For more report resources, please add WeChat (gasgoo2019) for consultation

As the attributes of automobiles evolve from mere transportation to a “third living space,” in-vehicle infotainment systems have transformed from simple radios and Bluetooth phones to comprehensive platforms integrating multiple functional modules such as audio, video, navigation, communication, ADAS driving assistance, body control, and human-computer interaction, becoming a crucial part of the smart cockpit.

The Gasgoo Automotive Research Institute conducts research and analysis on the in-vehicle infotainment system industry from four dimensions: industry overview, market analysis, technological innovation and development outlook, key manufacturers. The main content of this report is as follows:

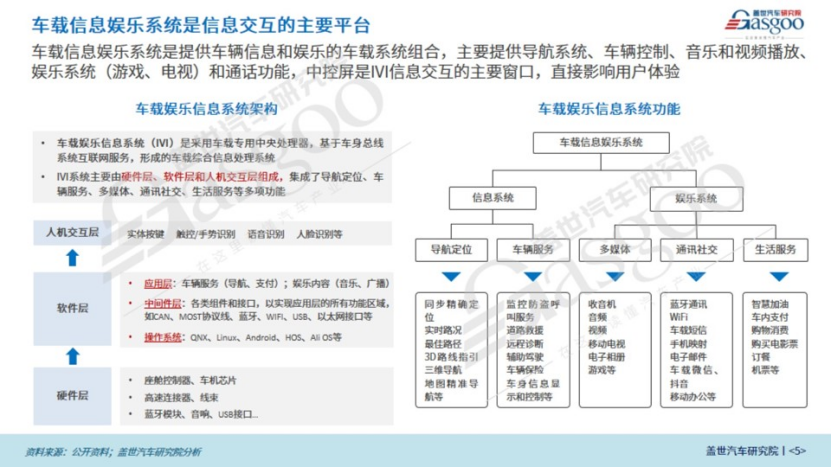

The in-vehicle infotainment system (IVI) is a comprehensive information processing system that uses a dedicated in-vehicle central processing unit, based on the vehicle body bus system and internet services, including in-vehicle information systems and entertainment systems. Its functions mainly include navigation, vehicle services, multimedia, communication, and lifestyle services, making it an essential part of cabin electronics.

The in-vehicle infotainment system mainly consists of hardware, software, and human-computer interaction layers, and its industrial chain is quite complex, involving hardware, software, services, and other fields.

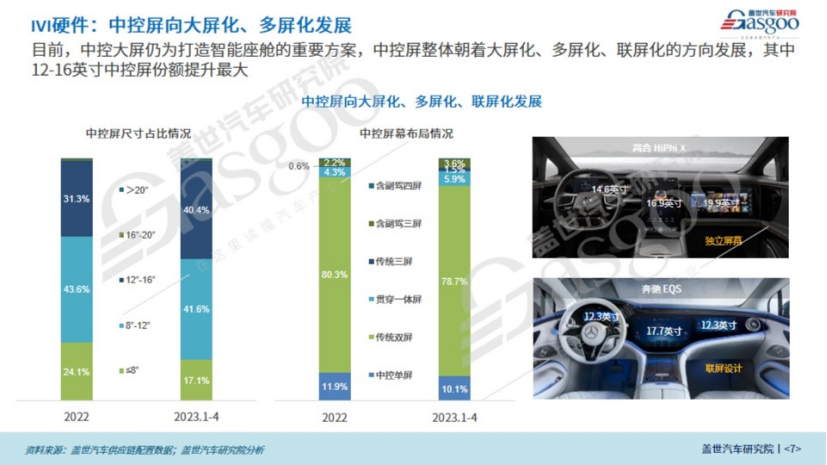

On the hardware side, the central control screen is the primary information interaction window and remains a crucial solution for creating a smart cockpit. The trend is towards larger, multi-screen, and interconnected displays, with the largest increase in the share of 12-16 inch central control screens. Meanwhile, as the entertainment aspect of the cabin increases, the passenger screen has become an important expansion direction for the central display.

As user demands for display screen quality increase, the resolution, color reproduction, and contrast of in-vehicle central screens are also continuously improving, with a clear trend towards high definition. Currently, in-vehicle display panels mainly use TFT-LCD technology, which has advantages such as wide applicability, low cost, and mature technology. OLED and MiniLED solutions are gradually being applied to high-end models.

The central control chip is the core hardware that determines the performance of the in-vehicle infotainment system, with high computing power, miniaturization, and low power consumption being the future development direction. Currently, there are relatively many players in the central control chip market, with traditional chip giants NXP, TI, and Renesas still occupying the leading market positions. Domestic manufacturers like Huawei, Horizon Robotics, Allwinner Technology, and YikaTong have achieved large-scale production and rapid development. In the “one chip, multiple screens” smart cockpit solution, Qualcomm is nearly monopolizing the market due to its rich product line and excellent product performance.

On the software side, the mainstream IVI software architecture currently consists of a lower-level operating system, middleware, and functional application software, supplemented by OTA to enhance the core value and potential of the software. Traditional Tier 1 suppliers mainly cover three areas: customized operating systems, SDKs, and BSPs. In the future, BSP will still be the foundation for traditional Tier 1 suppliers, but OEMs will compete for the customized operating system and SDK business to facilitate subsequent OTA upgrades and the self-development of applications that involve core user experiences.

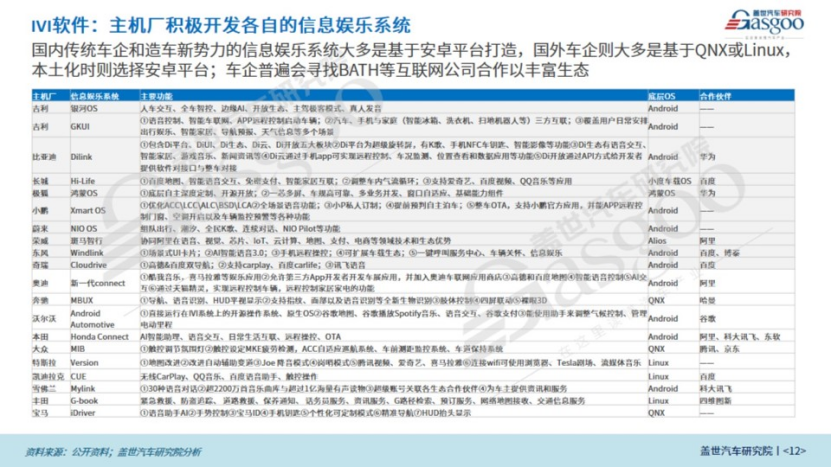

In the development of in-vehicle IVI systems, most domestic traditional automakers and new car manufacturers build on the Android platform, while foreign automakers mainly use the QNX or Linux platforms. During localization, they often choose the Android platform; automakers generally prefer to collaborate with internet companies like BATH to enrich their in-vehicle content and ecosystem, with domestic automotive systems and service ecosystems relatively advanced.

On the market side, in-vehicle infotainment systems have basically become standard in new cars, and the market is expected to maintain steady growth, with the overall market size of IVI in China projected to reach 52.78 billion yuan by 2027. In terms of competition, the IVI industry is currently relatively fragmented, with intense competition, and independent suppliers’ strength is gradually increasing, having successfully achieved domestic substitution. Desay SV has already ranked first in the domestic market share.

Human-computer interaction is a key development focus for in-vehicle infotainment systems. Human-computer interaction includes various methods such as buttons, touch, gesture operation, voice control, and biometrics, with voice interaction gradually becoming mainstream. Driven by AI large models, smart cockpit voice assistants are upgrading to “AI Smart Housekeeper,” and future human-computer interaction will show trends towards multimodal and proactive interactions, providing users with personalized, emotional, and contextual experiences.

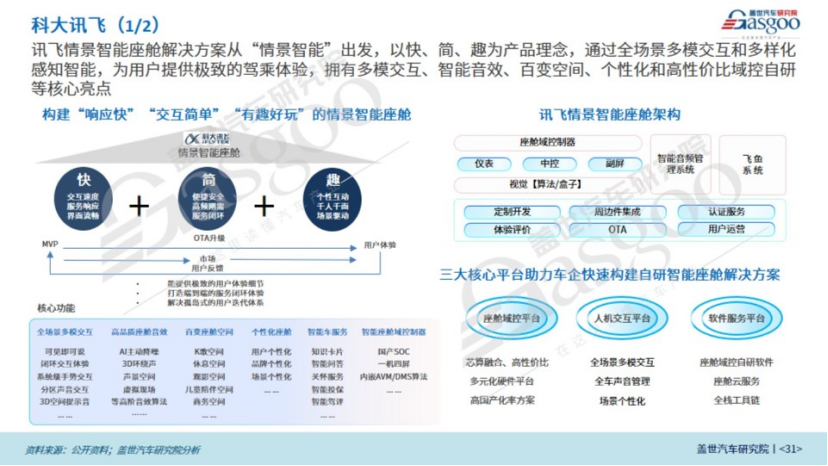

iFLYTEK’s scenario-based intelligent cockpit solution starts from “scenario intelligence,” with speed, simplicity, and fun as the product philosophy. It provides users with an ultimate driving experience through comprehensive scene-based multimodal interaction and diversified perception intelligence, featuring multimodal interaction, intelligent sound effects, versatile space, personalization, and high-cost performance domain control.

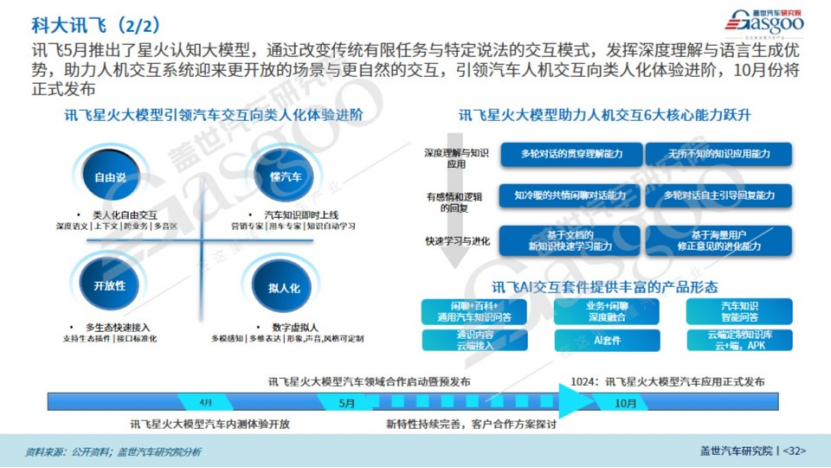

In May 2023, iFLYTEK launched the Spark cognitive large model, which changes the traditional limited task and specific expression interaction model, leveraging deep understanding and language generation advantages to help human-computer interaction systems embrace more open scenarios and more natural interactions, leading automotive human-computer interaction towards a more human-like experience, which will be officially released in October.

In addition to voice interaction, technological innovations in in-vehicle infotainment systems will also involve areas such as in-car digital displays and multi-device interconnectivity. With the continuous development of technologies like smart surfaces, window displays, and holographic projections, future display products will break physical limitations and appear in any area of the vehicle’s cabin, making human-computer interaction interfaces ubiquitous. Furthermore, driven by mobile internet technologies, devices such as in-car systems, smartphones, and laptops can interconnect, creating an ecological closed loop of human-vehicle-life-work, providing users with better software fluidity and human-computer interaction experiences, achieving seamless transitions across multiple scenarios.

/ Get the complete report /

Welcome to scan and order

Annual service of Gasgoo Automotive Research Institute

More Industry Reports Recommended

Click the themes below to view report details

|

Smart Connected |

|

|

1 |

In-Vehicle Voice Interaction System Industry Report (2023 Edition) |

|

2 |

In-Vehicle Display Technology Industry Report (2023 Edition) |

|

3 |

Automotive Industry ChatGPT Technology Application Outlook (2023 Edition) |

|

4 |

In-Vehicle Acoustic System Industry Report (2023 Edition) |

|

5 |

Cockpit Monitoring Industry Report (2023 Edition) |

|

6 |

Automotive Ambient Lighting Industry Report (2023 Edition) |

|

7 |

Flying Car Industry Report (2023 Edition) |

|

8 |

High-Precision Map Industry Report (2022 Edition) |

|

9 |

Smart Car OTA Industry Report (2022 Edition) |

|

10 |

Automotive Cybersecurity Research Report (2022 Edition) |

|

11 |

Smart Driving Sensor Industry Report (2022 Edition) |

|

12 |

Automotive Lighting Industry Report (2022 Edition) |

|

13 |

In-Vehicle Operating System Industry Report (2022 Edition) |

|

14 |

Automotive LCD Instrument Industry Report (2022 Edition) |

|

15 |

Automotive Basic Software Industry Report (2022 Edition) |

|

16 |

In-Vehicle Voice Interaction Industry Report (2022 Edition) |

|

17 |

In-Vehicle HUD Industry Report (2022 Edition) |

|

18 |

In-Vehicle Camera Industry Report (2022 Edition) |

|

19 |

Smart Car Domain Controller Industry Report (2022 Edition) |

|

20 |

Smart Car Cloud Service Industry Report (2022 Edition) |

|

21 |

Automotive Grade Chip Industry Report (2022 Edition) |

|

22 |

ADAS Industry Report (2022 Edition) |

|

23 |

V2X Industry Report (2022 Edition) |

|

24 |

Smart Cockpit Industry Report (2022 Edition) |

|

25 |

Human-Machine Co-Driving Era HMI Development Trends (2022 Edition) |

|

Autonomous Driving |

|

|

1 |

Smart Driving Operating System Industry Report (2023 Edition) |

|

2 |

In-Vehicle LiDAR Industry Report (2023 Edition) |

|

3 |

In-Vehicle Millimeter-Wave Radar Industry Report (2023 Edition) |

|

4 |

Integrated Domain Controller Industry Report (2023 Edition) |

|

5 |

Automotive Electronic and Electrical Architecture Report (2023 Edition) |

|

6 |

Trunk Logistics Autonomous Driving Industry Report (2023 Edition) |

|

7 |

Pilot Assist Driving Industry Report (2023 Edition) |

|

8 |

Smart Auxiliary Driving Trend Outlook (2023 Edition) |

|

9 |

High-Precision Map Industry Report (2022 Edition) |

|

10 |

In-Vehicle Computing Platform Industry Report (2022 Edition) |

|

11 |

Smart Parking Industry Report (2022 Edition) |

|

12 |

Comparison Report of Mainstream Automotive Grade Chip Enterprises (2022 Edition) |

|

13 |

Autonomous Driving Industry Research Report (2022 Edition) |

|

14 |

Smart Car Line Control Chassis Industry Report (2022 Edition) |

|

New Energy |

|

|

1 |

Body Integration Die Casting Industry Report (2023 Edition) |

|

2 |

New Energy Vehicle Thermal Management Industry Report (2023 Edition) |

|

3 |

New Energy Vehicle Onboard Power Supply Research Report (2023 Edition) |

|

4 |

Passenger Car Electrification Supply Chain Status and Outlook (2023 Edition) |

|

5 |

Sodium-Ion Battery Industry Report (2023 Edition) |

|

6 |

Hydrogen Fuel Cell Industry Report (2022 Edition) |

|

7 |

Power Battery Recycling Industry Report (2022 Edition) |

|

8 |

Power Battery Safety Industry Report (2022 Edition) |

|

9 |

Electric Drive System Technology Trend Outlook (2022 Edition) |

|

10 |

Solid-State Battery Industry Report (2022 Edition) |

|

11 |

Hybrid Power Technology Industry Research Report (2022 Edition) |

|

12 |

New Energy Vehicle Charging and Swapping Industry Report (2022 Edition) |

|

13 |

Power Battery Industry Report (2022 Edition) |

|

14 |

New Energy Vehicle Air Conditioning Thermal Management System Industry Report (2022 Edition) |

|

15 |

Research on Electrification of Passenger Car Powertrains in China (2022 Edition) |

|

Market Analysis |

|

|

1 |

Passenger Car Electrification Supply Chain Status and Outlook (2023 Edition) |

|

2 |

Research and Successful Practices of Chinese Automotive and Parts Overseas Markets |

|

3 |

2023 Outlook for the Chinese Passenger Car Market |

|

4 |

Analysis and Outlook of the Domestic New Energy Vehicle Market (2022 Edition) |

|

5 |

Impact Assessment of Domestic Epidemic on Automotive Industry Development |

|

6 |

Analysis of the Impact of the Russia-Ukraine Situation on the Chinese Automotive Industry |

|

Others |

|

|

1 |

Carbon Neutrality Actions and Thoughts in the Automotive Industry (2022 Edition) |

Gasgoo Automotive Research Institute Monthly Newsletter/Intelligence

Gasgoo Automotive Study Society

Contact Consultation

Phone: 021-39586121

WeChat: gasgoo2019

If you like this article, please give me a thumbs up