In the New Electronic Architecture,

How Does the Development Trend of Vehicle Controllers Evolve?

1. Controller (ECU): The Core of Functional Control, Assisting in Achieving Various Functions

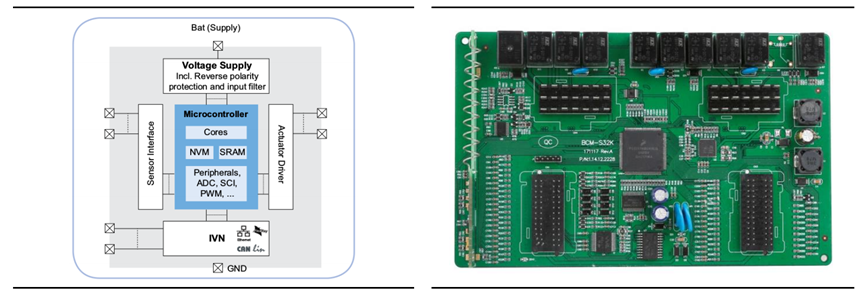

The central control hub for functions, processing input signals to achieve functional control. The automotive controller is a key component for implementing overall vehicle functional control, generally composed of MCU, power chips, communication chips, input processing circuits, output processing circuits, etc. By processing various sensor signals, switch signals, and control signals, it controls actuators such as valves, motors, pumps, and switches.

Functions achievable through the vehicle microcontroller include: receiving and parsing signals, logical judgment, network communication, fault diagnosis and processing, device address identification, etc.

1.1. Upgrade of Vehicle Electronic and Electrical Functions, Increasing Number of ECUs

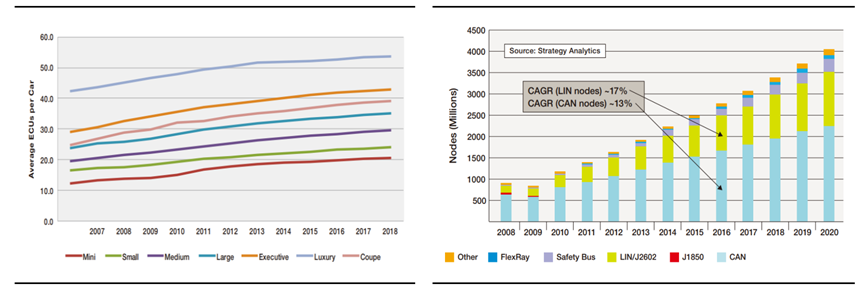

Microcontrollers in traditional vehicles follow a distributed architecture, where adding one function requires adding one ECU. With the continuous upgrade of electronic and electrical functions in vehicles, the number of ECUs is constantly increasing. According to data from Strategy Analytics, the average number of ECUs in vehicles is about 25, while high-end models have exceeded 100 ECUs. The connection between different ECUs mainly uses CAN/LIN buses, and in recent years, the number of CAN/LIN bus nodes in vehicles has been continuously increasing, with a CAGR of about 17% for LIN bus nodes and about 13% for CAN nodes.

Left Image: Changes in the Number of ECUs Across All Vehicle Levels

Right Image: Growth of CAN/LIN and Other Nodes in Vehicles

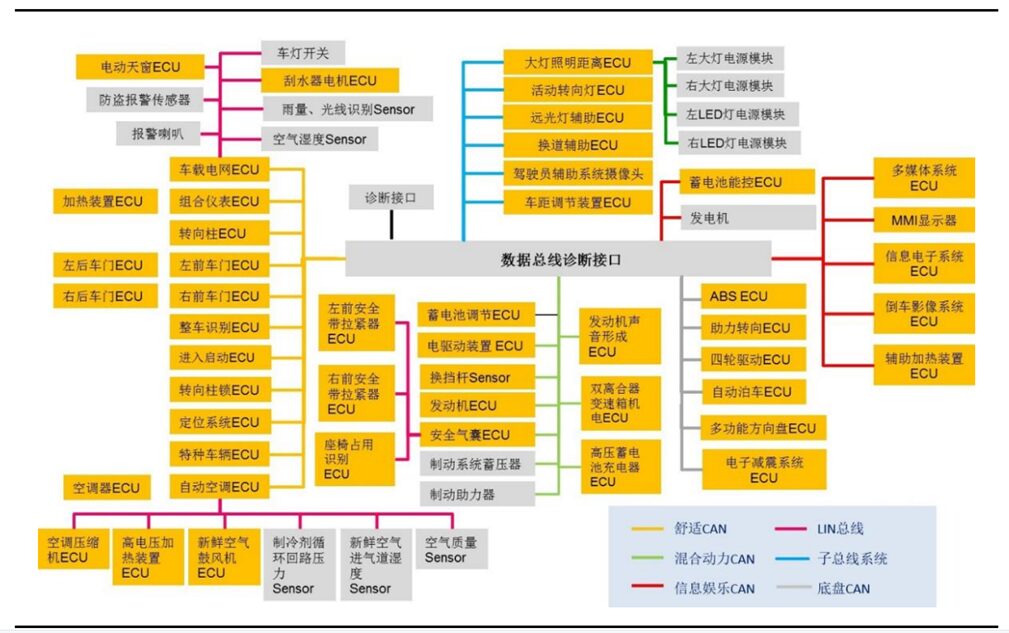

Centered around the data diagnostic interface, the distributed ECU architecture connects different ECUs through bus systems of varying speeds to achieve different functions.

Distribution of Volkswagen ECUs

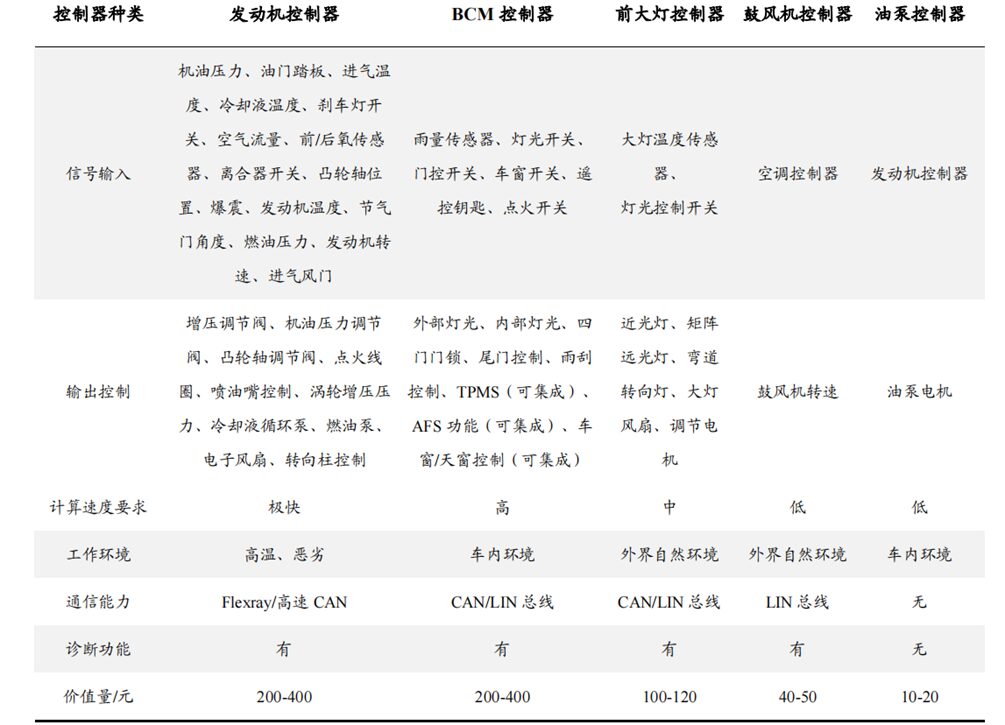

1.2. Differences in Signal Complexity+ Control Difficulty, Leading to Value Differences in Controllers

Signal processing+ increased output control difficulty, leading to continuous upgrades in controller complexity.

1) Simple Drive Controller: For example, a fuel pump controller only needs to receive non-bus signals and drive the actuator, valued at about 10-20 yuan;

2) Controllers with Bus Diagnostic Communication Function: For example, a blower controller needs to communicate via LIN bus and has diagnostic functions, valued at about 40-50 yuan;

3) Controllers Implementing More Complex Functions: For example, a headlight controller needs to communicate via CAN bus, has diagnostic functions, and controls more complex components such as cooling fans, adjustment motors, and lights, valued at about 80-100 yuan;

4) Controllers Implementing Complex Functions: For example, a body controller/engine controller receives various signal inputs, makes decisions to control multiple actuators, and has diagnostic functions, making it the most complex controller in a distributed architecture, valued at about 200-400 yuan.

Comparison of Controllers Across Different Vehicle Levels (2020)

2. The New Electronic Architecture Centralizes on“Functional Domains”, Leading to Increased Demand for Domain Controllers

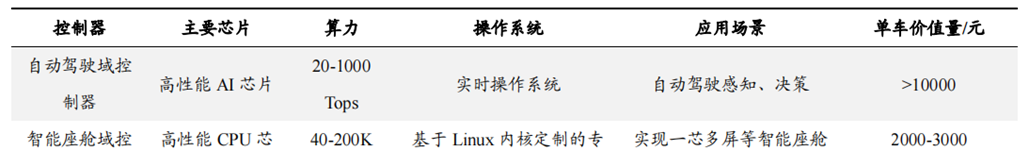

The era of “Software Defined Vehicles” requires high computational power control units. Unlike the previous distributed electronic and electrical architecture, in the era of “Software Defined Vehicles,” the overall vehicle hardware architecture is upgraded to an Ethernet + SOA architecture, with high computational power and rapid software iteration demands pushing the integration of distributed ECUs towards domain controllers. Before the emergence of central control computing units, vehicle control units were divided into autonomous driving domain controllers/intelligent cockpit domain controllers/body domain controllers and chassis domain controllers.

Classification of Automotive Domain Controllers (2020)

2.1. Autonomous Driving Domain Controllers: Highest Single Vehicle Value

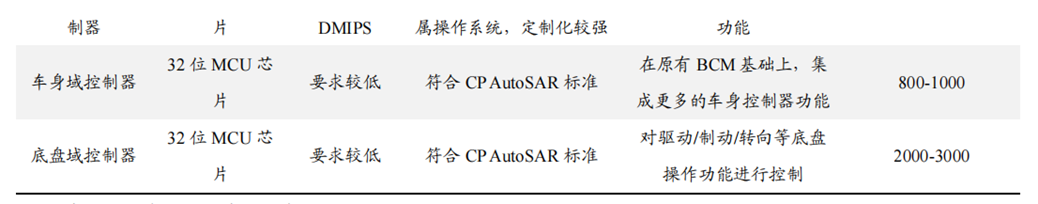

Autonomous driving domain controllers are the fastest in functional updates and are the most integrative controllers. By fusing and processing signals from cameras, ultrasonic radars, millimeter-wave radars, laser radars, and other sensors, combined with high-precision maps and navigation information, they make autonomous driving decisions and output overall vehicle control commands.

Audi’s zFAS leads industry transformation, with a powerful computing core supporting the first “domain integrated” controller. Audi is the first manufacturer in the world to implement a “domain integrated” controller architecture, with the launch of the Audi A8 in 2018, integrating all the separated ECUs of driving assistance ADAS systems, such as automatic parking, lane keeping, adaptive cruise functions, into the autonomous driving domain controller zFAS. It consists of four chips: Mobileye’s EyeQ3 (external image perception), Intel’s Cyclone V (sensor data fusion), Infineon’s Aurix TC297T (main control communication processing), and NVIDIA’s Tegra K1 (panoramic image fusion), with each chip focusing on different aspects, hardware integration provided by Delphi and software development by TTTech. zFAS achieves autonomous driving domain integration, while the remaining chassis + safety, power, body, and entertainment domains still use a distributed architecture.

Left Image: Audi A8 Using Multiple Sensors

Right Image: zFAS Controller

Autonomous driving domain controllers have high computational requirements for AI chips, with first-tier suppliers including NVIDIA, Mobileye, and Huawei; second-tier suppliers include Qualcomm, Horizon, etc. International Tier 1 suppliers are accelerating the launch of autonomous driving domain controllers, such as Aptiv, Veoneer, and Continental. Domestic independent enterprises are also starting to launch their own domain controller products, with typical examples including Desay SV’s use of NVIDIA Xavier chip solutions, providing the Xpeng P7 model with the IPU03 autonomous driving domain controller, and Huawei’s BAIC Arcfox αS Hi version providing the MDC 810 autonomous driving domain controller.

Tracking of Autonomous Driving Domain Controller Installations

2.2. Intelligent Cockpit Domain Controllers, Not Involving Driving Safety, Lead in Integration

The upgrade of vehicle cockpits is divided into several stages.

1) The 60s-90s were the Mechanical Era, where cockpit products mainly included mechanical dashboards and simple audio playback devices, with a single functional structure, primarily in physical button form, providing only basic information such as speed, engine RPM, water temperature, fuel consumption, etc.;

2) The years 2000-2015 were the Electronic Era, with the development of automotive electronic technology, cockpit products entered the electronic age, still dominated by mechanical instruments, but a few small-sized central control LCD displays began to be used, and navigation systems and audio-visual functions were added, providing more information to drivers.

3) The year 2015 marked the beginning of the Intelligent Era, with large central control LCD screens replacing traditional central controls, fully LCD dashboards gradually replacing traditional instruments, and integrated designs combining central control screens with dashboards beginning to appear, with a few models adding HUD head-up displays, streaming media rearview mirrors, etc. Human-machine interaction methods diversified, and the level of intelligence significantly improved. However, at this stage, most cockpit products still use distributed discrete control, meaning that operating systems operate independently, with core technologies reflecting modular and integrated designs. Technologies such as multi-screen integration, multi-screen interaction, and three-dimensional virtual presentation began to be gradually popularized, with core technologies further integrating intelligent driving capabilities.

Intelligent cockpits are in the early stages of the intelligent era.

Currently, the main purpose of intelligent cockpit domain controllers is to unify control of separately presented LCD instruments, LCD central controls, HUDs, streaming media rearview mirrors, etc., achieving functions such as “one chip multiple screens.” Tier 1 manufacturers both domestically and internationally are launching intelligent cockpit domain controller products, including Visteon’s SmartCore, which is equipped on GAC Aion LX; Desay SV’s latest dual-screen cockpit domain controller product, which has been equipped on Chery brand vehicles; and Yanfeng Technology’s cockpit domain controller, which has been equipped on IM Motors, etc.

2.3. Body Domain Controllers, Further Integrating BCM Functions

Body domain controllers are further integrated products of BCM (Body Control Module), where traditional BCM integrates control of functions such as sunroofs, windows, door locks, interior lighting, seats, electric tailgates, lights, wipers, PEPS (keyless entry and start), etc.

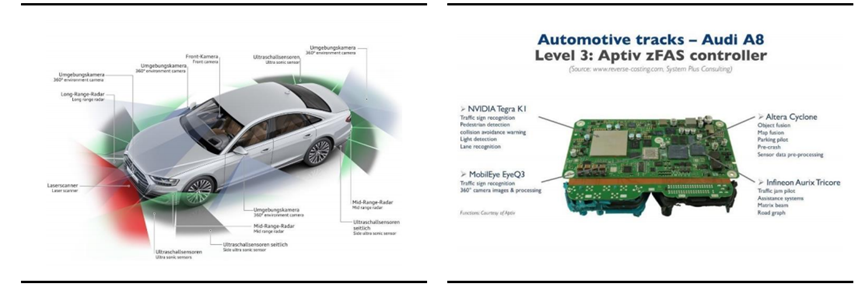

Tesla, as a pioneer in upgrading automotive electronic and electrical architecture, revolutionized its electronic and electrical architecture in the Model 3 launched in 2019, integrating driving assistance and audio-visual entertainment into dual domains, while also “regionally” integrating body domain-related controllers. Through three major domain controllers: left (RCM_LH), front (RCM_FH), and right (RCM_RH), it integrated functions such as window, door, seat, lock, light, and wiper switches, as well as modules like air conditioning, thermal management, and EPB, effectively reducing the overall vehicle wiring harness length, weight, cost, and wiring difficulty.

Left Image: Model 3 Body Domain Controller

Right Image: Tesla Model 3 Electrical Architecture

The main functions of the body domain controller include traditional BCM functions, PEPS (keyless entry and start), window control, sunroof control, air conditioning module, seat module, etc. We believe that the Tier 1 companies that can excel in the body domain controller field should possess the following characteristics:1) Strong experience in traditional BCM development;2) Ability to independently develop window and air conditioning modules;3) Strong hardware integration capabilities;4) Software architecture that meets the times, preferably with experience in AUTOSAR, SOME/IP and other related developments;5) Chip supply capability (company revenue scale);

2.4. Integration Demand for “Chassis Domain” Controllers, Bringing Opportunities for Autonomous Chassis Control Execution Units

In the era of electric intelligence, chassis control is fully shifting to wire control. Due to the absence of vacuum sources, energy recovery needs, and upgraded control sensitivity, chassis execution units are fully transitioning to X-By-Wire technology, which includes wire-controlled braking and steering functions in addition to motor drives.

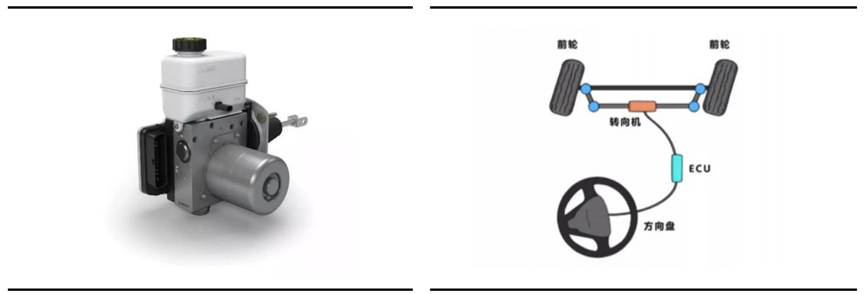

Left Image: One-Box Wire-Controlled Braking Unit

Right Image: Wire-Controlled Steering System

Compared to traditional chassis execution mechanisms, wire-controlled units have a significant increase in single vehicle value, with the wire-controlled braking One Box solution valued at about 2000 yuan, and the wire-controlled steering solution valued at about 3000 yuan. This represents about a doubling of value compared to traditional chassis execution mechanisms.

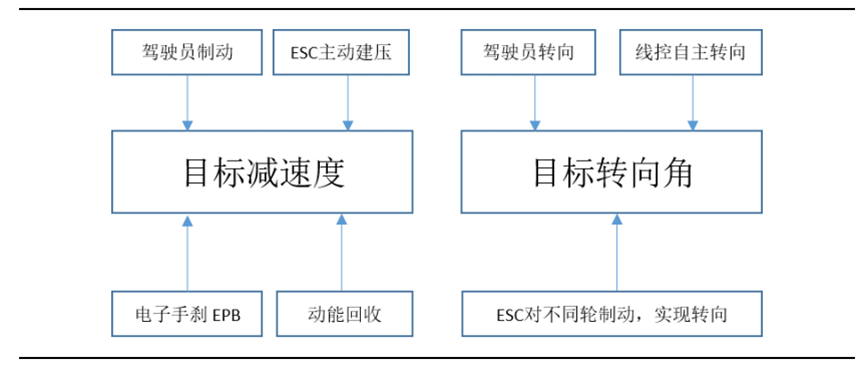

The upgrade of chassis execution mechanisms to wire-controlled units allows for multiple pathways to achieve braking and steering functions. In the upgrade of traditional chassis execution units to wire-controlled units, braking and steering functions can be achieved through multiple pathways. For example, braking functionality can be achieved through driver-initiated braking, ESC active pressure building, electronic parking brake (EPB), and energy recovery, etc. Therefore, consolidating all functions of chassis execution into a higher-level chassis domain controller for unified control has become the trend to improve overall vehicle control efficiency.

Electric intelligent vehicles achieve braking and steering through multiple pathways.

Challenges in achieving domestic replacement due to safety concerns create new opportunities in chassis domain controller integration. Chassis execution unit suppliers are primarily global top-tier Tier 1 companies. Due to safety concerns, it is challenging for OEMs to consider domestic replacements. However, under the trend of chassis domain integration, there is a need for more open suppliers to achieve integration of chassis domain drive + brake + steering algorithms, which also brings new opportunities for domestic chassis execution unit manufacturers.

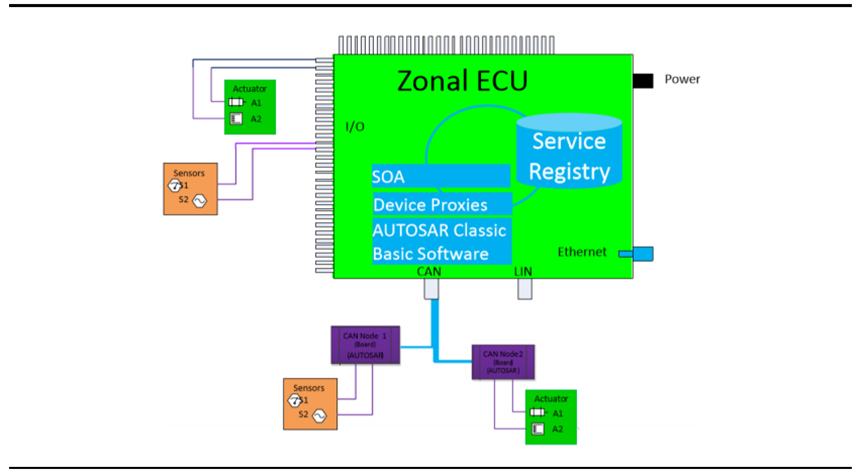

3. Emergence of “Zone” Controllers, Evolving Mechatronic Products into Intelligent Actuators

In Huawei’s CCA electronic and electrical architecture, 3-5 vehicle interface units (VIUs) become important nodes in the vehicle’s high-speed ring network. In this architecture, sensors, actuators, and ECUs distributed around the vehicle can connect to the VIU, which can perform the following functions:

1) Power Supply: Sensors, actuators, and ECUs can connect to the regional controller to obtain power supply.

2) Electronic Fuses: As a hub for power distribution, the regional controller can replace traditional relay fuses, especially when battery power is insufficient, allowing for selective shutdown of less important functions and temporarily withstanding peak loads to reduce wire diameters;

3) Isolation of I/O Ports from Computing Units: Each sensor and actuator connects to the local regional controller based on its position, allowing the regional actuator to execute data conversion and aggregation, and place it onto the connected Ethernet network, effectively abstracting I/O ports from actual computing, facilitating software abstraction and hardware plug-and-play;

4) Integration of ECU Functions: Some ECU functions are integrated into the regional controller for simple edge computing, improving information processing efficiency, such as blower controllers and audio controls in HVAC systems.

For the “ZONE” regional controller, it will absorb all input and output I/O interfaces in the vehicle’s physical layout area, allowing any function to connect via a safe and reliable high-speed Ethernet connection, ensuring data validity. Any I/O port can connect through “virtualization,” abstracting physical locations into services.

Structure of the Regional Controller ECU

Currently, the ZONE domain controller uses standardized software modules, compatible with existing ECU networks, connecting with ECU nodes through CAN/LIN buses, converting the data sent into Ethernet format data placed into the overall vehicle network. As ZONE controllers gradually develop, they will increasingly integrate other ECU functions, primarily to enhance their capabilities and reduce the number of ECUs. According to Huawei’s calculations, for a vehicle priced around 300,000 yuan, adopting the CCA architecture can save approximately 26% of the number of ECUs (from 38 to 28), reduce wiring length from 3.2 km to 2.6 km (saving 17%), reduce wiring costs from 3,000 yuan to 2,500 yuan (saving 19%), and lighten the vehicle by about 7 kg.

In the long run, under the regional controller architecture, ECU functions are gradually elevated to the ZONE regional controller or higher-level domain controllers, with the components connected to the ZONE controller mainly being intelligent sensors and intelligent actuators, such as electric water pumps, solenoid valves, wipers, and other traditional mechatronic products, with their controllers focusing solely on driving and diagnostic functions, becoming more standardized.

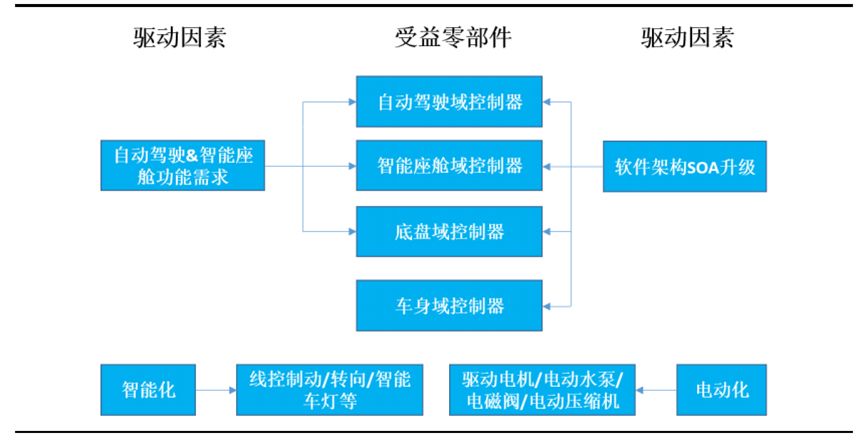

Under the Trend of Electric Intelligence,

Domain Controllers and Execution Controllers Grow in Sync

Under the trend of electric intelligence, on one hand, the demand for autonomous driving and intelligent cockpits and the upgrade of the overall vehicle electrical architecture to SOA will lead to continuous increases in the penetration rates of several domain controllers and regional controllers. On the other hand, the application of electric intelligence will drive the number of execution microcontrollers to continually rise, similar to vehicle light controllers, electric water pump controllers, solenoid valve controllers, electric compressor controllers, and wire-controlled chassis controllers, etc. The demand for both control and execution controllers will jointly promote the growth of the controller market scale.

Driving Factors for Controllers and Benefiting Components

1. Electrical Architecture Upgrade+ Promotion of Intelligent Functions, Domain Controllers Expected to Accelerate Penetration in 1-2 Years

The speed of penetration for domain controllers primarily depends on the update speed of the overall vehicle electrical architecture, and secondly on the demand for L2.5 and above high-level autonomous driving functions and intelligent cockpit functions. Upgrading the overall vehicle electronic and electrical architecture can promote the penetration rate of all domain controllers, while the rising demand for high-level autonomous driving functions and intelligent cockpit functions can drive OEMs to upgrade parts of their regional electronic and electrical architectures to meet the needs of autonomous driving domain controllers and intelligent cockpit domain controllers.

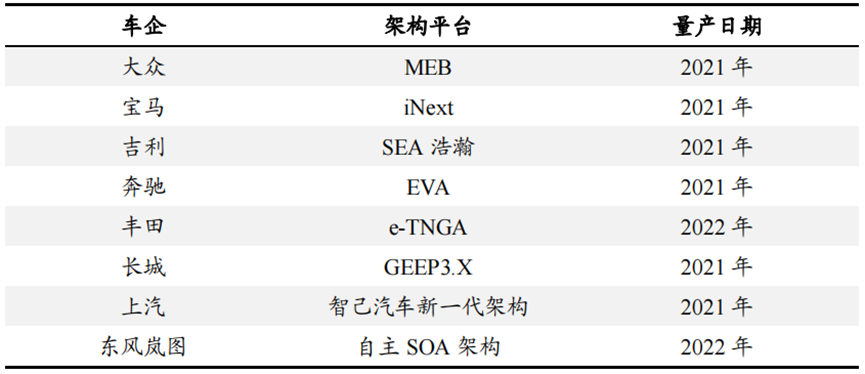

According to statistics, mainstream OEMs plan to implement new generation electronic and electrical architectures in the next 1-2 years, such as BMW’s iNext architecture with its first mass production version ix scheduled for release at the end of 2021; Geely’s SEA architecture debuting on the ZEEKR 001 in 2021; Mercedes-Benz’s EVA pure electric architecture with its first mass production sedan EQS launched in August 2021; Toyota’s first vehicle based on the e-TNGA architecture, BZ4X, unveiled at the Shanghai Auto Show in April 2021; Great Wall’s mocha equipped with the new generation GEEP3.X architecture launched in January 2021; SAIC’s IM Motors with the new generation electronic architecture set to launch at the end of 2021; and Dongfeng’s Lantu, which will introduce its self-developed SOA architecture in 2022.

Mainstream Automotive Companies’ Electronic and Electrical Architecture Plans

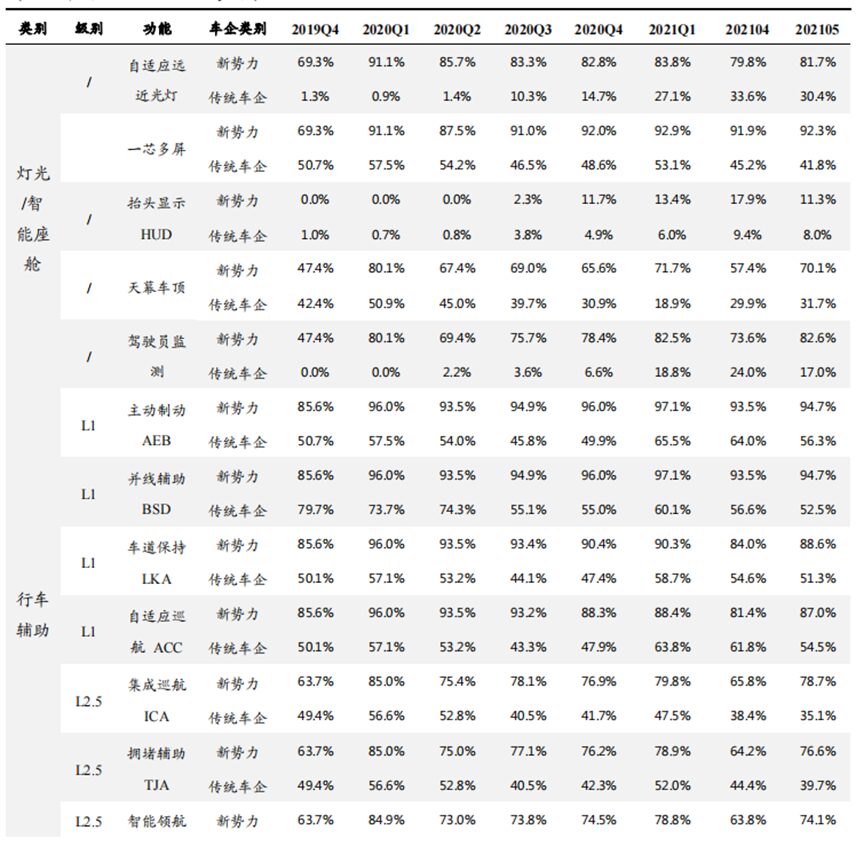

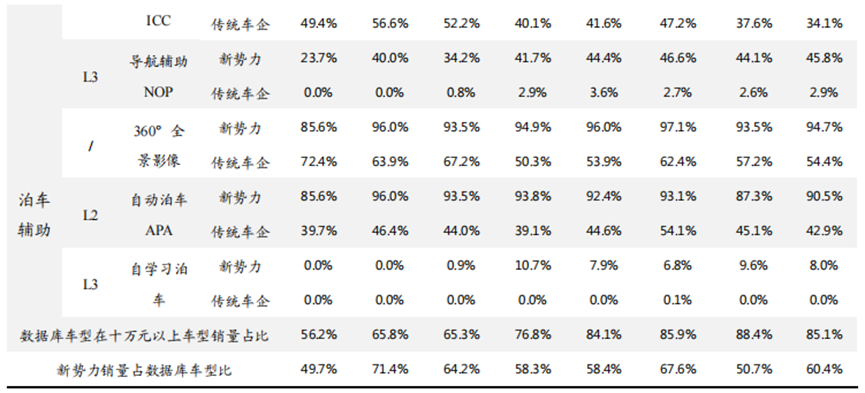

Intelligent Function Penetration Rate+ Rising Penetration of Electric Intelligent Vehicles Drives Continuous Growth of the Controller Market. According to our self-built database on the penetration rates of star electric intelligent vehicles (using 30 electric star models, accounting for over 85% of electric vehicles priced over 100,000 yuan, which can reflect the current level of intelligent penetration to some extent, from January 2020 to now), the penetration rate of L1-L2 level autonomous driving functions among new car-making forces has reached over 70%, while traditional automotive companies have significantly lower penetration rates than new car-making forces. The penetration rates of intelligent cockpits and adaptive high/low beam functions for traditional automotive companies still lag behind those of new car-making forces. Under competitive pressure, traditional automotive companies’ penetration rates for intelligent functions are expected to improve rapidly. Additionally, the overall penetration rate of electric vehicle sales steadily increased from 2.7% in Q4 2019 to 12.2% in May 2021. In the future, the controller market is expected to grow with the increase in intelligent function penetration rates + the rise in penetration rates of electric intelligent vehicles.

Penetration Rates of Intelligent Cockpit + ADAS Functions