(Report Author: CITIC Securities, Yang Zeyuan, Ding Qi)

1 Autonomous Driving Technology Path: Is LiDAR Necessary?

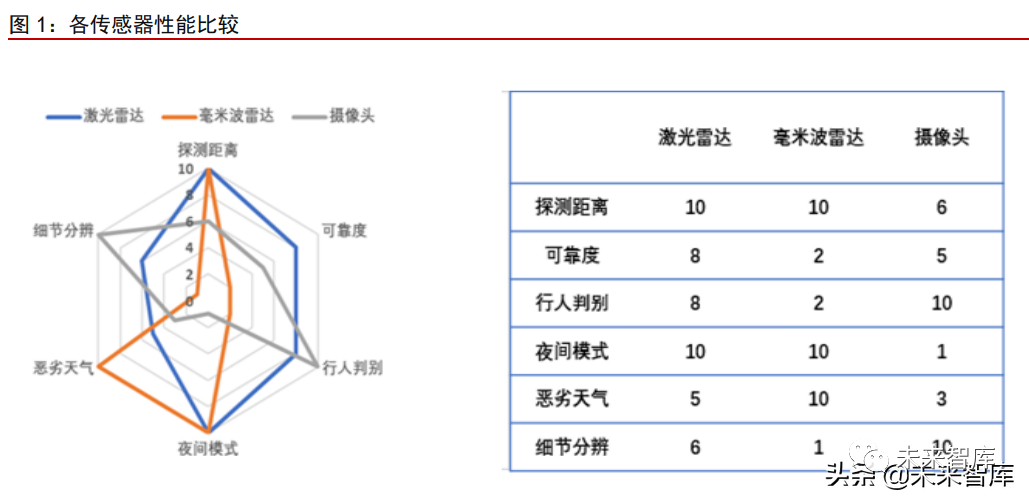

Currently, within the single-vehicle intelligent driving solutions, there are two different paths for the selection of autonomous driving sensors in the market: one is camera-dominated, combined with low-cost components like millimeter-wave radar, forming a purely visual computation, with typical representatives being Tesla, Mobileye, and Baidu Apollo Lite (the only pure visual closed-loop solution for urban roads in China, which no longer uses LiDAR but a pure visual solution); the other is LiDAR-dominated, combined with cameras, millimeter-wave radar, and other components for fusion perception, with typical representatives being Google Waymo, Huawei, Baidu Apollo (except Apollo Lite), Pony.ai, and WeRide, among other leading autonomous driving companies.

Since 2022, as domestic passenger vehicles began to layout high-level autonomous driving solutions, we see that almost all high-level ADAS passenger vehicles have chosen mixed perception solutions that include LiDAR. Although cost remains the main pain point of this advanced solution, automakers still choose to promote their intelligent solutions by raising the vehicle price, reflecting their confidence in attracting consumers through autonomous driving capabilities and building brand influence.

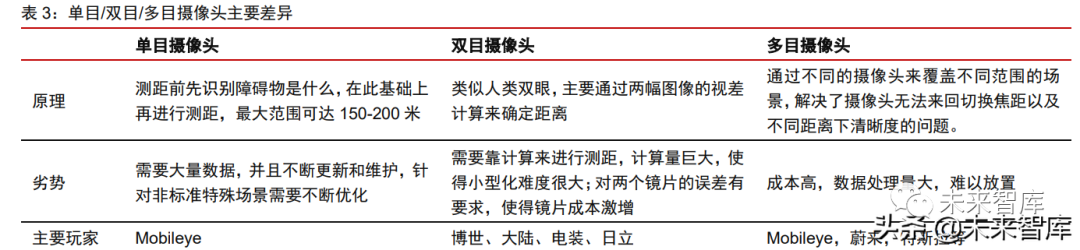

Visual Algorithms: Monocular is more mature compared to binocular/trinocular, and pure visual algorithms have drawbacks in specific scenarios.

The camera is one of the earliest sensors for autonomous driving, with Mobileye being the earliest and strongest developer in the industry. Mobileye originated in Israel as a monocular vision company and has now been acquired by Intel, having 12 years of R&D experience in advanced driver-assistance systems, providing chips and computer vision algorithms to assist driving functions. Under Mobileye’s development, monocular cameras can now perform functions such as lane departure warning (LDW), vehicle detection based on radar-vision fusion, front collision warning (FCW), headway monitoring (HMW), pedestrian detection, intelligent headlight control (IHC), traffic sign recognition (TSR), and vision-based adaptive cruise control (ACC) quite well; according to data compiled by Mobileye in 2019, Mobileye’s products occupy over 70% of the global L2 and below market.

Inherited from Mobileye, Tesla is another major supporter of camera algorithms. After July 2016, when Mobileye stopped providing technical support for Tesla’s Autopilot, Tesla’s Full Self-Driving (FSD, originally called Autopilot) continued to use the visual algorithm system developed during its collaboration with Mobileye, using cameras as the main sensor. Tesla’s visual algorithm perception components include eight cameras—one rearview camera, one front-facing trinocular assembly, two side surround cameras, and also includes a millimeter-wave radar.

With the development of monocular cameras, the industry has also discovered their disadvantages in handling special scenarios, and Mobileye’s monopoly position has led new entrants to hope to achieve a leapfrog through other technical paths, such as binocular and multi-camera technologies, which have rapidly developed in recent years. The current main challenge limiting the development of various technical paths is the chips that process camera data. It took Mobileye ten years to manufacture chips that meet automotive electronic specifications, which is extremely difficult. Currently, binocular and multi-camera systems can only use customized FPGAs, so monocular cameras are the most mature technical path in the industry.

Tesla has applied trinocular cameras, but the algorithm is processed by the FSD chip on Autopilot. Before 2016, Tesla’s Model S used Mobileye’s Eye Q3 chip with a monocular camera, and afterward, Tesla switched to in-house development.Model 3 Tesla’s trinocular camera is purely OEM hardware; the camera collects data and sends it to the Autopilot controller.The three cameras correspond to coverage ranges of 60m, 150m, and 250m, respectively.Tesla’s camera module embeds all CMOS sensors into the PCB, while the image processing is completed by the Autopilot controller. Unlike Tesla, other car manufacturers’ trinocular cameras mostly come from the Tier 1 supplier ZF, whose trinocular cameras are equipped with Mobileye’s algorithm capabilities.

However, in the selection of sensors for L4 level autonomous driving, pure visual solutions have limitations in accuracy, stability, and field of view, which cannot meet the performance requirements for sensors in advanced autonomous driving. Several major safety incidents involving Tesla frequently occur in scenes related to large white trucks, primarily because monocular or trinocular cameras cannot judge distance through visual disparity like binocular cameras can, relying solely on AI algorithms may encounter corner cases in new scenarios, potentially leading to distance judgment errors. Meanwhile, stationary objects may be ignored algorithmically by millimeter-wave radar. Both cameras and millimeter-wave radar may encounter failure scenarios, resulting in frequent collisions with stationary white trucks for Tesla.

In summary, pure visual solutions have certain issues that cannot be compensated for merely through algorithms. These include limited distance measurement accuracy, difficulty handling strong light scenarios, limited field of view, and poor mechanical stability of cameras. These issues make multi-sensor fusion solutions that include LiDAR, cameras, and millimeter-wave radar more advantageous.

The currently more mature algorithm solutions, even when using multi-sensor fusion, mostly use camera input data as the primary modeling data, while other sensors play a complementary role.Thus, sensors like LiDAR and cameras are not mutually exclusive; the use of LiDAR is precisely to solve corner case problems that cameras cannot address. However, we need to emphasize that the primary consideration of autonomous driving algorithms is safety, so while encountering problems that cameras cannot handle is a low-probability event, from the perspective of protecting vehicle safety, the importance of LiDAR is very significant.

Elon Musk’s insistence on supporting visual algorithms while rejecting LiDAR technology may be due to the following reasons: first, commercial cost considerations; when Tesla decided to develop the FSD pure visual solution, the LiDAR on the market was mainly mechanical LiDAR from Velodyne, which was expensive and difficult to mass-produce. The hardware price of visual algorithms is much lower than that of LiDAR solutions. Even in 2022, the price of LiDAR installed on vehicles was still generally around $800-1000, significantly more expensive than pure visual solutions. Second, the factor of rapid response; Tesla’s autonomous driving utilizes shadow mode and other technologies to achieve small steps and quick iterations, requiring a large number of vehicles to collect more data for iteration. If they were to install LiDAR, the large-scale delivery capability of LiDAR would be a significant challenge, as LiDAR only began large-scale delivery in 2022, clearly unable to meet Tesla’s demand for mass vehicle installations.

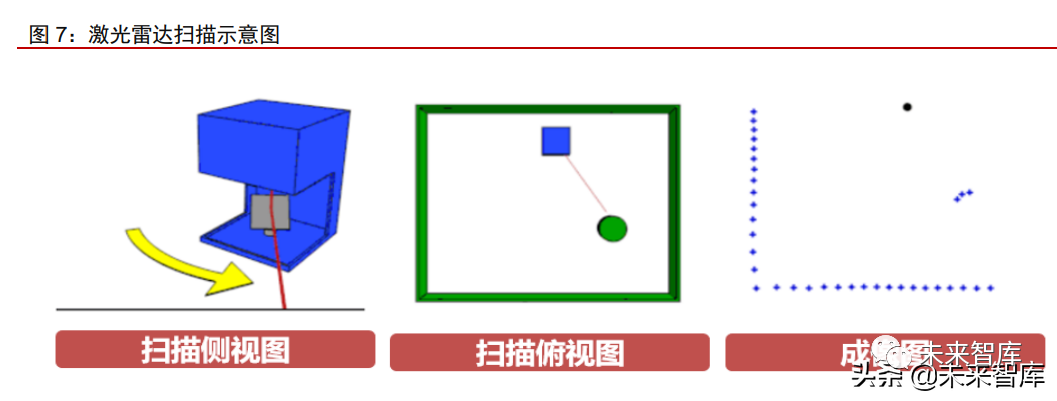

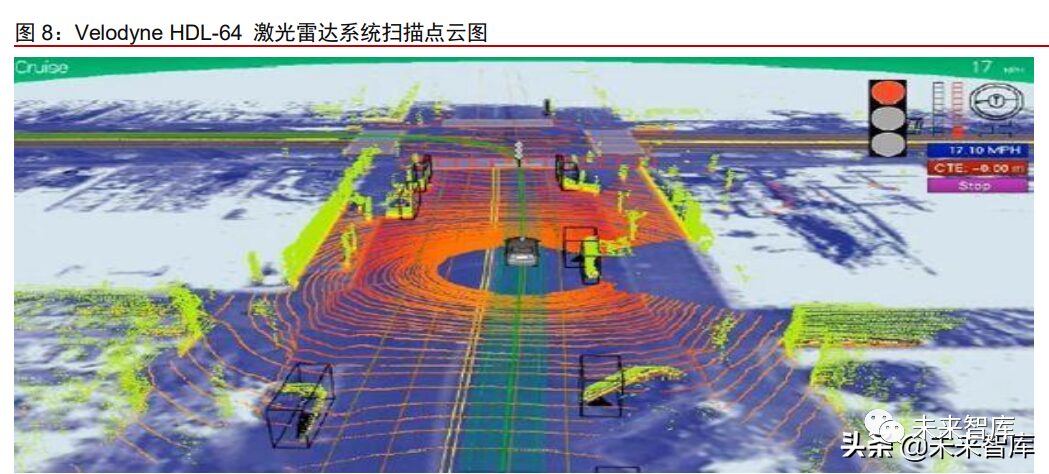

LiDAR Technology: Directly Provides Distance Information to Overcome Visual Algorithm Drawbacks, Essential Sensors for L3 and Above

Similar to radar working principles, LiDAR determines distance by measuring the time or phase difference of laser signals. Its greatest advantage is the ability to create clear 3D images of targets using distance measurements. LiDAR emits and receives laser beams, analyzes the return time of the laser after encountering a target object, calculates the relative distance to the target object, and quickly obtains the 3D model of the measured target along with various relevant data such as the 3D coordinates, reflectivity, and texture of the densely packed points collected during this process, establishing a 3D point cloud map to achieve environmental perception. To clearly see the situation of obstacles ahead, we hope that the point cloud generated by LiDAR is as dense as possible; for traditional mechanical LiDAR, the more laser emitter-receiver pairs, the denser the point cloud, and the higher the safety of vehicle operation.

Compared to traditional passive imaging technologies like visible light and infrared, LiDAR technology has the following significant characteristics: On one hand, it revolutionizes the traditional two-dimensional projection imaging mode, can collect depth information of target surfaces, obtains relatively complete spatial information about the target, reconstructs the 3D surface of the target through data processing, and acquires richer feature information that reflects the geometric shape of the target, such as surface reflection characteristics and motion speed, providing sufficient information support for target detection, recognition, and tracking data processing, thus reducing algorithm difficulty; On the other hand, the application of active laser technology gives it high measurement resolution, strong anti-interference capability, strong stealth capability, strong penetration capability, and all-weather operation characteristics.

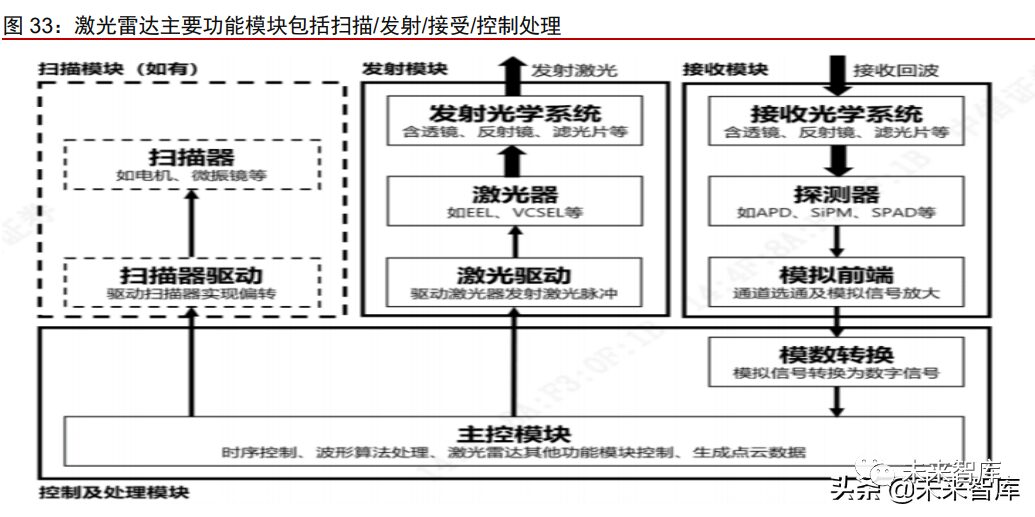

LiDAR mainly includes four systems: laser emission, scanning system, laser reception, and information processing. First, the laser source in the laser emission system periodically drives the laser to emit laser pulses; the scanning system (which can be in various forms such as bearings, rotating mirrors, MEMS mirrors, etc.) rotates at a stable speed to achieve the scattered emission of light; the laser reception system’s photoelectric detector receives the laser reflected back from the target object, receiving the feedback light signal; in the information processing system, the received signal is amplified and converted from analog to digital, and the information processing module calculates to obtain the characteristics of the target surface morphology and physical properties, ultimately establishing the object model.

Since Tesla has not adopted LiDAR to date, there is still controversy in the industry regarding whether LiDAR is necessary for autonomous driving at L3 and above. However, from the actual mass production situation of many car manufacturers, LiDAR is expected to become the essential sensor for L3 and above autonomous driving. Compared to millimeter-wave radar and cameras, LiDAR has excellent capabilities in target contour measurement, angle measurement, light stability, and general obstacle detection. Therefore, in some challenging scenarios, such as non-standard pedestrians in urban areas, non-standard roads, and even non-standard driving behaviors, LiDAR can be more easily judged than other sensors. It can be said that LiDAR is a key sensor for solving continuous autonomous driving experiences, providing a better driving experience, and causing most vehicle manufacturers and Tier 1 suppliers to choose LiDAR as an essential sensor for L3 and above. LiDAR is currently the most expensive sensor, but its price has significantly decreased with technological improvements and mass production.

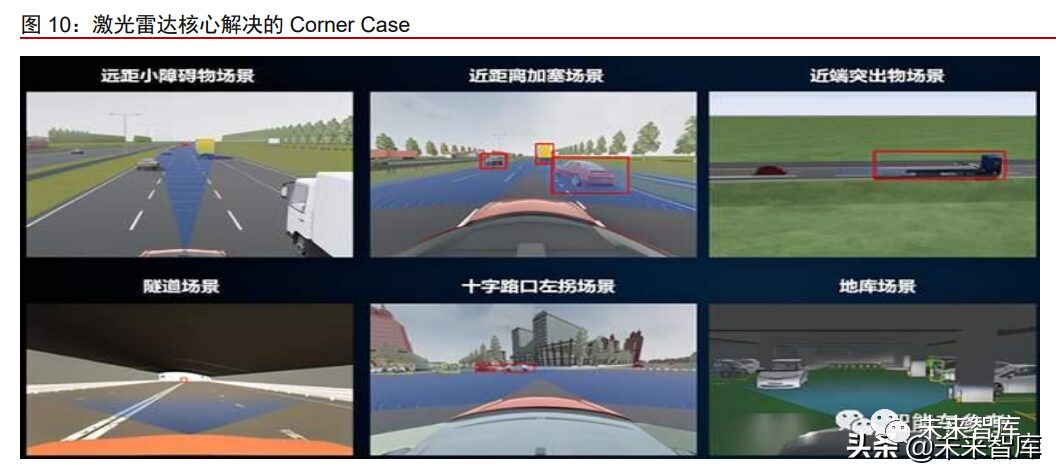

LiDAR is an important means to solve various driving corner cases. We believe that future mainstream autonomous driving solutions will integrate various sensors including cameras, LiDAR, millimeter-wave radar, and ultrasonic sensors, with LiDAR’s integration better addressing various emergencies.

Long-distance small obstacle scenarios: millimeter-wave radar’s angular resolution is insufficient, and cameras do not adequately identify general obstacles at great distances, while LiDAR can quickly identify such scenarios.

Close-range cut-in scenarios: millimeter-wave radar’s angular resolution is insufficient, and cameras usually need to accumulate multiple frames, requiring several hundred milliseconds to confirm a cut-in, while LiDAR, due to its precise angle measurement and contour measurement capabilities, can confirm a cut-in in 2-3 frames and make a judgment within a hundred milliseconds.

Close-range protrusion scenarios: LiDAR can make quick judgments compared to millimeter-wave radar and cameras.

Tunnel scenarios: cameras may experience blindness when there is a sudden change in light brightness, while millimeter-wave radar generally does not recognize stationary objects. If there is a stationary vehicle at the tunnel entrance, LiDAR’s accurate recognition capability is needed.

Intersection left-turn scenarios without protection: require LiDAR’s large-angle full-field measurement capability, while meeting both large field of view and long-distance measurement capabilities.

Parking garage scenarios: due to poor multi-path reflection performance of millimeter-wave radar, and the performance of cameras being affected by varying light intensity, LiDAR is the optimal solution.

2 Market Size Analysis: Four Major Application Scenarios, Rapid Growth Tracks

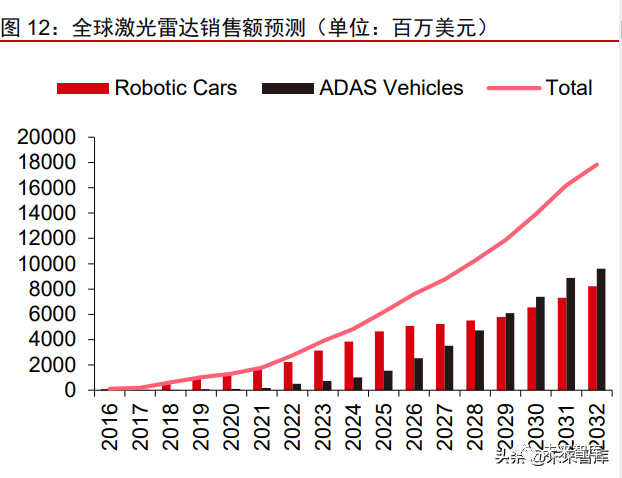

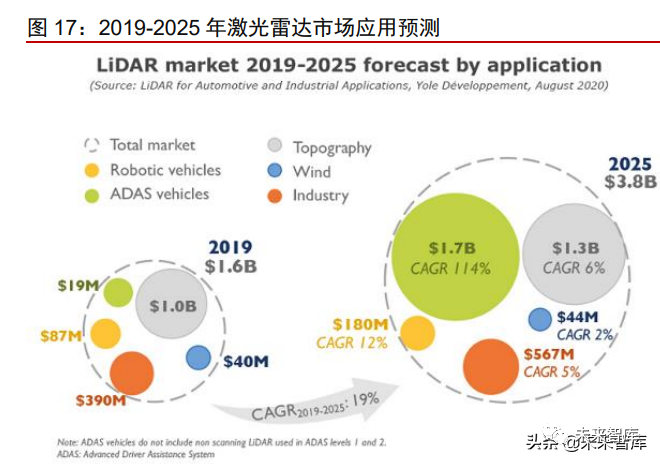

2022 was considered by the market as the true market year for LiDAR, with rapid market expansion. Consulting firm Yole predicts that LiDAR applications are currently one of the fastest-growing sectors in the automotive industry. From a shipment perspective: Yole’s data shows that global LiDAR shipments were about 340,000 units in 2020, expected to reach about 4.7 million units by 2025, and approximately 23.9 million units by 2030. In terms of sales: global LiDAR sales were approximately $1.295 billion in 2020, expected to reach about $6.19 billion by 2025, and about $13.932 billion by 2030.

In the future, as autonomous driving technology becomes more widespread, the LiDAR market size is expected to expand further, and the declining value per vehicle will further facilitate the mass production and use of LiDAR, with the global LiDAR market expected to exceed $10 billion by 2030.

According to application scenarios, downstream applications of LiDAR can be divided into four categories: Robo-Taxi (aftermarket), mass-produced passenger car ADAS (OEM), service robots, and vehicle networking. Among them, ADAS is expected to have the largest long-term growth potential.

From the perspective of application timing, LiDAR began small-scale applications in Robo-taxi and ADAS scenarios after 2017, and there was also small-scale application in the industrial sector; however, regardless of scale or technological maturity, 2022 is a significant watershed. With mass-produced passenger vehicles starting to install LiDAR as automotive-grade ADAS sensors, the LiDAR ecological chain has matured, and investment has begun to enter the return cycle.

Due to the differences in application scenarios and the carriers equipped with LiDAR, there are different requirements for LiDAR’s performance, price, size, and other dimensions.

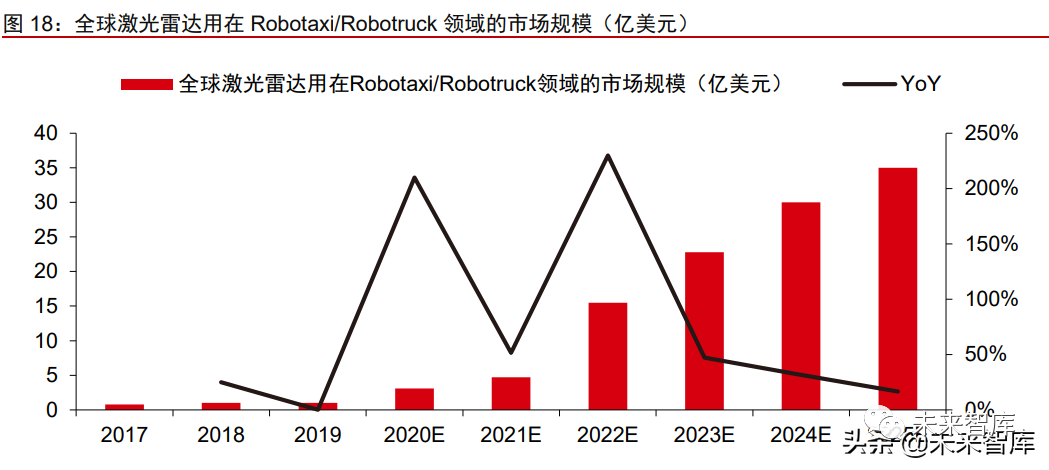

Robo-Taxi Aftermarket: Low price sensitivity and high profit stable market, with a space of $3.5 billion by 2025

Current Robo-Taxi manufacturers are mostly algorithm operation companies: major domestic manufacturers like Baidu Apollo, Didi, Pony.ai, etc. have lower requirements for product prices and integration with the vehicle body, and do not have automotive-grade requirements for usage time, but have high precision requirements for LiDAR. Robo-Taxi requires a high level of autonomous driving and is cost insensitive, making it the main source of income for LiDAR manufacturers. ReportLinker predicts that by 2025, the number of L4/L5 autonomous vehicles globally, including passenger and freight transport, will reach 535,000 units.

Robo-Taxi manufacturers are accelerating commercial landing, supporting market space. In October 2020, Waymo announced that it would provide fully autonomous driving services through its ride-hailing software Waymo One, leading globally. Domestic companies like Baidu Apollo, WeRide, TuSimple, and Zhaijia Technology are also accelerating commercialization; last year, Baidu opened an unmanned taxi service in Beijing, allowing passengers to ride Apollo GO for free, and WeRide currently has a fleet of 260 autonomous vehicles operating and testing in Guangzhou.

Due to the limitation of mechanical LiDAR in the downstream market only to Robo-Taxi manufacturers, the market space and growth rate of this type of LiDAR are limited. Robo-Taxi manufacturers adopt mechanical LiDAR mainly because of its high point cloud quality, which better trains algorithms; in the long run, the market space for this type of LiDAR will actually decrease as autonomous driving algorithms approach maturity. Once the algorithms mature, cost issues will need to be considered when mass-producing vehicles, leading to a greater adoption of other forms of automotive-grade LiDAR.

Mechanical LiDAR is currently the most mature style of LiDAR, meeting the needs of the Robo-Taxi scenario. Mechanical LiDAR, as a mature technology, was the first to be mass-produced and shipped. Since Robo-Taxi manufacturers require LiDAR to be primarily mounted on the vehicle’s roof and have high optical quality requirements, mechanical LiDAR is the most suitable.

In addition, the disadvantages of mechanical LiDAR fall within the acceptable range for Robo-Taxi manufacturers. The main issues with mechanical LiDAR are its high price and limited usable time of 2-3 years. For aftermarket forms, Robo-Taxi manufacturers that install LiDAR can accept this, and there are not many requirements for stability, as the scenarios dealt with are testing environments.

Before 2019, the LiDAR market for Robo-Taxi was monopolized by Velodyne. The monopoly position combined with the immaturity of the industry chain led to high costs, causing Velodyne’s products to be priced extremely high, with 64-line LiDAR prices reaching nearly 700,000 yuan at their peak. However, with domestic manufacturers rapidly expanding into the Robo-Taxi market, the prices of mechanical LiDAR have significantly decreased. Domestic manufacturers like Hesai Technology and RoboSense have developed products from high-end 64-line to low-end 16-line LiDAR, and the upstream and downstream industry chains have matured rapidly, leading many manufacturers to choose to collaborate with domestic manufacturers. For instance, Baidu Apollo has chosen to partner with LiDAR company Hesai Technology to jointly develop the next generation of LiDAR products to be installed in its fifth-generation Robo-Taxi. (Report Source: Future Think Tank)

ADAS:Mass-produced vehicles’ OEM contribution to a huge market of over $70 billion in the future

The demand for onboard LiDAR differs significantly between OEM and aftermarket: the aftermarket demand represented by Robo-Taxi is directly applied to L4~L5 fully autonomous driving development, with limited global demand and generally high prices, typically opting for high-performance mechanical LiDAR; the OEM demand represented by ADAS passenger vehicles is applied to automotive-grade LiDAR for L2+/L3 (ADAS advanced driver assistance/AD autonomous driving), which has strict requirements for size, price, manufacturability, and stability, while performance gradually iterates and upgrades based on meeting automotive-grade standards. Because it directly faces consumers and is the component with the highest penetration rate for future autonomous vehicles, the market space is the most extensive.

LiDAR was first applied to passenger vehicles in 2017, but at that time, laws and technologies were still immature. In 2017, the Audi A8 was equipped with Valeo’s Scala LiDAR, which, although only 4 lines, helped the Audi A8 achieve L3-level functions of Traffic Jam Pilot. However, due to being overly advanced, the global road policies for L3-level vehicles were still incomplete, leading to various legal issues for the Audi A8, making its market promotion less than expected, and thus no global car manufacturers installed LiDAR in the following three years.

LiDAR is expected to enter a period of full explosion in 2022. At the 2020 CES, most LiDAR suppliers launched new LiDAR products priced below $1,000, marking the entry of LiDAR prices into the mass production era for passenger vehicles. Throughout 2021, numerous car manufacturers announced autonomous driving models equipped with LiDAR, most of which plan to officially mass-produce in 2022, rapidly pushing the entire industry towards maturity.

Due to the importance of LiDAR, some car manufacturers have begun to establish deep cooperative relationships with LiDAR companies through joint R&D or even direct equity stakes. For example, NIO has realized a strong binding of shares with TuSimple and provided orders at the level of tens of thousands, driving TuSimple to mature rapidly. As LiDAR technology remains immature, LiDAR manufacturers also hope to collaborate with leading intelligent automotive companies to quickly bring their technology to automotive-grade implementation.

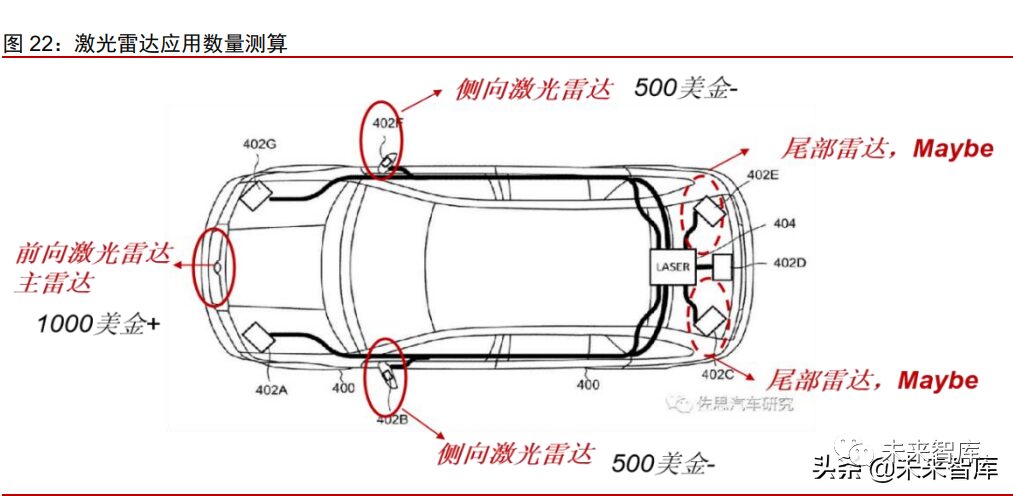

Currently, the mainstream configuration of LiDAR per vehicle is around 1-3 units. In the overall vehicle solution, the core LiDAR is the forward main LiDAR, responsible for the main forward driving signal perception. Car manufacturers will choose high-capacity LiDAR with a high line count; currently, the price of this main LiDAR still reaches $800-1000. After entering L4 autonomous driving levels, some car manufacturers’ solutions include 1-2 side LiDARs, aimed at covering the blind spots of the forward LiDAR; the detection distance of side LiDAR only needs to be around 100m, mainly used for processing side blind spots of changing lanes, thus the price will decrease to around $500, half of the main LiDAR’s price. From Great Wall’s Shark series, there may also be 1-2 LiDARs added to the rear, with unit prices expected to be similar to or slightly lower than that of side LiDAR, but currently, this design is not adopted in mainstream solutions.

Market Space Estimation: In the long term, according to IHS data, global automotive sales in 2019 were 91 million units, with the global passenger vehicle market space relatively stable. Assuming the intelligent vehicle coverage rate matures highly, with a penetration rate of 70%, and LiDAR solutions achieving an 80% market share, with an average of 2.5 LiDARs per vehicle, the corresponding market space is about $67.9 billion.

In the medium term, it is expected that by 2025, the penetration rate of L3-level autonomous driving in the global passenger vehicle new car market will reach about 6%, meaning nearly 6 million new cars will be equipped with LiDAR each year.

Yole predicts that Robo-Taxi and ADAS will rapidly become the main application directions for LiDAR in the next three years, with industrial applications accounting for 83% in 2018, and by 2024, vehicle-mounted LiDAR will account for over 70%.

Robot and Vehicle Networking Market: Space is relatively limited, cost-performance ratio becomes the main consideration factor

The complexity of service robot scenarios is low, with moderate performance requirements but high price sensitivity. Service robots are mainly applied in areas such as unmanned delivery, unmanned cleaning, unmanned warehousing, and unmanned inspection, with more and more e-commerce and consumer services giants and startups investing in this field. Currently, the application of service robots is mainly concentrated in relatively closed scenarios such as campuses, communities, and industrial parks. In December 2019, American autonomous delivery technology company Nuro partnered with retail giant Kroger to provide unmanned delivery services in Houston; in July 2020, JD Logistics’ unmanned delivery vehicle officially launched; in October 2020, Meituan officially released the smart store MAIShop, integrating unmanned micro-warehousing and delivery services; at the 2022 CES exhibition, domestic startups like Qianlong Intelligent also showcased commercial service robots that applied LiDAR technology for delivery, hotel, advertising, and disinfection.

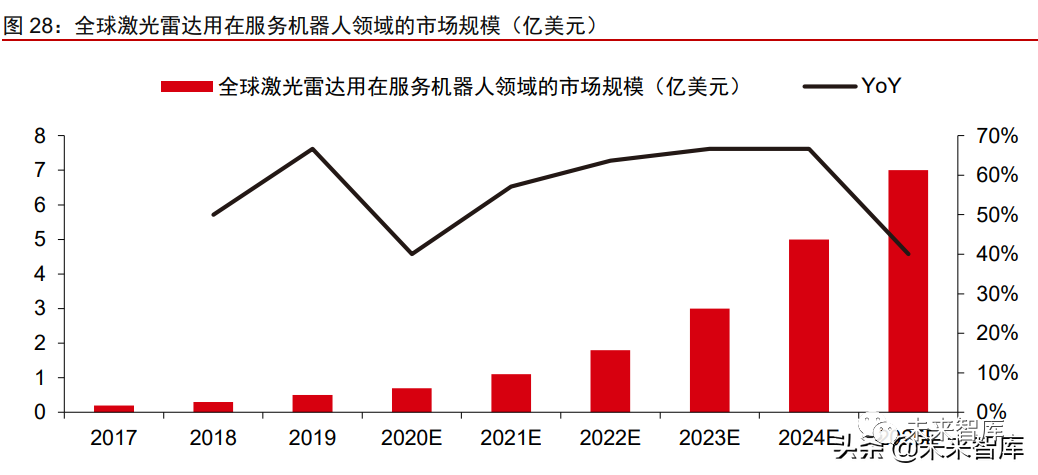

As the global shipment of service robots rapidly increases and the penetration of LiDAR in service robots continues to rise, IDC predicts that by 2025, the market size of LiDAR in this field will reach $700 million, with a CAGR of 57.9% from 2019 to 2025.

In addition to vehicle-mounted LiDAR, LiDAR installed in traffic facilities supporting vehicle-road collaboration applications can achieve dynamic precise perception and intelligent guidance of urban traffic, providing more data support for drivers and government traffic management departments. Osram claims that smart traffic can reduce vehicle accident rates by over 20%, reduce traffic congestion by about 60%, improve short-distance transport efficiency by nearly 70%, and increase the existing road network’s traffic capacity by 2-3 times. V2X LiDAR data can also support vehicle autonomous driving and provide comprehensive travel information services for drivers.

LiDAR manufacturers in the vehicle networking scenario often need excellent algorithm capabilities: vehicle networking applications have lower requirements for automotive grade and integration, but roadside applications require target object clustering and tracking based on LiDAR point clouds, thus requiring higher algorithm capabilities from LiDAR suppliers.

Due to the limitations of single-vehicle intelligence level and detection distance, using mixed perception algorithms with V2X signals is expected to become the implementation direction for L4+ level autonomous driving technology. In February 2020, 11 ministries, including the National Development and Reform Commission, Ministry of Industry and Information Technology, and Ministry of Science and Technology, jointly issued the “Intelligent Vehicle Innovation Development Strategy,” which requires that by 2025, vehicle wireless communication networks LTE-V2X achieve regional coverage, and the new generation of vehicle wireless communication networks 5G-V2X gradually start to be applied in some cities and highways. LiDAR combined with intelligent algorithms can provide high-precision information on location, shape, posture, etc., which is crucial for achieving vehicle-road collaboration V2X.

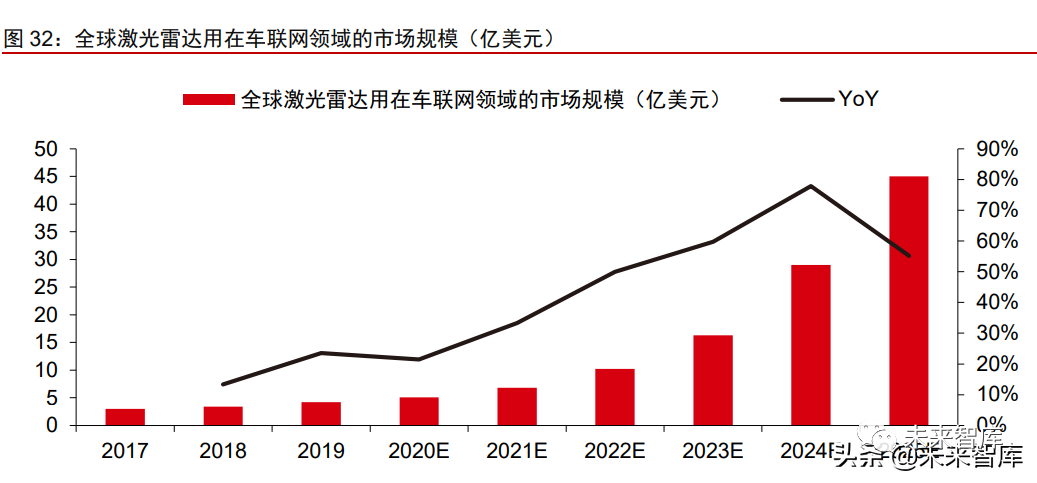

Market Space: As smart city and smart transportation projects gradually land, the demand for LiDAR in this market will show a stable growth trend. IDC predicts that by 2025, the global market size for road testing LiDAR will exceed $4.5 billion, with a CAGR of 48.5% from 2019 to 2025. However, due to the differences in communication and autonomous driving paths in different countries and regions, there may be significant differences in market penetration rates. Due to factors such as the impact of the pandemic and the economic conditions of various countries, we believe that in the next three to five years, improving the level of single-vehicle intelligence will still be the main path for achieving autonomous driving.

In China, which leads the world in infrastructure construction and V2X promotion, we believe that the main market for road testing LiDAR may take the lead in China. According to the domestic “14th Five-Year Plan,” we assume that by 2025, V2X can achieve coverage of core sections and core cities in the country, where there are 250,000 intelligent intersections that need to be transformed, with at least two LiDARs required to cover each intersection. The cost of road testing LiDAR is relatively low, assuming 4,000 yuan per unit, thus the market space is expected to reach 2 billion yuan.

3 Valuation Differences from a Technological Path Perspective: Application Scenarios and Technical Accumulation

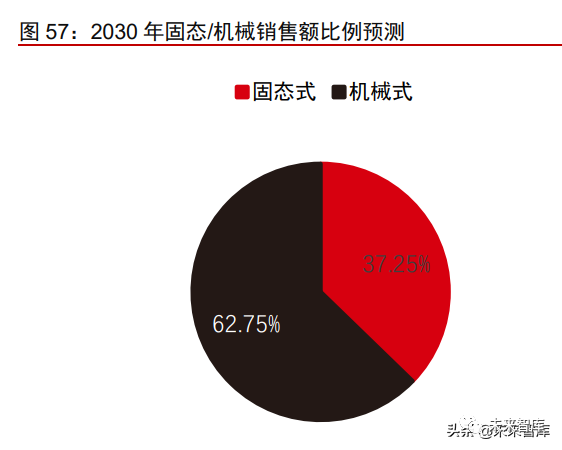

Different LiDAR technical paths are not entirely the same, and there is currently no clear optimal path. Almost every link of LiDAR has different execution methods; according to ranging principles, they can be divided into pulse ToF type, which relies on flight time, or continuous wave FMCW type, which does not rely on time. Most of the products we see are the pulse ToF type, relying on detecting the time it takes for the laser to travel to determine distance, and consist of four parts in hardware: the laser emitter, receiver, scanner, and data processing chip.

LiDAR manufacturers’ design and know-how, which determine the external form and functional implementation of LiDAR, is its scanning system. Since the optical emission and reception components mainly rely on the optical device industry chain, while the main control module part depends on the semiconductor industry chain, both are relatively mature, making the scanning system the primary classification direction for current LiDAR manufacturers. Currently, the industry is also iterating towards more suitable directions based on specific LiDAR needs.

Scanning System: Semi-solid and solid-state are the optimal choice for ADAS; Flash solutions are difficult to achieve in the short term

ToF LiDAR can be broadly divided into two categories based on whether it needs to change the direction of light propagation: beam steering (which changes the light propagation direction) and fixed beam (solid-state, which does not change the light propagation direction). Beam steering LiDAR can usually be subdivided into mechanical LiDAR and semi-solid-state LiDAR; semi-solid-state radars are represented by rotating mirror type, MEMS, and dual-prism types; while solid-state LiDAR includes OPA, Flash, and other technological directions. Overall, changing the direction of light propagation will always bring losses, so pure solid-state is the optimal solution for LiDAR in the long run; while when changing the light propagation direction, fewer physical components lead to slower losses, and under the same effective line count, fewer emitter/receiver components are needed to control costs. However, in practical use, factors such as technological maturity, cost, algorithm maturity, and compatibility with other sensors must be considered to determine which solution is currently optimal. Mechanical LiDAR has already been discussed above, so this section mainly introduces semi-solid-state and solid-state LiDAR.

Semi-Solid LiDAR: Rotating mirror/MEMS has become the current popular mass-production technology path

1) Rotating mirror LiDAR: High maturity, the mainstay

Rotating mirror LiDAR is currently the most mature type of semi-solid LiDAR. The principle is to keep the transceiver module still while the motor drives the rotating mirror to reflect the beam of light to a certain range in space, thus achieving scanning detection. Its technological innovation is similar to that of mechanical LiDAR. However, by varying the vertical angle of the rotating mirror surface, rotating mirror LiDAR can amplify the path of the light beam emitted by the light source, greatly reducing the number of optical components used, achieving an image effect similar to that of mechanical LiDAR relying purely on stacked laser/receiver pairs.

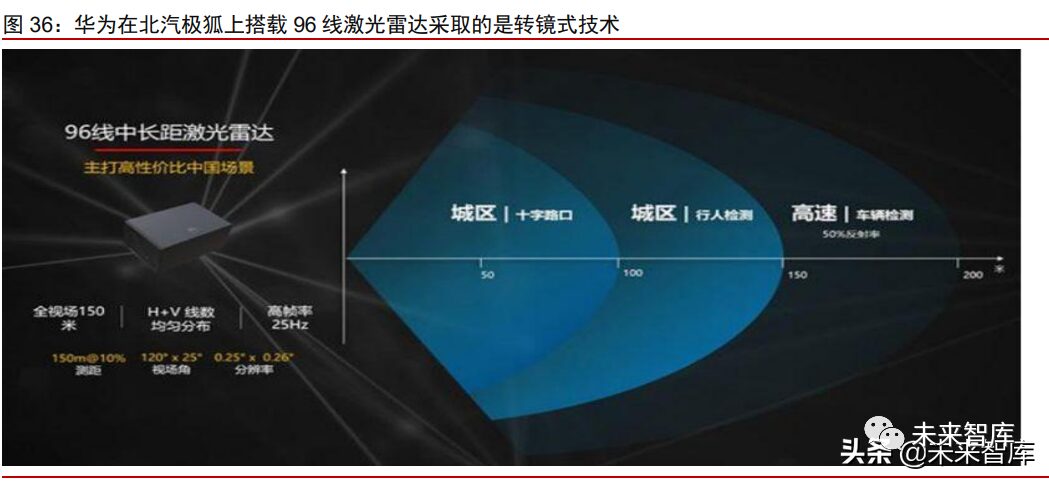

Rotating mirror LiDAR technology is relatively mature. Ibeo/Valeo’s Scala generation 1 and 2 use rotating mirror scanning methods and have been applied to Audi’s L3 intelligent driving models since 2017, and also have applications in the industrial sector, making it a rapidly realizable mass production choice aside from mechanical LiDAR. Huawei’s application on BAIC’s Arcfox uses a 96-line LiDAR of this technology path. Although rotating mirror LiDAR uses more laser sources compared to MEMS LiDAR, its technology path is mature, and mass production pressure is low, making it the technical choice for Huawei’s first generation of mass-produced LiDAR.

From a BOM cost perspective, the cost reduction of rotating mirror LiDAR is mainly driven by increased production. According to Valeo’s estimates, with an average output of one million units per year, the BOM cost per unit is expected to decrease to $105 (Scala GEN 1 is a 4-line LiDAR). In GEM1, the BOM cost currently comes from major hardware modules, accounting for 45% of the total; this proportion will be higher in higher line count LiDARs, exceeding 50%—including emitter-receiver components, FPGA boards, main control boards, and power modules, etc. Laser and receiver manufacturers with mature upstream lasers and receivers have limited room for cost reduction in this part, with an expected reduction of 20%-30% with large-scale production; while manufacturers using 1550nm transceiver components still have some cost reduction space. The second-largest part of the BOM cost is the optical module components—composed of mirrors, lenses, prisms, and window glass—accounting for about 25% of the total; other BOM costs include structural modules: brackets supporting the hardware and optical modules, motors, bearings (this part varies greatly among different types of LiDAR).

One of the leading domestic manufacturers, Hesai Technology’s semi-solid-state LiDAR AT128 is an automotive-grade rotating mirror LiDAR with a ranging capability of 200 meters at 10% reflectivity, and the maximum ground line can reach 70 meters. Through chip-based 128-channel solid-state electronic scanning, it achieves structured scanning of “true 128 lines,” avoiding the impact of two-dimensional high-speed mechanical scanning on product reliability and lifespan, while achieving complete field of view with evenly distributed point clouds in both horizontal and vertical directions, providing significant convenience for subsequent algorithms.Currently, Hesai’s ATB128 product has received orders for over 1.5 million units from automotive manufacturers and is expected to achieve large-scale production and delivery in 2022. In addition to Hesai Technology, Huawei is also using rotating mirror LiDAR for equivalent 96-line products.

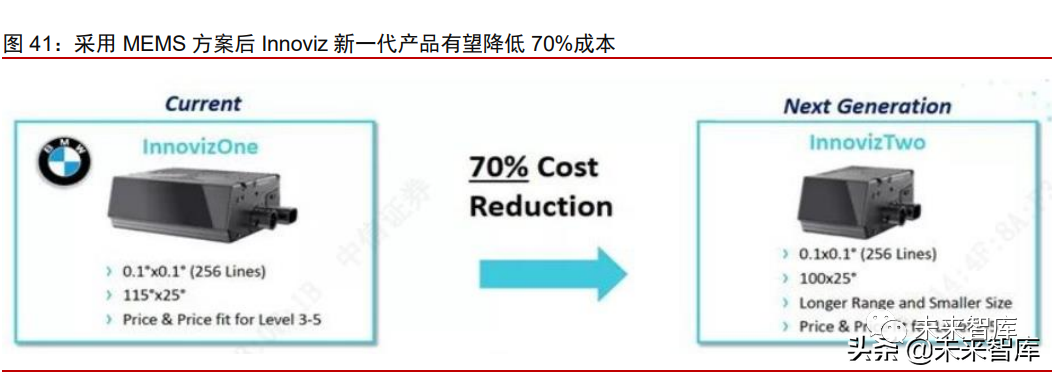

2) MEMS LiDAR: Currently the most widely applied product, maturity meets mass production requirements

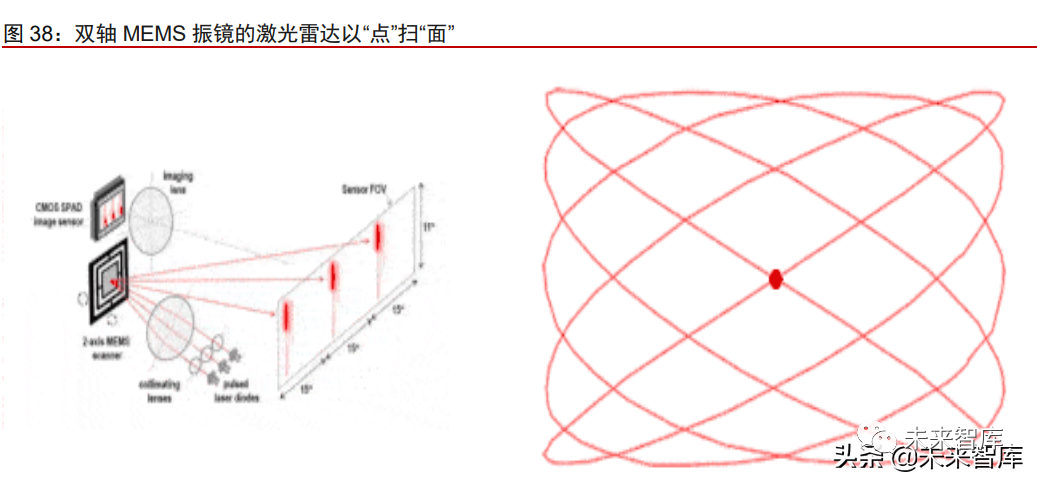

MEMS LiDAR achieves light beam deflection through MEMS mirrors, forming a scanning process with minimal wear from mechanical structures like motors and bearings, while also eliminating potential failures of optical devices due to mechanical rotation, effectively addressing the issues of high material costs and high mass production costs faced by mechanical LiDAR.

MEMS LiDAR uses MEMS micro-mirrors to achieve scanning by oscillating at a certain harmonic frequency, reflecting the laser beam, thus forming high-density point cloud maps at ultra-high scanning speeds. This changes the emission angle of a single emitter to create a wide scanning angle and a large scanning range. Its core beam manipulation component is the MEMS micro-mirror, greatly reducing the size of LiDAR, decreasing the number of lasers and detectors, and significantly lowering costs, while maintaining high performance, stability, and ease of manufacturing, meeting both automotive-grade mass production and high-performance requirements.

The advantages of MEMS include: first, MEMS micro-mirrors eliminate the need for bulky motors and prisms, greatly reducing the size of LiDAR while also improving lifespan; second, the introduction of MEMS micro-mirrors can reduce the number of lasers and detectors significantly, greatly lowering costs. For MEMS LiDAR, the number of lasers used for emission and reception is greatly reduced, even achieving equivalent high line counts with just a few emitters; reception can use single-line SiPM or arrays, making it more flexible. The BOM cost is significantly reduced, with the main cost concentrated on the MEMS mirror, which can be reduced to $30-$50 with large-scale production; depending on the differences in mirrors and light sources, the BOM cost of MEMS LiDAR is currently around $300-$1200. Innoluce has released a MEMS LiDAR design scheme that uses MEMS micro-mirrors and integrates various discrete chips into a LiDAR control chip set, controlling the cost of LiDAR to below $300. Among domestic manufacturers, RoboSense’s latest product based on MEMS mirrors, the M1 LiDAR, is priced around 5,000 yuan.

Third, MEMS has been commercialized in the projection display field for many years, and the technology is relatively mature. Automotive-grade MEMS chips have requirements for vibration resistance, operating temperature, and size, requiring customized R&D for automotive-grade needs.However, MEMS still has its drawbacks: its optical path is relatively complex, and the micro-mirror structure is relatively fragile, affecting the lifespan of the entire LiDAR; the scanning range is limited by the area of the micro-mirror, resulting in a relatively narrow field of view. Manufacturers of mirrors are making further improvements; electromagnetic MEMS mirrors, compared to electrostatic ones, are larger, have higher cantilever strength, and can withstand impacts exceeding 300G, far exceeding the automotive requirements of 50G.

In the MEMS technology sector, the leading domestic player is RoboSense, making it the most favored domestic LiDAR manufacturer among independent brands. RoboSense began its MEMS technology layout in 2016, launched early versions of MEMS LiDAR M1 at the 2018 CES, and announced the completion of China’s first automotive-grade solid-state LiDAR production line in March 2021. In addition to leading in landing progress, RoboSense has developed a “gaze” function based on MEMS two-dimensional scanning chip technology, allowing M1 to change the scanning speed in both horizontal and vertical directions at will, completing the switch in the next frame upon receiving instructions, helping vehicles focus on key perception areas and enhancing autonomous driving performance. This characteristic gives RoboSense’s products unique features beyond typical MEMS products. In addition to RoboSense, leading manufacturers applying MEMS technology include overseas companies like Luminar and Innoviz.

3) Dual-prism LiDAR: cost-optimized, with both advantages and disadvantages

In addition to rotating mirror and MEMS types, the relatively unique dual-prism LiDAR is primarily used by DJI Livox. Its scanning system uses two prisms to change the light path, and the optical emission components do not rotate, thus categorized as hybrid solid-state LiDAR. The advantages of this technology path include ease of passing automotive-grade standards (fewer rotating components, less prone to damage) and high cost-performance ratio (requiring fewer laser/receiver components to achieve equivalent line counts than MEMS types). Horizon is equivalent to 64-line LiDAR, and Tele-15 is equivalent to over 128-line LiDAR. DJI’s Livox has advantages that make it the cheapest among all LiDAR products that have been launched, with its earliest MID series sold at a price of 4,000 yuan, with new products priced similarly, making it one of the first LiDAR products to be mounted on the road in China (mounted on XPeng’s P5 series).

The drawbacks of dual-prism types are also quite evident. First, the non-repetitive scanning frame rate is low, and the point cloud density requires longer scanning times, posing a significant defect for ADAS scenarios that emphasize response time; second, under dual-prism conditions, the point cloud presents a “kaleidoscope” structure different from other methods, requiring companies using AI technologies like neural networks to develop new algorithms and match them with data from other sensors.

Solid-state LiDAR: may be a long-term trend, but difficult to land in the short term

In terms of LiDAR technology evolution paths, the solid-state LiDAR based on rotating mirrors and MEMS methods is the most promising mature solution for rapid landing, while OPA and Flash are the stars of tomorrow, but their landing progress continues to be slower than previously expected in the industry. Solid-state LiDAR based on OPA mainly utilizes the principle of optical interference, changing the phase difference of incident light in different slits to alter the position of the central bright fringe after diffraction, although it has advantages of fast scanning speed, high precision, and good controllability, its production difficulty is high.

OPA LiDAR: This type of solid-state LiDAR has advantages of fast scanning speed, high precision, good controllability, strong anti-vibration performance, small size, high consistency in mass production, and lower costs. However, it still has issues such as easy formation of side lobe effects, limited coverage of light signals, environmental light interference, and short measurement distances, and the processing difficulty is high.

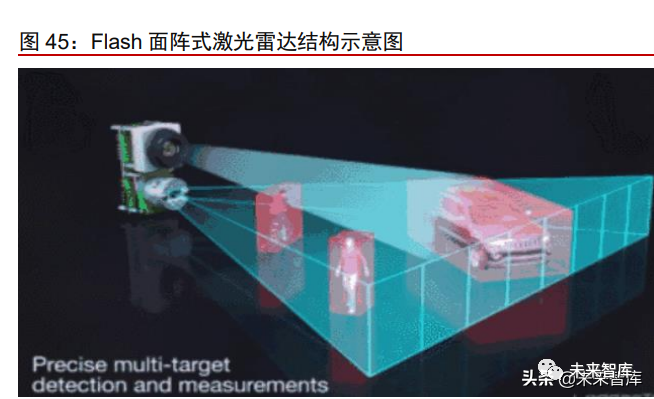

Flash LiDAR is also known as a depth camera. Its principle is to emit a large area of laser covering the detection area in a short time and then use highly sensitive receivers to complete the drawing of the surrounding environment image. Although Flash LiDAR has good stability and cost, its low power density generally limits its effective range to no more than 50 meters. To improve its performance, more powerful lasers or more advanced laser emission arrays are needed to allow the light-emitting units to light up in a certain pattern to achieve the effect of a scanner.

The long-term advantages of Flash are evident and are favored by manufacturers, including: the easiest to pass strict automotive standards, the smallest size, the most flexible installation position, full chip integration, the lowest cost (unit prices can easily be kept below $100), and the greatest potential for performance exploration (depth cameras can be used not only in the automotive field but also in other solid-state 3D sensing fields, as well as for AR/VR).

The transmitter (VCSEL) and receiver (SPAD) devices have been made into chip-level components, and with a driver and motherboard, they can be made into the LiDAR body. Because there are no precise rotating components inside, and the transmitter and receiver are designed at the chip level, it also solves the issues of meeting automotive standards and costs.

For these reasons, global tech giants have chosen to directly invest in this potentially “final” track for LiDAR, with the global technology sector’s R&D investment in the overall Flash field far exceeding that of other types of LiDAR: including Broadcom (Tesla’s partner, launched vehicle-mounted Flash LiDAR using SPAD or SiPM array chips at the EPIC online conference in November 2020), Apple (the ultra-wide-angle lens of the iPhone 12 Pro consists of the upper and lower parts of the laser radar’s VCSEL+SPAD design), Sony, Samsung, STMicroelectronics, Infineon, AMS, Lumentum, Toshiba, Panasonic, Canon, Hamamatsu, ON Semiconductor, and Toyota are all developing Flash vehicle-mounted LiDAR.

Relatively mature solid-state LiDAR manufacturers include Quanergy, Ibeo, etc. Among them, Quanergy’s new product S3 claims to be the world’s first fully solid-state LiDAR, which can be widely used in unmanned aerial vehicles, intelligent robots, security, smart homes, and industrial automation applications.Ibeo, after achieving great success with its mechanical LiDAR product SCALA series in cooperation with Valeo, was acquired by ZF for 40% of its shares in 2016 and began focusing on developing solid-state LiDAR products, with Ibeo expected to achieve mature solid-state LiDAR mass production in 2022. Traditional manufacturers that primarily use mechanical paths have begun to attempt to develop solid-state LiDAR, aiming for miniaturization, low cost, and high reliability as future development directions.

Laser Classification Differences: 1550nm Safety is Superior to 905nm, EEL Begins Transition to VCSEL

VCSEL (Vertical-Cavity Surface-Emitting Laser) chip consumer-level production lines are already very complete. Since Apple applied VCSEL in the front structure light scheme to realize facial recognition in 2017, VCSEL has gained widespread attention and application in the consumer electronics field. In 2020, Apple adopted a rear LiDAR solution in the new iPad Pro and iPhone 12 Pro, still using VCSEL as the core laser light source.

LiDAR manufacturers have also begun to transition from EEL lasers (edge-emitting lasers) to VCSEL lasers. From the perspective of light emission, EEL emits light from the edge, requiring the use of discrete optical components for beam divergence compression and independent manual tuning, heavily relying on the manual tuning skills of production line workers, leading to high production costs and difficulty in ensuring consistency. VCSEL emits parallel light and uses surface emission, eliminating the need for separate tuning of each laser, and is easy to integrate with silicon-based micro-lenses, improving beam quality. High-power VCSEL diodes with narrow pulse width and smaller beam divergence angles have become the optimal choice for solid-state LiDAR.

The main problem faced by VCSEL is insufficient optical power density. The traditional approach is to increase the number of light-emitting points in an array to raise optical power. However, in the application of LiDAR, increasing the area to boost optical power does not yield significant benefits; only a higher optical power density can allow the laser to detect farther. In 2020, various VCSEL manufacturers released multi-junction VCSEL technology solutions. Multi-junction VCSEL technology increases the number of light-emitting quantum layers to enhance optical power under unit current, thereby increasing the optical power density of the device.

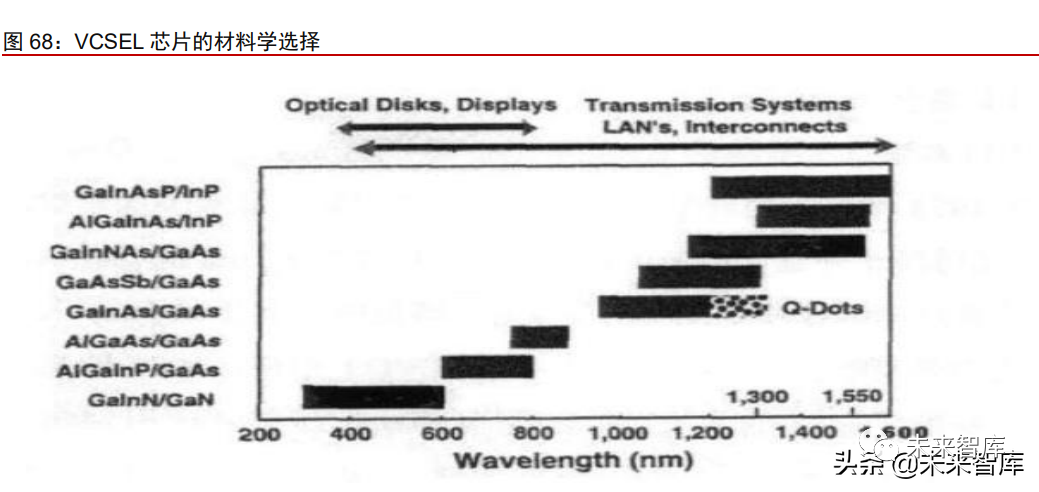

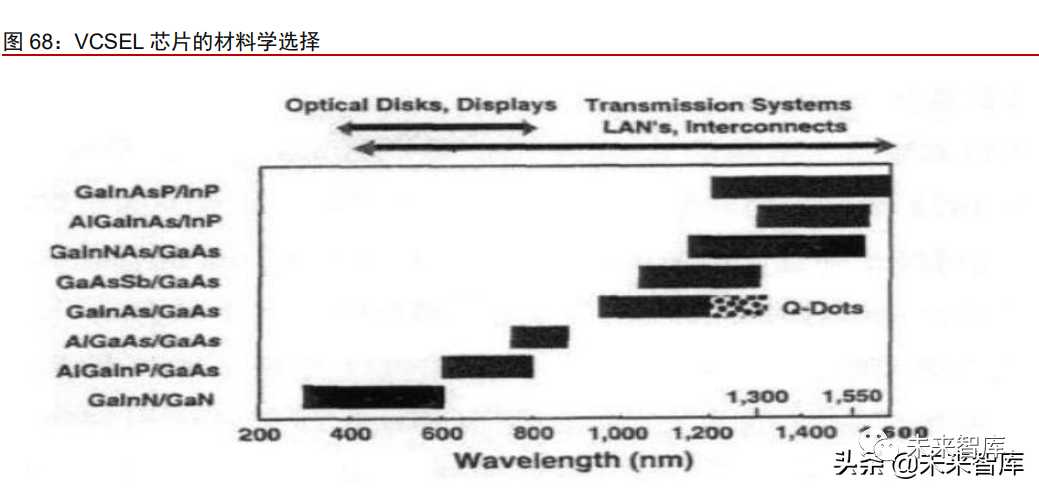

Currently, whether it is EEL lasers or VCSEL lasers, the suitable wavelength remains 905nm. The industry generally believes that 1550nm will be a necessary choice for future LiDAR. The advantages of 1550nm mainly lie in its safety to the human eye; since 905nm is close to the highest wavelength of the visible light range (850nm light is usually perceived as dark red), if the energy of 905nm LiDAR needs to be increased to enhance detection distance, it poses certain risks to human eyes.Laser in the 400-1400nm band passes through the vitreous body and focuses on the retina; a temperature rise of 10℃ in the retina can damage photoreceptor cells. Lasers below 400nm or above 1400nm will be absorbed by the lens and cornea, thus high-power lasers can cause cataracts or lens burns.

Compared to 905nm silicon photodetectors, 1550nm InGaAs has significantly increased safety and protection for the human eye. In rainy, snowy, or foggy weather, the reflectivity of objects decreases, leading to a reduction in the effective detection distance of LiDAR. 1550nm LiDAR can solve weather-related issues by increasing optical power. Luminar’s 1550nm products can achieve an effective detection distance of 250 meters even with a 10% reflectivity object and have a maximum detection range of 500m; it can also overcome the low signal-to-noise ratio issues of MEMS. Luminar’s latest solid-state MEMS 1550nm solution, Iris, is expected to achieve mass production in Q3 2022.

Material science limitations make mass production of 1550nm VCSEL chips challenging. The semiconductor multi-layer reflective mirror DBR of VCSEL is made of GaAs/AlAs and is etched to form an air-post structure. According to wavelength classification, VCSELs can be divided into 340nm, 640-670nm, 750-780nm, 850nm, 980nm, 1300nm, 1550nm bands, as well as tunable VCSELs. GaAs/AIGaAS is currently the most mature material used, corresponding to VCSEL chips of 850nm and 980nm, while InP-based VCSELs, such as InGaASP/InP and AlGalnAs/InP quaternary materials, have low thermal conductivity and small refractive index differences, requiring many pairs of DBR (>30 pairs) to achieve high reflectivity, complicating material growth. This makes achieving 1550nm VCSELs more difficult. Among them, 1550nm VCSEL chips are applied in long-distance, broadband high-speed optical fiber communication, which has a smaller market space compared to consumer applications, and the technology is currently not mature.

Additionally, on the detector side, InGaAs material is needed for 1050nm detectors. Solving the cost issue of materials has become one of the core advantages for Luminar. To address the high cost of InGaAs materials, Luminar acquired InGaAs receiver manufacturer Black Forest Engineering in 2017, significantly reducing the amount of InGaAs material used per LiDAR, effectively controlling the cost of 1550nm LiDAR for L3+ applications to below $1,000, which is within the acceptable range for passenger vehicles.

Receiver Classification Differences: Transition from APD to SPAD

Detectors refer to devices that convert light signals into electrical signals using the photoelectric effect, enabling the detection of light signals. They can be divided into frequency-modulated continuous wave types (FMCW) and time-of-flight types (ToF). The former mainly includes PIN PD (diodes) without gain capability, while the latter includes APD (avalanche photodiodes), SPAD (single-photon avalanche diodes), and SiPM (silicon photomultiplier tubes, similar to SPAD), which are commonly used receivers in the LiDAR field.

The consensus in the industry has basically been reached that SPAD will replace APD. Currently, APD is the most widely used detector, with diverse application scenarios, but it has obvious disadvantages in gain capability and large-size arrays. SPAD effectively addresses gain capability issues, while SiPM integrates multiple SPAD tubes, effectively solving large-size array problems, but its essence remains SPAD, making the trend of SPAD replacing APD obvious. The main issue with SPAD is its excessive sensitivity, which may lead to misjudgments in specific weather environments, needing to be compensated for through algorithms and sensor fusion perception solutions.

SPAD for vehicle-mounted LiDAR has advantages over APD solutions, such as stronger gain capability and easier integration of large-size arrays with CMOS. Japanese manufacturers have overwhelming advantages in the SPAD field, being global leaders in SPAD technology. Sony unveiled the first automotive-grade LiDAR receiver sensor IMX459 based on SPAD technology at the 2022 CES, achieving a pixel level of 110,000, with advantages including stronger light sensitivity, meaning that under the same laser emission conditions, the SPAD sensor can perceive weaker light and detect farther; secondly, the distance calculation delay is lower, with Sony achieving 6 nanoseconds.

(Report Source: Future Think Tank)

4 Investment Analysis: Technological Paths Bring Valuation Differences, Core Components Present Investment Opportunities

Lasers: Lumentum’s Leading Position is Significant, Domestic Companies’ Layouts are Already Apparent

VCSEL is small in size, low in cost, and easy to control, but has lower power. Several major VCSEL manufacturers are working hard to develop high-power VCSEL arrays, with the fastest progress being made by Lumentum, Apple’s main supplier, which is also the world’s largest VCSEL manufacturer. According to Yole data, its market share is about 45%. Current experimental products can achieve a maximum power of 10 watts, and 30-50 watts can match the effects of non-Flash LiDAR; at that time, Flash LiDAR will become the preferred choice.

905nm and 1550nm may coexist in the long term; it is recommended to distinguish wavelengths and focus on domestic startups. 905nm and 1550nm each have their advantages and disadvantages, both with certain room for improvement. Although 905nm is limited in automotive applications, it is widely used in smartphones; it uses silicon as a raw material, which has cost advantages; future performance can be improved through process improvements. Meanwhile, 1550nm can leverage scale advantages to reduce costs through mass production. We believe that the two may coexist in the long term, so it is advisable to distinguish between wavelengths when focusing on companies.

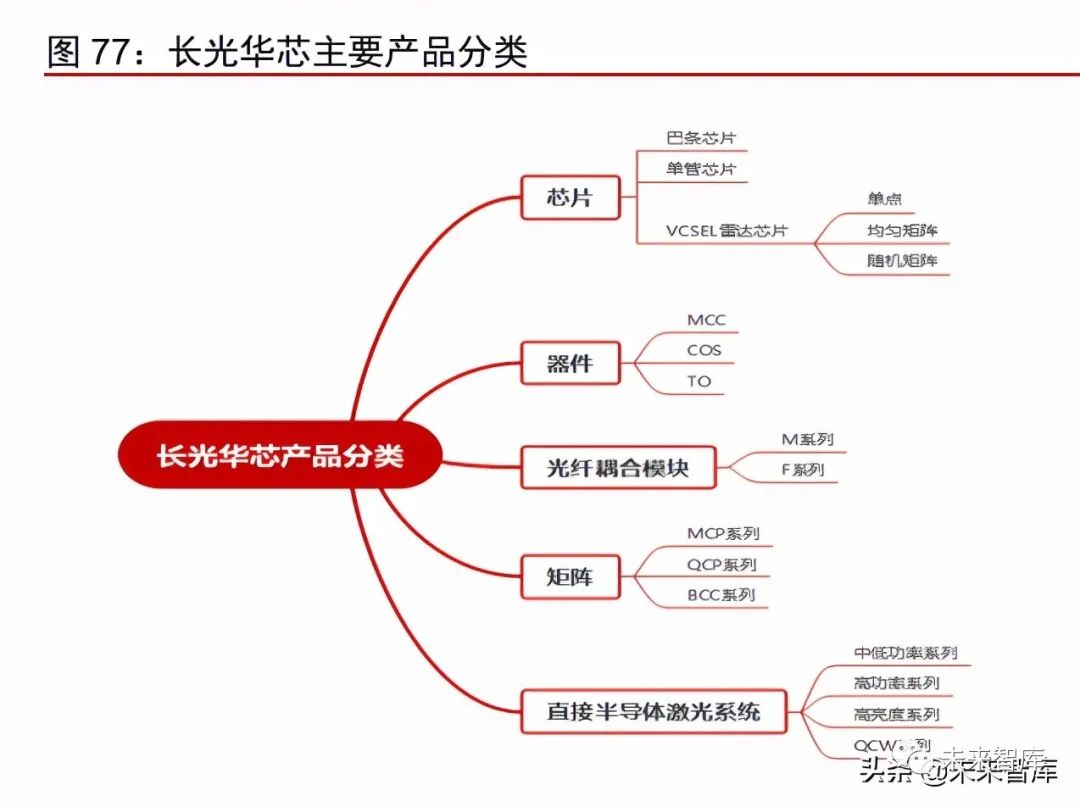

1. Changguang Huaxin: Focuses on the semiconductor laser industry. Founded in 2012, its main products include high-power single-tube series products, high-power bar series products, high-efficiency VCSEL series products, and optical communication chip series products. The company has formed a product matrix consisting of four categories and multiple series of products, gradually achieving the localization and import substitution of high-power semiconductor laser chips.

Its products can be widely used in: optical fiber lasers, solid-state lasers, and ultrafast lasers as pump sources for optical pumping lasers, laser intelligent manufacturing equipment. The national strategic high-tech, scientific research, medical beauty, LiDAR, 3D sensing, artificial intelligence, high-speed optical communication, and other fields have gradually realized the localization and import substitution of semiconductor laser chips.

After years of R&D and industrialization accumulation, the company has established a full-process technology platform covering chip design, epitaxy, photolithography, cleavage/coating, packaging testing, and fiber coupling, with 3-inch and 6-inch production lines. The 3-inch production line is currently the mainstream specification in the semiconductor laser industry, while the 6-inch production line is the largest in the industry, applied to the development of multiple semiconductor laser chips, and is one of the few companies that have developed and mass-produced high-power semiconductor laser chips.

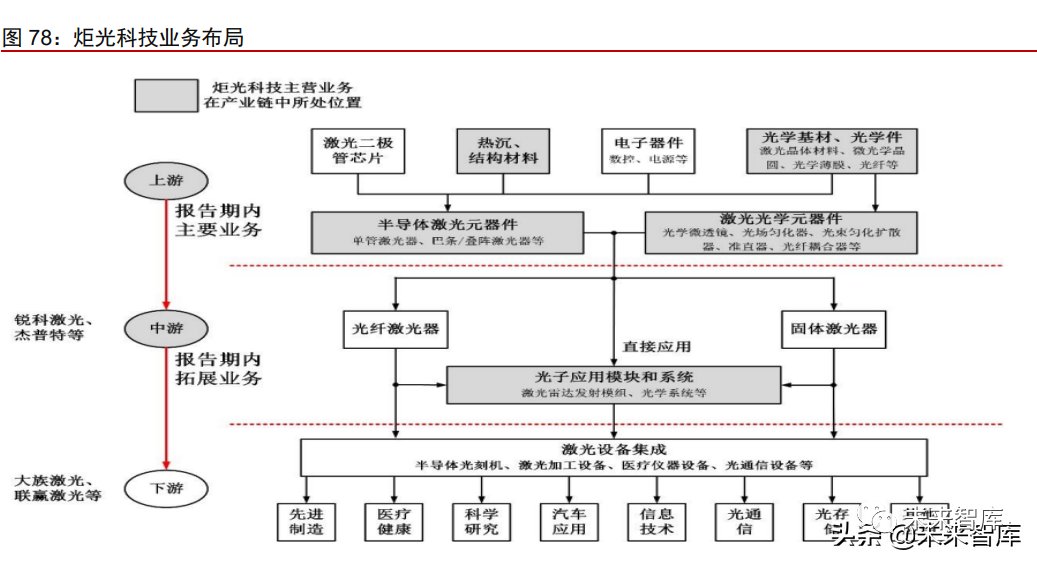

2. Juguang Technology, from light sources to optical devices to LiDAR, the growth space continues to expand. 1) The company was founded in 2007, and its initial business was mainly semiconductor lasers. In 2017, it acquired the German company LIMO and successfully completed the absorption of technology, expanding its optical device business.Currently, the company is expanding from upstream to midstream, exploring new businesses such as LiDAR.2) In terms of performance, from 2018 to 2020, the company’s revenue has been around 350 million yuan, but new businesses are expected to drive revenue growth.In terms of profit, it has crossed the turning point; after turning a profit in 2020, the profit in the first three quarters of 2021 reached 54.39 million yuan, greatly exceeding the 33.58 million yuan for the entire year of 2020.At the same time, the company’s gross profit margin increased from 38.15% in 2019 to 54.63% in the first three quarters of 2021.3) In terms of subdivided business, from 2018 to 2019, semiconductor laser products accounted for more than half of the company’s revenue; since 2020, optical components have become the largest revenue source, and LiDAR is expected to take over growth.Aside from optical systems, all business segments have high gross profit margins, with the gross profit margin of optical components reaching 61.07% in the first three quarters of 2021, semiconductor laser business gross profit margin reaching 50.42%, and LiDAR business gross profit margin at 47.5%.

LiDAR: A core growth point, Juguang Technology has technical barriers. 1) Necessity: LiDAR has become an essential component for autonomous driving; currently, except for Tesla, the mainstream schemes of car manufacturers generally include multi-sensor fusion with LiDAR. 2) Market size: The Ministry of Industry and Information Technology predicted in 2019 that the sales proportion of L2-level vehicles will exceed 25% by 2025, and the market space is expected to exceed $4 billion, with long-term market space expected to exceed $10 billion. 3) Competitive landscape: Domestic LiDAR development is faster than abroad. The domestic market is divided into three tiers, with the third tier not yet entering cooperative R&D with car manufacturers; the second tier is limited by technical routes, and it is expected that the market share of the first tier will continue to expand. Juguang Technology, as a core supplier of LiDAR for Huawei, is expected to benefit, and it is also likely to benefit from the development of Ouster and side LiDAR. 4) Industry chain positioning: Juguang Technology provides transmission modules, light sources, and optical devices for rotating mirror and flash LiDAR, fully covering the LiDAR transmission end. 5) Core advantages: The company has technical barriers in thermal management and optical precision design processing, with a local technical team long engaged in heat dissipation technology, and LIMO has leading technology in optical components.

3. Zonghui Xinguang, originating from Stanford, is China’s first VCSEL chip company with independent intellectual property rights, with products at the world-leading level.

Zonghui Xinguang was established in late 2015, headquartered in Changzhou, Jiangsu, with wholly-owned subsidiaries in Silicon Valley, USA, and Hsinchu, Taiwan, China. As of now, the company has mass-produced chips at 940nm, 940nm TOF modules, VCSEL, and other products. Among them, the single-junction VCSEL has a PCE (photoelectric conversion efficiency) of 40% at 75℃, and exceeds 30% at 105℃, meeting the high PCE performance requirements for automotive LiDAR light sources over a wide temperature range (-40~105℃); the accelerated aging test results of single-junction 2W VCSEL show that it can continuously emit light for 24 years under conditions equivalent to 24 hours a day, and the product has passed AEC-Q102 certification.

The company’s advantages include: 1) Early layout of the next generation of multi-junction VCSEL. Compared to single-junction VCSEL, multi-junction VCSEL has higher peak power, better signal-to-noise ratio, and smaller working current, and under the same optical power demand, the chip size is more compact, making it the best choice for future light sources. 2) High richness of downstream customers. As of September 2020, the company has over 100 customers worldwide, including many domestic smartphone OEM manufacturers, solution providers, and module manufacturers in the consumer electronics field; in the automotive application sector, it has passed automotive-grade quality system certification and has established close cooperation with many Tier-1 manufacturers. 3) In June 2020, Huawei’s Hubble Technology invested in Zonghui Xinguang, providing strong financial support for the company’s continuous development.

4. Anke Technology, deeply rooted in the optical communication industry for over 20 years, is also laying out optical communication pump lasers and industrial-grade fiber lasers. 1) Anke Technology was established in October 2000 and is a key high-tech enterprise of the National Torch Program, headquartered in Shenzhen, adhering to a global layout, with several subsidiaries in Beijing, Hangzhou, Hong Kong, North America, and Europe. The company’s core business includes optical network products and industrial application products, with rich production and research pipelines. In the laser field, the company has optical communication pump lasers and industrial-grade fiber lasers, the former mainly including 1999CVB, 1999CHB/SHB, and the latter including fiber lasers, Panda NT, and various power fiber laser systems. 2) Leveraging the 5G opportunity, it is accelerating the layout of optical data centers and continuously strengthening the upgrade of optical module technology. In September 2020, the company showcased new 200G/400G optical module products, based on mature PAM4 laser solutions, using Anke’s mass production packaging platform, with significant advantages of high density, high reliability, and excellent transmission performance. The product integrates the latest 7nm DSP chip, which not only provides the digital clock recovery function of CDR but also reduces power consumption and performs dispersion compensation operations, eliminating noise, nonlinear interference factors, and achieving a channel error rate (BER) below 1E-11, providing ample margin for customer application scenarios. 3) In October 2020, under the arrangement of Chairman and CEO Na Qinglin, the company completed privatization through an agreement, benefiting resource integration, optimizing configuration, and enhancing business flexibility.

Detector: The trend of SPAD replacement has become a consensus, focusing on domestic innovative enterprises

The domestic demand for SPAD infrared replacement is relatively strong. Foreign research on SPAD began in the 1990s, and it was only in the last 4-5 years that it began to achieve large-scale commercial landing; while domestic SPAD research started about 4-5 years ago.