We didn’t expect that the previous article “Investment Pitfall Guide for Scientific Instruments” would receive so much attention. For a public account established less than three months ago with only 1,600 followers, receiving over 10,000 reads and more than 1,500 shares made us feel the power of social media, and we realized that so many people are concerned about the growth of this emerging industry.

Through communication with many followers, we found that over 80% of investors interested in scientific instruments have investment experience in IVD, medical devices, etc. The most frequently asked question is:

“How should we invest in the scientific instrument industry?”

We noticed that many IVD companies want to learn from scientific instruments to expand their business into multiple categories and fields, while scientific instrument companies are also actively entering the clinical market in hopes of obtaining greater single product opportunities. However, both sides face huge difficulties in this mutual pursuit. What is the reason?

This article aims to discuss the differences in business philosophy and investment logic across different tracks from the perspectives of the distinctions between IVD and scientific instruments, as well as the core competency differences between the two types of companies.

01

—

Learning from Others

1. Thermo Fisher

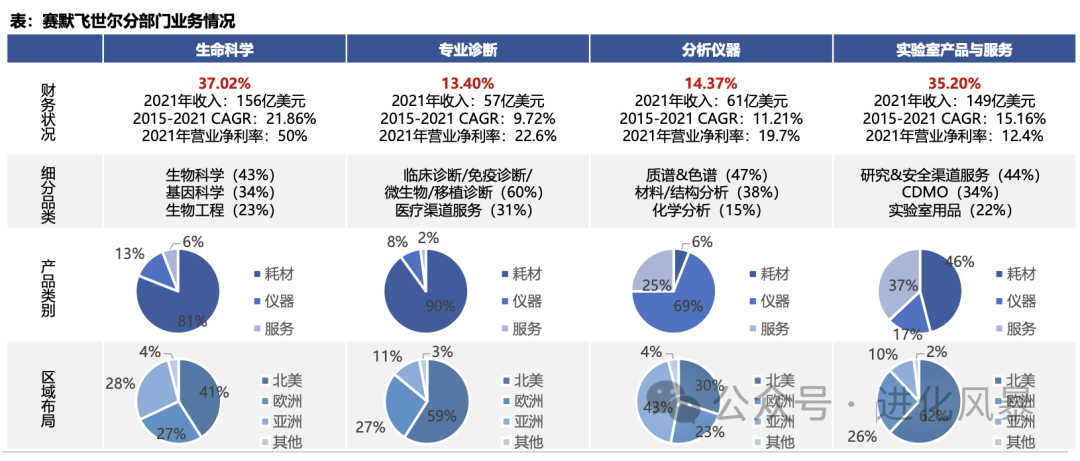

Thermo Fisher divides its business into four major segments, each containing consumables, reagents, instruments, and services. For example, in 2021:

(1) Life Sciences Business: Mainly serves drug research, gene sequencing, pharmaceutical processes, etc. Instrument products account for 13% (USD 2.028 billion), mainly including PCR, capillary electrophoresis, WB-related products, etc.

(2) Professional Diagnostics: Mainly serves hospitals, third-party testing centers, etc. Instrument products account for 8% (USD 456 million), including immunoassay analyzers, fully automated clinical biochemical analyzers products.

(3) Analytical Instruments: Mainly serves research institutions (including life science industry users). Instrument products account for 69% (USD 4.209 billion), mainly including chromatography, mass spectrometry, spectroscopy, automation instruments, electron microscopes, etc.

(4) Laboratory Products and Services: Mainly provides basic equipment and CDMO services for various laboratories. Instrument products account for 17% (USD 2.533 billion). Mainly includes laboratory refrigerators, centrifuges, pure water systems, etc.

2. Danaher

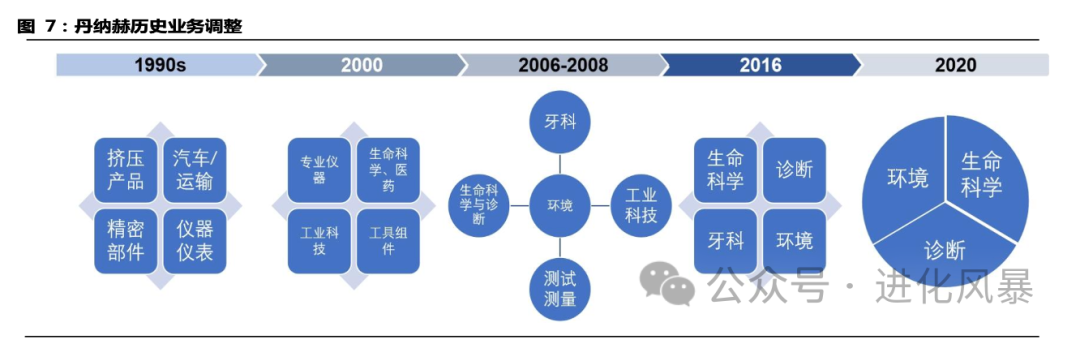

We mentioned in the previous article “Challenges in Strengthening the Scientific Instrument Industry in China – The Acquisition Dilemma” that Danaher adjusted its business segments in 2016. After acquiring PALL (separation and purification) for USD 14.8 billion in 2015 and Cepheid, a molecular diagnostics giant, for USD 4 billion in 2016, it officially separated life sciences from diagnostics.

02

—

(1) Different Product Positioning and Customer Groups

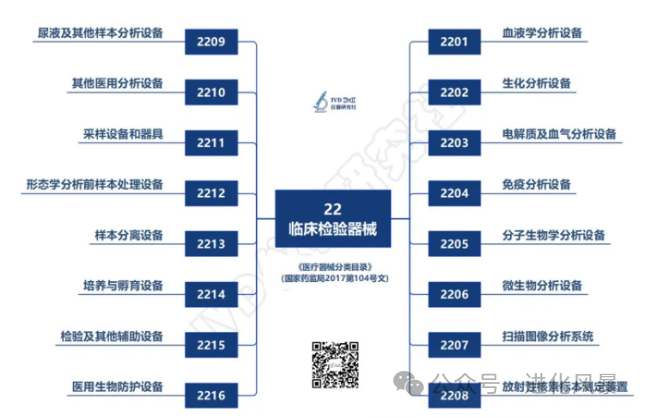

The ultimate customer group for IVD instruments is hospitals and disease control centers. They diagnose and monitor diseases by analyzing different human samples (such as blood, urine, etc.), belonging to a single market.

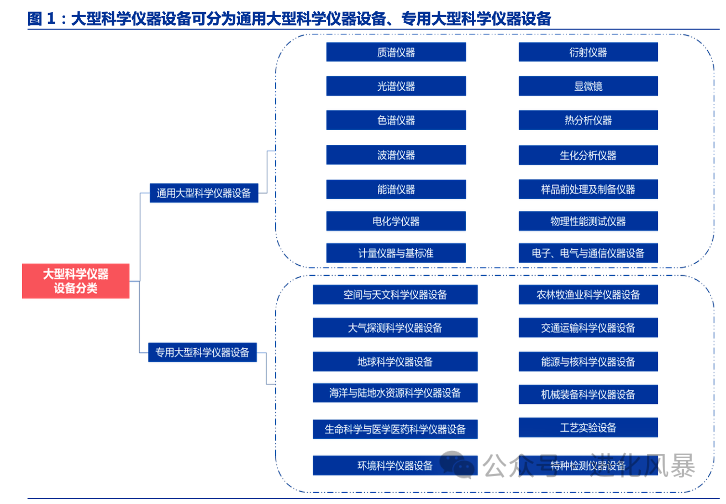

The definition of scientific instruments is broader, appearing in all fields involving scientific research. They are not only the basic tools for universities and research institutions to conduct scientific research but also serve multiple fields such as industrial production, quality control, and environmental monitoring. For specific reference, see “Scientific Services are Merely a Matter of ‘Cooking’.”

|

Investment Tip: Pay attention to the differences in channel capability construction and sales strategies between IVD and instrument companies Differences in product positioning, customer groups, and procurement habits lead to different strategies in market channel construction for IVD and scientific instrument companies.

The customer group of IVD companies is “clear-cut”. For hospitals of different levels, the annual procurement of instruments and reagents is public information. Therefore, it is particularly important for IVD companies to find channel companies in specific regions and medical institutions. The sales capability of IVD companies is highly dependent on resources, relationships, and channels, with management focusing on channels. When investing, it is essential to focus on whether IVD companies possess channel resources in key areas.

The mainstream user groups of scientific instrument companies include university research institutions, testing and inspection institutions, and corporate R&D centers. The procurement decision-making of university research institutions is similar to that of hospitals, generally adopting a bidding model, while testing and inspection institutions and corporate R&D centers usually adopt a direct sales model. The needs of scientific instrument companies’ target customers are extremely dispersed, requiring the establishment of a composite sales team that combines direct sales and distribution, while also actively exploring customer needs. This places higher demands on the daily work and skill enhancement of sales personnel. When investing, it is important to pay attention to whether the company has systematic sales management capabilities and whether it can build a sales service team for different application fields. |

(2) Significant Differences in Variety and Market Space

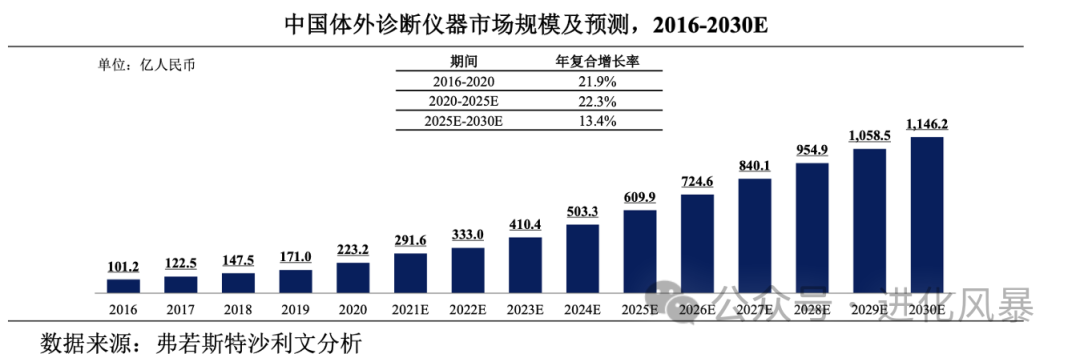

In 2022, the overall market size of IVD instruments in China was approximately 33.3 billion yuan, with fewer subcategories, belonging to a typical single product large market.

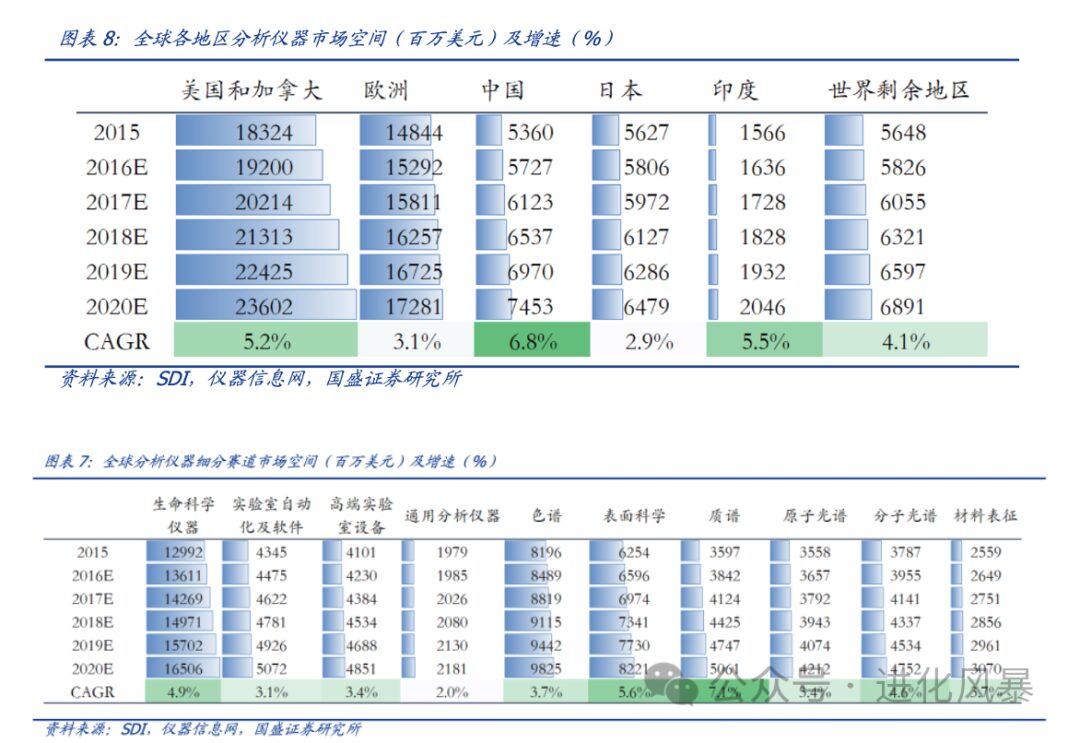

Although the overall market size of scientific instruments is large, with approximately

70 billion yuan

annually in China, the number of subdivided categories is too numerous, with very few single product markets exceeding 2 billion.

|

Investment Tip: Pay attention to the differences in market size and expansion capabilities of sub-products

IVD instruments belong to a large market and large single product logic. For startups, finding a good category and an ALL IN ONE model can be successful. Once they obtain medical device licenses and have supporting consumables and reagents, they have a foundation for early market expansion. The initial investment risk is high and costs are high, but once certified, the barriers are also high, especially for Class III or innovative medical devices. In the investment process, we prefer single product market spaces that are relatively large, with products that have certain innovations and teams with mature experience in medical device R&D and production certification.

Scientific instruments belong to a large market with small single product logic. For companies in the industry, it is challenging to achieve significant sales through a single product. Therefore, the initial products of scientific instrument companies do not fundamentally influence the future development potential and form of the company. When considering investing in scientific instrument companies, we focus more on whether the current product can achieve rapid breakeven, whether it can help the company accumulate underlying technologies and core personnel, and whether it is conducive to building a marketing system. We believe that continuous market-oriented selection capability is key to the success of scientific instrument companies. |

(3) Different Instrument Uses and Focus Areas

IVD instruments are directly related to medical diagnostic results, and the goal for operators is to quickly and accurately complete testing projects. The core demands for instruments are

high automation, ease of operation, and stable and reliable results

, generally without requiring peak performance of the instruments; at the same time, IVD instruments require strict R&D, clinical trials, and approval processes. The time from R&D to market for new products is relatively long, and continuous performance optimization is needed to meet new clinical demands or adapt to changes in policies and regulations. The R&D of IVD instruments focuses on improving detection accuracy, developing new biomarker detection methods, and responding to the trends of changing diseases and personalized treatment.

Scientific instruments, apart from testing and inspection institutions, are mostly used for innovative research, and the operators are generally professional R&D personnel, scientists, etc. Their personalized requirements for instruments are generally stronger than automation requirements, and they have higher demands for the ultimate performance of instruments, with many hoping that instruments can be multifunctional. The R&D of scientific instruments emphasizes breakthroughs in performance indicators, such as sensitivity, resolution, automation degree, and data processing capability. Additionally, cross-disciplinary integration of multiple technologies and innovation is also key.

|

Investment Tip: Pay attention to the differences in development goals and R&D capability construction of instruments

Based on the usage scenarios of IVD instruments, the product development of IVD companies has more clear directionality. When investing in IVD companies, we pay more attention to the R&D team’s development experience in this field and whether the product’s performance is stable (for example, in some optical detection-based instruments, whether the optical path stability and light source attenuation issues can be effectively solved), whether the automation degree is high enough (for example, whether the sample pretreatment steps require frequent manual intervention, whether it can achieve sample input and result output), and whether the reagent matching results are good (whether it can continuously develop reagents based on the instrument, whether it can form an effective commercial closed loop), etc.

However, due to the diversification of usage scenarios for scientific instruments, we focus more on whether the R&D team has a methodology or systematic management capability to establish a continuous evolution capability that is not limited to any single product; whether it has R&D ideas based on multiple user scenarios and has a dedicated application service team; and whether it has flexible development strategies and timely correction capabilities. Overall, the development difficulty of scientific instruments is, to some extent, higher than that of IVD instruments, with higher systematic requirements. |

(4) Different Profit Focus

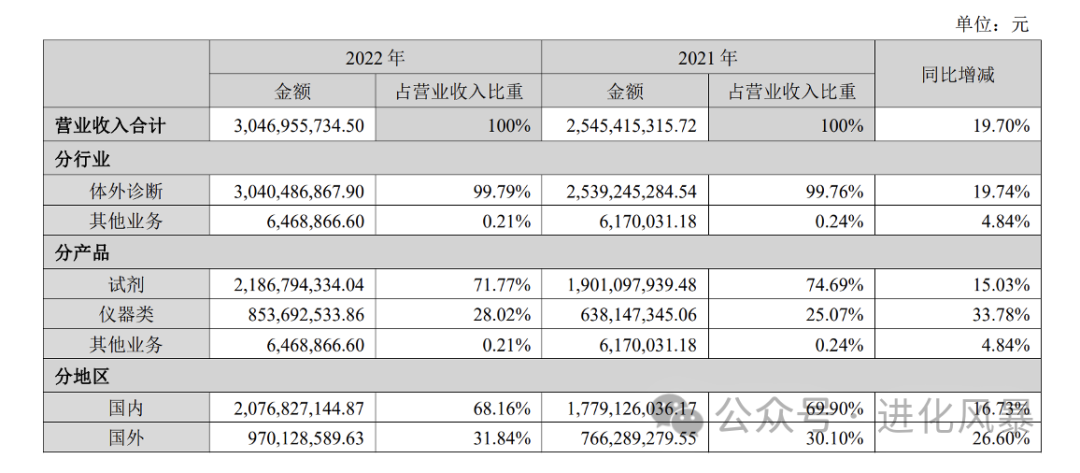

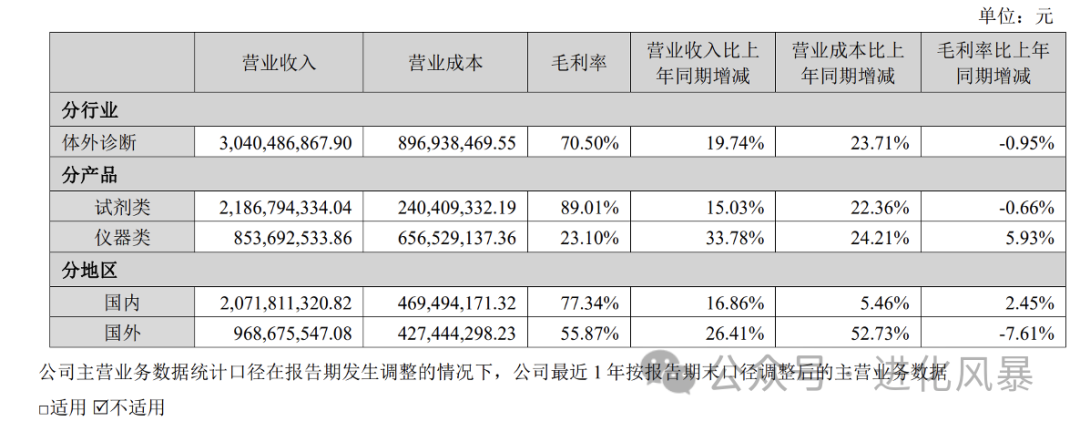

IVD companies generally divide their business into two major segments: diagnostic instruments and diagnostic reagents. For new industries, the revenue share of reagents reached

72%

, while the share of instruments was only

28%.

From the gross profit perspective, the gross profit margin of in vitro diagnostic reagents is as high as 89%, while the gross profit of instruments is only 23%.

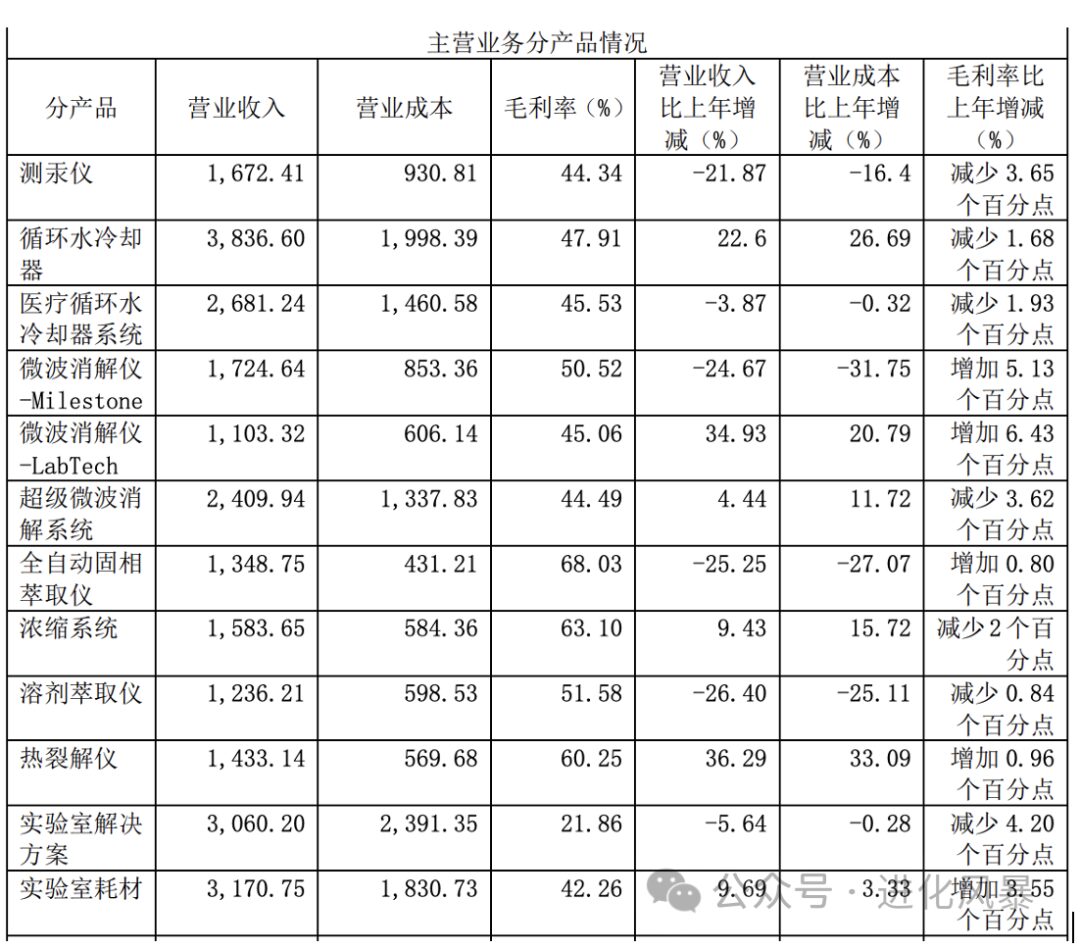

However, the scientific instrument industry is different. Taking Lab Tech as an example, the gross profit of its main instrument products generally maintains between

45% to 70%

, which is also the company’s main source of revenue.

|

Investment Tip: Pay attention to the differences in operational cash flow requirements

The core profit point of IVD companies is not in instruments; they focus more on the development of diagnostic reagents. The key to hardware development for IVD enterprises is to achieve a high degree of matching with reagents. The future profit of the company also comes from the development of reagents for different testing projects. Therefore, the instrument development of IVD enterprises follows principles such as rapid efficiency and cost priority, with over 20% gross profit meaning that the demand for instrument business from IVD companies is to cover costs or even allow losses. The company aims to minimize manufacturing costs as much as possible while complying with manufacturing compliance. Under this demand, CDMO companies, which focus on entrusted development, OEM production, and certification management, have a place.

The business foundation and driving force of scientific instrument companies is their continuous instrument development capability. Scientific instruments also have reagents and consumables, but unlike the IVD industry, the downstream application scenarios of scientific instruments are mainly research activities (aside from testing and inspection), and the usage frequency of reagents and consumables is generally not high, and it is often difficult to form continuous, bulk sales, generally belonging to additional income rather than the main source. Therefore, for investors, it is essential to focus on the competitiveness of the instruments themselves, as a cash-burning model may not necessarily build a core barrier in the scientific instrument industry. |

(5) Differences in Policy Environment and Regulatory Supervision

In vitro diagnostic instruments, as part of medical devices, must strictly follow the rigorous

regulatory approval

processes of various countries, which directly affect the product’s market launch timeline and commercialization process. At the same time,

health insurance policies

adjustments (such as inclusion in reimbursement catalogs), centralized procurement policy implementations, and other factors can significantly alter market demand structures and price levels.

Scientific instruments face relatively less direct medical regulatory pressure, but still need to meet certain quality and safety standards, such as CE certification, RoHS directives, etc. Moreover, in fields such as environmental protection, safety, testing, and biopharmaceuticals, government policies are more about

encouragement and promotion.

|

Investment Tip: Pay attention to the impact of policy opportunities and risks on the industry

Due to the relatively single customer type of IVD companies, and the downstream industry being primarily public welfare sectors, development is greatly influenced by policies. Centralized procurement, regulatory upgrades, and product approvals directly affect the commercialization process of the company’s products. In investing, risk control is more important than grasping opportunities.

Scientific instruments differ from IVD, as their downstream market is broad. Every industrial change brings different development opportunities, such as the heavy industry development that began in 2001, the environmental protection industry development that started in 2008, and the biopharmaceutical development after 2012. For instrument companies, whether they can layout products that meet industry needs in advance is a necessary factor for success. |

(6) Differences in Investment Stages and Exit Strategies

In the IVD industry,

the market size of 170 billion yuan

has around

70 listed companies

(mainly reagent companies).

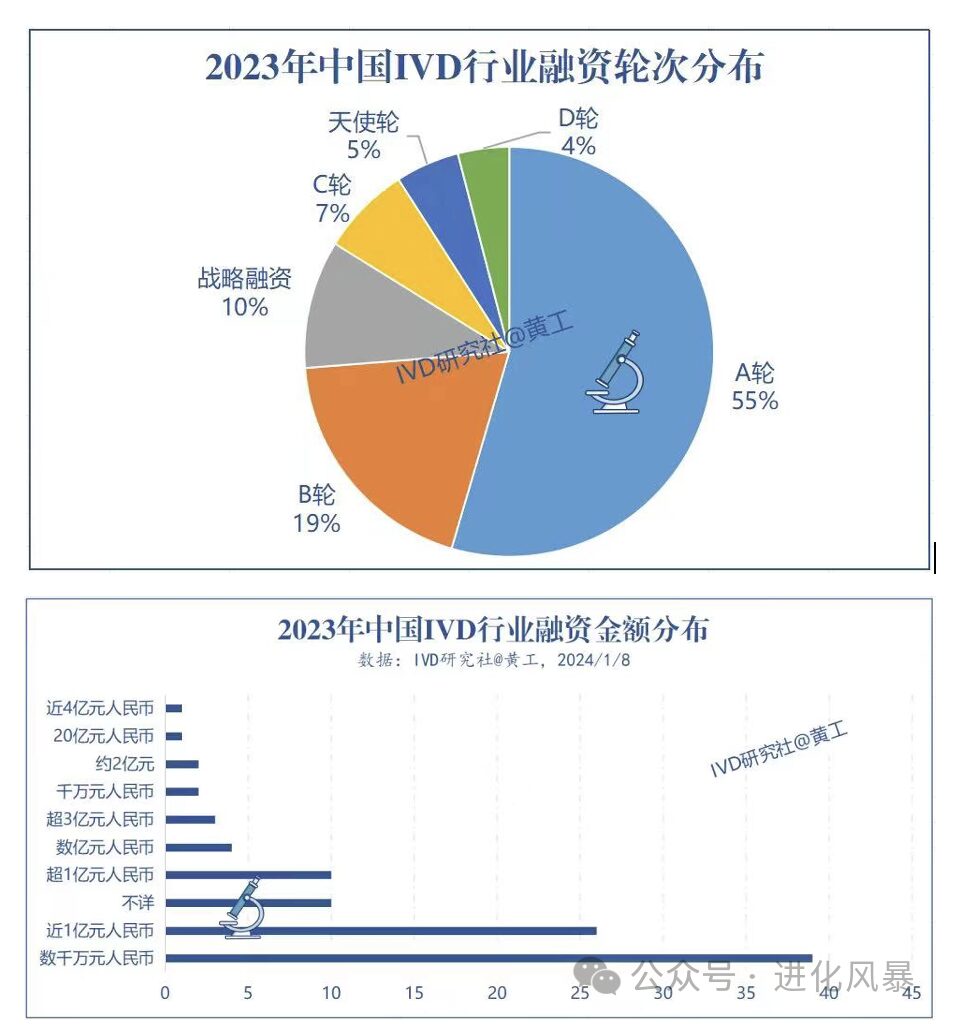

At the same time, first-level market investments are also very mature. According to incomplete statistics, there were 99 financing cases in the IVD industry in 2023, mainly in rounds A and B, with 55 in round A and 19 in round B, with financing amounts mostly between tens of millions to 100 million yuan.

In contrast, in the 700 billion market space

of the scientific instrument industry, the number of listed companies is

less than 20.

In the primary market, excluding IVD instruments, the financing of pure scientific instruments, whether in quantity, frequency, or amount, has a certain gap compared to the IVD industry. Some scientific instrument companies’ financing is also closely related to IVD instruments. This phenomenon reflects on the one hand that

existing investment thinking is still influenced by the IVD industry, and on the other hand, it indicates that the investment logic of the scientific instrument industry has not yet been recognized or formed a consensus among capital.

|

Investment Tip: Pay attention to the choice of investment stages and exit timing

We believe that investing in IVD instruments involves higher risks. Due to uncertainties in technology productization, certification time, commercialization processes, and regulatory policies, the failure probability of early projects is higher. Especially if a registration certificate is not obtained in time, the company may face a funding chain break due to a lack of other income items. However, once an IVD company’s investment successfully IPOs, the returns can be substantial.

|

For investments in scientific instruments, we believe that the risks of early projects are relatively controllable. The downstream scenarios of scientific instrument companies are diverse, and competition in many sub-tracks is insufficient. At the same time, instrument gross margins are high, customers are less sensitive to prices, and the company teams are more streamlined, making it easier for projects to survive. However, if a company lacks systematic management capability or continuous product expansion capability, it will also be difficult to grow. For early investors, it is recommended to adopt a staggered exit model for specialized single-product companies, while companies with expansion capabilities and excellent management capabilities can be held continuously after achieving breakeven.

03

—

Conclusion

IVD is an important path for scientific instruments to scale up, and scientific instruments are also learning objects for IVD companies to expand their product lines.

However, due to significant differences in products, customer groups, business models, and core competencies between the two,

the mutual pursuit process inevitably encounters challenges.

Due to the different core success factors, the logic for valuing enterprises also varies. Directly applying the investment logic of IVD to the scientific instrument industry often feels like

mixing apples and oranges.

We welcome more capital to pay attention to the scientific instrument industry. With the support of capital, the domestic scientific instrument industry will undoubtedly enter a period of rapid development. At the same time, we hope to contribute our modest efforts to help everyone view the industry more objectively, select targets more accurately, and avoid pitfalls.

Evolution Storm believes that there are three future investment models for scientific instrument companies:

(1) Emotion-driven investments based on national strategy

(2) Short-term investments based on acquisition exits

(3) Strategic investments based on long-term holding

Different investment goals suit different funding bodies and have different investment strategies and timing choices.

—The End—

If you like it, please like, view, and share!