Source: CITIC Securities Research Department, Electronic Industry Research Group. Original title: “[CITIC Electronics] Commentary on the Upgrade of US Restrictions on Huawei,” with edits.

Abstract: CITIC Electronics believes that Huawei has achieved significant self-research in chip design, but the manufacturing stage remains a major bottleneck. Domestic semiconductors will be forced to grow rapidly, especially in the chip manufacturing sector.

The overnight news has heightened market attention on Huawei’s de-Americanization of its supply chain.

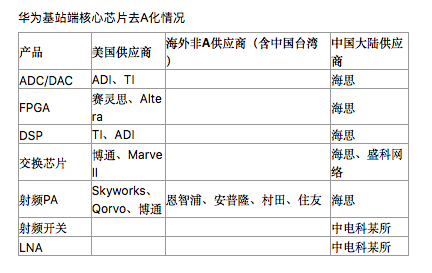

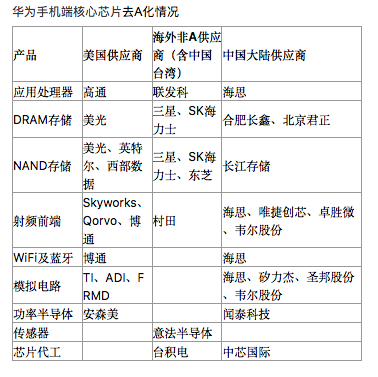

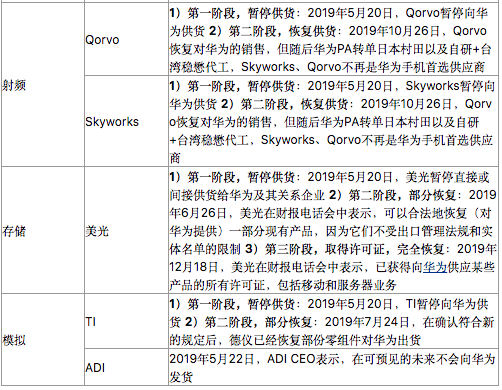

In this regard, CITIC Electronics believes that over the past year, Huawei has largely achieved self-research replacement or switched to non-American suppliers in IC design, while in manufacturing, Huawei still heavily relies on TSMC, and upstream semiconductor equipment and EDA software are still monopolized by American companies.

Currently, Huawei has achieved significant self-research in chips, but the manufacturing stage still heavily depends on TSMC, which is the main bottleneck in its supply chain. If manufacturing cannot place orders with TSMC, and SMIC’s technology and capacity ramp-up still require time, then the large number of self-researched chips will not be able to achieve mass production and application.

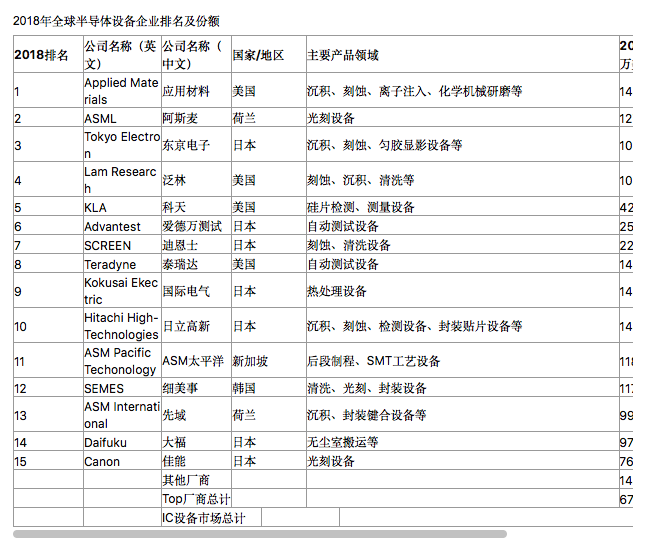

Moreover, in the semiconductor equipment sector, American companies currently hold about 40% of the semiconductor equipment market share, with leading technological advantages and stability in key processes such as deposition, etching, ion implantation, CMP, cleaning, and inspection, making it difficult to replace them in the short term. In the EDA software sector, the EDA tools for IC design are still largely monopolized by three American companies: Cadence, Synopsys, and Mentor, making complete replacement difficult in the short term.

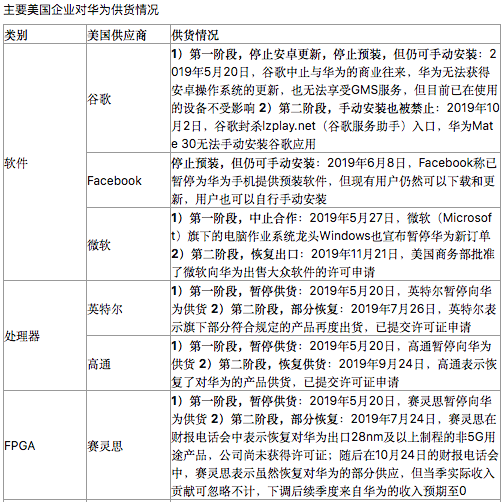

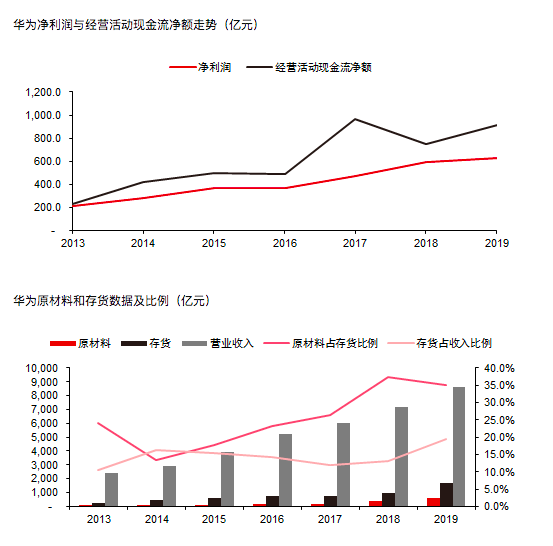

CITIC Electronics predicts that Huawei may face a short-term supply interruption, but it can be reasonably inferred that Huawei stockpiled a large number of related components and products in 2018 and 2019 for emergencies. Although there may be some pressure in the short term, it is unlikely to lead to a complete supply halt.

In the medium to long term, the technological bifurcation between China and the US will accelerate the closure of the industry.

The Chinese semiconductor manufacturing market is expanding and gaining attention from international equipment manufacturers. On May 14, Dutch company ASML signed a cooperation agreement with the government of Wuxi High-tech Zone in Jiangsu Province to establish a lithography equipment technology service base in Wuxi. ASML will build a specialized technical center for lithography machine maintenance and upgrades, as well as a supply chain service center to provide efficient material and logistics support, reflecting ASML’s emphasis on the Chinese market.

China’s leading chip manufacturer, SMIC, is expanding its advanced processes. On the evening of May 15, SMIC announced that its 14nm and below capacity platform, SMIC Southern, will receive an investment increase, raising its registered capital from $3.5 billion to $6.5 billion. After the increase, SMIC’s equity stake will decrease from 50.1% to 38.515%, while the National Integrated Circuit Fund, National Integrated Circuit Fund II, Shanghai Integrated Circuit Fund, and Shanghai Integrated Circuit Fund II will hold 14.562%, 23.077%, 12.308%, and 11.538% of the shares, respectively. SMIC will still maintain actual control over SMIC Southern and consolidate its financial statements.

The investment increase will help SMIC Southern establish a larger scale of 14nm and more advanced process capacity, which will help the listed company dilute the losses caused by high depreciation in the early stages of 14nm capacity. Currently, SMIC Southern’s capacity has reached 6,000 wafers per month, up from 4,000 wafers per month at the end of March, and is expected to reach 15,000 wafers per month by the end of the year, with a project target of 35,000 wafers per month.

On the other hand, the US is increasing its control over advanced semiconductor process technology. On May 15, TSMC announced its intention to build and operate a 5nm advanced wafer fab in Arizona, USA, which is set to begin construction in 2021 and start mass production in 2024.

Previously, TSMC had expressed intentions to build factories in the US, and we believe this move is a response to the Trump administration’s concerns about the security of the advanced semiconductor process supply chain, ensuring that the US has factories capable of manufacturing cutting-edge chips, which helps protect its supply chain security.

CITIC Electronics believes that in the field of core technology infrastructure and new infrastructure, a bifurcation will occur between China and the US, forcing rapid growth of domestic semiconductors:

In the technological competition between China and the US, the chip manufacturing sector will become a focus, which will benefit the long-term development of the semiconductor sector. As a core enterprise in domestic chip manufacturing, SMIC will bear the responsibility of supporting the autonomy of the domestic industrial chain in the future, and its benefits from policy and financial support will help drive the growth of upstream and downstream companies.

We still emphasize that the core logic of the domestic semiconductor sector is self-control over a ten-year dimension, and we will selectively focus on domestic replacement-related equipment, materials, and design companies.

Long press the QR code

Download “JianWen VIP”

Witness history in real-time