What data and rankings are worth noting this week?

IDC: 2024 Ezviz Retains Top Spot in Global Consumer Camera Shipments

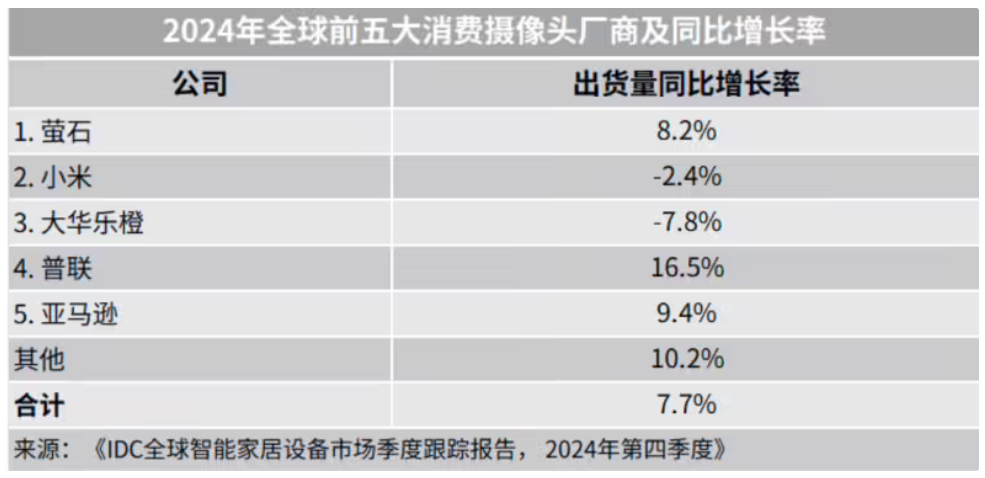

According to IDC’s “Global Smart Home Device Market Quarterly Tracking Report (Q4 2024)”, global smart camera shipments (including consumer-grade indoor and outdoor cameras, including carrier channels) are expected to reach 137 million units in 2024, a year-on-year increase of 7.7%.

In terms of brands, Ezviz is expected to maintain its position as the global leader in consumer camera shipments in 2024, with a year-on-year growth rate of 8.2%.

Xiaomi and Dahua’s Lechange rank second and third, respectively, but both have seen a year-on-year decline in shipments.

TrendForce Predicts NAND Flash Prices to Stabilize in Q2 2025

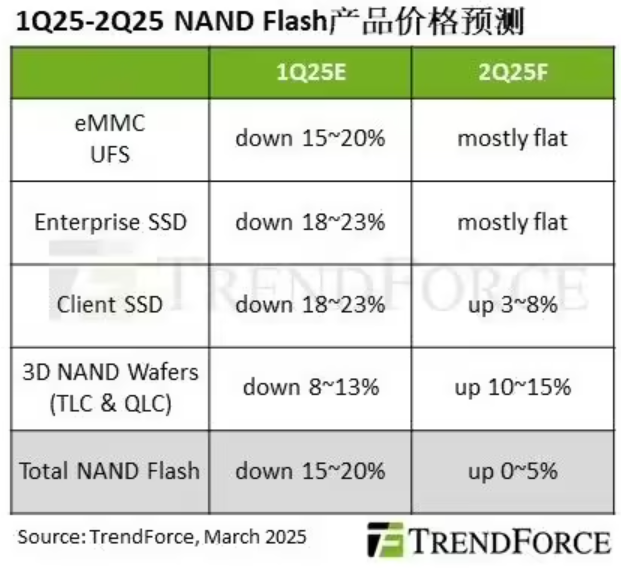

According to a report released by TrendForce, NAND Flash manufacturers have begun to reduce production since Q4 2024, and the effects are gradually becoming apparent.

Additionally, consumer electronics brands are ramping up production in response to international market changes, driving demand. With applications in PCs, smartphones, and data centers beginning to rebuild inventory, NAND Flash prices are expected to stabilize in Q2 2025, with wafer and client SSD prices showing a quarter-on-quarter increase.

TrendForce predicts that with the end of support for Windows 10 and the new generation of CPUs driving a PC replacement wave, along with the DeepSeek effect stimulating demand for consumer SSDs, and manufacturers gradually achieving supply-demand balance through production cuts and supply adjustments, the contract price for client SSDs is expected to increase by 3% to 8% quarter-on-quarter in Q2.

For enterprise SSDs, technologies like DeepSeek significantly reduce AI model training costs, leading to a surge in demand for high-performance storage solutions in mainland China. In North America, demand is polarized: SSD orders from server brands are underperforming expectations, while demand from CSPs is increasing with shipments of NVIDIA’s Blackwell platform, leading to a slight increase in enterprise SSD orders expected in Q2.

SEMI: Global Wafer Fab Equipment Investment to Reach $110 Billion by 2025

SEMI announced in its latest quarterly global wafer fab forecast report that global spending on front-end facilities and equipment is expected to grow by 2% year-on-year to $110 billion in 2025, marking the sixth consecutive year of growth since 2020.

SEMI forecasts that wafer fab equipment spending will grow by 18% in 2026, reaching $130 billion. The growth in investment is driven not only by the demand for high-performance computing (HPC) and memory to support data center expansion but also by the increasing integration of artificial intelligence (AI), which drives up the silicon content required for edge devices.

By investment area, the logic and microelectronics sectors are expected to be the main drivers of wafer fab investment growth. This growth is primarily due to investments in cutting-edge technologies. Investment in the logic and microelectronics sectors is expected to grow by 11%, reaching $52 billion in 2025, followed by a 14% increase in 2026, reaching $59 billion. Overall spending in the memory sector is expected to grow steadily over the next two years, with a 2% increase in 2025, reaching $32 billion, and a projected increase of 27% in 2026.

By region, SEMI notes that while spending on semiconductor equipment in China is expected to decline from the peak of $50 billion in 2024, China is still expected to maintain its leading position in global semiconductor equipment spending, with spending expected to reach $38 billion this year, a year-on-year decrease of 24%. By 2026, spending is expected to further decline by 5% year-on-year to $36 billion.

TrendForce: General DRAM Prices Expected to Decline by Less than 5% in Q2 2025

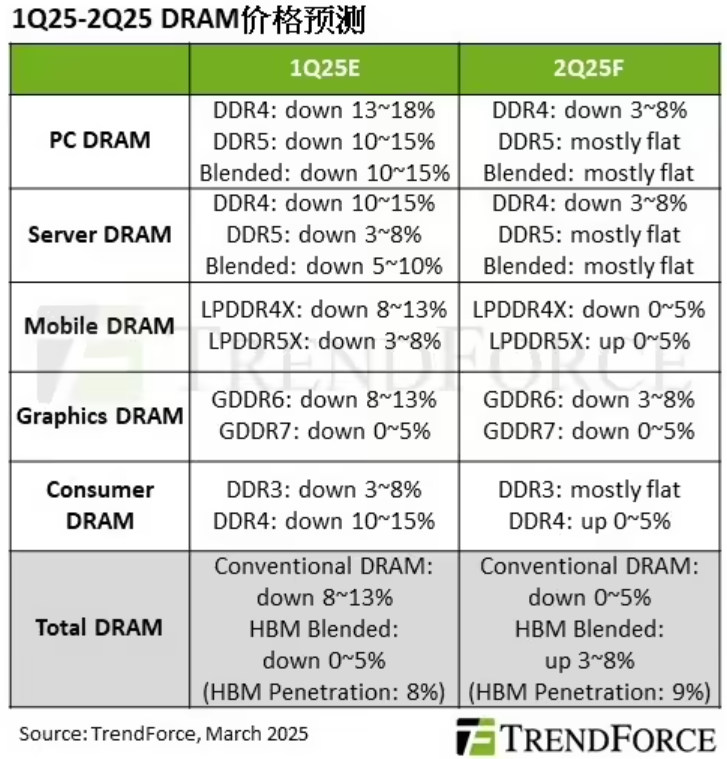

TrendForce reports that driven by early shipments from downstream customers, the overall reduction of DRAM supply chain inventory is proceeding smoothly. It is expected that the decline in general DRAM prices (excluding HBM) will converge to less than 5% quarter-on-quarter in Q2 2025, while the overall average price including HBM is expected to increase by 3% to 8% quarter-on-quarter.

For DDR5 in the PC and server markets, prices are expected to remain stable due to increased installation scale; while DDR4 prices for PCs and servers are also expected to maintain limited declines.

In the mobile sector, LPDDR demand for high-end models using LPDDR5X is increasing due to China’s trade-in subsidy policy, leading to slight price increases due to supply shortages; however, LPDDR4X prices are expected to see slight declines in Q2 due to factors such as capacity expansion by some manufacturers.

For GDDR memory, the new generation GDDR7 has begun shipping with NVIDIA’s Blackwell GPU, but supply remains unstable; prices for GDDR7 and the previous generation GDDR6 are expected to decline slightly by 0% to 5% or by 3% to 8%, respectively.

In the consumer DRAM segment, the launch of new telecom projects has increased procurement willingness among buyers, while supplier capacity has significantly contracted, driving a rebound in consumer DDR4 prices.

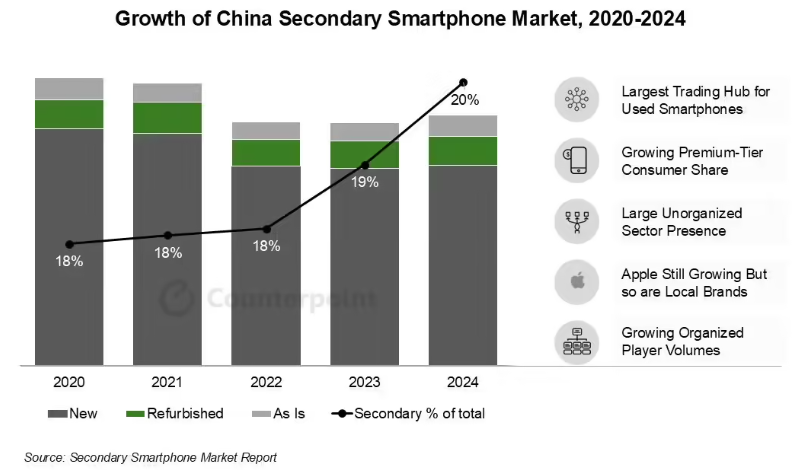

CounterPoint: China’s Second-Hand Smartphone Market to Account for 20% of National Sales in 2024, Up 6% Year-on-Year

Market research firm CounterPoint Research reports that in 2024, the second-hand smartphone market in China (including refurbished and used phones) will account for 20% of the total smartphone sales in the country.

The report shows that China remains the world’s largest trading center for second-hand smartphones, with the export market continuing to expand. The second-hand smartphone market in China is expected to grow by 6% year-on-year in 2024, with significant increases in domestic demand.

Apple’s iPhone continues to dominate the market, but consumer perception of upgrades to new models is limited, leading some users to shift towards domestic brands.

IDC Estimates Steady Growth in Global Semiconductor Market by 2025

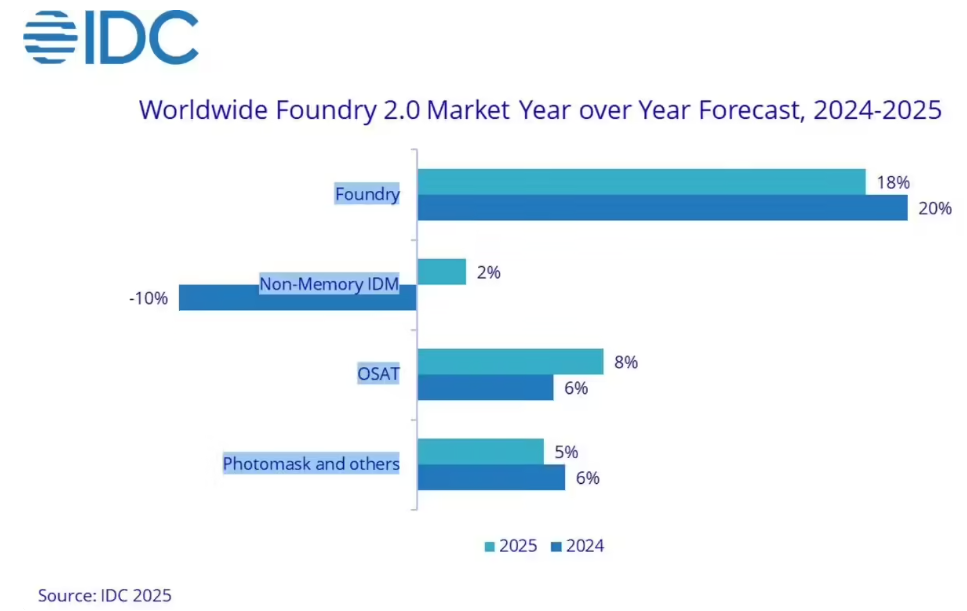

Market research firm IDC reports that after a recovery in 2024, the global semiconductor market is expected to achieve steady growth in 2025, driven primarily by sustained demand for AI and gradual recovery in non-AI demand.

IDC estimates that the broad Foundry 2.0 market (including wafer foundries, non-memory IDM, OSAT, and photomask manufacturing) will reach $298 billion in 2025, a year-on-year increase of 11%. In the long term, the compound annual growth rate (CAGR) from 2024 to 2029 is expected to be 10%.

IDC notes in the report that as the core of semiconductor manufacturing, the wafer foundry market is expected to grow by 18% in 2025. TSMC, leveraging its advantages in advanced nodes below 5nm and CoWoS advanced packaging technology, is expected to see strong orders for AI accelerators, with its market share projected to expand to 37% in 2025.

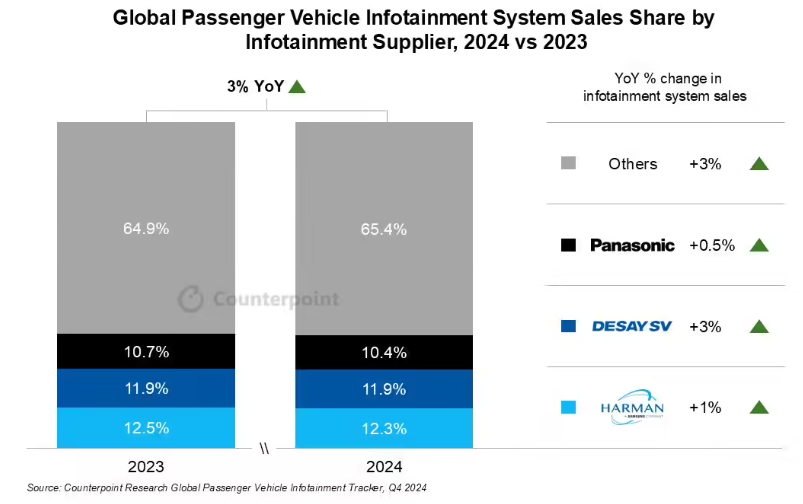

CounterPoint: Global In-Vehicle Infotainment System Market to Grow by 3% in 2024

Market research firm CounterPoint Research released the “Global Passenger Vehicle Infotainment System Tracking Report”, stating that the global sales of passenger vehicle (PV) infotainment systems are expected to grow by 3% year-on-year in 2024, consistent with the overall performance of the passenger vehicle market.

China, the United States, and Europe are expected to account for nearly 70% of the global infotainment system market in 2024. Southeast Asia (SEA), other regions of North America (Canada and Mexico), and the Middle East and Africa (MEA) are expected to become the fastest-growing markets between 2025 and 2035. The increase in vehicle sales in these regions, along with OEMs introducing the latest features, is driving market growth.

CounterPoint estimates that from 2025 to 2035, global infotainment system sales are expected to grow at a compound annual growth rate (CAGR) of 3%, with annual sales exceeding 105 million units.

Institutions: Prices of TVs and IT Panels Expected to Continue Rising in Q2

Recently, Morgan Stanley noted in a research report that due to capacity control, China’s trade-in policy, and seasonal stocking demand, prices of TVs and IT panels are expected to continue rising in the second quarter.

Morgan Stanley pointed out that the prices of mainstream 32-inch, 43-inch, 55-inch, 65-inch, and 75-inch TV panels increased by an average of 1% month-on-month in March, and this price increase is expected to continue into early Q2.

Additionally, regarding IT panels, Morgan Stanley stated that monitor panel prices showed a slight increase of 0.3% in March, while laptop panel prices remained stable. This may reflect spillover effects from the TV panel market, and looking ahead to Q2, both laptop and monitor panel prices are expected to see moderate monthly increases. On a quarterly average, IT panel prices are expected to increase by about 1% compared to Q1.

Furthermore, regarding foldable phone panels, Morgan Stanley indicated that according to data, global shipments of foldable display panels are expected to increase by only 3% year-on-year in 2024, reaching 22.5 million units, showing a significant slowdown compared to previous years. Shipments of global foldable smartphone panels are expected to increase by about 10% in 2025.

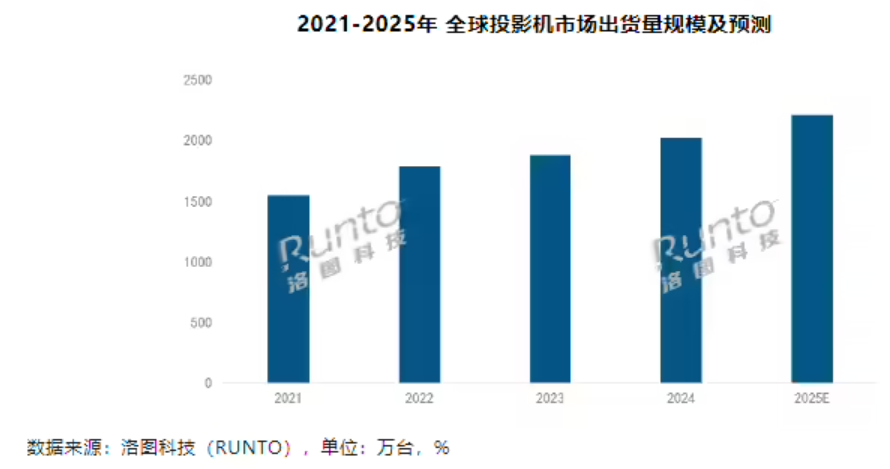

Lottu Technology: Global Projector Market to Exceed 22 Million Units and Break $10 Billion by 2025

According to data from Lottu Technology, in 2024, global projector shipments are expected to reach 20.167 million units, a year-on-year increase of 7.5%, with sales amounting to $9.27 billion, a year-on-year decrease of 6.2%.

Mainland China remains the largest projector market globally. In 2024, the projector market in mainland China is expected to ship 6.893 million units, a year-on-year decrease of 3.1%; its share of the global market is expected to drop from 37.9% in 2023 to 34.2% in 2024.

The North American market is expected to ship 4.267 million units in 2024, a year-on-year increase of 5.6%, accounting for 21.6% of the global market, making it the second-largest market.

Lottu Technology predicts that by 2025, the global projector market’s shipments are expected to reach 22.08 million units, a year-on-year increase of 9.5% compared to 2024, along with product structure upgrades driving sales to exceed $10 billion.

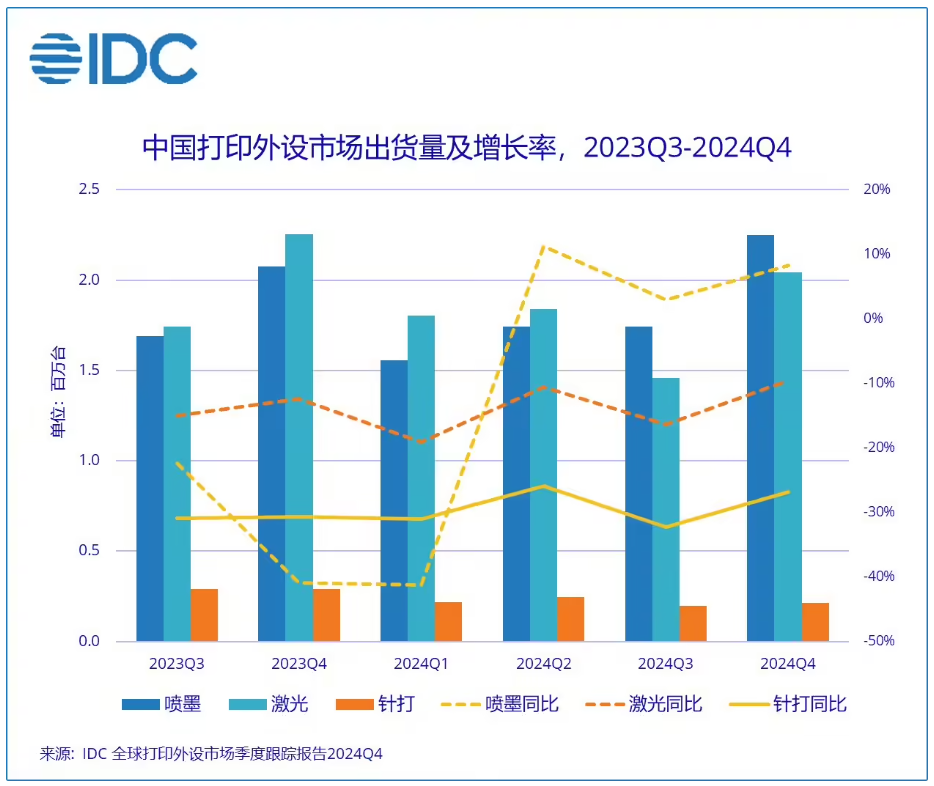

IDC: China’s Printer Peripheral Market Shipments Expected to Decline by 12.5% in 2024

Market research firm IDC reported that in 2024, shipments in China’s printer peripheral market are expected to reach 15.308 million units, a year-on-year decline of 12.5%.

Among them, inkjet printer shipments are expected to reach 7.292 million units, a year-on-year decline of 8.7%; laser printer shipments are expected to reach 7.143 million units, a year-on-year decline of 13.8%; and dot matrix printer shipments are expected to reach 874,000 units, a year-on-year decline of 28.9%.

In 2024, the inkjet market’s shipments are expected to exceed those of laser printers, with manufacturers showing relatively rational performance. Only in the first quarter, affected by the high base from Q1 2023, a year-on-year decline is expected, while the second to fourth quarters are expected to show a trend of year-on-year increases.

END