AuthorGuilin Zhong: (WeChat ID: great_baskerball) Editor of Smart Product Circle

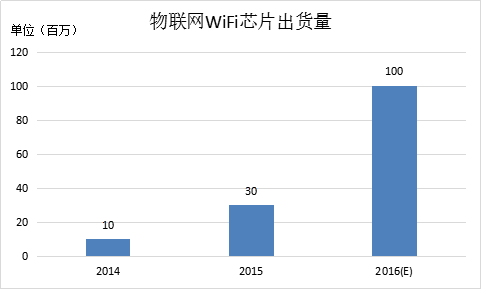

In 2015, the monthly shipment of WiFi chips used in the Internet of Things (IoT) reached 3-4 million units, and it is expected to surpass 100 million units in 2016. What are the reasons behind this surge? How has it evolved?

With the continuous stimulation of the IoT market, 2015 saw the first “explosive” growth of domestic WiFi chips used in IoT. According to statistics from Smart Product Circle, the shipment of IoT WiFi chips in 2014 was not optimistic, with only about 10 million units. By 2015, WiFi chips had basically become standard for many smart hardware products, with total shipments exceeding 30 million units. With the rise of smart hardware, it is expected that shipments will further increase to 100 million units in 2016.

Therefore, reporters from Smart Product Circle visited numerous original WiFi chip manufacturers and solution providers to analyze the evolution of WiFi chips from the perspectives of solutions, core technologies, and future trends, and to explore the reasons behind their surge.

From Multi-Chip to Single-Chip Development: The Competition Among Domestic and International WiFi Chip Manufacturers

In fact, in products such as mobile phones and tablets, independent WiFi chips only serve to connect and transmit signals. The signal processing and transmission protocol TCP/IP must be placed on a powerful AP side to form a complete communication architecture. However, many smart hardware products in the IoT field, such as kettles, rice cookers, lamps, and soymilk machines, do not have powerful APs, making independent WiFi chips essentially useless.

As a result, this demand first gave rise to a batch of comprehensive solution companies, such as Qingke, Hanfeng, Bolian, and Youren Technology, which provide services for traditional enterprises’ smart upgrades by using single-chip WiFi with an external MCU and writing the TCP/IP communication protocol into the MCU. “For a considerable period, the single-chip WiFi external MCU solution almost dominated the wireless connection market of IoT. However, due to the high cost of this solution and the extreme cost control in the traditional home appliance industry, adding a WiFi solution would impose an additional burden, which is not conducive to the popularization of IoT,” said Zhao Tongyang, CEO of Anxinke.

Therefore, driven by the enormous demand in IoT, international chip design giants began to integrate MCUs with WiFi to reduce chip size and lower chip solution prices (currently, module prices are around 9 yuan). Typical representatives include Qualcomm Atheros 4004, TI’s CC3200, and Realtek 8711. On the other hand, domestic chip design companies are also eager to catch up, with MTK launching MT7681, Southern Silicon Valley 6060, and Espressif 8266 chips, which perform no worse than international giants and offer more competitive prices and comprehensive services, achieving rapid entry into the IoT application market.

It is foreseeable that with so many chip design manufacturers entering the market, the WiFi chip market in 2016 will become even more “lively,” with unprecedented competition and rivalry among major manufacturers, attracting more chip manufacturers to follow suit.

Three Key Technical Elements of WiFi Chips: System, Power Consumption, RF

The influx of numerous chip design companies has enriched the variety of WiFi chips available in the market, but it has also led to a certain degree of uneven quality. So how should customers choose the right chip? “The design difficulties of WiFi chips are also key factors in assessing their quality, which lie in system stability and ease of development, low chip power consumption, and stable RF connection performance,” said Li Shaohui, Marketing Director of Lianshengde, in an interview with Smart Product Circle.

“Each company’s WiFi chip software system is developed based on RTOS, and there is a set of their own implementation methods under the standard TCP/IP protocol. This requires companies to have strong software system design capabilities in addition to hardware design capabilities, providing stable performance systems, a series of APIs, and a complete SDK to facilitate customers in product development. RF is mostly analog circuitry, which requires high technical standards from engineers. Even slight deviations in voltage and current can lead to unstable WiFi connections. Moreover, considering complex environmental factors, the chip’s sensitivity and receive/transmit power also have high requirements,” said Lang Liang, Regional Sales Manager of Qualcomm.

In most IoT applications, such as drones, robots, and WiFi speakers, there are high requirements for overall power consumption. Lang continued, “Home appliances have stringent power consumption requirements, especially when exported, and the overall power consumption of the device must be minimized, so the power consumption of the WiFi chip cannot be an additional burden. Qualcomm’s Atheros 4004 employs three low-power technologies.

The first is protocol optimization and firmware design, allowing the chip to have four working modes to avoid being in a full-load state all the time. For example, in normal working mode, the current is 300mA; in light sleep mode, the current is 130uA, with a wake-up time of 2ms; in deep sleep mode, the current is 10uA, with a wake-up time of 35mA; and in almost off state, the current is 5uA, with a wake-up time of 40ms.

The second is to automatically reduce the WiFi chip’s sending/receiving dB value based on the IoT application scenario. For instance, home appliances are generally in fixed locations, and the dB value can be automatically adjusted according to the distance between the appliance and the router, rather than staying at a full-load 18dB state.

The third is the chip’s listening and wake-up function, allowing users to set the listening time interval as needed. Additionally, the device itself can be awakened by the WiFi chip, keeping it in sleep mode for the rest of the time, further reducing chip power consumption.

Finally, the IP architecture of WiFi chips is also crucial. The ARM Cortex series is a widely used architecture, while Telica’s usage frequency is second only to ARM, showing better performance in power consumption and efficiency than ARM. The MIPS architecture has high execution efficiency and is primarily used in the router networking market. In summary, for most small appliances, such as kettles, lamps, and sockets, the performance of the M0 series is already sufficient. However, for applications with complex functional requirements, such as white goods, cloud platform integration, and voice recognition, at least M3 performance is required.

Future Development Trends of WiFi Chips: Customization, Security Integration, Distributed Intelligence

The fragmentation of the IoT market has led to significant differences in applications within niche markets, making the demand for customized WiFi chips increasingly apparent. For example, Allwinner launched the G102 chip at CES, the world’s first WiFi chip specifically for speakers; Lingxin Microelectronics also introduced the GKM910 chip, specifically addressing the wireless connection needs of multi-speakers in home theaters.

In the future, WiFi modules will undertake more tasks, with deep collaboration with cloud platforms and voice control being one of the development directions, achieving distributed intelligent demands. For instance, Jiangbolong Technology’s collaboration with IBM’s Super Vessel to create the “Cloud of Things” data service system; and Sibilich’s partnership with Lianshengde to embed voice control modules into WiFi chips for transmission and local intelligence.

At the same time, security vulnerabilities in WiFi chips will become increasingly prominent, so hardening encryption algorithms is also a trend in the development of WiFi chips. Currently, most WiFi chips on the market still use software encryption or an external encryption chip. For example, Qualcomm’s Atheros 4004 uses software encryption, while the next generation chip Atheros 4010 will adopt hardware encryption.

For more exciting original articles, please click “Read Original” to enter the Smart Product Circle website!