► This article is reprinted from the WeChat public account “Ning Nanshan” (ningnanshan2017)

► This article is reprinted from the WeChat public account “Ning Nanshan” (ningnanshan2017)

Recently, I looked at the development of domestic semiconductor industry chain companies, and I must say that we are now in a golden age of domestic development, with leading domestic enterprises in every link developing very rapidly.

The domestic leading enterprise in EDA tool software, Huada Jiutian, should be noted that the revenue I use below refers to the main business income, not total revenue. The company’s EDA main business income was 143 million RMB in 2018, which saw a significant increase of 77.12% in 2019 compared to 2018, rising to 253.4 million RMB. In 2020, it again increased by 60.32% compared to 2019, reaching 406.2 million RMB, with a domestic market share of 6%.

This company’s EDA revenue has long accounted for about half of the domestic local enterprises, so it can be said that in 2020, the sales of domestic EDA tool software in China historically broke through 100 million USD. I have seen different research reports on the EDA market, which generally estimate the global market size to be around 10 billion USD, with domestic enterprises accounting for about 1% in 2020, indicating that there is still a lot of room for development for domestic EDA companies.

This 1% is not easy to achieve. Of course, based on the growth rate, it is estimated that next year (2022), the sales of all domestic EDA companies will exceed 2% globally.

Even if it is 2%, it is still very small, but a small spark can start a prairie fire. It is much better than before when there was no hope, and almost all domestic chip companies used foreign EDA tools.

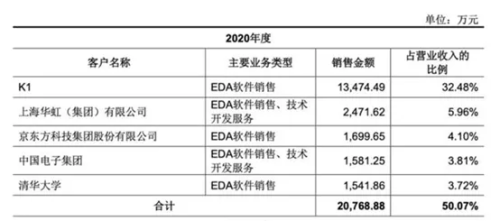

A chip design company codenamed K1 has been the largest customer of this EDA leading enterprise for three consecutive years, contributing 135 million RMB in revenue in 2020, accounting for 33.17% of the main business income (note that this is the proportion of main business income, while the proportion of total revenue is 32.48%). In 2018, K1 contributed only 23.5636 million RMB in revenue, and K1 contributed 42.3% of the increase in main business income from 2018 to 2020, highlighting its importance.

In 2020, the other four major customers were Huahong, BOE, China Electronics Corporation, and Tsinghua University.

This year, Huada Jiutian is expected to grow rapidly again. Although such software companies are still small in scale, their value to the country and the industry is very high. In addition to this leading EDA company, there are also other companies such as Guowei Group, Galanz Electronics, Xinheng Semiconductor, and Xinyuan Vision that are also working on EDA software. Additionally, some new EDA companies have been established in China, such as Quanxin Intelligent Manufacturing, which focuses on the manufacturing field and was established in 2019, and Xinhua Zhang, which was established in 2020.

I believe that many times it is like this. The domestic semiconductor industry chain is gradually starting to run and begin to cycle. Three years ago, the atmosphere in the domestic semiconductor industry was completely different from now. Everyone said they wanted to support domestic production, but when it came to actually putting real money on the table, it was different. To be honest, if the Americans hadn’t come out to push, I don’t know how many years it would take to establish this development cycle. For China, with such a large market and so many talented people, once things start to be done, they will eventually succeed. Moreover, the global semiconductor industry is already a field where Chinese people have a significant advantage, with AMD’s CEO Lisa Su, Nvidia’s founder Jensen Huang, Broadcom’s president Hock Tan, and of course, there are also HiSilicon, TSMC, UMC, MediaTek, etc.

Since the beginning of the trade war in March 2018, it has been three and a half years now. If I were to summarize this phase, I think there are both positive and negative aspects.

The most significant negative effect is that Huawei’s revenue began to decline in 2021. To be honest, Huawei is indeed very resilient. It was placed on the entity list in May 2019, but still maintained positive growth in 2019 and 2020, only experiencing a decline in 2021.

Huawei’s half-year financial report shows total sales revenue of 320.4 billion RMB, a decrease of 28.63% compared to last year (454 billion RMB).

Among them, the revenue from the carrier business was 136.9 billion RMB, down 14.2% from 159.6 billion RMB in the same period last year;

the enterprise business revenue was 42.9 billion RMB, up 18.2% from 36.3 billion RMB in the same period last year;

the consumer business was 135.7 billion RMB, down 46.9% from 255.8 billion RMB in the same period last year.

Huawei’s core remains its carrier business revenue, which is where Huawei started, and it is also the area where Huawei’s technology is most advanced, its patent layout is the richest, and its product competitiveness is the strongest. The goal of the carrier business is to maintain stability. As long as this is stable, it can bring Huawei about 300 billion RMB in revenue each year (the revenue in 2020 was 302.621 billion RMB), which can ensure that Huawei remains a large-scale Fortune 500 company.

The revenue from Huawei’s carrier business comes from a high proportion of the Chinese market, and China is currently building 5G on a large scale. Whether from the bidding shares announced by Chinese operators or from the global shares disclosed by third-party organizations, Huawei’s global carrier business share is stable. The negative growth in the first half of the year is not due to a decline in share, but rather due to the investment rhythm of Chinese operators in 5G.

This point can be confirmed in the explanation of Huawei’s rotating CEO Xu Zhijun regarding the half-year financial report: “Looking ahead to the whole year, despite the decline in consumer business revenue due to external impacts, we are confident that the carrier business and enterprise business will still achieve steady growth.” It can be seen that the carrier business will continue to grow in 2021, and the enterprise business will also continue to expand, which means that Huawei’s core will still be solid and will continue to survive.

The scale of enterprise business revenue is relatively small, and it is hoped to grow to some extent to make up for the losses caused by the decline in consumer business. Huawei’s enterprise business corresponds to the digital transformation of enterprises in various industries and energy businesses such as photovoltaics, or mainly relies on the growth of Huawei Cloud and Huawei Energy to drive the growth of Huawei’s enterprise business. The revenue in the first half of the year was over 40 billion RMB. If it can grow to 100 billion RMB for the whole year (this year or next year), then with 300 billion RMB from carriers and 100 billion RMB from enterprises, Huawei will also maintain a large scale.

Focusing on Huawei, the core is whether its carrier business and enterprise business will grow or decline next year, which is very important. After all, this is Huawei’s most core foundation. The domestic semiconductor manufacturing localization needs to be accelerated. Although it seems that the media attention has decreased now, and on the surface, it is calm, in fact, time is of the essence, and the urgency is high.

The consumer business has seen a significant decline, which is of course due to the sale of Honor and chip shortages. Honor’s annual sales are in the tens of millions of units, but the specific sales revenue has not been disclosed, so it is impossible to know.

After the sale of Honor, its development momentum in recent months has been good. According to Counterpoint data, in April this year, Honor’s sales in China reached a low point, selling less than 1.5 million units, but by June, it had rebounded to over 2 million units per month, with the Honor 50 series performing impressively.

On the evening of August 12, Honor released its latest flagship Magic3 series. Honor’s CEO Zhao Ming stated at the conference that in just three months, Honor’s market share has jumped from a historical low of 3% to 14.6%, indicating a significant rebound.

There are also reports that the U.S. may consider sanctioning Honor, but it is necessary to observe the intensity of the sanctions. If it is just an entity list, restricting the purchase of U.S. technology and products, Honor can still continue to survive. Currently, companies like DJI and SMIC are also on the entity list, but they are still surviving and developing.

However, if the U.S. treats Honor the same way it treats Huawei, requiring all chip manufacturers not to manufacture and ship chips to Honor, that would be a big problem, which is a risk point.

Huawei’s consumer business, aside from hardware such as smartphones,

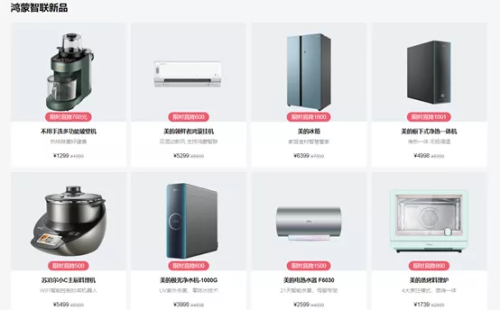

HarmonyOS is the most noteworthy point. HarmonyOS has already begun to contribute revenue to Huawei this year, with home appliances equipped with HarmonyOS being launched one after another, and they can be found in the Huawei Mall, where there is a “Harmony Smart Link” section. Other brands equipped with HarmonyOS will also be sold in this section of the Huawei Mall.

In addition to brands like Midea, Supor, and Joyoung, it has also expanded into electric motorcycles, sweeping robots, smart locks, lighting, and other fields.

The revenue from HarmonyOS can actually be estimated based on the income from Android from Google. The larger the installed base, the higher the revenue. This is why Huawei always announces and emphasizes the increase in the number of HarmonyOS installations. It can also be estimated from another angle, which is the income from HarmonyOS developers, as the two are shared based on a ratio.

Currently, the revenue from HarmonyOS is expected to ramp up in 2022-2023.

Another major business is Huawei’s automotive business. Huawei provides solutions for autonomous driving, cockpit operating systems, and electric drives in the automotive field, and has already begun to generate revenue this year. The BAIC Arcfox equipped with Huawei’s intelligent driving was launched for sale in April this year. On April 20, Huawei’s Yu Chengdong announced the sale of the Seres brand electric vehicle in Huawei’s flagship offline brand store. However, currently, both BAIC and Seres have not achieved significant sales, indicating that the exploration of this new and complex field is not smooth, and Huawei is still in the learning stage.

Additionally, from the recently launched P50, aside from the stock of chips, Huawei’s consumer business has also obtained some chip supply licenses from the U.S., including 4G chips for smartphones, but 5G products are strictly limited in supply. Therefore, at least from the current situation, the consumer business can still continue, but technically it is limited and does not support 5G, which means that the smartphones are technically a generation behind, which is a challenge. This issue can only be completely resolved once the chip problem is solved.

It is very clear that for Huawei’s consumer business, they hope to achieve new business expansion through the Harmony operating system, as well as software for autonomous driving, operating system software, and electronic control components.

For this year, 2021, if Huawei’s three major businesses can successfully achieve the goal of steady growth in carrier and enterprise businesses, while the consumer business experiences a significant decline but continues to exist and sell, and the installed base of Harmony increases rapidly, and the automotive business expands to multiple models and generates revenue, then the strategic objectives will be achieved.

Of course, Huawei also has a magic weapon for improving profit margins, which is patent fees. In the first quarter, it received 600 million USD, driving the group’s net profit margin to rise. In the first quarter of this year, Huawei’s net profit margin reached an unprecedented 11.1%, with a net profit of 16.876 billion RMB. Despite the decline in revenue, net profit actually increased by 3.8% year-on-year, mainly due to “benefiting from receiving a patent licensing fee of 600 million USD.“

Huawei’s lawsuit against U.S. carrier Verizon for 1 billion USD in patent fees was settled in July this year. Although the settlement agreement has not been disclosed, it is believed that Huawei gained benefits from it, which will be revealed in future financial reports.

The trade war has another negative effect on China, which is the outflow of some production capacity.

The biggest beneficiaries are Vietnam and Taiwan.

Due to the large amount of exports to the U.S., after the trade war began in 2018, many Taiwanese businesses returned to expand production capacity in Taiwan, and some Chinese-funded and foreign-funded enterprises have moved their production capacity to Vietnam to avoid the impact of U.S. tariffs on exports of goods from mainland China. The data below has been posted in previous articles about Taiwan, so I will review it here.

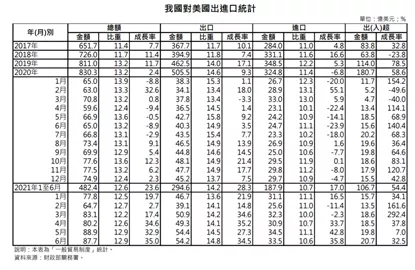

The total exports of Taiwan and the changes in Taiwan’s exports to the U.S. are as follows: In 2017, the export growth rate was 13%, and the growth rate of exports to the U.S. was 10.1%, accounting for 11.7%. In 2018, the export growth rate was 5.9%, and the growth rate of exports to the U.S. was 7.4%, accounting for 11.8%. In 2019, the export growth rate was -1.5%, and the growth rate of exports to the U.S. was 17.1%, accounting for 14%. From the data, it can be seen that the U.S. government’s increasing tariff policies against mainland China have led many Taiwanese businesses to return production capacity to Taiwan for manufacturing and then export to the U.S., resulting in a significant increase in Taiwan’s exports to the U.S. in 2019.

In 2020, Taiwan’s export growth was 4.9%, and the growth of exports to the U.S. was 9.3%, accounting for 14.6%.

In the first half of 2021, Taiwan’s export growth was 31%, and the growth of exports to the U.S. was 28.3%, accounting for 14.2%.

From the data, it can be seen that in 2018, the growth rate of Taiwan’s exports to the U.S. was 1.5 percentage points higher than the overall export growth rate. In 2019, the growth rate of Taiwan’s exports to the U.S. was the highest, exceeding the overall export growth rate by 18.6 percentage points. In 2020, it was 4.4 percentage points higher.

In the first half of this year, the growth rate of exports to the U.S. was lower than the overall export growth rate by 2.7 percentage points.

This also shows that the transfer effect brought about by the U.S. tariffs on mainland China has been fully released from 2018 to 2020, and this wave of dividends for Taiwan has ended.

As for Vietnam, its exports to the U.S. have also rapidly increased in recent years, and this year, exports to the U.S. are still growing rapidly.

In the first eight months of this year, Vietnam’s cumulative exports reached 212.5 billion USD, a year-on-year increase of 21.2%.

From January to August, Vietnam’s exports to the U.S. reached 62 billion USD, a year-on-year increase of 32.5%. However, it is noteworthy that from January to August, Vietnam imported goods worth 72.5 billion USD from China, a year-on-year increase of 47.1%.

If we look at the import and export data of Vietnam over the past few years, we can see that on the one hand, Vietnam’s exports to the U.S. are growing very rapidly, while on the other hand, China’s exports to Vietnam are also increasing rapidly. This indicates that while Vietnam’s exports are expanding, it needs to import more upstream raw materials and production equipment from China. Additionally, the development of Vietnam has expanded the local market, which has actually also expanded the export market for Chinese manufacturing. After all, Vietnam’s current consumption structure is more favorable to Chinese manufacturing, which has a higher share in the mid-to-low-end consumer goods sector.

I believe that the transfer of production capacity to Vietnam is better than to Taiwan. A typical example is that even if Taiwanese-funded enterprises move to Vietnam, they still need mainland cadres and employees to go to Vietnam to work in the factory, thus retaining some job opportunities. However, if they return to Taiwan, mainland people basically cannot obtain job opportunities in Taiwan due to the political atmosphere.

In summary, Huawei’s revenue decline and the outflow of the industrial chain are the biggest negative effects brought about by the trade war and technology war, especially for Huawei. Former White House chief strategist Steve Bannon proposed that “attacking Huawei is ten times more important than reaching a U.S.-China trade agreement,” which truly sees the core issue. The essence of the Huawei incident is the rise of China’s high-tech industry, which is of greater importance.

For the trade war, even if we completely lose the U.S. market, for China, it is only losing less than 20% of global exports, and we can still obtain supplements from other markets. In fact, unless the two countries completely sever relations, it is impossible to completely lose the U.S. market. Now that Vietnam’s exports to the U.S. are so fast, a lot of it is actually Chinese-funded enterprises building factories in Vietnam, and a lot of upstream components and raw materials are imported from China.

However, if the high-tech industry cannot break through upwards, it means losing 100% of the global high-tech and high-profit market. The significance and weight of the two are completely different.

The biggest positive effect over the past three and a half years, I believe, is twofold.

First, the tangible benefit is that China’s semiconductor industry has begun to rise.

More specifically, from 2018 to 2021, our semiconductor industry has added about 200,000 job opportunities, note that this is the net increase, and the average monthly salary for these 200,000 job opportunities exceeds 12,000 RMB, while the average monthly salary for R&D positions is even higher, exceeding 20,000 RMB. This means that all the new jobs are mid-to-high-end positions. These 200,000 jobs are a substantial increase and are the largest source of mid-to-high-end job growth in our country over the past three years. Moreover, the number of jobs in the semiconductor industry is still rapidly increasing, and the final increase will definitely far exceed 200,000.

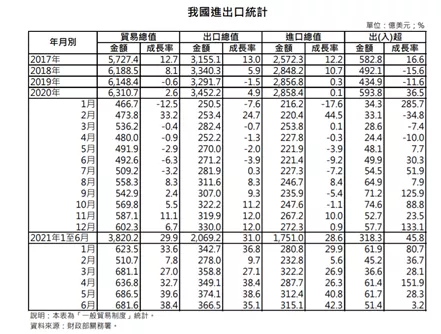

The second benefit is psychological, which is the enhancement of self-confidence, greatly reducing the fear of the U.S. and providing a new understanding of the country’s strength. We have been in friction with the U.S. for three and a half years, and as a result, our exports to the U.S. this year are expected to be even higher than in 2018. At that time, the total exports to the U.S. were 478.423 billion USD, while the exports to the U.S. from January to July this year were 302.447 billion USD.

Huawei was placed on the entity list in May 2019, and it has been more than two years since then. Despite a significant decline in revenue in the first half of this year, it is still operating normally, while greatly stimulating the development of the domestic semiconductor industry. This also reflects the comprehensiveness of our industrial chain. When the U.S. strikes one main battlefield, it instead provides huge development opportunities for other industries in the industrial chain.

When the trade war and technology war broke out more than three years ago, we were still quite fearful of the strong trade tariffs and technological blockades from the U.S. and lacked sufficient confidence in achieving victory through our own development in the trade war and technology war. On this basis, many people in the country began to reflect on whether we had done something wrong, whether we were too high-profile, or whether Huawei had violated international rules.

In fact, after more than three years, it can be seen that in terms of legal principles,

the WTO issued a ruling on September 15, 2020, stating that the U.S. tariff measures involved violate WTO obligations, and imposing tariffs on Chinese goods worth over 200 billion USD is illegal. It is not China that does not comply with international rules. Not only that, but the U.S. has imposed a series of sanctions on Huawei, yet has not been able to provide strong evidence of Huawei’s violations.

In terms of actual effects, China’s economy continues to grow at a much faster rate than the U.S. From 2018 to 2021, our export value has continued to grow, and our global share of exports continues to expand. Although Huawei’s revenue has been significantly affected this year, with a considerable decline in the first half of the year, it has instead led to the rise of the semiconductor industry chain. In terms of employment, Huawei had 194,000 employees at the end of 2019, which grew to 197,000 by the end of 2020. There has not been a large-scale reduction in employment, but rather it has stimulated the semiconductor industry chain to add about 200,000 jobs.

At least so far, China’s mid-to-high-end industrial chain has not been significantly affected by U.S. sanctions in terms of employment, but has continued to expand.

More and more people are beginning to agree with the view that as a large country with a population exceeding one billion, China’s revival depends entirely on itself. As long as China does well and internal issues can be continuously resolved, no external forces can stop us, not even the U.S.

Including the industrial outflow we have always worried about, we have now controlled the domestic epidemic well, while the epidemic abroad is severe. Even Vietnam, which has been controlling well, has recently experienced an outbreak. Therefore, the outflow of production capacity is not a problem at present. In fact, our global export share has increased significantly.

For the semiconductor industry chain and Huawei, the fundamental solution is to create our own domestic production lines, or to say that it still depends on whether we can achieve localization, because the Chinese market is very large, and there are companies in every link of the semiconductor industry chain, and there are also national research institutions outside the industry chain, which provide the basic conditions for localization.

These are my thoughts for today.

Source| WeChat public account “Ning Nanshan” (ningnanshan2017)