Compared to Huawei’s position in the smartphone market, its smart home business is not as prominent. However, at the AWE (China Household Appliances and Consumer Electronics Expo), smartphones naturally do not take center stage; instead, home appliances are in the spotlight. Therefore, after launching the Matebook products at MWC and before the P20 smartphone release on March 27, Huawei announced its new smart home ecological strategy. This strategy focuses on two main points: the “100 Billion Plan” and Huawei HiLink becoming the national standard for smart homes. Huawei announced that it will collaborate with partners to launch the “100 Billion Plan,” leveraging its comprehensive technology advantages in cloud, edge, and chip to build a full-scenario smart life for users. This will be pursued on both B2B and B2C fronts, aiming to achieve a revenue target of 100 billion in three years by opening up Huawei’s technology, sales, and brand capabilities, striving to create China’s leading smart home ecosystem within three years.

In simpler terms, Huawei’s smartphones already hold a significant global market share, providing a substantial entry point for Huawei HiLink smart home products. With its technological foundation in communications and a strong push into 5G, Huawei is well-positioned to develop standards, chips, and technologies, offering SDKs, IoT LiteOS, IoT chips, security, and artificial intelligence technologies. Additionally, Huawei has various online and offline channels, ensuring good sales prospects for HiLink smart home products. This means that manufacturers like Ecovacs Robotics and OPPLE Lighting, which use Huawei’s HiLink standard, will receive support in terms of entry technology and distribution channels. After HiLink becomes the national standard for smart homes, companies like China Overseas Land & Investment, COFCO Property, Hengming Group, and China Metallurgical Group will be the first pilot projects to introduce Huawei HiLink as the model smart home platform for their properties.

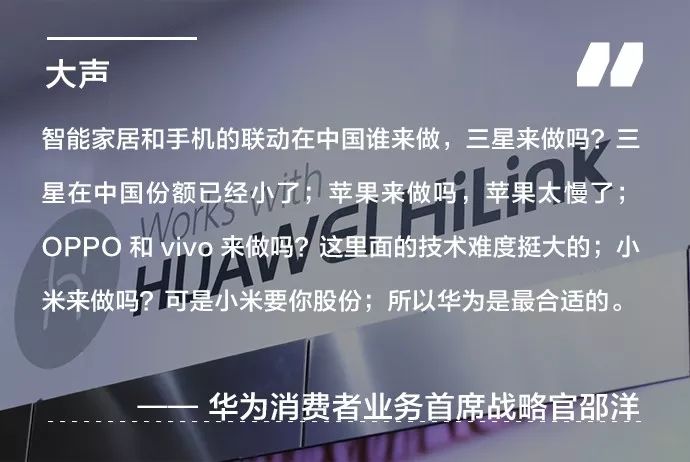

When discussing smart homes, one cannot overlook Xiaomi, which has been a fierce competitor to Huawei in the smartphone sector. Unlike Huawei’s open HiLink alliance, Xiaomi’s smart home strategy is more focused on its ecosystem of enterprises. Before Huawei and Xiaomi, appliance manufacturers like Haier and internet companies like Tencent had already announced their smart home alliance strategies, but there has been little follow-up since then. Therefore, before the announcement of Huawei’s smart home strategy, we interviewed Shao Yang, Chief Strategy Officer of Huawei Consumer Business, to ask how Huawei plans to avoid the embarrassing situation where large companies announce smart home strategies with much fanfare but fail to execute effectively.

Shao Yang stated: “One issue is sustainability. I have worked at Huawei for 20 years, and one characteristic of Huawei is that we do not abandon any field once we start. You can look at Huawei’s history; we started with fixed networks, then moved to mobile, began with optical discs, and then cloud computing. We have never stopped doing anything.” “When we started making smartphones, many media friends asked me if we would stop halfway. They wondered if we were serious about making smartphones, PCs, and tablets. People thought the market was challenging and questioned whether we could continue. Over the years at Huawei, I have seen that our PC launch was also successful, and people believe we are serious about PCs; we are not just playing around.” “The reason for this phenomenon is that in every field, the deeper you go, the more real problems you need to tackle. Huawei excels at this continuous deepening capability. If the mine is shallow, anyone can dig; only when the mine is deep do we feel it is difficult for others to dig.”

“Regarding our continued investment in this field, I believe we must invest. The reason is that smartphones will inevitably connect with home appliances. As a smartphone manufacturer, we have to do this to ensure a good experience for home appliances on smartphones. At the same time, partners also require Huawei to do this because appliance manufacturers see the linkage between smartphones and home appliances.”

“In China, who will connect smart homes and smartphones? Will Samsung do it? Samsung’s market share in China is already small. Will Apple do it? Apple is too slow. Will OPPO and Vivo do it? The technical challenges are significant. Will Xiaomi do it? But Xiaomi wants equity. Therefore, Huawei is the most suitable.”

As for the issue of user experience, Shao Yang compared iOS, Android, and Windows Phone, suggesting that Xiaomi’s ecosystem model is more like the closed iOS, while Huawei’s HiLink is more like the open Android: “The consistency issue has its pros and cons. The advantage is that the ID is indeed consistent, the packaging is similar, and the experience appears uniform. However, this consistency can actually limit manufacturers’ potential for innovation.” “We see that there were originally three mobile operating systems: Apple’s iOS is very consistent but does not allow others to choose; only Apple can use it. The other two, which everyone can use, are Google’s Android and Microsoft’s Windows Phone. Initially, Android lagged far behind Apple in terms of app quantity, but due to its openness, all manufacturers could develop their own products on Android, allowing it to quickly capture 80% of the global smartphone market share, while Apple only holds about 10%. Windows Phone is closed, and many things on Android can be modified, while many on Windows Phone cannot, making it difficult to create value.”

“Therefore, we will strive to ensure a consistent user experience on smartphones. All controls will be through voice or apps, but we still want to allow manufacturers their autonomy. For example, one rice cooker may have 15 modes, while another may have 20 modes; this is to give everyone the right to choose.”

Currently, the entire smart home market is still relatively limited. Huawei’s announced partners cover almost all mainstream appliance manufacturers, but when visiting Huawei’s online store, the variety of products available for sale is still not extensive, with Huawei’s own routers or portable WiFi products accounting for about one-third of the offerings. This indicates that while Huawei’s strategic goals are ambitious, they are still in the early stages. In a developing market, Xiaomi has already taken the lead, and from the perspective of corporate strength and execution capability, Huawei is indeed one of the few companies in China capable of building a smart home ecosystem. In this domestic smart home “iOS vs. Android” battle, do you favor Xiaomi or Huawei?

Follow the WeChat public account Aifanr (ID: ifanr) and reply with the following keywords to access popular articles.

“Apple Watch can finally make calls; please keep this comprehensive user guide.”

Keyword: make calls

“The lifecycle of the iPhone X is hidden in this key number.”

Keyword: lifecycle

“vivo APEX hands-on: flagship configuration, future black technology, when will it be mass-produced?”

Keyword: vivo

“Internet Dating Guide | Spring Story ①”

Keyword: spring

“Internet Love Guide | Spring Story ②”

Keyword: love

Midea showcased a remote-controlled robotic arm performing surgery at AWE 2018.