“Introduction”:

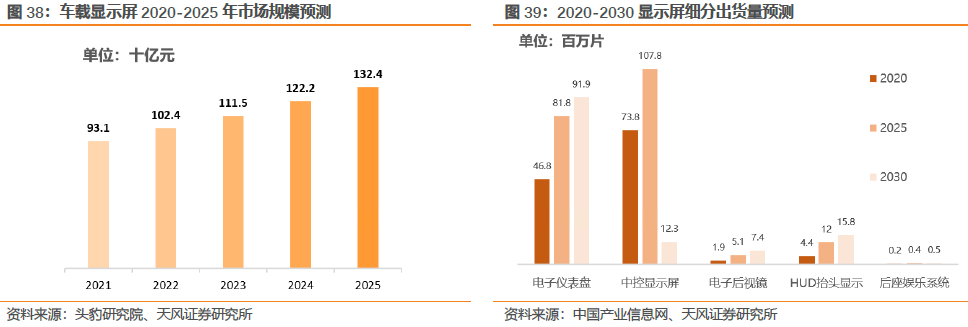

The recovery in automobile sales has driven the continuous growth of China’s automotive display screen market. According to data from the Guanyan Tianxia Data Center, global shipments of automotive display screens are expected to reach 207 million units by 2025, with a market size of 132.4 billion RMB and a compound annual growth rate (CAGR) of 10.4%.

At the same time, the intelligent, safe, and systematic transformation of automobiles is imperative. The upgrade of central control display terminals and rearview mirror display screens has significantly contributed to the increase in automotive display screen shipments.

//

Keywords: automotive heads-up display ; automotive display screen

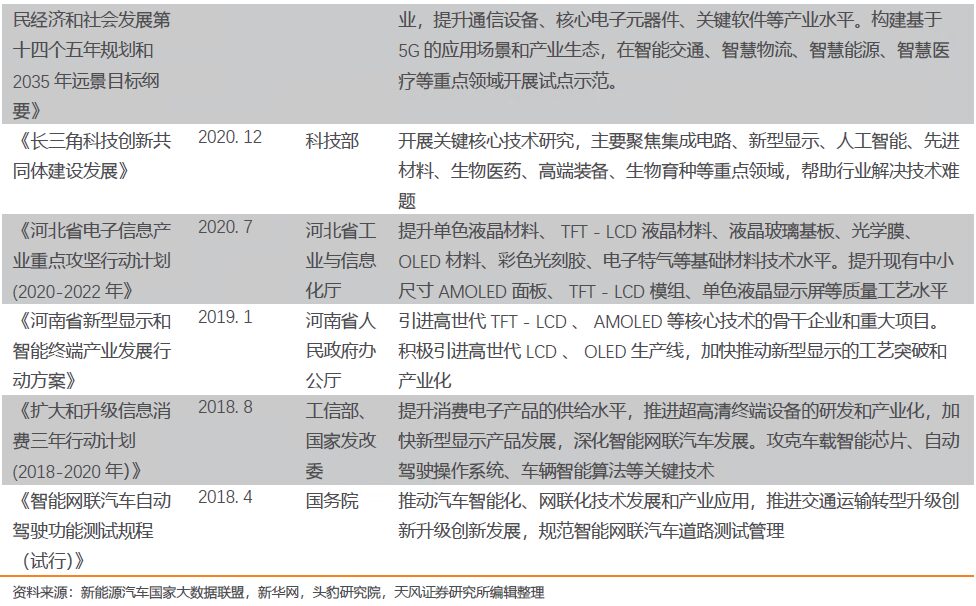

1.1. Classification of Display Technologies and Performance Features

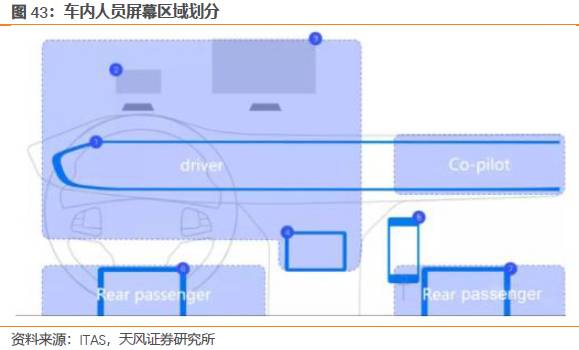

An automotive display screen refers to a display screen installed inside a vehicle, primarily used for driving assistance and entertainment. Depending on the installation location, automotive display screens can also be instrument displays, heads-up displays, rearview mirror displays, central control displays, and rear-seat displays.

Automotive display screens have been developed for many years, and their traditional LCD technology has matured, holding a major share of the automotive display screen market. Global annual sales of LCD screens have maintained a decade of continuous growth since 2009, rising from 18 million to 164 million units. However, due to the Sino-U.S. trade disputes and major display manufacturers beginning to layout new technologies such as OLED and MLED, LCD screen sales fell to 156 million units in 2019, a decrease of 5% year-on-year.

The main performance requirements for automotive displays include high brightness, long lifespan, fast response, and a wide operating temperature range: The brightness of automotive display screens must reach a level that ensures the driver can clearly see road condition information and vehicle parameters; the average lifespan of a vehicle is 7-12 years, so automotive displays must meet this lifespan requirement; the response time of automotive displays determines whether there is ghosting in the displayed images, affecting clarity and user interaction experience;

As vehicles are often in high-temperature environments or parked outdoors, automotive displays need sufficient heat resistance and cold resistance (operating temperature range of -30~85℃) to ensure normal operation. Other evaluation dimensions such as cost and technology maturity are considered from the perspective of consumer demand and display supplier supply.

While LCD has the advantages of low cost and high technology maturity, it does not hold advantages in other dimensions compared to the other three technologies. As of 2021, LCD still dominates the automotive display screen market, and the demand for the next-generation technology product LTPS-TFT LCD derived from TFT LCD is expected to strengthen further, with a global penetration rate likely to exceed 12%. However, as major companies begin to layout new display technologies, other new technologies will gradually gain more market share due to their performance and lifespan advantages. In the medium term, technologies like AMOLED are expected to mature and quickly capture the market, but in the long term, Mini LED may become a more promising option.

Compared to new display technologies like OLED and Micro LED, Mini LED has clear advantages in commercialization. Compared to traditional LCD, OLED has an organic light-emitting layer that emits light on its own, allowing each light-emitting point on the display to be controlled sensitively through voltage, resulting in excellent color gamut, contrast, and HDR effects. However, OLED also has significant issues: high cost, low brightness, and its lifespan is generally difficult to meet automotive requirements.

On the other hand, the “upgraded” technology Micro LED is constrained by industry technical challenges such as mass transfer, making low-cost mass production unachievable in the short term. Compared to the first two technologies, Mini LED has clear advantages. Mini LED is very small in size, with enough partitions to achieve fine control of light on very small parts of the display, for example, an 8-inch display can integrate thousands of LEDs.

By precisely controlling the light, Mini LED can achieve high contrast and dynamic display, resulting in significant improvements in contrast, HDR, and color gamut. Additionally, using this backlight solution not only makes the displayed images more realistic but also enhances overall screen brightness. Currently, Mini LED backlighting does not show significant advantages in terms of thinness compared to traditional LCD, but it is very suitable for automotive displays where thickness is not strictly required.

The automotive display screen industry chain consists of upstream material suppliers, component assemblers, production equipment manufacturers, midstream display manufacturers, and downstream vehicle manufacturers and display retailers.

Upstream production equipment manufacturers are currently still dominated by companies from Europe, the United States, Japan, and South Korea. However, as manufacturing technology improves, the trend of localization among material suppliers and component assemblers is gradually strengthening, which is expected to break the current situation controlled by overseas and Taiwan companies. Midstream display manufacturers have a high concentration, with CR5 accounting for 69.6% of automotive panel shipments in 2019. As international companies begin to reduce LCD production, LCD capacity is gradually shifting to China.

As of 2020, mainland China’s LCD capacity accounted for about 50% of global capacity, ranking first in the world. The downstream mainly includes vehicle manufacturers (OEMs) and automotive display screen retailers (automotive parts sellers). As downstream companies are often large enterprises, they have stronger bargaining power compared to midstream display manufacturers.

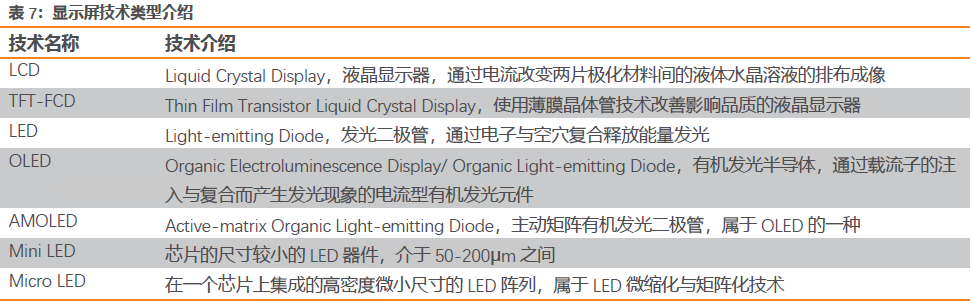

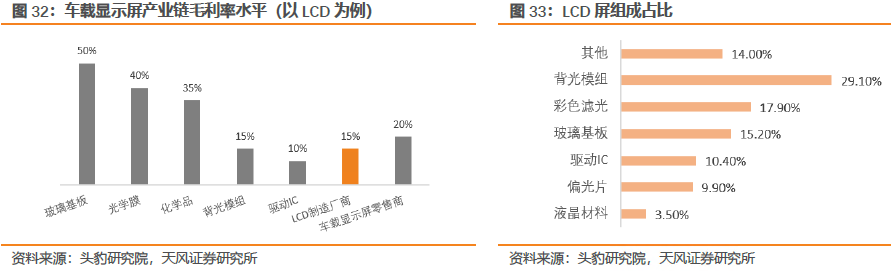

The upstream of the automotive display screen industry chain consists of material suppliers, component assemblers, and production equipment manufacturers. Currently, core material supply and production equipment in the upstream are controlled by international companies, which have the highest gross margins in the entire industry chain. Taking TFT-LCD displays as an example, the gross margin in the upstream of the industry chain is the highest, followed by downstream OEMs and retailers, with the lowest being backlight modules, driver ICs, and display manufacturers. This results in a left-skewed inverted “U” shape for the gross margin of the display screen industry chain, with the average gross margin mainly concentrated in the upstream materials, reaching 40%.

The high gross margin in the upstream mainly comes from the fact that international companies still dominate the upstream industry and control key raw material resources, while Chinese display manufacturers have relatively weak bargaining power. Backlight modules and driver IC components have a high degree of localization, avoiding tariff burdens, while large shipment volumes further reduce costs, keeping prices at a low level, and the gross margin is also low.

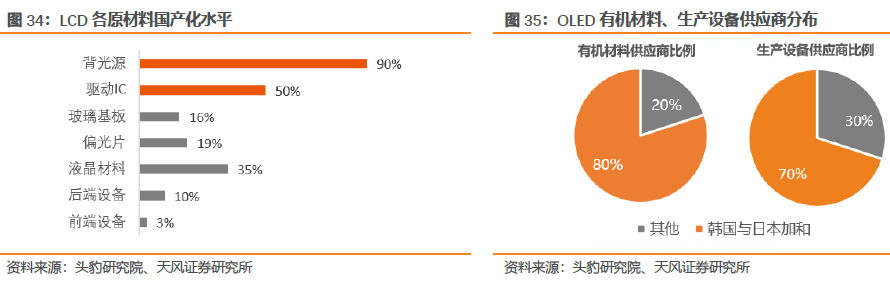

Currently, traditional LCD display technology is mature, and the trend of localization in the upstream is strengthening. The backlight module, which accounts for the highest proportion of raw materials, has now achieved 90% localization, but the localization rate of front-end equipment is still low. In contrast, the upstream organic materials in the OLED industry chain are still monopolized by some South Korean and Japanese companies, occupying more than 80% of the market, and they have also implemented technology blockade controls. In terms of OLED production equipment, South Korean and Japanese companies also monopolize control, with a market share exceeding 70%.

In the automotive display screen industry chain, the midstream market is highly concentrated, with companies from South Korea, Japan, and Taiwan occupying the leading positions. In 2019, the top five global automotive display screen shipment companies were JDI, Tianma Microelectronics, AU Optronics, LGD, and Innolux, accounting for 68.2% of total shipments. Except for Tianma, the other four are all Japanese and Korean companies, which together account for 53.8% of total shipments, still holding leading positions in the midstream of the automotive display screen industry chain.

Compared to domestic display manufacturers, international companies have more mature technologies and less stringent technology blockade, giving them stronger advantages in upstream material costs. Currently, Chinese companies have gradually mastered core LCD technologies, rapidly expanding capacity and capturing the mainstream of automotive display screen shipments;

In the expansion process of OLED display capacity, due to core equipment such as evaporation machines still being constrained by leading international companies, China’s OLED capacity is significantly lagging. From the perspective of corporate development layout, domestic display manufacturers may achieve a leapfrog development in the automotive display screen market through Mini LED.

The recovery in downstream automotive sales is driving an increase in demand for automotive display screens. Since the downstream mainly consists of large automotive brands and automotive parts retailers, they have strong bargaining power facing both midstream display manufacturers and consumers, with an average gross margin of about 20%. After hitting a low in 2020, automotive sales rebounded, reaching 26.275 million units in 2021, a year-on-year increase of 3.81%, indicating that automotive demand is gradually being released;

It is expected that automotive sales in China will reach about 30 million units by 2025, continuously driving the growth of demand for automotive display screens. At the same time, the rise of the stock market, with car owners who already own one or more cars looking to replace their original vehicles or purchase new ones, has increased the demand for replacement purchases. The proportion of replacement purchases increased from 10% in 2017 to 23% in 2019, and the proportion of additional purchases rose from less than 1% in 2017 to 7%, driving new demand for automotive display screens.

The recovery in automotive sales is driving the continuous growth of China’s automotive display screen market. According to Guanyan Tianxia Data Center, global shipments of automotive display screens are expected to reach 207 million units by 2025, and according to Zhongyan Puhua Industrial Research Institute, the market size of China’s automotive display screens is expected to reach 132.4 billion RMB, with a CAGR of 10.4%.

Downstream automotive sales have been declining year by year since 2018, especially in 2020, when the pandemic affected global automotive demand, with sales dropping to 78.03 million units, a decrease of 13% year-on-year. However, with the implementation and promotion of epidemic prevention measures and vaccines, the pandemic is gradually being controlled, and suppressed demand is expected to be released. Moreover, governments around the world are launching consumption stimulus policies, such as tax reductions for car purchases in China, which may lead to sustained growth in the automotive market and significant increases in automotive display screen sales in the coming years.

However, after the rapid release of automotive market demand reaches saturation, the growth rate of automotive sales may gradually slow down in the next three to five years; at this time, new energy vehicles and intelligent vehicles may become new growth points for automotive display screens.

In the segmented assembly market for automotive display screens, the installation rate of central control display screens is continuously increasing, maintaining the highest share of automotive display screen shipments; the updates of instrument displays and the penetration rates of heads-up/rearview mirror displays are driving the continuous growth of automotive display screens. Central control display screen configuration: As global automotive demand is released in the next two years, the high installation rate of central control displays and the updates of instrument displays will be the core guarantees for high automotive display screen shipments.

The intelligentization of automobiles will inevitably be accompanied by upgrades of central control display terminals. According to predictions from the Head Leopard Research Institute, the display installation rate in China is expected to reach 90% by 2025, with an average price of about 2000 RMB for a central control display. Traditional instrument displays will gradually be updated to LCD instrument displays, with the relevant LCD display shipments expected to reach an annual growth rate of 10%. An LCD instrument display is worth about 2000 RMB, making it highly valuable in the market.

At the same time, the intelligentization, safety, and systematization of automobiles are imperative, with heads-up and rearview mirror displays becoming significant contributors to the increase in automotive display screen shipments. Heads-up displays (HUD) can reduce the number of times a driver’s gaze shifts, improving driving safety. Currently, the HUD market still has significant growth potential. As domestic manufacturers break the monopoly of international companies, the decline in HUD prices is expected to further increase HUD penetration rates. According to ICVTank, the global HUD penetration rate is expected to reach 30% by 2025;

The Full Display Mirror (FSD) was first mass-produced in the new Cadillac CT6 by General Motors, which captures video through a rear-facing camera and streams it to an LCD display integrated into the rearview mirror, providing the driver with a panoramic view of the rear.

In 2018, global shipments of rearview mirror displays increased by 52% year-on-year, reaching 1.6 million units, and grew to 1.9 million units by 2020. In the future, increasing electronic rearview mirror displays by vehicle manufacturers and allowing car owners to install rearview mirror displays themselves are expected to promote the sustained high growth of rearview mirror displays.

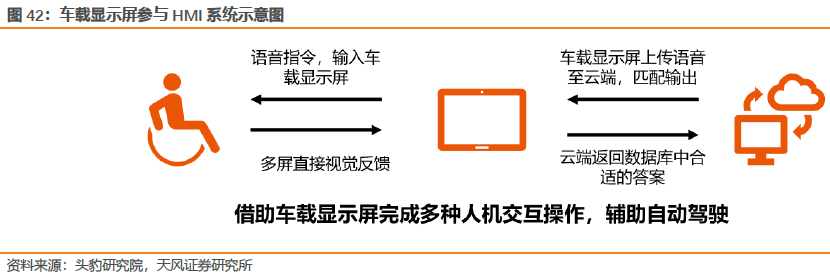

With the rapid development of the wave of automotive intelligentization, more advanced human-machine interaction (HMI) systems and the penetration rate of autonomous driving are gradually increasing. As an important component of HMI systems, automotive display screens will see rapid growth in market demand. At the same time, with the upgrade of autonomous driving, users are placing greater emphasis on vehicle safety. Since automotive display screens can provide multi-dimensional feedback on road information and timely remind drivers of hazardous road conditions, the number of automotive display screens is continuously increasing. According to IHS data, the average number of screens per vehicle was 1.75 in 2019; by 2030, the number of vehicles equipped with three or more screens is expected to reach about 20%. The multi-screen and large-screen setups brought by autonomous driving will promote the growth of automotive display screens.

In terms of safety configurations, the multi-screen setup of automotive display screens can effectively convey real-time road condition information, enabling drivers to react quickly. In recent years, touch screen interaction has become one of the mainstream forms of interaction in automotive cockpits. However, under traditional touch screen solutions, each time a driver touches the screen, it occupies “hand-eye” resources, leading to driver distraction, which is detrimental to driving safety. A safer interaction design solution should eliminate touch screens and adopt intelligent multi-modal interactions using “voice-HUD/AR”, while simultaneously configuring multiple screens to transmit different areas of road conditions, helping drivers drive safely and improving vehicle performance.

In terms of entertainment connectivity, users’ demand for enhancing cockpit experience is increasingly strong. When using mobile phones and other electronic products, users prefer larger, clearer screens. We expect this demand to shift to cockpit scenarios in the future, increasing the demand for integrated, large, and high-performance automotive display screens.

At the same time, with the development of smart homes, the connection between travel scenarios and life scenarios is crucial to the user experience. The integration of vehicle networking and home IoT is an inevitable trend. As the pursuit of safety and entertainment upgrades, people will increasingly value the improvements in driving safety, entertainment, and convenience brought by multi-screen, integration, and large-screen setups.

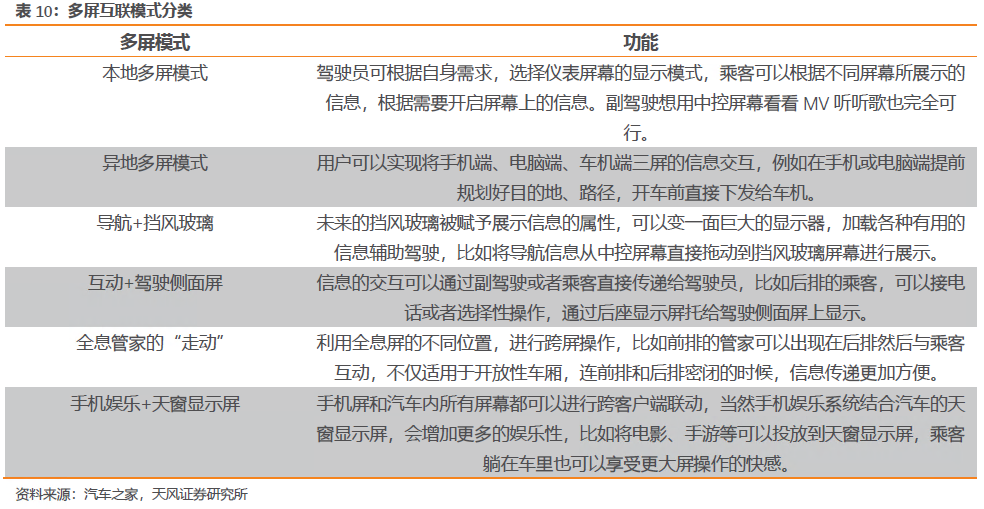

In traditional automotive cockpits, central control screens, instrument displays, and rearview mirrors exist independently. With the intelligent transformation of automobiles, multi-screen and multi-screen interactive displays have emerged. In terms of commercialization, new force car companies launched mass-produced vehicles with 4-screen interconnectivity, even 5-screen interconnectivity, as early as 2019, such as Li Auto ONE and Skyworth ME7, while traditional manufacturers quickly laid out multi-screen interconnectivity products starting in 2020.

The multi-screen interconnectivity model mainly enhances the human-vehicle interaction scenarios in intelligent cockpits in three ways: 1) Increased display area, the enlarged human-machine interaction window will enhance user experience. Multi-screen displays offer a larger display area than a single touch screen, providing more data information. 2) Enhanced interactivity, drivers, passengers, and rear-seat passengers can complete diverse interactive scenarios through the in-car screen system. 3) Improved customization capabilities, allowing for personalized customization based on customer needs, such as linking cockpit displays with rear-seat displays to enhance passenger entertainment interaction.

The demand for multi-screen interconnectivity will lead to a mainstream trend of single-chip multi-screen architecture. In terms of cost control, the total cost of the “single-chip multi-screen” solution is lower compared to the “multi-chip multi-screen” solution; in terms of communication, multi-screen interactive information in the “single-chip multi-screen” solution is transmitted internally within the chip, changing the way multiple operating systems communicate through CAN/LIN buses, significantly reducing communication time; in terms of safety, adopting the “single-chip multi-screen” solution reduces system complexity, decreases the number of components, and increases overall reliability.

There are two main approaches to implementing a single-chip multi-screen architecture: one is hardware partitioning, and the other is hypervisor. The main difference between them is whether hardware resources are shared.

Hardware partitioning divides and manages the memory area, peripheral devices, pins, and other hardware resources of the SoC chip through hardware partitions. Each partition has access and management functions for its respective resources, and hardware resources cannot be shared between partitions. The intelligent cockpit solution represented by NXP i.MX 8QM chips is based on hardware partitioning.

Within the chip, hardware partitions are established for the instrument and entertainment systems, allocating multi-core CPUs and other hardware resources to their respective partitions according to operating system requirements. Ultimately, the Linux system runs in the instrument partition, while the Android system runs in the entertainment system partition. Hardware partitioning simplifies hardware resource allocation and management, providing great convenience for software development.

The hypervisor is an intermediate software layer that runs between hardware devices and operating systems, allowing multiple operating systems to share hardware resources. In a virtualized environment, the hypervisor can schedule CPU cores, external devices, memory areas, and other hardware resources and allocate different resources to each virtual machine.

Under the coordination and control of the hypervisor, multiple operating systems achieve resource sharing at the hardware level while maintaining independence and non-interference at the software level. Even if one operating system experiences a software failure or crash, other operating systems can continue to operate normally.

The shipment of large-sized automotive display screens has surged, becoming a unanimous choice among brand automotive manufacturers. In Q3 2020, the shipment of 12.3-inch automotive display screens accounted for 32.7% of the overall market, while the market share of 10.2-inch display screens reached 20.2%. The market share of screens larger than 10 inches skyrocketed from 9.1% in Q3 2018 to 52.9%.

The Tesla Model S features a screen size of 17 inches, while the central control screen of the flagship Mercedes-Benz EQS reaches 17.7 inches. Large screens have become a unanimous choice among brand automotive manufacturers. Due to space constraints within the vehicle, the trend towards large screens necessitates higher requirements for the plasticity (flexibility) and curvature design of automotive display panels, making technologies like AMOLED and Mini LED more likely to further increase their market share.

Due to limited space on the console, the trend towards large screens in automotive display screens has also spurred the demand for integrated screens: Instrument display screens, central control display screens, and front-row entertainment display screens are trending towards being merged into one large screen, concentrating all button functions on a single automotive display screen, making the interior layout of the vehicle simpler and more aesthetically pleasing, and making operation easier for the driver. Manufacturers such as Mercedes-Benz and Li Auto have already integrated these elements into their newly launched models, merging the instrument panel and central control into one large screen. It is foreseeable that the front-row display screens of future vehicles will tend towards a “T” shape structure, with an integrated central control display extending from the driver’s seat to the passenger seat, providing users with a more convenient driving and riding experience.

The application of new display technologies is catalyzing the trend towards high-definition automotive display screens. Against the backdrop of rising numbers of display screens per vehicle, the quality of the display screens themselves will become a key focus for vehicle manufacturers. The native contrast specifications of traditional LCD panels are difficult to enhance, generally falling around 1000:1, with a maximum of only 5000:1, making it challenging to meet the existing high contrast, HDR, and other display effect requirements for automotive display screens.

In contrast, OLED and Mini LED technologies offer revolutionary improvements in display quality due to their inherent technical characteristics. Although the mainstream automotive display technology in the market is still a-Si TFT LCD, advanced display technologies such as LTPS TFT LCD, OLED, Mini LED backlighting, and Micro LED are gradually penetrating the market.

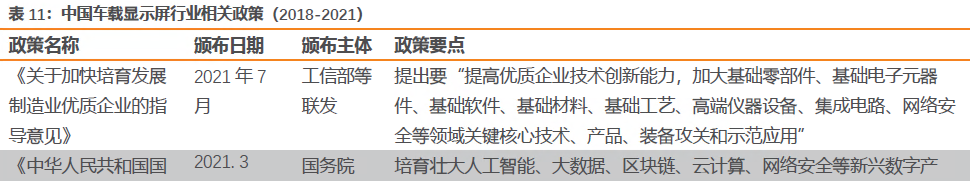

Currently, the Chinese government and various local governments have successively introduced multiple policies to provide support in upstream equipment, raw materials, and component technologies, as well as tax incentives, to promote the development and breakthroughs in new display technologies, enhancing the technological innovation capabilities of high-quality electronic display enterprises and gradually breaking free from the technological monopoly of international companies.