Table of Contents

“Medical Robots“

Table of Contents

1. Overview of Medical Robots

1.1 Definition and Classification of Medical Robots

1.2 Market and Industry Growth of Medical Robots

1.3 Analysis of the Medical Robot Industry Chain

2. Analysis of Core Components of Medical Robots

2.1 Servo Systems

2.2 Reducers

2.3 Sensors

2.4 Controllers

2.5 Navigation Systems (Magnetic Navigation, Ultrasound Probes, Optical, etc.)

2.6 Other Medical Instruments (e.g., Ultrasound Knives)

3. Analysis of Medical Robots in Various Midstream Segments

3.1 Orthopedic Robots

3.2 Laparoscopic Robots

3.3 Neurosurgical Robots

3.4 Vascular Intervention Robots

3.5 Puncture Robots

3.6 Consumer Medical Robots

3.7 Rehabilitation Robots

3.8 Capsule Robots

3.9 Medical Service Robots

4. Analysis of Hospitals in the Downstream of the Industry Chain

4.1 Price and Insurance Situations of Robot Products in Various Provinces

4.2 Usage of Robots in Various Hospitals

5. Analysis of Major Companies

5.1 Foreign Companies

5.2 Domestic Listed Companies

5.3 Domestic Unlisted Companies

6. Probe Capital’s Viewpoints

Note: This research content is lengthy and will be published in multiple parts. This is the third part.

Part One: Probe Capital_Industry Research: Medical Robots (1)

Part Two:Probe Capital_Industry Research: Medical Robots (2)

3.4 Vascular Intervention Robots

3.4.1 Definition and Overview, Including Application Scenarios

3.4.1.1 Overview of Vascular Intervention Robots

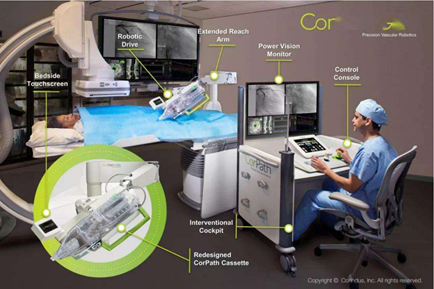

Vascular intervention surgical robots are a type of robot used for vascular intervention surgeries and are a kind of surgical robot. Vascular intervention robots are essentially an organic combination of surgical robots and vascular intervention technology. The robot manipulates interventional surgical instruments, capable of operating in environments unfavorable to doctors, accurately locating based on medical images, performing continuous actions without tremors, and quickly and accurately navigating complex trajectories to reach target blood vessels, ultimately completing vascular intervention surgeries under the doctor’s command or autonomously. Vascular intervention surgery is a technique for diagnosis and treatment using instruments such as puncture needles, guide wires, and catheters through vascular pathways under the guidance of medical imaging equipment.

Vascular Intervention Surgical Robot

Image Source: Internet

Traditional vascular intervention surgery has significant drawbacks: (1) Operators work in X-ray environments, which can be harmful to their health over long periods; (2) Existing surgical methods are highly skilled and risky, requiring extensive training for specialist doctors, limiting the widespread application of this technology; (3) Due to the complexity of operations, prolonged surgery times, fatigue, and instability of manual operations can directly affect surgical quality and, consequently, patient quality of life. These shortcomings limit the widespread application of vascular intervention surgery. The organic combination of robotic technology and vascular intervention technology is an important way to solve the above issues, as robots have many advantages in manipulating surgical instruments, such as precise positioning according to medical images, executing continuous actions without tremors, working in X-ray environments, and quickly and accurately navigating complex trajectories.

Advantages of Vascular Robots: (1) Radiation Protection: Reduces radiation dose for both doctors and patients; (2) Precise Operation, Improved Clinical Outcomes. Using image navigation and mechanical assistance, accurately locate lesions, optimize instrument delivery, shorten instrument positioning time, improve surgical accuracy, and reduce surgical complications; (3) Doctor-Patient Isolation, Reducing Contact, Lowering Cross-Infection Risks, and Decreasing the Spread of Infectious Diseases; for patients with infectious diseases, robots can perform surgeries remotely, reducing infection risks; (4) Surgical Control, Optimizing Processes; transforming from human-machine interaction to machine-machine interaction; (5) Providing True Potential for “Remote” Surgeries.

3.4.1.2 Application Scenarios of Vascular Intervention Robots

Vascular intervention surgical robots have been applied in various types of surgical procedures. In cardiovascular medicine, robotic systems are now commonly used for minimally invasive atrial septal defect closure, mitral valve repair, and CABG surgeries, such as the Da Vinci robot. New robotic systems are being developed for many other indications, such as percutaneous coronary intervention (PCI), endovascular and minimally invasive aortic repair, and catheter-based atrial fibrillation ablation. Currently, endovascular intervention robots are mainly used in coronary, cerebrovascular, and peripheral vascular intervention treatments.

Coronary Intervention Treatment: The Corpath 200 system was introduced clinically in 2010, and the first clinical research using this robotic system for percutaneous coronary intervention (PCI) treatment made Corpath 200 the only system currently available for robotic-assisted coronary intervention, receiving FDA approval in 2012. The results of the multi-center PRE-CISE study were reported in 2013, where the safety and efficacy of robotic-assisted PCI were evaluated in 164 patients with coronary artery disease. 97.6% of patients achieved surgical success, with a perioperative myocardial infarction rate of 2.4%, but no other major or device-related complications occurred. Additionally, it was reported that the radiation exposure of the cockpit operator was reduced by 95.2% compared to the radiation exposure on the angiography table. No radiation exposure was reported for patients.

Furthermore, based on the Corpath 200 surgical robot system, the Corpath GRX represents the interventional surgical robot system, which has been applied in nearly 5,000 cases in over 50 cardiovascular departments worldwide. In addition to guide wire control and balloon, stent delivery, it also supports robotic-guided catheter operations. The precise operation by the machine simulates the characteristics of manual operations, making it more suitable for interventional surgery. At the same time, increasing the diversity of robotic control also improves the success rate of surgeries under robotic assistance to some extent, and compared to Corpath 200, Corpath GRX has improved the success rate in complex lesions.

Cerebrovascular Intervention Treatment: In addition to cardiovascular interventional assist robots, robots for peripheral vascular interventions and cerebrovascular interventions are also developing. Kalyan et al. used Corpath GRX to complete selective diagnostic cerebral angiography in seven patients, three of whom underwent carotid angioplasty and stenting. All surgeries were completed successfully without complications. In 2020, Vitor et al. successfully completed the first robotic-assisted treatment for cerebral aneurysm embolization. This represents an important milestone in the treatment of neurovascular diseases and opens the door for the development of remote robotic neurovascular surgeries. Robotic-assisted treatment for carotid arteries is more mature than neurovascular treatments; Ben et al. have demonstrated improvements in the operability, accuracy, and stability of catheters in endovascular robotic techniques, while reducing access to target paths and minimizing contact with catheter walls, subsequently reducing high-intensity signals recorded by transcranial Doppler. Thus, robotic-assisted endovascular intervention treatments in the cerebrovascular field are gradually being carried out, leveraging the advantages of robotic-assisted technology to potentially reduce damage to blood vessels caused by catheters.

Peripheral Vascular Intervention Treatment: In robotic-assisted vascular surgery, Stadler et al. reported a wide range of cases, including 310 robotic-assisted vascular surgeries, including 61 abdominal aortic aneurysm repairs. This group has demonstrated the feasibility of robotic-assisted vascular techniques in treating occlusive diseases and aneurysms. However, currently, only some simple actions can be completed, such as axial movements. In 2020, Lu et al. developed a new type of robotic-assisted system for peripheral arterial stenting, addressing issues related to stent placement through design improvements, enabling remote operations throughout the endovascular process.

Research on vascular intervention surgical robots is gradually receiving more attention and has been successfully applied in clinical surgeries. Faced with more complex surgical environments, the future development trends of vascular intervention robots are as follows: (1) Achieving more complex surgical operations. Currently, vascular intervention robots can only operate guide wires, balloons, and stents, while guiding catheter insertion requires manual completion by doctors. Current vascular intervention robots cannot complete some complex cases of bifurcation, chronic total occlusion, and severe calcification lesions. The next generation of vascular intervention robots needs to address the limitations of current equipment, including compatibility with online devices and the ability to operate multiple devices without requiring doctors to switch catheters to complete more complex PCI cases. (2) Application of artificial intelligence technology. Deep learning has been widely applied in computer vision, enabling precise target detection and segmentation, which is very effective for determining the location of lesions in patients’ X-rays. Utilizing deep learning for vascular and catheter segmentation, pre-operative 3D vascular images can be registered with real-time 2D vascular images, displaying catheter positions in three-dimensional models, providing more direct visual feedback to doctors. Reinforcement learning and demonstration learning can better utilize existing knowledge from experts to learn execution strategies from expert demonstrations, achieving autonomous surgical robotic systems. (3) Remote surgery. With technological advancements, the speed of information transmission between the end and control ends has improved, enhancing the reliability of remote surgeries. Remote areas in China often lack experienced interventional doctors, making it impossible to perform interventional surgeries, while robotic systems can enable doctors to use remote interventions to perform surgeries for patients in multiple areas, reducing medical costs in remote areas and alleviating the imbalance in the distribution of medical resources.

3.4.1.3 Market Situation of Vascular Intervention Robots

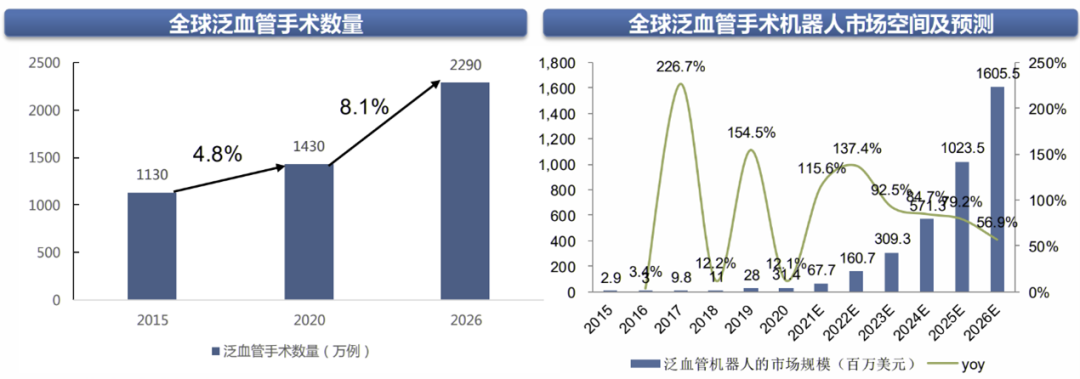

The volume of vascular surgeries is vast, and the global market for vascular surgical robots will flourish. On one hand, there is a large base of global interventional surgeries. According to Frost & Sullivan data, from 2015 to 2020, the global volume of vascular surgeries grew from 11.3 million to 14.3 million, and it is expected to grow at a compound annual growth rate (CAGR) of 8.1% to 22.9 million from 2020 to 2026. On the other hand, the availability of surgical robots in certain areas such as PCI and electrophysiology is gradually increasing, with clinical and commercial products continuously increasing. Therefore, the global vascular surgical robot market is developing rapidly. According to Frost & Sullivan data, the market size for vascular surgical robots was $31 million in 2020 and is expected to grow to $1.6 billion by 2026, with a compound annual growth rate of 92.7%.

Global Vascular Surgical Robot Market Space and Forecast

Image Source: Frost & Sullivan

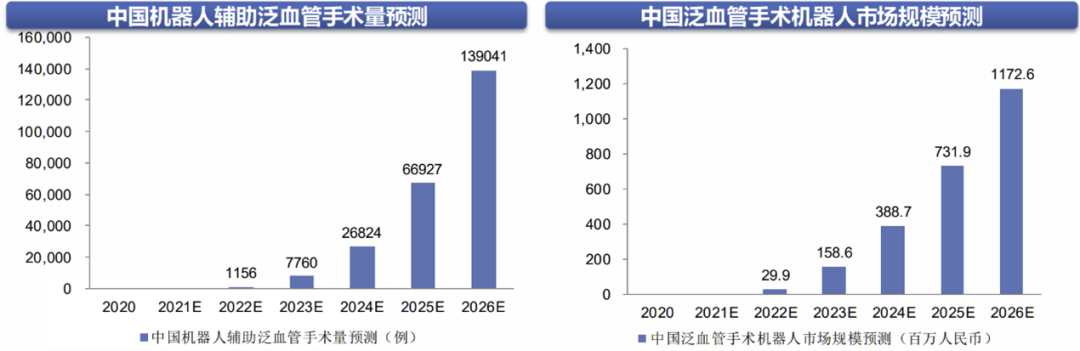

The domestic market for vascular surgical robots is relatively small, with room for increased penetration. There is a large number of patients with cardiovascular diseases in China, which continues to rise. It is estimated that the number of patients with cardiovascular diseases is 330 million, including 13 million with stroke and 11 million with coronary heart disease. Cardiovascular diseases remain the leading cause of death for urban and rural residents. Currently, interventional treatment is one of the most important means for reconstructing blood flow in cardiovascular diseases. According to the report of the National Interventional Cardiology Forum in 2020, the total number of cases of percutaneous coronary intervention in China in 2019 was over 1.038 million, maintaining an average annual growth rate of 13.5%. The interventional treatment of cerebrovascular and peripheral vascular diseases is also continuously developing. It is estimated that the market size for vascular surgical robots in China will be 299 million yuan in 2022, increasing to 1.173 billion yuan. By 2026, it is expected that the number of vascular robot surgeries in China will reach approximately 139,000 cases, with a penetration rate of 3%, indicating significant potential for growth.

Market Space and Forecast for Vascular Surgical Robots in China

Image Source: Frost & Sullivan

3.4.2 Major Technical Challenges

The main steps in vascular intervention surgeries are as follows: (1) The puncture needle penetrates the skin at the appropriate location and inserts the guide wire into the needle; (2) The vascular sheath is sent into the vessel along the guide wire and supported by it, pushing the catheter forward; (3) Under the guidance of DSA images, observe the path of the catheter and the position of the catheter tip, adjusting its position and direction until it reaches the lesion; (4) Under the monitoring of DSA images, perform catheter diagnostic and therapeutic operations, such as placing a device for atrial septal defect closure or a stent for arterial stenosis.

The three core technologies of vascular intervention surgical robots include catheter devices, image navigation systems, and force feedback systems, which can effectively address the complexity, time consumption, doctor fatigue, and radiation exposure issues associated with traditional vascular intervention surgery operations. The mechanical devices of vascular intervention robots have catheter advancement capabilities, assisting doctors in precisely and stably completing catheter retraction, rotation, and other surgical actions; the image navigation system enables positioning tracking and real-time image formation; the force feedback system during catheter advancement assists doctors in ensuring control over the interaction forces between the catheter and the blood vessel walls.

The research and development of vascular intervention surgical robots mainly focus on robot navigation positioning and assisting interventional operations, which can be categorized based on different mechanisms into magnetic navigation systems and electromechanical operation systems.

(1) Catheter Devices

The traditional catheter tip is pre-bent with different angles and shapes. During surgery, doctors need to replace different catheters based on varying vascular structures and surgical steps, complicating the surgical process. By designing actively driven catheters, doctors can control the shape of the catheter tip and select the direction of movement, effectively shortening surgery time and enhancing safety. The active catheter driving modes can be categorized into two types: generating driving forces at the catheter tip and transmitting forces to the catheter tip. The first mode includes magnetic drive, shape memory metal, etc., while the second includes cable drive and hydraulic drive.

Sikorski et al. combined permanent magnets at the catheter tip, using a moving electromagnetic array to create an external variable magnetic field that deflects the catheter tip toward the target direction. Sheng et al. designed a catheter tip composed of multiple curved modules, each driven by a set of shape memory alloy wires that bend when heated by electric current. Woo et al. designed a steerable catheter with rigid and flexible parts. Two wires pass through the catheter and connect to the flexible distal end, while another end passes through the rigid part to connect to the rotary shaft, allowing bending by pulling the catheter through the rotation of the shaft.

Due to the simple working principle and safety, cable-driven catheters are currently the most widely used active catheters. Magnetic-driven catheters, combined with corresponding navigation systems, have also seen significant development. Shape memory metals and hydraulic drives are limited in clinical applications due to temperature changes and the potential for hydraulic fluid leaks. Future active catheter technology needs further improvements in operational precision, safety, and miniaturization.

(2) Image Navigation Systems

Doctors use vascular imaging to determine the position of surgical instruments and perform vascular interventional actions. Therefore, the accuracy of vascular imaging is crucial for surgical safety. Common vascular imaging techniques include Digital Subtraction Angiography (DSA), Computed Tomography Angiography (CTA), Magnetic Resonance Angiography (MRA), and ultrasound imaging.

Currently, DSA is the most widely used in vascular interventional surgeries. Contrast agents are quickly injected into the heart cavity or blood vessels through cardiac catheters, allowing the heart and vascular cavity to be visualized under X-ray exposure. However, DSA only presents planar images, losing depth information. CTA can reconstruct 3D images of blood vessels, allowing pre-operative construction of vascular models and registration with real-time 2D images during the surgical process to accurately track the position of surgical instruments in the vessels. MRA has high soft tissue contrast without radiation hazards and can obtain 2D and 3D images. However, the presence of heartbeat and respiratory movements affects imaging clarity. Ultrasound imaging provides good visualization of tissues, allowing determination of organ positions, sizes, shapes, and identification of lesion ranges and physical properties, enabling catheter positioning through ultrasound imaging.

During surgery, doctors need to locate catheters, guide wires, stents, and other surgical instruments from images. However, due to the similarity between instruments and vascular structures, interference signals can make it difficult for doctors to make judgments. Algorithms can be utilized to achieve segmentation and positioning of catheters and guide wires, alleviating the burden on doctors. Sam et al. proposed a wire tracking algorithm based on B-spline curves that minimizes energy, but this algorithm requires enforced smoothness of the curves. Demircital et al. used a model-based approach to track stents, relying on Hessian-based filtering for preprocessing and fitting the geometric model of the stent’s metal framework to perspective images. Their method requires predefined models of stents and is limited to specific pillar shapes. In recent years, with the development of deep learning technology, convolutional neural networks have been applied to achieve more precise segmentation and tracking of instruments. In 2017, Ambrosini et al. proposed a fully automated segmentation method based on the U-net network model, using the current frame combined with the previous three frames as input to the network, extracting the centerline of the catheter through the extracted branches, with a single-frame detection time of 125 ms, promising real-time detection. In 2018, Breininger et al. based on U-net, combined with residual connections and batch normalization, achieved precise segmentation of stents in X-ray images, enhancing surgical accuracy and safety.

(3) Force Feedback Systems

Some studies have explored the necessity of force feedback during vascular intervention processes. Loss of tactile perception can make hand-eye coordination difficult for operators, causing doctors to rely solely on imaging to evaluate the magnitude of forces applied to the vascular walls, potentially leading to ruptures. The goal of integrating force feedback technology into minimally invasive surgical robots is to achieve “transparency” in the surgical process, allowing surgeons to feel as if they are directly interacting with patients rather than operating remotely.

Implementing force feedback faces two challenges. The first is the measurement of contact forces. The contact force between the catheter and the vascular wall can be measured by integrating pressure sensors at the catheter tip. Pressure sensors are usually classified into piezoelectric, resistive, and fiber-optic sensors. Piezoelectric and resistive sensors exhibit good linear characteristics, but piezoelectric sensors can only measure static forces, while resistive sensors can measure both static and dynamic forces but are susceptible to electromagnetic interference. Fiber-optic sensors have good dynamic performance and anti-interference capabilities, are small in size, and have been increasingly applied in force sensing for surgical robots in recent years. The integration of force sensors at the catheter tip increases its diameter, making insertion more difficult, and external sensors located outside the patient can also be used to estimate the contact forces between the catheter and vascular walls.

The second challenge is how haptic interaction devices can relay force feedback to surgeons. In 2009, Omega haptic devices were used to transmit the catheter insertion force to the surgeon’s hand by controlling the motor’s current to generate torque. Jaehong Woo et al. designed a main control device combining a three-degree-of-freedom translational mechanism with a four-degree-of-freedom rotational mechanism, generating resistance and torque through motors. Motor-driven systems can easily encounter instability, gaps, insufficient force, and shaking. Thus, in 2018, Guo et al. designed a haptic interface based on magnetorheological (MR) fluids, where the destruction of the particle chain structure occurs when the catheter passes through the MR fluid, generating resistance, with the ability to adjust resistance levels by changing the magnetic field strength. This interactive interface can quickly change resistance levels while maintaining the surgeon’s original intervention methods.

3.4.3 Major Company Situations

Compared to orthopedic surgical robots, neurosurgical robots, and endoscopic surgical robots, research on vascular intervention surgical robots started relatively late. In 2006, Israel developed the first vascular intervention surgical robot. With continuous research and development, common systems today include SenseiX surgical robots (UK’s Hansen Medical) and EPOCH surgical robots (US’s Steretaxis). In 2009, the Chinese Navy General Hospital, Beihang University, and Beijing Hospital collaborated to complete China’s first animal experiment on minimally invasive vascular intervention surgical robots.

Currently, successful overseas products in the vascular surgical robot market include R-ONE, CorPath GRX, and Genesis RMN. Among them, R-One received CE approval for market launch in 2019 for assisting PCI surgeries; CorPath GRX received FDA and CE certifications in 2016 and 2019 for assisting PCI surgeries; Genesis RMN was launched in the US in 2020 for assisting electrophysiology surgeries. The successful market launch and commercialization overseas mark the beginning of this industry.

(1) Shanghai Tumai Laparoscopic Surgical Robot

Minimally Invasive Medical, through self-developed TAVR surgical robots and the introduction of R-One™ vascular intervention surgical robots, has become a leading player in the domestic market. The company is heavily invested in the vascular surgical robot field, both through self-developed TAVR surgical robots and by signing a final agreement with French strategic partner Robocath on October 29, 2020, to establish a joint venture for vascular intervention medical robots in China, promoting the domestic launch and commercialization of R-One™. Additionally, domestic companies like Aopeng Medical and Shenzhen Aibo Medical are also developing vascular surgical robots.

(2) Aopeng Medical

Aopeng Medical, established in 2017, focuses on the research and development of medical robots, manufacturing products that incorporate high-end manufacturing, artificial intelligence, and 5G concepts for vascular interventional surgical robots. This surgical robot can be widely used in coronary, neurointerventional, peripheral vascular interventional, and tumor interventional surgeries. In October 2021, Aopeng Medical officially launched a clinical trial to evaluate the safety and feasibility of its “Vascular Interventional Surgical Instrument Control System (Product Name: ALLVAS)” for remote delivery and operation of guide wires, guiding tubes, and stent/balloon catheters in peripheral arterial interventional surgeries, marking an important step in NMPA registered clinical research.

Since 2019, Aopeng Medical has completed four rounds of financing. In August 2021, Aopeng Medical announced the completion of nearly 100 million yuan in Series B financing, exclusively invested by Poly Capital, with Haoyue Capital serving as the exclusive financial advisor. This round of financing will be used to accelerate clinical advancement.

(3) Shenzhen Aibo Medical Robotics Co., Ltd.

Aibo Medical, founded in June 2020, is a high-tech enterprise in medical robotics founded by overseas high-level talent and a team of foreign academicians from the Japanese Academy of Engineering. The company aims to industrialize significant technological achievements in the field of cardiovascular interventional surgical robots under the Ministry of Science and Technology’s “863 Program,” aiming to fill the gap in this field in China.

Aibo Medical’s self-developed vascular interventional surgical robot system has innovatively proposed technologies such as linear dragging and remote operation based on multi-source force information fusion, achieving internationally leading levels. Currently, Aibo Medical’s vascular interventional surgical robot products have iterated to the fourth generation. The team successfully completed human clinical trials at Beijing Tiantan Hospital in 2017, becoming the first technical research and development team in the field to complete human clinical trials.

According to changes in business registration information, the company has a registered capital of 1,271,965 yuan. In February and August 2021, two rounds of new shareholders were introduced, with undisclosed financing amounts, including Shenzhen Qianyan Chuangxing No. 1 Investment Partnership (Limited Partnership), Wanlian Daoyi (Tianjin) Venture Capital Partnership (Limited Partnership), Shenzhen Lenovo Angel Technology Venture Capital Partnership (Limited Partnership), and Beijing Natong Technology Group Co., Ltd., among others.

(4) Weimai Medical Devices

Beijing Weimai Medical Devices Co., Ltd. (English Trademark: WEMED, Pinyin Trademark: WEIMAI), established in 2014, specializes in providing interventional diagnostic equipment (DSA) and solutions. The company has extensive experience in the research, design, and industrialization of digital vascular imaging products, covering multiple interventional product lines including large vascular angiography machines (DSA), mobile vascular angiography machines (mid-C), surgical C-arms (small C), and interventional robots.

The ETcath vascular interventional robot is a fully independently developed vascular interventional surgical robot system by the Weimai Medical Robot team, which recently completed the first PCI surgery at Anzhen Hospital. Technically, this interventional surgical robot has achieved key breakthroughs in high-precision catheter and guide wire biomimetic pushing, guide wire tactile perception, multi-type catheter control, and 3s sterile box quick disassembly.

(5) Bangce

Bangce (Shanghai) Robotics Co., Ltd. is a technology-based enterprise that integrates medical, robotics, and artificial intelligence. Bangce is an innovative company incubated under Harbin Institute of Technology Intelligent (000584.SZ), relying on the industrial technology ecosystem of the Harbin Institute of Technology Robotics Group, creating the first AI+ROBOT+IMAGE medical robot platform in China; cooperating with GE to promote the technological integration of ultrasound and robotic platforms. Bangce has successively developed various robots for medical puncture and blood collection under ultrasound guidance, tumor interventional navigation robots, and anesthesia assistance robots, achieving applications in clinical vascular access, tumor interventions, and block anesthesia, enhancing intelligent diagnosis and treatment in hospitals, creating better equipment and conditions for medical services. Currently, Bangce’s mainstream products have entered clinical trials and successfully completed angel round financing led by Lenovo Capital, with Jinsha River United Capital participating.

Bangce’s main product, the hair transplant robot, has completed product development and is expected to obtain class III medical device registration in 2023; subsequent developments for the percutaneous interventional navigation robot, covering multiple application directions including prostate, liver, kidney, lung, and nerve block, are expected to enter clinical trials sequentially in 2022.

In February 2021, the company announced the completion of 20 million yuan in angel round financing, with Lenovo Capital leading and Jinsha River United Capital participating.

(6) Meiyu Medical Technology Co., Ltd.

Meiyu Medical Technology Co., Ltd. is a high-tech enterprise specializing in the research and development of medical robots, production, sales, and after-sales service. The company has strong technical and talent reserves and has in-depth cooperation with domestic well-known hospitals such as the Air Force Medical University Dental Hospital, 301 Hospital, and Peking University Third Hospital.

The company’s founder, Dr. Wang Lifeng, has collaborated with Professor Zhao Yimin’s team from the Air Force Medical University since 2013 to develop an autonomous oral implant robot, successfully completing the world’s first autonomous robot implant surgery in 2017. The research and development team members mainly come from the Robot Institute of Beihang University, Toshiba Medical, and Yaskawa Robotics, participating in several key technology research projects such as the National High Technology Research and Development Program (863 Program) and the National Natural Science Foundation. They possess years of experience in robotic and medical software development. The oral implant robot system developed by Meiyu has accumulated over 300 clinical surgical cases and received class III medical device registration in 2021.

(7) Aikang Medical Technology Co., Ltd.

Aikang Medical Technology Co., Ltd. is a high-tech enterprise specializing in the research and development, production, and sales of medical robots. The company focuses on the research and development of medical robots, particularly in the field of oral implants.

In 2021, Aikang Medical completed a series of clinical trials with its oral implant robot, achieving significant results and receiving positive feedback from the medical community. The company aims to further enhance its product offerings and expand its presence in the medical robot market.

Note: Due to the length of this industry research content, subsequent content will be published in installments.

Disclaimer

Some information and data in this report are sourced from publicly available materials, and no guarantee is made regarding the accuracy and completeness of the information. Without permission, no organization or individual may reproduce, copy, or publish in any form. For reprint requests, please contact for authorization and must prominently mark the source of reprints.

Focusing on Healthcare and Life Science Boutique Investment Banking

Contact Us

Beijing Office

Room 1002, Full Tower, 9 Dongsanhuanzhong St, Chaoyang, Beijing

Shanghai Office

21C Huasheng Tower, 400 Hankou Road, Huangpu, Shanghai

Project Submission

Media Inquiries

Equity Capital Market

Join Us