On April 15, 2025, an announcement after the close of the US stock market triggered concerns in the global tech community—NVIDIA’s market value evaporated by $178.4 billion (approximately 1.3 trillion RMB) overnight, equivalent to losing the size of Alibaba.

The catalyst for this crash was the sudden announcement by the US government on the same day, imposing strict licensing restrictions on the export of NVIDIA’s H20 chip to China. This global AI chip giant is being caught in the eye of an unprecedented storm due to the US-China tariff war.

From “Cash Cow” to “Hot Potato”

Just two months ago, NVIDIA was thriving, with its fiscal report for 2025 showing annual revenue exceeding $130.4 billion and net profit soaring by 145% to $72.88 billion, with the data center business contributing over 90% of the revenue.

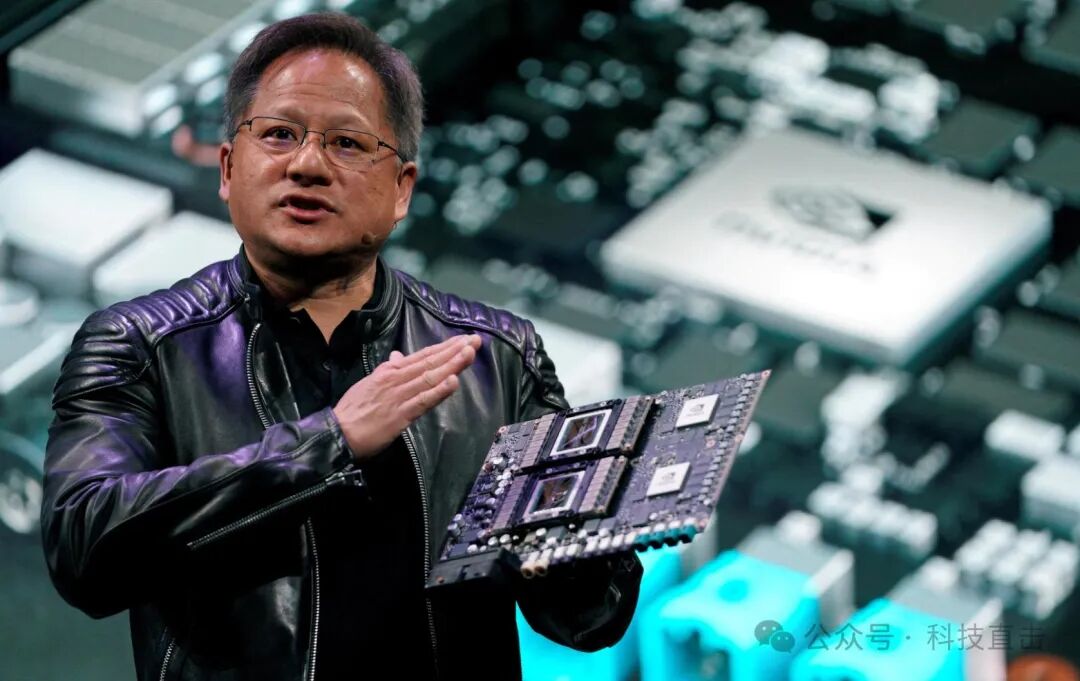

Jensen Huang boldly declared at the press conference that “AI is developing at lightning speed,” announcing the mass production of the Blackwell AI supercomputer and securing a $500 billion technical contract for the “Stargate” project. Who would have thought that these accolades would be as fragile as bubbles in the face of tariff policies.

A notice from the US Department of Commerce on April 9 completely rewrote the script. According to the new regulations, the export of NVIDIA’s H20 chip, specifically designed for the Chinese market, requires additional approval, forcing the company to recognize a loss of $5.5 billion.

This chip was originally a “special product” for NVIDIA to circumvent US bans, with performance close to the flagship H100, yet it “self-sabotaged” in interconnect speed.

Even so, the H20 is still viewed by the US government as “potentially usable for military AI,” directly cutting off NVIDIA’s last lifeline in the Chinese market.

The “Technical Siege” Under Tariff Blows

Behind this crisis is the ongoing escalation of the US-China tech war. By April 2025, US tariffs on China had skyrocketed to 34%-54%, with semiconductor equipment tariffs reaching 100%.

In retaliation, China imposed export controls on rare earths, causing prices of heavy rare earths to surge by 80% in three months, directly leading to an 18% increase in the cost of the US F-35 fighter jet.

NVIDIA, caught in the middle, has become the most unfortunate “sandwich”—having to comply with US bans while being reluctant to give up the $12 to $15 billion annual market in China.

This tearing is vividly reflected in the supply chain, as TSMC’s $40 billion wafer fab in Arizona has seen its production date pushed from 2024 to 2026 due to low worker efficiency and uncontrolled costs.

Meanwhile, Yangtze Memory Technologies’ 232-layer 3D NAND flash memory has achieved a 95% yield, with production capacity increasing by 300% over three years. More concerning for NVIDIA is that Huawei has been listed as its “number one competitor” for the second consecutive year in its annual report—this Chinese giant is making a comeback with domestically produced 7nm chips.

The “Eastern Light, Western Dark” Counterattack

While the US is still building walls with tariffs, Chinese companies have already started playing the “change track” game. Chinese companies have collaborated with Europe to develop photonic chips, successfully reducing the power consumption of traditional silicon-based chips by 90%; DJI’s sixth-generation agricultural drone has 100% self-developed code, and Shanghai Microelectronics’ 28nm lithography machine is entering mass production countdown.

This “you choke me, I flip the table” intensity makes NVIDIA’s market value evaporation particularly ironic—Chinese AI company DeepSeek has trained open-source models using the H20 chip, with a theoretical profit margin exceeding 500%.

In contrast, back in the US, Tesla’s Shanghai factory has seen parts costs soar due to tariffs, reducing profits by $2,000 per vehicle; OpenAI’s “Stargate” project requires NVIDIA to provide 100,000 H100 chips, but domestic production in the US cannot even meet its own demand.

Jensen Huang’s statement that “half of the world’s AI talent comes from China” now sounds more like dark humor regarding the US’s technological blockade.

The “Trust Crisis” on Wall Street

The capital market’s vote with its feet has unveiled a deeper crisis. Before NVIDIA’s stock price plummeted, its price-to-earnings ratio had reached 38 times, and its price-to-book ratio was an astonishing 34.5 times.

Investors had long harbored doubts—despite a 78% year-on-year revenue growth, the growth rate had plummeted from 262% in the same period last year. When the US government turns the tech game into “Russian roulette,” even the most loyal shareholders cannot withstand policy risks.

This panic has spread like a virus, with Japan’s Ministry of Finance selling $23 billion in US Treasury bonds in a single day, pushing the 10-year US Treasury yield up to 5.2%; China, holding $760 billion in US Treasury bonds, triggered a sell-off in early April that led Wall Street to plead with the White House to “stop stirring the pot.”

NVIDIA’s crash is merely the tip of the iceberg in this trust crisis. As Democratic Senator Elizabeth Warren put it: “Trump’s tariff policy is like throwing a bucket of paint on the global economy, leaving nothing but chaos!”

The Future Script of the Chip War

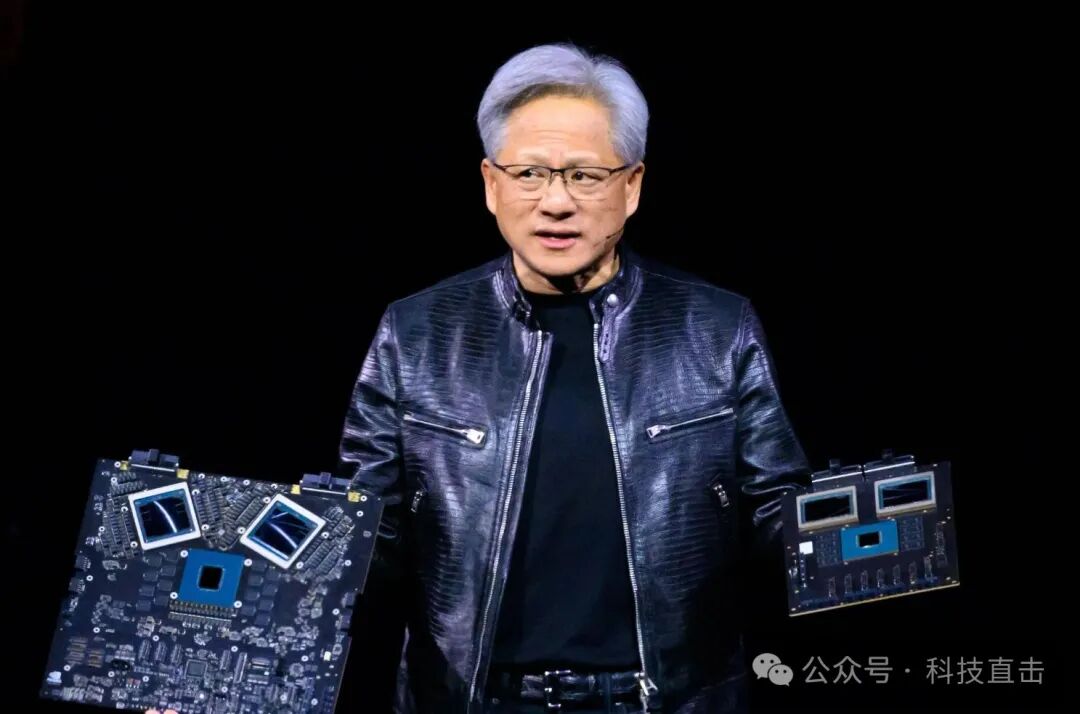

Currently, NVIDIA is facing its most difficult choice in history: continuing to comply with US bans means giving up the largest AI market globally; if it secretly “relaxes” its policies, it may be placed on the entity list.

Jensen Huang admitted in an internal meeting: “We must walk a tightrope between compliance and survival.”

This dilemma reflects the storm of global industrial chain restructuring. As China’s semiconductor self-sufficiency rate exceeds 40%, Southeast Asia becomes a new transshipment trade hub, and European car manufacturers collectively turn to Chinese electric vehicles, NVIDIA’s market value evaporation is merely a footnote to the dramatic changes of the era.

A War Without Winners

On the morning of April 16, cargo planes at Pudong Airport were still loading smart phones equipped with domestic chips bound for New York, and the 6G R&D team in the Guangdong-Hong Kong-Macao Greater Bay Area was working overnight as usual.

Meanwhile, across the Pacific, the lights in NVIDIA’s headquarters building remain on all night—they must find the key to breaking the deadlock before releasing their new financial report on May 28.

This crisis, which has seen a market value evaporation of 1.3 trillion, reveals the harsh truth of the tech cold war: when globalization is torn apart, even industry giants are merely pawns on the chessboard.

Do you think the collapse of American companies will mark the end of US tariffs? What are your thoughts on this?