Skip to content

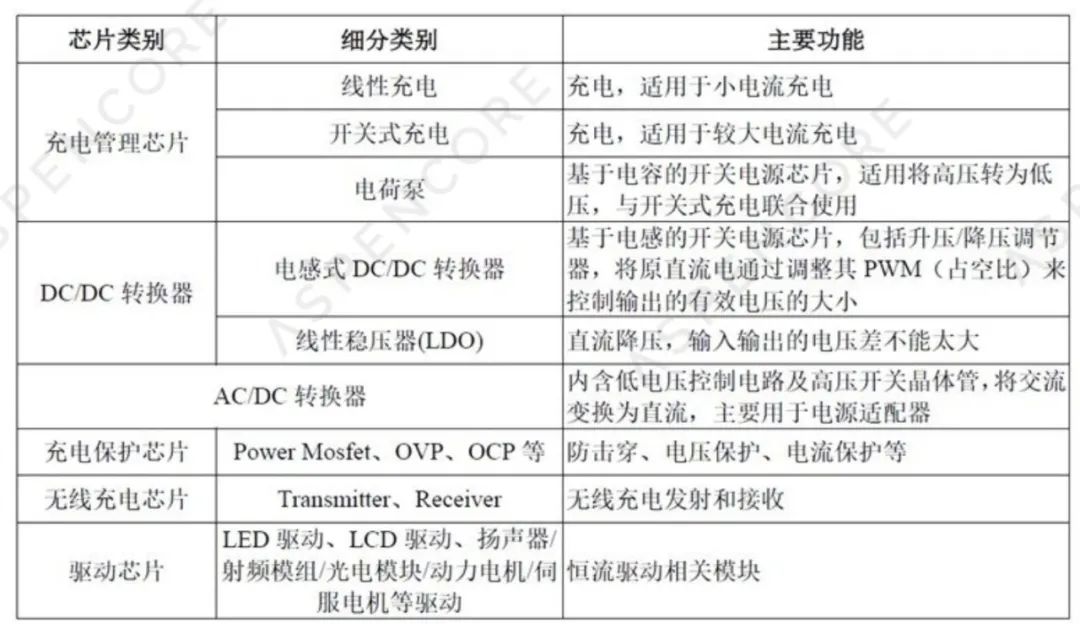

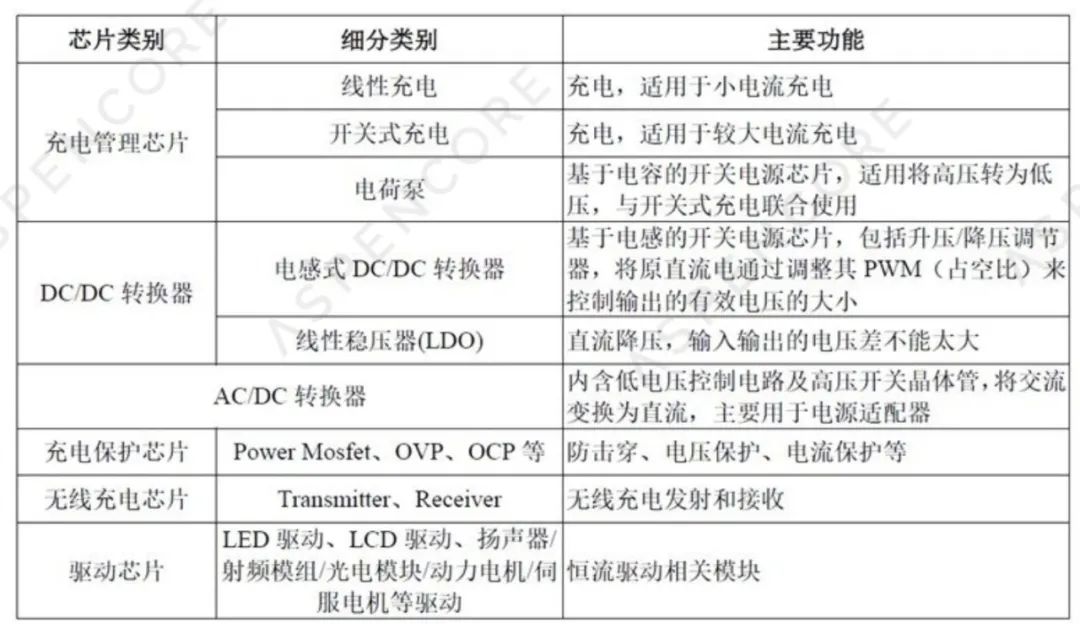

Chips can generally be divided into two major categories: analog and digital chips. Among them, analog chips include analog signal chains, mixed-signal chips, power devices, RF devices, and sensors. Power devices are further divided into Power Management Integrated Circuits (PMICs) and power devices. The technologies and application areas involved in PMICs include AC-DC and DC-DC conversion, linear voltage regulation (LDO), charging management and protection, wireless charging, LED lighting driving, and various output drivers (LED/LCD display drivers, audio drivers, motor drivers, optoelectronic drivers), etc.

As part of AspenCore’s Fabless100 series industry analysis reports, the PMIC report focuses on the technologies and applications involved in PMICs, as well as relevant domestic PMIC manufacturers. This report is roughly divided into the following sections:

Chips can generally be divided into two major categories: analog and digital chips. Among them, analog chips include analog signal chains, mixed-signal chips, power devices, RF devices, and sensors. Power devices are further divided into Power Management Integrated Circuits (PMICs) and power devices. The technologies and application areas involved in PMICs include AC-DC and DC-DC conversion, linear voltage regulation (LDO), charging management and protection, wireless charging, LED lighting driving, and various output drivers (LED/LCD display drivers, audio drivers, motor drivers, optoelectronic drivers), etc.

As part of AspenCore’s Fabless100 series industry analysis reports, the PMIC report focuses on the technologies and applications involved in PMICs, as well as relevant domestic PMIC manufacturers. This report is roughly divided into the following sections:

-

PMIC Basics – Basic classification, technology, and applications of power management chips

-

PMIC Technology Trends – Latest technology trends in the power management field, involving energy storage, BMS, GaN, display driving, and wireless charging

-

Main Application Markets for PMICs – Six major application markets including consumer electronics, computing and communication networks, industrial control, automotive electronics, medical, and IoT

-

Fabless 100 Rankings of PMIC Top 10 – The latest ranking of the top 10 domestic power management chip manufacturers published in 2023

-

Summary of Detailed Information on 50 Domestic PMIC Manufacturers – Basic information summary of the top 50 domestic PMIC manufacturers, as well as each company’s core technologies, main products, key applications, and market competitiveness

-

Power supply is an essential function for all electronic products and devices. Efficient conversion and safe, stable operation are the requirements for all power management chips and power devices. Power Management Integrated Circuits (PMICs) typically include AC-DC converters, DC-DC converters, charging management and protection chips, wireless charging devices, as well as display drivers and LED lighting drivers. Power devices include MOSFETs, IGBTs, various discrete power devices, as well as emerging GaN (Gallium Nitride) and SiC (Silicon Carbide) devices.

This report only covers the category of Power Management Integrated Circuits (PMICs). For industry analysis related to power devices, please refer to: Research and Analysis Report on 30 Domestic Power Device and Third-Generation Semiconductor Manufacturers.

Classification of Power Management Chips and Corresponding Functions

PMIC wafer manufacturing generally adopts relatively mature process technologies, while some use specialized processes. The technological innovation of PMICs mainly comes from chip design and features and functions tailored for specific applications. Currently, popular technology trends in the power management field include: outdoor energy storage power supplies, battery management systems (BMS), GaN fast charging, AMOLED display driving, and wireless charging.

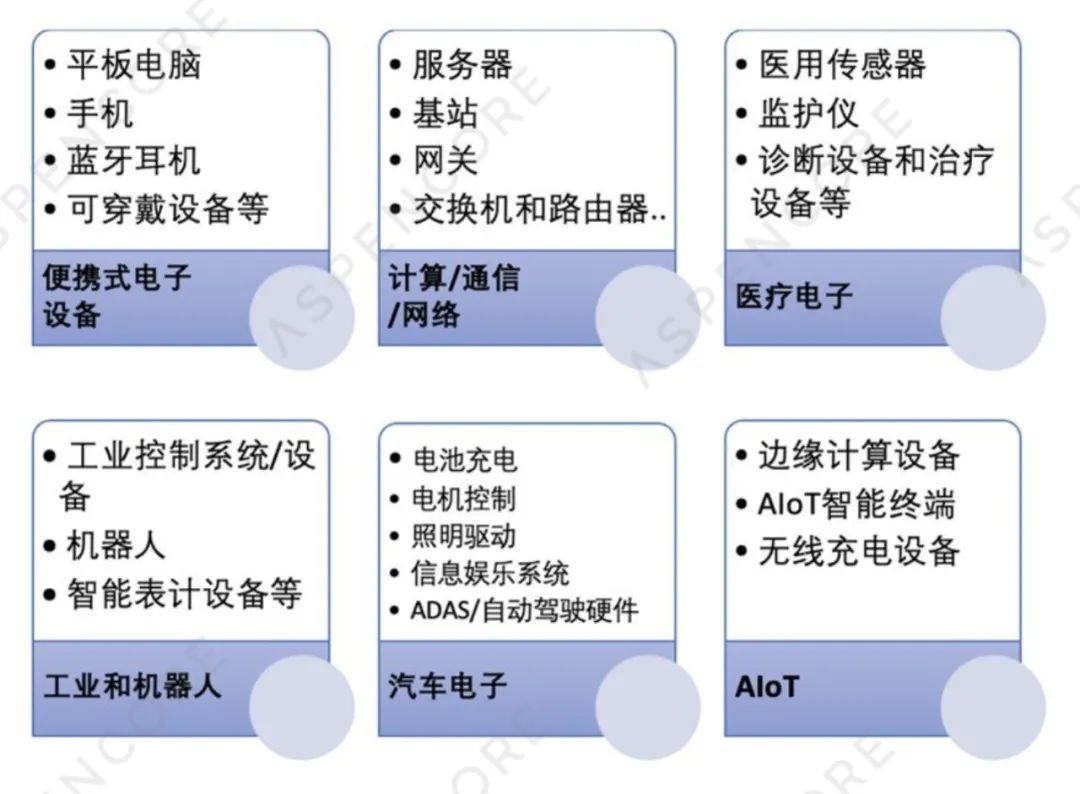

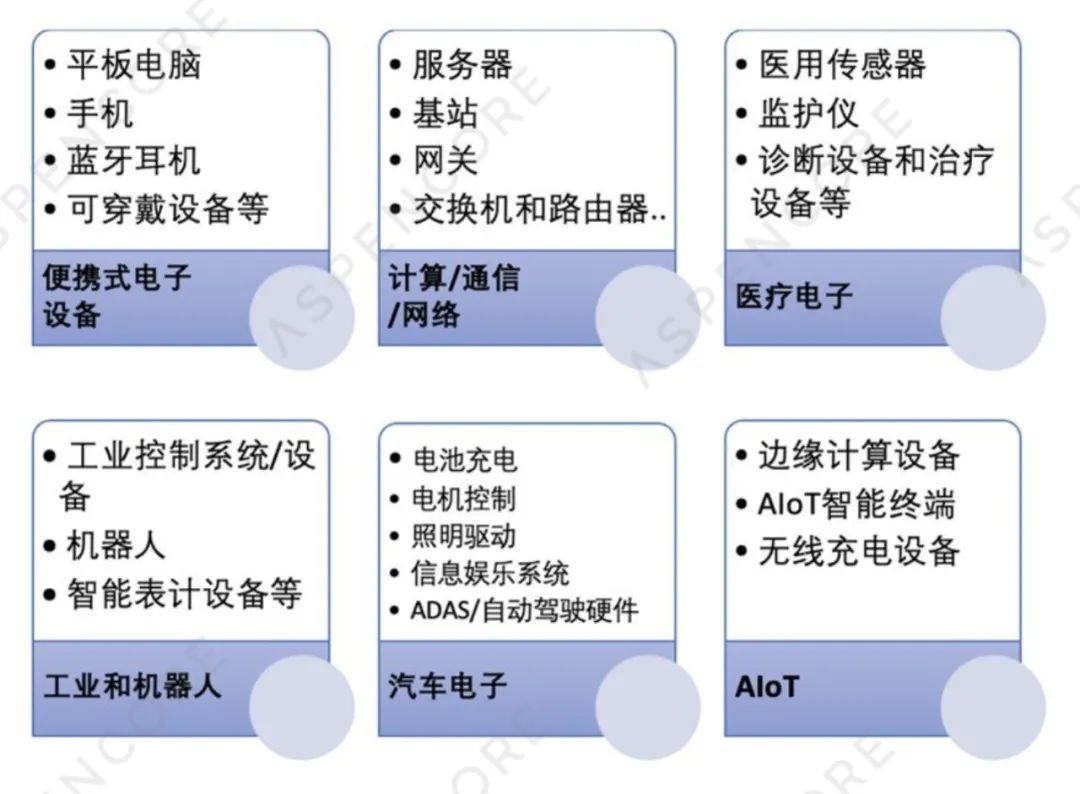

Power management chips are generic devices with a rich range of application scenarios, covering consumer electronics and portable devices, computing communication networks, industrial control and robotics, automotive electronics, medical devices, and the Internet of Things, among others. Different applications have varying performance requirements for power management chips, with automotive and industrial applications demanding higher stability and quality; while consumer electronics products have relatively lower requirements but are more sensitive to price. For example, in smartphones, the internal power management chips and modules have high requirements for size, stability, and consistency, resulting in high technical barriers. Additionally, the supply chain threshold for smartphone manufacturers is also very high.

Due to space constraints, this section only lists an overview of each technology trend. For those who wish to read the complete report, please: obtain the complete PDF report for free by scanning the QR code below to submit your application.

1. Outdoor Energy Storage Power Supply: Integration of Inversion, Battery Management, and DC Module Output

Outdoor power supplies (PPS, Portable Power Station) are multifunctional portable energy storage power supplies with built-in lithium-ion batteries, capable of storing electrical energy and providing AC output. PPS offers advantages such as lightweight, high capacity, high power, multiple input and output types, and ease of portability, suitable for both indoor and outdoor use. In terms of input power supply methods, it can provide conventional AC charging, car charging, or solar charging. The battery capacity of PPS generally ranges from 20Wh to 20KWh, with output power levels mainly between 200W and 8000W, capable of providing high-power AC output of 100-240V and equipped with various DC output modes such as 5V/9V/12V, which can not only start cars in emergencies but also be used for various types of electronic and electrical product loads in emergencies.

2. Battery Management System (BMS): Perfect Integration of Battery Management, Power Management, Analog Front-End, and Microcontroller

Today’s electronic devices, ranging from TWS earbuds and wearables to electric vehicles, rely on lithium-ion or polymer batteries for power. Depending on the power requirements of the electronic device, the battery pack may consist of multiple battery cells arranged together. The charging and discharging, input/output voltage and current, and other states of the battery pack need precise monitoring, measurement, and protection to ensure safe power supply for electronic devices. This requires a specialized battery management system (BMS) to monitor, calculate, communicate, and protect the operational status of the battery pack.

-

Monitoring: The BMS can monitor various state indicators of the battery pack, including voltage (voltage of individual battery cells, total voltage, or specific voltage between the two), temperature (average temperature, temperature of individual cells), input/output current, health status of individual cells, and balancing status of the cells;

-

Calculation: The BMS can calculate the values of many indicators, including voltage (minimum and maximum cell voltage), state of charge (SoC), state of health (SoH), safety state (SOS), maximum charging current (CCL), maximum discharging current (DCL), internal resistance of the cells that determines open circuit voltage, total energy provided, total operating time, temperature monitoring, etc.;

-

Communication: The central controller inside the BMS can communicate with internal hardware and also communicate externally through various methods (such as USB, CAN, or wireless communication protocols);

-

Protection: The BMS can also provide multiple protections for the battery to prevent the battery pack status from exceeding the safe operating area (SOA), such as overcharging/discharging current, overvoltage, overheating, overvoltage, and current leakage, etc.

3. GaN is Becoming the Mainstream Technology for Consumer Fast Charging Products

Compared to traditional silicon-based devices, Gallium Nitride (GaN) has obvious technical advantages in power management, power generation, and power output. At 600V voltage, GaN outperforms silicon in terms of chip area, circuit efficiency, and switching frequency, allowing for thinner and more efficient power product designs. According to Yole’s predictions, the market size of GaN in the consumer sector will reach $964.7 million by 2027, with a compound annual growth rate of 52%. The consumer market will account for 48% of the entire GaN industry, with fast charging products representing the main driving force for GaN applications.

4. The Penetration Rate of AMOLED Display Driver Chips is Steadily Increasing

As smartphones fully transition to OLED screens, tablets, wearables, TVs, and other devices are also increasingly adopting OLED screens. According to a forecast by global market research firm Omdia, the compound annual growth rate of global OLED TV panel shipments is expected to grow from 7.4 million units in 2021 by 14% to 12.7 million units by 2025. The market share of OLED TVs in the high-end TV market is increasing, therefore, this trend is expected to boost the demand for OLED driver chips.

According to TrendForce data, the penetration rate of AMOLED panels for smartphones was 42% in 2021. Despite the ongoing shortage of AMOLED display driver chips, the trend of smartphone brands and OEM manufacturers expanding the use of AMOLED panels in their new models will drive growth in the AMOLED market penetration rate, increasing to 46% in 2022. At the same time, the downstream applications of OLED are gradually expanding from smartphones to wearables, tablets, laptops, and other fields.

5. Wireless Charging Continues to Penetrate Applications in Smartwatches and TWS Earbuds

Wireless charging chips include transmitter chips (TX) and receiver chips (RX), which connect to the transmitter and receiver inductive coils, respectively. After the transmitter chip communicates with the power adapter to obtain the voltage and power required for wireless charging, it converts the DC voltage into AC energy, and the transmitter coil transmits energy to the receiver coil via magnetic coupling. The receiver chip converts the AC energy from the receiver coil into DC energy and outputs a high-precision, programmable DC voltage to power electronic devices. During the wireless energy transmission process, the transmitter chip and receiver chip communicate via FSK and ASK in-band communication methods to perform energy regulation, protocol authentication, foreign object detection, and other operations for wireless charging.

Main Application Markets for PMICs

The application scenarios for power management chips are very rich, covering numerous fields and involving all aspects of people’s work and life, with vast market space. These applications include, but are not limited to:

Application Scope of Power Management Chips

1. Portable Electronic Devices

The main applications of PMICs in portable electronic devices include:

-

Smartphones: Provide stable operating voltages for various components in smartphones, such as 1.8V, 3.3V; manage battery charging and discharging and display remaining power; realize fast charging and wireless charging functions; provide protections such as overcurrent, overvoltage, and overtemperature.

-

Tablets: Provide stable power for CPU, memory, display, etc.; manage battery power and realize multiple charging methods; ensure stable system power supply.

-

Bluetooth Earbuds: Provide working voltages for Bluetooth chips, DACs, amplifiers, etc.; manage battery power and alert for low battery; enable fast charging.

-

Smartwatches: Provide power for chips, displays, sensors, etc.; manage battery power; enable wireless charging; also provide power protection functions.

-

Other Wearable Devices: Miniaturization and low power consumption design are very important. In addition, power management chips can also be applied to digital cameras, portable gaming consoles, navigation devices, and other products.

2. Computing/Communication/Networking

PMICs have very broad applications in the computing/communication/networking fields:

-

Servers: Provide high-power and highly reliable power for CPUs, memory, disks, etc.; monitor power status and provide reports and alarms; require consideration of heat dissipation design and high-density integration.

-

Routers and Switches: Provide low-noise power for network chips, optical modules, interfaces, etc.; power range from a few volts to hundreds of volts; require high reliability.

-

Base Stations: Provide high-power power for RF amplifiers, antennas, analog-to-digital converters, etc.; output voltage can reach thousands of volts; need to consider efficiency, wide input and output ranges, and adaptability to harsh environments.

-

Client Devices: Provide several volts of power for WiFi/Bluetooth chips, network controllers, etc.; require ultra-low standby power design; some products also integrate battery management functions.

-

Display Terminals: Provide operating voltage for signal processors, display panel controllers, speakers, etc.; also need to manage batteries; need to consider low power mode design.

VoIP gateways, network cameras, etc. In the computing, communication, and networking fields, power management chips play a very critical role, providing high power, high efficiency, and high stability power for various electronic components to support large-capacity computing and massive data processing. These applications have high requirements for the reliability, efficiency, and intelligence of power management. As technologies such as 5G, cloud computing, and artificial intelligence evolve, these demands will further increase.

PMICs have the following main applications in the medical electronics field:

-

Medical Sensors: Provide operating voltages for various sensors such as blood oxygen, ECG, and blood glucose, requiring low power consumption and high precision.

-

Monitors: Provide isolated power for ECG, EEG, blood pressure monitors, requiring high reliability, low noise, and low power consumption design. Usually integrated within the sensor for compact size.

-

Diagnostic Equipment: Provide high-power power for imaging scanners, blood analyzers, etc., requiring wide input and output ranges and comprehensive protection functions.

-

Treatment Equipment: Provide precision waveform voltage for high-frequency surgical equipment, laser therapy devices, etc., requiring high reliability and excellent output performance design.

-

Others: Diagnostic equipment, ventilators, medical displays, etc.

Power management ICs provide high precision, low noise, and highly reliable power for various precision medical devices, ensuring personal safety and medical quality. In the future, as the industry moves towards smaller, more precise, and smarter directions, power management technology will trend towards higher integration and stronger stability, aiding the overall upgrade of the medical electronics industry. Additionally, the healthcare industry will widely adopt more precise, intelligent, and wearable electronic devices, which will drive power management technology to achieve higher levels of integration, performance, and reliability.

4. Industrial and Robotics

The main applications of PMICs in the industrial and robotics fields include:

-

Industrial Control Systems: Provide operating voltage for PLC controllers, sensors, and actuators; power range is wide, from a few volts to thousands of volts; require high reliability and anti-interference design; some applications work in harsh industrial environments, requiring high temperature and waterproof designs.

-

Machine Vision Systems: Provide low-noise and highly stable power for image sensors, signal amplifiers, FPGA/DSP, etc.; need to manage power rails of different voltages, requiring high reliability to ensure continuous system operation.

-

Industrial Motor Drives: Provide driving power for IGBTs, MOSFETs, encoders, etc.; output power and voltage range is wide; need to provide protections such as overcurrent, overtemperature, and disconnection; EMI design and anti-interference performance are also very important.

-

Industrial Lasers: Provide high-stability DC and waveform voltage for laser diodes, PCBs, etc.; output voltage can reach thousands of volts, requiring wide input/output ranges, high reliability, and overheat protection design.

-

Industrial Robots: Provide multiple different operating voltages for control systems, drive systems, and various sensors; also need to manage large-capacity battery packs as backup power systems. Require highly integrated and reliable designs.

-

Smart Meters: Such as smart electricity meters, water meters/gas meters, smart water quality monitoring devices, smart parking meters, etc. In these applications, PMICs provide efficient and continuous power for various sensors and microcontrollers; while monitoring and managing backup power in ultra-low power mode to ensure long-term continuous operation of the devices.

-

Other Devices: Such as industrial printers, vending machines, and various industrial and robotic products.

PMICs provide high power and high reliability for various electronic components in the industrial and robotics fields to drive complex mechanical systems and industrial processes. These applications have high requirements for the stability, performance, and safety of power management. With the development of Industry 4.0 and robotics technology, power management technology will greatly enhance the intelligence, performance, and integration of systems, driving the entire industry to achieve higher levels of automated production and efficiency.

5. Automotive Electronics

The applications of PMICs in automotive electronics include:

-

In-Vehicle Infotainment Systems: Provide working voltage for DSPs, displays, audio amplifiers, etc.; manage batteries; design needs to consider startup endurance, standby power consumption, and anti-interference and high-temperature performance.

-

Body Control Modules: Provide stable power for various sensors, actuators, MCUs, etc.; PMICs directly connect to the on-board battery, with a wide output voltage range; need to provide protections against overcurrent, overvoltage, short-circuit, and high temperature to achieve high reliability design.

-

ADAS Systems: Provide low-noise power for radars, cameras, image signal processors, etc.; have high PSRR and low ripple requirements; need to consider low EMI, anti-interference design, and high reliability to ensure safety.

-

Electric Vehicle Controllers: Provide high-power power for motors, inverters, DC-DC, etc.; need to manage high-voltage battery packs; should provide protections against overcurrent, overvoltage, overtemperature, and disconnection; also need to provide high reliability design to ensure driving safety.

-

Advanced Lighting Systems: Provide power for LED drivers, sensors, etc.; directly connect to the on-board power supply, with output voltage up to hundreds of volts; require wide input voltage range and high energy conversion efficiency, while considering low EMI and anti-interference design.

-

Start/Stop Systems: Manage engine start/stop processes; need to decide whether to shut down the engine based on battery power; require ultra-low static current to maximize energy savings; require high integration.

In addition, power management chips are also used in systems such as ABS, cruise control, and electric power steering. PMICs enhance the intelligence, comfort, safety, and environmental friendliness of automobiles. With the development of electric vehicles and autonomous driving technology, power management will become a key factor, with its reliability, efficiency, and high integration becoming increasingly important.

The main applications of power management chips in the AIoT field include:

-

Edge Computing Devices: Provide high power and highly reliable power for SoCs, memory, and various interfaces; while achieving thermal management and fault detection. Require highly integrated and low-cost design, while reducing overall system power consumption. Typical applications include gateways, micro base stations, smart routers, etc.

-

AIoT Smart Terminals: Provide working voltage for MCUs, various sensors, and communication modules; while managing rechargeable batteries; require ultra-low power and highly integrated design to achieve ultra-long standby, energy harvesting, and extend battery life. Typical applications include smart homes, wearable devices, smart monitoring, etc.

-

Wireless Charging Devices: Provide efficient wireless power transmission for transmitters and receivers, while detecting charging status and protecting powered devices; design needs to consider low EMI and heat management, etc. Typical applications include wireless charging docks and wireless charging for wearable devices.

From the perspective of application scenarios, PMICs can be applied in the following fields:

-

Smart Homes: Provide working voltage for WiFi/BT modules, MCUs, various sensors; mostly integrate battery management functions; require ultra-low power and small size design; such as smart sockets, lighting, door locks, smart appliances, etc.

-

Smart Wearables: Provide power for main control MCUs, sensors, communication modules; while managing charging batteries; require ultra-miniature and low-power designs, such as smartwatches, smart bands, smart glasses, etc.

-

Smart Cities: Provide power for various sensors, image processing modules, communication modules; typically deployed outdoors, requiring waterproofing and wide temperature range considerations, specifically including smart lighting, environmental monitoring, traffic monitoring, etc.

-

Smart Factories: Provide working voltage for PLC controllers, various sensors, and actuators; power is large and range is wide; require high integration, high reliability, and anti-interference design, such as industrial robots, smart AGVs, visual inspection, etc.

-

Smart Agriculture: Provide long-distance wireless power supply or solar power for numerous sensors distributed in fields and greenhouses; require ultra-low power and fault protection design, such as soil monitoring, crop management, etc.

-

Smart Logistics: Provide power for RFID tags, sensors, communication devices; due to wide environmental temperature range and frequent movement, require high reliability, including warehouse management, transport monitoring, smart express cabinets, etc.

-

Smart Vehicle Networks: Provide power for various in-vehicle sensors and V2X modules; while connecting to the vehicle battery. Require isolation and protection circuits as well as high reliability, such as smart navigation, vehicle network payments, etc.

Power management chips play a supporting and driving role in the entire AIoT industry. They provide ultra-low power and highly reliable power for various systems to achieve high levels of intelligence. With the widespread application of 5G and AI technologies, PMICs will become a strong driver in the era of Internet of Things.

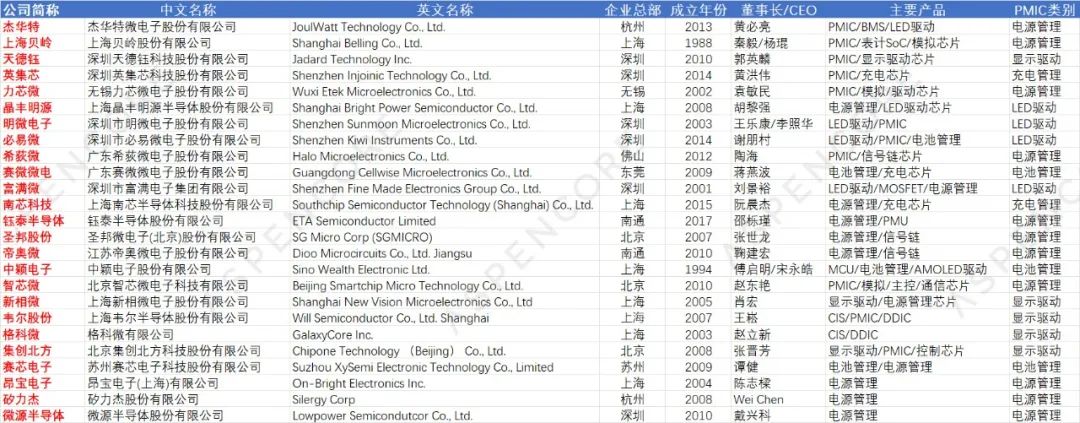

Fabless 100 Rankings of PMIC Top 10

The top 10 power management chip (PMIC) companies selected for the 2023 China IC Design Fabless 100 Rankings

Basic information of the selected companies is shown in the figure below:

For more information on the China IC Design Fabless 100 Rankings, please visit: Detailed Interpretation of the 2023 China IC Design Fabless 100 Rankings Report.

Detailed Information on 50 Domestic PMIC Manufacturers

1. Summary of Basic Information of 50 Domestic PMIC Manufacturers

Statistics on PMIC manufacturers:

-

Listed Companies: 19 listed companies, including: Jiewa Technology, Shanghai Beiling, Tiande Yu, Yinjixin, Lixinwei, Jingfeng Mingyuan, Mingwei Electronics, BiYi Micro, Xidi Micro, Saiwei Microelectronics, Fuman Micro, Nanxin Technology, Yutai Semiconductor, Shengbang Co., Ltd., Diaowei, Zhongying Electronics, Weier Shares, Geke Micro, Nanlin Electronics;

-

Headquarters: 16 in Shenzhen, 11 in Shanghai, 8 in Beijing, 4 in Wuxi, 2 each in Suzhou/Hangzhou/Chengdu/Nantong, and 1 each in Foshan/Zhuhai/Dongguan;

-

PMIC Categories: 25 power management, 9 charging management, 8 display driving, 4 battery management, 4 LED driving.

2. Core Technologies, Main Products, Key Applications, and Market Competitiveness of 50 PMIC Manufacturers

Due to space constraints, this section only lists information on a few listed companies. For those wishing to read the complete report, please: obtain the complete PDF report for free by scanning the QR code below to submit your application.

Core Technology: Ultra-low static current power management chip technology, inductive multi-cell lithium battery balancing management system technology, high voltage low power consumption linear regulator technology, high PSRR low power consumption linear regulator technology

Main Products: DC-DC, AC-DC, LED drivers, battery management, PMICs, interface protection, etc.

Key Applications: Security monitoring, set-top boxes, routers, smart meters, smartphones, smart wearable devices, etc.

Core Technology: High voltage high power synchronous rectification technology

Main Products: Switching DC-DC power chips, medium and high voltage power management chips, AC-DC power management chips

Key Applications: Automotive electronics, industrial control, communication equipment, consumer electronics, and home appliances, etc.

Competitiveness: Major product performance parameters with complete independent intellectual property rights are at the domestic leading level, and some product performance indicators reach or exceed those of internationally renowned manufacturers like TI, ADI.

Core Technology: High-precision battery metering algorithms and implementation technologies

Main Products: Battery charge measurement chips, battery management chips, battery protection chips, BMS front-end acquisition chips, USB charging control chips, etc.

Key Applications: Laptops and tablets, smart wearable devices, power tools, charging products, lightweight electric vehicles, smart appliances, smartphones, drones, etc.

Competitiveness: Linear charging chips are widely adopted by headphone manufacturers such as OPPO.

Core Technology: Digital-analog hybrid SoC integration technology, low power multi-power management technology, high-precision ADC and electric metering technology

Main Products: Power management, fast charging protocol chips, mobile power chips, wireless charging chips, battery management, digital-analog hybrid SoCs

Key Applications: Smartphones, tablets, set-top boxes, IPC, in-vehicle charging, etc.

Core Technology: LED lighting driver control technology, AC-DC adapter control

Main Products: LED lighting driver chips, AC-DC power management chips, motor driver control chips

Key Applications: LED lighting, consumer electronics, home appliances, and IoT power fields

Core Technology: SM-PWM technology, LED grayscale gradient adjustment technology

Main Products: LED display drivers, LED lighting drivers, LED landscape, Mini LED driver chips, power management devices

Key Applications: Indoor and outdoor LED displays, LED lighting, home appliances, mobile terminals, etc.

Core Technology: Accurate current and voltage detection charging management technology, intelligent switching and management technology for complex multi-power systems

Main Products: Power conversion and protection ICs, signal and detection ICs, display and LED driver ICs

Key Applications: Consumer electronics, home appliances, IoT, automotive electronics, network communications, etc.

Core Technology: Multi-mode wireless charging reception technology, low noise analog-to-digital conversion technology

Main Products: Lithium battery fast charging chips, DC/DC chips, super fast charging chips, port protection and signal switching chips, etc.

Key Applications: Smartphones, consumer electronics, automotive electronics

Competitiveness: Entered the supply chains of Huawei, MTK, and Samsung

Core Technology: Low power analog signal chain and power management technology

Main Products: Over 1400 models of high-performance analog IC products across 16 series, including operational amplifiers, comparators, audio/video amplifiers, ADCs, DACs, analog switches, level shifters, logic chips, LDOs, microprocessor power monitoring chips, DC/DC converters, backlight and flash LED drivers, OVP and load switches, motor drivers, MOSFET drivers, battery protection and charge/discharge management chips, etc.

Key Applications: Communication devices, consumer electronics, industrial control, IoT smart devices, wearable devices

Main Customers: General-purpose analog devices are widely used, with many customers

Competitive Advantage: A complete analog signal chain and power management product line

Core Technology: 30W isolated charging pump fast charging technology, MiniLED driver

Main Products: Battery management chips, DC-DC converters, overcurrent protection devices, LED drivers, PMUs

Key Applications: Consumer electronics, industrial applications, computers, communication network devices

Main Customers: Manufacturers of smart TVs, computers, and tablets

Competitive Advantage: Over 1200 PMIC-related patents

Core Technology: Smart lighting driver chip technology

Main Products: LED lighting driver chips, motor control chipsets, AC/DC power chips

Key Applications: LED lighting, motor drive, home appliances, and consumer electronics

Competitive Advantage: Expanded product lines through the acquisition of Nanjing Lingou Chuangxin and Shanghai Xinfeng, enhancing competitiveness in the motor drive and AC/DC power markets.

Power Management Integrated Circuits (PMICs) are generic chips, and the wafer manufacturing process is relatively mature, thus the market entry threshold is relatively low. The industry nature is similar to that of MCUs. Therefore, in this niche of PMICs, there are many domestic IC design manufacturers, and competition is naturally fierce. The AspenCore analyst team selected 50 relatively strong domestic PMIC manufacturers during the research and writing of this report. Inevitably, some manufacturers with considerable competitiveness in certain niche markets may be overlooked. We hope that relevant enterprises and industry professionals will provide valuable suggestions to make this report more comprehensive and in-depth, reflecting the industry status and market competition landscape of domestic PMIC manufacturers more objectively, so as to provide a more objective analysis and decision-making basis for industry professionals.