Disclaimer: This article is an original article by Huoshi Creation, personal forwarding and sharing are welcome, but reprinting on websites, public accounts, etc. requires authorization.

Disclaimer: This article is an original article by Huoshi Creation, personal forwarding and sharing are welcome, but reprinting on websites, public accounts, etc. requires authorization.

Medical robots refer to robots used in medical scenarios such as hospitals, clinics, and rehabilitation centers for medical or auxiliary medical purposes. Medical robots can assist doctors, extend their capabilities, and have three main characteristics: medical applicability, clinical adaptability, and good interactivity.

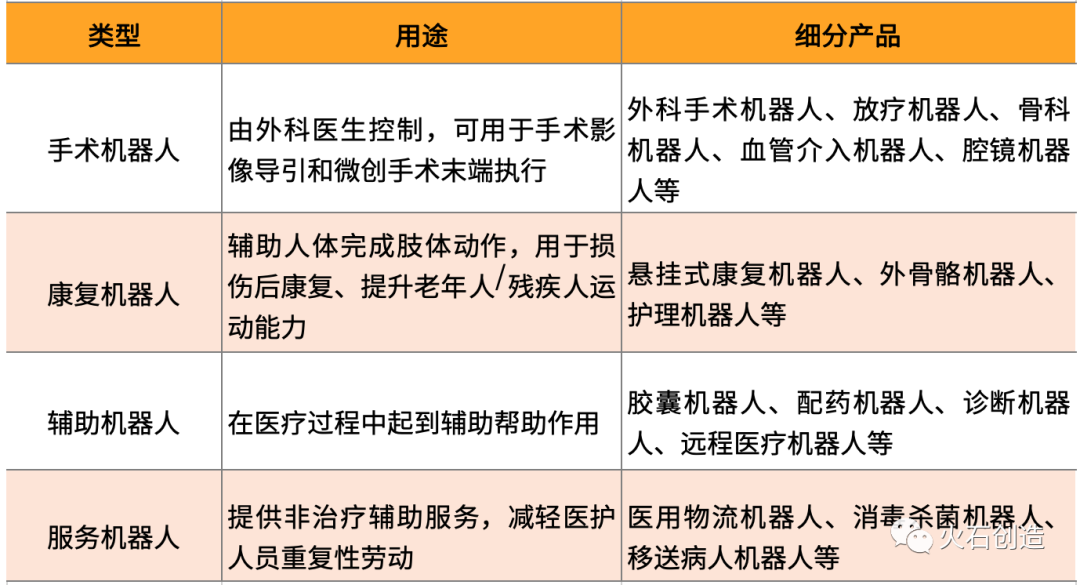

Although medical robots are a relatively small segment in robot applications, they have become a hotspot for development and investment in the current robotics and medical industries due to their high unit value as service robots.According to the International Federation of Robotics (IFR), medical robots can be divided into four main categories: surgical robots, rehabilitation robots, assistive robots, and service robots. Specific uses and detailed products are shown in Table 1.

Table 1 Classification of Medical Robots

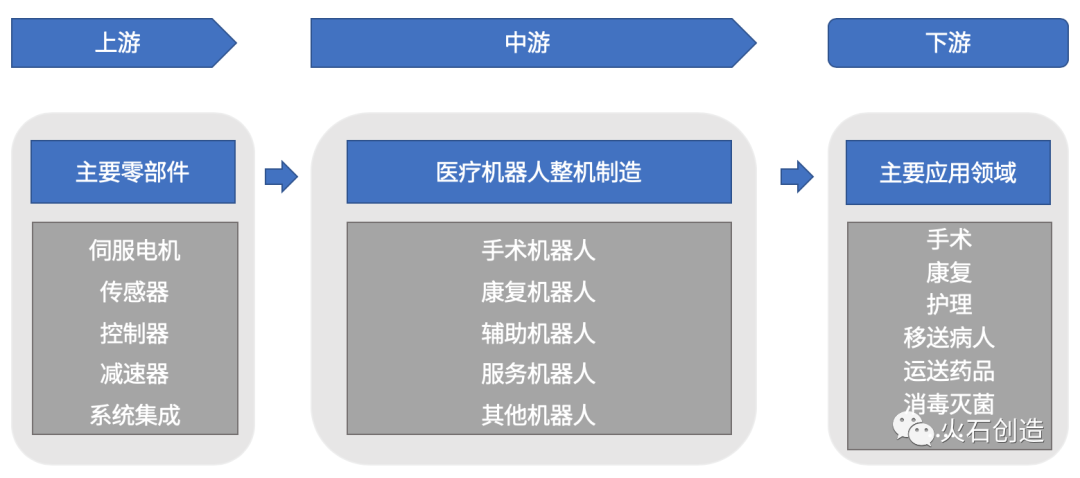

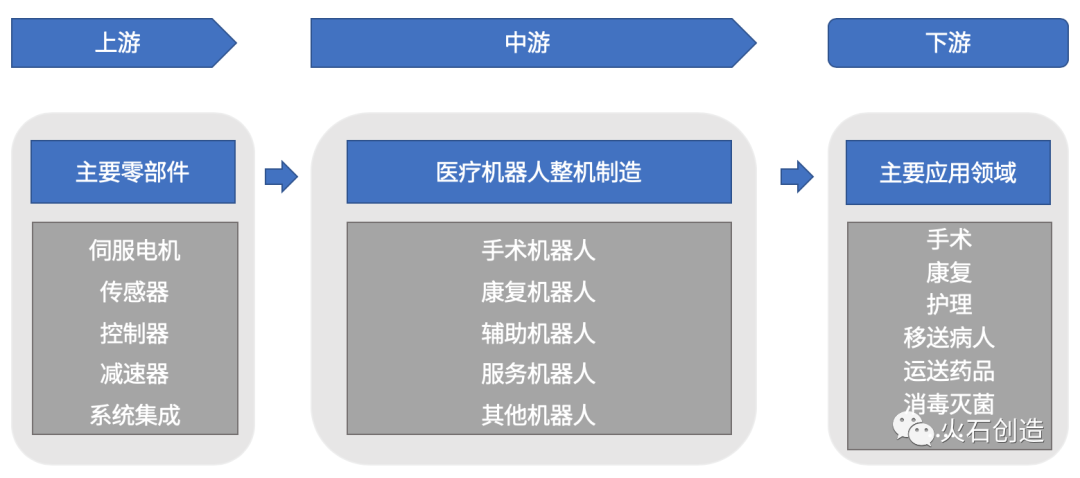

Analysis of the Medical Robot Industry Chain

The upstream of the medical robot industry chain consists of robot components, mainly composed of servo motors, sensors, controllers, reducers, and system integration; the midstream involves the production and manufacturing of medical robots; the downstream supplies the demand side of the smart medical market, mainly applied in surgery, rehabilitation, nursing, patient transfer, and drug transportation.

Figure 1 Schematic Diagram of the Medical Robot Industry Chain

UpstreamThe core components mainly consist of servo motors, sensors, controllers, reducers, and system integration, where the most critical components are the reducer, servo motor, and controller, which together account for about 70% of the total cost of the robot, with most being reliant on imports. The technical barrier for reducers is the highest, mainly including RV reducers and harmonic reducers. Domestic RV reducers are mainly monopolized by Japanese Nabtesco, Sumitomo, and SPINEA; for harmonic reducers, due to their relatively simple structure and the expiration of patents from Japanese Harmonic Drive, the gap between domestic and foreign products is not significant. Domestic servo motors are dominated by Japanese and European-American brands, with a domestic rate of about 15%, mainly concentrated in the mid-to-low end. The technical difficulty of controllers is relatively low, and domestic controller products can already meet most functional requirements, with the gap between domestic and foreign products mainly in algorithms and compatibility.

Midstream consists of companies that produce medical robots. In the business covered by Chinese medical robot companies, the number of rehabilitation robots and assistive robots is relatively high, both exceeding 30%. More than ten domestic rehabilitation robot companies have completed one or more rounds of financing, and there are approximately 20-30 companies in the entire sector, with intense competition and serious product homogeneity. Companies will compete comprehensively in clinical progress, technological advantages, marketing capabilities, sales capabilities, and product prices.

Aside from some diagnostic robots, most assistive robots have relatively low technical barriers and are mainly used for auxiliary diagnosis and treatment, with significant demand from large hospitals with high patient flow. Diagnostic robots for major diseases are a key development direction. Surgical robots have higher technical barriers and development difficulties, accounting for about 15%, with a large market space. Companies with obvious clinical advantages in applications (e.g., single-port laparoscopic surgical robots) and breakthroughs in core components have competitive advantages. Service robots in China have developed relatively late, with the main technical barriers being the product’s precise positioning ability and its integration with AI technology. Currently, there are not many companies in this area, and existing service robots are mainly applied in hospitals and nursing homes. In the future, with technological advancements, they are expected to enter households, greatly expanding the market space. Overall, most domestic medical robot companies’ products are still in the R&D and clinical stages, with only a few companies such as Tianzhihang, Anhui Medical, Baihui Weikang, and Daai Robot having their products approved by NMPA (formerly CFDA) for market sales.

Downstream applications are gradually penetrating various fields of medicine as technologies such as artificial intelligence, voice interaction, computer vision, and cognitive computing mature. Medical robots cover all aspects, including surgical procedures, hospital services, disability assistance, home care, and rehabilitation. Various new medical robots, new surgical tools, medical imaging collection and processing technologies, remote information transmission technologies, intelligent sensors, smart wheelchairs, intelligent rehabilitation devices, and other related technologies remain hot research topics.

Market Size and Growth Rate of Medical Robots

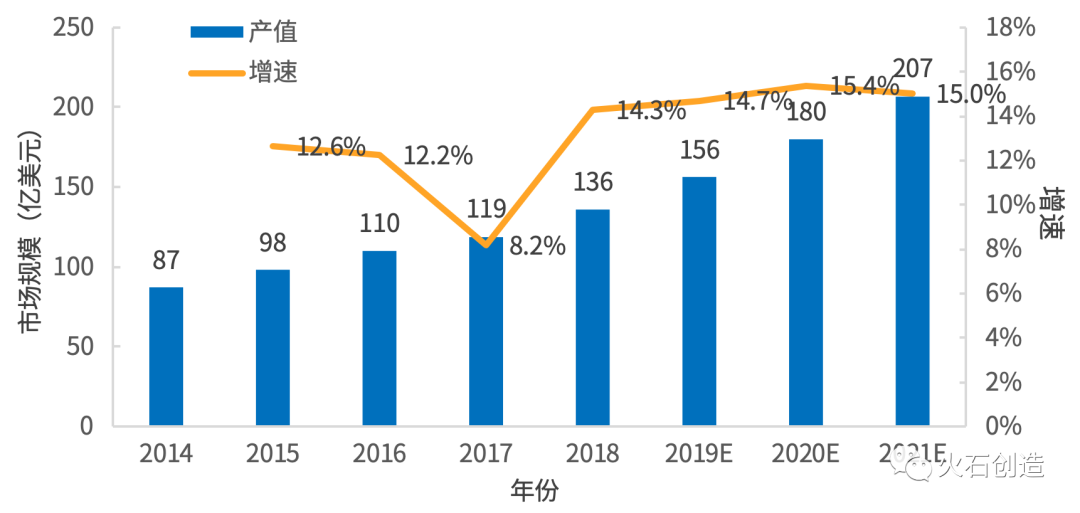

(1) Global Medical Robot Market Size and Growth Trend

In recent years, the global medical robot market has grown rapidly, with surgical robots having the largest scale, rehabilitation robots growing the fastest, and exoskeleton robots expected to experience explosive growth in the segmented field, with training robots and bionic prosthetic robots also expected to grow at a high rate. In 2021, the global medical robot market size is expected to reach $20.7 billion.

Figure 2 Global Medical Robot Market Size and Growth Rate from 2014 to 2021

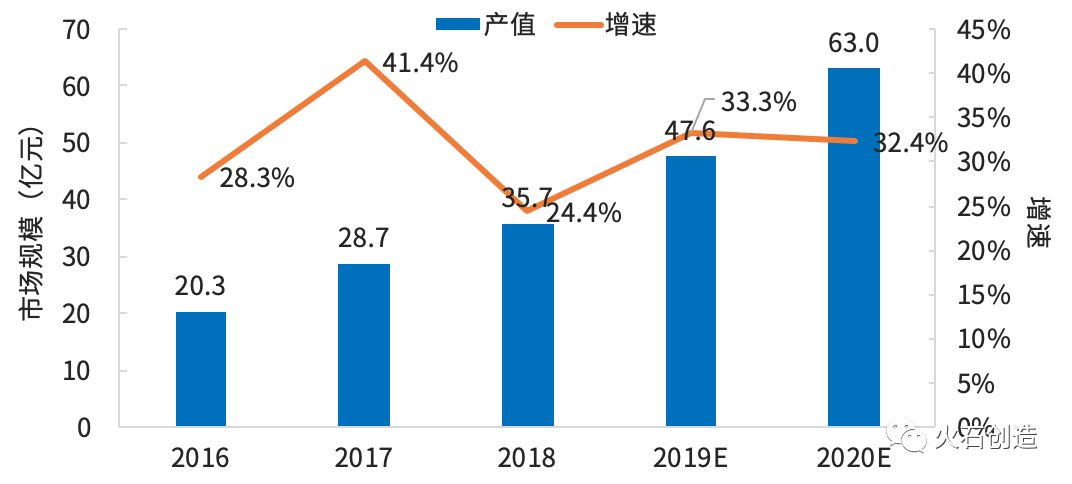

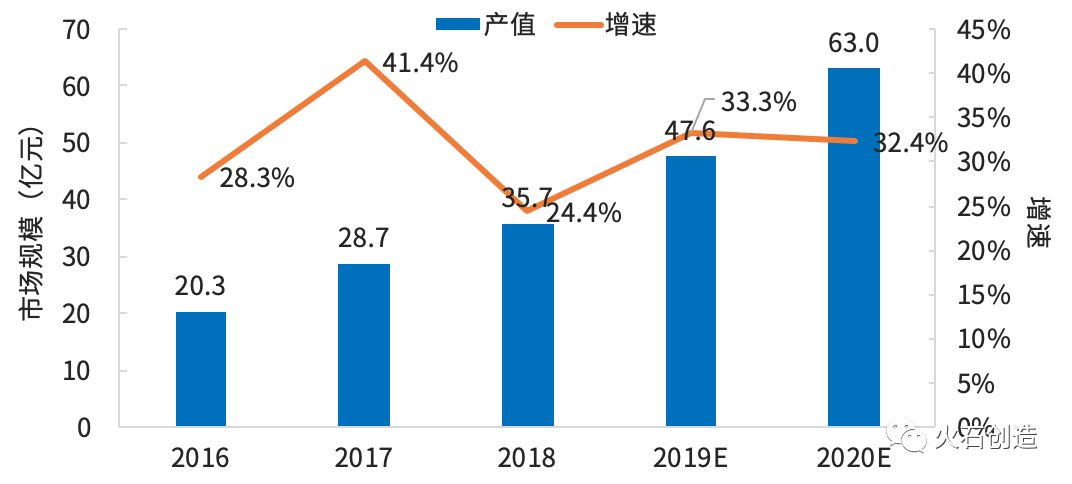

(2) Domestic Medical Robot Market Size and Growth Trend

Since 2014, China has started to introduce surgical robots, mainly in top-tier hospitals in central cities. Overall, the application of medical robots in China’s medical field is still in the introduction stage, both in terms of the technology of the robots themselves and the operational capabilities of medical staff.

From the application effects, large-scale use of medical robots will be a trend in the future. A number of medical robot companies in China have developed rapidly, with obvious industrial clustering characteristics, and new technologies such as 5G and artificial intelligence are accelerating their integration with medical robots.In 2018, the domestic market size reached 3.57 billion yuan, and it is expected to exceed 6.3 billion yuan in 2020..

Figure 3 Medical Robot Market Size and Growth Rate in China from 2016 to 2020

Representative Enterprises in Medical Robots

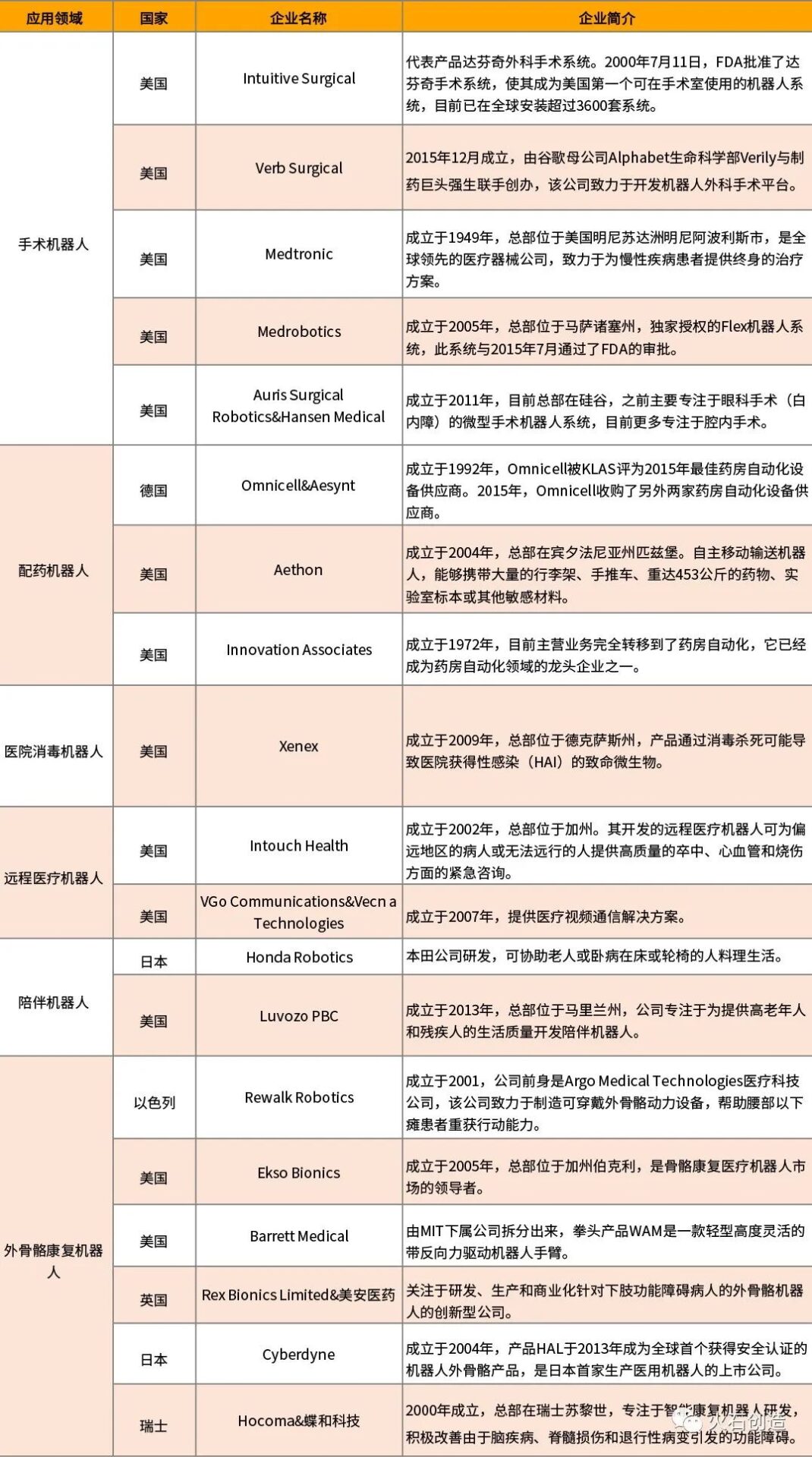

Currently, the development of medical robots is led and represented by American companies, with Germany and Japan closely following. The Da Vinci surgical robot from Intuitive Surgical is the representative of surgical robots and holds an absolute monopoly in the industry. In the fields of exoskeleton robots and telemedicine robots, Japanese companies Cyberdyne and Honda Robotics are leading the industry. In the fields of dispensing robots and exoskeleton robots, German and Israeli companies have certain advantages.

Table 2 Representative Foreign Medical Robot Enterprises

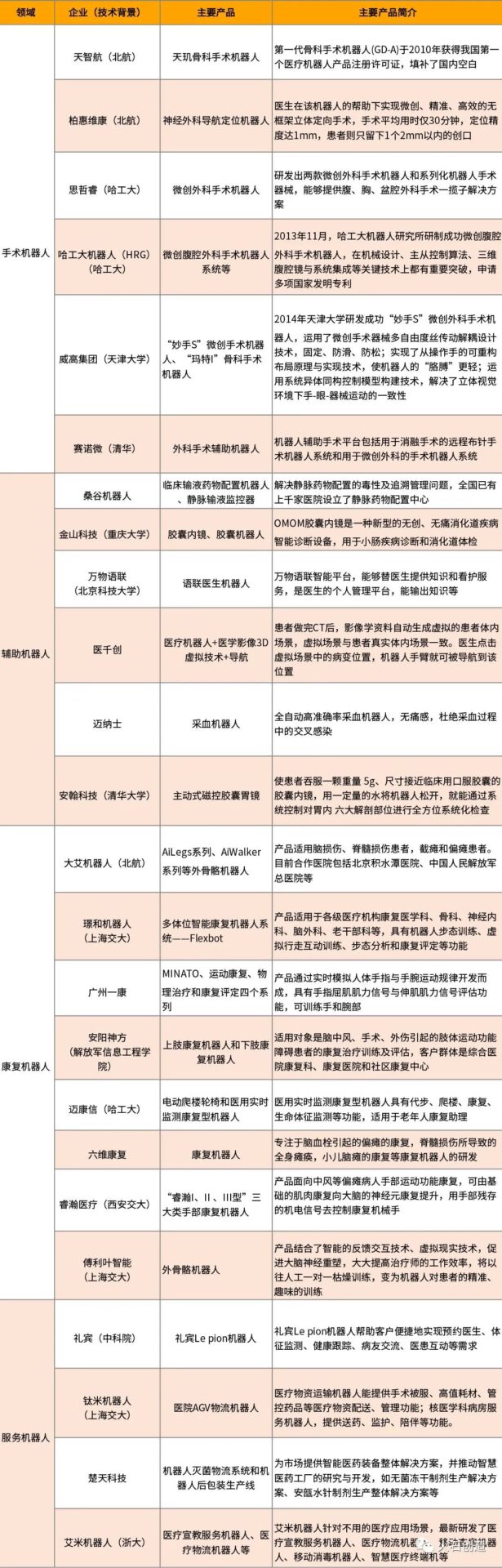

There are nearly a hundred companies in China engaged in medical robots, most of which are in the early stages of development. Listed companies such as Bosch, Jinming Precision Machinery, Fosun Pharma, and Weigao Group have recently expanded their businesses into medical robots. Surgical robots have developed relatively earlier, with Tianzhihang, a new three-board company focusing on surgical robots, currently undergoing the review process for listing on the Science and Technology Innovation Board.In the field of rehabilitation robots, Chu Tian Technology and Jinming Precision Machinery have already been listed.Assistive robots and service robot companies are still in the early stages of development, with most being established in recent years, and the industry is still in its nurturing period.

Table 3 Representative Domestic Medical Robot Enterprises and Their Main Products

Future Development Trends

(1) More Accurate Human-Machine Interaction and Perception Cognition Capabilities

Medical robots emphasize interaction between humans and machines, achieved through tactile and visual feedback, continuously increasing the sense of reality and authenticity. During the interaction process, higher-resolution sensors will improve accuracy. By using multi-model interaction, 3D sensing, and other technological means, recognition rates will be enhanced; by integrating with AR technology to identify objects and environments, robots will be able to move and respond. The cognitive and learning abilities of medical robots will also continue to improve, including knowledge cognition, reasoning, linguistic context, and situational awareness.

(2) Emergence of New Robots Such as Single-Port Surgery, Nano Targeting, and Flexible Robots

Single-port laparoscopic surgical robots have smaller incisions and lower costs compared to multi-port laparoscopic robots, and are likely to become a new type of surgical robot product that breaks the monopoly of the Da Vinci multi-port surgical robot market. North America, the EU, Japan, and South Korea have successively initiated research projects on single-port surgical robots, and Shanghai Jiao Tong University in China is leading the world in the development of single-port robots, which is expected to become an emerging niche in China’s medical robot industry for significant growth.

Currently, medical micro-robots, represented by capsule robots, are developing rapidly. With continuous technological advancements, nano-targeting robots can deliver drugs to the lesion area in the human body through magnetic field control and vascular injection. Important research results have emerged in the field of nano-targeting robots from Harbin Institute of Technology and Tianjin University, and this technology is expected to be first applied in tissues such as the urinary tract and eyeball, becoming a disruptive new technology in cancer treatment and other fields. Given the complex human body structure and the limited narrow spaces within the body, flexible robots will be more convenient to operate, representing a trend for future development.

(3) Deeper Integration of Doctors and Industry

Doctors are the direct users of medical robots and should play a more important role in the development process of medical robots. R&D personnel of medical robots should deeply communicate with doctors regarding functional requirements, safety requirements, and surgical methods and processes. After clarifying the requirements, they should determine design inputs, plan implementation methods, and form engineering language. Both parties should work together on the design scheme for validation, continuously modifying, iterating, and improving it. After forming the design scheme, doctors should also participate in technical testing, evaluation, and modification.

(4) Continuous Optimization of Product Supervision

As medical devices, medical robots face very strict access mechanisms for medical products. On the one hand, certification takes a long time; for example, clinical trials for a surgical intervention robot require at least 2-3 years. On the other hand, certification does not have cross-regional universality, with different localized certification systems in each region (such as the US FDA, Europe CE, China CFDA), which greatly increases the difficulty of industrialization for medical robots. Currently, some regions have opened green channels for certification of highly innovative and safe medical robot products. In the future, countries will continue to optimize regulatory mechanisms to better balance the safety and marketability of medical robots, improving industrial transformation efficiency.

With the development of technology and society, medical robots have increasingly broad market development space. It is essential to recognize that compared to advanced products abroad, domestic medical robots still have many shortcomings. Medical robots are an important part of the country’s strategy to achieve “Made in China 2025” and the upgrade of intelligent manufacturing.

The state has successively issued a series of important policy documents to support the development of the medical robot industry, including “Made in China 2025”, “Robot Industry Development Plan (2016-2020)”, and “Three-Year Action Plan for Promoting the Development of a New Generation of Artificial Intelligence Industry (2018-2020)”.Under the general direction of medical insurance reform, the related costs of medical robots will gradually be included in the scope of medical insurance reimbursement, providing a more favorable market environment for the widespread application of medical robots in China.

—END—

Author | Liu Yu

Editor | Lao Jiang

WeChat ID: huoshi201514

Remarks: Name-Company-Position

Click to read the original text to learn about Huoshi “Cloud Investment”.

Disclaimer: This article is an original article by Huoshi Creation, personal forwarding and sharing are welcome, but reprinting on websites, public accounts, etc. requires authorization.

Disclaimer: This article is an original article by Huoshi Creation, personal forwarding and sharing are welcome, but reprinting on websites, public accounts, etc. requires authorization.