Currently, the global civilian Internet of Things (IoT) is profoundly changing people’s production and life, social management, and public services, showing an accelerated development trend. The military IoT has also expanded the time, space, and frequency domains of future combat, achieving a revolution in military technology and changes in combat methods, and has received attention from multiple countries. To help decision-makers grasp the latest developments in IoT, we conducted research on the development of global civilian and military IoT, forming the article “Overview of IoT Development,” which summarizes the overall status of civilian and military IoT and predicts the future market development prospects for reference.

1 Overview of IoT

1.1 Connotation of the IoT Concept

Now, the concept of the Internet of Things (IoT) is no longer limited to wireless sensor networks based on RFID technology. Its definition and coverage have overturned traditional human thinking, integrating basic physical infrastructure and IT infrastructure. According to the internationally accepted definition of IoT, the IoT is a network that connects any object to the Internet through information sensing devices such as RFID, infrared sensors, GPS, and laser scanners according to agreed protocols, enabling information exchange and communication to achieve intelligent identification, positioning, tracking, monitoring, and management of objects.

1.2 Development History of IoT

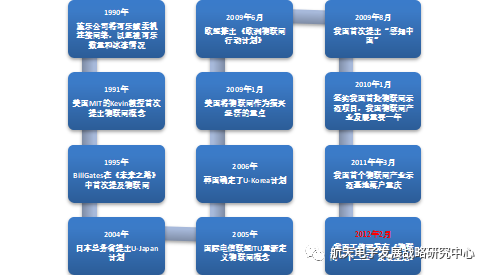

According to the 2018 China IoT Application Research Report by Yiou Think Tank and online information, the major events in the development history of IoT are summarized as shown in Figure 1:

Figure 1. Major Events in the Development of IoT

1.3 System Architecture of IoT

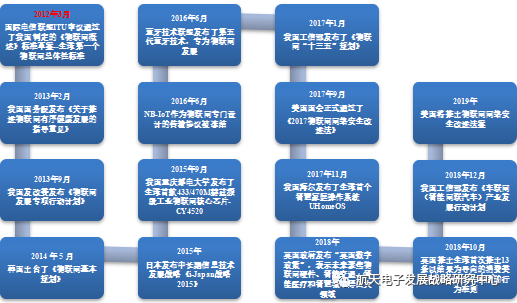

According to the 2019 China IoT Industry Panorama Report by the IoT Think Tank and the 2018 China IoT Application Research Report by Yiou Think Tank, the IoT system architecture is mainly divided into four layers: sensing layer, transmission layer, platform layer, and application layer, as shown in Figure 2.

Figure 2. The Four-Layer Architecture of IoT

Specifically, the sensing layer mainly utilizes sensors, QR codes, GPS, and radio frequency devices to collect data from the measured objects and their surrounding environments and perform preliminary analysis; the transmission layer is responsible for connecting the data collected by the sensing layer to access networks such as Ethernet, wireless networks, or satellite clusters, and then transporting the data over long distances through mobile communication networks, the Internet, or dedicated networks while transmitting instructions back to the sensing layer, thus completing the extensive processing and transmission of the physical world and achieving application and control of objects; the platform layer is for processing and analyzing the collected data to achieve effective integration and utilization; the application layer is customer-oriented applications centered on the objective physical world, providing interfaces between applications on any network endpoints.

1.4 IoT Industry Chain Layout

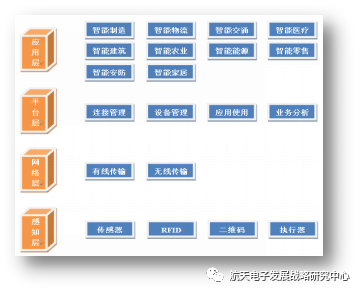

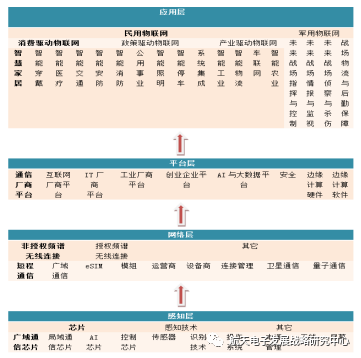

According to the 2019 China IoT Industry Panorama Report by the IoT Think Tank, the 2019 China IoT Industry Market Outlook Report by the China Business Industry Research Institute, and the 2018 China IoT Application Research Report by Yiou Think Tank, the IoT industry chain is divided into upstream, midstream, and downstream. The upstream provides middleware and applications, system integration solutions and implementations, as well as system operation and services for consumer (personal and home consumption), policy-driven, and industrial markets; the midstream includes communication network operators, including telecom network operators, broadcasting network operators, Internet operators, and dedicated network operators, mainly involving wired (fiber optic communication) and wireless (WIFI, Bluetooth, Zigbee, WLAN, NB-IoT, 2G/3G/4G/5G, etc.) application industries; the downstream includes suppliers of sensing devices such as sensors, QR codes, identification technologies, RFID, GPS/Beidou, and communication module suppliers. Currently, the layout of enterprises in various links of the IoT industry chain is shown in Figure 3.

Figure 3. The Industry Chain Layout of IoT

2 Key Technologies of IoT

According to Meng Xun’s “Overview of IoT Technologies” from China Knowledge Network and analysis of online information, IoT mainly involves the following six key technologies, as shown in Figure 4:

Figure 4. The Six Key Technologies of IoT

2.1 Wireless Sensing Technology

Wireless sensing technology in IoT integrates several nodes, including sensors, communication modules, and processing units. Each node forms a distributed network under certain protocol constraints, optimizing the collected data, and then uses radio waves to transmit information to the information processing center, ultimately completing the information data exchange and transmission between objects without damaging the original properties of the objects and the spatial environment.

2.2 RFID

RFID tags are a type of wireless radio frequency identification technology that uses radio frequency signals to achieve contactless information transmission through electromagnetic coupling in space and identifies objects through the transmitted information. It mainly consists of application software systems, readers, and responders. According to communication methods, it is divided into three categories: passive, semi-passive (also known as semi-active), and active. According to the power supply situation, it is divided into active tags, passive tags, and semi-active & semi-passive tags.

2.3 QR Code

2.4 Embedded System Technology

2.5 Information Security Technology

The information security technology of IoT mainly involves intrusion detection, information encryption, malicious node identification, and elimination. Once the IoT system suffers an information security attack, not only will the obtained data or information become meaningless, but it may also be harmful, even leading to system collapse or paralysis.

2.6 Edge Computing Technology

3 Status of Civilian IoT Development

3.1 Status of Global Civilian IoT Development

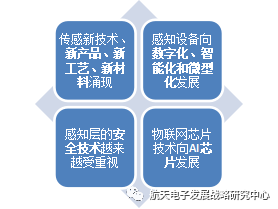

3.1.1 IoT Technology

Figure 5. Thematic Hotspots of Global IoT Patent Technology

Among them, G06K (data recognition; data representation; recording carriers; processing of recording carriers) accounts for far more than other technologies; the second is H04W (wireless communication networks); H04L (digital information transmission, such as typewriters, image telegrams, general encoding, telephone telegram communication devices, etc.) ranks third.

Figure 6. Distribution of Patent Technologies in the Global IoT Field

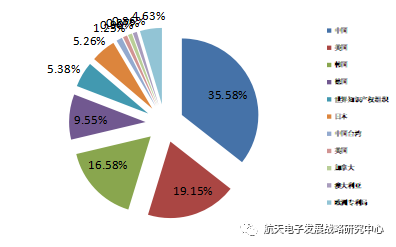

Figure 7. Proportion of Patent Numbers in the Global IoT Field

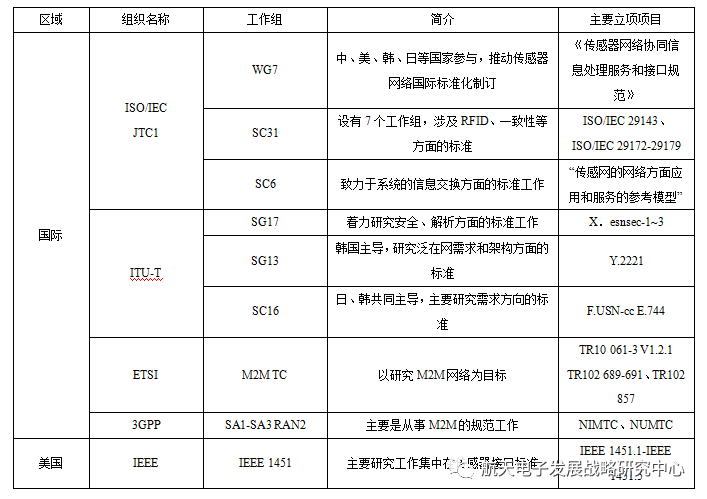

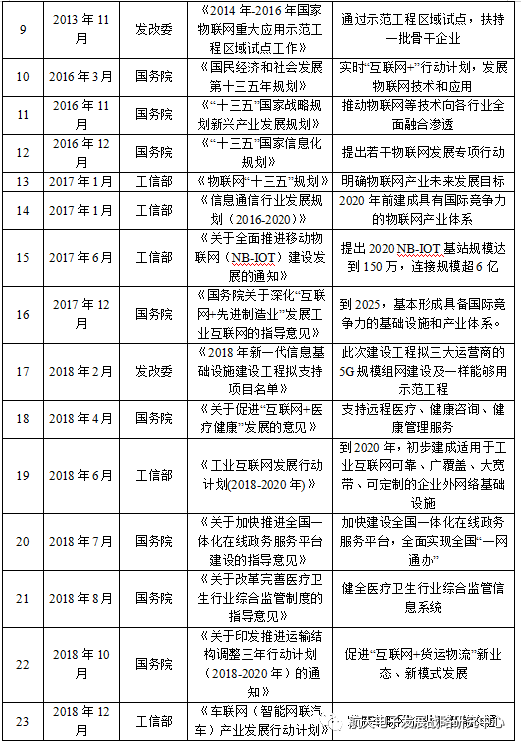

3.1.2 IoT Standards

Table 1. Current Status of Global IoT Industry Standard Formulation

3.1.3 IoT Policies

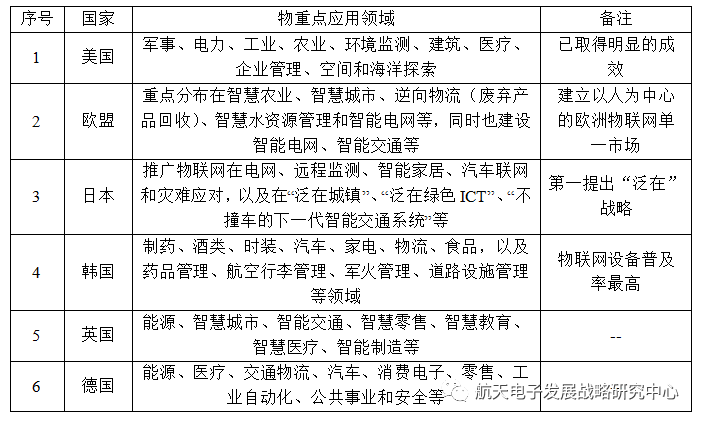

In recent years, many developed countries and regions, including the United States, the EU, the UK, Japan, and South Korea, have attached great importance to the development of IoT. These countries have different focuses in formulating IoT policies, including network security, ecosystem construction, manufacturing models, etc. According to Chen Qian’s “Trends in Foreign IoT Policies,” Xia Dan’s “Overview of Foreign IoT Industry Development,” and online statistics, by 2019, the summary of global IoT policies is shown in Figure 8:

Figure 8. Summary of Global Policies in the Field of IoT

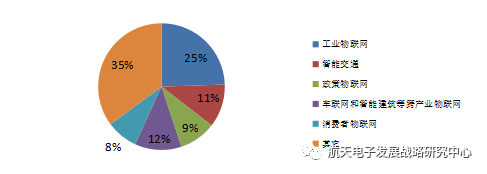

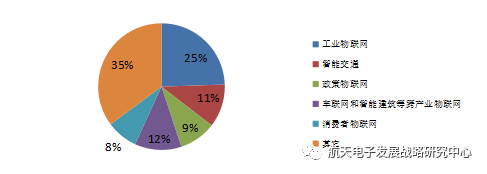

3.1.4 IoT Application Market

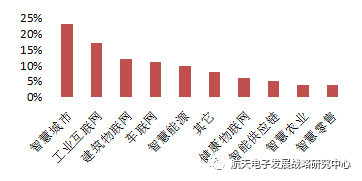

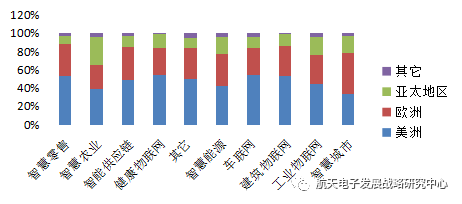

According to 51CTO’s “Analysis of the Current Situation of Global IoT Industry Development” and China Knowledge Network’s Xia Dan’s “Overview of Foreign IoT Industry Development,” as well as the Qianzhan Industry Research Institute’s “2018-2023 Analysis Report on Demand and Investment Opportunities in China’s IoT Industry,” the global IoT application areas are listed in Table 2. Except for the United States, which has begun to focus on military IoT, the main applications of global IoT lie in six areas: electricity, industry, energy, healthcare, transportation, and smart cities, as shown in Figure 9. According to the China Academy of Information and Communications Technology’s “IoT White Paper (2018),” from a global perspective, the industrial IoT (including smart city IoT and production IoT applications in industries such as energy, transportation, logistics, healthcare, and education) and consumer IoT (wearable devices, smart hardware, smart homes, vehicle networks, health and elderly care, etc.) are developing in sync, with trends in smart cities, productive IoT, and consumer IoT market applications shown in Figure 10, as well as overall application expenditure shown in Figure 11.

Table 2. Overview of Global IoT Application Areas

Military

Figure 9. Key Application Areas of Global IoT

Figure 11. Statistical Analysis of Global IoT Expenditures

Figure 12. Proportion of Global IoT Project Numbers by Subfield in 2018

Figure 13. Geographic Distribution of Global IoT Projects in 2018

3.2 Status of Civilian IoT Development in China

3.2.1IoT Technology

Figure 14. Thematic Hotspots of IoT Patent Technology in China

Figure 15. Number of Patent Applications for IoT Technology in China

Figure 16. Regional Distribution of Patent Applications for IoT Technology in China

Figure 17. Applicants of IoT Technology Patents in China

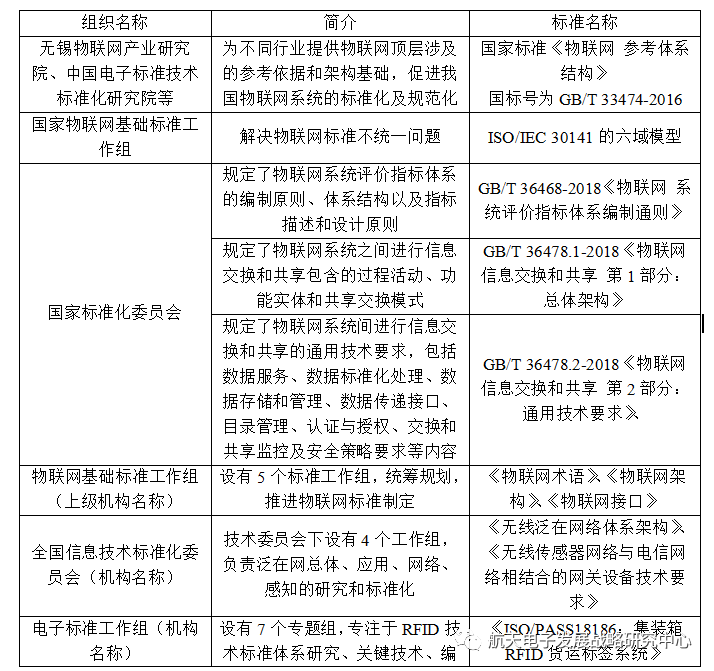

3.2.2 IoT Standards

Table 3. Current Status of IoT Industry Standard Formulation in China

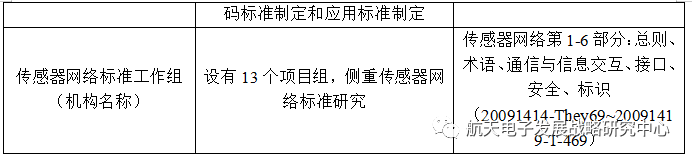

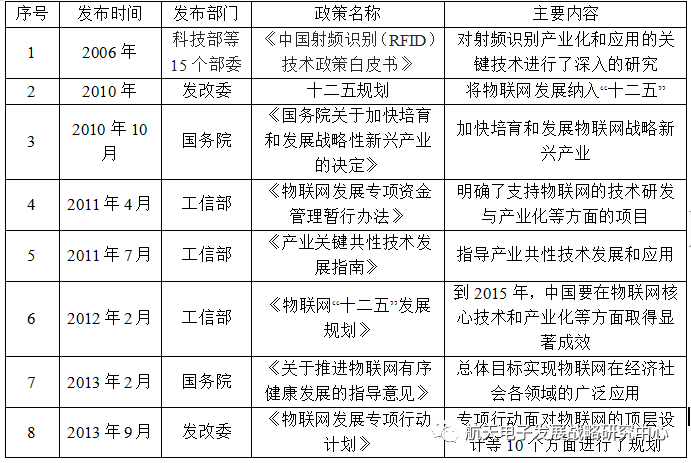

3.2.3 IoT Policies

Table 4. Current Status of National Policies Related to China’s IoT Industry

3.2.4 IoT Application Market

According to the China Academy of Information and Communications Technology’s “IoT White Paper (2018),” many industries in China have formed rigid demands for related industry IoT driven by government-related policies, facilitating the rapid implementation of IoT in these sectors, typically including various public affairs and security applications in smart cities. Currently, policy-driven IoT applications are landing faster than the spontaneous IoT application demands of enterprises, while consumer-driven IoT demands are slower than spontaneous demands from enterprises, as shown in Figure 16.

Figure 16. Overall Situation of the Civilian IoT Market in China

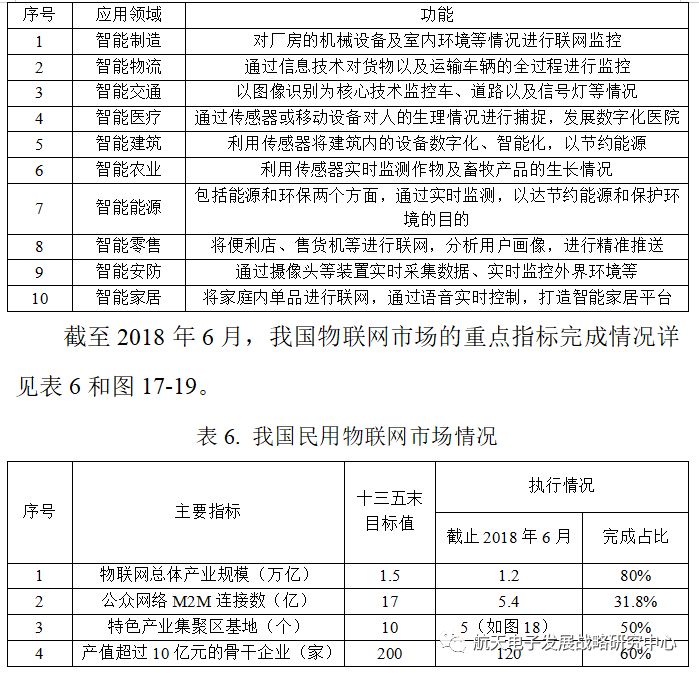

Table 5. The Top Ten Application Areas of Civilian IoT in China

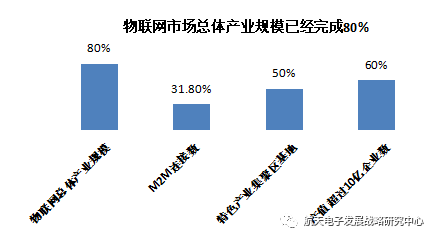

Figure 17. Proportion of China’s Civilian IoT Market Application Completion Rate Against the 13th Five-Year Plan Goals

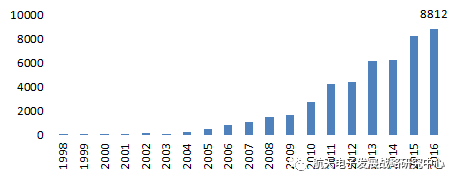

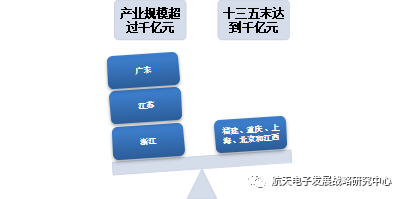

Figure 18. Overall Industry Scale of IoT in China

Figure 19. Five Characteristic New Industrialization Demonstration Bases of IoT in China

Figure 20. Statistics of IoT Market Connections in China

According to the 2017-2018 Annual Report on the Development of IoT in China by China Knowledge Network, since 2017, the scale and diversity of IoT data in China have continued to expand, the industry ecosystem has gradually improved, and innovative results in segmented fields have emerged continuously, while the development of industry technology and applications has entered a critical landing period.

4 Military IoT Development Status

Military IoT is based on existing military networks to build a vast network system covering core military applications such as battlefield perception, military training and command, logistics support, military logistics, smart barracks, and fault diagnosis. Utilizing military IoT, all elements and operational units related to combat can be operated through information and digitalization, completing communication, sharing, and collaboration between military application entities, ultimately enhancing the information-based combat capabilities and ensuring effectiveness across the military.

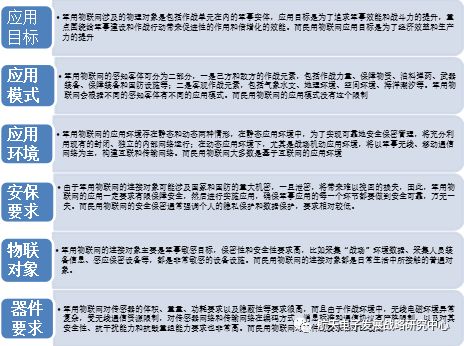

4.1 Differences Between Military and Civilian IoT

As an application of IoT in the military field, the top priority and core issue for military IoT is to clarify military needs, that is, how to integrate it into the joint operations and support system to effectively enhance combat capabilities and support effectiveness. Therefore, compared with civilian IoT, military IoT has many unique characteristics, as shown in Figure 21, which are specifically reflected in six aspects:

Figure 21. Differences Between Military IoT and Civilian IoT

4.2 Military IoT Demand in Wartime

4.2.1 Command and Control on Future Battlefields

According to Ma Liangli’s “IoT and Its Military Applications” and Liu Jie’s “Research on Military IoT Applications and Security Countermeasures” from China Knowledge Network, to adapt to joint operations under information conditions, military command and control have evolved from a hierarchical vertical command to a horizontal flat development, allowing direct combat command to frontline soldiers and control of combat equipment. Utilizing military IoT, a secure, flexible, and efficient integrated information combat command and control system can be established to achieve real-time sharing of intelligence, optimized decision-making strategies, dynamic control of combat actions, and precise assessment of combat effectiveness.

4.2.2 Intelligence and Surveillance on Future Battlefields

4.2.3 Reconnaissance and Strike on Future Battlefields

4.2.4 Military Logistics and Support on Future Battlefields

4.2 Status of Global Military IoT Development

4.3 Status of Military IoT Development in China

5 Prospective Predictions for IoT Development

5.1 Global IoT Development Prospects

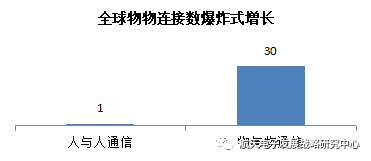

(1) IoT connections will reach 25.2 billion by 2025

The market in smart grids and airport intrusion prevention systems alone amounts to hundreds of billions of dollars.

Figure 22. Prediction of Global IoT Market Connections by 2020

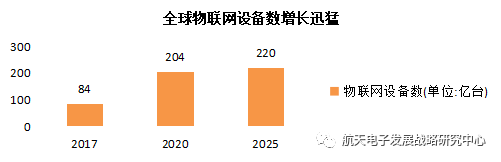

(2) The number of IoT devices will reach 22 billion by 2025

Figure 23. Prediction of the Number of IoT Devices in the Market by 2025

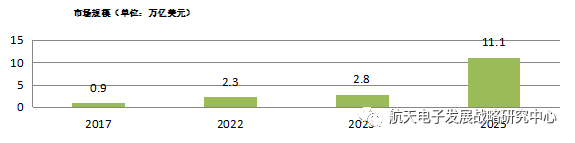

(3) The IoT market size will reach $3.9 to $11.1 trillion by 2025

Figure 24. Trends and Forecasts of Overall Global IoT Market Size from 2017 to 2023

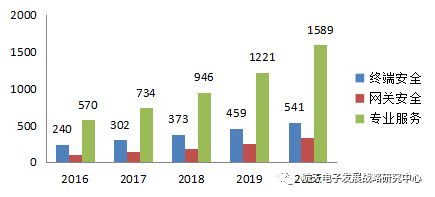

In the context of the rapid development of the IoT industry, security incidents based on IoT are frequent, and global IoT security spending will continue to increase. Currently, IoT-based attacks have become a reality. According to Gartner’s survey, nearly 20% of enterprises or related institutions have suffered at least one IoT-based attack in the past three years. To prevent security threats, Gartner predicts that global IoT security spending will reach $2.6 billion by 2020, with endpoint security spending of about $541 million, gateway security spending of about $327 million, and professional service spending of about $589 million, as shown in Figure 25.

Figure 25. Prediction of Global IoT Security Spending

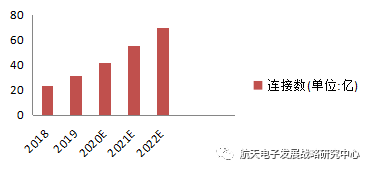

(1) The number of IoT connections in China will reach 7 billion by 2022

According to the Qianzhan Industry Research Institute’s “2019 IoT Industry Market Research Report,” by 2025, the number of authorized spectrum IoT connections in China is expected to increase to around 1.9 billion, and narrowband IoT (NB-IOT) technology has been deployed nationwide to support applications such as smart cities (such as public utility meters), shared bicycles, and smart agriculture. It is expected that by 2022, the number of IoT connections in China will reach 7 billion, as shown in Figure 26.

Figure 26. Prediction of the Number of IoT Connections in China

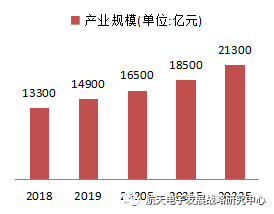

(2) The scale of China’s IoT industry will exceed 2 trillion yuan by 2022

According to the Qianzhan Industry Research Institute’s “2019 IoT Industry Market Research Report,” it is expected that by 2022, the scale of China’s IoT industry will exceed 2 trillion yuan, specifically 2.13 trillion yuan, as shown in Figure 27. According to China’s 13th Five-Year Plan for the IoT industry, the target scale for 2020 is 1.5 trillion yuan, but based on the trend of IoT development, this target is expected to be exceeded.

Figure 27. Prediction of the Scale of China’s IoT Industry

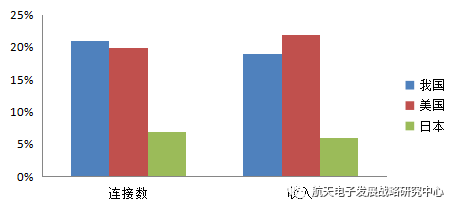

According to Machina Research predictions, in terms of IoT connections, China and the U.S. and Japan account for 21%, 20%, and 7%, respectively; in terms of IoT revenue shares, China and the U.S. and Japan account for 19%, 22%, and 6%, respectively, as shown in Figure 28. China is expected to lead the global IoT market in 2025, on par with the U.S.

Figure 28. Market Share Statistics of the Top Three IoT Markets by 2025

Thanks: The references used in this article mainly come from China Knowledge Network, and the statistical and forecast data of the IoT industry mainly come from the China Academy of Information and Communications Technology, Qianzhan Industry Research Institute, Yiou Think Tank, IoT Think Tank, China Business Industry Research Institute, McKinsey, U.S. market research company Forrester, market research company Machina Research, Gartner, GSMA, and other think tanks and consulting institutions. Some materials on military IoT come from “IoT and Its Military Applications” edited by Ma Liangli and others, “Military Applications of IoT” edited by Lan Yushi and others, and “IoT Technology and Its Military Applications” edited by Song Hang. Special thanks for this!

Source: Aerospace Electronic Development Strategy Research Center

Author: Science and Technology Committee of the Ninth Academy

Defense of Daliushu | dlswinds

Long press the QR code to follow Daliushu Defense