Silicon wafers (also known as silicon substrates) are made from purified silicon (99.9999999% to 99.99999999999%), where high-purity polycrystalline silicon is melted and drawn into single crystal silicon rods, then processed through rolling, cutting, grinding, polishing, and cleaning to become the substrate material for manufacturing semiconductor devices.

1.1 Silicon Wafers and the Industrial Chain

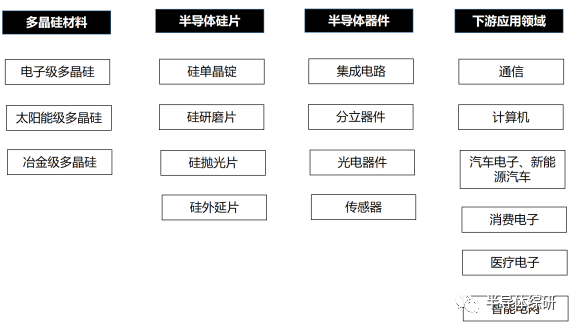

Silicon wafers are at the upstream of the semiconductor industrial chain, providing foundational support for the development of the semiconductor industry. They are processed and manufactured by silicon wafer producers and are primarily used to make integrated circuits and other semiconductor devices, which are then applied in fields such as communications, computers, automotive electronics, consumer electronics, medical electronics, and smart grids.

Figure 1. Semiconductor Industrial Chain

1.2 Fourth Generation Semiconductor Materials

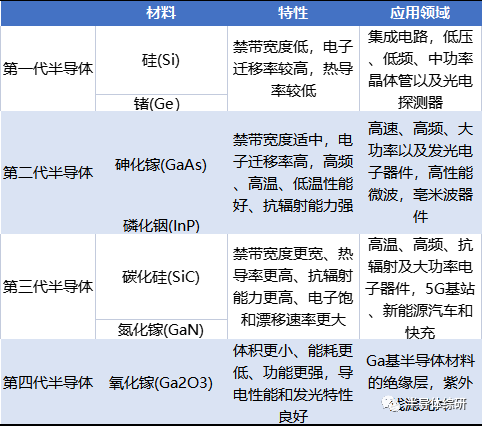

Currently, fourth-generation semiconductors have begun to emerge in the global semiconductor market. The evolution path of fourth-generation semiconductors is as follows:

The first-generation semiconductor materials were primarily germanium (Ge) and silicon (Si). They have low bandgap width, high electron mobility, and low thermal conductivity, mainly used for making integrated circuits, low voltage, low frequency, medium power transistors, and photo detectors.

The second-generation semiconductor materials were mainly gallium arsenide (GaAs) and indium phosphide (InP), characterized by moderate bandgap width, high electron mobility, good high-frequency, high-temperature, low-temperature performance, and strong radiation resistance, mainly used for producing high-speed, high-frequency, high-power, and optoelectronic devices, and are excellent materials for making high-performance microwave and millimeter-wave devices and light-emitting devices.

The third-generation semiconductor materials are primarily gallium nitride (GaN) and silicon carbide (SiC), which have wider bandgap widths, higher thermal conductivity, higher radiation resistance, and greater electron saturation drift rates. Third-generation semiconductor materials can achieve better electron concentration and motion control, making them more suitable for high-temperature, high-frequency, radiation-resistant, and high-power electronic devices, with significant application value in optoelectronics and microelectronics. Currently, the hot markets for 5G base stations, new energy vehicles, and fast charging are all important application areas for third-generation semiconductors.

The fourth-generation semiconductor materials are represented by gallium oxide (Ga2O3), which are smaller in size, consume less energy, have stronger functionality, and exhibit good conductivity and light-emitting characteristics. Therefore, they have broad application prospects in optoelectronic devices, being used as insulation layers for gallium-based semiconductor materials and ultraviolet filters.

Table 1. Comparison of Performance and Applications of Fourth Generation Semiconductors

1.3 Size

The more advanced the chip, the larger the size of the silicon wafer used, the higher the utilization rate of the wafer, and the lower the production cost of the chip. Therefore, the trend towards larger silicon wafer sizes is inevitable. The sizes of silicon wafers available in the market include 50mm (2 inches), 75mm (3 inches), 100mm (4 inches), 150mm (6 inches), 200mm (8 inches), and 300mm (12 inches), with mainstream sizes being 8 inches and 12 inches. According to SEMI data from 2021, the market shares of 8-inch and 12-inch wafers in the silicon wafer market reached 25% and 69%, respectively.

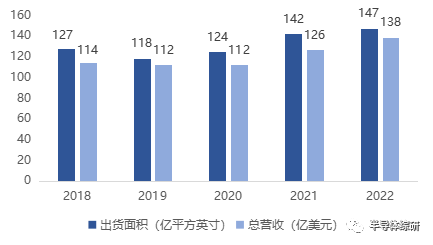

1.4 Global Market Landscape

Due to the impact of the US-China trade war and the decline in the semiconductor industry’s prosperity, the global silicon wafer market size experienced a brief decline in 2019. However, with the rapid development of artificial intelligence and the swift rise of emerging industries such as the Internet of Things, smartphones, and new energy vehicles, the global silicon wafer market size has shown a steady growth trend since 2020. By 2022, the global silicon wafer market had reached a shipment area of 14.713 billion square inches and total revenue of $13.8 billion, representing year-on-year growth of 3.87% and 9.35%, respectively.

Figure 2. Global Silicon Wafer Market Size

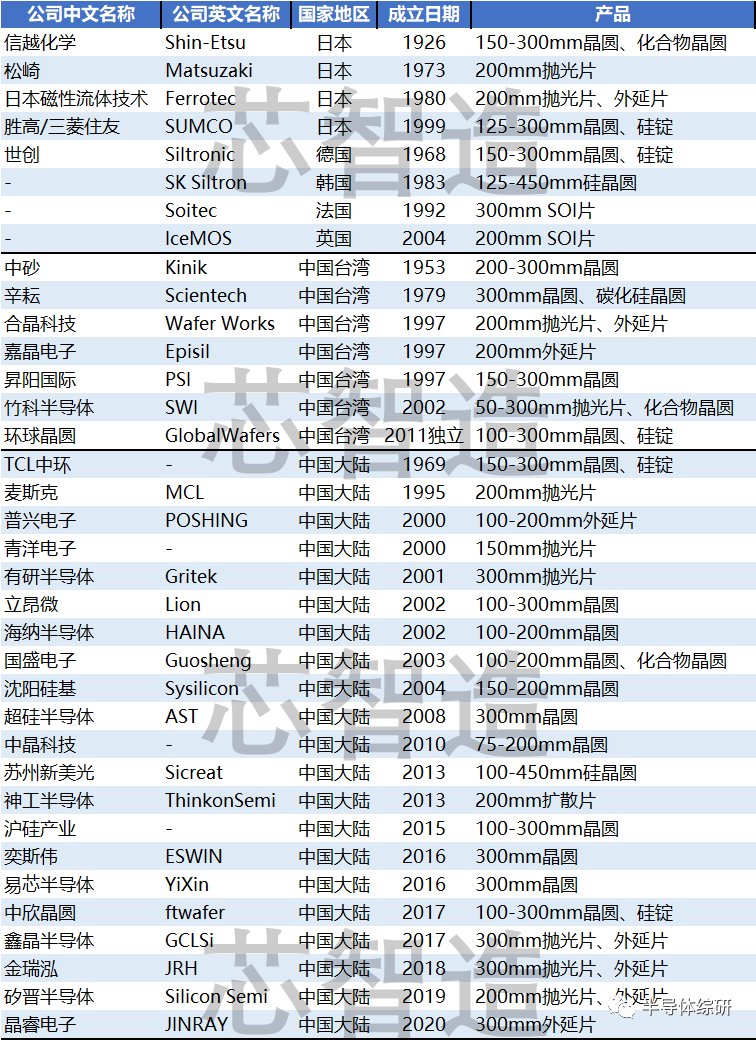

In terms of establishment time, semiconductor manufacturers in mainland China were generally established in the 21st century, slightly lagging behind those in Taiwan and overseas. Currently, the market for 12-inch silicon wafers is still largely occupied by countries such as South Korea, Japan, Germany, France, and Taiwan, while silicon wafer manufacturers in mainland China primarily focus on the production of 8-inch silicon wafers and are continually developing larger sizes.

Table 2. Silicon Wafer Manufacturer Product Information

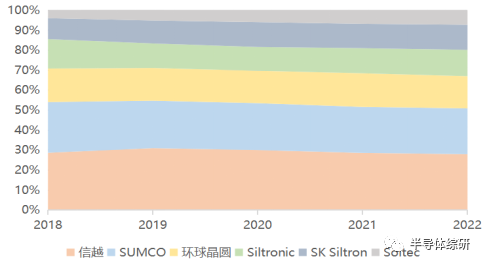

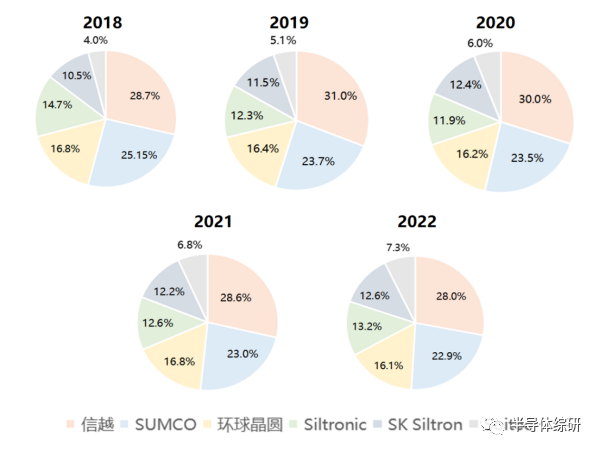

The global silicon wafer market is highly concentrated, with the top six suppliers (Shin-Etsu Chemical, SUMCO, GlobalWafers, Siltronic, SK Siltron, and Soitec) occupying a market share of up to 95%, while other suppliers account for only about 5%. From 2018 to 2022, the market share of each company has remained almost unchanged, solidifying the market landscape. Among them, two Japanese companies—Shin-Etsu and SUMCO—hold 50% of the market share, dominating the market.

Figure 3. Market Share of the Top Six Global Silicon Wafer Suppliers from 2018 to 2022

Figure 4. Market Share of the Top Six Global Silicon Wafer Suppliers from 2018 to 2022

Table 3. Basic Information of Major Global Silicon Wafer Suppliers

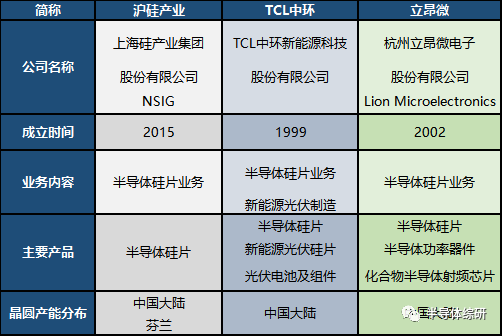

Shanghai Silicon Industry, TCL Zhonghuan (Zhonghuan Leading), and Lion Microelectronics (Jinruihong) are listed silicon wafer manufacturing companies in mainland China.

Table 4. Basic Information of Major Silicon Wafer Suppliers in Mainland China

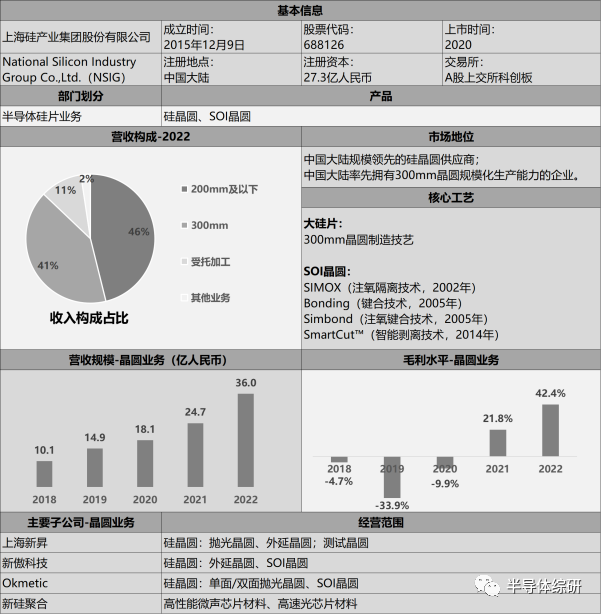

3.1 Shanghai Silicon Industry

Shanghai Silicon Industry Group is one of the largest semiconductor silicon wafer manufacturers in mainland China, accounting for nearly 20% of the mainland silicon wafer market. It was also the first company in mainland China to achieve large-scale sales of 300mm semiconductor silicon wafers. Since its establishment in 2015, through the acquisition of three major subsidiaries—Shanghai Xinxing, Xinao Technology, and Okmetic—Shanghai Silicon Industry Group quickly became a leader in China’s semiconductor silicon wafer industry.

Table 11. Basic Information of Shanghai Silicon Industry

Currently, Shanghai Silicon Industry has stable yield rates for large silicon wafers, and the company’s revenue growth rate exceeds the industry average. However, there is still a significant gap in scale compared to leading foreign companies. As a leading domestic large silicon wafer enterprise, Shanghai Silicon Industry is committed to the strategic focus of domestic substitution, with rapidly increasing customer certifications and revenue scale, indicating a promising development outlook.

3.2 TCL Zhonghuan

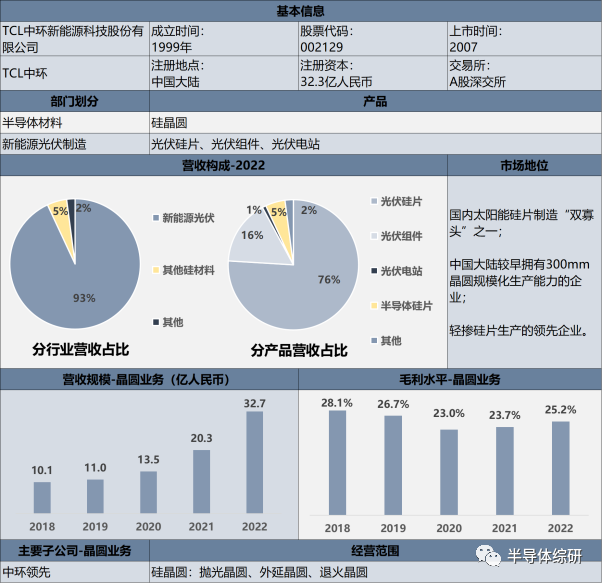

TCL Zhonghuan New Energy Technology Co., Ltd. (hereinafter referred to as “TCL Zhonghuan”) was established in 1999, originally known as Tianjin Zhonghuan Semiconductor Co., Ltd. (referred to as “Zhonghuan Co.”), which was acquired by TCL Technology and renamed “TCL Zhonghuan” in June 2022.

TCL Zhonghuan focuses on photovoltaic monocrystalline silicon and has actively laid out the semiconductor silicon wafer industry in recent years. Its main business revolves around silicon materials, starting with monocrystalline silicon and extending vertically into semiconductor material manufacturing and new energy photovoltaic manufacturing, forming semiconductor material segments, photovoltaic material segments, and photovoltaic cell and module segments; horizontally, it expands into related fields, forming photovoltaic power generation segments, including ground-mounted and distributed photovoltaic power stations.

Table 12. Basic Information of TCL Zhonghuan

As a “dual leader” in semiconductor silicon wafers and photovoltaic silicon wafers, TCL Zhonghuan has strong competitiveness in production scale and cost control; additionally, it has established unique advantages in the high-barrier 12-inch wafers and lightly doped silicon wafers, with broad development prospects.

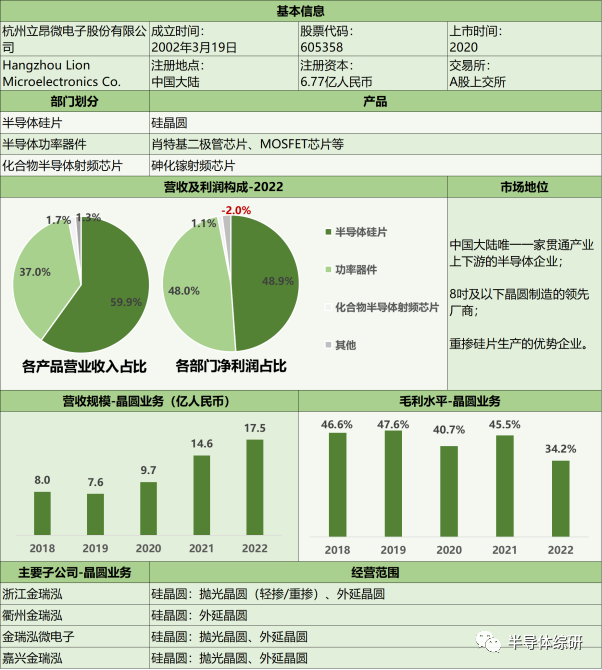

3.3 Lion Microelectronics

Hangzhou Lion Microelectronics Co., Ltd. (hereinafter referred to as “Lion Micro”) was established in March 2002 in Hangzhou, Zhejiang, and was formerly known as Hangzhou Lion Electronics Co., Ltd. (Lion Co.), a high-tech enterprise focused on the design, development, manufacturing, and sales of semiconductor materials for integrated circuits, power semiconductor chips, and integrated circuit chips. Lion Micro, as a leading silicon wafer supplier in China, accounts for over 10% of the market share in mainland China. It currently has five operational bases in Hangzhou, Ningbo, Quzhou, Jiaxing, and Haining.

Table 13. Basic Information of Lion Micro

Lion Micro’s business spans the entire industry chain, covering the production, manufacturing, and sales of silicon materials, silicon wafers, discrete device chips, and finished discrete devices. Its three major business modules—semiconductor silicon wafers, power semiconductor devices, and compound semiconductor RF chips—support each other and complement each other, establishing its current market position.

Lion Micro has relatively mature manufacturing processes for 8-inch and smaller semiconductor silicon wafers, and with its stable quality and relatively complete specifications, it has achieved slightly higher pricing than domestic competitors. In some advantageous varieties of heavily doped series, the pricing even exceeds that of global top silicon wafer suppliers; however, in the production of 12-inch silicon wafers, it is still in the early stages of capacity ramp-up and may face significant market competition pressure compared to domestic peers.

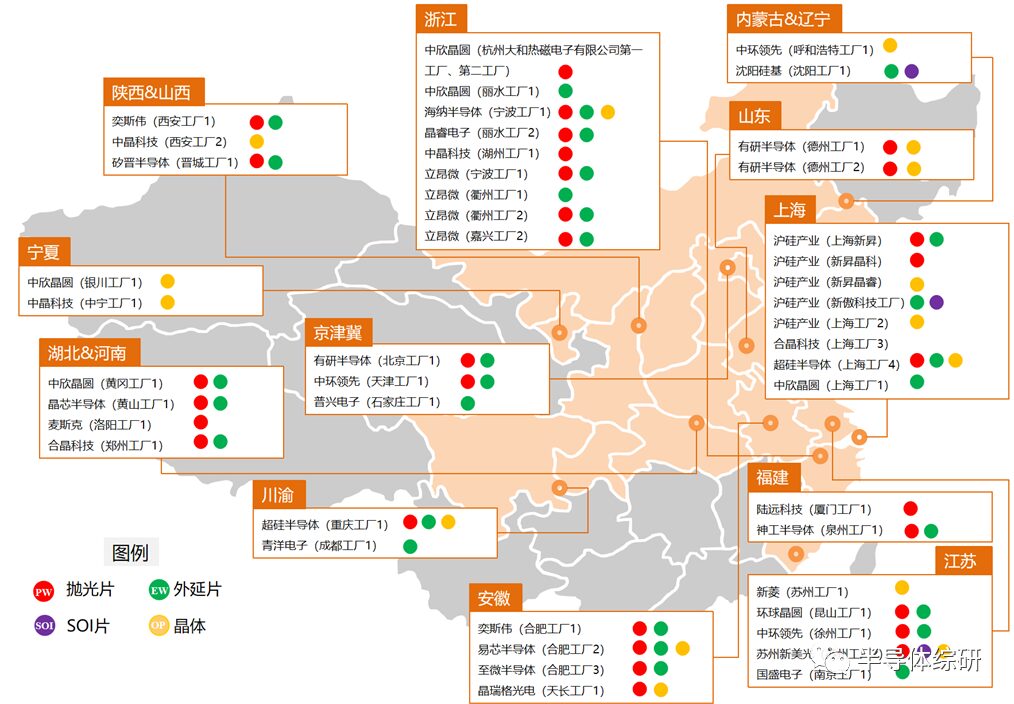

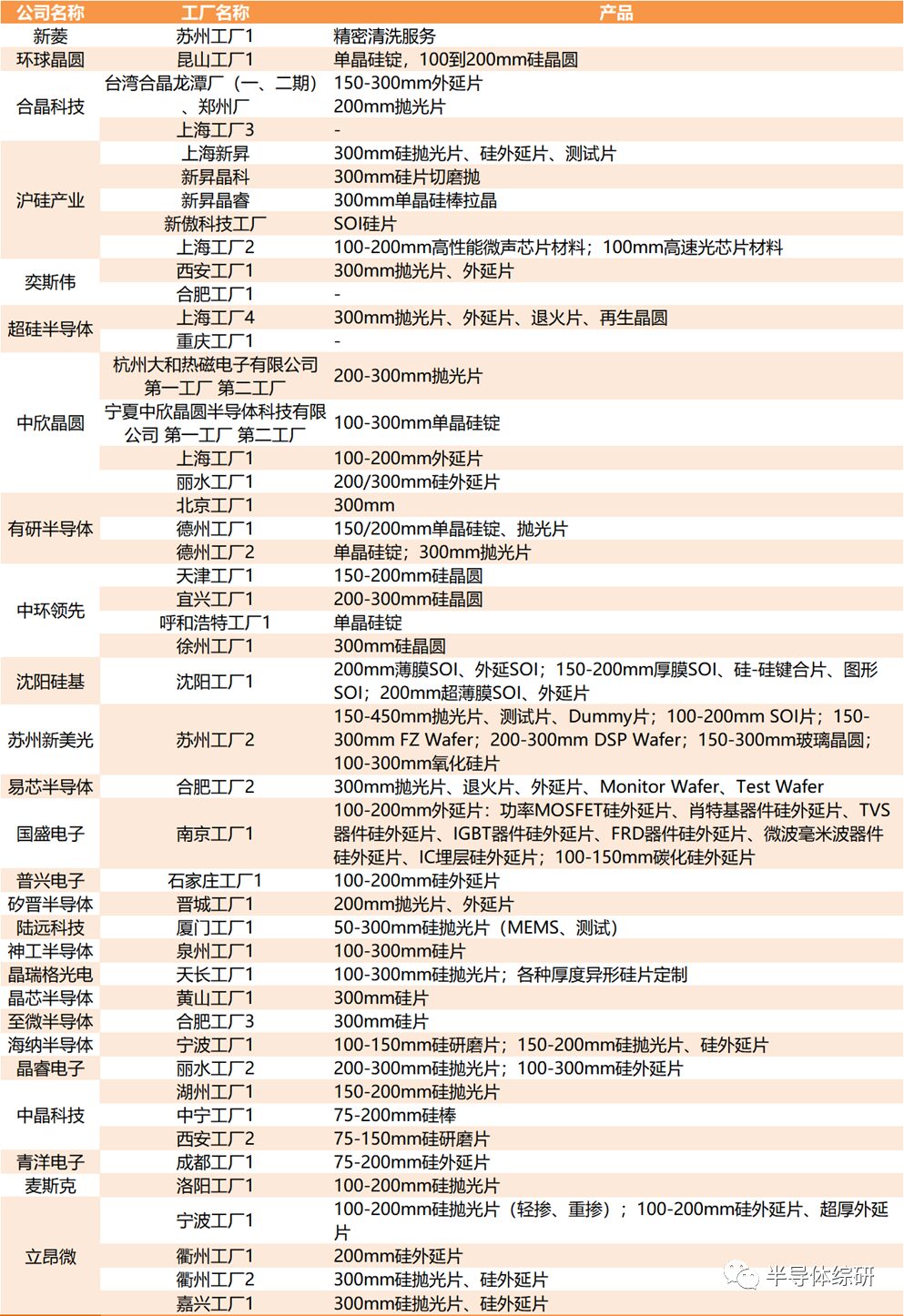

3.4 Distribution of Domestic Silicon Wafer Factories

Currently, there are about 50 silicon wafer factories recorded in mainland China, most of which are from domestic suppliers. Among non-mainland companies, only GlobalWafers has a silicon wafer factory in Kunshan, Jiangsu; while domestic manufacturers generally set up their factories locally, with the only exception being two silicon wafer factories acquired by Shanghai Silicon Industry in Finland in 2016 for the production of polishing wafers and SOI wafers (not included in this chart).

Figure 5. Distribution of Silicon Wafer Factories in Mainland China

3.5 Financial Status of Domestic Enterprises

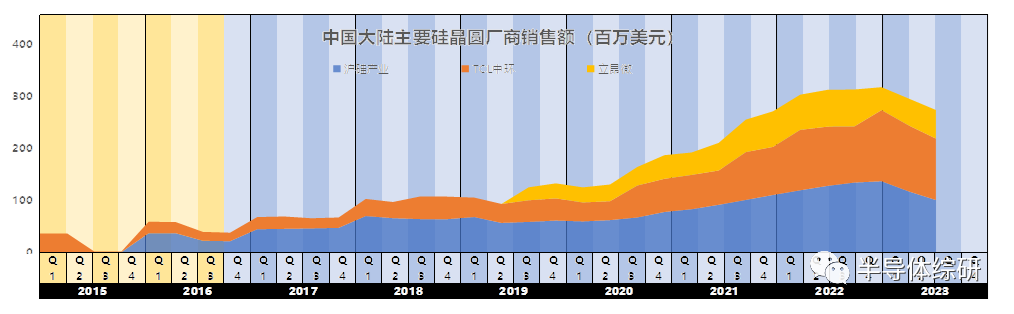

The silicon wafer market in China started relatively late, initially forming scale after 2015, and has been in a rapid expansion phase until 2022. With the gradual recovery of the silicon wafer industry and the development of domestic substitution, the related revenue scales of three representative listed enterprises—Shanghai Silicon Industry, TCL Zhonghuan, and Lion Micro (Jinruihong)—have at least doubled compared to the end of the recession, with TCL Zhonghuan’s silicon wafer revenue scale even increasing fivefold. The main growth drivers during this period are twofold: the realization of domestic substitution for 8-inch wafer production after 2015; and the gradual breaking of the complete reliance on imports for 12-inch wafers after 2018, with Shanghai Silicon Industry, TCL Zhonghuan, and others taking the lead in developing 12-inch capacity, which now has achieved a certain scale.

Figure 6. Sales Revenue of Major Silicon Wafer Suppliers in Mainland China

-

Market Share

From the market share perspective, domestic manufacturers still have a significant gap compared to international leaders. Among domestic manufacturers, Shanghai Silicon Industry is in the leading position. However, due to the rapid expansion of domestic manufacturers far exceeding the international average growth rate, the future market share situation may undergo significant changes.

-

Gross Margin

In terms of gross margin, international giant Shin-Etsu Chemical is far ahead, while among domestic manufacturers, Lion Micro’s gross margin level is close to it, mainly due to its high pricing creating a significant profit margin: in the field of 8-inch and smaller semiconductor silicon wafers, Lion Micro has achieved slightly higher pricing than domestic competitors due to its stable quality; in certain advantageous varieties of heavily doped series, pricing even exceeds that of global top silicon wafer suppliers. However, Shanghai Silicon Industry and TCL’s gross margin levels are much lower than these two.

-

Growth Potential

In terms of growth potential, domestic manufacturers have been in a phase of rapid expansion since 2015, with growth rates significantly higher than those of international leading manufacturers. Moreover, as the domestic substitution of the semiconductor industry progresses, China, as one of the largest silicon wafer markets, has broad growth potential.

-

Resilience

In terms of resilience, domestic manufacturers are also relatively weak compared to international leaders. Among them, TCL Zhonghuan is the most stable, partly due to its early entry into the silicon wafer industry, having entered a stable period, with its lightly doped silicon wafers as advantageous products providing stable income; on the other hand, as one of the domestic leaders in photovoltaic silicon wafers, the development of photovoltaic business has somewhat offset the cyclical fluctuations in the silicon wafer industry. The fluctuations of Shanghai Silicon Industry are mainly affected by the construction of its new 12-inch production line: early large equipment investments have led to high depreciation, while low production yields have caused a decline in gross margins. However, as Shanghai Silicon Industry has entered a stable production supply phase, gross margins are gradually recovering and stabilizing.

-

Research and Development Innovation

In terms of the emphasis on research and development innovation, domestic manufacturers’ R&D investment as a percentage of revenue is far higher than that of international leaders. This is partly influenced by production scale; as production scale expands, marginal costs approach zero. For leading enterprise Shin-Etsu Chemical, its low R&D investment ratio does not imply a low absolute investment amount; on the other hand, the two are at different stages of development: as late entrants, domestic manufacturers need to invest more in R&D to compensate for the first-mover advantages of the industry.

Since 2006, the global silicon wafer industry has experienced four stages: bubble, collapse, recession, and recovery. Through repeated cyclical changes, we find that industry leaders often exhibit characteristics of high market share, high gross margins, and small profit fluctuations, while followers typically demonstrate high growth potential, low gross margins, high volatility, and high R&D investment ratios.

Additionally, the historical development of the industry offers us two insights: first, always pay attention to cyclical changes in the industry; avoid blind production; reducing risks during downturns is often more important than seizing opportunities during peaks; second, focus on core businesses with high competitive barriers, enhance technological capabilities, and be wary of falling into a cycle of price competition.

(Source: National New Materials Industry Resource Sharing. This article is produced by the Qingdao West Coast International Investment Promotion Center, please indicate the source when reprinting.)

Recommended Reading

Learning and Implementing the Spirit of the 20th National Congress of the Communist Party, High-Quality and Efficient Investment Promotion, Advancing Chinese-Style Modernization

Launch of Tangdao Bay Innovation Center, Inspur Group Assists New District in Creating a New Engine for the Software Information Industry

New Projects in Technology Services Industry, Tianbao Medical Technology Industrial Park Project Signed and Landed in West Coast New Area