On April 16, U.S. local time, U.S. Secretary of Commerce Wilbur Ross announced that the Bureau of Industry and Security (BIS) had decided to impose an export ban on ZTE Corporation. Under this ban, U.S. manufacturers will be prohibited from selling components, software, and related technologies to the Chinese telecommunications equipment manufacturer ZTE until March 13, 2025.

The incident originated from ZTE’s alleged violation of U.S. export control policies against Iran, which may lead to penalties from the U.S. Department of Commerce. The Department of Commerce has placed ZTE and other Chinese companies on the “Entity List” for violating U.S. export control regulations, restricting ZTE’s suppliers in the U.S. from exporting products to ZTE.

As for the violation of U.S. export control policies against Iran, this is actually an old case. In 2012, ZTE was involved in signing a million-dollar telecommunications equipment contract with an Iranian telecommunications operator. Subsequently, the U.S. launched an investigation, and ZTE did not deliver this batch of equipment; nevertheless, it still faced severe penalties from the U.S. Now, at this sensitive time, the U.S. has chosen to sanction ZTE, ostensibly because ZTE did not comply with the agreement to “penalize or reduce bonuses for 35 employees.” However, this reason does not hold up under scrutiny.

Although ZTE made mistakes first, the U.S. government’s renewed attack and the severity of the punishment raise questions about whether the U.S. government has “ulterior motives.”

Chinese Telecommunications Industry Overtakes; U.S. Aims at 5G Market

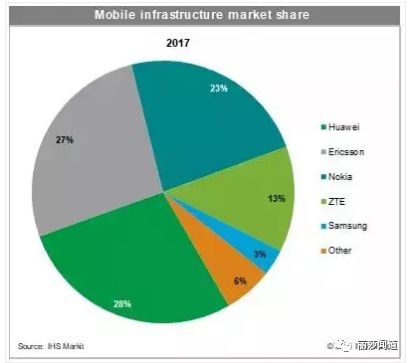

A report from research firm IHS Markit shows that Huawei surpassed Ericsson last year to become the world’s largest telecommunications equipment manufacturer, with a market share of 28% in mobile infrastructure business, up three percentage points from 25% in 2016. Meanwhile, ZTE Corporation captured 13% of the global mobile infrastructure market.

In 2017, ZTE made several significant breakthroughs in the 5G field. In February, ZTE launched a full series of pre-commercial 5G base stations and debuted the IP+Optical 5G bearer solution Flexhual; in October, ZTE collaborated with Italy’s Wind Tre and Open Fiber to launch Europe’s first pre-commercial 5G network; in December, ZTE introduced 5G core products based on service-oriented architecture.

On April 3, 2018, ZTE announced on its official Weibo that it had recently completed the first call based on the 3GPP R15 standard, officially opening end-to-end 5G commercial system scale outdoor sites, further accelerating the 5G commercial process.

China’s communication technology has transitioned from following in the 2G era, participating in the 3G era, to synchronizing in the 4G era. In the 5G era, the industry generally believes that China has successfully entered the first tier and is at the forefront of the world in 5G bearer standard formulation and the 5G industrial chain.

In the 3G and 4G eras, Qualcomm was the leader in rule-making, and these advantages have allowed Qualcomm to remain in a leading position in the development and standardization of 5G technology, which will significantly impact U.S. “national security.”

Some people argue that the 5G standards are still incomplete and in their infancy; technically, standards will always improve. In the absence of a substantial technological gap, what matters is the number of people and strength. The more users and supporters there are, the more established the standard becomes. With the introduction of 5G standards, the position of Chinese enterprises will be crucial in future discussions on mMTC and URLLC scenarios. As we move into 6G and 7G, China is set to transition from a follower to a leader, and it is likely that the standards will become dominated by Chinese manufacturers. In the 2G, 3G, and 4G eras, domestic mobile companies had to pay high patent fees due to competitors’ patents that could not be circumvented. However, in the 5G and 6G eras, for downstream companies such as Apple and Samsung, it will no longer just be a matter of paying patent fees to Qualcomm; Huawei and ZTE will also be involved. In the 5G and 6G eras, every iPhone sold by Apple could mean paying Huawei and ZTE a certain amount in patent fees, which is a deeply concerning prospect.

In the context of the rise of the Chinese technology industry, represented by telecommunications, the U.S. government views China as the only potential major competitor that could pose a threat in the technology field. The Chinese government actively invests in research and development in the technology industry, and the rapid rise of Chinese technology companies in the global market may challenge the U.S.’s dominant position in the global technology sector. Although Chinese companies hold less than 1% of the U.S. wireless network hardware market, the U.S. wants to prevent them from gaining more market share, especially at this critical time when 5G services are about to be commercialized.

2

Ban Harms Both Parties; U.S. Suppliers Also Affected

Does this ban only harm others and benefit the U.S.? In fact, this ban not only blocks ZTE but also its American partners.

Ironically, the impact of the sanctions on ZTE’s U.S. business may exceed that on its Chinese business. Despite being the second-largest telecommunications equipment manufacturer in China, Canalys reports that as competitors like Huawei, OPPO, Vivo, and Xiaomi rise, ZTE’s ranking in China’s smartphone sales has fallen out of the top ten in recent years. However, in the U.S., ZTE is the fourth-largest smartphone manufacturer, trailing only Apple, Samsung, and LG. Canalys data shows that ZTE held an 11.2% share of the U.S. smartphone market last year.

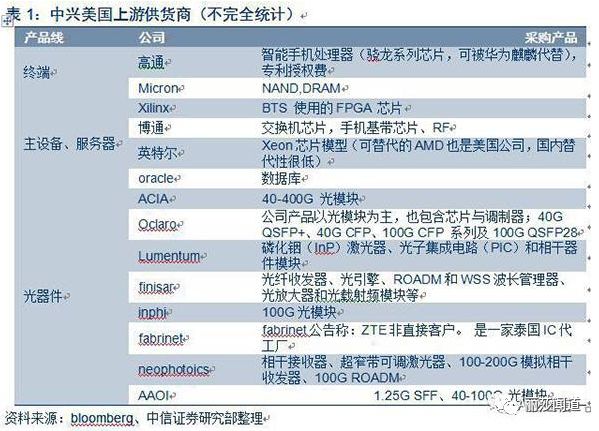

ZTE’s U.S. website lists mobile phone specifications showing that its U.S. phones use Qualcomm chipsets and processors; all signature phones use Qualcomm’s Snapdragon 820, Snapdragon 617, and other chips. ZTE sells about 45 million smartphones globally each year, with nearly half using Qualcomm chips. Calculating an average of $25 per chip, this business generates nearly $500 million in revenue. Qualcomm’s stock price fell 1.7% on Monday.

Meanwhile, the impact on U.S. component suppliers was immediate. Overnight, as the U.S. stock market rose, suppliers’ stock prices plummeted. By the close, Silicon Valley star photonics company Acacia fell 35.97%, Oclaro dropped 15.18%, Lumentum decreased by 9.06%, Finisar was down 4.05%, Inphi fell 4.05%, and Fabrinet dropped 9.81%.

Most of these companies rank among the top 10 global optical component suppliers, and their stock price crashes are due to their deep reliance on procurement from Chinese equipment manufacturers like ZTE and their heavy dependence on the Chinese market. For example, Acacia derives 30% of its revenue from ZTE. By suppressing China’s information and communication industry, U.S. suppliers find it hard to remain unaffected; it is bound to be a lose-lose outcome.

3

Challenges and Opportunities: Reflecting on the “Chip Pain” and Addressing Shortcomings

In fact, this is not the first time ZTE has faced heavy penalties. In 2016, ZTE was subjected to U.S. export controls and paid $892 million (about 6.155 billion yuan) in criminal and civil fines. However, two years later, ZTE did not face the bankruptcy outcome initially expected; instead, it actively engaged in strategic planning and industrial upgrades, gradually emerging from the shadow. For China’s chip industry, the U.S. restrictions on China present a great opportunity for rapid development.

Currently, integrated circuits have surpassed crude oil to become the most import-dependent product. Looking at the import data, it is very clear that among the top ten imported products, six are technology-related, namely integrated circuits, automobiles, LCD panels, measuring instruments, auto parts, and data equipment. The total import value of these six items was $390.7 billion in 2016, accounting for a staggering 24.6% of the total imports that year. From January to April 2017, the combined scale of these two items was $120.4 billion, accounting for 21.5%.

A market demand of $400 billion annually, if shifted to domestic production, will greatly stimulate the rapid development of the chip industry. We can take a look at the current domestic chip companies in China:

1. Main CPU for Mobile Phones

A) Spreadtrum and RDA Microelectronics

Spreadtrum was established in Shanghai in 2001, and RDA Microelectronics was founded in Shanghai in 2004. Both companies went public on NASDAQ in 2007 and 2010, respectively, and were privatized by Tsinghua Unigroup in 2013 and 2014. Spreadtrum and RDA mainly produce main chips for 2G feature phones, 3G and 4G smartphones, RF PAs, digital TV chips, tablet main chips, and provide related hardware and software reference designs, offering Total Service. In 2015, Spreadtrum and RDA’s baseband chip shipments ranked third after Qualcomm and MediaTek, supplying chips for brands like Samsung, Huawei, and Coolpad.

B) HiSilicon

HiSilicon was established in October 2004, originally as Huawei’s integrated circuit design center founded in 1991. The company mainly produces smartphone chips, base station chips, router chips, set-top box chips, and video surveillance chips. In the smartphone chip sector, it is mainly adopted by Huawei for its high-end flagship devices; in the base station chip sector, it holds a high market share due to Huawei’s presence; in video surveillance, it has gained many clients and achieved good results due to its cost-effectiveness.

C) MediaTek

MediaTek was founded in 1997, specializing in the development of main chips for feature phones and smartphones, digital TV chips, and related chips for DVDs and Blu-ray. MediaTek ranks first in the DVD and digital TV chip sectors, and it was the first to propose the concept of Turkey in the smartphone chip sector, quickly capturing market share.

2. Main Chips for Tablets

A) Rockchip

Rockchip was established in Fujian in 2001. It once held a high market share during the era of tape recorders, MP3s, and MP4s, and quickly recognized the opportunity in the Android market in 2008, launching Android-compatible tablet chips and maintaining a leading position in Android Wi-Fi-only tablets for a long time. In recent years, Rockchip has continued to strengthen its presence in tablets and actively expand into other related fields. Firstly, it continues to develop higher cost-performance ratio tablet chips; secondly, through collaboration with Intel, it developed and launched a tablet solution with calling capabilities; next, it began to make strides in OTT boxes and IPTV; and leveraging its years of experience in audio and video, Rockchip recently launched a VR platform, providing strong audio and video decoding capabilities for VR manufacturers to develop higher-performance VR devices; finally, it has also begun to show signs of success in IoT and automotive applications. Big vision, big perception, and big audio are the main lines of Rockchip’s future operations.

B) Actions Semiconductor

Actions Semiconductor was established in Zhuhai in 2001 and was the most significant supplier of MP3 and MP4 chips in the country at that time. During the MP4 era, Actions chose to use a low-power MIPS architecture instead of the ARM architecture. However, during the Android tablet era, Actions continued to conservatively adopt the MIPS architecture, which made it challenging for many software to run on MIPS, severely hindering the promotion of Actions’ tablet chips and missing the best opportunity to thrive in the tablet market. In recent years, Actions has been increasingly quiet in the smart chip market.

C) Allwinner Technology

Allwinner Technology was established in Zhuhai in 2007 by several key former employees of Actions. In 2012, it launched chips similar to ARM naming conventions, attracting much attention, and gained the top position in tablet shipments by capturing a significant market share from Rockchip. However, in the quad-core era, Allwinner suffered a setback due to the premature use of 64-bit DRAM and overheating issues, resulting in a poor start in the tablet market, and it has been unable to recover since. Currently, the overall shipment of tablets has significantly declined, and Allwinner is still searching for new breakthroughs.

3. Memory

A) Unisoc

In 2006, Infineon’s memory division was spun off to become Qimonda. After Qimonda’s bankruptcy in 2009, Inspur Group acquired Qimonda’s Xi’an R&D center and renamed it Xi’an Huaxin Semiconductor. In 2015, Unisoc acquired Xi’an Huaxin Semiconductor to enter the memory design industry. Although Unisoc’s acquisition of Micron and stake in Western Digital faced obstacles, it demonstrates Unisoc’s determination to enter the storage industry.

B) Nanya Technology

Nanya Technology is a DRAM company founded in 1995 by Wang Yongqing, the founder of Formosa Plastics Group. Most of its technology comes from Micron’s licensing, so it can currently only achieve a DRAM process of 30nm. However, it is currently the only company in China that can compete with Samsung, SK Hynix, and Micron in DRAM.

C) GigaDevice

GigaDevice mainly develops NOR Flash and produces it through Wuhan Xinxin. It is the largest supplier of memory for feature phones in the village. Currently, GigaDevice is also developing NAND Flash, and only with mature NAND Flash can it have a chance to enter the smartphone market.

4. RF PA

A) RDA Microelectronics

RDA Microelectronics started as a PA company and was one of the earliest PA companies in China. A few years ago, RDA was a winner in the PA field, but its relative silence in recent times is mainly attributed to insufficient investment in the PA product line before its acquisition by Unisoc. Now it has adjusted internally and has become a decisive force in the industry, supplying RF PAs for Samsung’s 3G/4G devices.

B) Airoha

MediaTek acquired Airoha from BenQ a few years ago and began developing RF PAs. MediaTek has started recommending Airoha’s PA for customers on the MT6737, but just like a few years ago when MediaTek used Sourcecom for RF PA, Airoha is also struggling to gain traction.

C) Vanchip

Vanchip is mainly composed of former RFMD employees. Last year, it was sued by its former employer RFMD but later reached a settlement. Currently, Vanchip performs relatively well among domestic PA manufacturers. However, other small domestic PA companies view Vanchip as a competitor and use low prices to suppress it, making it difficult for Vanchip.

5. Fingerprint Recognition

A) Silead

Silead was established in 2010 and is a chip company invested by the major supplier of camera sensors, Geke Micro. Previously, it mainly produced touch screen chips and achieved the number one market share in the tablet market, but it has not made significant achievements in the smartphone market. In 2014, Silead began entering the fingerprint recognition market.

B) Goodix

Goodix was established in 2002 and is a major supplier of touch screen chips for smartphones. Leveraging its good relationship with domestic smartphone brand manufacturers, Goodix quickly designed in with Meizu, ZTE, and LeTV after launching its fingerprint recognition technology in 2014. This year, Goodix, along with Silead, became a supplier for Huawei.

C) Micron Technology

Currently, Micron’s clients are still small design houses. Although Micron claims to have many patents for its products, it urgently needs brand clients to prove its capabilities.

D) Jichuang North

By collaborating with Unisoc, Jichuang North started to gain attention by leveraging Unisoc’s brand. However, its future development still requires better market expansion, rather than relying on other companies.

In recent years, the shipment of smartphones in China has accounted for about 30% of the global total, while major Chinese smartphone brands have reached 34% of global smartphone shipments. China has become the largest producer and market for smartphones.

However, in terms of key components, Chinese smartphone chips do not hold a competitive advantage. The CPUs of flagship devices are still primarily sourced from foreign manufacturers like Apple, Samsung, and Qualcomm. Although HiSilicon has secured a place in flagship CPUs through Huawei, it is not used by other brands. Domestic companies like Spreadtrum, Rockchip, and MediaTek still need to develop their technologies to compete with foreign manufacturers, which requires strong support from the state. In terms of memory, the domestic accumulation is even weaker; in 2015, China’s DRAM procurement amounted to about $12 billion, and NAND Flash procurement was $6.67 billion, accounting for 21.6% and 29.1% of global supply, respectively. Late development and technological lag mean that domestic smartphone chip companies will continue to rely on state support for faster growth.

Many believe that market economy is a matter of survival of the fittest and should not rely on state support. The U.S. and South Korea are concerned about the rise of China’s semiconductor industry, yet they also developed their semiconductors through government support. The development of Qualcomm and Samsung can be traced back to state assistance. If it weren’t for the U.S. government intervening, China Unicom would not have had GSM and would have accepted the mess of CDMA, which allowed Qualcomm to revive from a precarious position. Now, the U.S. government is still calling for the Chinese government not to implement unequal semiconductor policies. The irony is that they grew strong through government support but now do not allow other countries’ governments to support their semiconductor development, which is inherently laughable.

Of course, Chinese smartphone chips still have a long way to go. The state needs to support several leading enterprises to grow larger and stronger, as well as encourage and support small and medium-sized enterprises to innovate and develop new technologies. Only by mastering key technologies and innovating can they avoid being constrained and restricted by foreign companies. China urgently needs to vigorously develop its smartphone chip industry chain.

Source: Lisa Wenda