Regarding the statement “smart homes have great prospects,” readers may have grown tired of hearing it in recent years. According to data provided by 36kr, the scale of China’s smart home market has been steadily increasing from 2015 to 2023, and by 2020, it is expected to exceed 200 billion yuan. Especially with the gradual rollout of 5G technology in 2020, the high speed and low latency characteristics of new communication technologies provide a new development space for smart homes.

However, while we hope that smart homes will evolve year by year like stacking blocks, we must first clarify whether the concept of smart homes, which began to emerge in 2000, has truly shown a continuously accumulating stepped development curve over the past twenty years.

The reality may not be so.

Technology, home appliances, channels:

A flourishing smart home landscape

It is rumored that Bill Gates’ “smart mansion” was built in 1998, but starting from 1998 as the beginning of smart home development seems a bit unfair. Let’s consider 2014 as the starting point, the year Google acquired Nest, which showcased the opportunity for internet companies to integrate with furniture scenarios. By this time, China had basically completed the popularization of mobile terminals, and many manufacturers began to enter the smart home field.

This includes not only traditional home appliance manufacturers like Midea and Haier but also smartphone manufacturers like Huawei and Xiaomi, as well as a large number of startups. According to iResearch data, from 2013 to the first half of 2018, there were 140 angel round financing events in China’s smart home industry.

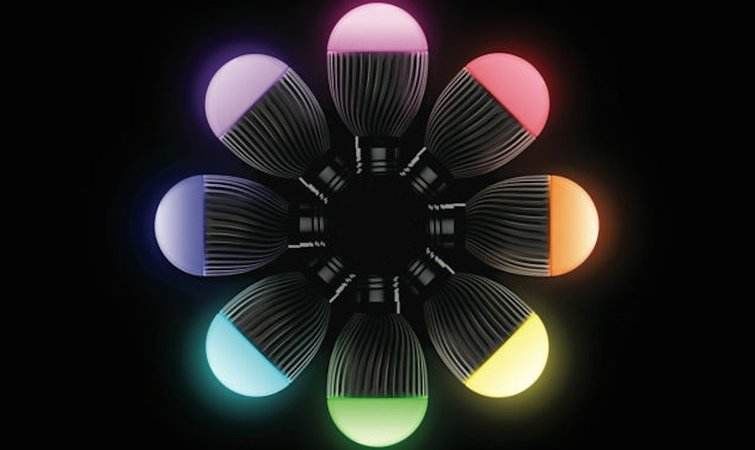

In addition to these commonly recognized participants, there is also a previously overlooked area in the tech circle—offline distribution channels. Since the concept of smart homes is broad, many ordinary products like sockets and light bulbs only need to add a communication module to achieve basic interconnectivity, resulting in a relatively low entry barrier for smart homes. The home decoration market, especially in third and fourth-tier cities, has thus seen a phenomenon of “smart home franchises,” with numerous distributors densely populating the lower-tier markets, often more accessible to customers than many well-known brands.

With such a rich array of participants, the early smart home market exhibited the following two characteristics.

First, the diversity of ecological platforms. In the early stages of smart home development, it was common to see an ecological platform formed by a mobile app and WiFi protocol. Gathering a large number of users on an ecological platform undoubtedly means acquiring significant traffic, which is highly tempting in an era where internet traffic is becoming increasingly expensive and scarce. Consequently, many funded startups sold products at very low prices just to acquire users. Clearly, for ordinary users, these ecological platforms are relatively closed, limiting their choices in smart homes and affecting the overall experience.

Secondly, there is the diversity of communication protocols. In the smart home market, there are five common communication protocols: Wi-Fi, ZigBee, Bluetooth, low-power Bluetooth, Bluetooth Mesh, Z-Wave, and RF433. Different ecological platforms support different communication protocols; some focus on a single protocol, like Xiaomi’s IoT applications, which predominantly use ZigBee, while others aim to support as many protocols as possible, such as Huawei’s Hi-Link. Although most hardware with the same communication protocol can join the same ecological platform, the differences are real.

The lost five years: What obstacles has the past smart home industry left for today?

After several years of wild growth in such a flourishing smart home landscape, it is difficult to assert that smart homes have accumulated a foundation for evolution year by year. After all, the ideal state of smart home applications is “whole-house interconnectivity”—to control as many products as possible with a single terminal, and even better if information and decisions can be automatically transmitted between products. Therefore, whether hardware, especially hardware purchased at different times, can open communication channels as much as possible becomes a key issue that smart homes need to tackle in the future.

The accumulation of the past few years has left many foundations for this industry, such as users’ aspirations for smart homes and initial contacts, as well as the technological accumulation of tech companies and traditional enterprises, but it has also left behind many obstacles.

For example, some “abandoned” ecological platforms. As mentioned earlier, from 2013 to 2018, over 140 smart home startups received angel round financing, but it is noteworthy that only about 30 of these companies received B-round financing during those five years. Among these companies, if any established an ecological platform, those platforms would no longer accommodate new hardware products, and both the platform itself and older products would gradually become obsolete.

Additionally, there are changes in communication protocols. Currently, in addition to different platforms and products choosing different communication protocols, many communication protocols themselves may also undergo updates and iterations. For instance, many IoT products that use 2G communication modules will become unusable after the 2G network is phased out, turning smart homes into “ordinary homes.”

If we consider whole-house intelligence as a network, then each hardware product becomes a node. If one node fails, it can significantly impact the entire network. Especially since home products are often not easily replaced once purchased, it is challenging to convince consumers to replace functioning home products for the sake of smart interconnectivity. For example, a user may have purchased a juicer in 2017 that could be remotely controlled via a mobile app. However, by 2019, the ecological platform may no longer be updated, making it difficult for both the user and other ecological platforms to integrate that juicer into a smart chain, even if the entire kitchen has been smartened up; that juicer may still remain an isolated island.

Therefore, we can only hope that those unreliable smart home products are all smart speakers!

Clearing obstacles, accumulating, and starting anew

So, what trends will the smart home market exhibit in 2020 under these circumstances?

Before answering this question, let’s continue from the perspective of the uses of smart homes.

As we mentioned, the “intelligence” in smart homes is a broad concept. Rather than making home products capable of sensing the owner’s needs or even emotions to work automatically, the ability for home products to connect and sense each other can significantly enhance the living experience. Especially through communication protocols, the inter-sensing changes more about the wiring issues in the room. For example, by using WiFi or Bluetooth protocols, controlling lights with a mobile phone or smart speaker eliminates the need for light switches in the room. This not only enhances aesthetics but also saves costs.

Therefore, the future development trend of smart homes must first meet the two conditions of “overall connectivity” and “pre-installation.”

We can also make some bold assumptions about the development of smart homes in the coming year.

First, after the industry has gone through a period of overheating, a consolidation phase will naturally emerge. For instance, this year, Midea’s Bugoo announced a partnership with Huawei HiLink, and Amazon acquired Eero. In the future, there may be more acquisitions and collaborations, with different products and brands becoming more unified in terms of protocols and ecological platforms. As IoT-related standards gradually take shape, traditional home appliance manufacturers may further yield and engage in deeper collaborations with tech companies, no longer attempting to build their own ecological platforms. At the same time, to better engage users, especially in the pre-installation phase, smart home brands are likely to focus more on building offline distribution channels. Establishing “smart model rooms” and increasing collaborations with home decoration companies and even real estate developers will also become more frequent.

In fact, from 2014 to 2019, smart homes developed without leaving a solid foundation. In the coming year, the smart home industry may need to quickly pick up the pieces, organize and clear up the legacies of past developments, grasp the useful parts, and eliminate unnecessary obstacles. Only then can true cumulative growth be achieved.