【Hot Topics】1. Trump’s tariffs may extend to NAND Flash2. Micron restructures its business units based on market segmentation3. Cambricon: Significant revenue growth in Q1 2025, achieving profitability for two consecutive quarters4. South Korea’s exports to the U.S. drop 14.3% in the first 20 days of April5. ASML: Expects stronger-than-expected performance in the Chinese market, no plans to set up factories in the U.S.6. China Mobile: The company’s direct investment in AI will continue to increase in scale and proportion by 2025

1. Trump’s tariffs may extend to NAND Flash

According to South Korean media reports, the Trump administration plans to impose tariffs on semiconductor products, including NAND Flash, as a separate category distinct from existing electronic product categories.

Previously, semiconductor products, including memory chips, were not directly included in the scope of the “reciprocal tariff” policy imposed by the U.S. Currently, approximately 30% of global NAND Flash capacity is in China, followed by South Korea (about 25%), Japan (about 20%), and the U.S. (about 15%). The introduction of specific tariffs on memory semiconductors would have a significant impact on the industry.

At the same time, the scope of NAND tariffs may also expand. For example, the scope could extend from NAND manufactured in China to all finished products, which would have an even greater impact. When determining the country of origin, the U.S. will consider not only the importing country but also the countries of production, assembly, and packaging. Therefore, products manufactured in China and assembled in a third country for export to the U.S. may also be subject to tariffs.

2. Micron restructures its business units based on market segmentation

On April 17 local time, Micron Technology announced a restructuring of its business units based on market segmentation. The new structure will begin transitioning immediately, with the restructuring expected to be completed in the early part of the fourth fiscal quarter (starting May 30, 2025) and financial data to be disclosed under the new structure starting in the fourth quarter of fiscal year 2025.

The existing business units include Compute and Networking (CNBU), Storage (SBU), Mobile (MBU), and Embedded (EBU). The restructured four major business units will be Cloud Storage Business Unit (CMBU), Core Data Center Business Unit (CDBU), Mobile and Client Business Unit (MCBU), and Automotive and Embedded Business Unit (AEBU).

Among them, CMBU is responsible for providing storage solutions for hyperscale cloud customers and HBM business for all data center customers. This is a strategic move aimed at providing customized memory for clients such as Microsoft and Amazon.CDBU is responsible for business with server manufacturers like Dell, HPE, and Gigabyte.

Micron stated that the new business units are customer-centric and enhance the ability to provide customized services.

3. Cambricon: Significant revenue growth in Q1 2025, achieving profitability for two consecutive quarters

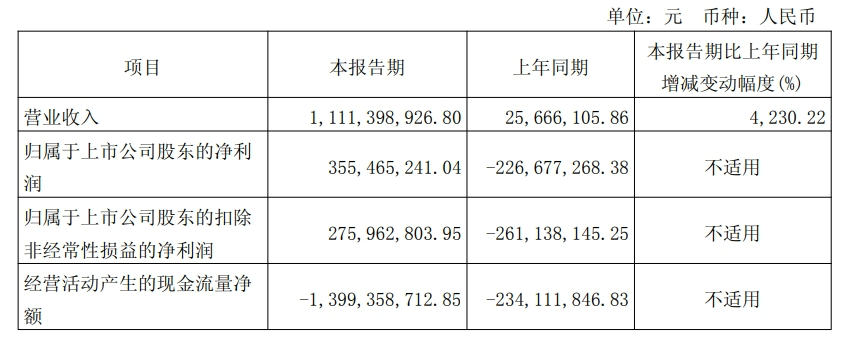

Cambricon released its Q1 2025 report: Operating revenue reached 1.111 billion yuan, a year-on-year increase of 4230.22% and a quarter-on-quarter increase of 12.36%; the net profit attributable to shareholders of the listed company was 355 million yuan, compared to a loss of 227 million yuan in the same period last year, achieving a turnaround. Cambricon’s net profit in the fourth quarter of last year was 272 million yuan, a quarter-on-quarter increase of 30.61%, achieving profitability for two consecutive quarters.

Source: Public Information

Source: Public Information

On the same day, Cambricon announced that it achieved operating revenue of 1.174 billion yuan in 2024, a year-on-year increase of 65.56%; the net loss attributable to shareholders of the listed company was 452 million yuan, compared to a net loss of 848 million yuan in the same period last year, narrowing the loss by 46.69%. During the reporting period, Cambricon invested 1.07 billion yuan in R&D, accounting for 91.30% of operating revenue.

Cambricon disclosed in the report that in terms of hardware, its next-generation intelligent processor microarchitecture and instruction set are under development. In terms of software, optimizations and iterations have been made to the underlying software system platform. Cambricon continues to advance the development and improvement of the training software platform, driven by customer needs for new features and general support, and is vigorously promoting support and optimization for large model business. At the same time, its inference software platform has also made progress in large model adaptation, open-source ecosystem construction, usability optimization, and large model inference solutions.

4. South Korea’s exports to the U.S. drop 14.3% in the first 20 days of April

Data from the South Korean Customs Service shows that the total value of South Korea’s exports from April 1 to 20 reached 33.87 billion USD, a year-on-year decrease of 5.2%, partly due to ongoing tariff measures leading to weak exports to the U.S.

By destination, exports to the U.S. fell 14.3% year-on-year to 6.18 billion USD; exports to China increased by 7.6% to 7.64 billion USD. According to agency officials, there is a trend of increasing exports by the end of the month, but whether this downward trend will continue remains to be seen.

By product category, semiconductor exports increased by 10.7% year-on-year, reaching 6.47 billion USD. Chip sales accounted for 19.1% of South Korea’s total exports during the same period, an increase of 2.8 percentage points compared to the same period last year.

5. ASML: Expects stronger-than-expected performance in the Chinese market, no plans to set up factories in the U.S.

On April 16 local time, ASML stated during its Q1 earnings communication that the demand for ASML’s chip manufacturing equipment in the Chinese market far exceeds expectations.

“Our original target was 20%, which was later adjusted to slightly above 20%. The current trend is slightly above this level, and it seems to have exceeded 25%.” ASML’s Chief Financial Officer Roger Dassen stated during the conference call that demand from China remains strong, better than the company’s forecasts three or six months ago. Regarding whether it would follow TSMC’s lead and move its lithography machine manufacturing plant to the U.S. to cope with potential tariff impacts, ASML stated that there are no such plans.

6. China Mobile: The company’s direct investment in AI will continue to increase in scale and proportion by 2025

China Mobile stated during an investor relations event that its capital expenditure in 2025 will remain stable with a slight decrease, planning for 151.2 billion yuan. The capital expenditure plan for computing power in 2025 is 37.3 billion yuan, increasing its proportion of total capital expenditure to 25%, while dynamically adjusting the structure of computing resource construction based on business development needs. First, it will continue to promote the integration of computing resources, focusing on improving the efficiency of existing resource utilization; second, it will accelerate the construction of a new intelligent computing resource layout, with significant increases in investment in inference. By 2025, it is expected that the scale of intelligent computing will add 5 EFLOPS (FP16), totaling over 34 EFLOPS (FP16).

In the past two years, China Mobile’s direct investment in AI has exceeded 12 billion yuan, with a year-on-year growth of over ten times in 2024, and the scale and proportion of direct investment in AI will continue to increase in 2025.

Latest Recommended Reading:

-

When will consumer PCIe 5.0 SSDs become mainstream?

-

How is the first financial report of Lianyun Technology after its listing? The U.S. AI chip ban severely impacts the three giants; JEDEC launches JESD270-4 HBM4 standard

-

Kioxia: Closely monitoring market trends to adjust production capacity, expects BiCS8 to become the main sales force by March next year

-

This week, spot storage product transactions are sluggish, and the ongoing tariff situation continues to shake market confidence

-

Reports say Micron is accelerating the expansion of HBM3E; NVIDIA plans to produce $500 billion AI devices in the U.S.; AMD’s first 2nm chip has completed wafer production

-

“Tariff exemptions” for electronic products are only temporary; Trump: Will announce semiconductor tariff rates within this week