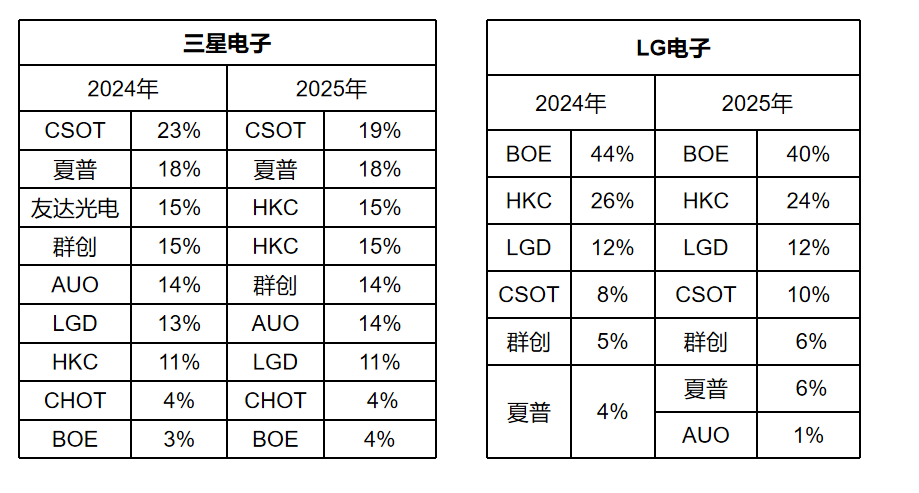

It is predicted that this year, Samsung Electronics will reduce the proportion of LCD TV panels procured from CSOT. This is due to CSOT’s acquisition of LG Display’s Guangzhou LCD factory, which has strengthened its influence in the LCD panel market. Conversely, LG Electronics is expected to increase its procurement of LCD TV panels from CSOT. LG Electronics needs to diversify its procurement channels, which have been overly reliant on BOE. Samsung Electronics Neo QLED (Mini LED) TV (Source: Samsung Electronics)Market research firm Omdia made this prediction at a forum held in Japan in late January. Omdia expects that the proportion of LCD TV panels procured by Samsung Electronics and LG Electronics from China will reach 61% this year. This proportion was 67% in 2023 and is expected to drop to 55% in 2024, but is anticipated to rise again this year as LG Display is set to exit the LCD TV panel business.Omdia predicts that Samsung Electronics’ procurement proportion from CSOT will decrease from 23% last year to 19% this year. During the same period, HKC’s proportion is expected to rise from 11% to 15%, and BOE’s proportion is expected to increase from 3% to 4%.In recent years, Samsung Electronics has been the largest purchaser of LCD TV panels from CSOT. However, with CSOT’s acquisition of LG Display’s Guangzhou LCD factory, Samsung’s increasing dependence on CSOT may become a burden, especially as CSOT’s parent company TCL’s TV shipments are also on the rise.According to statistics from several market research firms, TCL and Hisense’s TV shipments are roughly comparable, but when including the number of TVs produced by TCL’s subsidiary TCL Moka through original design manufacturing (ODM), TCL firmly holds the second position in global TV shipments. In terms of shipments, Samsung Electronics ranks first, Hisense ranks third, and LG Electronics ranks fourth.This year’s forecast for Samsung Electronics’ sources of LCD TV panel procurement is as follows: CSOT 19%, Sharp 18%, HKC 15%, Innolux 14%, AUO 14%, LG Display 11%, CHOT 4%, BOE 4%.

Samsung Electronics Neo QLED (Mini LED) TV (Source: Samsung Electronics)Market research firm Omdia made this prediction at a forum held in Japan in late January. Omdia expects that the proportion of LCD TV panels procured by Samsung Electronics and LG Electronics from China will reach 61% this year. This proportion was 67% in 2023 and is expected to drop to 55% in 2024, but is anticipated to rise again this year as LG Display is set to exit the LCD TV panel business.Omdia predicts that Samsung Electronics’ procurement proportion from CSOT will decrease from 23% last year to 19% this year. During the same period, HKC’s proportion is expected to rise from 11% to 15%, and BOE’s proportion is expected to increase from 3% to 4%.In recent years, Samsung Electronics has been the largest purchaser of LCD TV panels from CSOT. However, with CSOT’s acquisition of LG Display’s Guangzhou LCD factory, Samsung’s increasing dependence on CSOT may become a burden, especially as CSOT’s parent company TCL’s TV shipments are also on the rise.According to statistics from several market research firms, TCL and Hisense’s TV shipments are roughly comparable, but when including the number of TVs produced by TCL’s subsidiary TCL Moka through original design manufacturing (ODM), TCL firmly holds the second position in global TV shipments. In terms of shipments, Samsung Electronics ranks first, Hisense ranks third, and LG Electronics ranks fourth.This year’s forecast for Samsung Electronics’ sources of LCD TV panel procurement is as follows: CSOT 19%, Sharp 18%, HKC 15%, Innolux 14%, AUO 14%, LG Display 11%, CHOT 4%, BOE 4%.

(Translation and Tabulation: Semi Display)Omdia predicts that LG Electronics will reduce BOE’s proportion in its LCD TV panel procurement from 44% to 40% this year. Conversely, LG Electronics is expected to increase CSOT’s proportion from 8% to 10%, Sharp’s from 4% to 6%, and AUO is expected to account for 1% this year. Previously, LG Electronics had minimized the use of CSOT panels to counter competition from TCL in the TV market, but the gap between TCL and LG Electronics is now widening.This year, global shipments of LCD TV panels are expected to decrease by 1.7% compared to last year’s estimate (242.2 million units), reaching 238.1 million units. Despite the decrease in shipments, the shipment area is expected to increase by 5% from last year’s 174.77 million square meters to 184.29 million square meters, due to the trend of larger TV sizes.Omdia expects that shipments of LCD TV panels sized 55 inches and above will show a growth trend this year, while shipments of panels below 50 inches will decrease. The forecast for LCD TV panel shipments and growth rates by size is as follows: 32 inches and below 52.4 million units (decrease of 15.5%), 40 inches segment 59.7 million units (decrease of 1.4%), 50 inches 24.4 million units (decrease of 23.8%), 55-58 inches 41.9 million units (growth of 19.2%), 60 inches segment 29.8 million units (growth of 5.4%), 70 inches segment 18.4 million units (growth of 9.5%), 80 inches segment 9 million units (growth of 42.9%), and 90 inches and above 2 million units (growth of 67.1%).Chinese TV manufacturers are committed to promoting larger TV sizes and are vigorously developing Mini LED TV sales to surround OLED TVs in the high-end market. Omdia predicts that shipments of Mini LED TVs will reach 9.2 million units this year, surpassing the shipment of OLED TVs at 7.1 million units.Previously, shipments of Mini LED TVs had never exceeded those of OLED TVs. Last year, OLED TV shipments were 6.8 million units, while Mini LED TV shipments were 4.7 million units. This was because Samsung Electronics, which was originally expected to drive the Mini LED TV market, increased its shipments of OLED TVs instead of Mini LED TVs.Samsung Electronics’ annual shipments of Mini LED TVs increased from 1.3 million units in 2021 to 2.3 million units in 2022, then decreased to 1.7 million units in 2023 and is expected to drop to 1.4 million units in 2024. Meanwhile, Samsung Electronics’ OLED TV shipments are expected to increase from 1 million units in 2023 to 1.44 million units in 2024. From 2022 to 2024, the total shipments of Samsung Electronics’ OLED and Mini LED TVs remain between 2.6 million and 2.7 million units.This year’s forecast for LCD TV panel shipments from various panel manufacturers is as follows: BOE 60 million units, CSOT 56.5 million units, Innolux 39.4 million units, HKC 36.2 million units, AUO 17 million units, CHOT 13.2 million units, Sharp 11.5 million units, LG Display 4 million units, Tianma 300,000 units. Among Chinese manufacturers, 69.8% of the total shipment of 238.1 million units comes from Chinese manufacturers.

(Translation and Tabulation: Semi Display)Omdia predicts that LG Electronics will reduce BOE’s proportion in its LCD TV panel procurement from 44% to 40% this year. Conversely, LG Electronics is expected to increase CSOT’s proportion from 8% to 10%, Sharp’s from 4% to 6%, and AUO is expected to account for 1% this year. Previously, LG Electronics had minimized the use of CSOT panels to counter competition from TCL in the TV market, but the gap between TCL and LG Electronics is now widening.This year, global shipments of LCD TV panels are expected to decrease by 1.7% compared to last year’s estimate (242.2 million units), reaching 238.1 million units. Despite the decrease in shipments, the shipment area is expected to increase by 5% from last year’s 174.77 million square meters to 184.29 million square meters, due to the trend of larger TV sizes.Omdia expects that shipments of LCD TV panels sized 55 inches and above will show a growth trend this year, while shipments of panels below 50 inches will decrease. The forecast for LCD TV panel shipments and growth rates by size is as follows: 32 inches and below 52.4 million units (decrease of 15.5%), 40 inches segment 59.7 million units (decrease of 1.4%), 50 inches 24.4 million units (decrease of 23.8%), 55-58 inches 41.9 million units (growth of 19.2%), 60 inches segment 29.8 million units (growth of 5.4%), 70 inches segment 18.4 million units (growth of 9.5%), 80 inches segment 9 million units (growth of 42.9%), and 90 inches and above 2 million units (growth of 67.1%).Chinese TV manufacturers are committed to promoting larger TV sizes and are vigorously developing Mini LED TV sales to surround OLED TVs in the high-end market. Omdia predicts that shipments of Mini LED TVs will reach 9.2 million units this year, surpassing the shipment of OLED TVs at 7.1 million units.Previously, shipments of Mini LED TVs had never exceeded those of OLED TVs. Last year, OLED TV shipments were 6.8 million units, while Mini LED TV shipments were 4.7 million units. This was because Samsung Electronics, which was originally expected to drive the Mini LED TV market, increased its shipments of OLED TVs instead of Mini LED TVs.Samsung Electronics’ annual shipments of Mini LED TVs increased from 1.3 million units in 2021 to 2.3 million units in 2022, then decreased to 1.7 million units in 2023 and is expected to drop to 1.4 million units in 2024. Meanwhile, Samsung Electronics’ OLED TV shipments are expected to increase from 1 million units in 2023 to 1.44 million units in 2024. From 2022 to 2024, the total shipments of Samsung Electronics’ OLED and Mini LED TVs remain between 2.6 million and 2.7 million units.This year’s forecast for LCD TV panel shipments from various panel manufacturers is as follows: BOE 60 million units, CSOT 56.5 million units, Innolux 39.4 million units, HKC 36.2 million units, AUO 17 million units, CHOT 13.2 million units, Sharp 11.5 million units, LG Display 4 million units, Tianma 300,000 units. Among Chinese manufacturers, 69.8% of the total shipment of 238.1 million units comes from Chinese manufacturers.

Source:

If there is any infringement, please contact us for deletion

–

END

–

About UsCompany introduction

Shenzhen Flat Panel Display Industry Association (abbreviated as: SDIA) was initiated and established in January 2005 by more than 30 leading enterprises in the industry, and the Touch Screen Branch was established in 2009. It is one of the earliest optical display industry associations established in China, with members covering both domestic and international markets. It is currently one of the largest, most influential, and most active optical display industry organizations in China.The association is the only one in the country that integrates twelve major industry services, including industry research, expert consultation, policy services, exhibition forums, professional media, industry training, member communication, international cooperation, legal consultation, trade services, industrial investment, and financial services.

For inquiries about the “twelve major” industry services, or membership applications, please contact:

Secretariat: 0755-86149674/13027903795 Minister Liu

Submission/Complaint Email: [email protected]