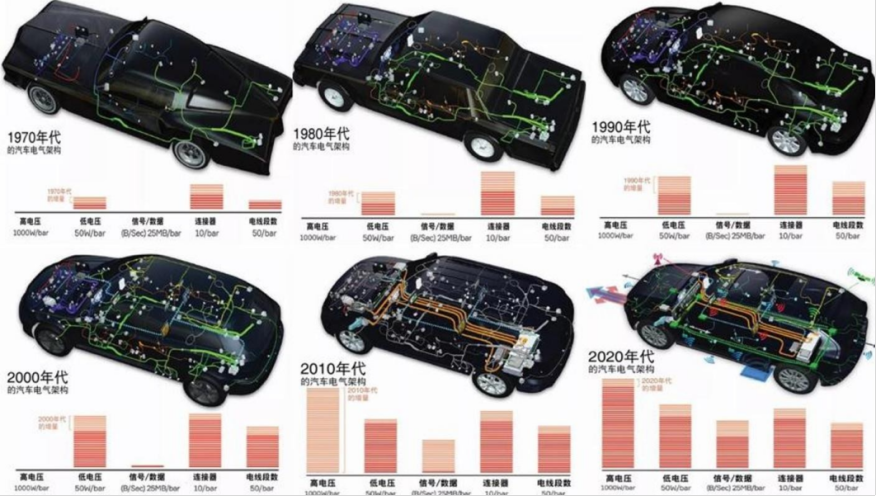

The structure of vehicles is becoming increasingly complex, and the variety of functions is leading to an increase in the length and complexity of wiring harnesses. The wiring harness is the main network of the automobile’s electrical circuits, connecting various components of the car and responsible for the transmission of related electrical power and signals, earning it the title of “the car’s nervous system.” The improvement in the intelligence and electrification of vehicles relies on the increase in the number of automotive sensors and ECUs (Electronic Control Units). In the 1990s, a car had about a dozen ECUs, while the number of ECUs in a single vehicle has now increased to over a hundred. The increase in the number of control units has made the network structure increasingly complex, significantly increasing the length of wiring harnesses in vehicles.

Figure 1: Trends in Automotive Electrical Architecture Changes

Source: Aptiv

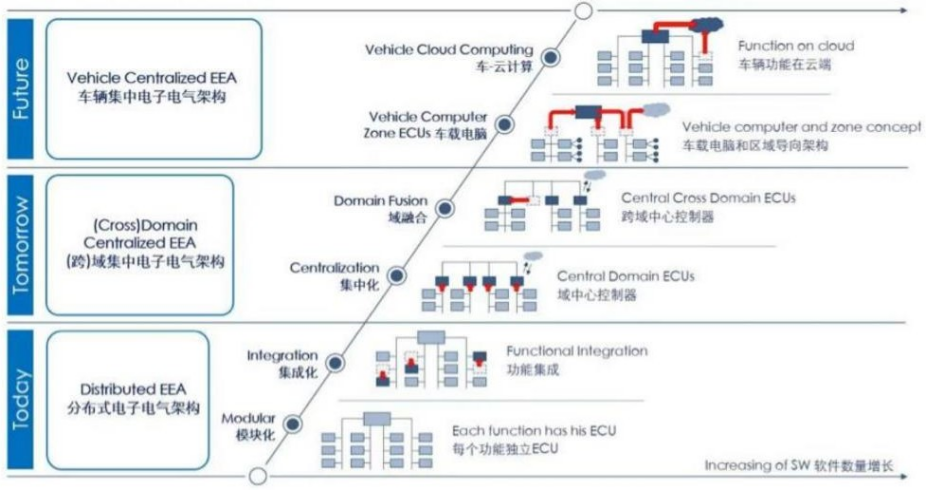

Reducing the complexity of wiring harnesses relies on innovations in electronic and electrical architecture. According to Bosch’s electronic and electrical architecture strategy diagram, automotive electronic and electrical architectures are mainly divided into three categories: distributed electronic and electrical architecture, domain-centralized electronic and electrical architecture, and vehicle-centralized electronic and electrical architecture. Traditional cars mainly adopt a distributed architecture, which consists of multiple relatively independent ECUs, with each ECU corresponding to a specific function. The wiring harness is responsible for connecting different ECUs to enable information exchange. Therefore, under the traditional distributed architecture, the increase in the number of ECU modules and the decentralized layout inevitably leads to longer wiring harnesses and increased manufacturing costs. Currently, the wiring harness length of traditional distributed architecture vehicles is approximately 5 km.

Figure 2: Bosch Electronic and Electrical Architecture Evolution Diagram

Source: Intelligent Driving Frontline WeChat Official Account

Tesla’s early Model S and Model X reformed the architecture by dividing domain controllers based on functionality, resulting in an overall architecture that lies between distributed and domain-centralized. The Model S and Model X only consist of domain controllers for driving, power, chassis, cabin, and body, which greatly reduces the number of ECUs and simultaneously shortens the length of the CAN bus, with the wiring harness length of the Model S being approximately 3 km.

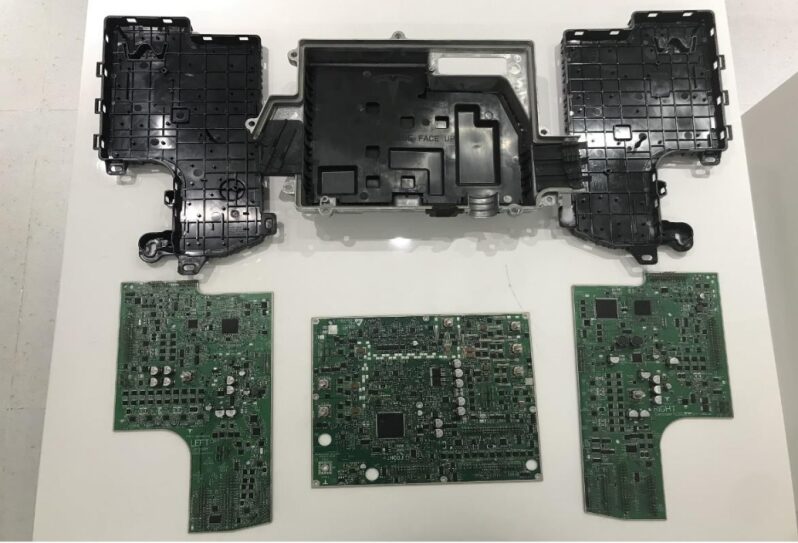

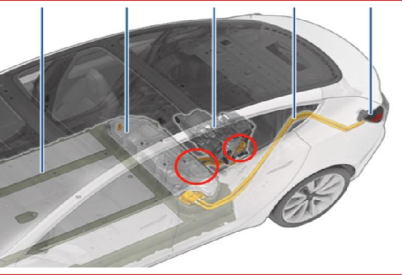

Model 3 redefines the “domains” by integrating across domains based on the foundation of Model S and Model X. The various ECUs are no longer divided by function but are directly categorized by physical location into four main parts: CCM (Central Control Module), BCM LH (Left Body Control Module, LBCM), FBCM (Front Body Control Module), and BCM RH (Right Body Control Module, RBCM). CCM is responsible for the functional requirements originally from the driving and cabin domains, including the autonomous driving module, infotainment module, and internal and external communication connections; BCM LH is responsible for steering, braking, and stability control on the left side of the body; FBCM is responsible for power distribution and logic control; BCM RH is responsible for the power system and thermal management. By replacing dispersed ECUs with a small number of high-performance computing units and migrating the required functions through software to several major modules, integration is further enhanced, thus reducing the wiring harness length of the Model 3 to 1.5 km.

Figure 3: Model 3 Left, Front, and Right Body Control Modules

Source: Zhongcheng Compass Technology Development (Shenzhen) Co., Ltd., CITIC Securities Research Department

Shortening the wiring harness length is a common requirement to improve product range and manufacturing efficiency. The weight of traditional automotive wiring harnesses accounts for about 5% of the total vehicle weight, and shortening the length can free up more physical space for automotive design, as well as reduce the total weight of the vehicle, thereby decreasing fuel consumption and increasing range. Additionally, the variety of wiring harnesses, complex layouts, and relatively soft materials mean that the production and installation of wiring harnesses mainly rely on manual labor. According to Zosi Automotive Research data, 95% of wiring harnesses require manual production, and the low automation in the production model of wiring harnesses limits the manufacturers’ ability to further expand capacity. To address this issue, Model 3 shortens the wiring harness length through innovative architecture, reducing its hindrance to capacity enhancement.

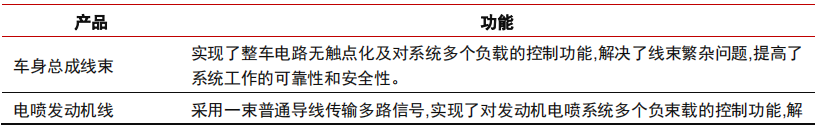

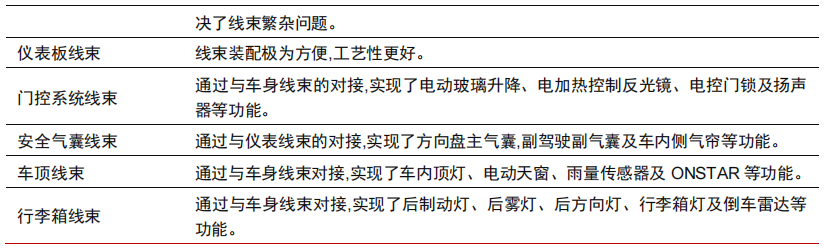

Table 1: Main Wiring Harness Products and Basic Functions in Automotive Wiring Harnesses

Source: Huajing Industry Research Institute, CITIC Securities Research Department

Figure 4: Display of Wiring Harnesses Around BCM RH (Right Body Control Module)

Source: Zhongcheng Compass Technology Development (Shenzhen) Co., Ltd., CITIC Securities Research Department

Figure 5: Display of Some Low-Voltage Wiring Harnesses

Source: Zhongcheng Compass Technology Development (Shenzhen) Co., Ltd., CITIC Securities Research Department

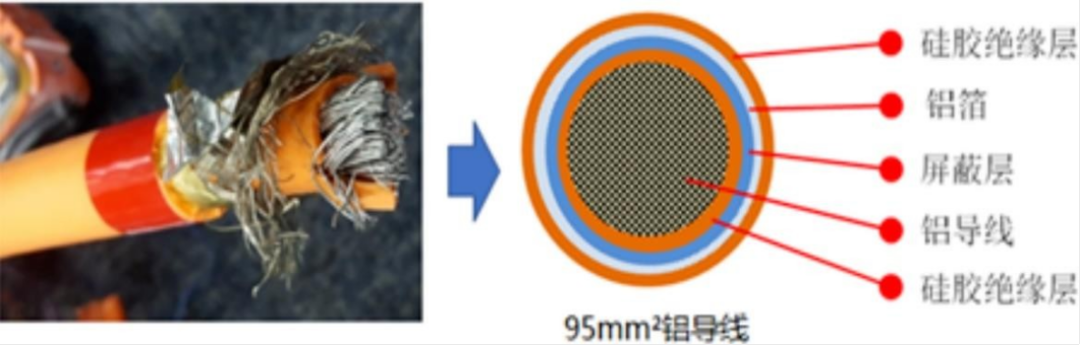

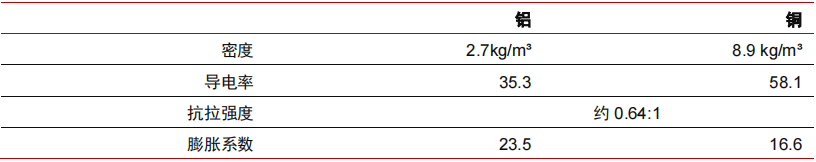

In addition to adjusting the architecture to shorten the wiring harness length, disassembly revealed that Model 3 uses aluminum wires instead of traditional copper wires in the high-voltage wiring harness, further achieving lightweighting. The densities of aluminum and copper are 2.7 kg/m³ and 8.9 kg/m³, respectively, and the cost of aluminum is more than half cheaper than that of copper. Even considering the disadvantages of aluminum in conductivity, increasing the diameter of aluminum wires (approximately 1.6 times larger) can still further reduce the vehicle’s weight (approximately 21%) and lower manufacturing costs.

Figure 6: Model 3 High-Voltage Aluminum Wire and Its Structural Diagram

Source: Electric Knowledge Home

However, using aluminum wires instead of copper wires also faces many issues that have made manufacturers hesitant to try high-voltage aluminum wires. First, the conductivity of aluminum is significantly lower than that of copper, so to achieve the same conductivity, the wire diameter needs to be increased; aluminum has lower tensile strength, affecting mechanical performance; the difference in expansion coefficients between aluminum and copper can create gaps at the interface where aluminum wires meet copper terminals, leading to increased impedance; aluminum is prone to oxidation, and the insulating aluminum oxide may affect contact performance.

Although aluminum wires are widely used in the automotive field, they are mainly found in low-voltage applications. The use of aluminum wires in high-voltage applications in Model 3 is an important representation of its cost management and technological advancement leveraging its own technical advantages.

Table 2: Comparison of Performance Coefficients between Aluminum and Copper

Source: Wiring Harness World, CITIC Securities Research Department

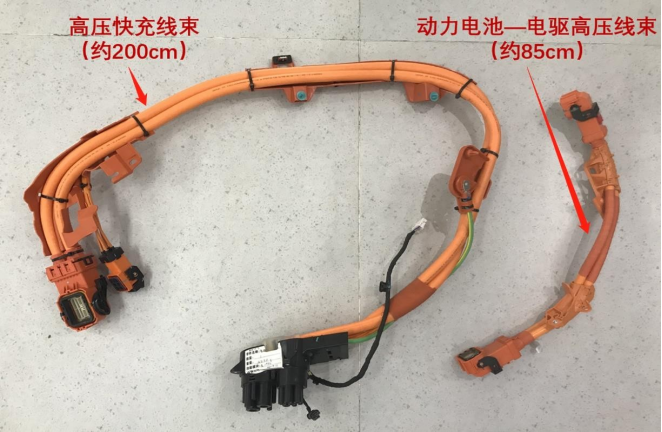

Figure 7: Display of Model 3 High-Voltage Wiring Harness

Source: Zhongcheng Compass Technology Development (Shenzhen) Co., Ltd., CITIC Securities Research Department

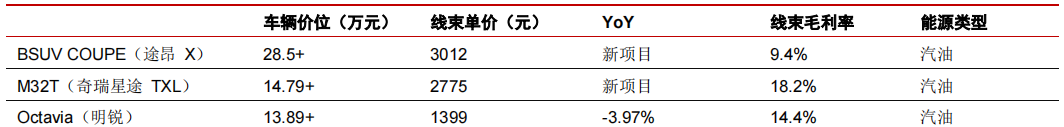

From an industry perspective, the single vehicle value in the wiring harness industry is relatively stable, with prices mainly affected by the differences in vehicle models, project pricing, and structure. In the early stages of launching new and refreshed models, due to the higher vehicle prices, the corresponding pricing of parts is also relatively high. However, as time goes by and new models are introduced, manufacturers will lower the prices of existing models and also require automotive parts manufacturers to lower prices, thus reducing the sales prices of company products. According to the prospectus of Huguang Co., Ltd., in 2019, the prices of complete wiring harnesses (the main wiring harness combinations that make up the vehicle body, excluding engine-related wiring), engine wiring harnesses, and other wiring harnesses were 1587 yuan/set, 199 yuan/piece, and 29 yuan/piece, respectively. The unit price of wiring harnesses for the same vehicle model is relatively stable, with price differences mainly depending on the vehicle model, and in 2019, the unit price of complete wiring harnesses for different vehicle models was generally between 1000 and 3000 yuan.

Table 3: 2019 Sales Prices and Gross Profit Situation of Huguang Co., Ltd. Complete Wiring Harness Major Projects

Source: Huguang Co., Ltd. Prospectus, Autohome, CITIC Securities Research Department

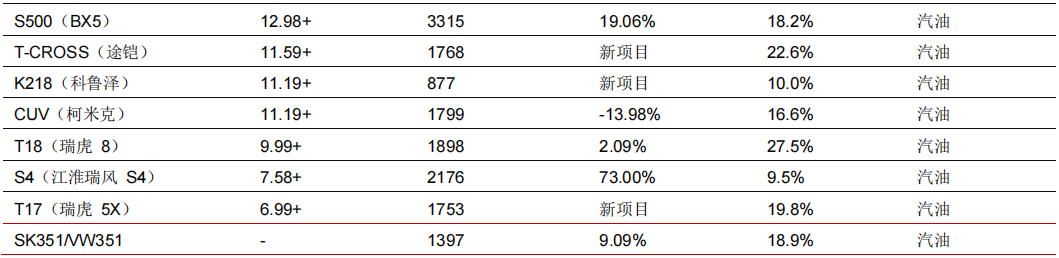

New energy vehicles like Model 3 are developing rapidly, and the increase in volume and price opens up growth space for the wiring harness industry. Currently, the wiring harness industry is a stock market, and the market size depends on the sales situation of downstream automobiles. Under the trend of “new four modernizations” in automobiles, China’s automobile production and sales in 2021 were 26.082 million and 26.275 million, respectively, ending three consecutive years of decline since 2018. At the same time, the incremental demand for high-voltage wiring harnesses and the lightweighting trend increase the single vehicle value, further opening up industry space. According to data from Huajing Industry Research Institute, the single vehicle value of wiring harnesses for traditional low, medium, and high-end cars is approximately 2500, 3500, and 4500 yuan, respectively, while the average single vehicle value for new energy vehicle wiring harnesses has increased to around 5000 yuan. If calculated based on a single vehicle value of 3000 yuan, the market size for wiring harnesses could reach 78.2 billion yuan in 2021.

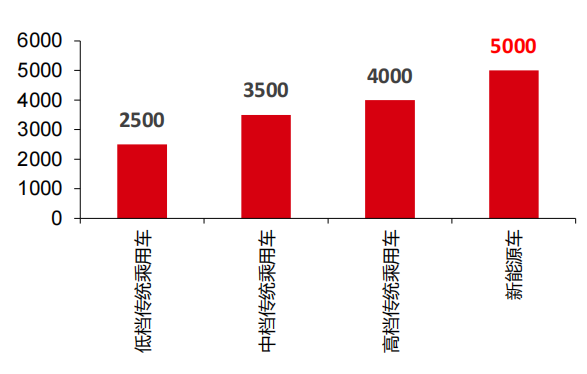

From a profitability perspective, cost impacts have led to poor performance in the industry’s gross profit margin. The wiring harness industry is labor-intensive, and product costs are heavily influenced by the prices of raw materials like copper, leading to relatively low gross profit margins for companies in the industry. In recent years, the gross profit margin of the wiring harness industry has shown a downward trend due to negative impacts from labor and material costs.

Figure 8: Distribution of Single Vehicle Value of Different Models of Wiring Harnesses (Yuan)

Source: Huajing Industry Research Institute, CITIC Securities Research Department

Figure 9: Changes in Gross Profit Margin of Domestic Wiring Harness Manufacturers

Source: Wind, CITIC Securities Research Department

In terms of market structure, the wiring harness industry has stable cooperation with vehicle manufacturers, and the market concentration is relatively high. The development of the automotive wiring harness industry highly depends on the automotive industry, and most brand manufacturers have a mature and stable automotive matching system. For a long time, the high standards for components have led to relatively stable cooperation between wiring harness suppliers and automotive manufacturers. Currently, the global automotive wiring harness market is mainly dominated by Japanese companies such as Yazaki, Sumitomo Electric, and FCI, Korean companies such as LS Cable & System and Kyungshin, as well as European and American companies like Leoni, Aptiv, and Delphi. According to the Forward Industry Research Institute, the top five manufacturers, Yazaki, Sumitomo Electric, Delphi, Leoni, and Lear, accounted for 29.81%, 24.38%, 16.71%, 6.05%, and 4.70%, respectively, with a CR5 of 81.65% in 2018.

In the domestic market, large independent brand manufacturers mostly have stable local wiring harness suppliers for matching production, while foreign and joint venture manufacturers have higher requirements for wiring harnesses and mostly choose wiring harness manufacturers that are wholly-owned or joint ventures of international parts manufacturers in the country, such as Denso mainly supplying Guangzhou Honda and Dongfeng Honda. In recent years, as international automotive manufacturers increasingly focus on cost control, localized procurement of automotive parts has been strengthening, and domestic manufacturers are gradually entering the supply chains of international automotive manufacturers.

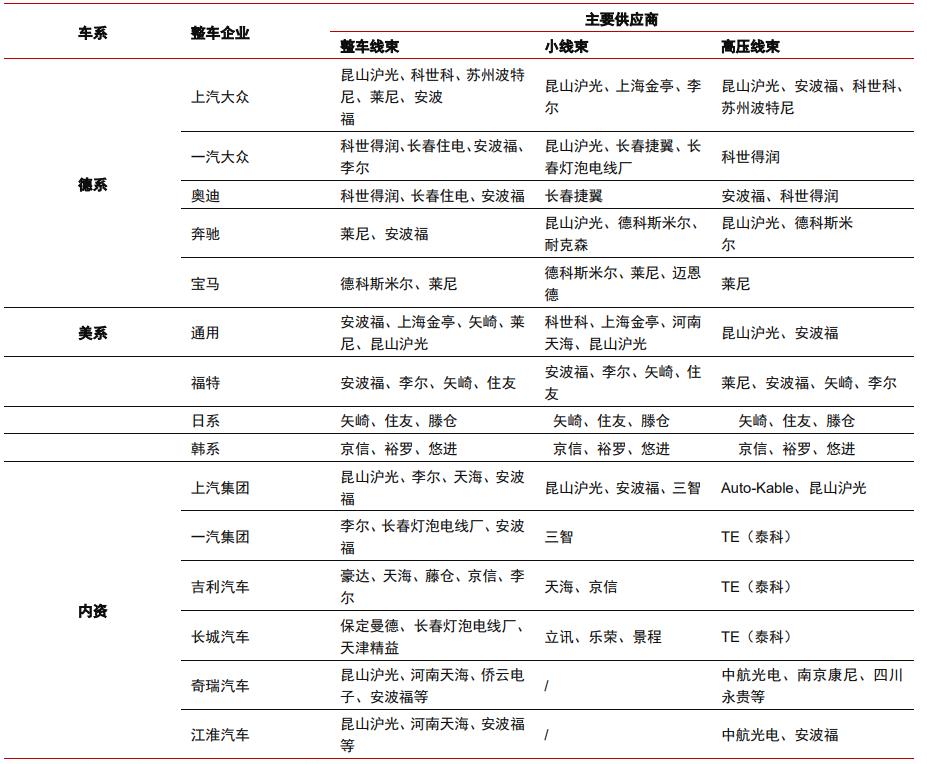

Table 4: Corresponding Major Wiring Harness Suppliers for Automotive Manufacturers

Source: Huguang Co., Ltd. Prospectus, CITIC Securities Research Department

Connectors: Electrification Drives Incremental Applications, Design Innovations Continue to Optimize

Connectors are commonly used to connect two active devices at the ends of wires, and their forms and structures are diverse, typically consisting of contact parts, insulating parts, housings, and accessories. The contact parts are the core components that complete the function of the connector, achieving electrical connection through the insertion of male and female contact parts; the housing provides mechanical protection and secures the connector; the insulator ensures that the contact parts are arranged at specified positions and distances while providing insulation; accessories can be further divided into structural and installation accessories, including retaining rings, positioning keys, positioning pins, guiding pins, and connecting rings, while installation accessories include screws, nuts, bolts, and spring rings. Depending on performance and application scenarios, automotive connectors can be classified into high-speed connectors, low-voltage connectors, and high-voltage connectors.

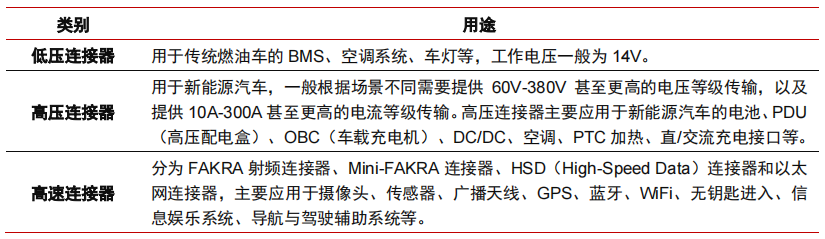

Table 5: Types of Automotive Connectors and Application Scenarios

Source: Intelligent Connected Vehicle Network, CITIC Securities Research Department

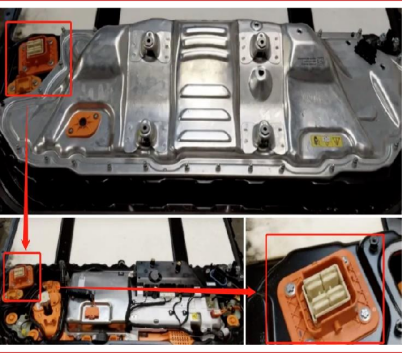

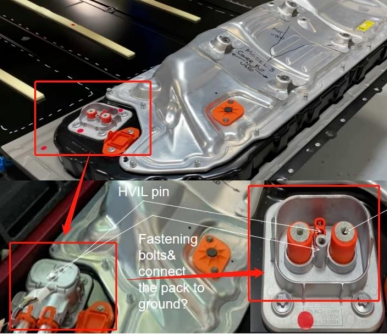

High-voltage connectors are key components under the backdrop of automotive electrification. According to Wiring Harness World data, a modern vehicle can contain as many as 700 connectors. As the trend of automotive electrification accelerates, scenarios with voltages above 60V in vehicles are rapidly increasing. The drive of vehicles relies on high-voltage, high-current circuits, which provides a huge incremental demand for high-voltage connectors. Disassembly has found that the number of high-voltage connectors in Model 3 has also increased linearly, with corresponding changes in functions and forms.

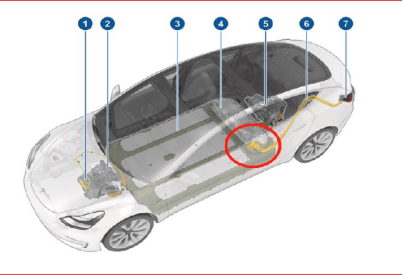

Figure 10: Application of High-Voltage Connectors in New Energy Vehicle Systems

Source: Dingtong Technology Prospectus

In high-voltage fast charge connectors, Model 3 uses a custom plug-in high-voltage connector HC Stak 35 from TE (Tyco), which connects the vehicle battery and the charging wiring harness. The plug-in structure is Tesla’s consistent choice, which increases the welding options for aluminum wires, and compared to cylindrical terminals of the same type, it is smaller in size and has better current-carrying capacity (about 20% improvement), allowing for optimal space-saving in the electrical system layout.

Figure 11: Location of Model 3 Plug-in High-Voltage Fast Charge Connector

Source: Tesla Official Website – User Manual, CITIC Securities Research Department

Figure 12: Size Comparison of Plug-in and Cylindrical High-Voltage Connectors

Source: Wiring Harness World WeChat Official Account

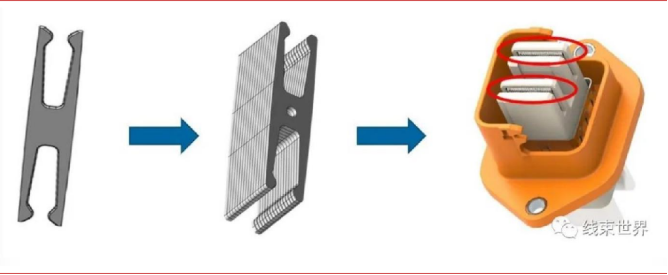

From a design perspective, the terminals of HC Stak 35 are connected by a copper plate (35mm thick) and 35 fork-type terminals. Since the terminals at the socket end are formed by stacking 35 DEFCON terminals, they can be configured like building blocks to meet different port requirements by changing the number of stacked plates to create different models of connectors. This modular design can further reduce terminal processing costs. HC Stak 35, paired with a 95 mm² high-voltage wiring harness, can support Model 3 charging for 15 minutes to increase the range by 279 kilometers. However, plug-in connectors also have their drawbacks, such as being less durable during insertion and removal, and the plug-in structure can easily deform, causing the positive and negative terminal plates to not remain on the same horizontal plane.

Figure 13: Structural Diagram of Multi-Plate Stacked Fork-Type Terminals

Source: Wiring Harness World WeChat Official Account, CITIC Securities Research Department

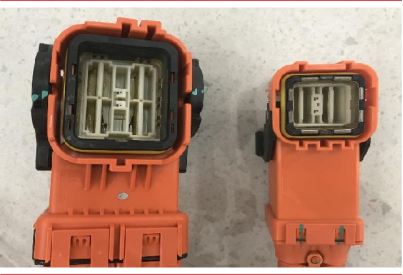

For the connector on the power battery – electric drive high-voltage wiring harness, Model 3 uses TE’s HC Stak 25. Its structure and function are similar to HC Stak 35, with the difference being the size. It can be observed that HC Stak 25 is smaller than HC Stak 35, and thus the socket end of HC Stak 25 is composed of 20 DEFCON terminals (HC Stak 35 has 35 terminals). Different models share the same connector terminals. The variation in the number of stacked terminals allows for rapid assembly of different models, reflecting the cost control advantages of modular production of connectors.

Figure 14: Location of Power Battery – Electric Drive High-Voltage Connector

Source: Tesla Official Website – User Manual, CITIC Securities Research Department

Figure 15: Size Comparison of HC Stak 35 (Left) and HC Stak 25 (Right)

Source: Zhongcheng Compass Technology Development (Shenzhen) Co., Ltd., CITIC Securities Research Department

In terms of materials, the connectors in Model 3 are made of nylon plastic, but we believe that the application of metal alloy housings will become more prevalent in the future. Although metal material connectors are more expensive than nylon materials, they have higher strength and will not crack or break under stress at the plug-in points; at the same time, fast charging requires connectors to withstand higher currents in a short period, and the good thermal conductivity of metal materials is beneficial for better temperature control. Therefore, we believe that metal housings will become more common in future applications. This may also be based on the above considerations, as Tesla’s Model Y has replaced its high-voltage connector housing from plastic to metal.

Figure 16: Model 3 Connector Housing Made of High-Voltage Material

Source: New Energy High-Voltage Connector Alliance, CITIC Securities Research Department

Figure 17: Model Y Aluminum Alloy High-Voltage Connector Housing

Source: New Energy High-Voltage Connector Alliance, CITIC Securities Research Department

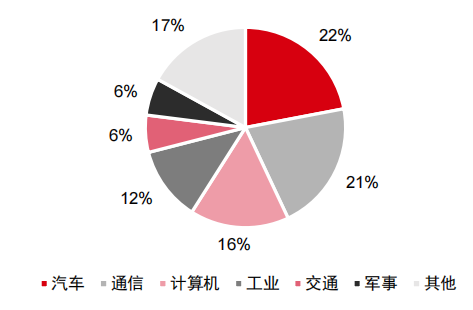

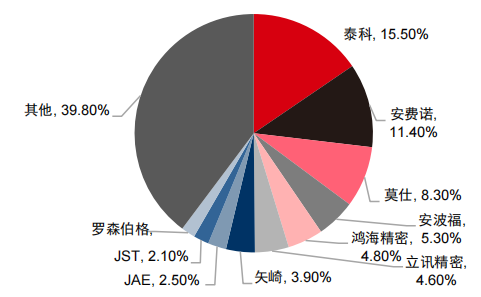

In terms of competition, the automotive sector is the largest application scenario for connectors, and the industry is highly competitive, with strong overseas leaders. In 2020, the automotive connector market accounted for 22% of the total connector market, making it the largest sub-market for connectors. The trends of electrification and intelligentization are expected to further enhance the market space for automotive connectors. At the same time, the trend of top-tier manufacturers is becoming increasingly evident in the industry. In 1980, the market share of the top 10 global connector suppliers was 38.0%, while in 2019, the share of the top 10 suppliers increased to 60.2%. The top 10 global connector manufacturers in 2019 were TE, Amphenol, Molex, Aptiv, Foxconn Technology, Luxshare Precision, Yazaki, JAE, JST, and Rosenberger.

Figure 18: Global Connector Market Share by Application Field in 2020

Source: Bishop & Associates, Inc., CITIC Securities Research Department

Figure 19: Competition Pattern of Global Connector Manufacturers in 2019

Source: Bishop & Associates, Inc., CITIC Securities Research Department

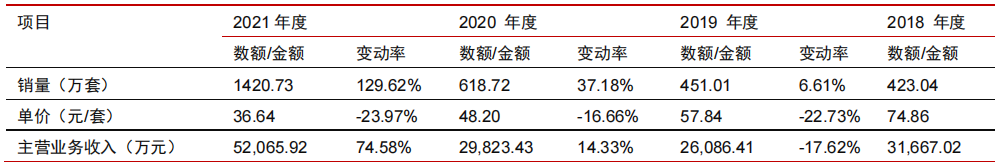

In the future, the further development and expansion of new energy vehicles are expected to drive the demand for connectors to continue growing rapidly, but prices may show a downward trend. Taking the domestic connector leader Ruikeda as an example, in 2019, its revenue from new energy connectors fell by 17.62% year-on-year, mainly due to a decrease in product prices, as the average subsidy standard for new energy vehicles in the country decreased by 50%, impacting the demand for new energy vehicles. In 2020, the new energy vehicle market gradually warmed up, and the company became a supplier to new energy vehicle manufacturers such as NIO, Tesla, and SAIC Group, with year-on-year sales increasing by 37.18% and sales revenue increasing by 37.37 million yuan. In 2021, the “new four modernizations” of automobiles further landed, and the company successfully entered the supply chains of high-quality domestic and foreign customers, including T Company, NIO, SAIC Group, Changan Automobile, BYD, Jianghuai Automobile, King Long Bus, Xiaokang, Aptiv, CATL, and Penghui Energy. However, along with the industry’s economies of scale, mature production processes, and intensified competition, connector prices are steadily declining.

Table 6: Revenue and Changes of Ruikeda’s New Energy Connector Products

Source: Ruikeda 2021 Annual Report and Prospectus, CITIC Securities Research Department

Statement: Respecting and protecting originality is our consistent principle. This public account will note the source at the end of any reposted articles for sharing purposes. The copyright of reposted articles belongs to the original author or original public account. If there is any infringement, please inform us in a timely manner, and we will verify and delete it.