Recently, the “14th Five-Year Plan for the Development of the Petroleum and Chemical Industry” was released, emphasizing that while the petrochemical industry enhances its independent innovation capabilities, it must accelerate the development of the new chemical materials industry. Key breakthroughs include high-end polyolefins, engineering plastics, high-performance fluorosilicone materials, high-performance membrane materials, electronic chemicals, bio-based and biodegradable materials, as well as key raw materials such as hexanedinitrile, high-carbon α-olefin copolymer monomers, metallocene catalysts, etc. The focus is on optimizing and enhancing polycarbonate (PC), engineering plastics such as polyoxymethylene, specialty resins, and biodegradable materials, carbon fibers, aramid fibers, and other high-performance fibers, as well as membrane materials such as perfluorinated ion exchange membranes, high-flux nanofiltration membranes, and separators for lithium batteries. Taking this opportunity, we have sorted out the layouts of major chemical companies in the new materials field, which are mainly concentrated in high-end polyolefins, engineering plastics PC, and biodegradable materials, aligning closely with the guidelines.

01

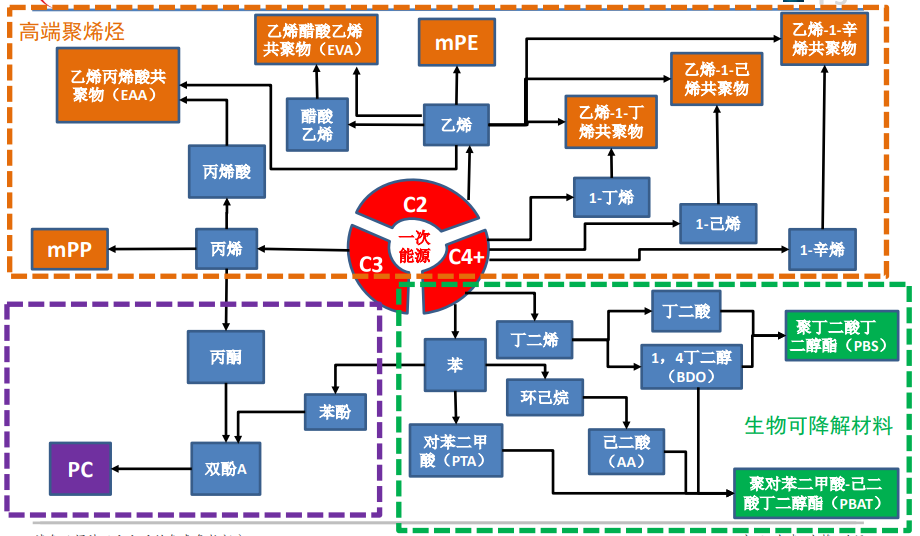

Connections Among the Three Types of New Chemical Materials

The three types of new chemical materials are derived from primary energy sources such as coal, oil, and natural gas, obtained through reactions like cracking to produce intermediates. We categorize them into C2, C3, C4, and above, which are then polymerized or reacted with each other before polymerization to ultimately produce high-end polyolefins, engineering plastics PC, and biodegradable materials.

High-End Polyolefins: Ethylene and propylene can be polymerized under the action of metallocene catalysts to produce mPE and mPP. Ethylene can copolymerize with 1-butene, 1-hexene, and 1-octene to form various ethylene α-olefin copolymers, with increasing difficulty as the carbon number increases. Ethylene copolymerizes with vinyl acetate to produce EVA, and copolymerizes with propylene acid from the C3 industry chain to form EAA.

Engineering Plastics PC: Propylene from the C3 industry chain is oxidized to produce acetone, while benzene from C4 and above is oxidized to produce phenol. Acetone and phenol react to produce bisphenol A, which is then polymerized under phosgene or other catalytic conditions to form PC.

Biodegradable Materials: Butadiene is oxidized to produce succinic acid, and 1,4-butanediol (BDO) can be produced via acetylene or butadiene methods. The two can be polymerized to form polybutylene succinate (PBS); benzene can be hydrogenated and oxidized to produce adipic acid (AA) and terephthalic acid (PTA), which can then be polymerized with BDO to produce polybutylene adipate-co-terephthalate (PBAT).

Source: Pacific Securities Research Institute

02

High Barriers and High Demand for High-End Polyolefins

High-end polyolefins refer to polyolefin products with high technical content, high application performance, and high market value. They mainly include two types: one is high-end grades of bulk products, such as metallocene polyethylene and polypropylene products (mPE, mPP), and polyethylene grades copolymerized with high-carbon α-olefins; the other is specialty polyolefin resins, such as ethylene-vinyl acetate copolymers (EVA), ethylene-acrylic acid copolymers (EAA), polybutene-1 (PB-1), ultra-high molecular weight polyethylene (UHMWPE), and ethylene-vinyl alcohol copolymer resins (EVOH).

High-end polyolefins have a wide range of applications, with the most significant application areas including high-end pipes, automotive parts, medical devices, and prosthetic implants.

High-End Polyolefin Production Concentrated Overseas

Globally, high-end polyolefin production is mainly concentrated in Western Europe, Southeast Asia, and North America, while the Middle East focuses on bulk general materials. Japan is the primary producer of high-end polyolefins in Southeast Asia. Related companies include ExxonMobil, Dow Chemical, BASF, LyondellBasell, Total, Mitsui Chemicals, Sumitomo Chemical, and Asahi Kasei.

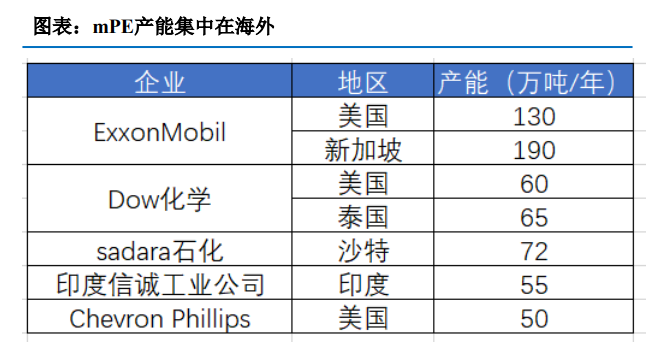

For example, the global mPE production capacity is about 15 million tons, with five companies having a capacity of 500,000 tons/year or more, mainly concentrated in the United States, with a CR5 of about 40%.

Significant Structural Contradictions in China’s Polyolefin Industry

In recent years, China’s polyolefin industry has gradually expanded, with significant growth in polyethylene and polypropylene production capacity and output. However, structural contradictions have also become increasingly evident. China’s polyolefin products are primarily mid-to-low-end general materials, leading to fierce market competition, while high-end polyolefin products heavily rely on imports. Additionally, the differences in polyethylene copolymer monomers reflect the varying grades and technical levels of polyethylene products in different regions, with the dividing line being C6 (hexene). The higher the carbon number, the more advanced the product and the higher the required technical level. Similarly, North America, Western Europe, and Japan have a higher proportion of high-end polyethylene copolymers, while China’s proportion remains relatively low.

In 2019, China’s high-end polyolefin output was about 5.8 million tons, with a consumption of 12.8 million tons, resulting in a self-sufficiency rate of only 45%. Breaking it down, the self-sufficiency rate for hexene copolymerized polyethylene is about 50%, while that for octene copolymerized polyethylene is less than 10%, and the self-sufficiency rate for mPE is less than 30%. Various types such as mPP, POE elastomers, and cyclic olefin copolymers have not achieved industrial production and rely entirely on imports. Therefore, high-end and differentiated products will become the upgrade direction for China’s polyolefin industry, and companies with high-end polyolefin production capabilities will have a competitive advantage.

Metallocene Polyethylene (mPE)

mPE is a copolymer produced from ethylene and α-olefins (such as 1-butene, 1-hexene, 1-octene) under a metallocene catalyst system, mainly including mLDPE, mHDPE, and mLLDPE. mPE was the first metallocene polyolefin to achieve industrial production and is currently the largest in output, with the fastest application progress and the most active research and development. The development of mPE relies on improvements in metallocene catalysts and large-scale industrial production. Metallocene catalysts are single-site catalysts with high activity, allowing precise customization of the molecular structure of polyethylene resins, including relative molecular weight distribution, copolymer monomer content, and the distribution of copolymer monomers along the molecular chain. Compared to traditional Ziegler-Natta catalysts and chromium-based catalysts, polyethylene resins produced using metallocene catalysts have a narrower relative molecular weight distribution and better uniformity.

mPE has the following performance characteristics: high molecular structure regularity, higher crystallinity, high strength, good toughness, and good rigidity; good transparency, high cleanliness; low odor, low initial heat sealing temperature, and high heat sealing strength; excellent stress crack resistance.

mPE varieties and applications are extensive, with the most demanded mLLDPE products mainly used for producing various film products, while mMDPE and mHDPE are primarily used in pipes, injection molding, and rotational molding. The packaging sector is the largest consumer of mPE, accounting for over 60% of global consumption and 70% of domestic consumption.

Global mPE production capacity is about 15 million tons/year, with production exceeding 14 million tons in 2019, and the market size surpassing 200 billion yuan. Major mPE producers include ExxonMobil, Dow Chemical, BASF, etc., all of which have their own mPE grades and engage in technology lock-in.

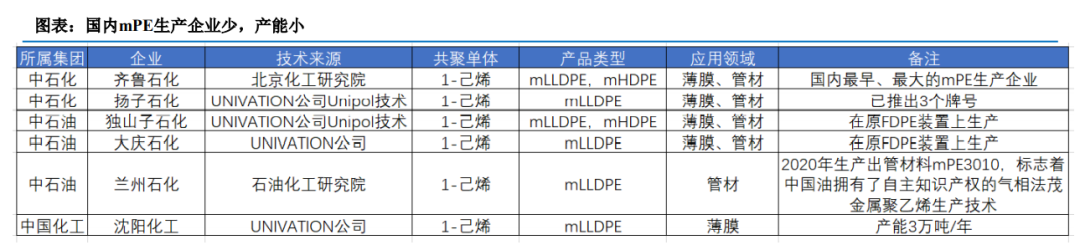

Domestic research and development of metallocene catalysts and polyolefins began in the early 1990s, starting late and still catching up with overseas technology. In recent years, as the structural contradictions in the domestic polyolefin industry have become more pronounced, the number of research units has gradually increased. Currently, the main R&D units are concentrated in PetroChina (Petrochemical Research Institute, Dushanzi Petrochemical, Lanzhou Petrochemical, Daqing Petrochemical, etc.) and Sinopec (including the Petrochemical Science Research Institute, Beijing Chemical Research Institute, Shanghai Chemical Research Institute, Qilu Petrochemical, Yangzi Petrochemical, etc.). China’s mPE supply is severely insufficient, with major production enterprises including Qilu Petrochemical, Daqing Petrochemical, Dushanzi Petrochemical, Shenyang Chemical, and Yangzi Petrochemical, all of which are refining and chemical enterprises under PetroChina and Sinopec. In 2019, domestic production was about 120,000 tons, mainly applied in ordinary films and packaging, while the consumption was about 600,000 tons, with a self-sufficiency rate of only 20%, and an import dependence of 80%.

Metallocene Polypropylene (mPP)

From both global and domestic perspectives, the initiation time and development scale of mPP lag far behind mPE. Due to price issues and continuous improvements in traditional Z-N catalysts, mPP accounts for less than 10% of polypropylene production. In 2020, global mPP demand exceeded 500,000 tons. Compared to Ziegler-Natta catalyst system polypropylene products, mPP has more regular molecular chain segments, a narrow relative molecular weight distribution, and superior product appearance and transparency. Currently, applications are mainly concentrated in spinning and non-woven fabrics, injection molded products, and films. Major global mPP producers include LyondellBasell, ExxonMobil, Total, JPP, Mitsui Chemicals, and a few others, far fewer than mPE.

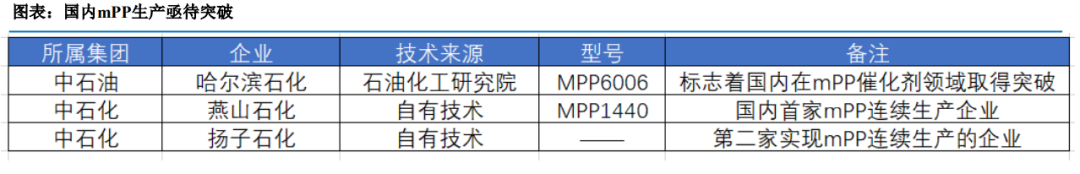

Currently, commercial production of mPP in China is still absent, with all products required for high-end applications relying on imports. In 2019, domestic mPP consumption was about 80,000 tons, mainly used for high transparency polypropylene products, especially microwave utensils and medical supplies, spunbond non-woven fabrics, and food packaging films. It is expected that with the structural upgrade of downstream product industries, domestic mPP demand will maintain rapid growth, potentially reaching over 150,000 tons by 2025. Currently, PetroChina and Sinopec remain the main enterprises investing in mPP R&D. Although the world’s mainstream advanced polypropylene production processes have been introduced, the catalyst systems used are all traditional Ziegler-Natta catalysts, and domestic mPP production is still in its infancy. Only a few petrochemical companies have conducted industrial production of mPP, such as PetroChina’s Harbin Petrochemical and Sinopec’s Yanshan Petrochemical and Yangzi Petrochemical, which have developed industrial mPP grades, with future goals including the development and industrial production of mPP catalysts and new grades.

Ethylene-Vinyl Acetate Copolymer (EVA)

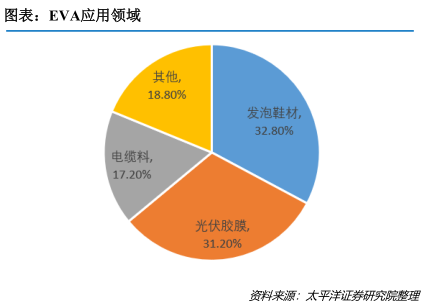

EVA is a specialty polyolefin resin produced by the bulk polymerization of ethylene and vinyl acetate under certain temperatures and high pressures. It is the fourth largest ethylene series copolymer after HDPE, LDPE, and LLDPE. EVA improves flexibility, impact resistance, and optical properties compared to polyethylene due to the introduction of VA monomers, and is mainly used for manufacturing foamed materials (shoe materials), photovoltaic adhesive films, and cable materials, with consumption shares of 33%, 31%, and 17% respectively in 2019, totaling over 80%.

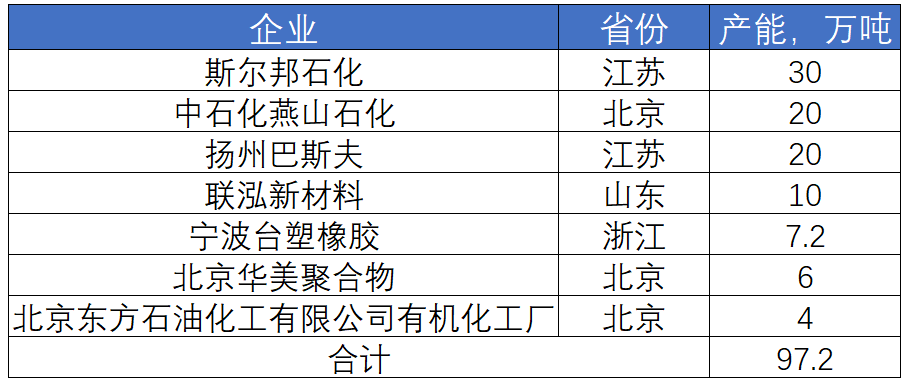

Due to factors such as technology sources, process difficulties, resources, and markets, China’s EVA resin industry has developed relatively slowly for a long time, but has begun to accelerate in recent years. Domestic EVA capacity has gradually increased, from 500,000 tons/year in 2012 to 720,000 tons/year with the startup of Formosa Plastics’ Ningbo EVA plant in 2016, and 300,000 tons/year with the startup of Jiangsu Secco’s EVA plant in 2017, bringing China’s EVA annual production capacity to 972,000 tons. The COVID-19 pandemic in 2020 caused delays in the construction progress of planned capacities due to difficulties in the arrival of foreign technical personnel and large equipment, resulting in a delay in actual production progress, with domestic EVA resin capacity remaining at 972,000 tons in 2020.Figure: Domestic EVA Capacity in 2020

In recent years, the EVA resin industry in China has shown a rapid growth trend, with production increasing from 245,000 tons in 2010 to 750,000 tons in 2020. At the same time, industry demand has also grown rapidly, with an average annual compound growth rate of about 9.4% from 2016 to 2020. In 2020, the demand for EVA resin in China was about 1.88 million tons, with the market size exceeding 20 billion yuan. It is expected that from 2021 to 2025, driven by downstream fields such as foamed shoe materials, photovoltaics, and cables, domestic EVA demand is expected to maintain an annual growth rate of around 10%. In recent years, China’s EVA import dependence has remained high. In 2020, China’s net EVA import volume reached 1.125 million tons, with an import dependence of 60%.On December 31, 2020, Shaanxi Coal and Chemical’s 300,000 tons/year EVA project successfully started up, and there are still many capacities under construction, with expectations that domestic EVA capacity will exceed 2 million tons/year by 2023, gradually alleviating the tight supply-demand situation and reducing import dependence. Nevertheless, the technical challenges in producing high VA content EVA products still need to be strengthened.

Ethylene-Acrylic Acid Copolymer (EAA)

EAA is a specialty polyolefin resin formed by the high-temperature, high-pressure free radical polymerization of ethylene and acrylic acid. EAA has excellent heat sealing properties, tear resistance, and barrier properties against air and moisture, making it widely used in soft packaging for food and pharmaceuticals, with excellent adhesion to metals and glass, and can also be applied in wire and cable, and steel coatings. According to statistics, the current global EAA production capacity is about 300,000 tons/year, dominated by a few major producers, resulting in a high concentration. Among them, Dupont (72,000 tons/year, 24%), Ineos (57,000 tons/year, 19%), Mitsui (56,000 tons/year, 19%), SK (55,000 tons/year, 18%), and Exxon (28,000 tons/year, 9%) account for 90% of the market share. Europe and North America are the main production and consumption regions for EAA, with market shares of 39% and 33% respectively. The Asia-Pacific market accounts for about 23%, but only Japan’s Polychem company has a factory in the Asia-Pacific region, using Dupont’s technology, built by Dupont and Mitsubishi. Assuming global EAA demand is about 250,000 tons/year, with an average price of 20,000 yuan/ton, the estimated global EAA market size is about 5 billion yuan. Currently, there are no EAA producers in China, and all products rely on imports, with an import volume of about 20,000 to 30,000 tons/year, of which the market demand for coating-grade products is about 15,000 tons/year.

03

Expansion of Engineering Plastics PC Capacity, Strong Supply and Demand

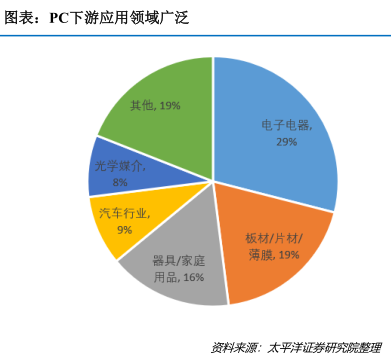

PC refers to high molecular compounds containing carbonate groups (—COO—) in their molecular chains, which are excellent durable thermoplastic engineering plastics. In terms of usage, PC is the most widely used and fastest-growing among the five major general engineering plastics in China, accounting for nearly half of the total usage of engineering plastics. The upstream of PC is bisphenol A, with the industrial chain generally being benzene/propylene-phenol/acetone-bisphenol A-PC. PC has good mechanical, optical, thermal, and flame-retardant properties, with a wide range of downstream applications, mainly driven by the electronics and electrical industry, accounting for about 29%, followed by sheets/films, accounting for about 19%. In the future, the application fields of PC will continue to develop towards high functionality and specialization, with expected further improvements in applications for sheets and lightweighting in transportation.

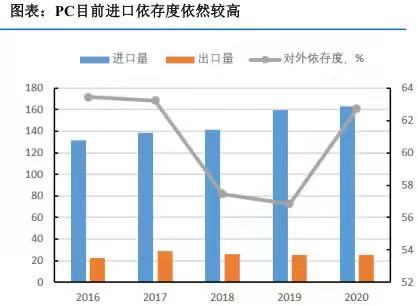

Since 2017, global PC total production capacity has exceeded 5 million tons/year, with production facilities mainly concentrated in Western Europe, North America, and Northeast Asia. In recent years, driven by demand from Asia, especially China, investments and production focus for PC have shifted to countries like China, India, and Thailand. It is expected that global capacity will exceed 6 million tons/year in 2021, with operating rates maintaining around 80% in recent years. The global PC market demand is strong, with total demand in 2018 being about 4.5 million tons, and it is estimated to reach 5.5 million tons by 2023. We expect total global demand in 2021 to be about 5 million tons, assuming an average price of 20,000 yuan/ton, resulting in a market size of about 100 billion yuan. In 2020, China’s PC production capacity was 1.85 million tons/year, accounting for about 31% of the global total. There are also many PC projects under construction or planned, such as Zhejiang Petrochemical’s 520,000 tons/year, Sinopec Tianjin’s 260,000 tons/year, Hainan Huasheng’s 520,000 tons/year, and Pingmei Shenma Group’s 400,000 tons/year. In the next three years, domestic capacity is expected to exceed 3 million tons/year. In recent years, domestic PC production and consumption have shown a steady upward trend, with production dropping to 820,000 tons in 2020 due to the impact of the pandemic, and apparent consumption dropping to 2.2 million tons, but the external dependence has remained around 60%. As new capacities are gradually put into production, domestic PC production is expected to increase significantly, with import volumes rapidly decreasing, leading to a decline in external dependence. If no new large application markets emerge downstream, it is expected that within 3-5 years, domestic supply and demand will reach a balance, eventually turning into a net exporter. Currently, the mainstream industrial production processes for bisphenol A type polycarbonate are two: interfacial polycondensation and melt polycondensation.

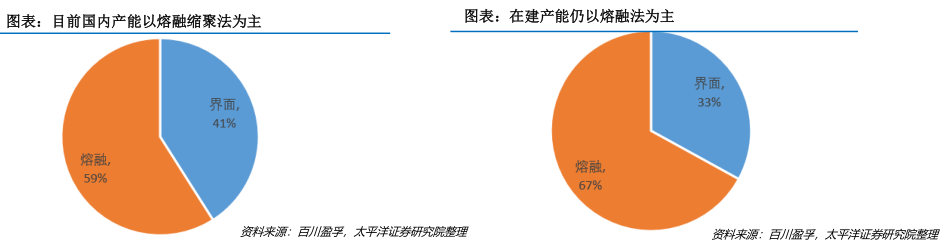

Currently, the mainstream industrial production processes for bisphenol A type polycarbonate are two: interfacial polycondensation and melt polycondensation. Interfacial Polycondensation uses phosgene and bisphenol A in the presence of alkaline hydroxides and inert organic solvents to synthesize PC through interfacial polycondensation reactions. Companies such as Teijin, Mitsubishi Gas, Luxi Chemical, and Wanhua Chemical adopt this process route. The phosgene method has high requirements for process technology and environmental protection, but the quality of the products produced is also high. In the context of rapid growth of domestic capacity, we believe that its competitive advantage comes from product high-endization.Melt Polycondensation uses diphenyl carbonate (DPC) and bisphenol A under the action of catalysts to first undergo an ester exchange reaction, followed by a polycondensation reaction to synthesize PC, with phenol as a byproduct. Covestro, Sinopec Mitsubishi Chemical, and Zhejiang Iron and Steel Daifeng all adopt this process route. The melt polycondensation method can be further divided into phosgene route and non-phosgene route, depending on the route for preparing DPC. Due to the toxicity and transport hazards of phosgene, the phosgene route is increasingly restricted. Currently, more and more new domestic producers, including Zhejiang Petrochemical and Lihua Yi, are using dimethyl carbonate (DMC) as a raw material for non-phosgene melt ester exchange process routes. Due to the limitations of the technical route, the products are mostly general-purpose types. Similarly, in the context of rapid growth of domestic capacity, with 66% being melt polycondensation method, we believe that its competitive advantage comes from low cost.

Interfacial Polycondensation uses phosgene and bisphenol A in the presence of alkaline hydroxides and inert organic solvents to synthesize PC through interfacial polycondensation reactions. Companies such as Teijin, Mitsubishi Gas, Luxi Chemical, and Wanhua Chemical adopt this process route. The phosgene method has high requirements for process technology and environmental protection, but the quality of the products produced is also high. In the context of rapid growth of domestic capacity, we believe that its competitive advantage comes from product high-endization.Melt Polycondensation uses diphenyl carbonate (DPC) and bisphenol A under the action of catalysts to first undergo an ester exchange reaction, followed by a polycondensation reaction to synthesize PC, with phenol as a byproduct. Covestro, Sinopec Mitsubishi Chemical, and Zhejiang Iron and Steel Daifeng all adopt this process route. The melt polycondensation method can be further divided into phosgene route and non-phosgene route, depending on the route for preparing DPC. Due to the toxicity and transport hazards of phosgene, the phosgene route is increasingly restricted. Currently, more and more new domestic producers, including Zhejiang Petrochemical and Lihua Yi, are using dimethyl carbonate (DMC) as a raw material for non-phosgene melt ester exchange process routes. Due to the limitations of the technical route, the products are mostly general-purpose types. Similarly, in the context of rapid growth of domestic capacity, with 66% being melt polycondensation method, we believe that its competitive advantage comes from low cost.

04

Huge Growth Potential for Biodegradable Materials

Plastic is ubiquitous in our lives, and while its applications are becoming more common, it has also become an environmental burden, with plastic bags representing a significant global disaster that urgently needs to be addressed. Scientists estimate that there are currently about 150 million tons of plastic in the oceans, and it continues to grow at a rate of 10 million tons per year. In less than a decade, scientists predict that there will be 250 million tons of plastic in the oceans, which will have a devastating impact on marine life. At the same time, many additives are required to meet the usage requirements during the synthesis of plastics, most of which are toxic, leading to soil compaction, damaging soil structure, causing biological pollution, and harming the soil ecological environment. Traditional plastics, such as PVC, PE, and PP, are high molecular polymers that are physically and chemically stable under normal temperature and pressure, and typically take decades or even centuries to degrade under natural conditions. Biodegradable plastics are a type of polymer material that has excellent performance and can be completely decomposed by environmental microorganisms after disposal, ultimately becoming part of the carbon cycle in nature. Biodegradable plastics can fundamentally solve the problem of white pollution and are increasingly gaining attention. Currently, there are over 20 types of biodegradable plastics, categorized into petroleum-based and bio-based, with petroleum-based including PBS (polybutylene succinate), PBAT (polybutylene adipate-co-terephthalate), and PVA (polyvinyl alcohol), and bio-based including PLA (polylactic acid), starch-based plastics, and PHA (polyhydroxyalkanoates). Among them, petroleum-based PBAT and bio-based PLA are typical fully degradable plastics, with excellent impact resistance, tensile strength, and elasticity, and domestic technology maturity is relatively high, making them the most promising types of biodegradable plastics currently.

Polybutylene Adipate-Co-Terephthalate (PBAT)

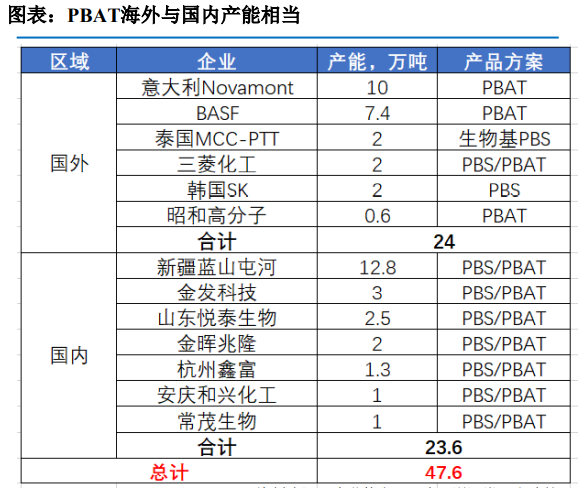

PBAT, PBS, and PBSA (polybutylene succinate-adipate) are collectively referred to as binary acid-binary alcohol copolyesters, abbreviated as PBS types. Although PBS and PBSA were developed earlier, due to insufficient supply of succinic acid in China and limited performance, coupled with high prices, their market usage is less than that of PBAT. Currently, global production of PBS-type biodegradable materials is mainly based on PBAT. PBAT has good thermal and mechanical properties, mainly used for producing film products, with characteristics such as good transparency, high toughness, and impact resistance, widely applied in packaging and agricultural fields. PBAT can be metabolized by microorganisms in the natural environment, ultimately being converted into carbon dioxide and water, making it one of the most actively researched and well-applied degradable materials. PBAT is synthesized from terephthalic acid (PTA), adipic acid (AA), and 1,4-butanediol (BDO) through direct esterification or ester exchange methods. Globally, Italy’s Novamont is one of the earliest companies to industrialize biodegradable plastics, with Novamont’s PBAT brand being Origo-Bi, currently having a production capacity of 100,000 tons/year. BASF’s PBAT brand is ecoflex, with a capacity of 74,000 tons/year. Domestically, Xinjiang Blue Mountain Tunhe has collaborated with Tsinghua University to develop various biodegradable materials, with products certified by the EU, the US, and other countries, among which PBAT has a production capacity of 128,000 tons, making it the largest PBAT biodegradable material producer globally.

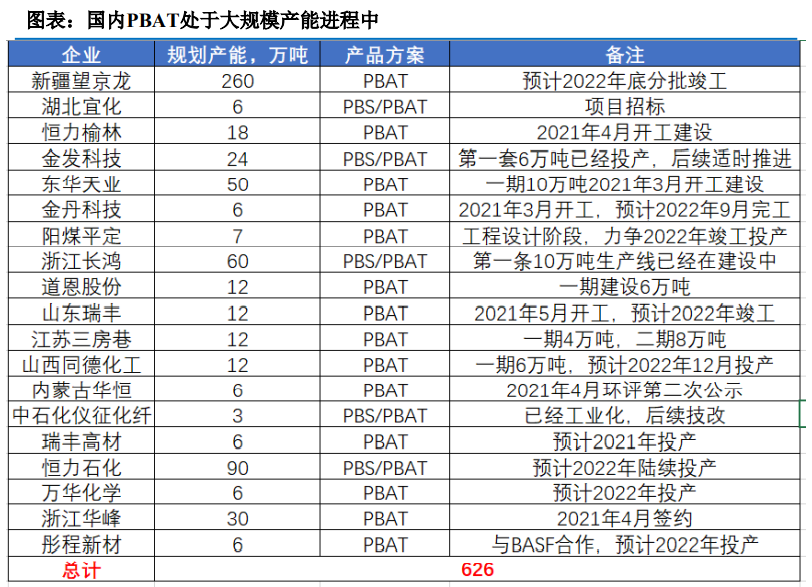

Currently, domestic PBS/PBAT capacity is about 236,000 tons, accounting for about 50% of the global total, leading the market, and large-scale capacity expansion is underway. According to incomplete statistics, over 6 million tons of project capacity planning has been initiated, with Xinjiang Wangjinglong alone planning 2.6 million tons of PBAT capacity. From 2021 to 2022, it is expected that more than ten projects, including Hubei Yihua, Hengli Yulin, Jinfeng Technology, Jindan Technology, and Dawn Co., will release over 700,000 tons of PBAT capacity. In the future, as market competition intensifies, we believe that the degree of integration will be the core advantage of PBAT.

Wanhua Chemical – Layout in High-End Polyolefins, PC, and Biodegradable Materials❤Wanhua Chemical is laying out in the high-end polyolefin field: POE On December 22, 2020, the Yantai Ecological Environment Bureau approved Wanhua’s integrated polyurethane industry chain – ethylene phase II project, with a total investment of about 20 billion yuan, producing a total of 3.3299 million tons/year, including external sales products such as HDPE 350,000 tons/year, LLDPE 250,000 tons/year, polyolefin elastomers (POE) 200,000 tons/year, polypropylene 500,000 tons/year, butadiene 114,000 tons/year, mixed xylene 23,100 tons/year, styrene 18,200 tons/year, and other chemical products totaling 2.284 million tons/year. After years of R&D, Wanhua Chemical has successfully developed POE production technology with independent intellectual property rights, and has produced qualified products in pilot production, which can reach the level of foreign products after customer trials. Wanhua Chemical’s ethylene phase II project has been submitted to the state for approval, and the domestic replacement of POE is imminent.❤Wanhua Chemical’s layout in the PC field In 2014, Wanhua Chemical initiated the construction of a 200,000 tons/year polycarbonate (PC) project. The interfacial polycondensation phosgene method PC production process used in the project was entirely developed by Wanhua Chemical and has passed actual production verification of a total annual output of 200,000 tons for the 1# and 2# PC units, with the technology becoming increasingly mature and refined. The first phase of 70,000 t/a interfacial phosgene method polycarbonate (PC) unit successfully achieved continuous production in early 2018, producing high-quality qualified products; the second phase of 130,000 tons/year unit was completed in May 2020 and has achieved continuous production. This series of products has gained wide recognition in the market, with many well-known domestic and foreign brand customers reaching strategic cooperation agreements with Wanhua Chemical. In January 2021, Wanhua Chemical’s 140,000 tons/year polycarbonate (PC) project environmental assessment was publicly announced, which will build a set of 100,000 tons/year ordinary PC production unit, a set of 40,000 tons/year specialty PC unit, and corresponding supporting facilities, expected to be completed and put into production in October 2021, with raw materials sourced from the already approved 480,000 tons/year bisphenol A unit, ensuring the supply of raw materials for PC production. According to Wanhua Chemical’s 140,000 tons PC unit environmental assessment report, the bisphenol A consumption for ordinary PC is about 0.875 tons/ton, while for specialty PC it is about 0.7 tons/ton. Wanhua Chemical plans to build a 480,000 tons bisphenol A unit, which can supply over 550,000 tons of PC demand. The existing PC capacity in the park is 200,000 tons, and the planned construction of 140,000 tons, with upstream raw material bisphenol A ensuring the continuous expansion of future PC scale. Additionally, Wanhua’s PC production uses the phosgene method, which produces higher quality products compared to the non-phosgene method, with higher prices. The integrated layout combined with high-end products gives Wanhua a significant competitive advantage in the PC field.❤Wanhua Chemical’s layout in the biodegradable materials field Wanhua Chemical has planned a 60,000 tons/year biodegradable polyester (PBAT) project in the second phase of the Meishan base project, with a total investment of 360 million yuan, expected to be put into production in the first half of 2022. At the same time, it is actively promoting the natural gas to acetylene project, followed by the methanol unit and formaldehyde unit to produce 1,4-butanediol (BDO), with a capacity of 100,000 tons/year, providing raw materials for PBAT, increasing the degree of integration, and is expected to gain cost advantages in future competition. On September 4, 2021, the company announced the international tender for the 60,000 tons/year biodegradable polyester project, with the tender product being the PBAT pelletizing unit, and construction is proceeding in an orderly manner. Wanhua has accumulated years of R&D in the field of biodegradable plastics, forming a production technology for PBAT with independent intellectual property rights through direct esterification, and the project planning includes upstream major raw materials BDO, with a cost advantage in the industrial chain layout.Sinopec – Layout in High-End Polyolefins and Biodegradable Materials On September 27, 2020, Sinopec signed a strategic cooperation framework agreement with the Tianjin Municipal Government, planning to invest 70 billion yuan in key projects during the “14th Five-Year Plan” period, including the Tianjin Petrochemical South Port 1.2 million tons/year ethylene and downstream high-end new materials industry cluster project, and the Sinopec North Chemical Institute pilot base project, among others. On December 22, 2020, Sinopec New Materials Technology (Shanghai) Co., Ltd. was established, mainly engaged in technology services and development in the fields of new materials technology, new energy technology, chemical technology, and environmental protection technology. Sinopec’s recent series of significant actions further demonstrate its emphasis on the new materials field, and the company will vigorously promote the extension from chemical raw materials to high-end materials, aiming to move towards the mid-to-high end of the value chain. Sinopec Yizheng Chemical Fiber is one of China’s modern chemical fiber and chemical fiber raw material production bases, and is a production base for Sinopec’s high-end polyester and specialty fiber R&D. The company currently has a polyester polymerization capacity of 2.2 million tons/year, with the highest production and sales of polyester staple fiber globally. In 2020, Yizheng Chemical Fiber completed the industrialization of three biodegradable plastic varieties: PBST, PBAT, and PBSA, and will accelerate the promotion of industrial production of biodegradable plastics as a key project for tackling and creating value, planning to form a production capacity of 30,000 tons/year of biodegradable plastics through technological transformation, and fully meet market demand through a series of product development and project construction.Hengli Petrochemical – Layout in Biodegradable Materials Hengli Petrochemical is becoming an industry leader in the early and rapid implementation of a global benchmark-level 20 million tons refining and chemical integration project, determining polyester new materials as a major development direction for the future. Hengli Petrochemical will further develop and expand PBS/PBAT biodegradable new materials, high-performance industrial yarns, and high-end polyester films based on consolidating existing polyester new materials capacity and industry competitiveness advantages. Hengli Petrochemical’s subsidiary, Kanghui New Materials, has developed the first PBS/PBAT process technology and product formula with complete independent intellectual property rights in China. This new material, with advantages such as recyclability, easy recovery, non-toxic and harmless, and high safety, is fully applicable to the tight applications in the biodegradable food-grade field. Kanghui New Materials completed the construction and production of the largest single set of 33,000 tons/year PBS/PBAT biodegradable new materials production unit in the country in 2020 (on December 25, 2020), and achieved full-load operation in January 2021, quickly responding to the national plastic ban call and filling the growing demand gap for biodegradable materials in the country. On January 19, 2021, Kanghui New Materials officially signed a contract for a 600,000 tons/year PBS-type biodegradable plastic project. Kanghui New Materials plans to build a new capacity of 900,000 tons/year (with two phases of construction, the first phase of 600,000 tons is expected to be gradually put into production in mid-2022, and the second phase of 300,000 tons is expected to be gradually put into production by the end of 2022), with all equipment contracts signed and construction gradually starting, expected to gradually release capacity in mid-2022, at which point the company’s PBS/PBAT biodegradable new materials will reach 933,000 tons, becoming the largest and highest capacity biodegradable new materials production base in the country.Rongsheng Petrochemical – Layout in High-End Polyolefins and PC❤Rongsheng Petrochemical is laying out in the high-end polyolefin field: differentiated polyolefins and EVA Rongsheng Petrochemical is the first listed company in China to have an integrated industrial chain of “crude oil-aromatics (PX), olefins-PTA, MEG-polyester-spinning, films, and bottles”. In 2020, the “40 million tons/year refining and chemical integration project” invested in the Zhoushan base achieved full production. Compared to the first phase, the product oil yield of the second phase of Zhejiang Petrochemical has further compressed, with two sets of 1.4 million tons of ethylene, one more than the first phase, and more mid-to-high-end chemical materials such as EVA, ABS, rubber, and various grades of PP and PE are matched, resulting in higher added value. The differentiation and high-end nature of the products will bring significant excess returns. The polyethylene unit centered on differentiation is expected to achieve excess returns: by introducing the monomer 1-hexene instead of the conventional 1-butene as a copolymer monomer, significant differentiation is reflected in HDPE products. The first and second phases of Zhejiang Petrochemical have a total of four sets of units covering conventional LLDPE, LDPE, HDPE, and EVA products. By introducing 1-hexene as a copolymer monomer in LLDPE and HDPE products, the performance will be stronger than that of traditional 1-butene-based polyethylene products, and the selling price will also be higher.❤Rongsheng Petrochemical’s layout in the PC field Zhejiang Petrochemical is building a fully integrated industrial chain of crude oil-propylene/benzene-phenol/acetone-bisphenol A-non-phosgene polycarbonate with a total scale of 520,000 tons/year. The integration of the entire industrial chain combined with scale effects leads to the lowest costs, and it is expected to become the leader in the non-phosgene method in the domestic polycarbonate field. Since phosgene is not only costly but also has high danger levels, the non-phosgene method uses methanol, carbon dioxide, and oxygen as cheap raw materials instead of phosgene, thus having significant cost advantages and environmental benefits. However, its product performance still does not reach that of polycarbonate produced by the phosgene method. Most high-end polycarbonate in the market is produced using the phosgene method. Therefore, the main competitiveness of phosgene method polycarbonate lies in product high-endization and differentiation, while non-phosgene method polycarbonate production capacity relies on cost leadership as its core competitive advantage.Baofeng Energy – Layout in High-End Polyolefins As a leading enterprise in coal-to-olefins in China, the first, second, and third phases of the olefin project have integrated advanced technologies and processes from both domestic and international sources. Currently, the first phase (300,000 tons/year of polyethylene + 300,000 tons/year of polypropylene) and the second phase (300,000 tons/year of polyethylene + 300,000 tons/year of polypropylene) projects have been put into production, with the second phase project capable of producing high-end polyethylene bimodal products and metallocene polyethylene products, which have begun to replace general materials and contribute profits. Existing grades include: metallocene bimodal high-density polyethylene film material-32ST05, which has achieved replacement of imported high-end grades in FFS heavy packaging films and shrink films; 1-hexene copolymerized bimodal polyethylene pressure pipe material TRB-432, which has passed the safety evaluation standard of “GB/T17219-1998 for safety of drinking water transmission and distribution equipment and protective materials”. Green and thin bimodal polyethylene small hollow materials-BM593, which exhibits excellent environmental stress crack resistance, has reached the best level among similar imported products, and is expected to be widely used in food packaging for cleaning. On September 2020, the Ningdong third phase of 500,000 tons/year coal-to-olefins and 500,000 tons of C2-C5 comprehensive utilization of olefins project officially started construction, with products including 500,000 tons of polyethylene, 300,000 tons of polypropylene, and 250,000 tons of EVA. The methanol and olefin units are planned to be put into production by the end of 2022, and the 250,000 tons/year EVA unit is planned to be put into production in 2023.Satellite Petrochemical – Layout in High-End Polyolefins 2021 marks the first year for the company to become a dual leader in C3+C2. Since its establishment, the company has focused on building the C3 industrial chain, especially after introducing propane dehydrogenation (PDH) units to solve the core raw material propylene self-sufficiency, bringing significant cost advantages and establishing itself as a leader in the C3 industrial chain. At the same time, the company has planned the layout of the ethane cracking to produce ethylene project since 2017, entering the C2 industrial chain, with the 2.5 million tons ethane cracking to produce ethylene project phase I having been completed on December 29, 2020, with trial production starting in April 2021 and solidification gradually beginning in May. On March 11, 2020, the company announced that its wholly-owned subsidiary, Jiaxing Shantela Investment Co., Ltd., signed a “Memorandum of Understanding” with SK Global Chemical (China) Holding Co., Ltd. (referred to as “SKGC”) in Lianyungang City, Jiangsu Province, to establish a joint venture (SKGC holds 60%, Shantela holds 40%) to build and operate an ethylene-acrylic acid copolymer (referred to as “EAA”) unit project, with a planned EAA unit production scale of 40,000 tons/year and a total investment of about 163 million USD. This project is SKGC’s third unit globally and the first unit in Asia.

Source: Chemical Dual Carbon Times, Pacific Securities

Disclaimer: The content is sourced from the internet, public channels such as WeChat official accounts, and we hold a neutral stance on the views expressed in the text. This article is for reference and communication only. The copyright of the reprinted articles belongs to the original authors and institutions. If there is any infringement, please contact us for deletion.