The full name of a drone is an unmanned aerial vehicle, which is controlled by radio remote control devices and self-equipped program control devices. There is no pilot on board, but it is equipped with autopilots, program control devices, and other equipment. Personnel on the ground, ships, or mother aircraft control stations track, locate, remotely control, measure, and digitally transmit through radar and other devices.

There are roughly several types including unmanned helicopters, fixed-wing aircraft, multi-rotor aircraft, unmanned airships, and unmanned gliders. According to different usage fields, drones can be divided into military, civil, and consumer categories.

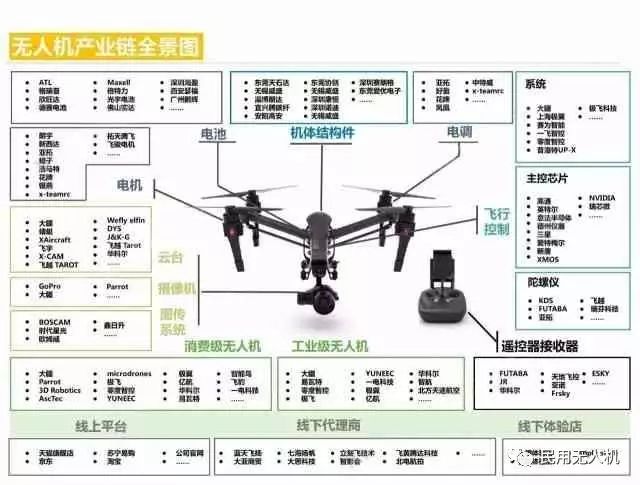

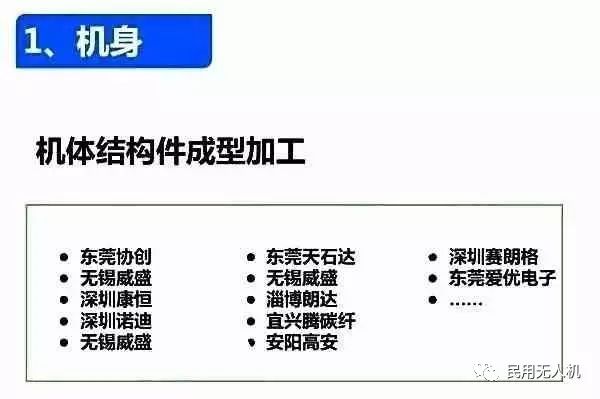

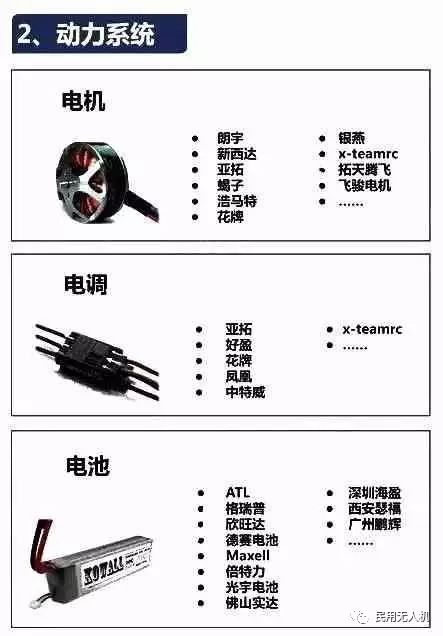

This article integrates the components required for each link of the drone supply chain and lists the major suppliers in each link for reference only.

One category includes complete machine manufacturers like DJI and GoPro; the other category consists of upstream manufacturers that provide hardware and software for drones, including chips, flight control, batteries, sensors, GPS, gyroscopes, power systems, data systems, etc.

In terms of hardware, chips are core components that directly determine the drone’s control performance, communication capabilities, and image processing capabilities.

Major manufacturers of drone main control chips include: Qualcomm, Intel, STMicroelectronics, Texas Instruments, Samsung, Atmel (acquired by Microchip), Nuvoton, XMOS, NVIDIA, Rockchip, etc.

Consumer hardware manufacturers include: DJI, Parrot, ZeroTech, Yuneec, ASC Tec, XAG, 3DR (formerly a competitor to DJI, now exited the consumer drone market), GoPro, etc.

Solution providers include: XAG (providing complete machine solutions), ZeroTech (launching overall solutions based on mobile chip technology), etc.

Technology providers include: Skydio (provider of drone navigation systems), Aerotenna, Woxu, Panoptes EBumper, Percepto, BetterView, AMIMON, Vertical AI, Dedrone, etc.

Core component suppliers include: InvenSense (acquired by Japan’s TDK, developing and selling micro-electromechanical system gyroscopes in motion tracking devices), MicroPilot (producing autopilots for drone systems), PolarPro (professionally producing filters and accessories for action cameras), uAvionix, etc.

Accessory suppliers include: ParaZero, Fuerte Cases, etc.

Main Control: Qualcomm Snapdragon chip. It has functions such as wireless communication, sensor integration, and spatial positioning. Using “RealSense” technology, it can build 3D maps and perceive the surrounding environment, allowing it to fly like a bat and actively avoid obstacles.

To let Qualcomm inside, it aims to leverage its chip advantages in the drone field. Qualcomm began acquisitions and investments in 2015, acquiring drone development company KMEL Robotics in February and leading a $50 million Series C investment in 3DR, a former competitor in the consumer field. Additionally, Qualcomm launched the Snapdragon Flight drone design platform in September.

The fundamental advantage of Snapdragon Flight lies in reducing the manufacturing cost and price of drones. Delving deeper, this is because:

1. Qualcomm’s drone chips are similar to those used in smartphones, possibly including other identical components, allowing for scaled production that brings cost optimization effects;

2. The chips are highly integrated, saving the combined cost of multiple high-priced modules, which reportedly account for 30% to 40% of the drone’s total cost.

Compared to the main drone chip solutions available, Qualcomm’s Snapdragon Flight has the smallest CPU size and the highest clock speed. It has been applied to domestic manufacturers’ small drone products like Hover Camera and ZeroTech’s selfie drone Dobby prototypes.

Main Control: Intel Atom processor. It is equipped with up to six Intel “RealSense” 3D cameras and uses a custom PCI-express card with a quad-core Intel Atom processor to handle real-time information about distances and how to avoid nearby obstacles.

As traditional PC sales continue to decline, Intel is shifting its chip business to the booming drone battlefield. However, compared to selling terminal products, Intel is more keen on providing solutions for drones, especially in drone vision. Intel’s biggest advantage lies in its RealSense technology, which uses infrared lasers, avoiding extensive calculations required for computer vision object recognition and effectively improving accuracy.

In terms of market strategy, Intel spent $60 million in 2015 to hire Typhoon H as the promoter of RealSense in the consumer market. Its developer-oriented Aero drone is also equipped with RealSense technology.

Additionally, Intel had previously invested in two drone companies, Airware and PrecisionHawk, and acquired wearable device and smart glasses manufacturer Recon, as well as the German drone manufacturer Ascending Technologies focused on algorithm research in 2015.

Main Control: STM32 series. ST’s complete MEMS gyroscopes, accelerometers, sensors, and power management chips.

STMicroelectronics’ STM32L0 series microcontrollers are based on the ARM Cortex – M0+ architecture and are designed for ultra-low power consumption, primarily used in wearable, medical, and industrial sensor applications. Previously, many STM32 F0 and F4 series products have been used in drones.

Main Control: TI OMAP3630. Micron flash memory, Texas Instruments power management + USB solutions, Atheros 802.11b/g/n WiFi controller, Bosch BMA150 accelerometer, BMP180 barometric pressure sensor, and other components.

Main Control: Samsung Artik chip. Artik 10 features a 1.3GHz octa-core processor with 2GB of RAM and 16GB of flash memory. It includes Wi-Fi, Bluetooth, Bluetooth Low Energy, ZigBee, and Thread.

Samsung launched the low-power Artik chip in May 2015, which comes in three specifications, with Artik1 being only 12mm*12mm and priced under $10. It is reported that the specifications vary in processing speed, storage capacity, and wireless communication capabilities. This chip targets drones and smart home devices. The industry generally believes that Artik will become Samsung’s killer weapon against Qualcomm and Intel, but strictly speaking, Samsung is still a latecomer.

Main Control: ATMEL MEGA2560 development board. AT91M55800A, ARM7TDMI core, embedded ICE interface, memory, and peripherals.

Compared to Intel’s attempts to use its processors to enter the drone market to compensate for the sluggish PC sales, NVIDIA has no urgent reason to enter the drone market as its core GPU graphics processing business has a year-on-year growth rate of 7%, accounting for 82% of its revenue in the first half of 2016.

It is understood that in 2015, NVIDIA successively provided chips for Parrot and its competitor DJI, and developed the Jetson TX1 chip solution for the drone market, which is capable of handling various image recognition and advanced AI tasks, enabling drones to stay airborne longer.

Previously, NVIDIA also provided chip solutions for both DJI and Parrot. Of course, NVIDIA has not limited the potential of the TX1 motherboard to drone applications; it can also be used in robots, IoT devices, or lab equipment. NVIDIA also provides developers with libraries like OpenVX1.1 to help them use the motherboard.

Main Control: Nuvoton MINI5 series. Low-end remote controllers use SOP20 packaged 4T 8051 N79E814; mid-to-high-end remote controllers use the Cortex-M0 M051 series with ARM9 and H.264 video decoding capabilities in the N329 series.

Main Control: XMOS XCORE multicore microcontroller. 32-bit RISC core with a frequency of up to 500MHz, equipped with Hardware Response I/O interfaces. Multi-rotor aircraft require four to six brushless motors to drive the drone’s rotors.

Main Control: Rockchip RK3288. Rockchip has showcased drone products based on RK3288, but this is the first time they are demonstrating and testing them domestically.

It is reported that this drone product adopts a quadrotor with a wheelbase of 300mm, based on the Rockchip RK3288 processor, with an integrated design for the camera and body, supporting 1080p video recording. The body weighs about 730g, with a flight time of 14 minutes. In terms of functionality, it supports one-click panoramic shots, return to home, point-to-point cruising, one-click selfies, one-click circling, geofencing, etc.

Founded in Zhuhai, Guangdong, Allwinner Technology has launched several products based on its R series chips for the IoT market, including the R8 portable internet TV solution; the “Dingdong” smart speaker co-launched with JD Smart (Allwinner R16 solution); and the $9 computer Banana Pi successfully crowdfunded by Next Thing in the US (Allwinner R8 solution).

All three products are based on Allwinner’s R series chips targeting the IoT market. Remix launched the first “Android PC” based on Allwinner’s A64 chip – Remix Mini, which successfully raised nearly $1.5 million on Kickstarter. The main control solution used in Xiaomi drones is also based on Allwinner Technology’s latest R16 platform.

The DJI Phantom 4 has used the 联芯 solution LC1860, and ZeroTech has also launched a binocular vision overall solution based on the 联芯 LC1860. It is reported that 联芯 has also jointly established Pinecone Electronics with Xiaomi, focusing on the smart hardware field.

In the drone field, Huawei’s fully-owned subsidiary Hisilicon originally held a 70% market share in the security camera market. Subsequently, to give wings to these security cameras, it launched the Huawei drone platform in July 2016, collaborating with the Shenzhen-based startup ZHOUXIN Technology to launch a series of drone solutions based on Huawei Hisilicon chips.

Currently, there are about 200 domestic drone manufacturers, with only about 10 holding core technologies, most of which focus on the civilian drone consumer market, accounting for 90% of the global share, especially with DJI, EHang, XAG, and ZeroTech performing exceptionally well.

Dubbed the “Apple of the drone field,” DJI ranks first in the global civilian drone market and is also a leading pioneer in flight imaging systems. Representative works: DJI Phantom 3 4K, DJI “Inspire 1 Pro.”

Controlled by the Chinese Academy of Sciences’ Institute of Remote Sensing and Digital Earth, founded in 2007, with five wholly-owned subsidiaries, it has strong capabilities in the field of drone remote sensing and has previously conducted aerial surveys during the Wenchuan earthquake.

Founded by Shenzhen Rapoo Technology and Beijing ZeroTech, the company focuses on the research and manufacture of small intelligent drones, positioning itself as a pioneer and leader in the global intelligent aircraft field. Currently, it has a leading product system in intelligent drones, multi-axis gimbals, and high-definition transmission. Representative works: Explorer 2.

In the field of model aircraft and flying devices, it independently develops communication transmission hardware and mobile navigation control systems. Representative: EHang 184.

Dedicated to the research and manufacture of civil drones and flight control systems, XAG is a leader in the drone industry and a leading enterprise in commercial drone development in China. It has made significant breakthroughs in commercial drones and agricultural drones. Representative works: XMission “Extreme Hero” (all-weather drone).

It has revolutionized the balance, stability, and control of single-rotor remote-controlled helicopters, marking a new chapter in single-rotor model helicopters. The “Nine Eagles” brand has products mainly sold to over 150 countries and regions, including North America, South America, Japan, and the European Union. Representative works: MOLAX1 drone.

FLYPRO is an innovative technology company specializing in drone design and development, with an international R&D team and industry-leading innovative drone design and development capabilities, as well as advanced flight control systems, visual positioning systems, and automatic obstacle avoidance technologies. Representative works: FLYPRO XEagle drone.

AEE Technology is a global leader in multi-rotor drone systems and is the first to create an integrated multi-rotor drone system.

They produce receivers, transmitters, aircraft models, dual-rotor helicopters, simulation aircraft models, and micro-mechanical gyroscopes.

Dagu Technology is a high-tech joint-stock company formed by integrating the latest technologies and resources in the IT wireless communication transmission field, collaborating with military product manufacturers, and has rich customer resources and markets, aiming to provide customers with various access methods for unlimited interconnectivity in wireless communication transmission.

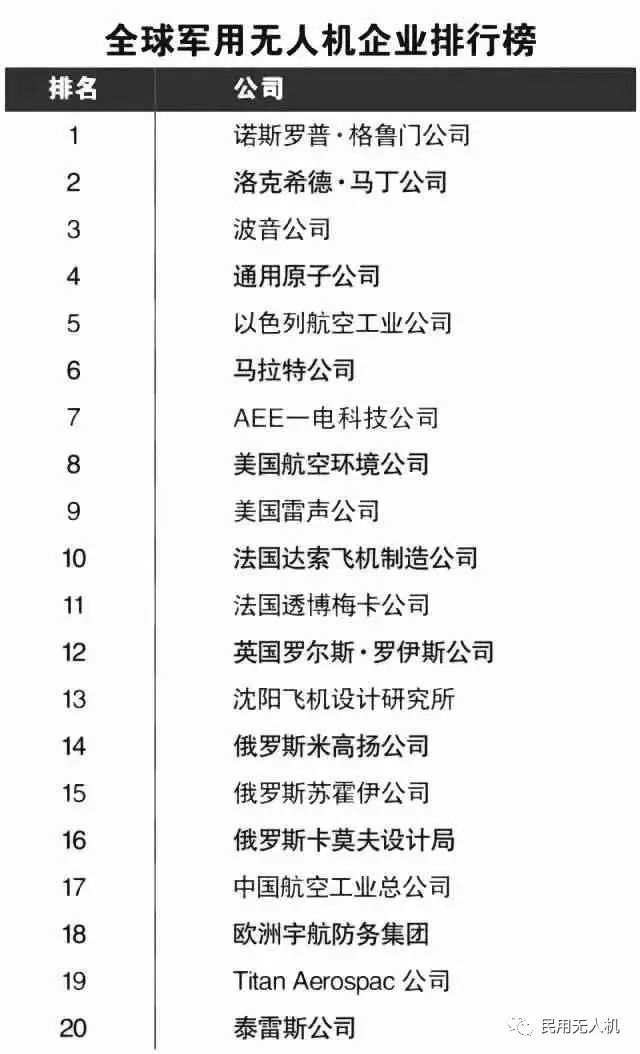

In the civilian drone field, Chinese enterprises dominate the rankings. DJI ranks first with an absolute advantage, while AEE Technology, ZeroTech, and EHang also rank among the world’s leaders. In the military drone field, European and American manufacturers mainly dominate.

In recent years, drones have risen rapidly, but due to the huge upfront investment, the consumer base is relatively narrow, and many new companies have flooded in, leading to intense market competition where many enterprises have collapsed early.

Since 2017, the global drone industry has faced a chill. The top three drone manufacturers, Parrot, announced massive layoffs, and the star drone company Lily applied for bankruptcy due to depleted funds. Recently, mainland China has also begun implementing a real-name system for drones, which may accelerate the drone market’s decline.

Long press the QR code to follow us!