▎“From an ecological perspective, smartwatches have never been independent; they are an extension of smartphones.”

Author|Du Zhiqiang

Editor|Zhong Yi

This article was first published on the Titanium Media App

In 2015, the first generation of the Apple Watch was released, injecting new imagination into the smartwatch market and was once considered a groundbreaking product under Cook’s leadership. Eight years later, if we only consider the product, the Apple Watch is undoubtedly successful, consistently ranking first in the industry.

However, it still falls far short of being comparable to the iPhone.

Simply put, there is a significant gap between smartwatches and smartphones in terms of market capacity and the imagination of terminal capabilities. Smartphones are necessities, while smartwatches have not yet reached that level. Even with improvements in battery life, design, and functionality, and even with added communication features, smartwatches still cannot shed the label of being “accessories” to smartphones.

“From an ecological perspective, smartwatches have never been independent; they are an extension of smartphones,” said Ivan Lam, a senior analyst at Counterpoint, to the Titanium Media App. Amid the chill in consumer electronics, the entire smartwatch market has also been affected, especially in the Chinese market, where shipments have dropped to a low point not seen in 12 quarters.

Growth in the Indian Market Against the Trend

Huawei and Apple Dominate the Domestic Market

In the consumer electronics market, to some extent, smartphones can serve as a barometer for the entire industry.

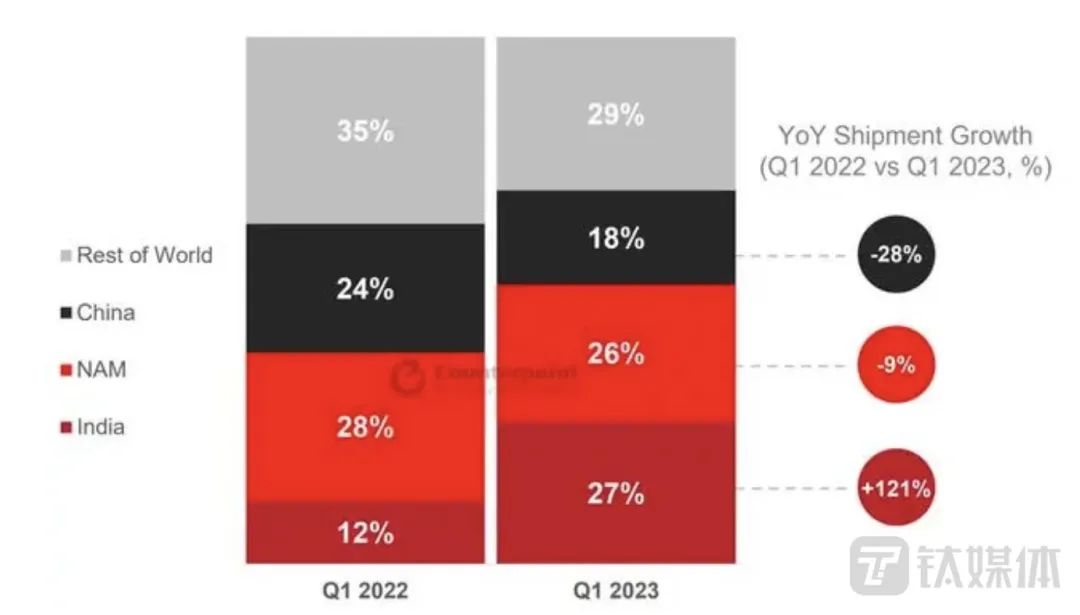

In 2022, global smartphone shipments fell by more than double digits, and the first quarter of this year still shows no signs of recovery. For smartwatches, although there is support from emerging markets, the overall market is still in a downward trend in the first quarter.

Image Source: Counterpoint

According to the latest report from market research firm Counterpoint Research, global smartwatch shipments in the first quarter of 2023 fell by 1.5% year-on-year. Among them, Apple’s shipments fell below 10 million units for the first time in three years, a year-on-year decline of 20%. The Indian brand Fire-Boltt surpassed Samsung for the first time, with shipments increasing by about three times, ranking second in the global market.

Fire-Boltt’s growth is not only due to its cost-performance strategy but also significantly driven by the strong growth of the Indian market. Compared to the global market’s decline, the Indian market grew by 121% in the first quarter, surpassing North America to become the largest market in the world with a 27% share of global smartwatch shipments.

In contrast to the rapid growth of the Indian market, China’s smartwatch market share has dropped to third place, with shipments in the first quarter of this year declining by 28% year-on-year and 16% quarter-on-quarter, reaching the lowest level in 12 quarters.

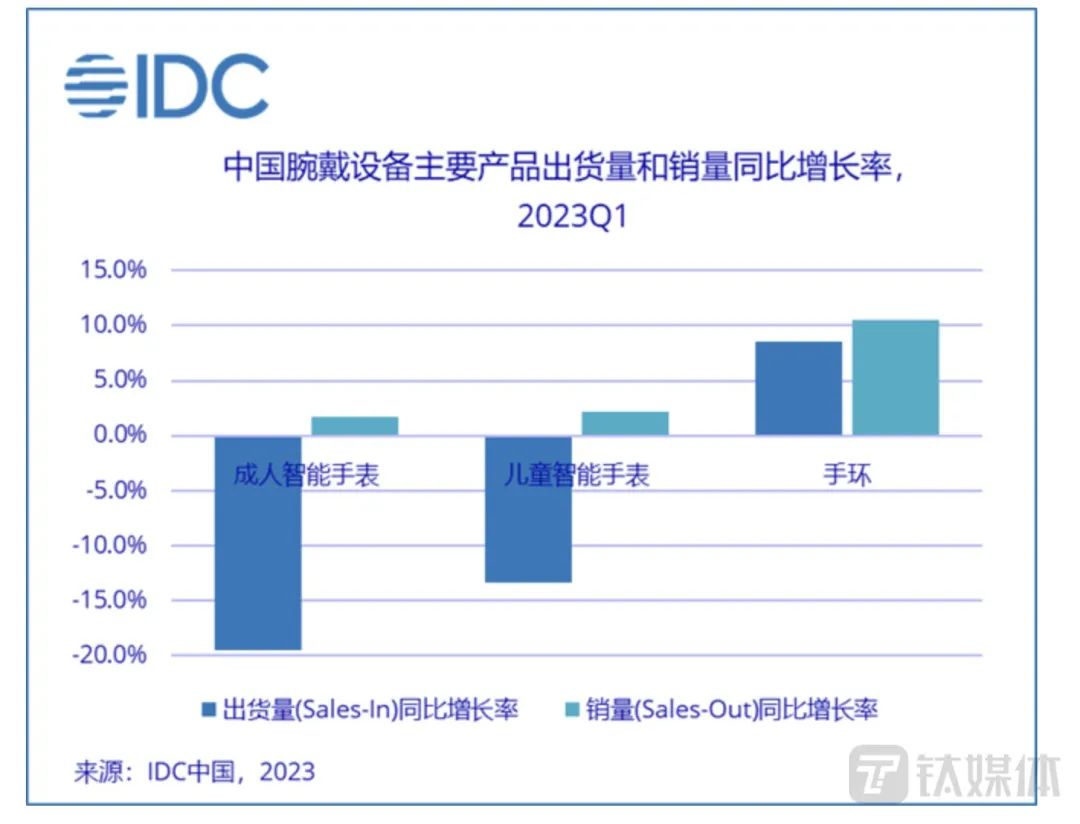

In 2022, China’s smartwatch shipments fell by 9.3% year-on-year. Data from IDC also indicates that in the first quarter of 2023, domestic smartwatch shipments were 5.9 million units, a year-on-year decline of 16.7%. Among them, adult smartwatches accounted for 3.1 million units, down 19.5% year-on-year; children’s smartwatches accounted for 2.8 million units, down 13.3% year-on-year.

Shenghao Bai, a senior analyst at Counterpoint, stated: “Although the Spring Festival usually boosts consumption, the demand for smartwatches remained sluggish in the first quarter of 2023. This is similar to the situation with smartphone shipments in China. The market needs more time to recover.”

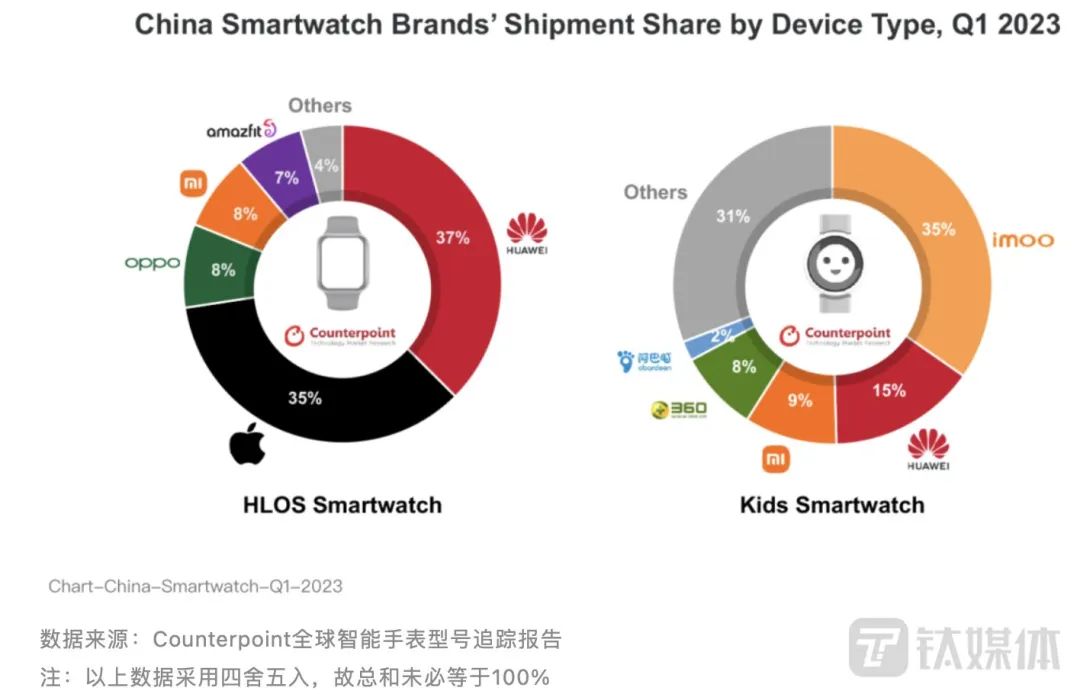

Image Source: Counterpoint

From the brand perspective, excluding children’s smartwatches, Apple and Huawei occupy more than 70% of the entire market share. Among them, Huawei ranks first in all price segments from $101 (approximately 707 RMB) to $400 (approximately 2800 RMB). Apple holds 87% of the market share in the segment above $400 (approximately 2800 RMB).

It is worth noting that market fluctuations have also affected the manufacturers behind smartwatches. The most obvious is the strong growth of Indian brands, which has benefited the outsourced manufacturing side of smartwatches.

Counterpoint’s data indicates that global smartwatch outsourced manufacturing shipments grew by 15% year-on-year, accounting for 69% of the total global shipments in the second half of 2022.

Additionally, due to the unshakeable position of the Apple Watch, more manufacturers are still actively competing for Apple Watch orders. In the second half of 2022, Luxshare Precision ranked first among outsourced manufacturers, benefiting from taking on about 40% of Apple Watch orders.

However, some companies have reduced their orders from Apple for higher profits, such as Compal. A supply chain insider stated, “During the market downturn, manufacturers are facing increasing demands, and while improving delivery capabilities, profits are being compressed.”

Are Fitness Bands the Biggest Threat?

The decline in smartwatch shipments was anticipated by many research institutions. As for the rapid growth of the Indian market, it is more of a consumption delay. Moreover, in terms of price, the Indian smartwatch market is still primarily entry-level, with trying out being the main purchasing purpose.

Regarding the market decline in the first quarter, IDC’s assistant research director Pan Xuefei told the Titanium Media App that the decline in smartwatch shipments is mainly due to manufacturers focusing on inventory optimization in the first half of the year, and flagship product launches are mainly concentrated in the second half, while the recovery of consumption from travel and dining services to IT consumer electronics still requires time.

Ivan Lam also pointed out that this year, the only significant growth in the smartwatch market is likely to be in India. During a period of low consumption, smartwatches, as non-essential products, will still be affected on the sales side.

Interestingly, compared to the continuous decline of smartwatches, fitness bands have shown signs of recovery. IDC data shows that in the first quarter, the shipment of fitness band products in the Chinese market was 2.86 million units, a year-on-year increase of 8.5%.

From this perspective, there is still demand for wearable devices among users. However, the imbalance in price and product value has led to smartwatches being “neglected.”

In terms of price, fitness bands are mostly priced around 200 RMB, while smartwatches are priced above 1000 RMB. Demand drives purchasing; although fitness bands have gaps in display and smart interaction compared to smartwatches, their core functions can meet the needs of most people for wearable devices. As one netizen put it, “Fitness bands achieve 70% of smartwatch functionality at 30% of the price.” This also reflects the “deficiency” in the product strength of smartwatches.

“From thinking about the Apple Watch to Huawei, I used to chase new products every year, but now I just wear a fitness band,” a digital enthusiast told the Titanium Media App. “The perception of new features is getting smaller; now I wear a fitness band just to monitor my steps and sleep.”

As this enthusiast said, the product strength of smartwatches no longer offers the leap experience it did seven or eight years ago. Nowadays, even though smartphone products face innovation bottlenecks, the annual improvements in processors and imaging performance can still spark some users’ desire to upgrade. In contrast, the upgrades of smartwatches fail to resonate with users.

In 2022, Qualcomm launched the “Snapdragon W5 Gen1” series smartwatch platform, which made significant improvements in process, GPU solutions, and AI computing power. However, unlike the annual upgrades of smartphones, even with the latest platform released, not all brands adopt it; based on cost and functional positioning, sufficiency remains the mindset of many manufacturers in product development.

Due to this, fitness bands, as lower-priced entry-level products, are more likely to tap into mass demand.

Pan Xuefei believes that the technological content or development challenges of smartwatches mainly lie in improving the accuracy of sensors and data algorithms, which are crucial for expanding and perfecting health scenarios. The requirements for high performance and computing speed are relatively low, which is determined by the current usage scenarios of different terminal devices.

Unable to Shed the “Accessory” Label of Smartphones

The first generation of smartwatches was born in the 1980s, and it wasn’t until the second decade of this century that they experienced rapid development. Over the past decade, smartwatches have made qualitative leaps in functionality, materials, and battery life. From small screens to large screens, from daily charging to battery life exceeding one week, from exercise tracking to blood oxygen, blood pressure, and sleep monitoring, many brands have also established their own ecosystems.

However, their non-essential nature means that smartwatches will not become super terminals like smartphones.

Even with eSIM independent communication and systems, smartwatches still cannot shed the label of being “accessories” to smartphones. Ivan Lam stated that smartwatches have never been independent from an ecological perspective; they are an extension of smartphones.

From the shipment rankings, we can see the strong correlation between smartwatches and smartphone brands. Leading brands like Apple, Samsung, Huawei, and domestic brands like OPPO and Xiaomi all have smartphone products, and their corresponding sales are also at the top. In contrast, brands without smartphone products rank only fifth in the domestic market. For users, one of the key decision points for purchasing a smartwatch is the smartphone product within the ecosystem.

At the same time, smartwatches aim to concentrate more functions independently within their terminals, hoping users can break free from smartphone dependency, but many deeper functions, such as exercise and sleep monitoring analysis, still require viewing on the smartphone side. Imagine, which would make you more anxious to lose: a smartwatch or a smartphone?

“Relying solely on replacing smartphones is unlikely to truly open up the smartwatch market,” Pan Xuefei pointed out. Leveraging the unique advantage of being worn on the wrist, smartwatches need to enhance their health attributes and improve their ability to track and monitor physical indicators, which can further broaden the audience and market for smartwatches.

This year, the popularity of generative AI has brought new thoughts to many industries. Previously, Huami also revealed related plans, stating that it will recently apply generative AI technology to smart wearable products to enhance user experience. Moreover, Huami stated that it will continue to develop the Zepp operating system and will integrate the latest GPT-4 into it in the future.

In this regard, Pan Xuefei believes that generative AI will gradually be adopted in smart terminal devices, and the application of large models will provide richer content for the generation and presentation of health and exercise-related data on smartwatches in the long run. However, from the current practical technology adoption perspective, generative AI and large models still have limited impact on the explosion of smartwatches.

She stated that the bottleneck in the development of the smartwatch market mainly lies in the expansion and perfection of health scenarios, as well as the expansion and matching of the user base.

(This article was first published on the Titanium Media App)

Recommended Hot Videos

On June 14, Messi appeared in the live broadcast room of Taobao host Li Xuanzhuo. However, many netizens complained that Messi’s live broadcast was short and had too many ads. In response, Taobao stated that the live broadcast time was changed from evening to afternoon, fully considering Messi’s training schedule, and the live broadcast room was specially set up in the hotel where he stayed. Although it wasn’t perfect, it was an effort to present it. The entire live broadcast did not involve sales and was purely content-based.

Like and FollowTitanium MediaVideo Account, watch more exciting videos

*Friendly Reminder: Friends who like the Titanium Media public account, please note! According to the new rules for public account push, please set Titanium Media as “Starred”, so you can receive push messages first. Those who have already set it need to reset “Starred”.

———–Gorgeous Divider————

Download the Titanium Media App, stay ahead, and go deeper.

Download【Titanium Media App】, stay ahead, and go deeper.