On February 22, ofo signed a cooperation agreement with China Telecom and Huawei for the application of NB-IoT in shared bicycles, providing wireless network solutions including NB-IoT chips. The three parties stated that in the near future, “little yellow bikes” will be able to connect to China Telecom’s wireless network using the latest NB-IoT technology, providing users with a better experience.

On February 22, ofo signed a cooperation agreement with China Telecom and Huawei for the application of NB-IoT in shared bicycles, providing wireless network solutions including NB-IoT chips. The three parties stated that in the near future, “little yellow bikes” will be able to connect to China Telecom’s wireless network using the latest NB-IoT technology, providing users with a better experience.

Why Use NB-IoT? What Changes Will It Bring to Little Yellow Bikes?

As we all know, the main reason shared bicycles are recognized by the market is their convenient usage. The core processes include finding a bike, unlocking it, returning it, and billing, all of which heavily rely on a high-quality wireless network to stably “connect” the bike to the cloud server.

The key challenge behind the “connection” lies in network coverage and the power consumption of electronic locks. This is also a major pain point for shared bicycle companies in developing their businesses. Specifically, on one hand, the current insufficient coverage of cellular networks can lead to a situation where after users lock the bike, the vehicle status cannot be fed back to the cloud, resulting in delays in billing and releasing the vehicle.

On the other hand, electronic locks using traditional communication technologies have high power consumption, forcing bicycles to be equipped with mini-generators to charge the locks through user pedaling, which inevitably affects the user riding experience and increases the probability of malfunctions.

Currently, most shared bicycles outside of ofo use 2G technology, which has issues such as response delays and high power consumption, leading to a poor user experience. The technical characteristics of NB-IoT are precisely designed for such shared scenarios, and this partnership between ofo and Huawei Telecom can be seen as leading the global shared bicycle industry development, even pushing everyone into the Internet of Things (IoT) era ahead of time.

Moreover, the 800MHz low-frequency 4G network used by China Telecom has better penetration, thus providing better network coverage. Through technologies such as discontinuous reception, NB-IoT can significantly reduce the power consumption of terminal devices compared to traditional technologies, allowing “little yellow bikes” to no longer rely on user pedaling for power.

Having discussed the impressive NB-IoT, what exactly is NB-IoT? What other uses does it have? What are its pros and cons? The following article will answer your questions:

Born for IoT: Detailed Interpretation of NB-IoT

NB-IoT, you might think it stands for Niubility Internet of Things? No, no, NB-IoT refers to Narrow Band – Internet of Things technology.

1. Why Did NB-IoT Emerge?

It is predicted that in 2016, there will be 6.4 billion IoT devices globally, with 5.5 million devices connecting to the internet daily. One of the foundations for achieving the “Internet of Everything” is data transmission, and different IoT businesses have varying requirements for data transmission capacity and timeliness.

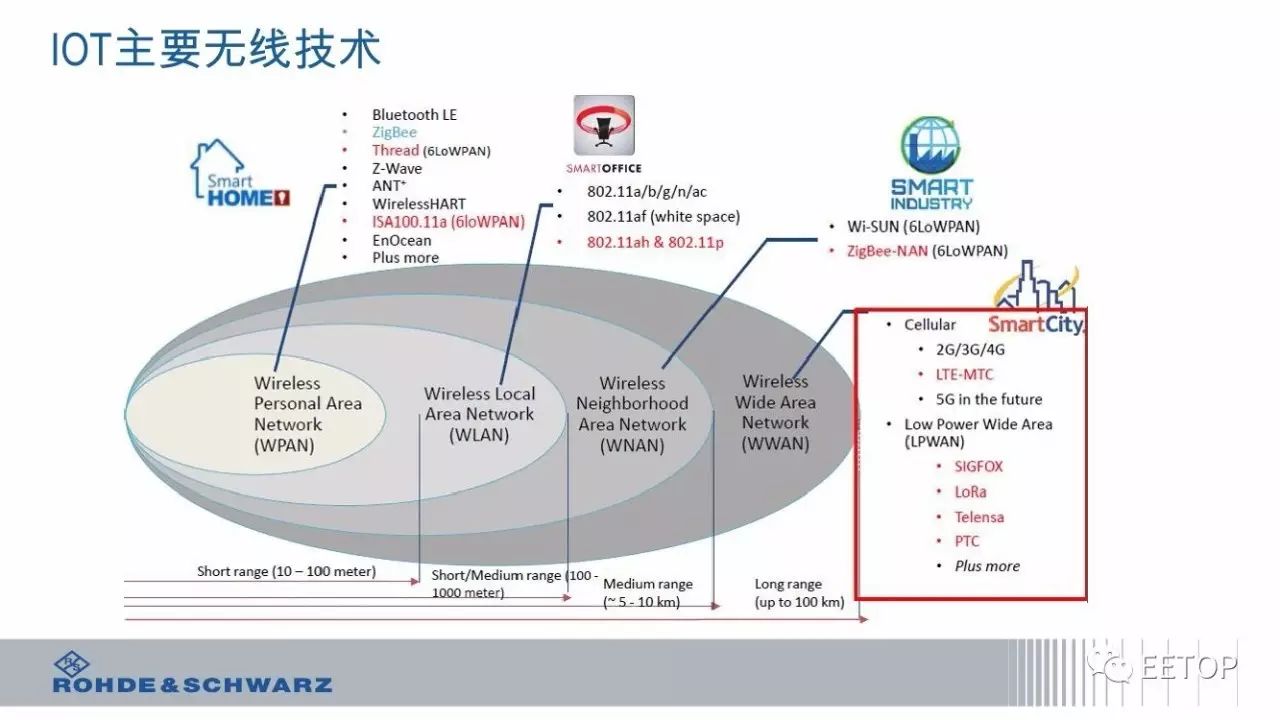

Based on transmission rates, IoT businesses can be classified as high, medium, and low-speed:

• High-speed services: Mainly use 3G and 4G technologies, such as vehicular IoT devices and surveillance cameras, which require real-time data transmission;

• Medium-speed services: Mainly use GPRS technology, such as storage lockers in residential areas or supermarkets, which are frequently used but not in real-time, and have lower requirements for network transmission speed than high-speed services;

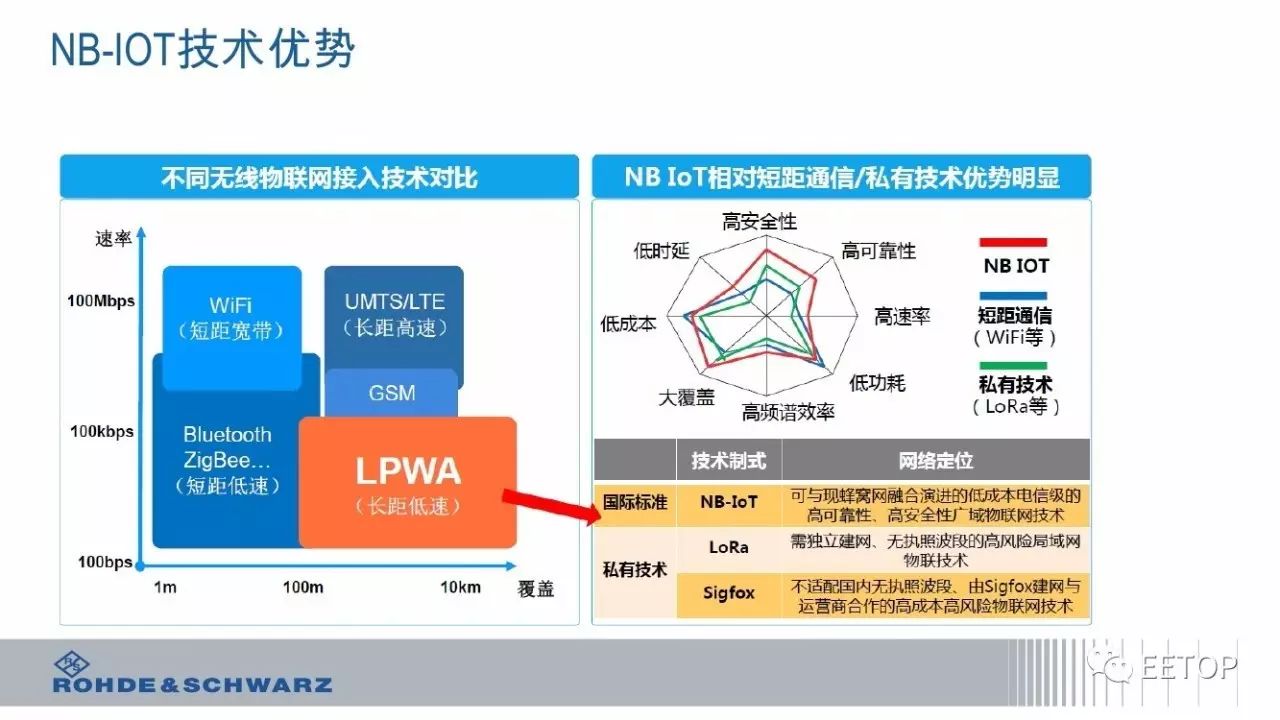

• Low-speed services: The industry categorizes the low-speed service market as LPWAN (Low Power Wide Area Network). Currently, there is no corresponding cellular technology, and most cases rely on GPRS technology, leading to high costs and low penetration of low-speed services.

In other words, the low-speed service market is in urgent need of development, and it is actually the largest market, such as fire extinguishers in buildings and various monitoring devices used in scientific research. Although these devices appear infrequently in daily life, their total number is substantial, and the data collected can be used for various purposes, such as improving urban equipment allocation.

NB-IoT is a new narrow-band cellular communication LPWAN technology that can help us solve this problem.

2. What Are the Advantages of NB-IoT?

As a technology applied in low-speed services, the advantages of NB-IoT are not hard to imagine:

Strong Connectivity: Under the same base station, NB-IoT can provide 50-100 times more access than existing wireless technologies. A single sector can support 100,000 connections, supporting low latency sensitivity, ultra-low device costs, low device power consumption, and optimized network architecture. For example, due to bandwidth limitations, operators only allow 8-16 access points per router in a household, while a household often has multiple smartphones, laptops, and tablets. Achieving smart home connectivity with hundreds of sensor devices becomes a tricky problem. NB-IoT can easily meet the future demand for connecting numerous devices in smart homes.

High Coverage: NB-IoT has strong indoor coverage capabilities, improving coverage area capacity by 100 times compared to LTE with a 20dB gain. This not only meets the broad coverage needs of rural areas but also applies to scenarios requiring deep coverage, such as factories, underground garages, and manhole covers. For example, in manhole cover monitoring, the GPRS method previously required an antenna to be extended, which could easily be damaged by passing vehicles, whereas NB-IoT can effectively solve this problem if deployed properly.

Low Power Consumption: Low power consumption is a crucial indicator for IoT applications, especially for devices and scenarios where batteries cannot be frequently replaced, such as various monitoring devices located in remote mountainous areas. These devices cannot recharge like smartphones daily, so a battery life of several years is essential. NB-IoT focuses on small data volumes and low-speed applications, allowing NB-IoT devices to achieve very low power consumption, significantly extending device battery life from several months to years.

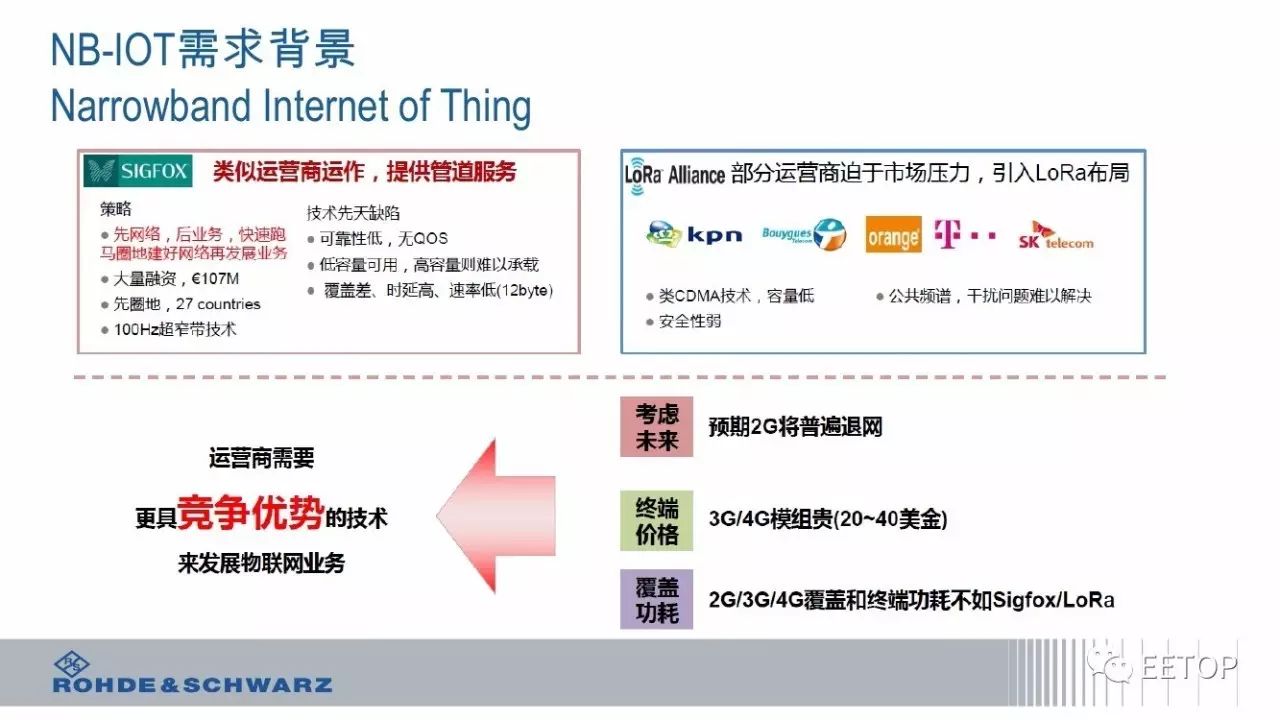

Low Cost: Compared to LoRa, NB-IoT does not require a new network to be built, and the RF and antennas are mostly reused. For instance, in the case of China Mobile, a relatively wide frequency band within the 900MHz range only needs to clear a portion of the 2G spectrum to enable simultaneous deployment of LTE and NB-IoT. Low-speed, low-power, and low-bandwidth also provide cost advantages for NB-IoT chips and modules. The expected price for modules is less than $5.

However, NB-IoT still has its limitations. In terms of cost, while the NB-IoT module cost is expected to drop below $5 in the future, currently, chips supporting Bluetooth, Thread, and ZigBee standards are priced around $2, while chips supporting only one standard are priced below $1. The significant price gap will undoubtedly cause concerns for companies deploying NB-IoT.

Moreover, most IoT scenarios like smart locks and data monitoring do not require real-time wireless connectivity and can be completed through near-field communication or wired connections. If replaced with NB-IoT, is it worth it?

3. The NB-IoT Industry Chain

Compared to traditional industries, the IoT industry ecosystem is quite large, requiring analysis from both vertical industry chains and horizontal technology standards across multiple links.

For low-power wide-area networks, from a vertical perspective, a complete industry chain has formed from “underlying chips – modules – terminals – operators – applications.”

Among them, chips occupy a foundational core position in the entire NB-IoT industry chain, and almost all mainstream chip and module manufacturers have clear NB-IoT support plans.

Huawei’s acquisition of Neul’s chips was implemented relatively early, with testing samples already available;

Qualcomm’s chips are expected to be released in the fourth quarter of 2016, and Qualcomm’s chips are dual-mode for NB-IoT and eMTC;

Intel’s chips are expected to provide the first batch in the fourth quarter of this year, mainly for testing, with commercial chips being released early next year;

MTK’s chips are also under development and will be released in the first half of next year;

Chips from ZTE Micro and Datang are also under development.

Next, let’s specifically discuss Huawei and Qualcomm.

1. Huawei

As an active participant in NB-IoT, Huawei sees NB-IoT as a major strategy, and it is said that all departments of Huawei are actively involved.

In fact, as early as 2014, Huawei invested $25 million to acquire Neul, a leading provider of cellular IoT chips and solutions in the UK, and plans to build a global IoT around Neul.

As expected, after the standard was announced, Neul is set to quickly launch the industry’s first commercially available NB-IoT chip by the end of this month, and its chip price is approaching that of short-range communication chips.

Reportedly, the NB-IoT chip launched by Huawei integrates BB and AP, Flash, and battery management within the size of a coin, and reserves sensor integration capabilities. The AP includes three ARM-M0 cores, each responsible for applications, security, and communication functions, allowing for convenient function management while reducing costs and power consumption. Future chips will also integrate Soft SIM to further reduce costs.

Additionally, after providing the first batch of chips at the end of September, Huawei will cooperate with ublox and Quectel to provide the first batch of commercial modules, which are expected to be released in mid to late October. The initial batch will be small, with large-scale commercial use starting early next year.

Besides chips, Huawei’s layout in the NB-IoT field is comprehensive.

At this year’s Mobile World Congress IoT Summit, Huawei officially launched its end-to-end NB-IoT solution globally, which includes: Huawei Lite OS and NB-IoT chip-enabled intelligent terminal solutions, smoothly evolving eNodeB base stations to NB-IoT, IoT Packet Core that supports Core in a Box or NFV slicing for flexible deployment, and cloud-based architectures with big data capabilities for IoT connection management platforms, meeting the core needs of operators for low-power wide-area coverage IoT services.

Moreover, at the second China NB-IoT Industry Alliance Summit held last month, Huawei’s NB-IoT project leader Xu Haiping stated that the open laboratory being built by Huawei will better serve end-to-end NB-IoT business. “Starting this year, Huawei has established seven open laboratories globally, with two already open, one at Vodafone and the other at Huawei’s Shanghai Research Institute. The open laboratories mainly build a complete end-to-end NB-IoT environment, providing NB-IoT chips and modules, and collaborating with closely related partners for end-to-end integration, including chip module integration, backend connection management platforms, and business server integration. Vodafone’s open laboratory mainly targets European partners, while the Shanghai laboratory mainly targets the Chinese market, and an open lab will be established in South Korea in September, with other countries like Italy also progressing in succession.”

2. Qualcomm

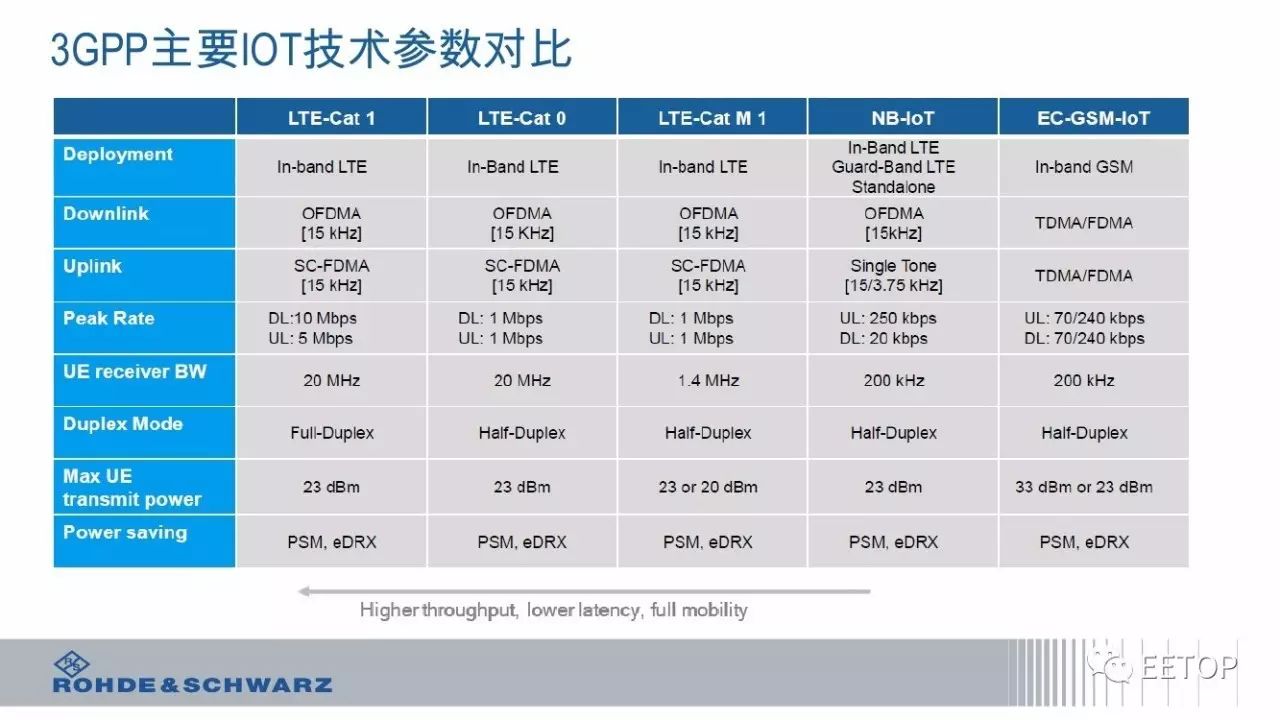

Qualcomm believes that in the next five years, LTE will still be the foundation for development from the IoT perspective. The NB-IoT introduced in 3GPP Release 13 will continue to evolve with the development of 3GPP, and the low-cost, low-power requirements for massive IoT will rely on LTE NB-IoT technology to promote its development, laying a foundation for the development of IoT 5G technologies.

This year, Qualcomm launched the MDM 9×07, supporting Cat 4, with a maximum of 150Mbps; another is MDM 92071, supporting Cat 1 standards; and the MDM 9206 launched last October, supporting Cat M1, with future software upgrades to support NB-IoT. Module OEM manufacturers are expected to release modules based on MDM 9206 that support Cat M1 in early 2017, with support for Cat NB1 expected shortly thereafter through software upgrades.

Moreover, in the current Release 13, NB-IoT does not support VoLTE, but in the future Release 14, Qualcomm will attempt to add voice function support. With the continuous evolution of NB-IoT, Qualcomm hopes it can lay the groundwork for IoT standards applicable to 5G.

Having discussed chip manufacturers, let’s talk about operators.

Since last year, several mainstream operators in China, South Korea, Europe, the Middle East, and North America have begun pilot projects based on pre-standard NB-IoT technology and initiated end-to-end technology and business verification.

1. China Telecom

China Telecom is actively following the development of NB-IoT technology and has officially launched research and development on key NB-IoT technologies, terminals, and services. In terms of specific deployment plans, NB-IoT will be deployed based on the fully covered 800M LTE network; base stations will support both LTE and NB-IoT, sharing baseband, RF, and antenna resources with 800M LTE base stations. Additionally, to avoid potential frequency interference and consider the flexibility of LTE800’s future evolution, independent working modes are prioritized.

Moreover, at the “2016 Tianyi Smart Terminal Transaction Expo” held in July this year, China Telecom, along with Qualcomm, Huawei, ZTE, Intel, Bosch, SAP, IBM, Ericsson, Shenzhen Capital Group, Shanghai Institute of Microsystem and Information Technology, Beijing University of Posts and Telecommunications, and Southeast University, jointly initiated the establishment of the “Tianyi IoT Industry Alliance.”

2. China Mobile

For China Mobile, its public IoT platform has been commercially available since the end of November 2014, and as of June this year, the number of users has exceeded 27 million. Currently, China Mobile is accelerating the promotion of the maturity of globally unified standard narrowband IoT industry and IoT application innovation, building an open IoT laboratory, promoting the mature development of chips and modules, and striving to achieve commercial use in 2017 with a low-cost, low-power, broad coverage, and high reliability public IoT network. To build the NB-IoT IoT network, it is expected that from the end of 2016 to mid-2017, China Mobile will obtain FDD licenses and will be allowed to refarm the existing 900MHz and 1800MHz frequency bands.

3. China Unicom

In July 2015, China Unicom established and opened the world’s first NB-IoT new technology demonstration site; in the first half of 2016, the IoT at Shanghai Disneyland started commercial use; from 2015 to 2016, it conducted NB-IoT business pilots and experiments, and is currently advancing the commercial deployment of NB-IoT in key cities (Beijing, Shanghai, Guangzhou, Shenzhen, Yinchuan, Changsha, Fuzhou), planning to achieve large-scale commercial deployment in 2017, and to fully promote nationwide commercial deployment in 2018.

China Unicom is deploying on the 900MHz and 1800MHz frequency bands for NB-IoT and VoLTE. In the 900 MHz band, a DSSS dynamic spectrum solution is used, while in the 1800MHz continuous coverage area, a 5MHz bandwidth LTE is deployed. In areas without continuous coverage in 1800MHz, the bandwidth automatically narrows to 3MHz, but the center frequency point remains unchanged, and 14 GSM frequency points are automatically deployed in the unused spectrum on both sides.

From a horizontal perspective, there are different technology standard manufacturers such as NB-IoT, LoRa, Sigfox, ZETA, Ingenu present in every link of the industry chain.

Speaking of this, it is necessary to mention the previous LPWAN, as NB-IoT, LoRa, Sigfox, ZETA, and Ingenu are all branches of LPWAN.

Technologies like LoRa and Sigfox operate in unlicensed frequency bands, mostly non-standard and custom implementations; while technologies like GSM, CDMA, and WCDMA are mature 2G/3G cellular communication technologies that operate in licensed frequency bands, and these technologies are mostly standardized by international standard organizations such as 3GPP (which mainly formulates relevant standards for GSM, WCDMA, LTE, and their evolution technologies) or 3GPP2 (which mainly formulates CDMA-related standards).

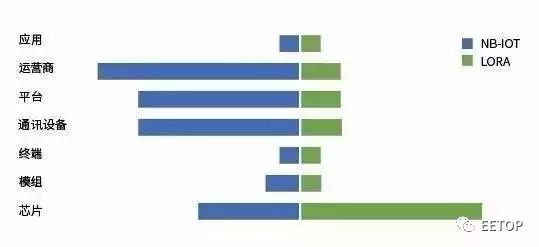

Next, we will select the currently more developed NB-IoT and LoRa technology standards to roughly estimate the market concentration of each link, with the length of the corresponding rectangles in the diagram reflecting the concentration level, where longer lengths indicate higher concentration and shorter lengths indicate lower concentration (higher concentration indicates higher market monopoly rate).

In the underlying chip field, it is well-known that current manufacturers such as Huawei HiSilicon, Qualcomm, Intel, MTK, ZTE Microelectronics, Datang, and Spreadtrum already have plans and implementation steps for NB-IoT chip development. Manufacturers with existing LTE chip capabilities can all participate, making it impossible for a few to monopolize most of the market. However, due to the limited number of manufacturers in this field, there will not be a large number of market participants, and market concentration will remain below 50%; in the LoRa camp, the current RF chip supply is concentrated in Semtech, which holds the vast majority of market share, forming a market concentration greater than 80%.

In the module segment, due to advantages in channels, technology, and scale, many NB-IoT module shipments are expected to be controlled by manufacturers that originally had 2G/3G/LTE module product lines. This group is relatively large, and with the entry of new manufacturers into this field, it is also unlikely to form a high market concentration; in the LoRa module group, original manufacturers are mostly small and medium-sized enterprises, and with the increasing applications of LoRa, many manufacturers are entering the market, resulting in a relatively competitive market with low market concentration.

In the terminal segment, since low-power wide-area network communication technology is required by numerous industry and consumer terminals, and the types of terminals are diverse, it is impossible for a few enterprises to own a large-scale terminal market, thus the terminal market is highly fragmented with low market concentration.

In the communications equipment and platform segment, manufacturers such as Huawei, Ericsson, ZTE, and Nokia are core participants and promoters of the NB-IoT standard, and these mainstream equipment manufacturers occupy the vast majority of market share in the cellular communication market. In the commercial use of NB-IoT, they will also inevitably occupy the vast majority of share, indicating a high market concentration in this segment, potentially reaching over 80%; conversely, for LoRa, many small and medium-sized enterprises have participated in the development and production of LoRa base station equipment and management platforms from the beginning, and currently, many manufacturers have overall solution capabilities, so high market concentration cannot be formed. In China, the China LoRa Application Alliance (CLAA) initiated by ZTE may enhance the concentration of equipment and platforms to some extent, but it still will not reach the high concentration levels of NB-IoT in this segment.

In the operator segment, mainstream operators are very clear about deploying and operating NB-IoT networks, meaning that future NB-IoT network operations will still be concentrated in the hands of the three major operators, resulting in a market concentration of 100%; for LoRa network operations, due to the need to meet the diverse needs of various government and enterprise users, various forms of operators may emerge in the future, including cross-regional cloud network operators from CLAA, industry-level network operators, and enterprise private network operators, resulting in very low market concentration.

As for the application segment, whether NB-IoT or LoRa networks, both face thousands of diverse application demands. These IoT applications cannot form homogeneous application services at the level of hundreds of millions as in traditional communication eras, but rather exhibit prominent fragmentation characteristics, with even significant differences in demand within the same industry, thus the application segment will not form a highly concentrated market.

In summary, it is evident that multiple segments of the NB-IoT industry chain have high market concentration, indicating that this field is predominantly led by giants; in the LoRa industry chain, the chip segment has formed a high market concentration, while other segments have numerous participants.

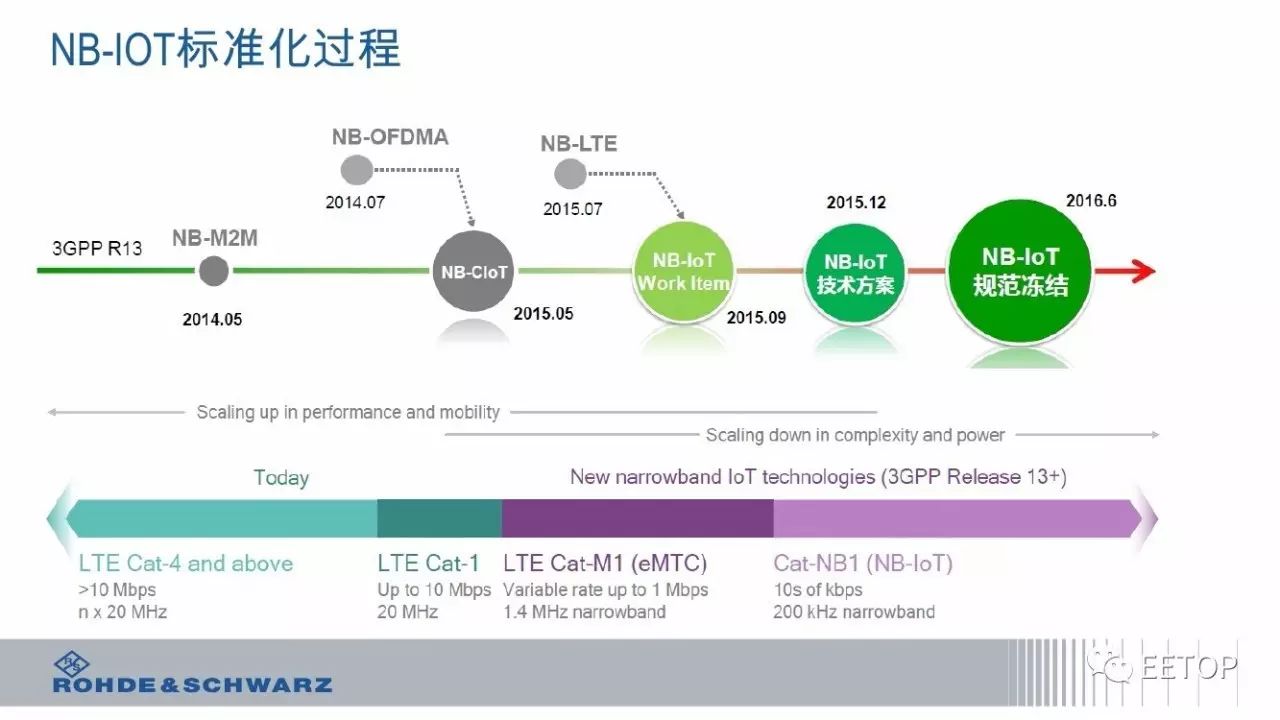

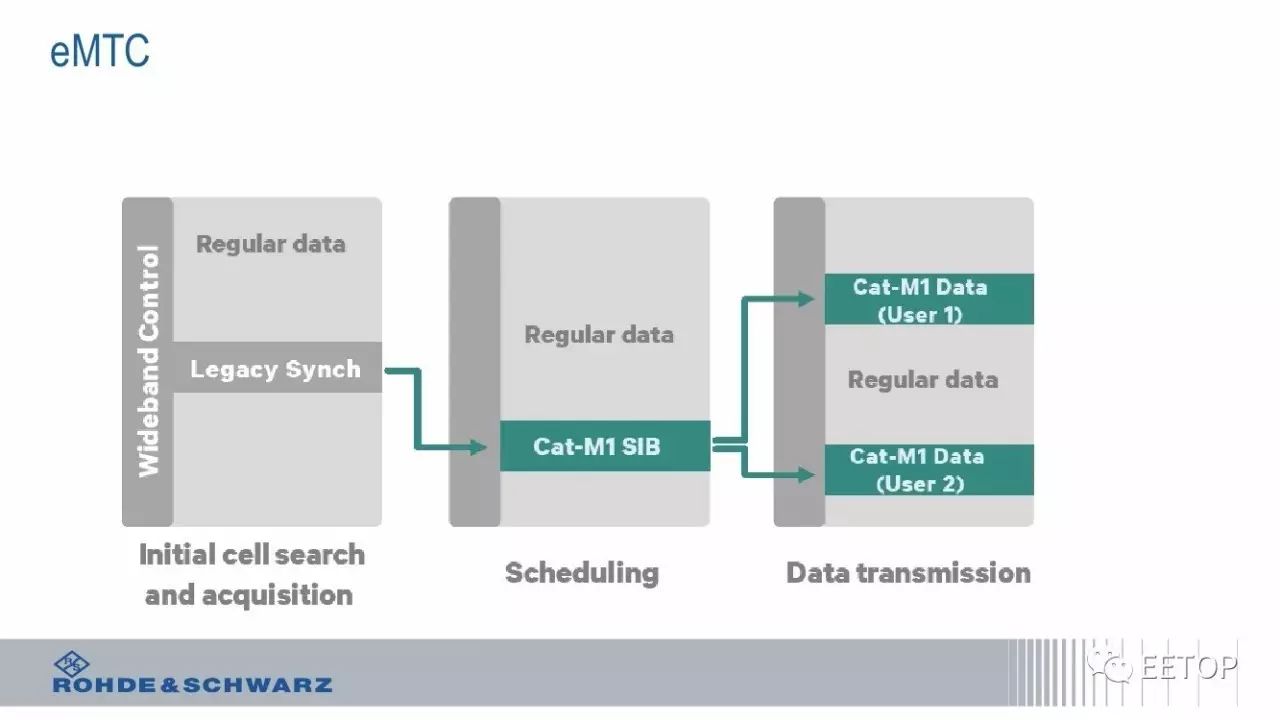

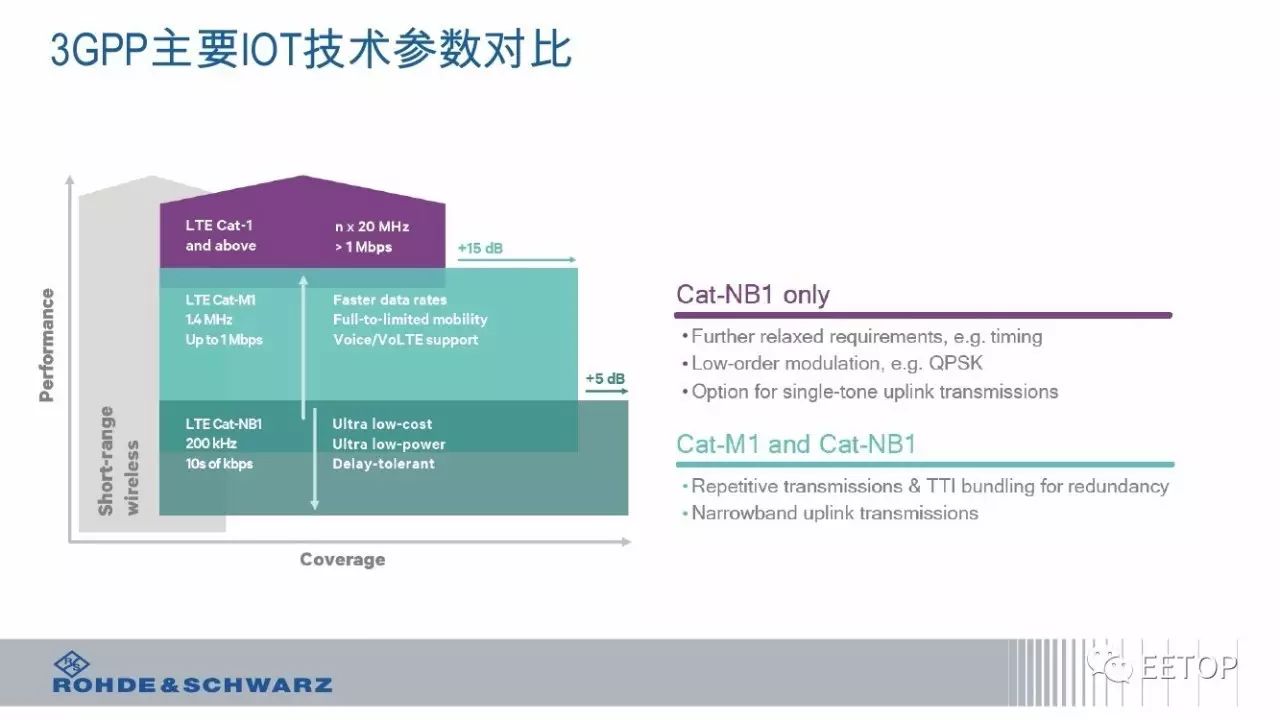

To further explain the principles of NB-IoT, we found a detailed PPT on NB-IoT Principles and Testing from Baidu Wenku, which we will share with you below:

(There are a total of 96 pages; here we only share the first ten pages. For the complete document, please click to read the original text)

(Author: Rod Schwartz Li Qiang. If this document is improperly reprinted, please contact us.)

The remaining parts of the PPT can be downloaded by clicking to read the original text.

Click below to read the original text and download the PPT.