Virtual digital human interaction, Oracle’s instant recognition, accounting robots, the world’s first blockchain trophy… Artificial intelligence is changing people’s lives.

At the 2021 World Artificial Intelligence Conference exhibition area, many “signature” AI products made their debut, showcasing the latest cutting-edge explorations by financial institutions in the direction of convenient services and digital empowerment. From July 7 to 8, reporters from Securities China discovered multiple AI financial “black technologies” on-site.

It is reported that the 2021 World Artificial Intelligence Conference is hosted by the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Science and Technology, and the Shanghai Municipal People’s Government, held from July 8 to 10 in Shanghai. This conference, themed “Intelligent Connection of the World, Collective Wisdom for City Building,” consists of four major sections: “Conference Forum, Exhibition Display, Competition Awards, and Application Experience,” focusing on AI empowering urban digital transformation, aiming to create a global benchmark for artificial intelligence technology, an industry accelerator, an application showcase, and a governance discussion platform.

AI + Banking: What Imagination Space Does It Bring?

At the exhibition site, various AI applications were showcased at bank booths around the theme of fintech benefiting the public. What imagination space will the combination of artificial intelligence and banking financial services bring?

This year, the Bank of Communications presented its booth themed “Digital New Communications with More ‘AI'” at the venue, showcasing the application results of new technologies such as big data and artificial intelligence.

In recent years, as the only state-owned bank headquartered in Shanghai, the Bank of Communications has focused on building a “leading bank in the Yangtze River Delta” to serve Shanghai. At this exhibition, reporters from Securities China observed that the Bank of Communications’ exhibition hall featured four major areas: a naked-eye 3D virtual anchor interaction area, an immersive financial service experience area, a “Jiangyin e-Service” brand display area, and a digital RMB scenario service area.

Exhibitors introduce the results of artificial intelligence products to the audience.

In the exhibition area, attendees could see products benefiting the public such as “Convenient Medical Treatment,” “Intelligent Investment Advisors,” “Electronic Certificate Display,” “Mobile Banking Elderly Care Version,” and “Intelligent Customer Service,” as well as financial products serving the real economy like “Convenient Account Opening,” “Inclusive e-Loan,” “e-Connection,” and “Cross-Border e-Finance,” fully reflecting the concept of “Letting Data Walk More, Letting Customers Walk Less.”

Reporters experienced the Bank of Communications’ “Convenient Medical Treatment” function on-site, a digital credit product tailored for Shanghai residents insured by the city’s medical insurance. By reshaping the medical payment process, it can reduce the patient queue payment step from at least three to zero, achieving zero waiting time for medical payments and reducing the average waiting time for patients by over 30 minutes. This product is now available in over 400 public medical institutions across Shanghai, with an approval rate exceeding 95%.

This year, the Construction Bank’s exhibition area created three major zones: “Quantum Guidance,” “AI Empowering Industries,” and “A Beautiful Life with AI,” focusing on showcasing “AI + Finance” applications.

In the AI Empowering Industries area, through the Beidou Seven Stars AI platform, Longyan Tong project, inclusive finance, rural revitalization, and global matchmaking, the Construction Bank demonstrated its achievements in applying intelligent business scenarios, supporting the implementation of the national Belt and Road strategy, and aiding the development of small and medium-sized enterprises and the real economy. The AI Beautiful Life area highlighted intelligent outlets, allowing attendees to interact with intelligent customer service robots and experience projects like 5G interaction, breaking the boundaries of traditional outlets.

Many banks set up digital RMB consumption experience areas. For example, at the Bank of Communications booth, attendees could experience digital RMB consumption covering scenarios such as chain dining, life services, retail, transportation, health care, and education.

Next to a coin exchange machine produced by Julong Co., an exhibitor demonstrated how, in less than two minutes, small “change” in a personal digital RMB account could be exchanged for coins; at the same time, it could also recycle coins on-site, where a one-yuan coin placed into the machine would immediately generate an account value, allowing the exchanger to choose to convert the recycled coins into equivalent amounts in Alipay, WeChat Wallet, and digital RMB accounts.

Are Intelligent Robots ‘All-Powerful’?

Fraud prevention robots, large humanoid service robots, Athena intelligent robot platforms, multi-modal virtual digital humans, patrolling robotic dogs… At the AI conference exhibition area, the most frequently seen and introduced by exhibitors were robots applied in various scenarios.

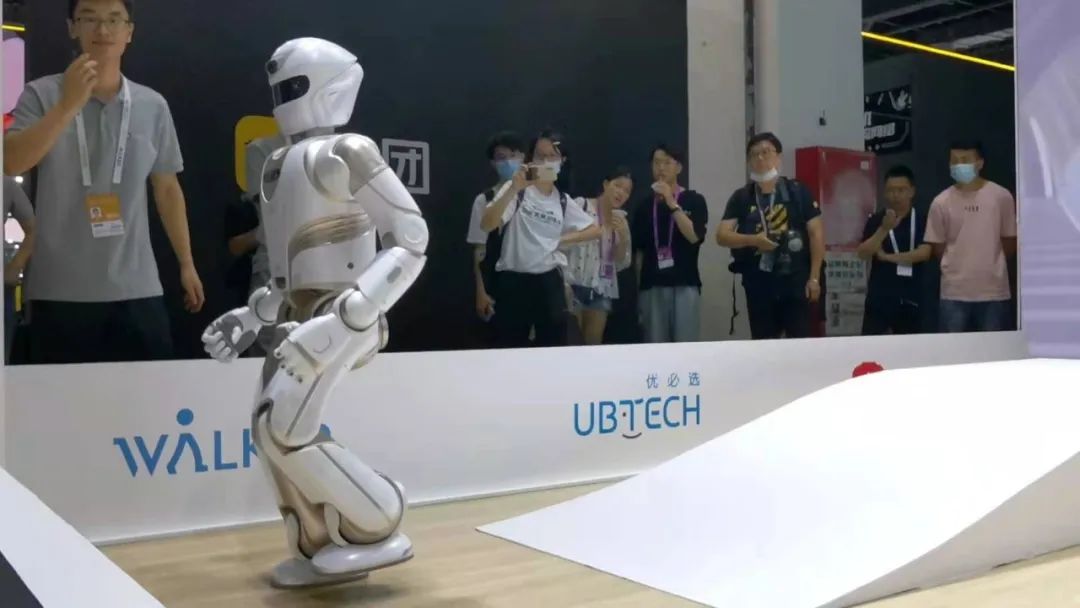

Large humanoid robots demonstrating downhill walking.

The new generation humanoid service robot X from Shenzhen UBTECH Technology Co. was the “star” of this exhibition hall. This humanoid robot walks with alternating legs like a human, adapts to terrain for uphill and stair climbing, and can use its arms to give back rubs and play chess with the audience. According to Xie Zheng, the product manager of UBTECH’s Walker product, Walker X integrates six AI technologies and is positioned as a home service robot, capable of serving tea, pouring water, delivering items, watering plants, and cleaning tables, while also autonomously controlling appliances like refrigerators and vacuum cleaners.

Behind these functional scenarios is the robot’s dexterous limbs composed of 41 high-performance servo joints, along with a comprehensive perception system that includes multi-dimensional tactile, multi-eye stereo vision, omnidirectional hearing, and inertial and distance sensing.

In the financial application field, reporters from Securities China also observed several physical and virtual robots that have matured applications around different scenarios.

In the Bank of Communications exhibition hall, there is an Athena intelligent robot platform. It was reported that as early as 2018, the Bank of Communications began researching the application of artificial intelligence in credit card business, forming an AI system centered around the Athena robot platform based on the vast business data accumulated from credit cards.

Staff at the exhibition hall introduced that the Athena AI system is now widely used in credit card intelligent customer service, marketing, collection, risk control, and other businesses. In the intelligent customer service field, the platform diverts 44,000 calls daily, with a diversion rate of 51.0%, and the proportion of diverted human calls reaching 32.3%.

Ant Group showcased the world’s first interactive risk control product for fraud prevention, the “Wake-Up Hotline.” From the demonstration by staff from the Alipay security lab, when a user is induced by a scammer to transfer money, the Ant AI robot can make a judgment and issue a call alert to the user in 0.1 seconds, compared to the previous manual customer service which took at least 2 minutes (to assess the scam scenario, organize the script accurately, and then make an outbound call to persuade).

The staff introduced that to compete with scammers in speed, over 90% of the calls from the Ant fraud prevention wake-up hotline are made by AI, and the success rate of wake-up calls has exceeded that of manual customer service.

In the more segmented AI + field, I also saw more technology companies exploring intelligent interactive virtual robots. “Hello everyone, I am the multi-modal digital human Xiao Yi from Zhuiyi Technology.” In the exhibition area, I completed a credit card installment transaction with a “real person” in front of a computer, while in reality, this “customer service” with a lifelike appearance is supported by various types of digital humans from Shenzhen Zhuiyi Technology, including simulation/3D, interaction/broadcast types, meeting the rapid response and delivery of digital human external image, intelligent super brain, and hardware carrier.

Additionally, for insurance companies, there is an intelligent training robot capable of one-on-one scenario-based interactive training; an intelligent marketing service assistant robot (Pal) assists human agents by providing precise customer profile information, script recommendations, and business process navigation.

What you cannot see behind this is the transition from “replacing manpower” to “human-machine collaboration,” and then to the “new data” era, where intelligent analysis reveals the value of unstructured data in the financial field. “Robots” are now ubiquitous.

The Rise of Mid-Tier Enterprises in Artificial Intelligence

Huawei brought the Pangu large model aimed at establishing a universal and user-friendly artificial intelligence development workflow to empower more industries and developers, while iFlytek showcased its accounting robot and autonomous driving AR minibus; the Shanghai Institute of Microsystem and Information Technology of the Chinese Academy of Sciences developed a “non-invasive, minimally invasive high-throughput flexible brain-machine interface” to tackle major brain diseases such as ALS, high-level paraplegia, and epilepsy through breakthroughs in full-brain AI interaction technology…

At the exhibition site, many leading domestic enterprises in the field of artificial intelligence confidently showcased their explorations and achievements in cutting-edge technology.

However, during the visit to the exhibition hall, reporters also noticed that in addition to these well-known artificial intelligence companies, there are many enterprises deeply engaged in the subfields of artificial intelligence. The number of these companies is continuously growing, and while their AI products targeting the C-end are penetrating daily life, they may not be widely known to the public.

For example, many attendees have used three C-end APP products: Scanning King, Business Card King, and Qixinbao, but they may not know that behind these is a Shanghai-based artificial intelligence company called Hehe Information. It is reported that the monthly active users of this company’s C-end APPs total about 120 million, and it has gone global, with a cumulative user download of about 2.3 billion.

On that day, the Hehe Information booth attracted many visitors, where staff demonstrated the intelligent text recognition technology that identified ancient characters from 3,600 years ago of Chinese civilization—multiple replicas of rich oracle bone inscriptions on imitated tortoise shells. With just a scan, the “oracle bone inscriptions” could be extracted and translated in real-time: terms like “rich beauty” and “buy it, buy it” were recognized and translated. This technology is currently in the internal testing phase and was showcased for the first time at the AI conference, with the Anyang Yin Ruins scenic area as the academic support unit for this technology.

The aforementioned staff told reporters that currently, Hehe Information’s intelligent text recognition technology supports document images in 56 languages including Chinese, English, and Russian, and fast reading and intelligent classification of over 100 types of documents.

Artificial intelligence products based on these technologies are being more widely and maturely applied in scenarios such as ticket digitization, supply chain finance, intelligent identification verification in banking, insurance, securities, economy, automotive finance, as well as in manufacturing, logistics, and government sectors for digital efficiency upgrades.

Similarly, in the Ping An Technology exhibition area, Ping An’s Financial One Account provided solutions in the credit technology field, such as “One Question, Multiple Loan Solutions” and the intelligent verification product “Intelligent Review Solution” designed for the Centralized Financing Unified Registration and Publicity System.

At the exhibition site, reporters noticed that there are many enterprises in the artificial intelligence subfields that are not well-known to the public, but many have been widely applied in B-end and G-end (government end).

This also means that in the field of artificial intelligence, in addition to well-known companies like Huawei, Alibaba, Tencent, Ant Group, 360 Group, iFlytek, and SenseTime, many mid-tier enterprises with original technology research and development capabilities are rising rapidly.

According to statistics from the event organizers, this year, the number of offline exhibiting companies exceeded 300, with over 40% being first-time exhibitors, and companies from outside Shanghai and foreign enterprises accounting for over 50%.

Millions of users are watchingExplosive! Chip giant’s net profit surged 12 times, and a heavy document was issued. What signal? The “national team” also took action, will the chip bull market continue?So tragic! Hong Kong stocks plummeted 800 points, China’s number one evaporated 2.4 trillion! What happened? Will the dual innovation market in A-shares continue?Beyond imagination! Over 37 trillion yuan flowed into the stock market in half a year, what signal? American retail investors are crazier, buying 180 billion in a month! How long can the “bull market” last?The Central Commission for Discipline Inspection made a heavy statement! Special supervision and inspection of the entire business chain of the China Securities Regulatory Commission’s securities issuance registration, digging deep into corruption behind risk events.Heavyweight! A 20 trillion track welcomes super strong stimulus, is there still space for a 9-fold bull? “Phoenix” evaporated 230 billion in one day, who is the real “culprit” behind it?What is going on? The leading cancer drug suddenly plummeted 14%, two major rumors hit! New drug pricing at 1.2 million is still considered too low? A 170 billion giant opportunity is coming?

Securities China is an authoritative media outlet in the securities market under the Securities Times. Securities China holds copyright to the original content published on this platform, and unauthorized reproduction is prohibited; otherwise, legal responsibility will be pursued.

ID: quanshangcnTips: Enter the stock code or abbreviation on the Securities China WeChat page to view individual stock trends and latest announcements; enter the fund code or abbreviation to view fund net values.

ID: quanshangcnTips: Enter the stock code or abbreviation on the Securities China WeChat page to view individual stock trends and latest announcements; enter the fund code or abbreviation to view fund net values.