Author: Gu Zhengshu

EET Electronic Engineering Magazine Original

Emerging markets such as wearable devices, smart homes, and industrial IoT are driving the development and popularity of wireless connection technologies, while also raising higher requirements for the reliability and security of wireless connection chips, modules, and terminal devices. This report selects four relatively common wireless connection technology standards in the Chinese market (including Bluetooth, WiFi, NB-IoT, and LoRa), briefly introducing the development prospects of each technology and related domestic chip design companies, and summarizes 30 domestic wireless connection chip manufacturers, analyzing and showcasing the core technologies, main products, application solutions, and target markets of each company.

Bluetooth BLE Drives Rapid Growth of TWS Headphones and Location Services

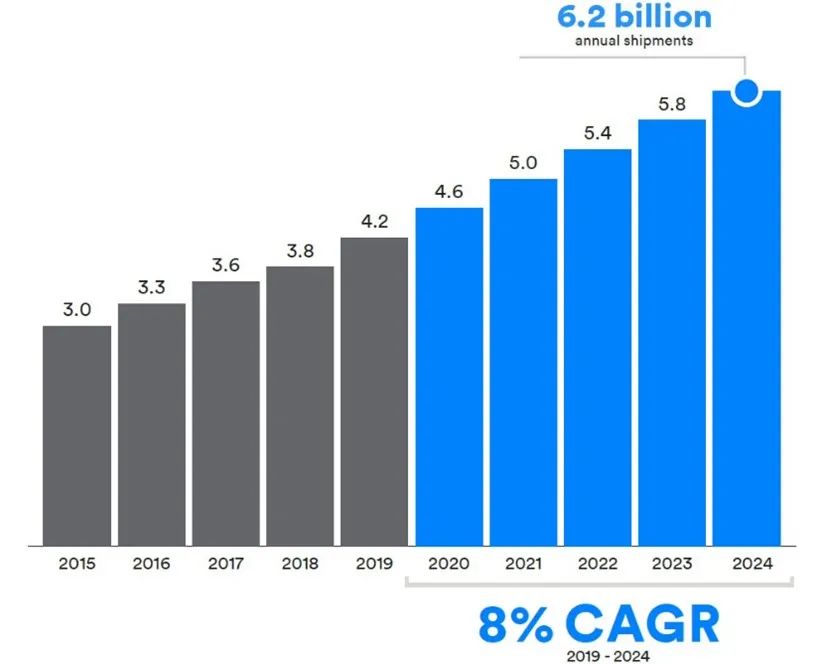

According to the Bluetooth Special Interest Group (Bluetooth SIG) 2020 Bluetooth Market Report, the annual shipment of Bluetooth devices is expected to reach 6.2 billion by 2024, with a compound annual growth rate (CAGR) of 8% from 2019 to 2024. An obvious trend is that Low Energy Bluetooth (BLE) technology is becoming the new market standard, with Bluetooth chips and devices supporting BLE growing at the fastest rate, up to 26%.

When classified by Bluetooth application categories, there are mainly audio streaming devices, data transmission, location services, and Mesh networks.

-

Audio streaming applications include: voice calls, listening to audio/music, audiovisual devices, and smart voice control. The growth rate from 2019 to 2024 is 7%, with shipments expected to reach 1.54 billion by 2024. The fastest-growing segment is TWS headphones. According to Strategy Analytics data, global Bluetooth headphone sales exceeded 300 million units in 2020, with sales of true wireless stereo (TWS) Bluetooth headphones growing nearly 90%. This market still has a low penetration rate, with less than 10% of people worldwide owning Bluetooth headphones, indicating significant growth potential.

-

Data transmission applications include: measuring fitness data, healthcare, input and control, IoT, etc. The growth rate from 2019 to 2024 is 13%, with shipments expected to reach 1.5 billion by 2024.

-

Location service applications include: item tagging, warehouse goods management, indoor navigation, access control, etc. The growth rate from 2019 to 2024 is 32%, with shipments expected to reach 538 million by 2024.

-

MESH networks include: smart homes, smart buildings and lighting, factory and hospital monitoring systems, etc. The growth rate from 2019 to 2024 is 26%, with shipments expected to reach 892 million by 2024.

The fastest-growing application category is location services, with shipments in 2024 expected to be four times that of 2020. Battery-powered Bluetooth devices with direction-finding capabilities will become market highlights in the next five years, and Bluetooth RF chips that can support these functional demands will have significant growth potential. The startup TaoXin Technology, located in Suzhou, focuses on Bluetooth AoX positioning technology.

In fact, Bluetooth is one of the most concentrated technology fields among domestic chip design companies. Among the 30 wireless connection chip manufacturers we selected, 20 have Bluetooth or WiFi + Bluetooth product lines. The biggest beneficiary of the booming TWS headphone market is Hengxuan Technology, which successfully listed on the Science and Technology Innovation Board just five years after its establishment, with a market value exceeding 36 billion yuan.

WiFi 6 Will Become Mainstream Within 3 Years

Wi-Fi technology is upgraded every 4-5 years, with the current mainstream being Wi-Fi 5. The latest generation of Wi-Fi technology standard is IEEE 802.11ax, which was renamed Wi-Fi 6 by the Wi-Fi Alliance upon its release in 2018. The improvements of the first five generations of Wi-Fi technology mainly focused on bandwidth enhancement, while Wi-Fi 6 optimizes performance in terms of supported frequency bands, increased maximum modulation nodes, enhanced maximum transmission rates, MU-MIMO, OFDMA, energy efficiency, and more.

Similar to 5G, Wi-Fi 6 is suitable for application scenarios with high requirements for high speed, large capacity, and low latency, mainly including: consumer applications such as smartphones, tablets, smart homes, and smart wearable devices, as well as ultra-high-definition video and VR/AR; service scenarios such as telemedicine; crowded venues such as airports, hotels, and large sports venues; and industrial environments such as smart factories and smart warehousing.

Currently, Wi-Fi devices are still mainly based on Wi-Fi 5 products, while Wi-Fi 6 products are expected to enter a rapid penetration period in 2021. According to predictions from Dell’Oro, the shipment of chips supporting Wi-Fi 6 accounted for 10% of total shipments in 2019 and is expected to reach around 90% by 2023, making Wi-Fi 6 truly mainstream.

The Internet of Things (IoT) is the main driving force behind Wi-Fi 6. According to Techno Systems Research data, the global shipment of IoT Wi-Fi chips was approximately 500 million in 2019 and is expected to maintain a growth rate of over 40% in the coming years. Wi-Fi MCUs are mainly used in household appliances within smart homes, home IoT accessories (such as lights and sockets), and industrial IoT.

Among the 30 wireless connection chip manufacturers we screened, there are not only listed companies like Broadcom Integrated and Espressif Technology focusing on the Wi-Fi field, but also startup companies like SUTONG Semiconductor and Wi-Fi router chip developers like Silan Communication, as well as domestic Wi-Fi chip manufacturers like Liangniu Semiconductor and Southern Silicon Valley.

LPWAN Technology and Market Are Still Exploring

LPWAN (Low-Power Wide-Area Network) is a type of long-distance, low-power, low-bandwidth wireless communication network. Most LPWAN technologies can achieve network coverage of several kilometers or even dozens of kilometers, addressing issues in the IoT industry such as high terminal power consumption, massive terminal connections, insufficient wide-area coverage, and high costs, making it suitable for large-scale deployment.

LPWAN does not refer to a specific technology standard but is a combination of various low-power, wide-area network technologies, which generally share the following characteristics:

-

Low power consumption: Battery life can last up to 10 years;

-

Long distance: Wide coverage, reaching dozens of kilometers, typically exceeding 2 km in urban environments;

-

Low data rate: Occupies little bandwidth, transmits a small amount of data, and has low communication frequency;

-

Insensitive to transmission delay: Does not have high real-time requirements for data transmission;

-

Low cost: Deployment costs are low due to large scale requirements.

LPWAN can be divided into two categories: one operates on unlicensed spectra, such as LoRa and SigFox, also known as non-cellular LPWAN; the other is based on licensed spectra promoted by 3GPP, using cellular communication technologies such as EC-GSM, LTE Cat.1/0/M1 (eMTC), and NB-IoT, also known as cellular LPWAN. Among the various LPWAN technologies, NB-IoT and LoRa are the most widely used and the most debated, often compared with each other, but they actually differ in technical positioning and application fields.

Currently, NB-IoT is mainly promoted in China; this narrowband IoT based on cellular technology supports software updates to existing cellular infrastructure, such as upgrading existing LTE and GSM base stations. By reusing existing 2G or 3G spectra, rapid domestic and international coverage and deployment can be achieved. There are no restrictions on NB-IoT chips, and anyone can produce them, with major contributions from companies like Huawei HiSilicon, Unisoc, and MediaTek.

LoRa is a wireless digital communication modulation technology at the physical layer, known as Chirp Modulation. Its main feature is operating in the free sub-1GHz frequency band, extending the communication distance by 3-5 times compared to traditional wireless RF communication under the same power consumption, reaching 1-20 km.

LoRa terminals can be powered by batteries or other energy harvesting methods, with battery life reaching 3-10 years. At the same time, the lower data rate of 0.3-50 kbps also extends battery life and increases network capacity, achieving a balance between low power consumption and long distance. LoRa signals also have strong penetration through buildings, with application scenarios including low-power, low-cost sensors in smart agriculture; battery device tracking and status monitoring in industrial automation; and logistics tracking or positioning, where LoRa provides more stable communication compared to NB-IoT during high-speed movement.

LoRa is primarily controlled by Semtech in terms of chip research and supply, with manufacturing, assembly, and distribution taking place in Asia. Moreover, Semtech has licensed its LoRa technology as IP to certain semiconductor companies in Europe and Asia, including domestic company Aojie Technology.

Currently, there are not many domestic chip design companies in the LPWAN field; this report includes two NB-IoT chip companies, namely Yixin Communication and NuLink Technology; and three LoRa chip manufacturers, namely Zhiyuan Electronics, Shengzhe Technology, and Aojie Technology.

China Fabless Series Research Report

The analyst team of Aspencore’s “Electronic Engineering Magazine” conducted firsthand investigations and online compilations of domestic wireless connection chip companies, selecting 30 from numerous manufacturers and analyzing them from multiple dimensions, including core technologies, main products, application solutions, and target markets.

This is part of the China Fabless series research analysis report. Interested readers can refer to other categories of research reports or contact us directly. The published research reports include:

At the upcoming 2021 China IC Leaders Summit, we will select the Top 10 from each category to form the China IC Design 100 (China Fabless 100) ranking.

Basic Information Statistics of Wireless Connection Chip Manufacturers

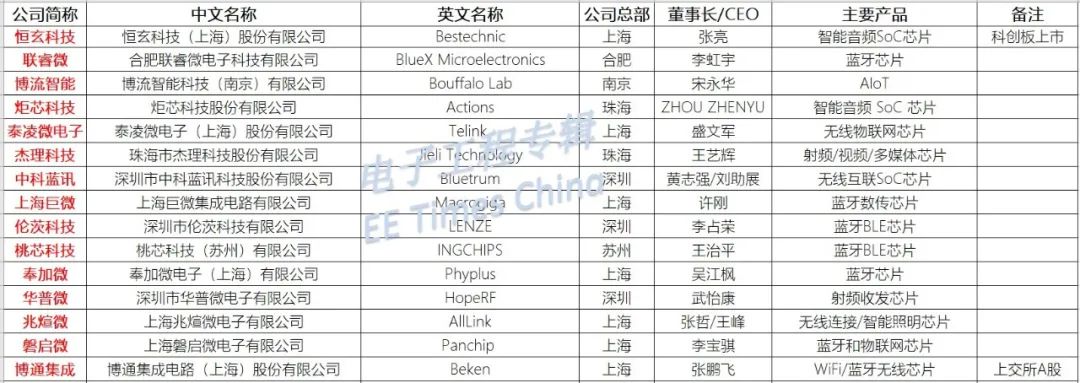

Among the 30 wireless connection chip design companies listed in the table below, the distribution by company registration location is as follows: 14 in Shanghai; 4 in Shenzhen; 2 in Beijing; 3 in Nanjing; 2 each in Zhuhai and Suzhou; and 1 each in Hefei, Guangzhou, and Hangzhou.

From the perspective of wireless connection technology categories, the largest number of companies provide Bluetooth chip products, totaling 20; 8 companies provide Wi-Fi chips; there are 2 companies for NB-IoT chips; and 3 companies for LoRa chips. Additionally, nearly all companies are involved in the IoT field, such as AIoT, smart homes, and industrial IoT.

Detailed Information of 30 Wireless Connection Chip Manufacturers

Next, we will showcase each of these 30 companies from aspects such as core technologies, main products, application solutions, and target markets.

Hengxuan Technology

Core Technology: Ultra-low power RF technology, active noise cancellation and call noise reduction, voice AI technology, IBRT patented technology

Main Products: General Bluetooth audio chips, smart Bluetooth audio chips, Type-C audio chips

Target Market: TWS headphones, Bluetooth headphones, USB headphones, and other portable wearable devices.

Broadlink Smart

Core Technology: Ultra-low power/ultra-secure IoT WiFi, NB-IOT, BLE, and Zigbee wireless solutions

Main Products: Wi-Fi + BLE chipset BL602, BLE + Zigbee chipset BL702, high-performance MCU BL561/BL563, low-power WiFi chipsets BL606/BL608

Target Market: Edge computing applications such as face recognition tracking, voice recognition, multi-sensor fusion, such as smart locks and smart gateways.

Lingrui Microelectronics

Core Technology: Bluetooth BLE technology

Main Products: Low-power Bluetooth SoC series chips, lithium battery protection ICs, RTC clock switch chips, watchdog monitoring chips

Target Market: Smart wearables, smart homes, industrial control, consumer electronics, healthcare, etc.

Pangqi Micro

Core Technology: Wireless spread spectrum communication Chirp-IOT modulation technology, indoor positioning system xLOCATE 1.0 based on Bluetooth AOA technology

Main Products: LPWAN physical layer chips, low-power 2.4GHz SoCs, 125KHz low-frequency trigger chips, image processing chips

Target Market: IoT, new retail shelf tags, Bluetooth BLE, indoor positioning, smart homes, consumer drones, image processing, broadband wireless transmission, and other application fields.

Juchip Technology

Core Technology: Full audio signal chain technology; Bluetooth RF, baseband, and protocol stack technology

Main Products: Bluetooth audio SoC chips, portable audio and video SoC chips, smart voice interaction SoC chip series

Target Market: Bluetooth speakers, Bluetooth headphones, Bluetooth voice remote controls, Bluetooth transceivers, smart education, smart office, smart home, and other fields.

Tailing Microelectronics

Core Technology: IoT protocol stack technology (Bluetooth/BLE/Thread/Zigbee/2.4GHz)

Main Products: Multi-protocol IoT chips, Bluetooth audio chips, 2.4GHz chips

Application Solutions: Dual-mode Bluetooth multi-connection, electronic shelf labels, location services, smart remote controls, supply chain management, ultra-low latency, and other application solutions.

Target Market: Wireless toys, health care, wearable devices, smart homes, computer peripherals, industrial applications, etc.

Jieli Technology

Core Technology: Low-power Bluetooth technology, multimedia AI technology

Main Products: Headphone chips, speaker chips, WiFi Bluetooth chips, and general audio decoding chips; AI RF chips; video smart chips; multimedia artificial intelligence chips; health smart chips.

Target Market: TWS headphones, AI smart speakers, Bluetooth speakers, Bluetooth headphones, smart voice toys, ultra-high-definition recorders, smart video monitoring, blood pressure monitors, and other IoT smart terminal products.

Zhongke Lianxun

Core Technology: Multi-core parallel computing chip design, low-power RF architecture, hybrid active noise reduction technology

Main Products: Wireless interconnection SoC chips, Xunlong Bluetooth headset chips, Bluetooth speaker chips, Bluetooth IoT chips

Target Market: High-performance headphones, speakers, AI intelligence, and the Internet of Everything.

Shanghai Juwei

Core Technology: Beacon receiving and transmitting technology, BLE RF transceiver technology

Main Products: Bluetooth data transmission chips, BLE RF transceiver front-end devices

Target Market: Indoor positioning tags, smart thermometers, smart lighting, Bluetooth scales, and other smart terminal devices.

Lentz Technology

Core Technology: Bluetooth MESH, low-power Bluetooth BLE technology

Main Products: Bluetooth BLE chips

Target Market: TWS headphones, smart bracelets, smart locks, selfie sticks, game controllers, Bluetooth lamps, body fat scales, anti-lost devices, electronic tags, etc.

TaoXin Technology

Core Technology: Bluetooth AoX positioning technology

Main Products: Bluetooth BLE 5.1 chips

Target Market: Smart homes, positioning TAGs, MESH smart lighting, smart cities, etc.

Fengjia Microelectronics

Core Technology: Low-power RF chips and communication protocol stack technology

Main Products: PHY6202 Bluetooth chips

Target Market: Smart terminal peripheral devices, smart voice, smart home, smart manufacturing, smart transportation, and other applications.

Hapoo Micro

Core Technology: “NextGenRF” algorithm patent technology

Main Products: Sub-1GHz transmission chips, encoding remote control transmission chips, SoC remote control transmission chips, Sub-1GHz receiving chips, Sub-1GHz transceiver chips, Bluetooth SoC chips, 2.4G wireless transceiver chips, etc.

Target Market: Automotive electronics, security alarms, wireless collection, smart devices, etc.

Zhaoxuan Micro

Core Technology: RF architecture and baseband algorithms

Main Products: Wireless connection chips, voice signal processing chips, smart lighting AIoT dedicated chips

Target Market: Smart home market represented by smart lighting; broadcasting market represented by Bluetooth remote controls and set-top boxes.

Broadcom Integrated

Core Technology: Wireless RF transceiver and integrated microprocessor wireless connection system-level (SoC) chip technology

Main Products: IoT wireless connection chips, including wireless data transmission, wireless audio, wireless video, and all-scenario positioning chips.

Application Solutions: IoT, vehicle networking, smart speakers, smart story machines, Bluetooth speakers, Bluetooth headphones, drones, intercoms, wireless keyboards, digital microphones, etc.

Target Market: Smart transportation and smart home application fields.

Espressif Technology

Core Technology: Wi-Fi and Bluetooth connectivity, as well as Mesh networking technologies, operating system ESP-IDF, audio development framework ESP-ADF, Mesh development framework ESP-MDF, device connectivity platform ESP RainMaker, face recognition development framework ESP-WHO, and smart voice assistant ESP-Skainet.

Main Products: ESP series wireless chips

Application Solutions: Smart audio, face recognition, HMI human-machine interaction, predictive maintenance devices based on machine learning, etc.

Target Market: AIoT smart IoT.

Furukawa Kun

Core Technology: Mixed-signal wireless SoC chips

Main Products: FR801XH/FR801x series ultra-low power Bluetooth chips, FR508X dual-mode Bluetooth chips

Application Solutions: Smart lighting control, smart locks, smart toys, electronic tags, wearable applications, TWS headphones, smart homes

Target Market: Consumer electronics, smart homes.

Yizhao Microelectronics

Core Technology: Ultra-low power Bluetooth SoC technology

Main Products: Low-power Bluetooth chips

Target Market: Bluetooth headphones, Bluetooth passthrough devices, selfie sticks, voice remote controls, and other consumer electronics products.

Silan Communication

Core Technology: Wireless smart router

Main Products: 2.4G/5G dual-band Wi-Fi wireless router system-level chips

Target Market: Wi-Fi routers, home and commercial wireless routers.

Sutong Semiconductor

Core Technology: WiFi 6 modulation and demodulation technology

Main Products: Wi-Fi 6 chips

Target Market: Consumer electronics such as smartphones, laptops, HD televisions, and set-top boxes.

Xinxingyuan Microelectronics

Core Technology: Mixed-signal wireless SoC chips

Main Products: WiFi, Bluetooth, NB-IOT chips

Target Market: IoT, smart homes, and consumer electronics.

Lianshengde Microelectronics

Core Technology: AIOT IoT technology

Main Products: Wi-Fi/Bluetooth dual-mode SoC chips, WiFi chips

Target Market: Smart appliances, smart homes, driving positioning, smart toys, medical monitoring, wireless audio and video, industrial control, and other IoT fields.

Kangxi Communication

Core Technology: RF front-end integrated chips and optimized RF solutions

Main Products: WLAN RF PA/FEM chips, 5G NR RF PA and FEM chips, smart IoT RF FEM chips

Target Market: WLAN, 5G NR, smart speakers, smart homes, smart electric/water/gas meters, wireless remote controls, and other fields.

Liangniu Semiconductor

Core Technology: IoT WiFi wireless technology

Main Products: IoT WiFi chips, WiFi + MCU chips

Target Market: Smart speakers, smart lighting, and other smart home applications.

Southern Silicon Valley

Core Technology: High-integration solutions supporting WiFi a/b/g/n specifications

Main Products: WiFi SoC chips, WiFi transceivers, BLE chips, 2.4GHz chips

Target Market: WiFi locators, smart appliances, smart lighting, and other smart home applications.

Yixin Communication

Core Technology: Cellular IoT

Main Products: NB-IoT single-mode SoC EC616

Target Market: Water, gas, fire protection, smart homes, smart agriculture, and other NB-IoT commercial networks.

NuLink Technology

Core Technology: IoT positioning and narrowband connectivity

Main Products: NB-IoT / GNSS SoC NK6K series

Target Market: IoT devices (such as smart meters, wearable devices, asset trackers, and industrial sensors), positioning tracking, and asset management.

Zhiyuan Electronics

Core Technology: LoRa modulation and spectrum spreading processing technology

Main Products: LoRa smart networking chips

Target Market: Long-distance wireless communication in the IoT field.

Shengzhe Technology

Core Technology: Low-power LoRa wireless transmission technology

Main Products: Narrowband IoT chips, deep learning chipsets

Target Market: Base stations, positioning tracking, smart city security, AI, and machine vision applications.

Aojie Technology

Core Technology: Obtained LoRa IP authorization, narrowband IoT

Main Products: ASR6501 LoRa chips

Application Solutions: Ultra-long-distance, ultra-low-power LPWAN solutions

Target Market: Infrastructure, streetlights, air quality, traffic, meter reading, positioning, construction, and other IoT fields.

Conclusion

From personal wearable devices, home WiFi routers, and connected appliances to commercial building networks, smart cities, and connected factories, “the Internet of Everything” is gradually becoming a reality. This is thanks to the “wireless connections” that we cannot see but can truly feel, with technologies such as Bluetooth, WiFi, and LPWAN becoming popular and rapidly developing. Domestic IC design companies in China are seizing the trends of the emerging IoT, seeking opportunities in various niche markets.

However, the fragmented IoT market makes it difficult to nurture chip companies with absolute technological and competitive advantages. Homogenization and price competition will hinder the healthy development of the Chinese IC design industry, and only those enterprises that continuously seek new technological breakthroughs and application innovations can grow and thrive.

‧‧‧‧‧‧‧‧‧‧‧‧‧‧ END ‧‧‧‧‧‧‧‧‧‧‧‧‧‧‧

👇👇Click to read the original text to learn about the summit activities