This is an interesting and special 5G plan.

The plan is as follows:

Phase One (November 2018 to March 2020)

First, through shared towers and satellite backhaul, quickly establish a nationwide coverage 700MHz NB-IoT network.

Phase Two (March 2020 onwards)

Transition from NB-IoT to 5G, supporting all 5G applications except mobile broadband services, specifically providing IoT services for vertical industries.

As we know, 5G is divided into three major scenarios: eMBB, mMTC, and URLLC. eMBB refers to the enhanced version of 4G mobile broadband services (MBB), while mMTC and URLLC refer to 5G IoT services.

In simpler terms, the idea behind this plan is:

As a new entrant wanting to seize 5G business, since it’s impossible to compete with traditional mobile operators in mobile broadband services (MBB), I might as well skip the eMBB scenario and directly build an NB-IoT network that evolves into the 5G Internet of Everything era, focusing solely on the IoT business.

Recently, the American satellite TV service provider Dish announced the official construction of an NB-IoT network.

There are two reasons:

First, Dish believes that NB-IoT is recognized as the “global wide-area IoT network of choice” and can smoothly evolve into 5G, capturing the large IoT market.

Second, the US FCC stipulates that operators holding spectrum resources cannot “sit on their hands”; Dish holds the 700MHz golden band spectrum resources and must build a network with a coverage of 70% by March 2020.

How will this satellite TV service provider seize the IoT era?

Although Dish has not publicly disclosed specific network construction plans, by combining an internal “Base Station Design Plan” from Dish and documents submitted to the FCC, it is not difficult to infer that this is a very interesting and thought-provoking 5G deployment plan.

New NB-IoT Network→Smooth Transition to 5G IoT

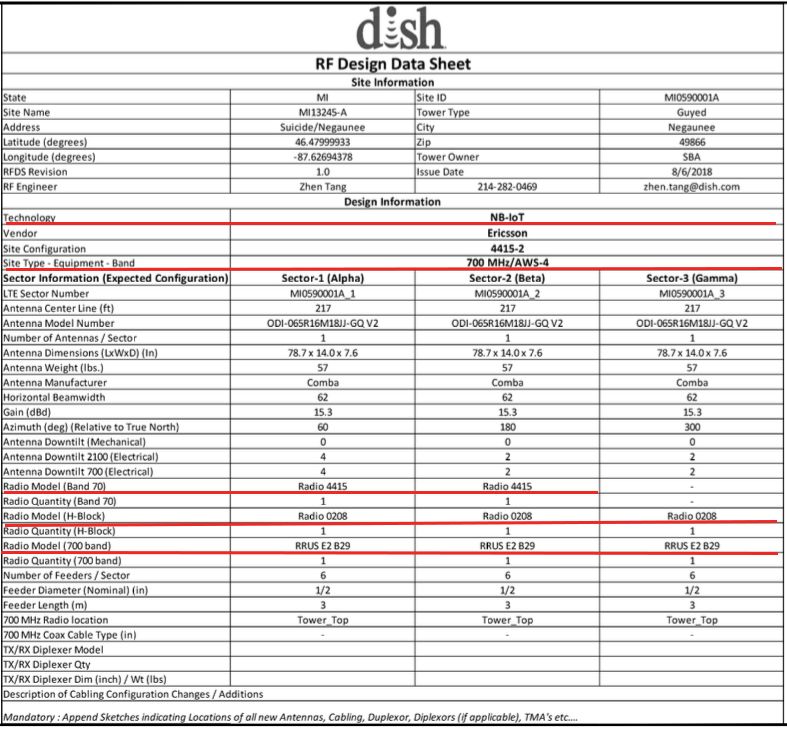

First, let’s take a look at the RF design part of Dish’s “Base Station Design Plan”…

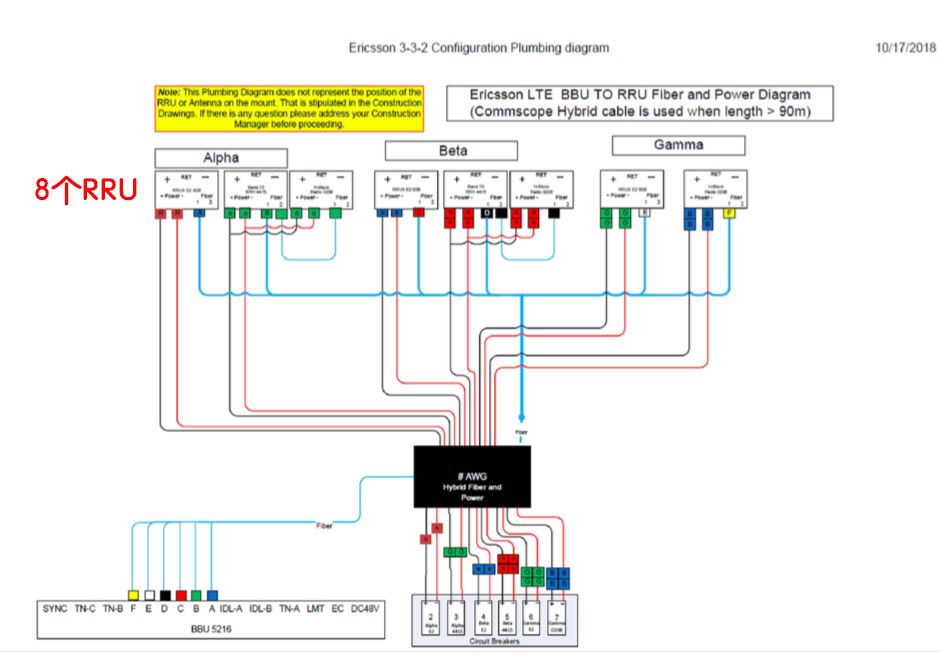

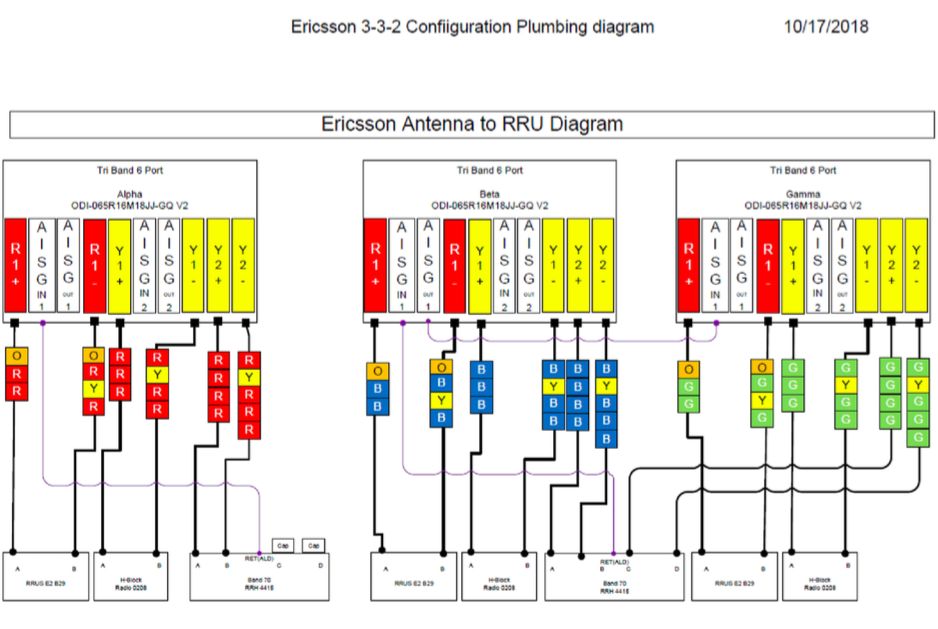

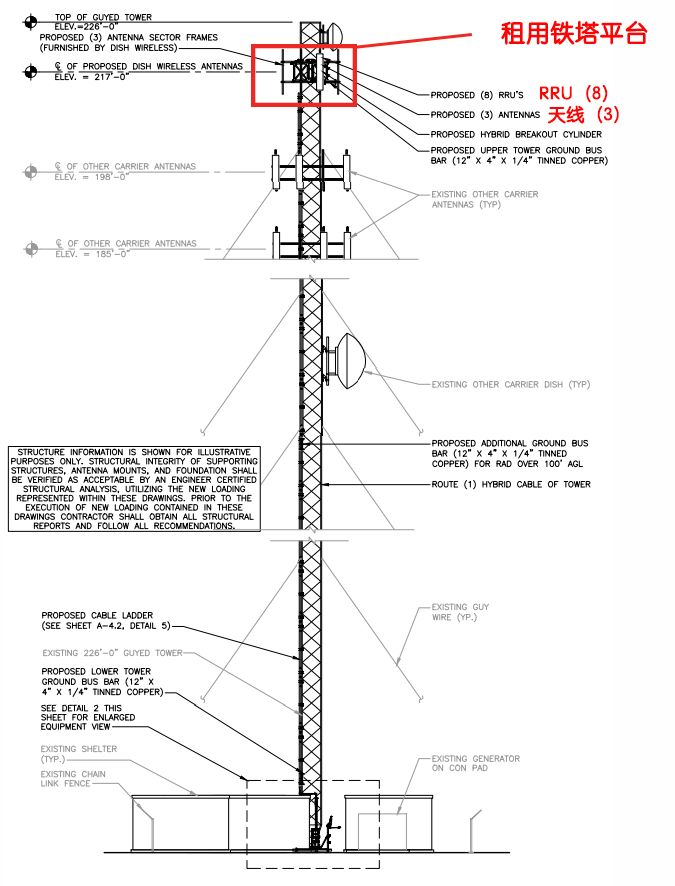

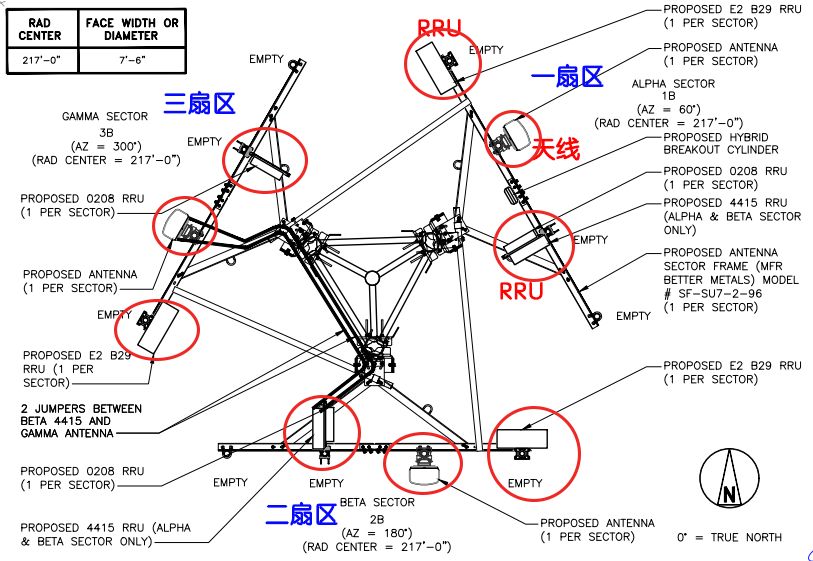

From the design diagram, it can be seen that in the first phase, Dish uses three frequency bands: 700M E Block, H Block, and AWS 4 to construct the NB-IoT network, with Ericsson as the equipment supplier.

This diagram designs three types of RRU (Ericsson Radio4415, Radio0208, and RRU E2 B29), and each of the three sectors is configured with 8 RRUs.

Dish’s three main NB frequency bands are as follows:

700M E Block:722-728 MHz (corresponding to RRU E2 B29)

H Block:1915-1920 MHz UL / 1995-2000 MHz DL (corresponding to RRU Radio0208)

AWS-4:2000 MHz to 2020 MHz (corresponding to RRU Radio4415)

A base station requires 8 RRUs, which is a big profit for Ericsson.

The three frequency bands used by Dish are all included in the 3GPP standards, corresponding to B29, B66, and B70.

As for phase two, which is the 5G IoT phase, Dish indicated in its proposal to the FCC that it will introduce new frequency bands such as 600MHz for IoT construction.

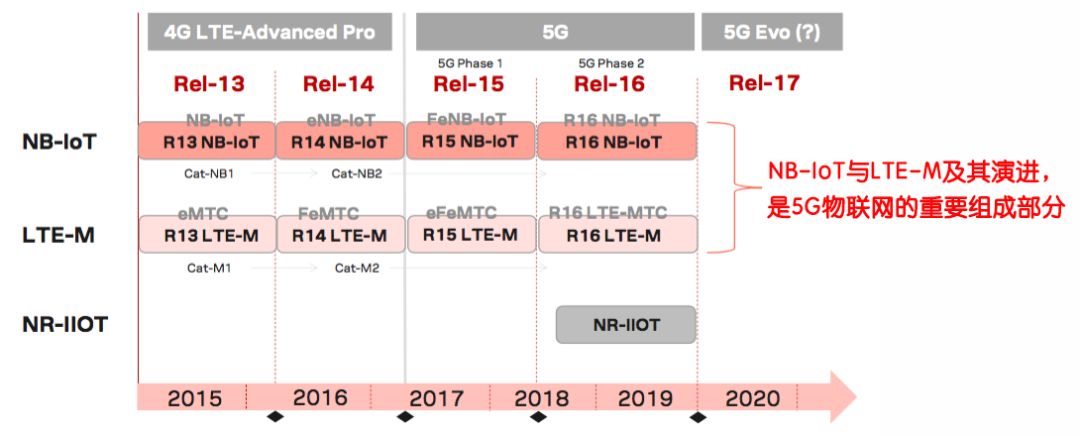

Why did Dish choose NB-IoT? As mentioned earlier, Dish believes that NB-IoT is currently recognized as the “global wide-area IoT network of choice” and can smoothly evolve into 5G.

In fact, the continuously evolving NB-IoT and LTE-M are part of the future 5G mMTC scenario, with the evolution direction as follows:

As shown in the figure, NB-IoT and LTE-M will evolve from 4G R13 and R14 versions all the way to 5G R15 and R16 versions, and they are important components of 5G IoT.

From NB-IoT to 5G IoT, Dish’s IoT plan is both grounded in the present and oriented towards the future.

Shared Towers, Rapid Network Construction

To quickly and cost-effectively build an NB-IoT network, sharing towers is certainly essential, and Dish has reached a cooperation agreement with tower company SBA.

From the perspective of tower design, to better achieve wide coverage of NB-IoT, Dish plans to lease the top platform of the tower.

Since NB-IoT covers “things”, while traditional 2/3/4G cellular networks cover “people”, there are differences in coverage range, direction, etc., which provides Dish with greater flexibility in choosing tower platform locations, helping to optimize costs and accelerate construction speed.

NB-IoT Satellite Backhaul→Integrated 5G IoT

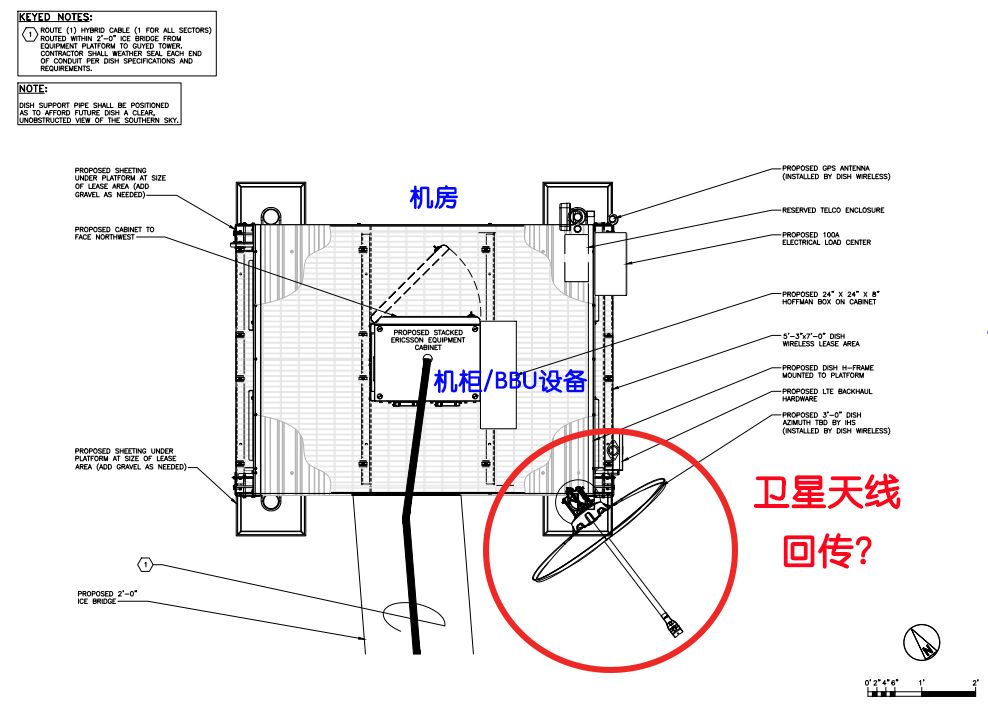

In this design diagram, we also found a new piece of equipment…

Outside the base station room at the bottom of the tower, a satellite antenna is also configured, and Dish is likely to use satellite antenna backhaul.

Satellite communication was also mentioned in the documents submitted by Dish to the FCC, stating:

We are exploring the construction of an NB-IoT network that is different from other operators, including enhancing connectivity through our mobile satellite service (MSS) satellites.

At the same time, Dish also stated that it is working to explorethe integration of satellite and non-terrestrial network architecture for 5G technology.

Satellite communication, non-terrestrial networks, and 5G integration technology are also important research topics for the second phase of 5G (3GPP R16).

Clearly, Dish’s plan is to first use satellite communication for NB-IoT backhaul, and then follow the 3GPP standards to build an integrated IoT network that combines satellite communication, non-terrestrial networks, and terrestrial 5G to meet low-cost, seamless wide coverage IoT application scenarios.

In short, Dish, holding quality spectrum resources, knows very well that building an LTE network and then evolving into the 5G eMBB scenario has no chance of competing with traditional mobile operators like AT&T and Verizon. Thus, it chooses a different path, evolving from NB-IoT to 5G IoT, and aiming to build an integrated, seamless coverage IoT network focused on IoT business.

Dish’s 5G plan is unique; in fact, this satellite TV service provider has never played by the rules.

As early as 2012, Dish launched the Hopper HD set-top box with a 2000GB large hard drive, which can locally record and store HD programs from the four major broadcast networks in the US during prime time, with local storage serving as an on-demand library for HD programs, and it can automatically filter ads, allowing users to replay on-demand at any time.

This blatantly cut off the revenue stream of broadcast networks, and within two weeks, Dish was sued by the four major broadcast networks in the US, strongly condemning Dish for disrupting the ecosystem of the broadcasting industry.

However, Dish was unfazed and instead advised the four major broadcasters to face reality, as the traditional advertising model would eventually be disrupted.

Later, Dish was also the first to cancel traditional monthly fees.

Always walking its own path and disrupting others.

In the industry’s view, Dish is a troublemaker, and every action sends shivers down the spines of its peers.

This time, Dish’s “special 5G plan” has also attracted strong attention from all sectors, and in the documents submitted to the FCC, a phrase stating “to build a highly secure open-source or neutral 5G network, focusing on new partnerships and shared models to provide services for vertical industries” is particularly thought-provoking.

Lightweight, practical, integrated, and orderly, this 5G plan is a bit different.