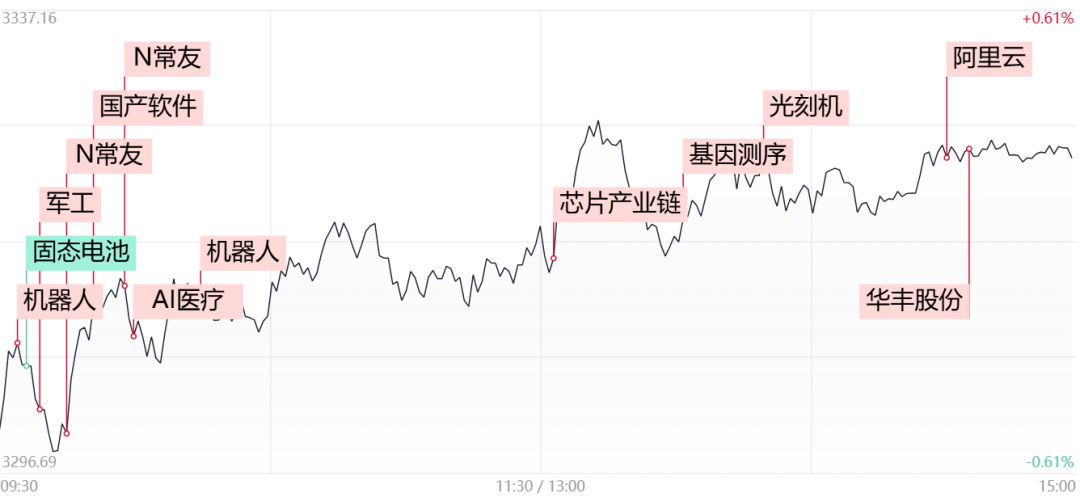

Introduction: The market experienced fluctuations throughout the day, with the three major indices showing mixed results and trading volume shrinking further to less than 1.5 trillion; on the market, robotics concept stocks rebounded collectively, with over 20 stocks hitting the daily limit, and in the afternoon, chip stocks surged due to the RISC-V concept gaining traction; short-term sentiment gradually warmed up, with over 4,000 stocks in the green and more than 100 stocks rising by over 10%.

Market ReviewThe market fluctuated throughout the day, with the three major indices showing mixed results. The total trading volume in the Shanghai and Shenzhen markets was 1.44 trillion, a decrease of 189.1 billion compared to the previous trading day. The market’s hotspots were relatively scattered, with more stocks rising than falling, and over 4,000 stocks in the entire market rising. In terms of sectors, chip stocks surged collectively, with Chipone Technology and several other stocks hitting the daily limit. Military stocks showed a strong performance, with Hongdu Aviation and others hitting the daily limit. Robotics concept stocks rebounded at one point, with over 20 stocks including Hangzhou Gear and others hitting the daily limit. On the downside, solid-state battery concept stocks underwent adjustments, with Sanxiang New Materials hitting the daily limit. By the close, the Shanghai Composite Index rose by 0.22%, the Shenzhen Component Index rose by 0.28%, and the ChiNext Index fell by 0.29%.

Key Sector AnalysisSemiconductor ChipsThe semiconductor chip sector strengthened in the afternoon, with Chipone Technology, Neusoft Carrier, Anlu Technology, and Yitong Technology hitting the daily limit, while Allwinner Technology, Aojie Technology, Huada Jiutian, and Feilixin saw gains of over 10%.On the news front, on February 28, the 2025 Xuantie RISC-V Ecosystem Conference was held in Beijing. Academician Ni Guangnan from the Chinese Academy of Engineering pointed out that the open-source model helps RISC-V build an inclusive and collaborative global ecosystem, becoming a new engine for the transformation of the chip industry. The RISC-V ecosystem has made breakthroughs in several key areas, especially in emerging fields such as AI, IoT, and high-performance computing, bringing new opportunities to the global market.Haitong Securities stated that China is in the first tier of RISC-V ecosystem construction. The contribution in terms of technology and application is increasing, which also means that China is playing a key role in the global RISC-V ecosystem construction. From a market perspective, with the RISC concept exploding in the afternoon, it successfully boosted short-term sentiment, and it is expected that this theme still has room for further development, with core targets in the front row still worth tracking.Military IndustryMilitary stocks also performed strongly, with Beifang Changlong, Construction Industry, New Equipment, Lihang Technology, and Hongdu Aviation hitting the daily limit, while Hangxin Technology, Hangfa Technology, and Zhongwu Drone saw significant gains.AVIC Securities stated in a recent research report that Deepseek‘s breakthrough once again highlights the development of China’s industrial autonomy. The military industry, as a pioneer of domestic hardware and software, is expected to accelerate the value restoration process of the military electronics industry related to military intelligence under the support of the rising risk appetite in the technology sector. From a market perspective, military stocks are overall at a relatively low level, aligning with the current aesthetic of capital rotating from high to low. However, it should be noted that based on past experience, the continuity of military stocks is relatively poor, and attention should be paid to whether there are more favorable catalysts in the future.RoboticsRobotics concept stocks also rebounded, with Hangzhou Gear, Wanma Co., Zhiwei Intelligent, Jiechang Drive, Zhaowei Electromechanical, and Shida Group hitting the daily limit.On the news front, on March 3, the Shenzhen Municipal Bureau of Science and Technology Innovation issued the “Shenzhen Action Plan for the Innovation and Development of Embodied Intelligent Robot Technology (2025-2027)”. It mentioned that it will focus on supporting key core technologies such as core components of embodied intelligent robots, AI chips, bionic dexterous hands, bases, and large models in vertical fields.From a market perspective, as one of the previous mainline hotspots, the robotics sector’s rebound today after two consecutive days of adjustments has played a positive role in stabilizing the overall market. However, in the current environment of continuous shrinking volume, it remains challenging for robotics concept stocks to initiate a new round of market trends, and attention should be paid to local stock movements in the future.Market OutlookToday, the three major indices of A-shares showed mixed results, closing with varying gains and losses. The total trading volume in the two markets was 1.44 trillion, a decrease compared to the previous trading day. On the market, chip stocks surged collectively, military stocks showed strong fluctuations, and robotics concept stocks experienced a wave of daily limits.On the news front, Shenzhen issued the “Shenzhen Action Plan for the Innovation and Development of Embodied Intelligent Robot Technology (2025-2027)”, which proposed to focus on supporting key core technology breakthroughs in embodied intelligent robots. The development trend of humanoid robots is clear, with significant growth expected by 2025, making it worthwhile to pay attention to the relevant industrial chain in the medium to long term. In addition, DeepSeek publicly disclosed a profit cost rate, with a theoretical cost rate as high as 545%, achieving a closed-loop profit model for model manufacturers. From the perspective of industry demand, there is significant room for both downward cost and upward capability in the model segment, which is expected to accelerate the release of downstream AI application demand.