This article is about 6,200 words, recommended for collection and reading.

Produced by | Automotive Electronics and Software

If I had to choose a word to represent the feelings in the automotive industry this year, it would definitely be “intense competition.” For our work, it means working overtime; for OEMs, it means competing over vehicle configurations and prices; for Tier 1 suppliers, it means competing over component prices and project development costs; and for Tier 2 suppliers, it means competing over chip or component prices. Recently, I heard a friend who works in electronic components say that in the current automotive industry, if you dare to sell an electronic module for 300, someone will dare to sell it for 200; if you dare to ask for development costs for a project, someone will dare to develop it for free, as long as they can secure the contract. It’s incredibly competitive.

So how much should it cost to develop a vehicle-grade electronic module or ECU? Or how do we determine the price of electronic components and how much development costs should be? How do we report development costs to OEMs? This issue seems to be rarely discussed in articles. Recently, I have been working on several new project quotes, so I wanted to take this opportunity to summarize and organize this information, while also communicating with colleagues in the industry.

The two core data points in product development quotes are the unit cost (i.e., product price) and the development cost quote (i.e., development fees, including engineering costs, development costs, testing, and calibration fees, etc.). Due to space limitations, this series is planned to be divided into several parts. The first part will cover BOM cost calculation, how to determine pricing, how to calculate engineering and design fees, how to calculate testing costs, and how to quote various costs to OEMs. The product pricing is the first part of this series.

Note:The content of this article regarding quotes, product testing, and development costs is excerpted from the author’s new book “General Vehicle Grade Electronic Reliability Design and Development Practice,” published by the Machinery Industry Press in June 2024.

Component Development Models: Outsourcing vs. Vertical Integration

The traditional component development method in the automotive industry has generally been that OEMs issue tenders, and Tier 1 suppliers carry out the development. Once completed, the components are supplied to OEMs, who then integrate and assemble various components into complete vehicles. In simple terms, OEMs are large integrators, while the actual R&D and production of various components are completed by Tier 1 suppliers (in fact, electronic component Tier 1 suppliers are also considered integrators, as their chips and other components are also sourced externally). However, with the current industry trends, this development method is also undergoing some changes. For example, the leading position of OEMs is gradually increasing, the proportion of software in complete vehicles is also increasing, and OEMs are becoming more involved in the development of components, especially in software, which traditionally they did not engage in much.

Of course, there are currently some components, such as ECUs related to autonomous driving and the three electric systems, in which some OEMs are fully self-developed, such as Tesla. It is said that the self-developed controller ratio for Model Y is 61%, and for Cybertruck, it has risen to 85%. However, at present, apart from Tesla and BYD, the path of full self-development does not seem to be easy and is not the mainstream in the industry. From a commercialization perspective, the collaborative division of labor supply chain model seems to be the optimal solution, which is the best business model explored by all industries, including the automotive industry, over a century of development.

When talking about vertical integration in the automotive industry, one cannot overlook Ford. A hundred years ago, Henry Ford almost blocked the path of Tier 1 suppliers. From coal mines in West Virginia to rubber plantations in Brazil, his ultimate goal was to achieve complete self-sufficiency by owning, managing, and coordinating the production of all resources needed to produce a complete vehicle. Ford once owned 700,000 acres of forests, iron mines, and limestone quarries in Michigan, Minnesota, and northern Wisconsin. To achieve rubber independence, between 1928 and 1945, Henry Ford invested $20 million to plant millions of rubber trees in Brazil’s Landia and Belterra plantations. This ability for vertical integration is something that even Tesla, which can build rockets, can only aspire to.

However, vertical integration has also severely impacted American automakers, including Japanese automakers. For example, under the overall strategy of Toyota, its subsidiaries like Denso and Aisin have also faced challenges in electrification and intelligence, which we must take seriously. Automakers’ component subsidiaries generally face issues of excessive dependence on the parent company’s business, lack of competitiveness in technology and costs, low profitability, and hindering overall vehicle competitiveness. Taking Delphi (now Aptiv) as an example, when it separated from General Motors in 1999, its revenue was $29.2 billion, with GM accounting for 76%. Revenue began to decline in 2001, leading to huge losses in 2004, and from 2005 to 2009, it underwent bankruptcy reorganization and divested businesses, with the new company being relisted in 2010 but revenue dropping to just over $13 billion. The story of Visteon is similar; after separating from Ford, it continuously incurred losses, divested businesses, and underwent bankruptcy reorganization, with revenue plummeting from $19.5 billion in 2000 to over $3 billion in 2015. Both Delphi and Visteon were already independent when they underwent bankruptcy reorganization, and GM and Ford only bore partial rescue responsibilities; otherwise, the systemic risk would have compounded, leading to a greater disaster.

So sometimes when we discuss whether a model is good or bad, history serves as a mirror that we can learn from. Vertical integration has been the mainstream model in the automotive industry for nearly a century, but since the 1990s, specialized division of labor and collaboration has gradually become mainstream. However, it is hard to say; perhaps a hundred years from now, vertical integration will again become the mainstream, just as the trends in the world ebb and flow.

Of course, whether outsourcing or self-development, developing an ECU always costs money; the only difference is whether the money is paid to external parties or to internal subsidiaries. The necessary expenses cannot be lessened, and sometimes they may even be more. Next, we will discuss the BOM costs for a Tier 1 developing an ECU based on the mainstream industry outsourcing approach, starting with a brief introduction to the vehicle and component development methods.

Vehicle Development vs. Component Development

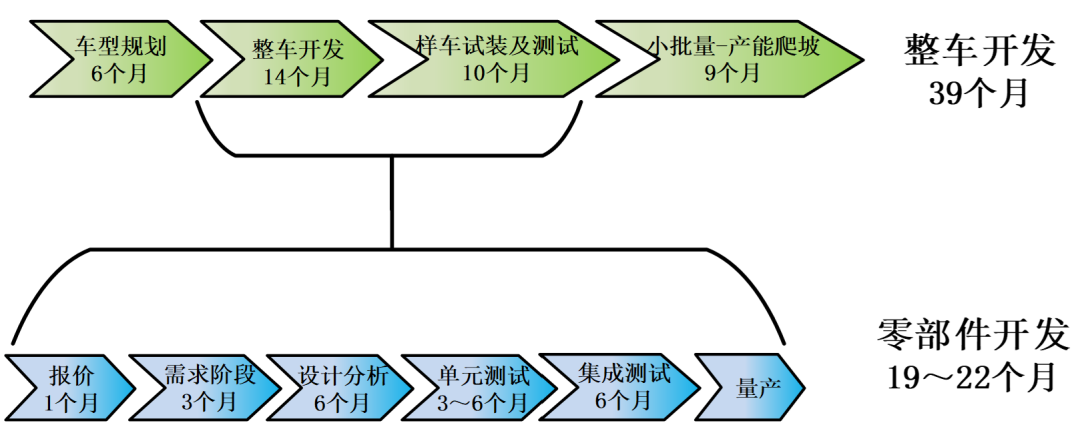

In the automotive industry, from vehicle development to component development, from model planning to prototype assembly, from component pricing to design analysis, every stage follows a strict development process and timeline. The following diagram illustrates an example of the development stages and cycles for vehicles and components.

Stages of vehicle development and automotive electronic component development (Source: Zuo Chenggang “General Vehicle Grade”)

Vehicle development generally occurs about six months ahead of component development. After completing model planning and entering the vehicle development phase, specific component development begins, and OEMs issue component development requests to Tier 1 suppliers, commonly referred to as the Specification Of Requirements (SOR). For passenger vehicles, the vehicle development cycle is approximately 3 to 4 years, while component development typically takes 2 to 3 years. However, there is currently a trend in the industry to shorten development cycles, with reductions becoming common; for instance, vehicle development time has shortened to under 3 years (for example, Xiaomi took three years to produce its first car), and component development has shortened to under 2 years. Regardless of how the development cycles are shortened, the overall development stages and processes remain the same.

Automotive electronic component product development can be divided into the following stages:

1) Stage 0: Quotation stage. OEM issues development requests to multiple Tier 1 suppliers, who conduct technical evaluations based on the specifications and provide quotes (including development costs and production prices) within the required timeframe, participating in project bidding.

2) Stage 1: Requirement definition and system design stage. A Tier 1 supplier secures the project and begins product requirement analysis and system-level design.

3) Stage 2: Design analysis stage. This stage involves detailed design of the product, including hardware schematic design, PCB design, software detailed design, and product structural design.

4) Stage 3: Unit testing stage. This stage will conduct unit-level testing of the product, such as electrical performance testing of the power supply, load capacity testing of the driver chip, thermal testing of the power chip, and physical layer testing of the communication chip.

5) Stage 4: Integration testing and documentation release. This stage focuses on system-level functional testing of the product, including real vehicle functional testing and DV validation testing. Once DV testing passes, hardware and structural designs can be frozen, and after software functions are confirmed, all designs can be frozen, while preparing documentation for mass production.

6) Mass production stage: The product enters the mass production phase. At this stage, the design and development work for the product is essentially completed, and design documents are released to the production department, which develops corresponding tooling and testing equipment based on the production process and mass production requirements, and conducts small-batch trial production in advance to prepare for bulk supply.

Product inquiry requests (Request For Quotation, RFQ) in the automotive industry are typically referred to as quotations or RFQs. The entire quotation document released to Tier 1 suppliers needs to include specific project information, development requirements, and commercial terms. Project information includes model platform, product name, product line, launch time, vehicle lifecycle, production factory address, intended market, and estimated annual sales during the lifecycle; development requirements include functional requirements, testing requirements, testing standards, etc.; commercial and cost aspects include how to pay for mold costs, development costs, sample costs, as well as payment methods, payment cycles, and specific business terms, quality terms, etc.

The following diagram shows part of the project information provided by OEM in the RFQ, including project name, vehicle model, project lifecycle, estimated production volume, and quotation method.

Project information in an RFQ (Source: Zuo Chenggang)

The following diagram shows the project timeline information required by OEM in an RFQ, including product design, sample trial production, DV testing, vehicle matching, and APQP submission.

Part of the timeline information in an RFQ (Source: Zuo Chenggang)

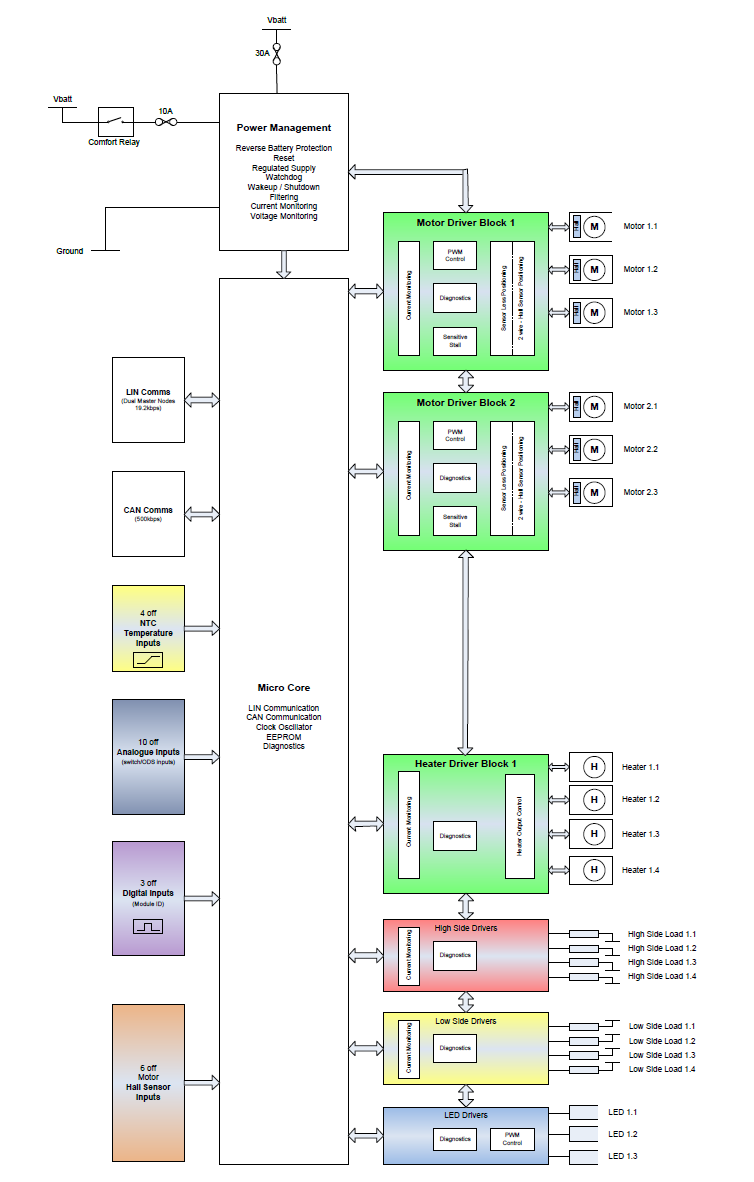

At the same time, while providing detailed functional specifications, OEMs will also provide a functional block diagram of the product to define and guide product design. The following diagram shows a system block diagram of a product, which includes the basic functional modules of the product, such as power supply, MCU, CAN, LIN, NTC temperature detection, signal input, motor output drive, heating drive, etc.

A system block diagram in an RFQ (Source: Zuo Chenggang)

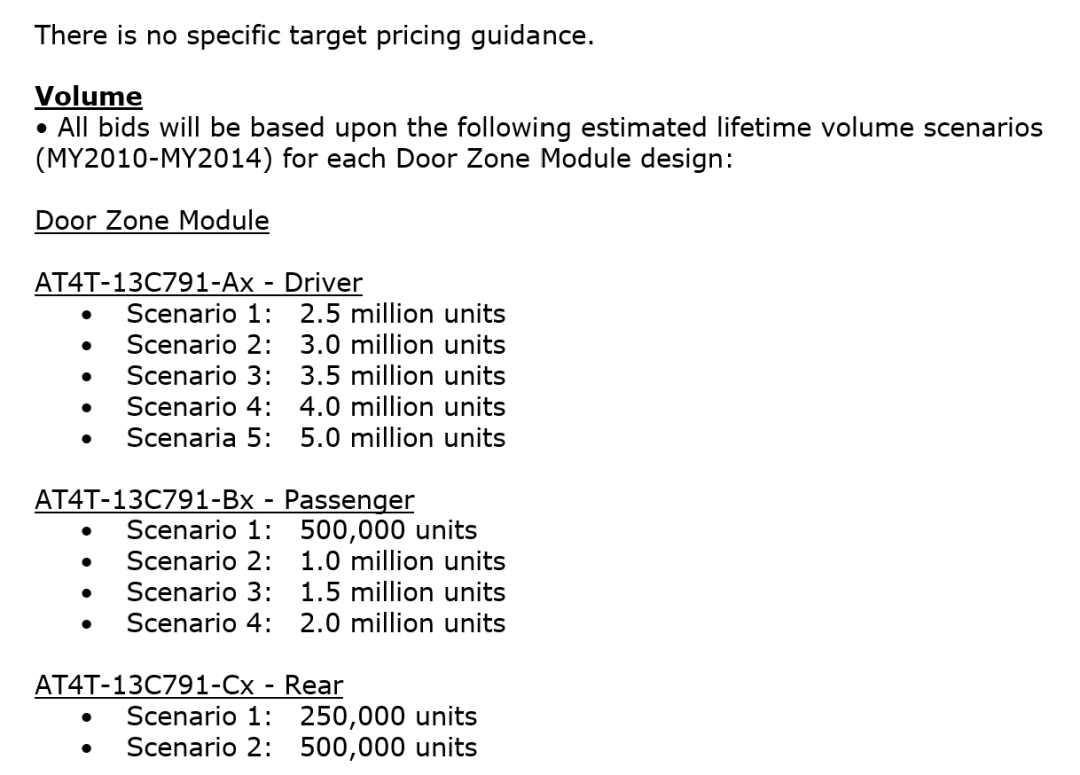

For a project’s quotation, what Tier 1 suppliers care most about is the estimated annual sales, as sales are closely related to product pricing and are the most important dimension for price assessment. Everyone prefers projects with large volumes, as larger volumes make it easier for Tier 2 suppliers to cooperate, and various costs during development become easier to negotiate. The following diagram shows the sales volume for the entire lifecycle of a door module RFQ, with products divided into three models based on installation position: driver module, passenger module, and rear module.

Sales volume over the entire lifecycle in an RFQ

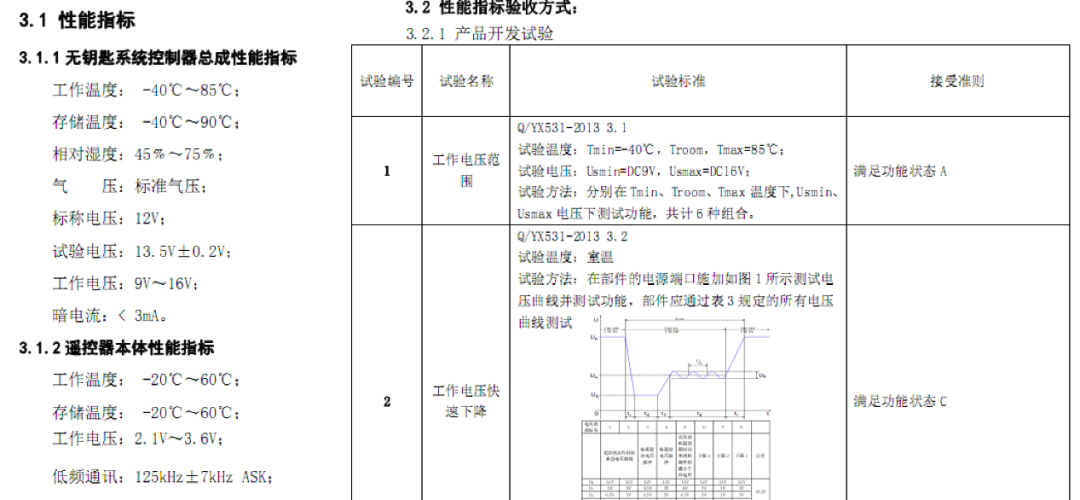

SOR, as part of the RFQ, is drafted by the technical department and then circulated among various departments before being sent to the procurement department (or resource development department) for bidding and contract awarding. The primary responsibility of OEM’s product engineers is to write the product requirements, such as the quantity and configuration of parts, functional requirements, performance requirements, testing requirements, etc.; for appearance parts, color definitions and other details need to be specified; for electronic components, corresponding functional requirements, interface information, network communication, and diagnostic requirements must be provided. For parts requiring supplier collaborative design, the OEM’s technical department will propose relevant design requirements and testing standards, such as product DV testing items and qualification criteria.

In the SOR, OEMs specify concrete requirements for product performance indicators, such as working temperature, humidity, voltage, static current, etc. The right image shows the testing items, standards, and testing level requirements. The performance indicators and testing requirements of the product largely determine the design and testing plans, and will also involve the product’s development costs, unit price, and testing costs.

Part of the technical requirements and testing requirements in an SOR (Source: Zuo Chenggang)

The quality department will propose quality requirements for parts, quality assurance, change notification management requirements, quality responsibilities, recall and warranty requirements, liability for breach of contract, etc. Quality requirements include PPM values, warranty, packaging and logistics requirements, after-sales requirements, mold tooling inspection requirements, and incoming inspection requirements; the business department will propose payment methods, payment cycles, and specific business terms; finally, all information is compiled into a complete SOR document package and provided to Tier 1 suppliers as the quotation requirement document.

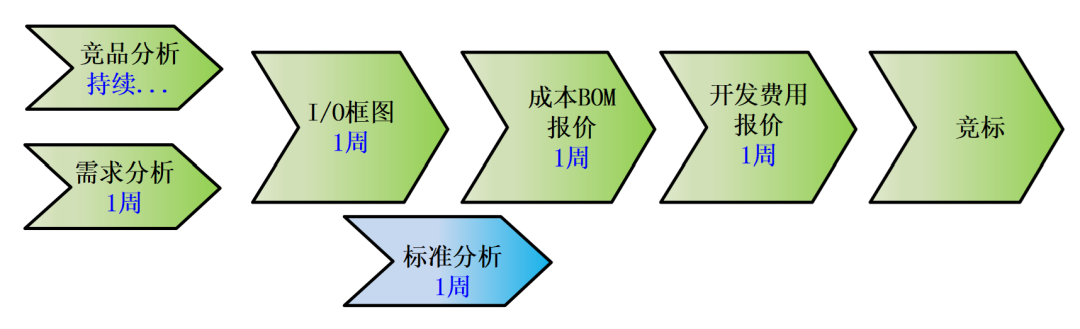

The pricing of automotive electronic components can typically be divided into five stages, with the quotation stage usually taking about a month. The main tasks in the quotation stage can be divided into: competitive product analysis, requirement analysis, I/O block diagram design, BOM cost analysis, development cost and cycle analysis, and bidding. A typical automotive electronic component quotation stage is illustrated in the following diagram.

Automotive electronic component quotation stages and cycles (Source: Zuo Chenggang “General Vehicle Grade”)

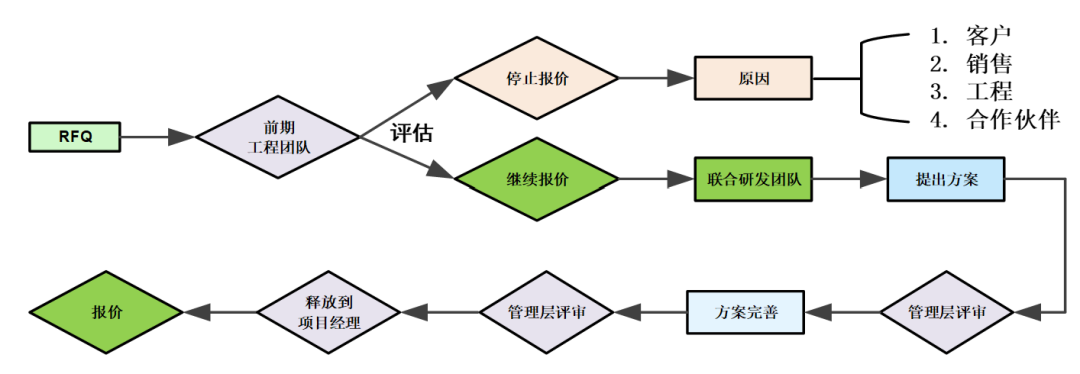

Additionally, for Tier 1 suppliers, they receive many RFQs each year, gradually forming a mature RFQ process. The following diagram illustrates an RFQ processing flow.

Automotive electronic component quotation process (Source: Zuo Chenggang “General Vehicle Grade”)

The RFQ requirements may come from customers, sales teams, early engineering teams, or partners. The early engineering team needs to summarize the project information based on the RFQ inputs and conduct a preliminary feasibility assessment of the project; at the same time, they collaborate with the sales team to make a decision on whether to continue quoting based on the company’s long-range planning (LRP) and product strategy. If at this point any party, such as sales, engineering, or partners, believes that the quotation should not continue, for instance, if sales sees risks in cooperating with this customer, or if the engineering team sees feasibility issues with the project, then the quotation will be halted; otherwise, the quotation work will continue.

If the quotation continues, a development team needs to be formed. The project manager responsible for this quotation will assemble a quotation team, with members from various technical teams such as systems, software, hardware, structure, and testing teams, to jointly break down the RFQ and propose design solutions. For example, the development team first needs to analyze customer requirements in detail to see if they can use existing mature products or conduct variant designs based on mature products; if the RFQ requires a completely new design, they first need to assess the technical feasibility of this RFQ, and if technically feasible, check if there are any reserve design solutions or reference designs from competing products available.

The project engineering team needs to provide a detailed design solution based on the SOR and past project experience. The solution needs to include:

3) Main performance parameters

4) Network requirements and diagnostic requirements

5) Software design solution

6) Structural design solution, such as housing, PCB, connectors, brackets, 3D exploded views, etc.

7) The testing team needs to output a Design Validation Plan (DVP)

8) The hardware team needs to output the initial BOM for the product

9) Quotation clarifications

Then, the engineering team also needs to provide an open issue list based on the assumed design solutions and communicate with the client during the quotation process.

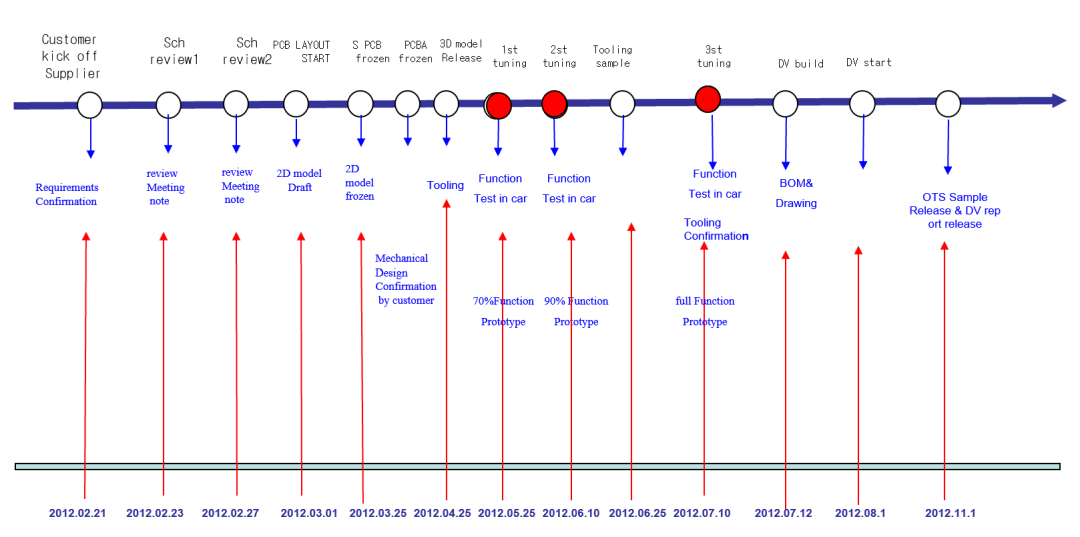

The detailed design solution needs to be reported to management by the various technical teams, and after management review, the technical teams will refine and finalize the design solution, assessing the engineering, design, and testing costs (Engineering, Design & Testing, ED&T) based on the final solution. This assessment requires the participation of the systems, software, hardware, structure, and testing teams, ultimately providing a project timeline as shown in the following diagram.

A project timeline (Source: Zuo Chenggang)

Finally, the design solution, ED&T, and timeline need to undergo another management review, which requires the participation of all technical supervisors, core technical personnel, and early engineering team members. After the review, the responsible hardware engineer outputs the BOM, the project manager outputs ED&T, and the team outputs the engineering design solution. The project manager will package all documents and provide them to the sales team, while also requiring the finance department to provide the Annual Percentage Rate (APR); then the sales team can bid according to the OEM’s required timeline. If the contract is secured, the project manager will confirm the project team for project development with management.

Based on the product’s design solution, the engineering team can arrange for detailed hardware, software, and structural design, then generate the product’s BOM, which includes specific electronic component models, suppliers, and quantities per unit. Based on this information, the procurement department will provide the price for each component, including structural components. Typically, commonly used components can directly refer to current mass production prices, while new components need to be quoted by Tier 2 suppliers based on vehicle sales volumes, and structural components can usually be assessed based on material costs, such as plastic and metal housings based on weight.

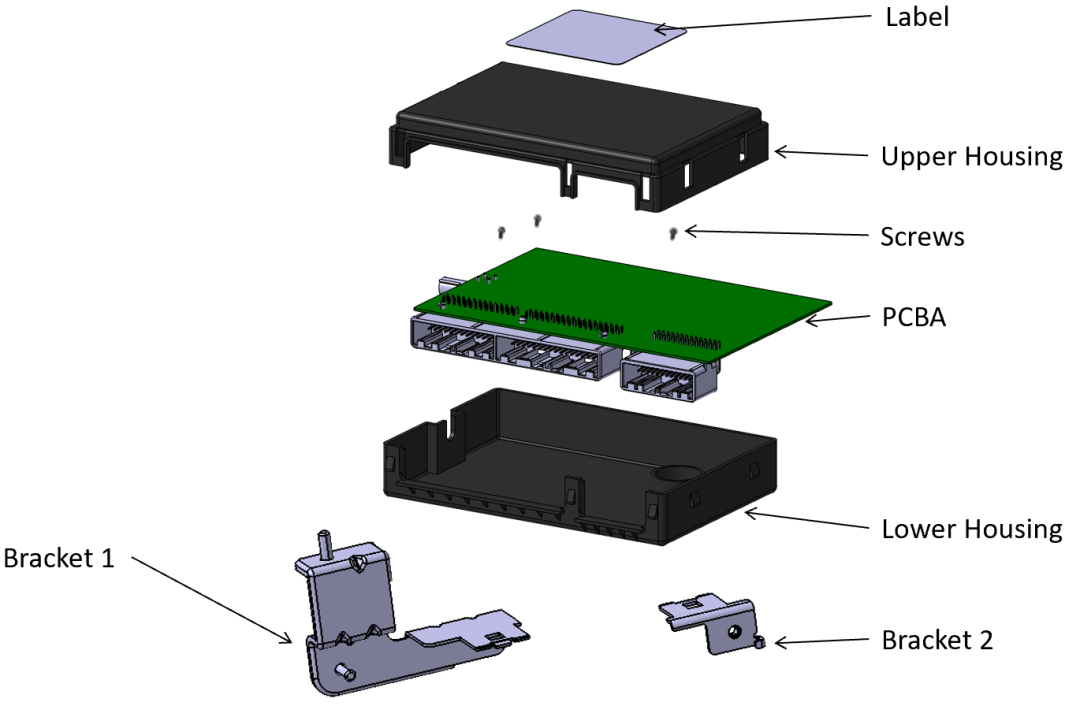

BOM cost is relatively straightforward; it is the total cost of the various subcomponents that make up the product. For electronic components, this generally includes electronic components and PCB boards, as well as other structural components such as housings, screws, brackets, etc., as shown in the following diagram.

Product design solution (Source: Zuo Chenggang)

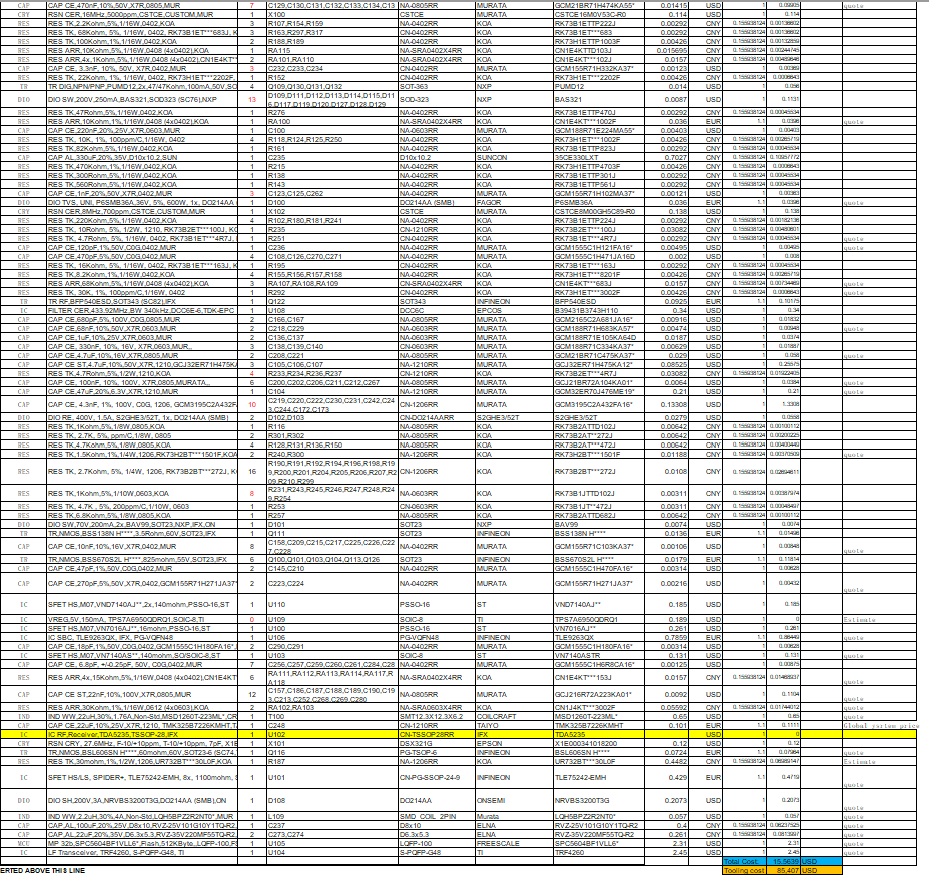

The following is a Cost BOM for a product, which includes the price of each material in the BOM. Based on this BOM, we can obtain the product’s BOM cost; the BOM cost shown below is $15.56.

A Cost BOM for a product (Source: Zuo Chenggang)

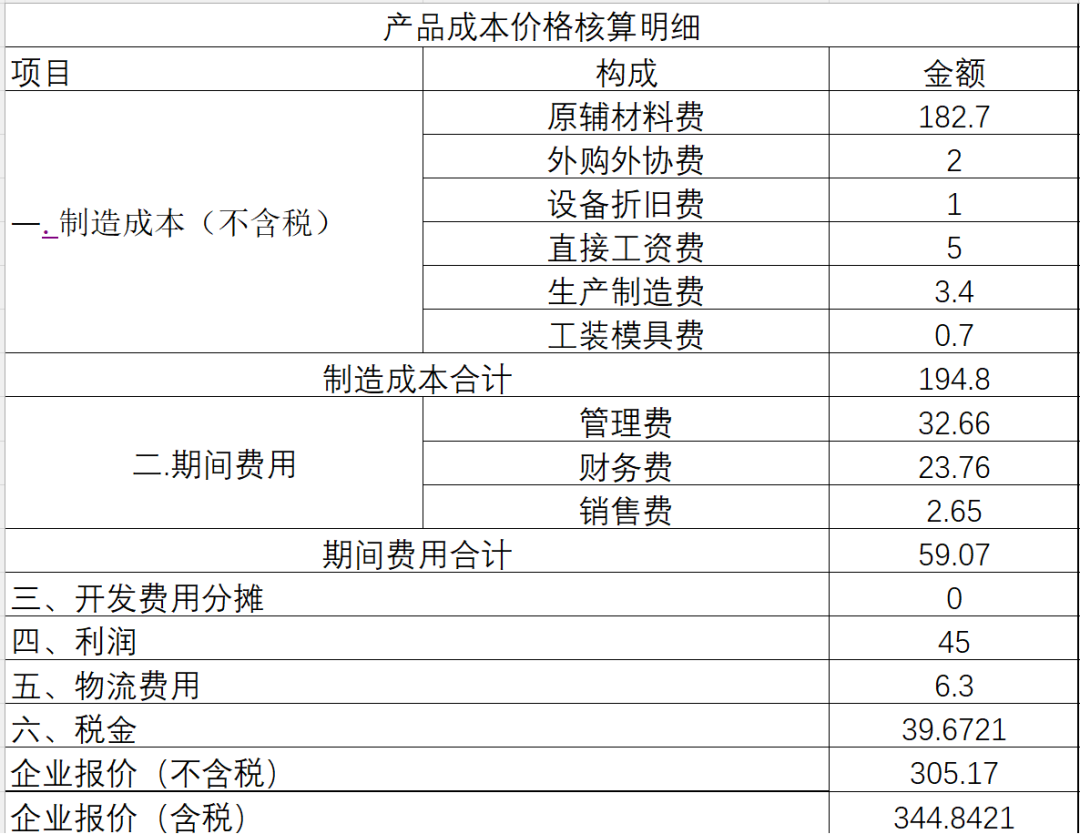

The most critical data affecting product quotations are BOM costs. With the BOM cost of the product, Tier 1 can derive the product price based on other costs (such as manufacturing costs, overhead costs, etc.), as shown in the following diagram:

A product quotation (Source: Zuo Chenggang)

Of course, the product quotation is also influenced by the development method, such as whether certain development costs are shared. For example, the quotation shown above does not include shared costs, with a price excluding tax of 305.17 yuan. If the OEM requires the mold cost to be shared, assuming the mold cost is 1 million, divided over 2 years for 100,000 units, the cost allocated to each product would be 10 yuan, thus the product’s price excluding tax would need to be adjusted to 315.17 yuan. This means that the price for quantities up to 100,000 units would be 315.17 yuan, and after exceeding 100,000 units, it would drop to 305.17 yuan. Additionally, if the production volume does not reach 100,000 units within 2 years, the remaining mold costs must be paid in full by the OEM.

Furthermore, other business terms may also affect the product price, such as warranty and after-sales requirements. For instance, a longer warranty period or stricter after-sales terms will increase Tier 1’s overall costs, and consequently, Tier 1 will need to reflect this cost in the unit cost of the product; specific details will not be elaborated here.

At the same time, product prices are not set in stone; they can be adjusted based on sales volume, and chip prices tend to decrease year by year. OEMs will also require Tier 1 to reduce prices annually, so Tier 1 typically provides a price matrix based on the base price of the product and annual sales volume, as shown in the following table:

Product price matrix (Source: Zuo Chenggang “General Vehicle Grade”)

Overall, the two core data points for quotations are BOM costs and ED&T costs. BOM costs determine the mass production price of the product, while ED&T costs determine the development costs.

ED&T costs mainly include three parts:

1. Engineering Costs

Engineering costs mainly include the following parts: mold costs, software and toolchain costs, third-party service costs (technical authorization, technical services, training, certification, etc.).

2. Design and Development Costs

Design and development costs mainly refer to labor costs and travel expenses, which are the human resource costs that the company needs to incur, mainly related to workload and working hours.

3. Testing and Calibration Costs

Testing and calibration costs mainly include: testing platform costs (software platform, EMC platform, DV platform, EOL platform, etc.), testing samples (A samples, B samples, DV samples, etc.), testing project costs (durability, environmental, mechanical, EMC, etc.). The testing costs in laboratories mainly relate to the testing projects and required testing time, while calibration costs involve static calibration, laboratory calibration, and real vehicle road test calibration. For example, in some EMC tests within DV testing, the testing costs are quoted as follows:

EMC testing costs – part (Source: Zuo Chenggang “General Vehicle Grade”)

Due to space limitations, this article mainly discusses the product quotation part of developing a vehicle-grade ECU. Engineering costs, design and development costs, and testing costs will be detailed in the following articles.

Author: Zuo Chenggang

Source: Automotive Electronics and Software

Editor: Wang Xingyu

Reviewer: Zhang Ping

●How to Design Automotive Grade Chips?

●(Ten Thousand Words Long) The Growth of Automotive Electronics Hardware Engineers

●Automotive Electronics Application Environment

●Building Core Competitiveness for Future Vehicles Start with This Book

“General Vehicle Grade Electronic Component Reliability Design and Development Practice” has officially been published and is available for sale in the Machinery Industry Press Tmall flagship store, JD Mall, Dangdang Mall, Youzan flagship store, and major Xinhua bookstores nationwide!

Click the “Read Original” at the bottom of the article for a discount on the book!