J]. Shandong Industrial Technology, 2019, 05.

[5] Minsheng Securities Research Institute. “Semiconductor Series Report: MCU Shortage Accelerates Domestic Replacement Process, Local Manufacturers Welcome Development Opportunities.” 2021.07.23

[6] IC insights. “Semi Capex on Pace for 34% Growth in 2021 to Record $152.0 Billion.” 2021.12.14.

Semi Capex On Pace For 34 Growth In 2021 To Record 1520 Billion

[7] China Electronics News: “MCUs are structurally short; hot spots are clear.” 2021.12.24.

http://www.cena.com.cn/semi/20211224/114584.html

[8] Caidi Network. “Domestic MCUs Welcome Market Window Period.” 2021.12.14.

http://news.ccidnet.com/2021/1224/10579783.shtml

[9] Caidi Network. “Automotive MCUs Have the Greatest Growth Potential.” 2021.12.27.

http://news.ccidnet.com/2021/1227/10579864.shtml

[10] Huatai Securities. “First Coverage: MCU and Storage Business Drive Performance Growth.” 2021.12.16

[11] China Merchants Securities. “Zhongying Electronics Special Report: Domestic Household Appliance MCU Leader, DDIC + BMIC Accelerates Volume.” 2021.10.23.

[12] Jimi Network. “The Nine Major Household Appliance Giants in China Rush In, the Household Appliance ‘Chip’ War Reignites”

https://laoyaoba.com/n/778482

[13] AI Electric Hall. “The Wave of Domesticization After MCU Shortages and Price Increases (I): MCU Demand Diversification, Automotive and IoT Leading Future Growth.” 2021.09.14.

https://mp.weixin.qq.com/s/KxCxAWJI5ySPLlcsAgQDsQ

[14] Qianzhan Industry Research Institute: “2021 China MCU Industry Application Market Status and Development Prospects Analysis, Industrial Control MCU Market Size Expected to Reach About 3.5 Billion Yuan.”

https://www.qianzhan.com/analyst/detail/220/211022-b78fa58a.html

[15] Jimi Consulting: “The Rise of Automotive-grade Semiconductors to the Billion-Dollar Level, IGBT is in Short Supply, and MCU is Falling Behind.” 2021.12.24.

https://laoyaoba.com/n/802515

[16] Kechuangban Daily: “Tracking | Chipsea Technology’s Progress in Automotive Chips: Convertible Bond Financing is About to Be Reviewed, Automotive MCUs Have No Orders Yet.” 2021.12.22

https://mp.weixin.qq.com/s/8LMxKCmcJEBax9HCC-zV-w

[17] Techsugar: “Huada Semiconductor Sets a Benchmark for Domestic Industrial-grade MCUs.” 2021.10.09.

https://mp.weixin.qq.com/s/3p30HmkIqGY2hMsZtJRX2A