U.S. President Donald Trump initially excluded semiconductors from the latest round of U.S. tariffs. However, he may impose tariffs on semiconductors in the future. How would tariffs on semiconductors imported into the U.S. affect American semiconductor companies?

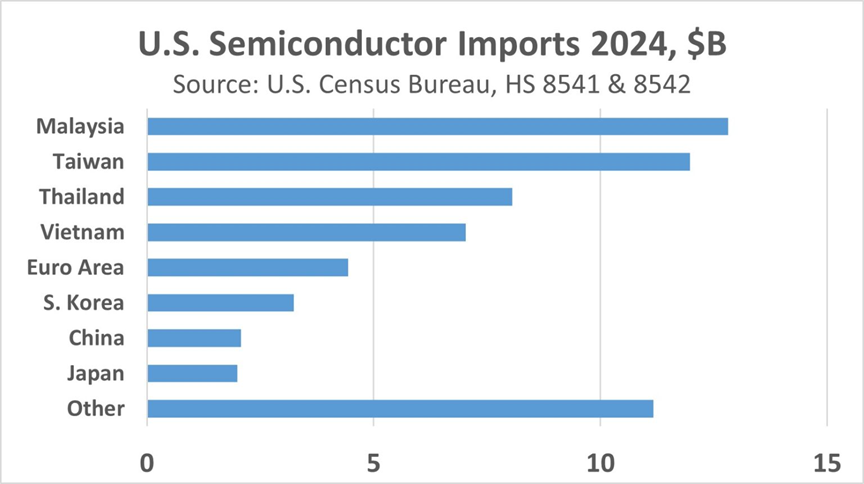

The chart below shows the semiconductor imports to the U.S. in 2024. 64% of imports come from four countries and regions: Malaysia, Taiwan, Thailand, and Vietnam. Mainland China accounts for only 3% of the imports. Semiconductors manufactured in mainland China typically enter the U.S. as components of finished electronic devices such as personal computers and smartphones.

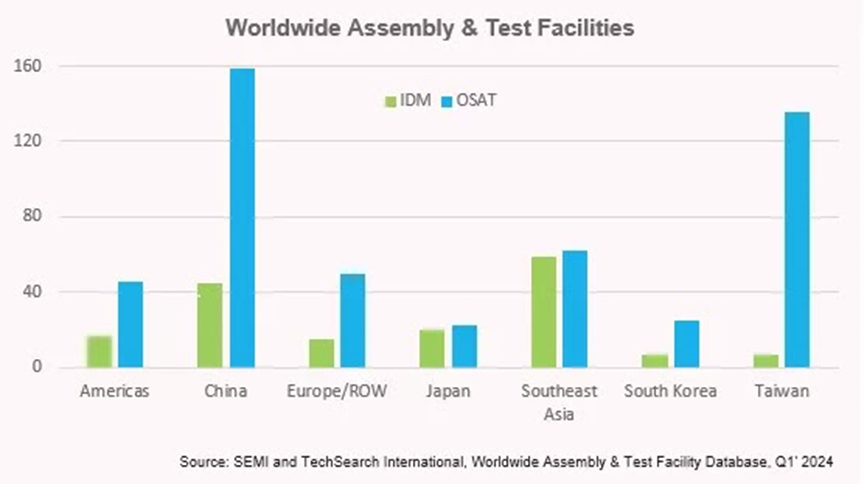

Why do these four countries or regions account for such a large share of U.S. semiconductor imports? Except for Taiwan, these countries do not have large wafer fabs. However, they dominate the majority of semiconductor assembly and test (A&T) facilities. These facilities obtain wafers from fabs, assemble them into packages, and test them to ensure they meet specifications. These A&T facilities may belong to integrated device manufacturers (IDMs) or outsourced assembly and test (OSAT) companies. The chart below from SEMI shows the distribution of these facilities. Mainland China, Taiwan, and Southeast Asia account for 70% of A&T facilities.

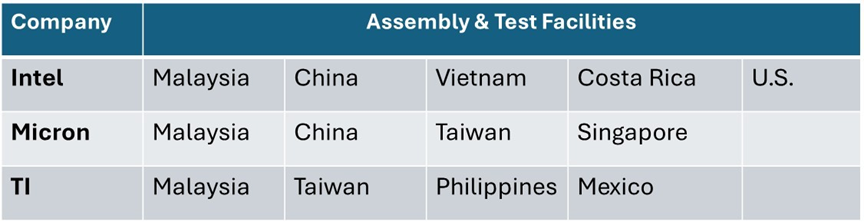

Most of the A&T facilities of major U.S. IDMs are located outside the U.S., as shown below:

U.S. fabless companies like Nvidia, Qualcomm, Broadcom, and AMD primarily use TSMC’s foundry services. TSMC mainly utilizes its own A&T facilities located in Taiwan.

Therefore, if tariffs are imposed on semiconductor products imported into the U.S., it would increase the costs for U.S. semiconductor companies. U.S. companies with their own fabs have most of their wafer production capacity in the U.S., but the vast majority of their assembly and test (A&T) capacity is located outside the U.S. TSMC is building a fab in the U.S., but currently has no A&T facilities in the U.S.

One solution to avoid tariffs is for companies to build more A&T facilities in the U.S. However, constructing these facilities requires significant time and money. Below are the new A&T facilities announced in recent years.

According to these projects, building a new A&T factory takes two to three years and can cost over $4 billion. Only two of these new factories are located in the U.S. OSAT company Amkor is building an A&T factory to support TSMC’s fab in Arizona. OSAT company Integra Technologies announced plans to build an A&T factory in Kansas, but the project has been delayed. Intel’s A&T factory in Poland has also been delayed by at least two years.

The cost differences for building facilities in the U.S., Europe, and Asia are significant. The three A&T facilities planned in the U.S. and Europe have an average expected cost of $3 billion and an average employment of 1,900 people. The three facilities planned in Asia have an average cost of $840 million and an average employment of 3,500 people.

Imposing any tariffs on U.S. semiconductor imports would increase costs for most U.S. semiconductor companies as well as foreign companies. If U.S. companies decide to build more A&T facilities in the U.S., it would take years and increase A&T costs.

Why is the world competing for chips?

Computer chips are the engine of the digital economy, and their increasing performance is empowering technologies like generative AI that are expected to transform multiple industries.

No wonder these devices have become the focal point of fierce competition between the world’s economic superpowers. Under President Joe Biden’s leadership, the U.S. has implemented a series of restrictions to curb China’s semiconductor capabilities. His predecessor, Donald Trump, is further intensifying these efforts.

Why are chips so important? Because they are essential for processing and understanding vast amounts of data, which has become the lifeblood of the economy, akin to oil.

Chips (short for semiconductors or integrated circuits) are made from materials deposited on silicon wafers and can perform various functions.

Memory chips used for data storage are relatively simple and can be traded like commodities. Logic chips, which run programs and act as the brain of devices, are more complex and expensive. The acquisition of components like Nvidia’s H100 AI accelerator is not only a matter of national security but also crucial for the fortunes of tech giants like Alphabet Inc.’s Google and Microsoft. These giants are racing to build AI data centers to secure a leading position in what is seen as the future of computing.

Even everyday devices are increasingly reliant on chips. In a car filled with various electronic devices, every button press requires simple chips to convert touch into electronic signals. All battery-powered devices need chips to convert and regulate current.

Why is the chip manufacturing race so intense? Part of the reason is that the COVID-19 pandemic disrupted chip production in Asia, causing chaos in the global tech supply chain, which has also heightened awareness of chips.

Most of the world’s leading semiconductor technologies originate from the U.S., but today, Taiwan and South Korea dominate chip manufacturing. China is the largest market for electronic components and is increasingly eager to produce more of its own chips.

The U.S. is implementing export controls and import tariffs to curb China’s chip ambitions. Leading Chinese tech companies, including Huawei Technologies Co., have been placed on the so-called “Entity List,” meaning U.S. chip technology suppliers must obtain government approval to sell products to these blacklisted companies. U.S. restrictions are often justified on national security grounds and accuse China of unfair competition in trade.

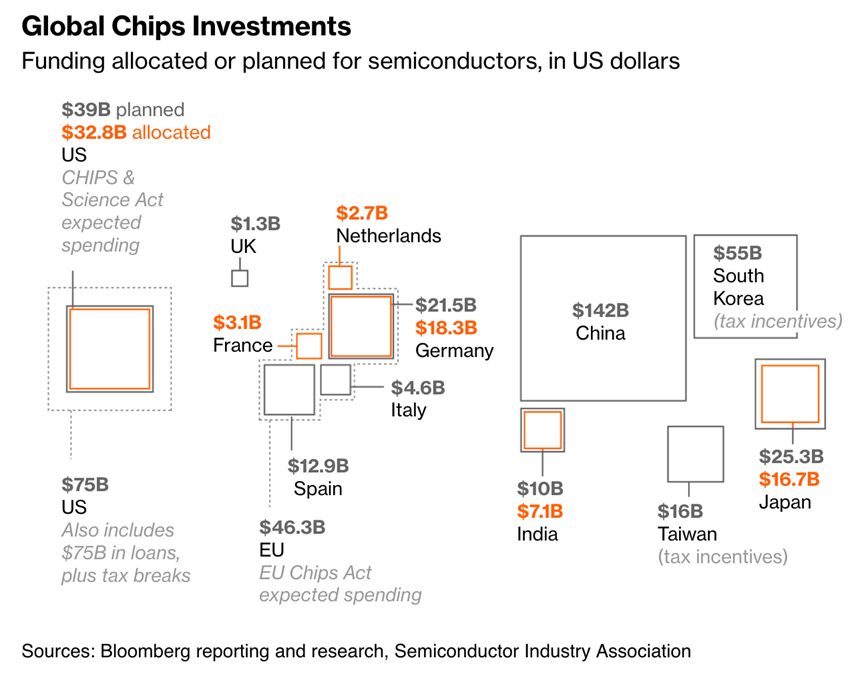

The Biden administration has allocated substantial federal funds to shift the physical production of these components back to the U.S. and reduce what it sees as a dangerous reliance on a few factories in East Asia. Trump has expressed disapproval of this plan, and his administration has also slowed the disbursement of funds. Trump seems to prefer relying more on tariffs to encourage foreign chip manufacturers to produce semiconductors domestically in the U.S.

Several other countries or regions are trying to strengthen their semiconductor industries, either by bringing chip manufacturing back home or establishing it for the first time.

So, who controls the supply?

Chip manufacturing has become an increasingly exclusive industry. New factories cost over $20 billion, take years to build, and require continuous operation to be profitable. Such large-scale capacity has reduced the number of companies with cutting-edge technology to just three—Taiwan Semiconductor Manufacturing Company (TSMC), South Korea’s Samsung Electronics, and the U.S.’s Intel Corporation. TSMC and Samsung act as so-called foundries, providing outsourced manufacturing services to companies worldwide.

The world’s largest tech companies rely on access to the most advanced manufacturing capabilities, most of which are located in Taiwan.

Downstream in the supply chain, there is a large analog chip manufacturing industry. Companies like Texas Instruments and STMicroelectronics are leading manufacturers of these components used to regulate power inside smartphones and control temperature. As China cannot access many of the machines needed to manufacture more advanced components, it is targeting this area and investing heavily to increase production.

Source: Semiconductor Industry Observer, content compiled from semiwi, thank you.

Reference Link

https://semiwiki.com/semiconductor-services/355143-semiconductor-tariff-impact/