Today, let’s briefly discuss IGBTs in power semiconductors, which is currently a very popular track in the semiconductor industry chain.

Power semiconductors are a core part of the entire industry, positioned after semiconductor materials and equipment. A term often mentioned here is “power devices”; some people think these two are the same, but they are not identical.

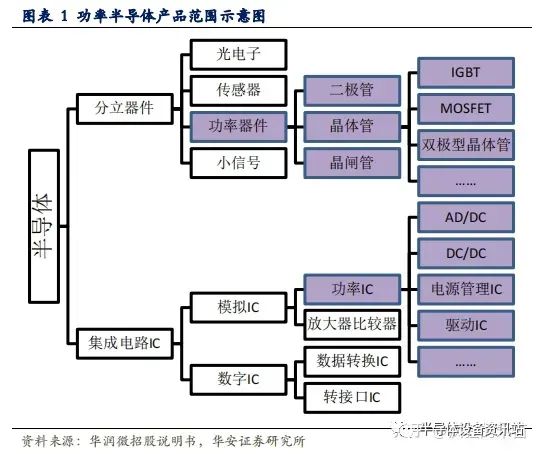

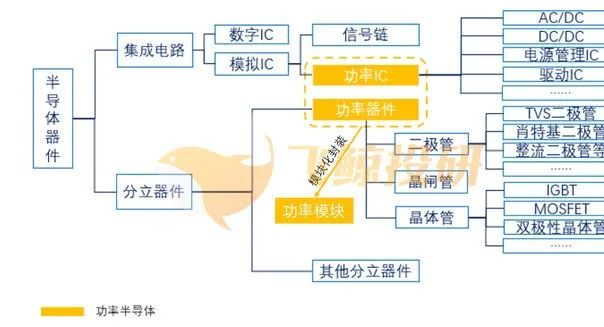

Power semiconductors consist of two parts: power devices and power ICs. Power devices are a branch of discrete power semiconductor devices, while power ICs integrate discrete power semiconductor devices with various functional peripheral circuits.

The main function of power semiconductors is to convert electrical energy, control circuits, and change the voltage and frequency in electronic devices, whether DC or AC, all capable of handling high voltage and large current.

In an ideal situation, the converter has no voltage loss when opened and no power loss during switching, so the product and technological innovation in power semiconductors mainly aim to improve energy conversion efficiency.

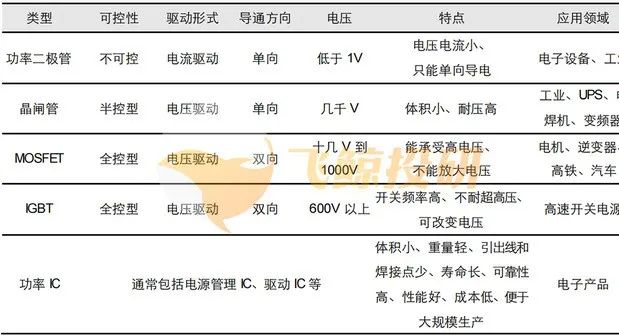

In the realm of power devices, the first to develop were power diodes and transistors, followed by a rapid development of thyristors.

Now, MOSFETs and IGBTs are gradually rising, having experienced transformations such as planar and trench types, and they remain the most valuable and technically challenging power devices.

However, currently, the vast majority of discrete devices and integrated circuits are silicon-based materials, while the previously mentioned silicon carbide and gallium nitride power devices are the trend of the future. Interested readers can refer to the earlier article “The Most Comprehensive Analysis of the Silicon Carbide Industry Chain”.

The IGBT, formally known as Insulated Gate Bipolar Transistor, is a fully controlled voltage-driven power semiconductor composed of BJT (Bipolar Junction Transistor) and MOSFET (Metal-Oxide-Semiconductor Field-Effect Transistor).

Thus, IGBTs possess the advantages of both, making them incomparable to other power devices in high voltage, large current, and high speed; they are ideal switching devices in the field of power electronics.

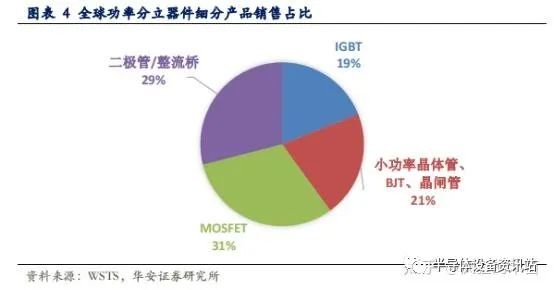

According to statistics from Yole, about 50% of global power semiconductors are power ICs, while the remaining half consists of power discrete devices.

In the sales proportion of power discrete devices in 2017, MOSFETs had the highest share at about 31%, followed by diodes/rectifiers at about 29%, thyristors and BJTs accounted for about 21%, and IGBTs accounted for 19%, but their compound growth rate is the fastest.

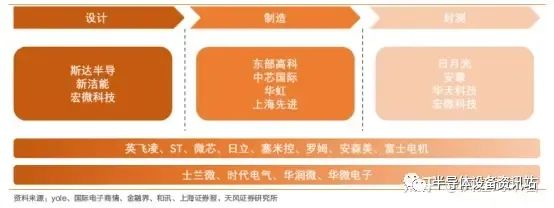

The IGBT industry chain includes upstream IC design, midstream manufacturing and packaging, and downstream applications in fields such as industrial control, new energy, home appliances, and electrical high-speed rail.

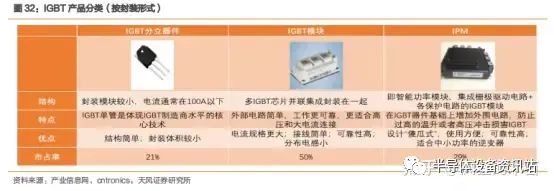

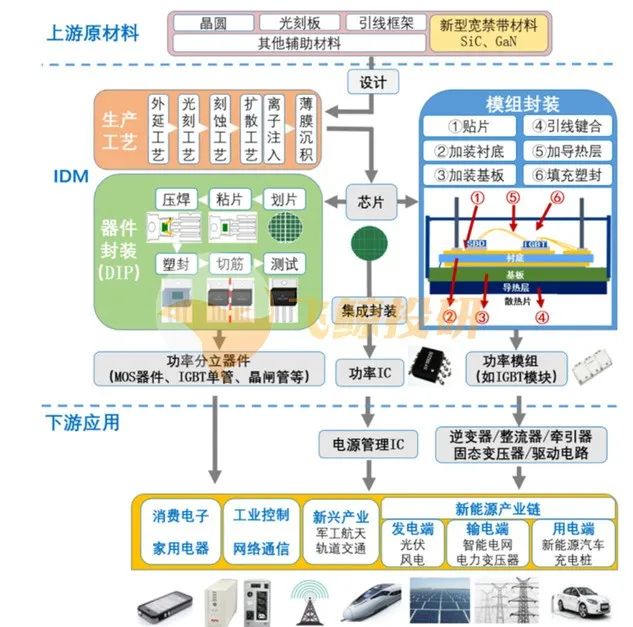

According to packaging forms, it can be divided into three main categories: IGBT discrete devices, IGBT modules, and IPMs.

IGBT discrete devices refer to a device consisting of one IGBT chip and one reverse parallel diode.

IGBT modules refer to the assembly of multiple (two or more) IGBT chips and diode chips insulatedly onto a DBC substrate, followed by modular packaging.

IPMs refer to a combination device that integrates power devices (mainly IGBTs) with driver circuits, overvoltage and overcurrent protection circuits, temperature monitoring, and over-temperature protection circuits.

Currently, module packaging has become one of the core competitive advantages of IGBTs, suitable for various high voltage scenarios.

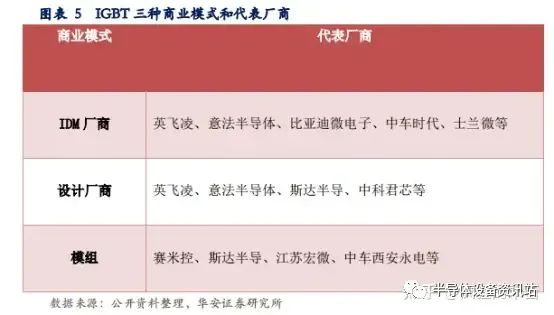

In addition, IGBT companies mainly have three business models: IDM, design, and module.

The IDM model refers to vertically integrated manufacturers, encompassing all aspects of circuit design, wafer manufacturing, packaging testing, and consumer market deployment. This model requires high technology, capital, and market share from companies.

The design model means that companies focus on chip design while outsourcing chip manufacturing to foundries, which are responsible for procuring wafers and processing production. This model lowers capital requirements, reduces investment risks, and can quickly develop chips needed for the end market.

Most foreign giants adopt the IDM model, while domestic companies like Sadar Semiconductor adopt the Fabless+module model.

Chinese companies tend to prefer the Fabless model mainly because power semiconductors do not require particularly advanced wafer foundry, and building production lines independently has a long capital recovery period. Moreover, there are many mature foundries in China, so as latecomers, domestic companies adopting Fabless is beneficial for rapid catch-up.

The IGBT industry has technical barriers. Since power semiconductors are similar to analog ICs, unlike digital circuits that can be designed using EDA software, power semiconductors require continuous adjustments and compromises based on actual product parameters, thus demanding higher experience from engineers.

Moreover, due to the harsh working environment and heavy load on IGBTs, there are high requirements for performance stability and reliability, leading to high barriers in both design and manufacturing.

In addition to improving reliability, IGBTs will also develop towards higher density, larger wafers, and thinner thicknesses. Furthermore, materials with higher thermal conductivity, thicker copper layers, and better integrated heat dissipation functions are also directions for the development of IGBT modules.

The product lifecycle of IGBTs is relatively long. Taking Infineon as an example, although it has now updated to the seventh generation, the third generation product released 20 years ago still dominates in high voltage fields such as 3300V, 4500V, and 6500V, and the fourth generation product remains the most widely used IGBT chip technology today.

Moreover, the stability of new products usually requires time for verification, so many customers choose to purchase old products even when they know there are new products available. This results in high replacement costs for products from large manufacturers, giving them a clear competitive advantage.

As a major manufacturing country, power semiconductor devices have widespread applications in our country’s industry, renewable energy, and military industries, holding a high strategic position.

Power semiconductors are the core of energy conversion and circuit control in electronic devices, making them a very important niche in the semiconductor industry. Today, Feijun Investment Research will provide a detailed introduction to the power semiconductor industry.

1. Overview of the Power Semiconductor Industry

Power semiconductors are the core of energy conversion and circuit control in electronic devices, primarily achieving the functions of power switching and energy conversion by utilizing the unidirectional conductivity of semiconductors, with specific applications including frequency conversion, phase transformation, voltage transformation, inversion, rectification, amplification, and switching.

1. Classification of Power Semiconductors

Power semiconductors can be classified into power discrete devices, power modules, and power ICs based on packaging forms and integration levels.

① Power Discrete Devices: Refers to devices such as diodes and thyristors used for processing electrical energy, which cannot be further subdivided in function.

② Power Modules: Consists of two or more semiconductor discrete device chips connected in a certain circuit and modularly packaged, mainly applied in high voltage and large current scenarios, such as the main drive inverter of new energy vehicles and high-speed trains.

③ Power IC: Refers to integrated circuits that combine high voltage power devices with their control circuits, peripheral interface circuits, and protection circuits on the same chip.

Among power devices, transistors have the largest share, with common transistors mainly being BJT, MOSFET, and IGBT.

① MOSFET: Metal-Oxide-Semiconductor Field-Effect Transistor, widely used in both analog and digital circuits, more suitable for high-frequency scenarios.

② IGBT: Insulated Gate Bipolar Transistor, a fully controlled power semiconductor device that combines the gate voltage control characteristics of MOSFETs and the low conduction resistance characteristics of BJTs, more suitable for high voltage scenarios.

2. Power Semiconductor Industry Chain

The upstream of power semiconductors includes raw materials such as silicon wafers (grinding wafers, polishing wafers, and epitaxial wafers), molybdenum sheets, lead frames, casing, and heat sinks, involving materials, equipment manufacturing, and chemical industries. The prices of raw materials directly affect the overall costs of downstream companies. The downstream applications of power semiconductors are extensive, covering nearly all electronic manufacturing industries, including consumer electronics, industrial control, power transmission, and renewable energy.

3. Application Scope of Power Semiconductors

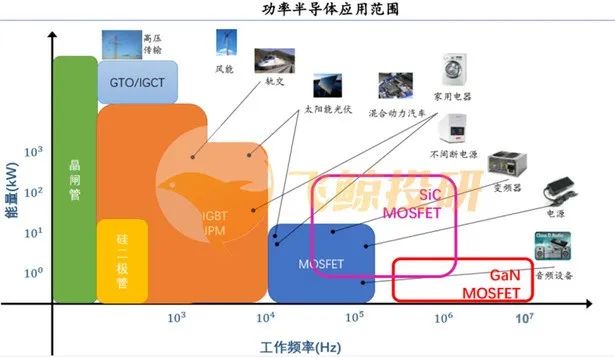

The downstream applications of power semiconductors are extensive, basically involving any place where power systems are used. The downstream application fields can be divided into several major parts: consumer electronics, new energy vehicles, renewable energy generation and power grids, rail transportation, white goods, and industrial control, with the market scale showing a steady growth trend. Based on the corresponding power and frequency for different application scenarios, people choose to use corresponding power devices and substrates.

4. Market Size of Power Semiconductor Devices

Benefiting from downstream demand, the global power semiconductor market size is steadily growing. According to Omdia data, the global power semiconductor market size reached $42.2 billion in 2020, and is expected to reach $53.8 billion by 2024.

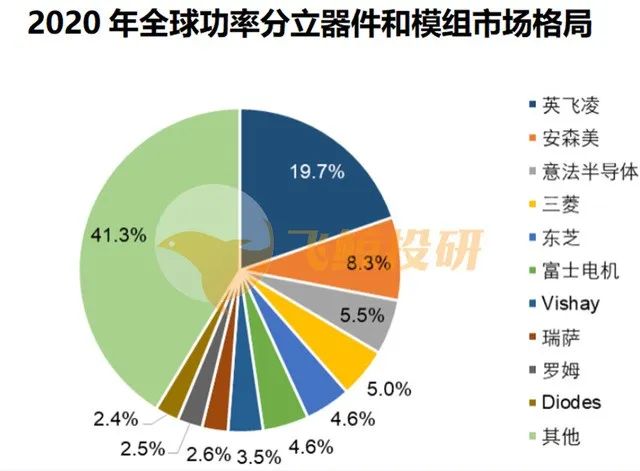

The global power semiconductor market is primarily dominated by European, American, and Japanese manufacturers. According to Omdia data, the global market size for power discrete devices and modules was $20.9 billion in 2020, with Infineon holding a 19.7% share, ranking first; Onsemi holding an 8.3% share, ranking second; and STMicroelectronics holding a 5.5% share, ranking third; the top 10 manufacturers collectively accounted for 58.7%, indicating a high market concentration.

The Chinese power semiconductor market size also continues to grow. According to Omdia data, the Chinese power semiconductor market size reached $15.3 billion in 2020, accounting for 36.3% of the global market, and is expected to reach $19.7 billion by 2024. In terms of product structure, power management ICs account for 61%, MOSFETs account for 20%, and IGBTs account for 14%.

2. Competitive Landscape of Power Semiconductors

Although the domestic development prospects are good, there is still a certain gap in both technology reserves and revenue capabilities compared to foreign companies.

According to Omdia’s 2021 global power semiconductor top ten list, the global power semiconductor market is still controlled by American, Japanese, and European companies, just as it has been for the past decade. Among the top ten, the first-ranked Infineon from Germany and the second-ranked Onsemi from the United States have a very stable position, while the rankings after the third place change rapidly.

Half of the top ten global power semiconductor companies are Japanese, including Mitsubishi Electric (4th), Fuji Electric (5th), Toshiba (6th), Renesas (9th), and ROHM (10th). Europe occupies three seats, in addition to the first-ranked Infineon and the third-ranked STMicroelectronics, there is NXP located in the Netherlands. In the United States, apart from the second-ranked Onsemi, Vishay is also listed, ranking seventh.

Only one Chinese company made the list—Nexperia, a subsidiary of Wingtech Technology, ranking eighth. Therefore, domestic manufacturers still face high competition in the face of significant growth opportunities.

There are about 20 publicly listed companies in A-shares engaged in power semiconductor-related businesses. In addition to Wingtech Technology, Sadar Semiconductor, Yangjie Technology, China Resources Microelectronics, Silan Microelectronics, and BYD Semiconductor and other large manufacturers, there are also some small and medium-sized enterprises focusing on specific fields.

1. Jiejie Microelectronics

Jiejie Microelectronics specializes in the R&D, design, production, and sales of power semiconductor chips and devices, with a core competitive IDM business system based on advanced chip technology, packaging design, process, and testing.

Currently, the company’s thyristor series products, diodes, and protection series products adopt a vertically integrated (IDM) business model, integrating power semiconductor chip design, manufacturing, device design, packaging, testing, and terminal sales and services into a vertical industry chain; the company’s MOSFET series products adopt a Fabless+testing model.

2. New Clean Energy

New Clean Energy is a leading domestic power semiconductor chip and device design company.It mainly engages in the R&D, design, and sales of power semiconductor chips and devices.

New Clean Energy has a complete MOSFET product matrix, with its technical strength and sales scale being in a leading position domestically.The company develops leading products based on advanced theoretical technology in global semiconductor power devices and is one of the first domestic companies to master super junction technology and mass-produce shielded gate power MOSFETs and super junction MOSFETs;it is also one of the earliest domestic companies to simultaneously have four product platforms: trench power MOSFETs, super junction power MOSFETs, shielded gate power MOSFETs, and IGBTs.

3. Dongwei Semiconductor

Dongwei Semiconductor mainly engages in the R&D and sales of high-performance power devices and is one of the few domestic high-performance power device design companies with complete experience from patent to mass production, achieving domestic substitution in the fields of high voltage super junction MOSFETs and medium-low voltage power devices used in industrial and automotive applications.

4. Huayi Electronics

Focuses on the design, R&D, chip manufacturing, packaging testing, and sales of power semiconductor devices, ranking first in the Chinese power semiconductor device industry for ten consecutive years.

3. Conclusion

In the future, driven by the demand for automotive-grade IGBTs and the accelerated penetration of third-generation semiconductors, we remain optimistic about the growth of “small but beautiful” companies in the IGBT and SiC&GaN layouts, while “leading tracks” have long-term configuration value.Feijun Investment Research believes that power semiconductors are expected to become one of the fastest-growing niche fields for domestic substitution in the future.

Welcome to all angel round and A round companies in the entire automotive industry chain (including the power battery industry chain) to join the group (which will be recommended to 800 automotive investment institutions including top institutions);there are communication groups for leaders of sci-tech innovation companies, as well as dozens of groups related to automotive industry complete vehicles, automotive semiconductors, key components, new energy vehicles, intelligent connected vehicles, aftermarket, automotive investment, autonomous driving, vehicle networking, etc. To join, please scan the administrator’s WeChat (please indicate your company name)