With DS8201 continuously dominating the field of HER-2 solid tumors such as breast cancer, gastric cancer, and lung cancer, the pressure on other HER2-ADCs is increasing day by day. Faced with a suddenly strong competitor, various HER2-ADC manufacturers have their own responses; some choose to join forces when they cannot compete, quickly following in the footsteps of DS8201. Some avoid its sharpness, seeking survival in niche areas that DS8201 has yet to reach, engaging in differentiated competition. Others, recognizing the competitive landscape, have already declared their withdrawal from the race.

The HER-2 Target, The Main Stage of ADCs

As a classic old target, HER-2 has led to the development of many blockbuster drugs, with both large and small molecules showcasing their prowess at this target. The launch of trastuzumab in 1998 changed the fate of breast cancer patients, significantly improving the prognosis for HER2-positive breast cancer patients. Subsequently, the first-generation HER-2 ADC representative TDM-1 (Kadcyla) pushed the treatment of HER2-positive breast cancer to a new level, remaining the best-selling ADC drug on the market. The second-generation HER-2 ADC DS-8201, with its exceptional efficacy, again breaks through the application boundaries of TDM-1, opening the door to a new world of HER-2 targeted therapy.

In the Face of Strong Rivals, The Responses of HER-2 ADCs

TDM-1 has been the first approved HER2-ADC drug and has maintained a considerable market share in the field of HER2 breast cancer, continuing to show steady performance growth since its launch. In 2018, TDM-1’s sales exceeded 1 billion USD, making it the world’s best-selling ADC drug.

With DS8201 making a full-scale advance in the field of HER-2 positive breast cancer, the territory that TDM-1 relies on for survival has begun to face the most severe threat. In the head-to-head DESTINY-Breast03 clinical trial, DS8201‘s crushing efficacy quickly allowed it to replace TDM-1 as the new standard for second-line therapy in HER-2 positive breast cancer.

In the face of such fierce market impact from DS8201, Roche can only choose to respond with price cuts. Just before DS8201’s domestic launch, Roche proactively implemented price reductions twice last year, with reductions reaching 56.7%, close to the average reduction level in medical insurance negotiations.

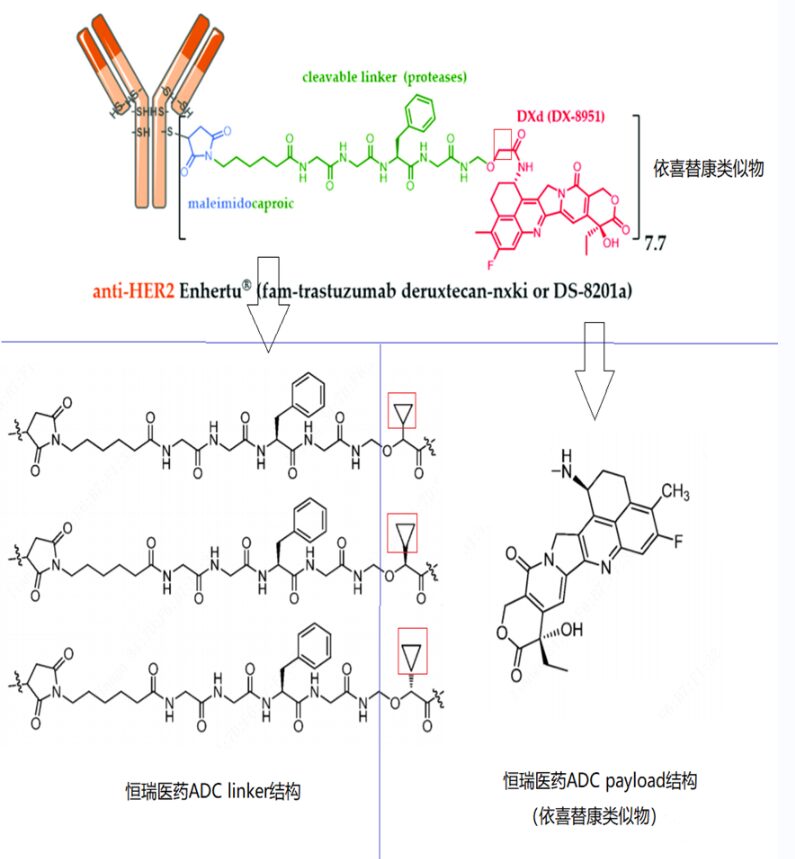

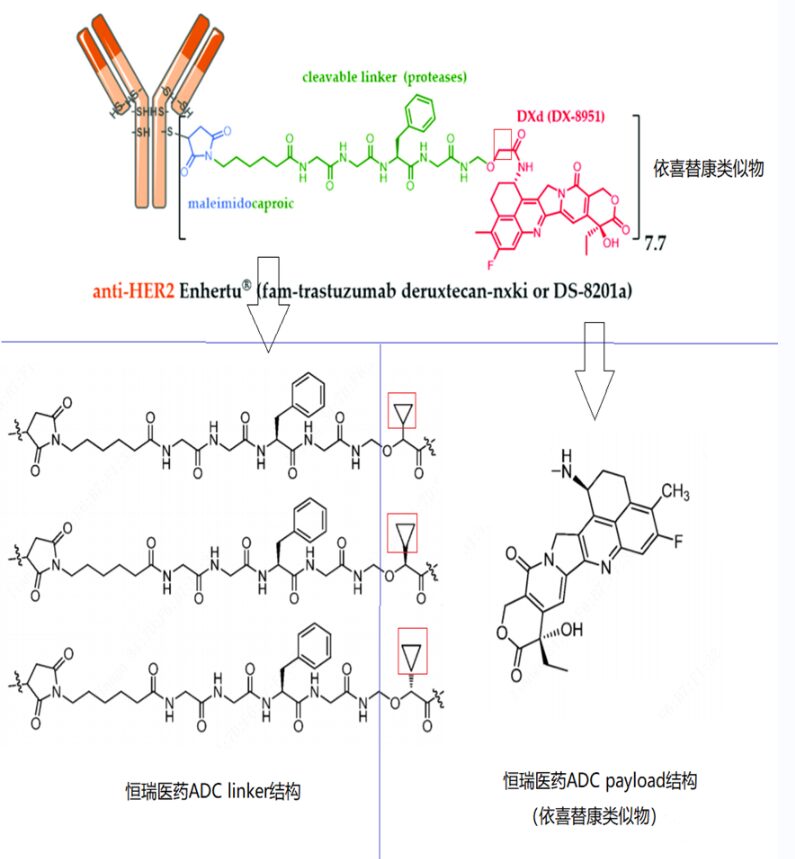

For more players, the response strategy to DS8201 is“ if you can’t beat them, join them”. The success of DS-8201 has made its technical route and design philosophy highly sought after, with companies like Baiyao, Chengda Tianqing, and Hengrui quickly following suit.

Baiyao was once very advanced in the HER2-ADC race, being the first to develop a TDM-1 similar drug BAT8001, which entered Phase III clinical trials first. BAT8001 was once thought to be able to obtain the first domestic listing for an ADC drug, but clinical data indicated that BAT8001 is a me worse product compared to T-DM1. After the Phase III clinical failure, Baiyao decisively abandoned development and quickly shifted strategies, aiming to create a me-better drug compared to DS-8201. With a “topoisomerase I inhibitor + cleavable linker” technical route, Baiyao quickly sent its second HER-2 ADC drug (BAT8010) into clinical trials.

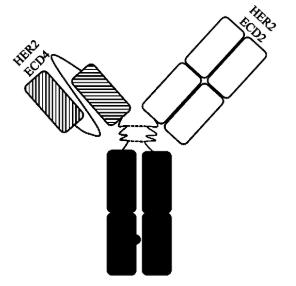

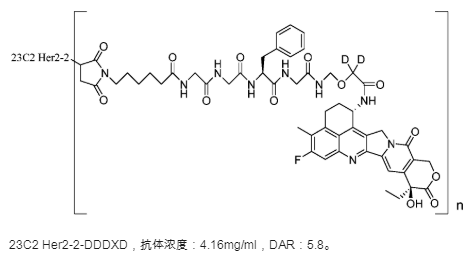

Hengrui has shifted from following TDM-1 to following DS-8201, with an increasing determination to layout ADCs. Ten years ago, Hengrui developed its first ADC drug SHR-A1201 by mimicking TDM-1, which had already progressed to the clinical stage in 2016. However, SHR-A1201 gradually fell behind in the domestic HER2-ADC race, becoming an abandoned pipeline. After DS8201’s impressive data presentation, Hengrui quickly changed its follow target to DS-8201, fast-following with its second HER2-ADC pipeline SHR-A1811, rapidly advancing to Phase III clinical trials.

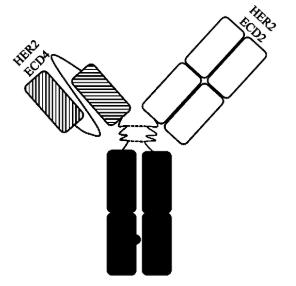

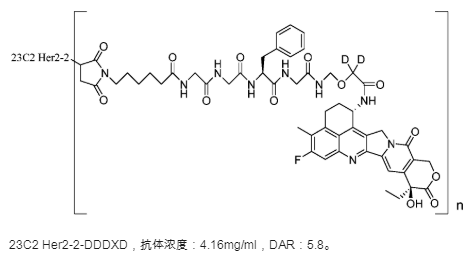

Although Chengda Tianqing’s follow speed is not as fast as Hengrui and Baiyao, they cleverly utilized deuterated technology to avoid the patent protection of DS-8201 by Daiichi Sankyo. On February 17, 2022, Chengda Tianqing publicly disclosed the relevant patent for deuterated DXD-ADC drugs (WO2022033578), finding loopholes in DS-8201’s patent protection through deuterated design—DS-8201 does not cover deuterated structural protection. In the synthesis process, they also avoided using the linker structure protected by Daiichi Sankyo, cleverly circumventing the patent protection of the non-cleavable linker. The new drug clinical application for the HER2 bispecific ADC TQB2102 born from deuterated technology has recently been accepted by the NMPA, with indications for advanced malignant tumors.

Although Chengda Tianqing’s follow speed is not as fast as Hengrui and Baiyao, they cleverly utilized deuterated technology to avoid the patent protection of DS-8201 by Daiichi Sankyo. On February 17, 2022, Chengda Tianqing publicly disclosed the relevant patent for deuterated DXD-ADC drugs (WO2022033578), finding loopholes in DS-8201’s patent protection through deuterated design—DS-8201 does not cover deuterated structural protection. In the synthesis process, they also avoided using the linker structure protected by Daiichi Sankyo, cleverly circumventing the patent protection of the non-cleavable linker. The new drug clinical application for the HER2 bispecific ADC TQB2102 born from deuterated technology has recently been accepted by the NMPA, with indications for advanced malignant tumors.

There are also some looking for survival space in fields not yet touched by DS8201, with Rongchang Biopharma being a typical example. The first domestically marketed ADC drug, Vidisic, is still encouraging. However, from the perspective of indication layout, Vidisic’s first indication is not the major indication for HER2-targeted drugs—breast cancer, but rather gastric cancer. In subsequent indication applications, Rongchang Biopharma still chose differentiated indications—urothelial carcinoma, forming a differentiated competition with DS8201.

In the face of DS8201’s dominating presence in the field of HER2-targeted tumors, apart from firm responses, some players have also assessed the situation and are preparing to withdraw from the arena. Ambrx Biopharma previously announced the abandonment of internal development for its leading pipeline ARX788, aiming to seek other partners for external development. The reason for abandoning development was expressed very calmly by Ambrx. The company believes that in the crowded market space for HER2-ADCs, ARX788 is unlikely to stand out. Especially in the vast clinical landscape of DS8201, ARX788 struggles to compete for clinical resources. Abandoning internal development of ARX788 was a decision made after careful consideration by the company.

There are also some looking for survival space in fields not yet touched by DS8201, with Rongchang Biopharma being a typical example. The first domestically marketed ADC drug, Vidisic, is still encouraging. However, from the perspective of indication layout, Vidisic’s first indication is not the major indication for HER2-targeted drugs—breast cancer, but rather gastric cancer. In subsequent indication applications, Rongchang Biopharma still chose differentiated indications—urothelial carcinoma, forming a differentiated competition with DS8201.

In the face of DS8201’s dominating presence in the field of HER2-targeted tumors, apart from firm responses, some players have also assessed the situation and are preparing to withdraw from the arena. Ambrx Biopharma previously announced the abandonment of internal development for its leading pipeline ARX788, aiming to seek other partners for external development. The reason for abandoning development was expressed very calmly by Ambrx. The company believes that in the crowded market space for HER2-ADCs, ARX788 is unlikely to stand out. Especially in the vast clinical landscape of DS8201, ARX788 struggles to compete for clinical resources. Abandoning internal development of ARX788 was a decision made after careful consideration by the company.

It is undeniable that the stunning clinical performance of DS-8201 has left other players in the HER2-ADC race with a sense of unattainability. The replacement of the first-generation HER2-ADC by DS-8201 not only squeezes the existing survival space of HER2-ADCs but also raises the threshold for newcomers to enter the market.

Regardless of how DS-8201 will profoundly change the market landscape for HER2-targeted drugs in the future, for the vast number of HER2 tumor patients, the emergence of DS-8201 brings a significant survival transformation that is far-reaching.

1.https://www.biospace.com/article/ambrx-announces-abrupt-leadership-shuffle-as-hermans-replaces-tian-/

2.https://endpts.com/squeezed-by-astrazeneca-daiichi-sankyo-biotech-developing-her2-adc-switches-ceo-launches-pipeline-review/

3.https://www.businesswire.com/news/home/20220816005844/en/Ambrx-Biopharma-Appoints-Kate-Hermans-as-Interim-CEO-Replacing-Feng-Tian

4.Deuterated DXd-ADC Technology: Chengda Tianqing’s Clever Layout / Pharmaceutical Notes

5. Re-fighting HER-2, Baiyao’s New Generation HER-2 ADC Approved for Clinical Trials / Biopharmaceutical Editor

6. Hengrui’s Heavy Investment in ADCs / Biopharmaceutical Editor

7. The Predicament of Other ADCs Under the Shadow of DS-8201 / Antibody Research