Key Points

Panel module manufacturers, along with ODM (Original Design Manufacturers) and OEM (Original Equipment Manufacturers), are gradually shifting the manufacturing base of mobile PC display modules from mainland China to Southeast Asia, particularly Vietnam, in response to geopolitical issues and tariff risk management strategies.

Mainland China has long been the primary hub for the assembly of laptop and tablet LCM (Liquid Crystal Module) and the overall manufacturing of mobile PC systems. However, ongoing geopolitical issues and the risk management strategies adopted by module manufacturers, ODMs, and OEMs are reshaping this landscape.

Here are some observations from Omdia:

• Panel manufacturers are establishing new LCM manufacturing lines in Southeast Asia (especially Vietnam) or relocating their module factories from mainland China to Southeast Asia.

• PC ODMs, OEMs, and subcontractors are expanding their mobile PC system manufacturing capacity in Southeast Asia.

• With the emergence of a new Glass-Cell business model, particularly in the mid-range and low-end tablet and laptop markets, more LCM manufacturers can now purchase Glass Cells directly from panel manufacturers. This enables them to assemble LCMs independently. Traditionally, the assembly facilities for these LCM manufacturers were located in mainland China, but they are slowly migrating to Southeast Asia. This shift is driven by cost considerations, export convenience, and the need to manage geopolitical risks.

• More brands and OEMs, such as Dell and HP, are requiring their supply chain partners, including display panel manufacturers, system integrators, and subcontractors, to move their manufacturing operations out of mainland China and Taiwan. Some PC brands and OEMs are adopting this policy. This shift is driven by geopolitical considerations, particularly the escalating tensions between the U.S. and China, and the potential for additional tariffs on products made in China.

• More LCM and system manufacturers are establishing two distinct supply chains: one for China and another for regions outside of China. Local Chinese brands, such as Huawei, Xiaomi, and Lenovo, are increasing their dominance in the Chinese tablet and laptop markets. As a result, LCM and mobile PC system manufacturers serving Chinese domestic brands are establishing their supply chains within China. Conversely, for markets outside of China, geopolitical risks and tariff considerations are prompting these manufacturers to set up production facilities outside of China, particularly in Southeast Asia.

The Business Model from LCD to LCM is Evolving

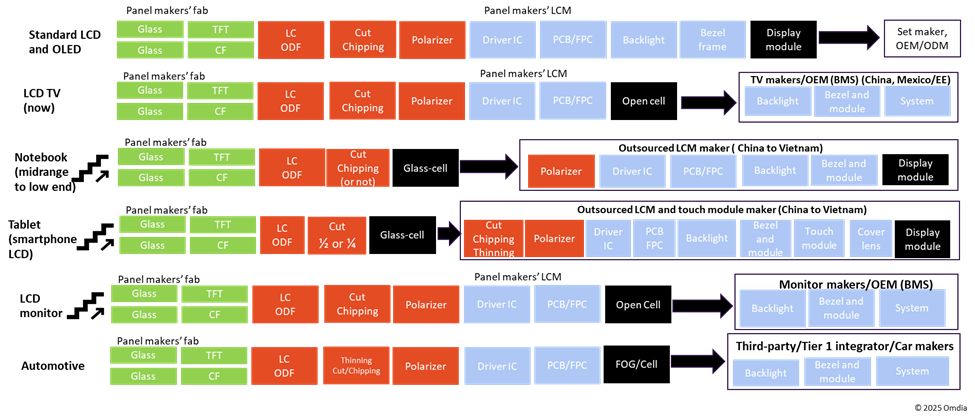

Traditionally, in the standard panel business model, panel manufacturers produced LCMs themselves. They were responsible for both the front-end and back-end manufacturing processes: the front-end involved the manufacturing of TFT LCD arrays and Cells, while the back-end included the assembly lines for LCMs. Once completed, the LCMs would be shipped to consumer electronics system or equipment manufacturers, including brands as well as OEMs and ODMs.

However, a few years ago, LCD TV brands and OEMs began implementing a new business model known as Backlight + Module + System (BMS). This model integrates the LCM component with the TV chassis. In this model, LCD TV panel manufacturers focus on producing and shipping Open Cells, which include the LCD array unit combined with driver PC and printed circuit board (PCB).

Figure 1: The Business Model from LCD to LCM has Changed, Increasing Use of Open Cell and Glass Cell

Source: Omdia

The burden of maintaining module assembly lines and related management costs and overall cost structures has become heavy. As a result, these panel manufacturers have begun outsourcing the assembly process of LCMs.

This has facilitated the growth of independent and specialized LCM manufacturers. With the expansion of low-cost and low-end models, the mobile PC market is becoming increasingly diversified, and as panels standardize in the mid-range to low-end markets, more independent LCM manufacturers are entering the industry. This means these companies purchase Glass Cells from panel manufacturers, handle module assembly themselves, and then sell the finished products without needing to involve TFT LCD manufacturers.

However, geopolitical risk management, along with tariff and cost considerations, is prompting panel and LCM manufacturers to relocate LCM and module assembly lines from China to other regions, including Southeast Asia and Mexico.

At the same time, Korean panel manufacturers such as Samsung Display and LG Display have already established their OLED module factories in Southeast Asia.

China has long been the primary region for display module assembly, and the proportion of LCM assembly in China remains the highest. However, the proportion of module assembly in Southeast Asia is on the rise.

This shift in mobile PC LCM manufacturing from outside China is influenced not only by geopolitical factors and tariff considerations but also by changes in the business model from LCD to LCM.

Notebook OEMs and ODMs in Taiwan are Moving Their Operations from Mainland China

Due to geopolitical risks and demands from major PC brands, notebook OEMs and ODMs, such as Quanta, Compal, Wistron, Inventec, and Foxconn, have begun establishing manufacturing bases outside of China in recent years. Most of these are Taiwanese companies. Although they still rely on China as a primary manufacturing center, an increasing amount of production is shifting to new regions outside of China, including Thailand, Vietnam, and Mexico.

On the other hand, the notebook assembly and manufacturing bases in China have been operating for decades, making it challenging to upgrade these assembly lines with the latest automation tools and AI-assisted manufacturing technologies. In contrast, the new factories in Vietnam, Thailand, and Mexico are newer and more adaptable, making it easier to install automation and AI tools. As a result, the efficiency of these new factories has significantly improved.

In some cases, notebook OEMs also manufacture AI database servers, allowing them to co-locate manufacturing facilities in the same region for easier factory management and greater economies of scale. This has attracted more LCM manufacturers to migrate to the same locations as notebook OEMs and ODMs to enhance supply chain efficiency and reduce logistics costs.

Table 1 shows that Vietnam is becoming a key location for notebook OEMs and ODMs, attracting more notebook display module assembly lines to establish in Vietnam.

Table 1: Factories, Capacities, and Locations of Notebook System OEMs

Source: Omdia

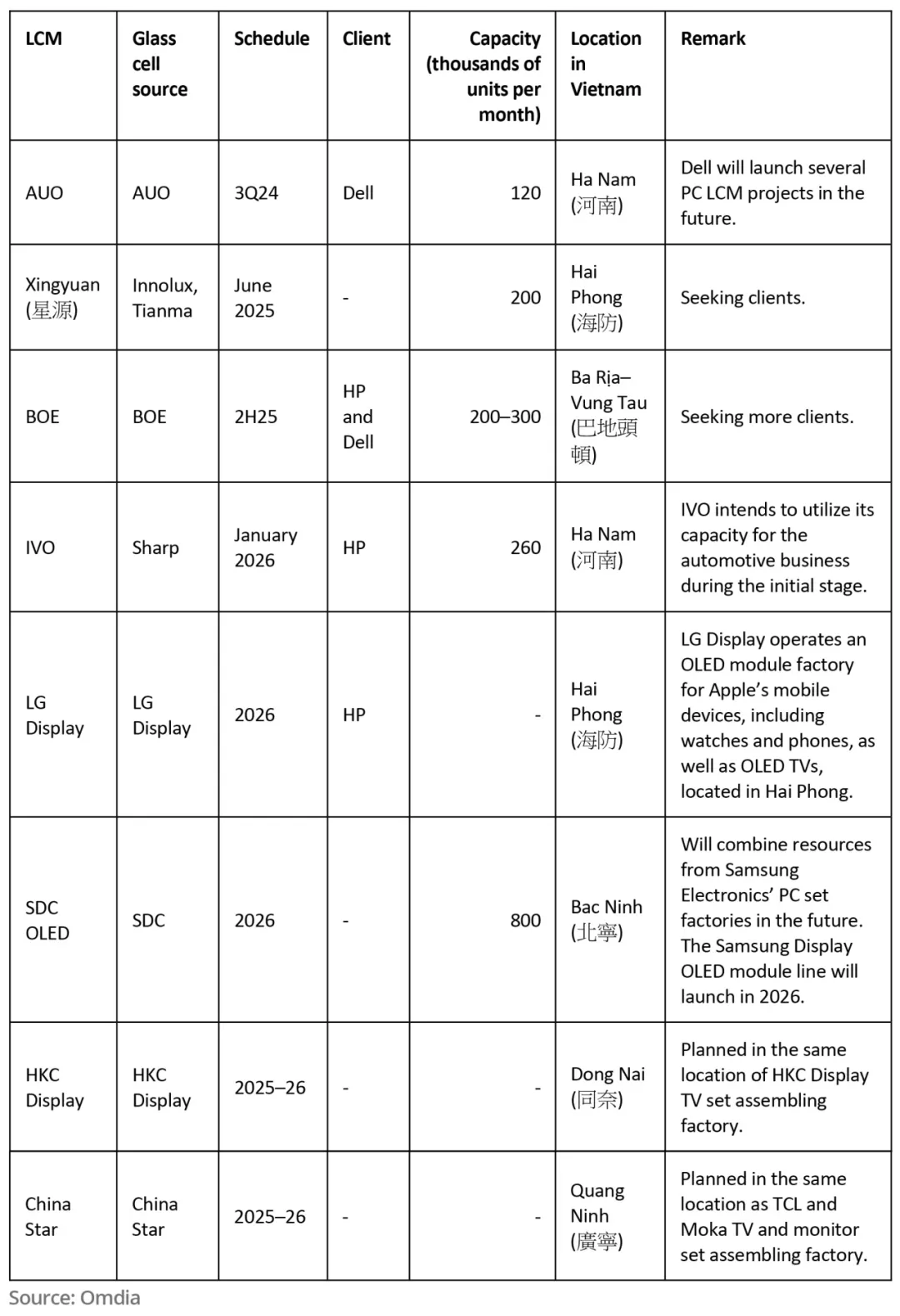

Notebook LCD and OEM Module Factories in Vietnam are Thriving

TFT LCD panel manufacturers and OLED manufacturers are also establishing their module manufacturing facilities in Vietnam. Although China still holds most of the production capacity, Vietnam’s capacity is increasing to meet customer demand, especially in the context of geopolitical considerations. Manufacturing LCD and OLED modules in Vietnam may not necessarily be cheaper than in China, as many components are still sourced from China. However, in the long run, with the introduction of new automation tools, Vietnam’s new LCM factories are becoming significant investment opportunities for panel manufacturers, particularly for clients like Dell and HP.

Table 2: Notebook Computer LCD and OEM Module Factories in Vietnam

Source: Omdia

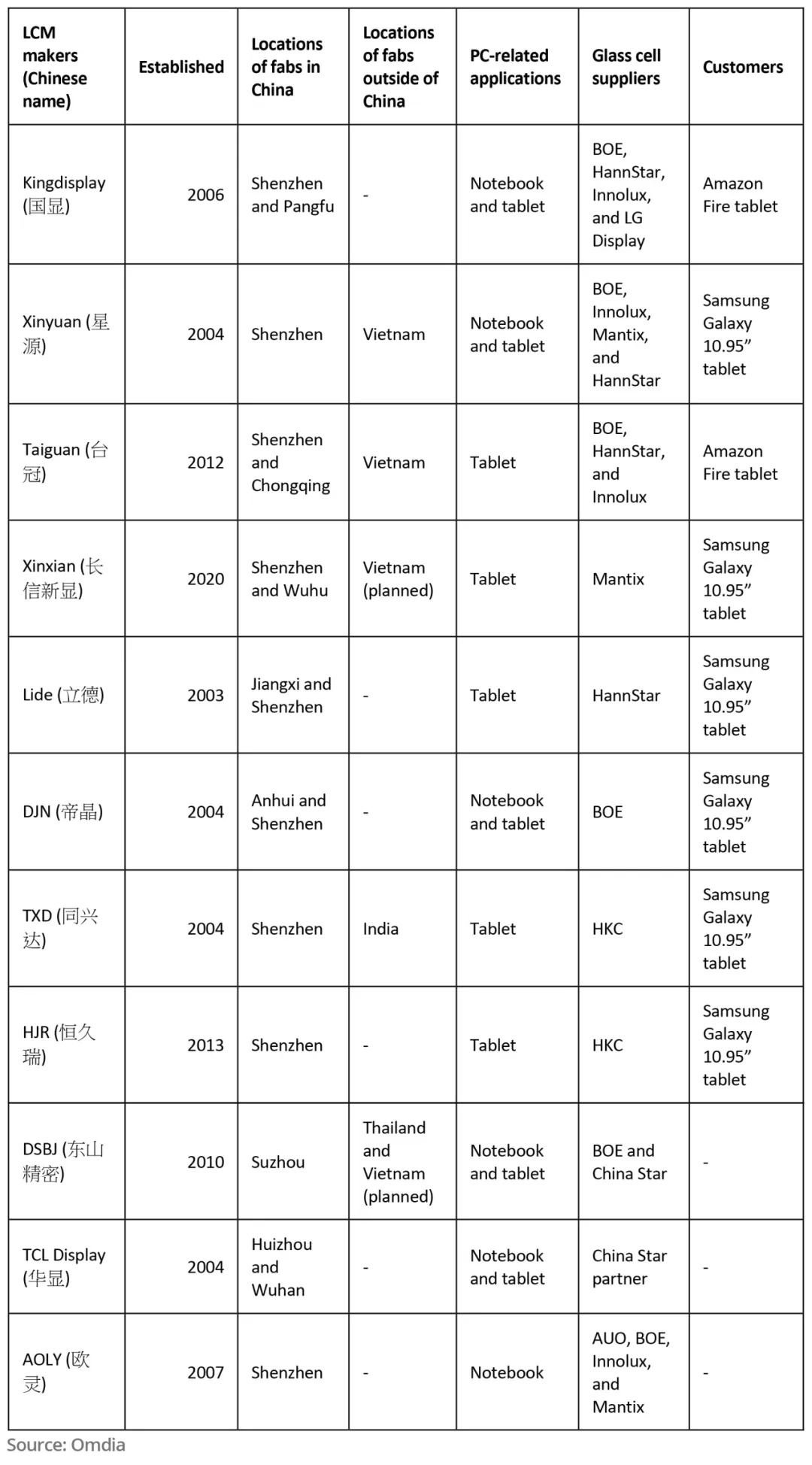

Chinese LCM Manufacturers are Rising and Starting to Establish a Presence Outside of China

In recent years, tablet and laptop panel manufacturers have found that module assembly is not a guaranteed profitable business. Instead, maintaining module assembly lines and related management costs and overall cost structures has become burdensome. As a result, these panel manufacturers have begun outsourcing the assembly process of LCMs.

This has facilitated the growth of independent and specialized LCM manufacturers. With the expansion of low-cost and low-end models, the mobile PC market is becoming increasingly diversified, and as panels standardize in the mid-range to low-end markets, more independent LCM manufacturers are entering the industry. This means these companies purchase Glass Cells from panel manufacturers, handle module assembly themselves, and then sell the finished products without needing to involve TFT LCD manufacturers.

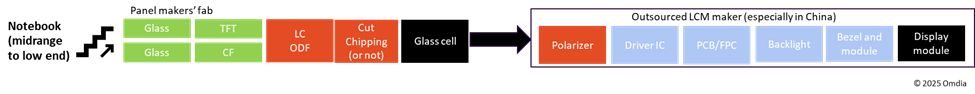

Figure 2 shows the growth of the Glass Cell business model in mid-range and low-end tablets and laptops.

Figure 2: The Business Model of Outsourced LCM Manufacturers

Source: Omdia

These Chinese LCM manufacturers operate independently of panel manufacturers but rely on these panel manufacturers to provide glass units for tablets and laptops. Sometimes, they procure LCM components such as driver ICs, PCBs, and electronic parts themselves, while at other times, these module components are commissioned by panel manufacturers. Most of their LCM business focuses on mid-range and low-end tablets and laptops, targeting not only the domestic Chinese market but also international exports.

Some companies initially produced backlight units and later expanded into LCM manufacturing. Other companies started as touch panel laminators and later entered LCM production. Additionally, some companies simultaneously create automotive display modules and smartphone display modules, indicating that they have long been engaged in the glass unit module business model.

Companies like Kingdisplay, Xinyuan, Taiguan, DJN, and TXD primarily manufacture their LCMs in China, but they have also begun migrating to Southeast Asia in recent years.

Table 3: Major Chinese LCM Manufacturers

Source: Omdia

Chinese Notebook OEMs and ODMs are Rising and Expanding Their Assembly Operations Outside of China

As mentioned earlier, notebook and tablet OEMs and ODMs, such as Quanta, Compal, Inventec, Wistron, and Foxconn, are primarily Taiwanese companies. Although these companies maintain large system assembly and manufacturing facilities in mainland China, they are gradually shifting some of their operations to Southeast Asia.

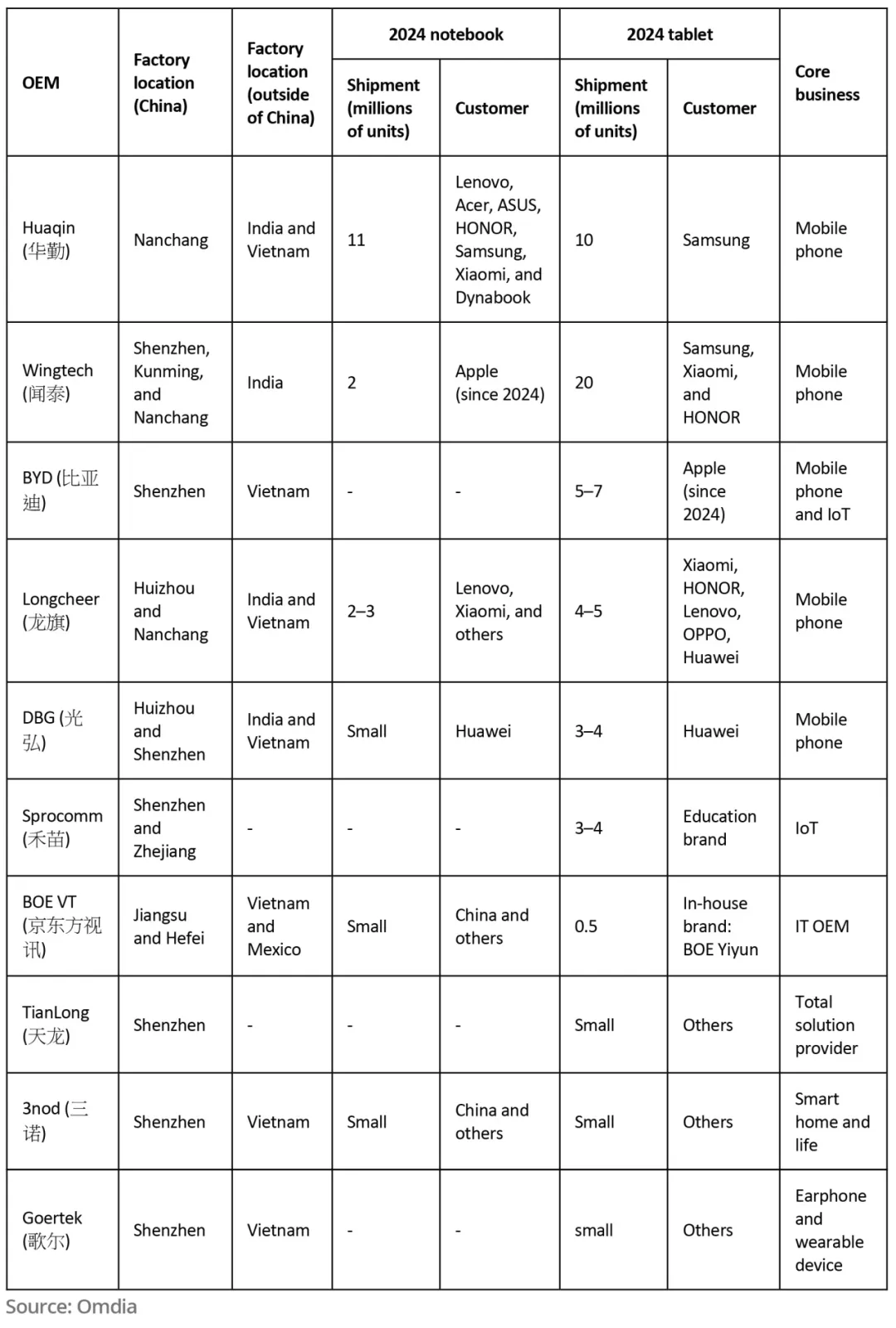

With the rise of local Chinese PC brands such as Huawei, Honor, Xiaomi, and Lenovo, as well as the emergence of various white-label brands, domestic notebook and tablet OEMs and ODMs have also seen growth in recent years. Notable companies include Huaqin, Wingtech, BYD, Longcheer, and Goertek.

Many of these companies were originally independent design houses (IDH) and independent design and manufacturing companies (IDM) that initially focused on smartphones and feature phones. Recently, they have expanded their business to include notebooks and tablets. While most of these manufacturers produce their products in China, they are also beginning to establish facilities outside of China (such as in India, Vietnam, and Mexico) targeting export markets.

Table 4: Emerging Chinese PC OEMs

Source: Omdia

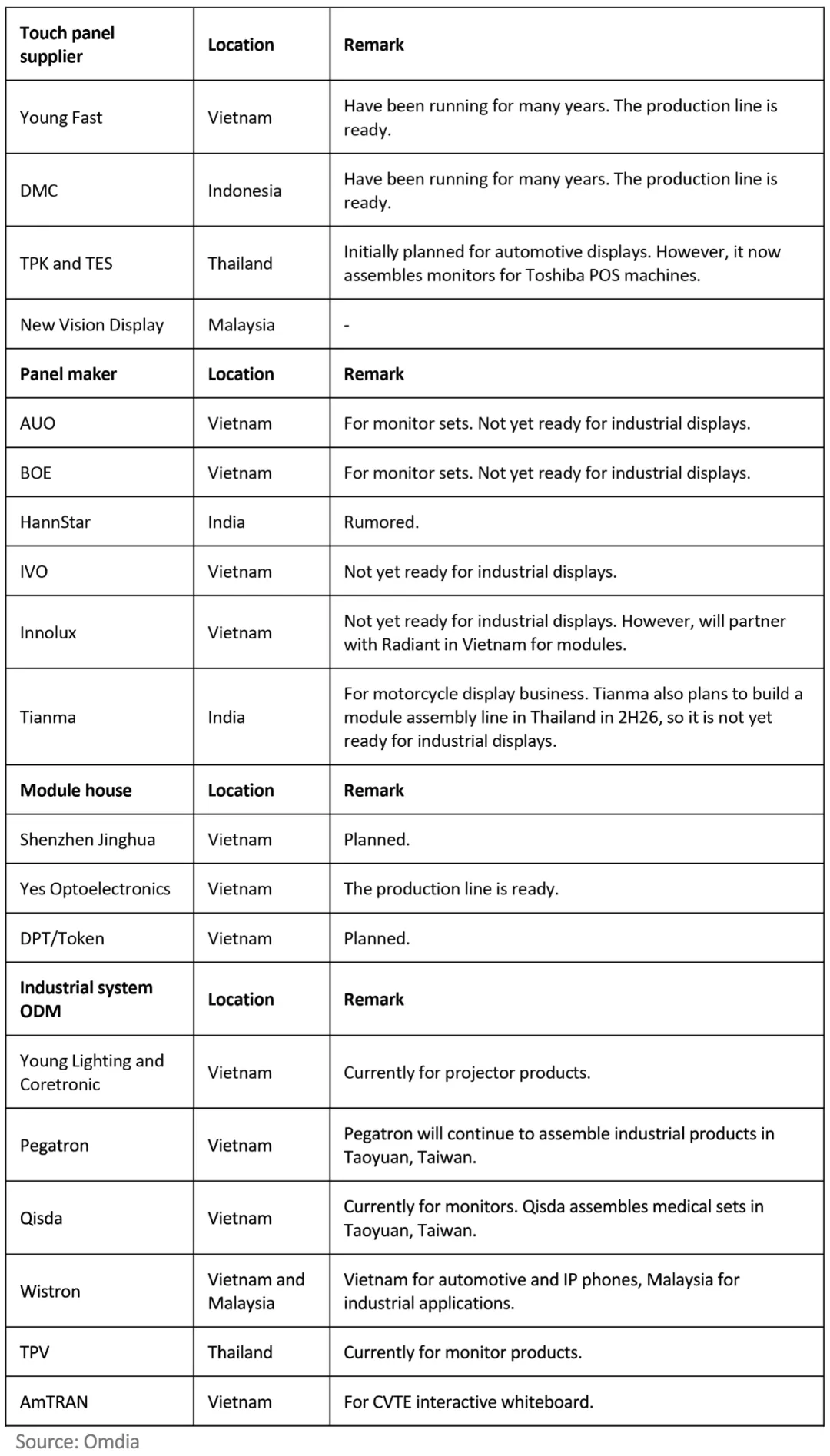

Industrial Display Panel, Touch Panel Module, and System Manufacturers are Increasingly Expanding Manufacturing in Southeast Asia

Industrial display panels typically include touch panel modules. The supply chain for industrial systems includes several key manufacturers: touch module manufacturers, industrial display manufacturers (panel manufacturers), system integrators (also known as ODMs), and module factories.

In recent years, industrial display panel manufacturers have increasingly established manufacturing facilities in Southeast Asian countries, particularly in Vietnam, Malaysia, Thailand, and India.

Table 5 shows the progress of companies within the industrial display panel supply chain outside of China.

Table 5: Industrial Display Panel and System Supply Chain Manufacturers Outside of China

Source: Omdia