1. Ongoing Upgrades of Automotive Sensors

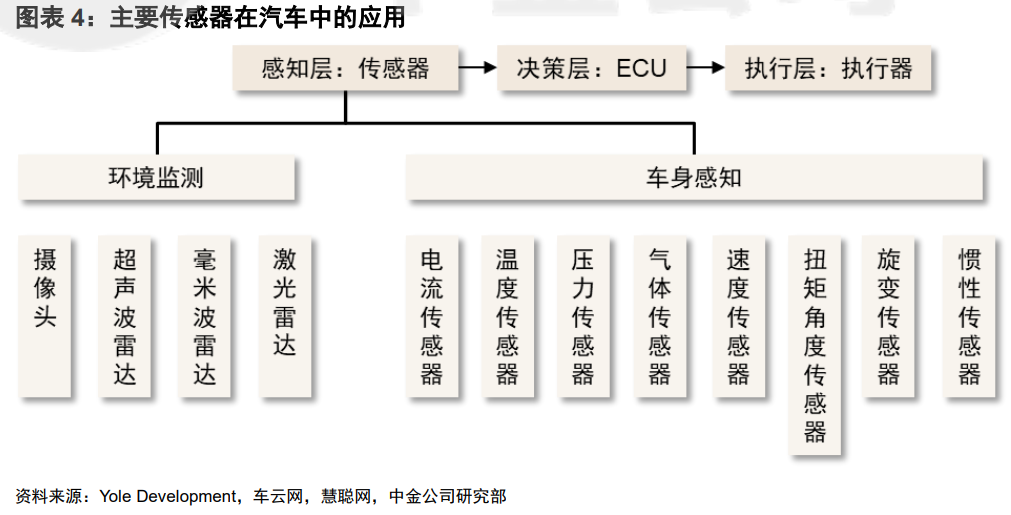

The functions of automotive sensors have evolved from merely perceiving internal systems to also considering the perception of the environment and people. Based on their functions, automotive sensors can be divided into two main categories: environmental perception and body perception sensors. Body perception sensors are responsible for sensing internal systems, while environmental perception sensors are a new addition in the era of autonomous driving, responsible for sensing both the cabin’s internal and external environments as well as the driver and passengers. We believe that driven by the intelligence and electrification of vehicles, both body perception sensors and environmental perception sensors are ushering in industry opportunities.

-

Driving Force 1: Vehicle Intelligence

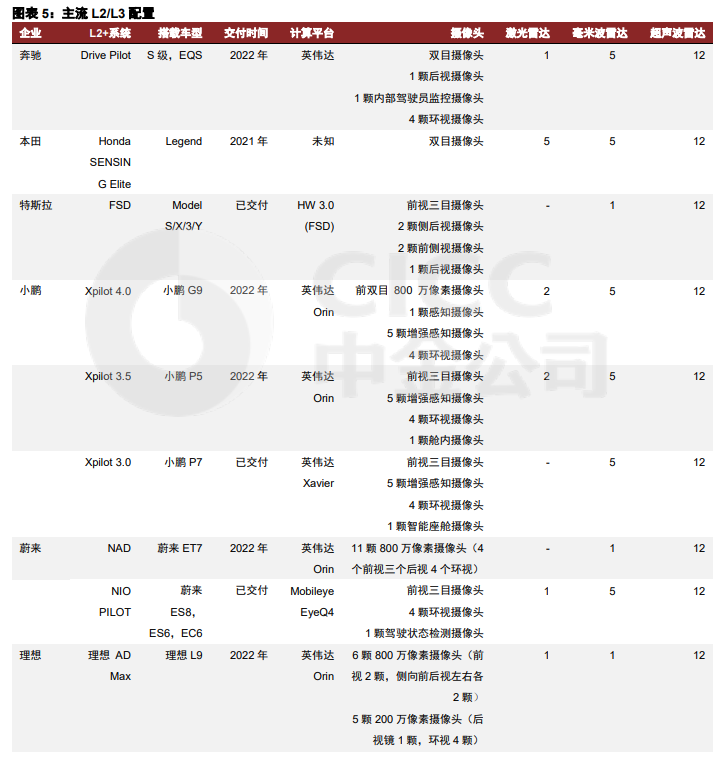

The increase in autonomous driving penetration rates is pushing up the configuration rate and value of sensors. With continuous support from regulatory policies and key technological advancements, by September 2021, the penetration rate of L2 level passenger cars in China reached 20%. Meanwhile, Mercedes-Benz’s L3 level autonomous vehicles are expected to be realized in 2022. The realization of L3 level autonomous driving relies heavily on the application of numerous sensors, which, in addition to conventional ADAS (like millimeter-wave radar), has embedded more hardware and software to achieve “redundancy,” increasing the inclusion of devices such as LiDAR, side window cameras, humidity sensors, and more, along with a more systematic mapping and differential GPS to assist L3 level autonomous driving. We believe that as autonomous driving upgrades, the complexity of functions will be positively correlated with sensor demand, with a clear trend towards the selection of radars and cameras, driven by hardware embedding and OTA models that rapidly increase sensor penetration, adoption rates, and value.

The driving factor for the intelligent upgrade of body perception sensors is the intelligent upgrade of automotive components and architecture. As automotive-grade products, traditional body sensors are nearing a steady state in terms of technology and cost, but the comprehensive application of sensors still holds marginal value. For example, functions such as facial recognition, smart entry, and personalized body control in intelligent cockpits rely on the perception of the driver; intelligent air conditioning outlets and smart ambient lights raise the demand for intelligence from built-in sensors; heads-up displays and gaze tracking functions that need to integrate with other hardware provide new installation space for automotive sensors. We believe that in the context of the upgrade of vehicle intelligence, the application scenarios for body perception sensors are becoming richer, while the demands for intelligence are expected to enhance value.

-

Driving Force 2: Vehicle Electrification

The sustained high prosperity of new energy vehicles presents industry opportunities for body sensors. New energy vehicles fundamentally transform the power and transmission systems of vehicles, with energy provided by power batteries, leading to different sensor requirements; most mechanical rigid signals in the vehicle are replaced by flexible electrical signals, increasing demand for current sensors in the power system; to better control the voltage and current entering and exiting the motor, the precision requirements for sensors are also elevated. We believe that the increase in penetration rates of new energy vehicles will drive significant demand for related body sensors.

Environmental perception sensors can be categorized into external and internal perception sensors based on their installation locations in vehicles. External perception sensors include cameras, LiDAR, millimeter-wave radar, and ultrasonic radar. As vehicles enter the era of autonomous driving, the demand for environmental perception has evolved from simple reversing warnings to meeting the demands of various levels of autonomous driving, triggering a new round of upgrades and iterations for environmental perception sensors; internal perception sensors (DMS) have become industry standards significantly due to regulatory pushes, with the demand for cabin perception expanding from monitoring the driver to monitoring passengers, and the penetration rate of OMS gradually increasing. We believe that in the era of vehicle intelligence, the automotive sensor industry is welcoming new growth.

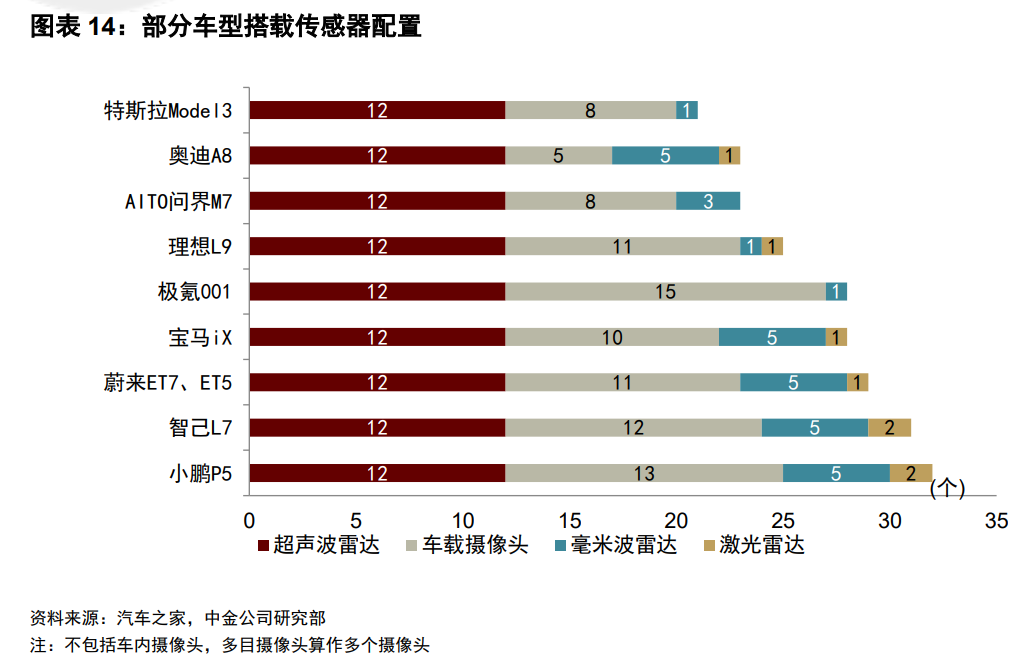

Autonomous driving is the core driving force for the upgrade of external perception sensors. As the levels of autonomous driving gradually improve, the number and clarity of onboard cameras are also increasing; ultrasonic radar and millimeter-wave radar are currently relatively mature in application. We believe that as the levels of autonomous driving continue to improve, major manufacturers and suppliers will focus on better-performing perception components and solutions, and the external perception sensor industry is expected to welcome upgrades, such as the 4D millimeter-wave radar, which is likely to bring new industry growth, and LiDAR becoming standard for L3 level and above autonomous driving, with its installation rates expected to rise.

Millimeter-wave radar is currently a widely used environmental perception sensor in autonomous driving. Millimeter-wave radar emits waves with wavelengths of 1-10 millimeters through antennas, converting reflected echoes into electrical signals to obtain physical information about target objects, and then transmitting the signals to the vehicle’s controller. Millimeter-wave radar has advantages such as small size, high accuracy, low susceptibility to environmental interference, and high cost-performance ratio. In terms of technology, frequency-modulated continuous wave (FMCW) is the current mainstream solution, measuring distance, angle, and speed by continuously emitting frequency-modulated signals, characterized by low transmission power, low cost, and relatively simple signal processing. We believe that millimeter-wave radar has obvious advantages in short-range detection and is cost-effective, likely becoming the mainstream sensing solution.

LiDAR is the cornerstone of high-level autonomous driving, and manufacturers are accelerating their layout. LiDAR achieves centimeter-level detection accuracy through laser pulses and is one of the core sensors in non-pure visual solutions. Currently, the market structure for LiDAR has not yet reached a steady state, and structural changes are still possible as technology iterates and the demand for autonomous driving from manufacturers increases. According to Valeo’s annual report, the current price of a single LiDAR is below $1,000, and as the price of LiDAR decreases, its installation rates are expected to increase. We believe that under the current technical conditions, LiDAR is the standard configuration for achieving L3+ level autonomous driving technology, and L3 intelligent driving vehicles are expected to drive the large-scale production of LiDAR in 2022.

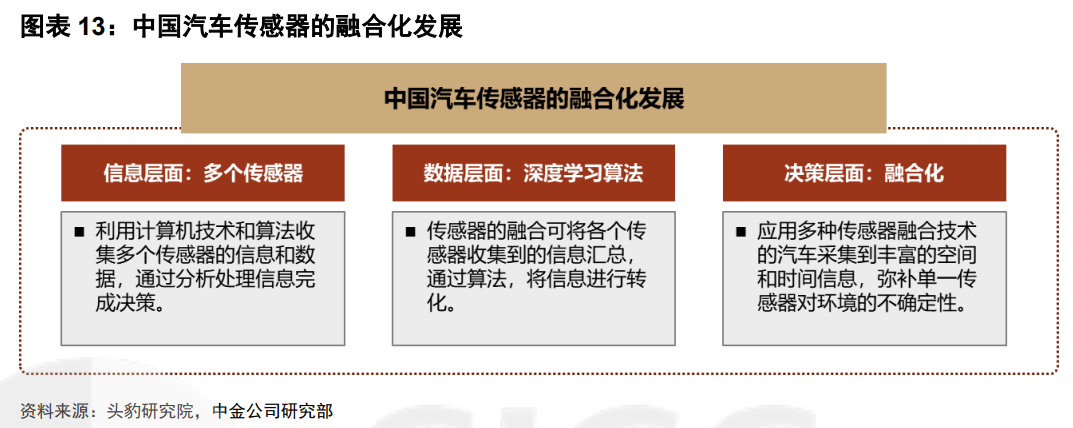

There is a trend towards integration in automotive sensors. By integrating data collected from different sensors into the same ADAS subsystem, supported by software algorithms, multiple sensor fusion can be achieved. Through the aggregation and analysis of information from various sensors, sensor fusion possesses stronger reliability and stability, enhancing the vehicle’s adaptability in different environments. The large amounts of raw data generated from multiple sensor fusions also require specific algorithms and microcontrollers for optimization, and the interaction upgrades between hardware and software may become the research and development focus for automotive sensor suppliers and manufacturers. We believe that compared to single sensors, sensor fusion has significant advantages and is expected to become mainstream in the future.

Cameras, millimeter-wave radar, LiDAR, and ultrasonic radar have different parameters due to their imaging principles, making them complementary or a better choice. Relying solely on visual solutions from cameras has lighting dependencies, requires converting 2D information into 3D images, has lower accuracy than expected, and has higher algorithm requirements; millimeter-wave radar has advantages in short-range detection and cost performance, but compared to LiDAR, it has a shorter detection range and lower resolution; LiDAR has advantages in detection range and accuracy, but its current cost is much higher than other sensors. Currently, apart from Tesla’s pure visual solution, most mainstream manufacturers adopt a sensor fusion approach to achieve performance complementarity. We believe that in high-level autonomous driving, perception fusion solutions will become the industry mainstream.

Body perception sensors are widely used in various parts of vehicles. Body perception sensors mainly collect information about the vehicle’s status, such as temperature, speed, pressure, position, acceleration, vibration, tire pressure, and oil pressure, converting the collected signals into electrical signals transmitted to the vehicle’s central processing unit. Body perception sensors are mainly distributed in the vehicle’s power system, transmission system, chassis and safety systems, and body comfort systems. They can be categorized based on function into speed sensors, temperature sensors, pressure sensors, etc.; based on working principles into electrical sensors, magnetic sensors, optical sensors, etc.

-

Market Space Estimation

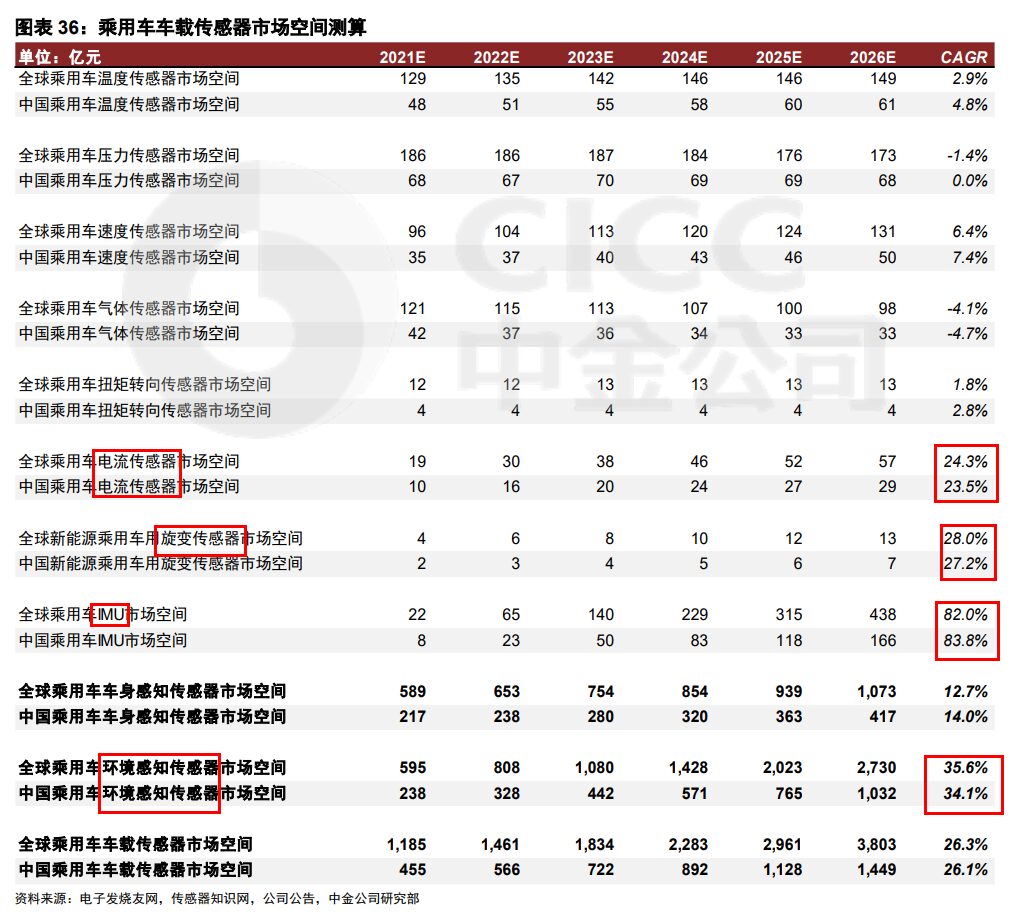

In the future, the traditional sensor market has a large stock, while the intelligent sensor segment shows strong growth. According to our estimates, the global market space for automotive sensors in passenger vehicles was approximately 118.5 billion yuan in 2021, and it is expected to reach approximately 380.3 billion yuan by 2026, with a five-year CAGR of 26.3%. Environmental perception sensors are growing rapidly, with a five-year CAGR of 35.6%, while body perception sensors are also seeing significant growth, with a five-year CAGR of 12.7%. Among body perception sensors, inertial sensors, current sensors, and rotary sensors are deeply benefiting from the trend of automotive electrification and intelligence, showing rapid growth; in addition, specific segments such as temperature sensors, pressure sensors, gas sensors, and torque sensors present structural opportunities.

-

Industry Chain Overview

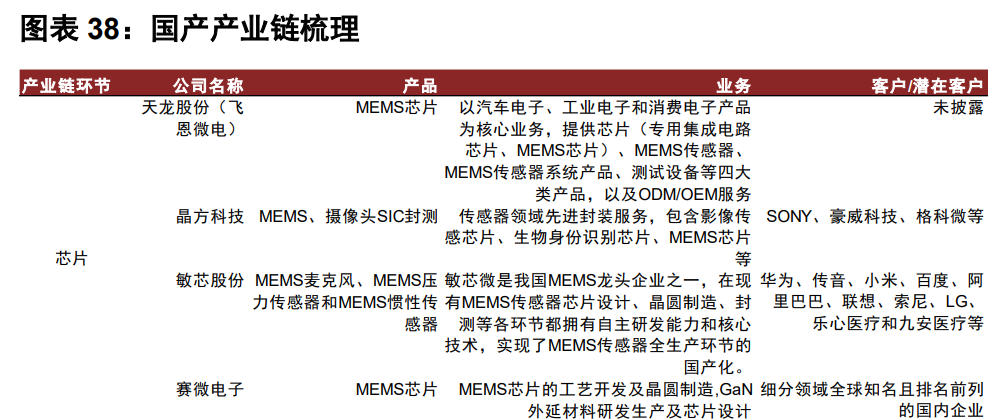

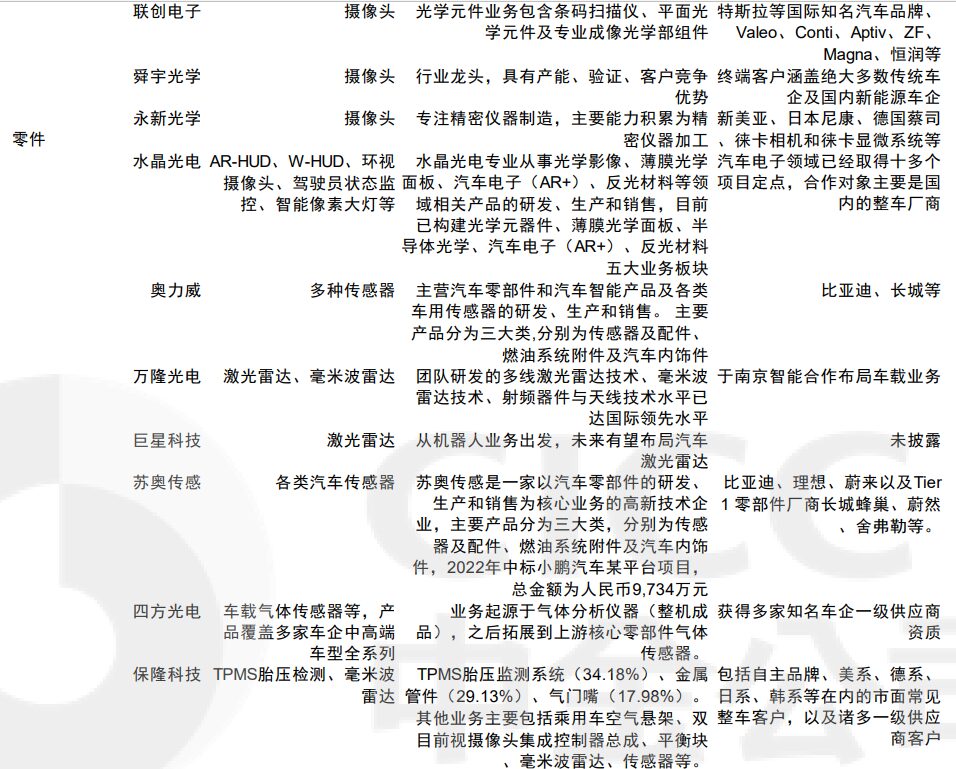

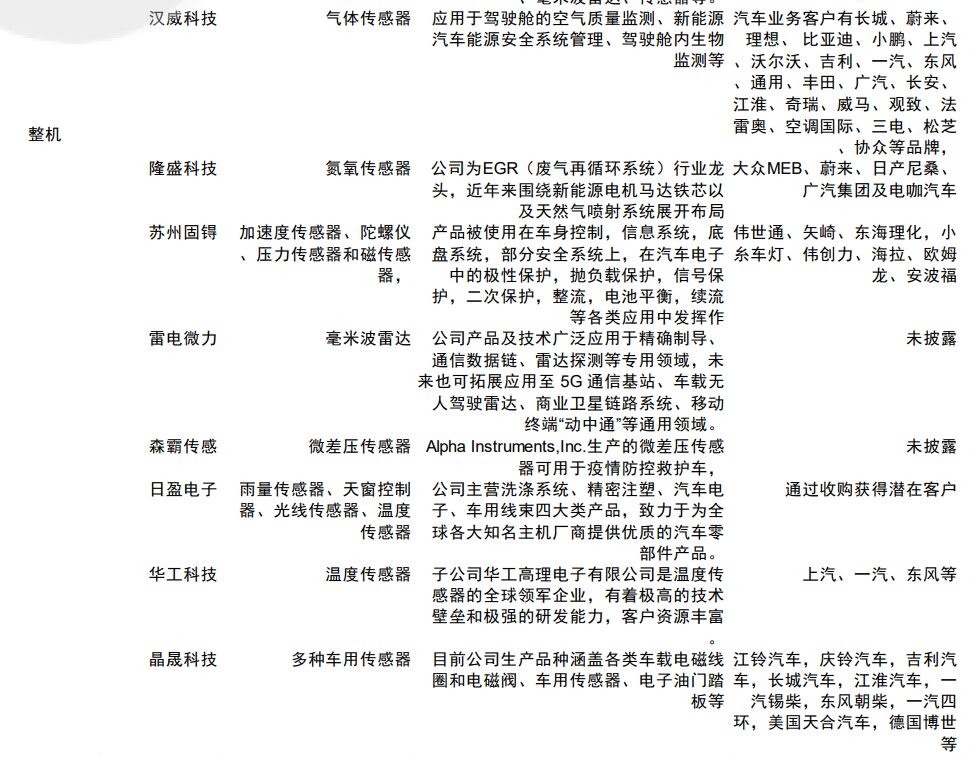

Automotive sensors are located in the midstream of the industry chain. The upstream mainly consists of suppliers of raw materials for sensor manufacturing. Ceramic material suppliers include Wanfeng Electronics, Fenghua High-Tech, and Guoci Materials; semiconductor material suppliers include Hu Silicon Industry, Asent, Jiangfeng Electronics, and Yuyuan New Materials; metal material suppliers include Baosteel, Jiangxi Copper, Zijin Mining, and Tongling Nonferrous Metals. In the midstream sensor manufacturing field, representative domestic sensor manufacturing enterprises include Baolong Technology, Aoliwei, Riying Electronics, Huagong Technology, Tenglong Automotive, and Jingsheng Technology, along with chip and camera manufacturers. The downstream consists of automotive OEMs, including joint ventures, independent brands, and new forces.

Broadly speaking, midstream manufacturing can be divided into three major segments: chip, component, and complete machine manufacturing. The chip segment is mainly focused on analog chips, with barriers mainly related to process understanding, product matrix, and cost control. The barriers in the component segment mainly lie in research and development, precision manufacturing capabilities, and costs, while the barriers in the complete machine segment mainly relate to integration capabilities and customer validation.

Baolong Technology: Rapid Layout of Automotive Electronics, Continuous Expansion of Sensor Categories

Baolong Technology’s business mainly includes intelligent perception (tire pressure monitoring systems TPMS, sensors), air suspension, ADAS, and traditional businesses (metal fittings and valve stems). The company’s sensor business follows policy guidance and trends of intelligence and diversification, achieving category expansion and overseas development through acquisitions, covering pressure sensors, optical rain sensors, speed sensors, acceleration/yaw sensors, and current sensors. Since entering the OEM mass supply phase in 2016, the customer base includes SAIC General, Changan, Dongfeng Nissan, as well as independent brands such as Changan, Chery, FAW, Dongfeng, GAC, Wuling, and BYD. The company’s sensor products are matched with emerging products like air suspension, and we expect that with the rapid penetration of air suspension and configuration sinking, the volume will gradually increase; currently, the company’s air suspension products are equipped on luxury models such as BMW 7 Series, Mercedes-Benz S-Class, Hongqi H9, Audi A8, and Dongfeng Lantu.

Huayu Automotive: Leading Domestic Auto Parts Company, Actively Laying Out Millimeter-Wave Radar

Huayu Automotive is one of the largest auto parts companies in China. The company’s main business includes interior and exterior trim (dashboard, seats, car lights, etc.), metal forming and molds (mainly body skeleton parts), functional parts (air conditioning compressors, steering gears, etc.), electronic and electrical components (generators, starters, etc.), and thermal processing parts (cylinder heads, etc.). The company is actively laying out millimeter-wave radar through its automotive electronics subsidiary. The 4D imaging millimeter-wave radar products independently developed by the company cover the basic needs of ADAS for millimeter-wave radar, with the 77GHz forward millimeter-wave radar already achieving mass production for passenger vehicles, while other millimeter-wave radar products have been designated for vehicle projects. Additionally, the company is also developing its own sensor nR1V fusion system and collaborating on solid-state LiDAR development.

SuAo Sensors: Leading Automotive Sensor Company, Capital Increase and Acquisition Aligning with Industry Trends

SuAo Sensors is a leading player in the automotive fuel level sensor niche market and one of the leading suppliers of automotive fuel level sensors in China. According to the prospectus, the company’s market share for fuel level sensors and accessories was 30.5% in 2015. The company’s sensor products include fuel level sensors, water level sensors, and vapor pressure sensors, with the sensor business growing rapidly, contributing 24.27% of revenue in 2021. The company is expanding its sensor categories in line with the trend of electrification and intelligence, developing around 30 core component sensors for traditional fuel engine systems, new energy three-electric systems, hydrogen fuel cell systems, and vehicle chassis (air suspension, brakes), and thermal management systems. The company conducted a private placement in August 2021, raising 450 million yuan for the construction of intelligent production lines for automotive sensor products and acquiring Changzhou Huaxuan to complement its rotary sensor business.

Sifang Optoelectronics: Leading Gas Sensor Company, Broad Downstream Applications Bring Incremental Growth

Sifang Optoelectronics is a leading optical gas sensor company, forming a full industry chain layout for gas sensors through collaboration between its parent company and four subsidiaries, with a complete core technology platform for gas sensing, and core components produced in-house to achieve domestic substitution. The company’s products cater to applications in automotive, home appliances, medical, and other livelihood sectors, with cabin air quality sensors gradually penetrating from mid-to-high-end models and entering the supply chain of manufacturers like FAW-Volkswagen, Dongfeng Motor, Great Wall Motors, Geely, Chery, and Chehejia. The company raised 570 million yuan through its IPO to expand ultrasonic gas sensors and gas meter products, and the continuous expansion of sensor categories is expected to create another growth point.

Jingwei Hengrun: Full-Stack Automotive Electronics Capabilities, Laying Out Automotive Sensors

The company has formed a three-in-one layout of intelligent driving electronics, research and development services, and high-level autonomous driving business. The intelligent driving electronics product business revolves around vehicle intelligence, mainly including advanced driver assistance systems (ADAS), intelligent driving domain controllers (ADCU), in-vehicle high-performance computing platforms (HPC), millimeter-wave radar (RADAR), in-vehicle cameras (CAM), high-precision positioning modules (LMU), driver monitoring systems (DMS), and automatic parking assist system controllers (APA). Currently, the company’s in-vehicle cameras have achieved mass production for GAC Group, FAW Group, and Huaren Yuntong, while millimeter-wave radar has been designated for Jiangling Motors and JAC Motors.

Desay SV: Leading Automotive Electronics Company, Increasing Investment in Automotive Sensors

The company is committed to “providing overall solutions for intelligent driving,” from intelligent sensors to intelligent driving domain controllers and related algorithm full-stack self-research solutions and various business model combinations. The sensors cover products such as ultrasonic radar, cameras, millimeter-wave radar, T-BOX, etc., with annual cumulative shipments of camera products exceeding 10 million units, and intelligent driving cameras have also been designated by multiple vehicle manufacturers; the 77GHz millimeter-wave radar has already achieved large-scale production in several domestic mainstream models; and the development design of the new generation AK2 ultrasonic radar has been completed, along with investment layout related to key components and manufacturing.

Keboda: Leading Domain Controller for Car Lights, Horizontally Expanding Automotive Electronics

The company is deeply engaged in the automotive electronics field, with a rich product matrix, and has established a subsidiary, Keboda Chongqing Automotive Electronics Co., Ltd., primarily engaged in the research, development, production, and sales of automotive sensors. In 2021, Keboda Chongqing achieved revenue of 23.15 million yuan. In addition, the company’s urea quality sensor has been officially installed in FAW Liberation. The company is expected to leverage its technological advantages in automotive electronics to gradually explore market opportunities for new categories such as millimeter-wave radar.

Welcome all angel round enterprises in the entire automotive industry chain (including the power battery industry chain) to join the groupAround (will recommend to 800 automotive investment institutions including top-tier organizations);there are communication groups for leading sci-tech companies and dozens of groups related to the automotive industry, including complete vehicles, automotive semiconductors, key components, new energy vehicles, intelligent connected vehicles, aftermarket, automotive investment, autonomous driving, and vehicle networking, please scan the administrator’s WeChat to join the group (please indicate your company name)