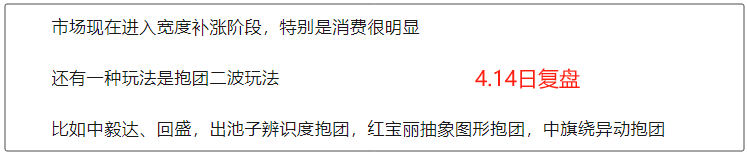

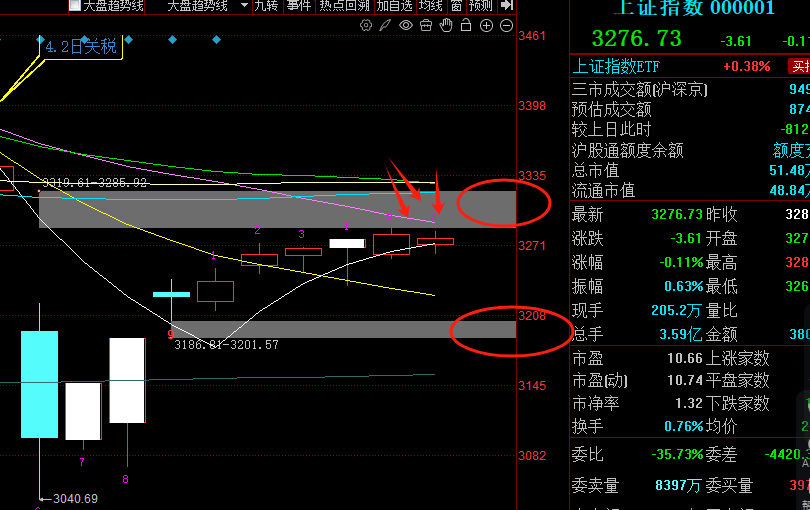

On Friday, the focus of quantitative analysis and the industrial chain was on 5G and real estate, and there is certainly no sustainability in this. One reason is the news from Germany regarding 5G that stimulated the market, and the other is the post-market hype around real estate.For those involved in these two areas on Friday, it’s best to cash out and not be greedy.Here, funds are also starting to explore other directions, as the speculation on the S sector has been ongoing for a long time. The remaining stocks are experiencing some localized rebounds, and there are still some stocks that are being held together. In my review article on April 14, I reminded everyone about the stocks that are being held together. Last week, only those stocks that were held together made some profit, while the rest were really difficult, with daily rotations. Let’s see what new cycles will be speculated on in the future. Everyone should try to explore new things and not cling to the old ones.As for the index, it still hasn’t broken through the 20-day line. It’s uncertain whether those at the top want to fill the gaps above first or the gaps below. It’s all up to those at the top. As long as they pull some weights, the index can be in the green, which is impressive. The poor profit effect doesn’t matter as long as the index is in the green.In summary, be cautious with the index here. The A-share market has its own characteristics; if it doesn’t go up, it will probe downwards.

Let’s see what new cycles will be speculated on in the future. Everyone should try to explore new things and not cling to the old ones.As for the index, it still hasn’t broken through the 20-day line. It’s uncertain whether those at the top want to fill the gaps above first or the gaps below. It’s all up to those at the top. As long as they pull some weights, the index can be in the green, which is impressive. The poor profit effect doesn’t matter as long as the index is in the green.In summary, be cautious with the index here. The A-share market has its own characteristics; if it doesn’t go up, it will probe downwards. I think it’s best to fill the gaps early; there’s no need to waste time. By May, a new cycle can begin, and the performance announcements will be over. The market in May is promising~Finally, let’s talk about the weekend discussions regarding the robot marathon competition. The overall public feedback has been mixed, but I believe we shouldn’t be too harsh. In my view, this competition is more about popular science and entertainment. The control and battery life indeed need improvement. The 20 participating teams do not represent all robot companies. The commercialization of robots mainly brings more convenience in industrial or daily life scenarios. Who would buy a robot just to run a half marathon? If you ask me to run a half marathon, I’d probably run out of battery after 5 kilometers.

I think it’s best to fill the gaps early; there’s no need to waste time. By May, a new cycle can begin, and the performance announcements will be over. The market in May is promising~Finally, let’s talk about the weekend discussions regarding the robot marathon competition. The overall public feedback has been mixed, but I believe we shouldn’t be too harsh. In my view, this competition is more about popular science and entertainment. The control and battery life indeed need improvement. The 20 participating teams do not represent all robot companies. The commercialization of robots mainly brings more convenience in industrial or daily life scenarios. Who would buy a robot just to run a half marathon? If you ask me to run a half marathon, I’d probably run out of battery after 5 kilometers. ST stocks with performance expectations:

ST stocks with performance expectations: