1. Additive Manufacturing – Directly Addressing Pain Points of Traditional Manufacturing Processes

1. Overview of Additive Manufacturing

(1) Definition of Additive Manufacturing

Additive manufacturing, also known as “3D printing,” is a manufacturing method that creates three-dimensional physical entity models that are identical to corresponding digital models by layer-by-layer stacking of materials, which is completely opposite to traditional subtractive manufacturing techniques (removal, cutting, and assembly of raw materials). This method will profoundly impact traditional processes, production lines, factory models, and industrial chain combinations and is a representative disruptive technology in manufacturing. It integrates information network technology, advanced materials technology, and digital manufacturing technology, making it an important part of advanced manufacturing. The basic principle is: based on a computer 3D design model, through software layering and numerical control forming systems, the three-dimensional entity is transformed into several two-dimensional planes, and special materials such as powders and resins are layered and bonded using methods such as laser beams and thermal melting nozzles, ultimately forming solid products. Additive manufacturing simplifies the processing of complex component structures into simple two-dimensional plane processing, solving the difficulty of processing similar components.

(2) Historical Development of Additive Manufacturing

The industrialization of additive manufacturing began in 1986, with technological advancements leading to large-scale industrialization improvements. In 1986, American Hull invented the light curing technology (SLA) and established the world’s first 3D printing company, 3D Systems, marking the beginning of the industrialization of 3D printing technology. In 1995, the German Fraunhofer Institute for Laser Technology (ILT) introduced SLM technology, and laser technology began to be applied in additive manufacturing and gradually popularized, opening the phase of large-scale industrialization trials and applications of 3D printing. For China, the start was relatively late, with a shorter industrialization period for additive manufacturing. With the expiration of 3D printing patents in the US and Europe from 2009 to 2015, China’s additive manufacturing technology entered a rapid technological catch-up phase. Statistics show that from 2011 to 2016, the number of 3D printing patents in China surged from 5 in 2011 to 6564 in 2016. Since 2016, China has gradually transitioned from technical accumulation to commercial batch applications, entering a phase of rapid growth.

(3) Characteristics of Additive Manufacturing Technology

As an emerging manufacturing method, metal additive manufacturing has the following characteristics compared to traditional precision machining technology: shortening the research and development and realization cycles of new products. The 3D printing process is directly driven by the 3D model, eliminating the need for molds, fixtures, and other auxiliary tools, significantly reducing the product development cycle and saving expensive mold production costs while increasing the speed of product R&D iteration. It can efficiently form more complex structures. The principle of 3D printing is to slice complex three-dimensional geometries into two-dimensional cross-sectional shapes for layered manufacturing, thus achieving the formation of complex components that are difficult to realize with traditional precision machining, improving the yield of parts while enhancing product quality. It realizes integrated and lightweight design. The application of metal 3D printing technology optimizes the structure of complex components, transforming complex structures into simple structures while ensuring performance, thereby reducing weight. 3D printing technology can also achieve integrated forming of components, enhancing product reliability. The material utilization rate is relatively high. Compared to traditional precision machining technology, metal 3D printing technology can save a significant amount of material, especially for expensive metals, resulting in considerable cost savings. It achieves excellent mechanical properties. Based on the rapid solidification characteristics of 3D printing, the internal metallurgical quality of the formed parts is uniform and dense, without other metallurgical defects; at the same time, the rapid solidification characteristic leads to fine substructures within the material, allowing the formed parts to significantly increase strength without sacrificing plasticity.

The principles of metal 3D printing technology are mainly divided into two categories: powder bed fusion and directed energy deposition. Both types of metal 3D printing technologies can manufacture metal parts that meet forging standards. According to Wohlers’ statistics on 36 major global metal 3D printing companies, including Plural, in 2018, 18 companies adopted powder bed fusion technology, while 8 companies used directed energy deposition technology, accounting for a total of 72%. To achieve broader applications, both mainstream metal 3D printing technologies are striving to develop in the direction of high performance, high precision, high efficiency, low cost, larger size range, and wider material applicability.

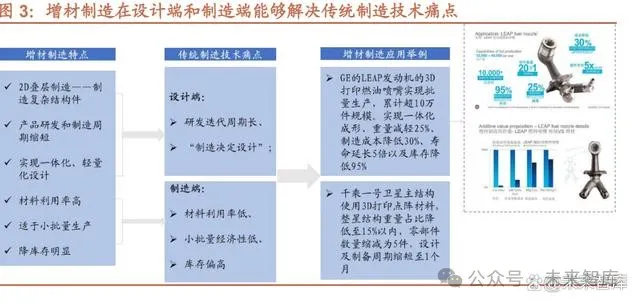

2. Additive Manufacturing’s Ability to Solve Pain Points of Traditional Manufacturing Technology from Both Design and Manufacturing Ends

Based on the five characteristics of additive manufacturing, it can address the following pain points in downstream applications of traditional precision manufacturing technology: ① Design end: long R&D iteration cycles and issues like “manufacturing determines design”; ② Manufacturing end: low material utilization rates, high costs of small batch production, and high inventory levels.

Design end: Additive manufacturing accelerates the realization and iteration of product design, enhancing design freedom, effectively combining with lightweight and integrated design methods such as topology optimization design. The advantages of additive manufacturing in the design end are prominent, making it easier to penetrate downstream industries and continuously enhance penetration rates. Its advantages mainly include: shortening product R&D and manufacturing cycles, helping product manufacturers rapidly realize the transformation from “drawings to physical products” at the design end. Compared to traditional precision machining technology, which requires a longer cycle to prepare molds and tools, additive manufacturing can quickly realize and iterate at the design end. Layered manufacturing of complex structural components from two-dimensional cross-sections provides greater freedom at the product design end, breaking through the traditional “manufacturing determines design” issue and achieving “design guides manufacturing.” Additive manufacturing can assist product manufacturers in overcoming the limitations of traditional precision machining technology in the manufacturing of complex structural components, providing greater freedom to the product design end; in addition, additive manufacturing technology can effectively combine with topology optimization design, lattice structure design, and integrated structural design, solving the issue of “manufacturing determines design” in structural optimization and achieving breakthroughs at the design end in product integration and lightweighting.

Manufacturing end: eliminating molds, reducing waste, and lowering inventory, with significant advantages in small batch production. The advantages of high material utilization rates, direct drive by 3D models, and short production cycles in additive manufacturing can achieve cost reduction and inventory reduction at the manufacturing end. Moreover, its marginal costs decrease relatively gently with the number of prints, presenting a threshold for economies of scale compared to traditional manufacturing methods, showing significant advantages in small batch production. Additive manufacturing boasts high material utilization rates. By using metal powders, resins, and various materials to manufacture products through layer-by-layer stacking, it achieves higher material utilization rates than traditional precision machining, even reaching over 95%. Additive manufacturing shortens production cycles, effectively reducing inventory levels. Since additive manufacturing does not require molds and tools, products can be printed using raw materials and equipment, significantly shortening production cycles; for example, GE Aviation reduced inventory by 95% after adopting additive manufacturing for fuel nozzles. The marginal cost of additive manufacturing decreases more slowly compared to traditional manufacturing methods as production scales up, meaning that it may lose its cost advantage after reaching a certain production scale, but it shows significant advantages in small batch production before that threshold. Additive manufacturing is highly flexible and possesses strong flexible production capabilities. It can switch flexibly according to different downstream demand areas, but requires a deep understanding of parameters such as equipment scanning speed, partition scanning, and laser power settings.

3. Additive Manufacturing Industry Chain

(1) Overview of the Industry Chain

The additive manufacturing industry chain mainly consists of upstream raw materials (metal and non-metal powders), hardware equipment (galvo systems, lasers, etc.), and auxiliary operations (scanners, software, etc.); midstream additive manufacturing equipment and product manufacturing services; and downstream demand sectors. Currently, it has covered fields such as aerospace, automotive, industrial machinery, and medical care.

① Upstream: Mainly composed of raw materials (metal powders and non-metal powders), core hardware (galvo, lasers, motherboards, etc.), and auxiliary operations such as software and scanners. Raw materials: Domestic metal powders account for nearly 40%, mainly titanium alloys, aluminum alloys, and stainless steel. Additive manufacturing raw materials are one of the important factors affecting the quality of additive manufacturing products and are the material basis for the development of additive manufacturing technology. Currently, additive manufacturing raw materials can be divided into metal materials and non-metal materials. According to data, in China’s entire additive manufacturing market, titanium alloys, aluminum alloys, and stainless steel account for 20.2%, 10.0%, and 9.1%, respectively, totaling 39.3%, with the remainder being non-metal materials, including nylon, PLA, ABS plastics, resins, etc.

Core hardware: The value of lasers and galvo systems is relatively high, with significant room for domestic substitution. According to the Polar Bear 3D Printing Network, the value of lasers generally accounts for over 20% of the total equipment cost; according to Plural’s prospectus, the galvo system averages about 6% of the cost of various models of equipment. With equipment upgrades, the number and quality of lasers and galvos installed in the same 3D printer will also increase, resulting in a higher value proportion. Currently, lasers and galvos in domestic equipment are mainly imported; according to Huashu High-Tech’s prospectus, the average import ratios of lasers and galvos from 2019 to 2022 were 81.72% and 99.29%, respectively, with the laser import ratio dropping to 69.90% in 2022, indicating that domestic substitution is underway.

② Midstream: Mainly consists of additive manufacturing equipment (metal printing equipment/non-metal printing equipment) and additive manufacturing services.

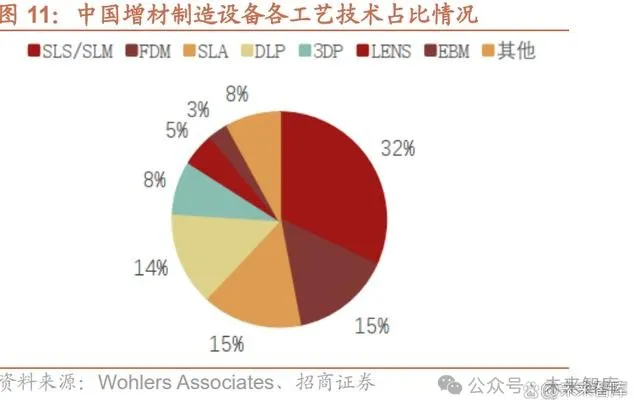

Additive manufacturing equipment: There are many additive manufacturing processes, with PBF processes such as SLM/SLS dominating. According to the international standard ISO/ASTM52900:2015 released by the ISO/TC261 Additive Manufacturing Technical Committee in 2015, 3D printing process principles can be divided into seven categories: powder bed fusion (PBF), directed energy deposition (DED), stereolithography, binder jetting, material extrusion, material jetting, and sheet lamination. Currently, printing equipment is mainly composed of SLS/SLM, FDM, SLA, and DLP, accounting for 32%, 15%, 15%, and 14%, respectively.

Additive manufacturing services: Manufacturing costs are the main expense, and there is a certain scale effect. According to Plural’s annual report and prospectus, from 2019 to 2022, the cost of customized 3D printed products has consistently maintained over 60% of total costs, but has shown a downward trend; direct labor costs have also shown a downward trend; direct material costs have been increasing, reaching 27.1% in 2022. Although the cost structure of customized additive manufacturing products depends on the complexity and size of the products themselves, the aforementioned trends in manufacturing costs, direct labor ratios, and direct material ratios can partially explain the existence of certain scale effects in additive manufacturing services.

③ Downstream: Domestic aerospace and other sectors are the main downstream areas, with significant potential for expansion and penetration. Additive manufacturing is currently widely applied in aerospace, automotive, medical, etc., and is gradually being tested in more fields. According to the Wohlers Report 2022, in 2021, additive manufacturing was mainly applied in aerospace, automotive, consumer and electronic products, medical and dental, and academic research. Compared to the global and Chinese downstream application fields, in 2022, the concentration of the top five downstream fields (industrial machinery, aerospace, automotive, consumer & electronics, medical & dental) in China’s additive manufacturing reached 78.90%, while the global concentration of the top five fields was 69.90%, indicating that there is still room for improvement in China’s downstream expansion and penetration rates.

(2) Midstream Equipment Segment Dominates the Industry Chain

Vertical analysis of the industry chain: The midstream additive manufacturing equipment occupies a dominant position in the industry chain, promoting the overall improvement of the industry chain. The additive manufacturing industry chain mainly includes raw materials and core hardware, additive manufacturing equipment, and additive manufacturing services. Among them, additive manufacturing equipment is in a critical position in the industry chain, ① connecting downstream demand, expanding downstream fields, and enhancing penetration rates: connecting downstream demand across various fields and developing equipment to provide additive manufacturing equipment that meets the needs of corresponding downstream fields, promoting the application of additive manufacturing technology in downstream fields and increasing penetration rates in single fields; ② paving the way for midstream additive manufacturing service business: as additive manufacturing equipment continues to expand downstream fields and enhance penetration rates, midstream additive manufacturing service businesses emerge, allowing companies to provide product manufacturing services to downstream by purchasing additive manufacturing equipment, continuously expanding market space; ③ forcing upstream raw material capacity expansion, improving efficiency, and reducing material costs: during the process of midstream equipment connecting downstream demand, the demand for upstream powders raises higher requirements for quantity and quality, forcing upstream raw materials to improve powder yield and material utilization rates, thus reducing material costs. Horizontal analysis of the industry chain: Domestic additive manufacturing equipment accounts for the highest proportion of output value. According to statistics from Wohlers Associates, in 2021, the global additive manufacturing output value (including products and services) was $15.244 billion, a year-on-year increase of 19.50%. Among them, the output value of additive manufacturing-related products (including sales and upgrades of additive manufacturing equipment, raw materials, specialized software, lasers, etc.) was $6.229 billion, a year-on-year increase of 17.50%, including equipment sales revenue of $3.174 billion; the output value of additive manufacturing-related services (including printing of additive manufacturing parts, maintenance of additive manufacturing equipment, technical services and personnel training, consulting services, etc.) was $9.015 billion, a year-on-year increase of 20.90%. In China, the output value of additive manufacturing equipment accounted for 44% in 2021, while the output value of additive manufacturing services accounted for 31%, and the output value of additive manufacturing materials accounted for 25%, with the equipment segment accounting for the highest proportion. Compared to the structure of additive manufacturing output value in China and globally, the current domestic focus is on midstream additive manufacturing equipment, while the global focus is on additive manufacturing services, reflecting that China is still in the stage of expanding downstream and rapidly penetrating the market.

2. Two Major Drivers Propel Market Space Expansion

1. Domestic Market Scale Expected to Exceed 60 Billion Yuan by 2025, Growth Rate Higher than Global Level

It is estimated that the global additive manufacturing market will reach $36.2 billion by 2026, with a CAGR of 19.0%. After years of development, the additive manufacturing industry has entered a phase of accelerated growth. In the past five years, the additive manufacturing industry has shown an overall growth trend globally. In 2020, the growth rate of the global additive manufacturing industry slowed down, but in 2021, the industry resumed rapid growth. According to the “Wohlers Report 2024,” the global additive manufacturing market size (including products and services) reached $20.035 billion in 2023, a year-on-year increase of 11.1%. According to the “Wohlers Report 2023” forecast, by 2026, the revenue scale of additive manufacturing will more than double compared to 2022, reaching $36.2 billion, and by 2032, the revenue scale will grow 5.7 times compared to 2022, reaching $102.7 billion. It is expected that the domestic additive manufacturing market will reach 60 billion yuan by 2025, with a growth rate higher than the global level. According to the Forward Industry Research Institute, as the application of additive manufacturing deepens and becomes more widespread in various industries, the market for additive manufacturing will maintain rapid growth in the coming years, with the market scale expected to exceed 63 billion yuan by 2025, with a compound annual growth rate of over 20% from 2021 to 2025.

2. Driver One: Transition from Prototype Manufacturing to Batch Production, Additive Manufacturing’s Penetration Rate in Single Fields Expected to Increase

With cost reductions and efficiency improvements, additive manufacturing is entering a transformation period towards batch production. According to the aforementioned characteristics of additive manufacturing, its economies of scale compared to traditional manufacturing methods present a threshold. Under unchanged technical conditions, as production scales increase, the marginal cost of additive manufacturing decreases relatively slowly compared to traditional manufacturing methods. While it is widely recognized that the economies of scale of additive manufacturing are relatively limited compared to traditional manufacturing methods, additive manufacturing is currently 1) reducing unit fixed costs by lowering equipment prices and increasing the number of lasers per machine; and 2) lowering unit variable costs by reducing powder material costs and adding powder recycling systems. These two aspects combined push the economy of scale curve of additive manufacturing downward, continuously increasing the maximum production scale threshold, thus promoting additive manufacturing to break through the limitations of prototype manufacturing and enter the batch production era of “Additive Manufacturing 2.0.” According to the “Wohlers Report 2023,” in 2022, the direct manufacturing output value of parts was $2.68 billion, a year-on-year increase of 22.1%, with growth rates exceeding 20% for nearly six years.

Aerospace, medical and dental, and model manufacturing sectors have already begun to apply batch production, with increasing penetration rates in single fields becoming a focus of attention. According to iResearch, in 2021, the domestic industrial-grade additive manufacturing (accounting for 65%-70% of the overall application fields) mainly concentrated in aerospace, model manufacturing, automotive manufacturing, and biomedical sectors, accounting for 93% in total, with metal additive manufacturing as the main focus, where aerospace accounts for 58%, making it the primary field for domestic additive manufacturing applications.

(1) Aerospace & Defense Sector: The Foundation for Technological Iteration and Scale Expansion

The aerospace sector is one of the most successful industries for the demand realization of additive manufacturing. With continuous iteration of product models and breakthroughs in technology, the aerospace sector has demands for lightweight, integrated, shortened R&D cycles, and the integrated formation of complex structures, all of which perfectly align with the characteristics of additive manufacturing mentioned earlier. Meanwhile, the aerospace sector is more sensitive to the functionality of parts compared to other industries, with lower price sensitivity, laying the foundation for the priority landing of additive manufacturing. According to the “Wohlers Report 2022,” the application of additive manufacturing technology in the aerospace industry has been increasing year by year, making it the most widely applied industry. In 2021, the global aerospace additive manufacturing scale reached $2.561 billion, but its proportion relative to the overall aerospace industry is still small, indicating significant growth potential with the continued promotion and application of metal 3D printing technology.

The aerospace sector has become the cornerstone for the iteration and scale expansion of additive manufacturing technology. Currently, additive manufacturing is mainly applied in the design and manufacturing of precision components for aircraft, engines, missiles, rockets, satellites, etc., with a gradually expanding range and variety of application parts, showing an upward trend in penetration rates. Meanwhile, in the process of expanding applications in the aerospace sector, downstream customers continuously propose new demands for high reliability, large-scale, lightweight, complex component manufacturing, as well as cost reduction and efficiency improvement, which in turn drives additive manufacturing to conduct technical iteration and upgrades, addressing issues such as multi-laser consistency, joint stability, and high costs, promoting the upgrade of equipment and reduction of material costs, thus catering to downstream demands and driving the expansion of additive manufacturing’s output value in this field.

(2) Automotive Manufacturing: Transitioning from Design to Batch Production, Opening New Markets in Mold Manufacturing

1) Prototype Manufacturing

Rapid prototyping, lightweighting, and other key characteristics have facilitated the smooth entry of additive manufacturing into the automotive industry. 1) Automotive companies are shortening their R&D cycles: In the era of the “new four modernizations” in the automotive industry, to meet consumer demands for rapid product iteration, automotive companies are launching new models at an increasingly fast pace. Especially in the current accelerated “involution” of the automotive market, the speed at which automotive companies launch products significantly affects sales performance. According to First Financial News, a traditional automotive company’s development project cycle is generally around two years, while for Japanese companies, it can even take four to five years. To seize market opportunities, Chinese automotive companies generally require suppliers to meet development cycle requirements of around nine months. 2) The trend of automotive lightweighting is significant: As carbon emission standards become increasingly strict, automotive lightweighting has become a common goal for the global automotive industry. According to research by the European Automobile Manufacturers Association, for every 100 kg reduction in vehicle weight, fuel consumption can decrease by 0.4L per 100 km, and carbon emissions can be reduced by about 1 kg. For electric vehicles, every 10% weight reduction can improve the range by 5-6%. The shortening of R&D cycles in automotive manufacturing and the demand for lightweighting closely align with the advantages of additive manufacturing. Additive manufacturing achieves rapid prototyping capabilities by removing cumbersome mold-making processes through the direct application of 3D models; it can also achieve lightweighting through design optimization methods such as topology optimization. By better addressing the pain points and demands of automotive companies from the design end, additive manufacturing has successfully entered the automotive industry. For example, Ford has established a rapid technology center in Germany to leverage various 3D printing technologies for quick prototype manufacturing. Engineers and designers can obtain design results in just a few hours, whereas traditional methods would require several weeks.

2) Batch Production of Components

Limitations are gradually being overcome, and batch production of automotive components through additive manufacturing is expected to expand from high-end models to lower-end models. Observing the current relative batch application cases of additive manufacturing in the automotive industry, most are concentrated in high-end models with lower price sensitivity and small batch production, such as the 3D printed brake calipers for the BMW M850i Night Sky Special Edition and 3D printed parts for BMW’s most powerful six-cylinder engine S58. As the economies of scale curve of additive manufacturing continues to shift downwards, its limitations in small batch production are expected to gradually break through, and batch production will increasingly expand from high-end models to lower-end models. Currently, public information shows that both domestic and foreign automotive companies have made significant layouts in additive manufacturing, with BMW’s “Additive Manufacturing Industrialization and Digitization” (IDAM) project establishing two production lines capable of achieving an annual output of 50,000 parts, operating simultaneously with minimal human intervention.

According to the 3DPBM automotive industry additive manufacturing white paper, the market space for additive manufacturing of automotive components is expected to reach $20.35 billion by 2030. According to a 2021 white paper released by 3DPBM on the automotive industry, the revenue from additive manufacturing for automotive component production was $2.678 billion in 2020, and it is expected to reach $12.974 billion by 2026, with $20.35 billion by 2030 (25% of which is related to electric vehicle components). Additionally, the main applications of additive manufacturing in automotive components are segmented into four parts: body, electronic accessories, interior, and power components, with the application space for power components expected to reach $7 billion by 2030, the highest proportion in the overall market.

3) Mold Manufacturing

Furthermore, as the application of additive manufacturing in the automotive sector advances, mold manufacturing may open up new markets. The design process for traditional metal molds is extremely costly. According to 3D printing technology references, once a large metal test mold is made, adjustments during the design process can cost around $100,000, or completely remaking the mold could cost $1.5 million. Another source indicates that the entire design process for large metal molds typically costs around $4 million. 3D printed sand molds aid in integrated die-casting to reduce costs and enhance efficiency. In September 2023, according to Reuters, Tesla (TSLA.O) achieved a technological breakthrough by combining a series of innovative technologies, allowing it to cast almost all complex components of electric vehicles as a single piece rather than casting approximately 400 parts. This technology will halve Tesla’s production costs or change the traditional manufacturing methods for electric vehicles. To this end, Tesla uses 3D printers to create test molds made of industrial sand. Through binder jetting technology, the printing equipment deposits liquid binder onto thin layers of sand, constructing molds that can be used for die-casting molten alloys layer by layer. According to the Polar Bear 3D Printing Network, the cost of the design verification process for sand casting (even with multiple versions) is also the lowest – only 3% of the cost of metal prototypes; the design verification cycle takes only two to three months, while metal mold prototypes require six months to a year. This means that Tesla can adjust prototypes multiple times as needed, using machines from Desktop Metal (DM.N) and its subsidiary ExOne, German company Voxeljet, and several domestic companies to reprint a new prototype in just hours. According to the Shanghai Securities Journal on September 27, 2023, the rear floor assembly system of the Tesla Model Y produced at Tesla’s super factory in Shanghai Pudong has successfully adopted integrated die-casting technology for rapid casting. Compared to traditional methods, the body system saves over 10% in weight. Moreover, there are significant cost advantages due to optimized structural design and material recycling results, with the overall cost of the rear floor assembly system reduced by 40% after adopting the integrated die-casting method.

(3) Medical & Dental Sector: Personalized Demand Leads to Batch Applications

Personalized demand leads to the batch application of additive manufacturing. Given the individual differences in human bodies, traditional manufacturing of medical devices often results in standardized styles or sizes. Additive manufacturing, with its capability for personalized customization, is gradually being applied in the medical field, mainly for manufacturing medical models, surgical guides, surgical/oral implants, rehabilitation devices (mainly using materials such as plastics, resins, metals, and polymer composites), and bioprinting human tissues and organs. The application of additive manufacturing technology in dentistry has gradually matured, being used for printing dentures, making orthodontic devices, creating preoperative models, and producing surgical guides, helping to improve precision and efficiency while reducing surgical risks. The application of additive manufacturing technology in orthopedic implants has also developed rapidly, with metal additive manufacturing techniques now being used to produce total knee implants, acetabular cups, and spinal implants, which benefit from the layered structure that mimics human bones, promoting better integration with human tissues through porous designs, and providing greater design freedom for implants.

As future economic levels and precision medical requirements continue to rise, the development of additive manufacturing technology in the medical industry will have enormous potential. According to a report published by Acumen Research and Consulting, the global medical 3D printing application market size was $2.8 billion in 2022, and it is expected to reach $11 billion by 2032, with a compound annual growth rate of 16.6%.

3. Driver Two: Disruption of Manufacturing Methods Across Industries, Continuous Expansion of Downstream Application Fields

(1) Consumer Electronics Sector: Titanium Alloy Additive Manufacturing Leads to Transformation, Expected to Open Industry Ceiling

Leading companies like Honor and Apple have begun to use 3D printed titanium alloy components on a large scale in the consumer electronics sector for the first time.

According to a video released by Honor CEO Zhao Ming titled “Ming Ge Answers Netizens’ Questions,” the axle cover of the “Luban titanium alloy hinge” used in the Huawei Honor Magic V2 is the first to adopt 3D printing technology. The axle cover is critical in affecting the thickness of the folding screen, and titanium alloy technology allows the axle cover to become lighter and thinner, with a strength increase of 150% compared to aluminum alloy materials, and a 27% reduction in hinge width, making it more ductile and corrosion-resistant, thereby reducing the overall thickness and weight of the folding screen. On October 12, 2023, Honor officially launched the Honor Magic Vs2, which also features the Honor Luban titanium alloy hinge made using 3D printing technology.

Titanium alloys are difficult to process, and additive manufacturing offers a high material utilization advantage. Titanium alloys have characteristics such as low elastic modulus, large elastic deformation, high cutting temperatures, low thermal conductivity, and high chemical reactivity at high temperatures, making them more challenging to process than aluminum alloys, leading to issues like work hardening and tool wear during traditional machining, resulting in lower efficiency and material utilization. However, additive manufacturing of titanium alloys allows for higher material utilization and has gradually revealed processing advantages with recent improvements in equipment efficiency and cost reductions.

(2) Humanoid Robots: Lightweight Demand and Complex Structures, Additive Manufacturing Brings Efficiency Improvements

Humanoid robots are currently in a rapid iteration phase of development, and additive manufacturing offers significant advantages in shortening R&D cycles, rapid prototyping capabilities, and lightweighting, enabling entry at the R&D and small batch stages.

Humanoid robots have complex structures and lightweight demands, posing higher requirements for manufacturing methods. 1) The demand for shortened R&D cycles: Currently, humanoid robots are in the early stages of industrial development, requiring constant iteration and adjustments based on future application scenarios at the design end. In the early stages of industrial development, a company that can quickly launch stable products that meet downstream demands and can be mass-produced will quickly gain a market advantage. Therefore, humanoid robots have high demands for shortening R&D cycles and rapid prototyping capabilities. 2) Lightweight demand: To achieve human-like flexibility, humanoid robots require higher demands for structural and manufacturing lightweighting. 3) Complex structure manufacturing demand: The internal and external structures of humanoid robots are complex, and traditional manufacturing methods would create significant supply chain management pressures, raising higher demands for integrated manufacturing of complex structural components.

The rapid prototyping capabilities and unique advantages of additive manufacturing in lightweighting and complex structure manufacturing determine its advantages in humanoid robots. According to 3D printing technology references, Boston Dynamics’ Atlas humanoid robot uses 3D printing technology to help reduce weight, improve space utilization, and enhance efficiency, optimizing as follows: 1) 3D printing customized non-standard components (such as servo valves); 2) 3D printing optimized structural designs to reduce the inertia of robot limbs; 3) 3D printing hydraulic power units (HPUs) for higher efficiency.

(3) Nuclear Energy Sector: Directly Addressing Demand Pain Points, Expected to Open a Broad Market

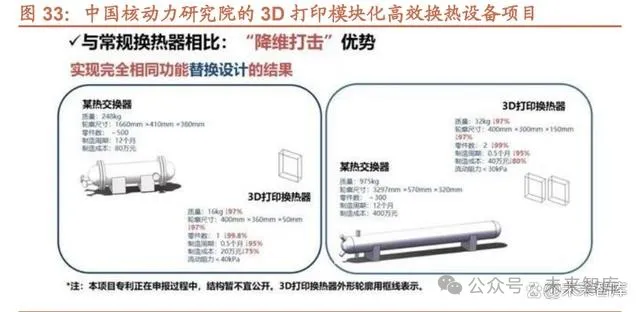

Nuclear energy equipment with complex components perfectly adapts to additive manufacturing processes, achieving high-efficiency production and replacement. With the rapid development of China’s nuclear power industry, the design of certain nuclear energy equipment has become increasingly precise and complex. If traditional manufacturing methods are used, there can be long production cycles, complex manufacturing processes, and lengthy industrial chains. However, additive manufacturing can achieve integrated and rapid forming, significantly reducing the weight and volume of components and enabling the production of complex precision components. Additive manufacturing can leverage significant manufacturing and design advantages. According to He Genning, director of the China Nuclear Power Research Institute, in his keynote speech titled “Additive Manufacturing Empowerment, Nuclear Innovation Co-Progress,” the 3D printing modular high-efficiency heat exchange equipment project selected melting technology, with the printed heat exchange equipment reducing weight, volume, the number of components, and manufacturing cycles by over 90%. Due to the reduction in weight and volume, manufacturing costs decreased by over 50%.

Domestic and foreign research and applications are gradually increasing, and the energy market is expected to open up. Foreign giants in nuclear power such as Oak Ridge National Laboratory, Westinghouse Electric Company, and Framatome are actively researching additive manufacturing technology, while domestic companies such as China National Nuclear Corporation’s North Nuclear Fuel Component Co., Ltd. and China Nuclear Power Research and Design Institute are also committed to applying this technology in the nuclear industry. As domestic and foreign research and application explorations gradually increase, the penetration of additive manufacturing in the energy sector is expected to continue to rise, becoming the next potential breakout point.

(4) Mold Sector: 3D Printing Fitting Water Channels to Industry Needs, Rapid Development of Commercialization in Shoe Molds

Additive manufacturing fitting water channel designs to industry needs has led to rapid commercialization in the shoe mold sector. Fitting water channels, also known as conformal cooling channels, are a new type of mold cooling channel based on 3D printing technology. Due to their processing characteristics, fitting water channels can closely match product shapes, and the cross-section of the channels can be made in any shape other than circular. During injection molding, the cooling of plastic products mainly relies on the cooling channels of the molds, while traditional cooling channels are manufactured through machining processes such as milling, which have limitations in shape and are farther from the surface of the mold cores, resulting in low cooling efficiency, long injection cycles, uneven cooling, significant deformation, and low yield rates. In contrast, additive manufacturing fitting water channels can arrange the channels evenly according to the shape of the parts, increasing the density of the channels in heat accumulation areas, thereby balancing cavity temperatures, improving product yield, effectively reducing cooling cycles, and enhancing production efficiency. According to Yisu 3D printing, compared to traditional water channels, fitting water channels can reduce cooling times by 20% to 80% and decrease deformation by 15% to 90%; although the mold costs slightly increase, the overall efficiency significantly improves due to enhanced injection capacity and yield rates. Currently, fitting water channels mainly use selective laser melting (SLM) 3D printing technology and diffusion welding technology for processing. Since SLM 3D printing technology can create more complex and smoother channel shapes at lower costs, it is more widely applied in fitting water channels.

The shoe mold sector is progressing rapidly, with multiple companies collaborating with leading additive manufacturing equipment manufacturers. As one of the traditional processing industries, shoe mold manufacturing includes a complete process of design, wooden mold production, casting, mold making, engraving, sandblasting, electroplating/spray iron fluorine protective treatment, etc. The entire processing process is very complex, time-consuming, and costly, requiring substantial labor and meeting strict environmental protection requirements. The application of additive manufacturing in shoe companies significantly simplifies the production process of shoe molds, greatly enhances production efficiency, and accelerates product update speed. SLM technology allows for direct metal 3D printing, eliminating the need for wooden molds, casting, and engraving processes, achieving faster product delivery, more three-dimensional pattern presentation effects, and a more environmentally friendly manufacturing approach. Metal 3D printing has become a focal point for many shoe mold manufacturers, who are actively engaging in understanding, testing, and promoting its application, undoubtedly sparking a revolution and innovation in the shoe mold industry. According to Hanbang Technology, if the HBD-350T equipment is used for 39 hours of printing, the comprehensive printing cost has reduced to about 1500 yuan/kg (in the case of self-use equipment), and the entire set of molds can be delivered within 5 to 7 days, showing a significant improvement in efficiency compared to traditional processing methods, enabling the production of more complex shoe molds with anti-counterfeiting patterns and advantages in precision casting and CNC on-site management, saving labor.

Collaboration Case: In June 2022, Zhongke Fengyang (Fujian) Technology Co., Ltd. reached a cooperation agreement with Plural. Zhongke Fengyang, as a technology-oriented shoe mold production enterprise in Quanzhou, known as the “Shoe Capital” (one of the largest shoe production, processing, and trade bases in China), will introduce metal 3D printing technology and high-end equipment through Plural, combining it with independently developed technology for widespread application in the manufacturing of various professional sports shoe molds. On July 21, 2023, Xi’an Plural Additive Technology Co., Ltd. signed a strategic cooperation agreement with Yongjing Group. This signing demonstrates both parties’ confidence in establishing a long-term, stable, and in-depth strategic partnership, leveraging each other’s strengths to collaborate sincerely in mold design optimization, process iteration, material research and development, and new application development.

3. Competitive Landscape: Leading Players Begin to Emerge

A coexistence of full industry chain layout and specialization. As previously mentioned, from an industry chain perspective, the additive manufacturing industry’s subfields mainly include additive manufacturing materials, additive manufacturing equipment, and additive manufacturing services. Currently, there are mainly two types of layout situations in the domestic industry chain: 1) Full industry chain layout: represented by Plural, whose business extends from additive manufacturing equipment to upstream powder materials and printing services, continuously integrating the layout of core components such as software and galvos; 2) Specialized layout: represented by Huashu High-Tech, Youyan Powder Materials, Fei’er Kang, and AVIC Mite, which specialize in certain segments but show trends toward expanding upstream and downstream, such as Huashu High-Tech and AVIC Mite.

Major participants in each segment remain relatively stable, with leading players beginning to emerge. Analyzing each segment of the additive manufacturing industry chain, the domestic additive manufacturing industry is in the early stages of application expansion and rapid growth, characterized as a competitive incremental market. Although there have been some new entrants in each segment, the major participants remain relatively stable, and leading players, leveraging long-term technological accumulation and iterative feedback from downstream, have begun to show initial competitive advantages.

1. Major Participants in the Raw Materials Segment

Raw materials: Major players are racing to expand production and layout additive manufacturing powders. Currently, the additive manufacturing materials segment mainly consists of titanium alloys, high-temperature alloys, mold steels, and aluminum alloys. Major participants include Plural, Youyan Powder Materials, AVIC Mite, Weilai Li, Xi’an Sailong, and Zhongyuan New Materials, among others. According to statistics, the major participants in the raw materials segment all have expansion plans, aiming to capture the additive manufacturing powder market. According to incomplete statistics, the total expansion plans will increase the production capacity of additive manufacturing powders (regardless of powder type) to over 18,000 tons.

2. Major Participants in the Equipment Segment

Additive manufacturing equipment: Leading players begin to emerge. Currently, major participants in the domestic additive manufacturing equipment segment include Plural, Huashu High-Tech, Yijia 3D, and Hanbang Technology. Among them, Plural, with its full industry chain layout, has stronger control over the entire industry chain, enabling it to provide customers with a complete solution for metal additive manufacturing and remanufacturing technology, rapidly expanding its market share and becoming the current leader in the equipment segment. Additionally, Huashu High-Tech, as a provider of SLS and SLM equipment, has an international strategic direction and layout, with rapidly growing domestic and international equipment sales, becoming one of the leading companies in industrial-grade additive manufacturing equipment in China.

Leading players are continuously pushing additive manufacturing into new application fields and actively entering international markets. As previously mentioned, additive manufacturing equipment occupies a dominant position in the industry chain, promoting the overall improvement of the industry chain and expanding application fields and markets. After years of technological accumulation and industry chain layout, leading players like Plural and Huashu High-Tech have begun to exhibit core competitiveness, with larger size and more laser additive manufacturing equipment being successively released. Leading players are enhancing efficiency and reducing costs through multi-laser and large-format approaches, driving additive manufacturing towards new application fields such as 3C electronics, shoe molds, and automotive manufacturing. Furthermore, companies like Plural, Huashu High-Tech, and Hanbang Technology are also making certain layouts in international markets by establishing subsidiaries abroad to open international markets and compete with international competitors.

3. Major Participants in the Additive Manufacturing Services Segment

Additive manufacturing services: The domestic stock of industrial-grade metal 3D printers exceeds 3,500 units, with Plural becoming the leading provider of industrial-grade additive manufacturing services. Currently, major participants providing additive manufacturing services in China include Plural, Fei’er Kang, Xin Jinghe, Steel Research Aurora, Chenglian Technology (dentures printing cloud factory), and various military research institutes. According to statistics and estimates from the Polar Bear 3D Printing Network, the number of metal 3D printers used for processing services in China exceeds 3,500 units, with Plural leading the way with approximately 380 units and nearly 1,400 laser heads, becoming the leading provider of metal additive manufacturing services for aerospace, 3C electronics, shoe molds, and other fields.

4. Core Targets in the Industry Chain

1. Plural – Leading Company Covering the Full Additive Manufacturing Industry Chain

Plural is a high-tech enterprise focused on industrial-grade metal additive manufacturing, providing customers with a complete solution for metal additive manufacturing and remanufacturing technology. Its business encompasses the research and development and production of metal additive manufacturing equipment, customized products for metal additive manufacturing, research and development and production of metal additive manufacturing raw materials, and structural optimization design and process technology services for metal additive manufacturing, forming a relatively complete industrial ecosystem for metal additive manufacturing, leading the industry both domestically and internationally. From 2016 to 2023, the company’s revenue increased from 166 million to 1.232 billion, with a compound growth rate of 33.2%; net profit attributable to the parent company increased from 31.32 million to 141.59 million, with a compound growth rate of 24.05%. In 2023, the company’s revenue was 1.232 billion (year-on-year +34.24%), with a net profit of 141.59 million (year-on-year +78.11%). In Q1 2024, the company’s revenue was 206 million (year-on-year +54.72%), achieving a net profit of 1.3435 million (year-on-year +104.72%). The company launched a restricted stock incentive plan in October 2020, excluding the impact of share payments, the net profit attributable to the parent company has steadily increased year by year, with the net profit attributable to the parent company excluding share payments increasing from 120 million to 220 million from 2021 to 2023, with a compound growth rate of 35.4%.

The full industry chain layout gives Plural a powerful advantage, accelerating the industry’s maturity and opening up production capacity bottlenecks. As a leading company with a full industry chain layout in China, Plural’s business extends from additive manufacturing equipment to upstream powder materials and printing services, continuously integrating the layout of core software and galvos. The full industry chain layout allows Plural to respond to downstream demands quickly and efficiently, opening up new application fields and providing comprehensive solutions, acting as a “main promoter” to accelerate industry maturity and downstream expansion, and strengthening customer stickiness with excellent solutions, benefiting all segments during the industry’s maturation process. On December 27, 2023, the company released the “2022 Annual Report on the Issuance of A Shares to Specific Objects,” raising a total of 3.029 billion yuan by issuing 32,048,100 shares to specific objects for the construction of a large-scale intelligent production base for metal additive manufacturing and to supplement working capital. In response to the company’s needs for the industrial development of metal additive manufacturing, it plans to invest approximately 2.509 billion yuan to build high-quality production lines for metal 3D printing raw materials and high-efficiency and high-precision customized metal 3D printing product production lines on the land it plans to purchase, covering a total construction area of approximately 163,200 square meters. The project will include a total of 505 sets of automated production lines for metal 3D printing powders, product inspection and testing equipment, large-size/super-large-size 3D printing equipment, and post-processing equipment. This expansion will significantly enhance the company’s capacity for customized metal additive manufacturing products and raw material powders, meeting the rapidly growing demand for additive manufacturing in aerospace, medical, and automotive applications, while also satisfying the demand for metal additive manufacturing powders in both the company and the industry.

2. Huashu High-Tech – Dual Layout of SLS+SLM, Committed to Internationalization Strategy

Huashu High-Tech specializes in the R&D, production, and sales of industrial-grade additive manufacturing equipment, dedicated to providing global customers with metal (SLM) and polymer (SLS) additive manufacturing equipment, as well as 3D printing materials, processes, and services. The company’s core products are metal 3D printing equipment and polymer 3D printing equipment with independent intellectual property rights and core application technologies. It also provides customers with self-developed 3D printing polymer powder materials. The company has a complete intellectual property system corresponding to its products and services, having independently developed a full set of software source codes for data processing systems and control systems for additive manufacturing equipment, making it the only company in China to achieve industrialized mass production and sales of SLM and SLS equipment with all independently developed industrial software and control systems. From 2019 to 2023, the company’s revenue increased from 155 million to 606 million, with a compound growth rate of 40.62%; net profit attributable to the parent company increased from 17.95 million to 131 million, with a compound growth rate of 64.41%. In 2023, the company’s revenue was 606 million (year-on-year +32.74%), with a net profit of 131 million (year-on-year +32.26%). In Q1 2024, the company’s revenue was 124 million, a year-on-year increase of 23.49%, achieving a net profit of 26 million, a year-on-year increase of 28.44%.

As a pioneer in internationalization, the company established subsidiaries in the US and Europe in 2017 and 2018, respectively, and has developed local agents or distributors in the Asia-Pacific region to achieve early internationalization layout. It has also equipped experienced after-sales engineers in key strategic areas, creating a “localized and specialized” global after-sales service network to respond to customer demands as quickly as possible. In the first half of 2023, Huashu High-Tech’s US and European subsidiaries generated revenues of 22.6472 million yuan and 31.2809 million yuan, respectively, with the European subsidiary achieving a net profit of 5.7632 million yuan. From November 7 to 10, 2023, the company showcased its dual-laser Flight SS403P-2 fiber laser equipment and FS621M metal additive manufacturing equipment at the Formnext exhibition in Frankfurt, Germany. These two devices have been ordered by European users. This exhibition marked the first time the largest size powder bed technology metal additive manufacturing equipment was displayed on-site, representing an important step in Huashu High-Tech’s internationalization strategy and overseas market layout. According to 3D printing technology references, the Fraunhofer Institute for Material and Beam Technology (Fraunhofer IWS) will recently install a “unique” industrial-grade large-size metal 3D printing device. This equipment, sourced from Huashu High-Tech, is a powder bed technology-based metal laser melting device capable of printing aluminum alloys, titanium alloys, nickel-based high-temperature alloys, stainless steels, copper alloys, and other metal powder materials, producing complex structural solid components. Professor Christoph Leyens, director of Fraunhofer IWS, emphasized, “The introduction of large-size additive manufacturing technology will inject a powerful driving force into the SpreeTec neXt project and the industrial transformation in the region of Sattia, helping SMEs in Eastern Germany develop unique advantages and high value-added industrial products.”

3. Youyan Powder Materials – Layout in 3D Printing Powder Materials, Expected to Bring Rapid Growth

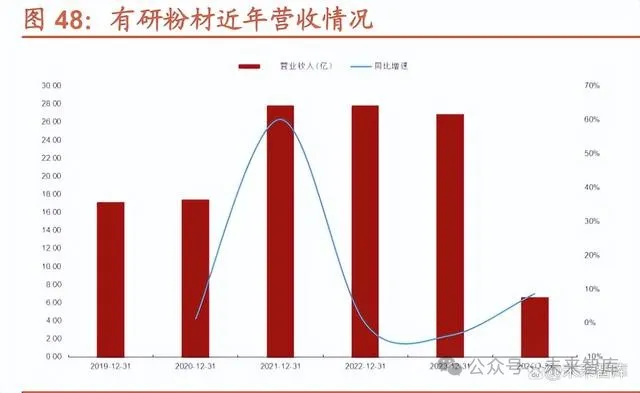

Youyan Powder Materials has focused on the design, R&D, production, and sales of advanced non-ferrous metal powder materials since its establishment. Its main products include copper-based metal powder materials, microelectronic tin-based solder powder materials, and 3D printing powder materials, making it a leading enterprise in the domestic copper-based metal powder materials and tin-based solder powder materials sector, and one of the internationally leading producers of advanced non-ferrous metal powder materials. From 2019 to 2023, the company’s revenue increased from 1.712 billion to 2.681 billion, with a compound growth rate of 11.87%; net profit attributable to the parent company decreased from 60.192 million to 55.119 million, with a compound growth rate of -2.18%. In 2023, the company reported revenue of 2.681 billion (-3.58%), with a net profit of 55.119 million (-0.59%). In Q1 2024, the company achieved revenue of 661 million, a year-on-year increase of 8.76%, with a net profit of 9.7789 million (year-on-year -8.44%). The company has established Youyan Additive as a subsidiary, planning a 500-ton/year additive project. In December 2021, the company, together with its wholly-owned subsidiary Beijing Kangpu Xiwai and Steel Research Investment, jointly established Youyan Additive Technology Co., Ltd., holding a total of 80% (including 20% from Kangpu Xiwai) and Steel Research Investment holding 20%. The designed capacity is 2500 tons/year, with 500 tons/year for additive manufacturing. Youyan Powder Materials will focus on developing and producing additive manufacturing metal powder materials, as well as high-temperature specialty powder materials such as soft magnetic powders and injection molding (MIM) powders, with a total designed capacity of 2,500 tons/year, including a designed capacity of 500 tons/year for additive manufacturing metal powder materials and 2000 tons/year for high-temperature powder materials. From 2019 to 2023, the company’s overall gross margin decreased from 11.20% to 8.31%. Copper-based metal powder materials and microelectronic tin-based solder powder materials have become the company’s two core main businesses, with their combined revenue accounting for 99.6% of the company’s main business revenue in 2023. Among them, the revenue share of copper-based metal powder materials decreased from 72.0% to 55%, still being the company’s largest business; the revenue share of microelectronic tin-based solder powder materials increased from 18.4% to 30%; and the revenue share of 3D printing powder materials rose from 0.1% to 1.14%.

4. Super Excellent Aerospace Technology – Layout in Cold Spray Additive Remanufacturing Technology, Targeting Aerospace Maintenance Aftermarket

Since its establishment, Super Excellent Aerospace Technology has focused on the maintenance of airborne equipment, mainly engaging in the maintenance of pneumatic, hydraulic, fuel, and electrical accessories for military and civilian aircraft. Through years of R&D innovation, the company has achieved high-strength deposition of various metal materials by customizing production lines, establishing a raw material supply chain and quality testing system, formulating and modifying metal powders, and researching the compatibility of substrate materials with cold spray parameters, establishing its cold spray additive manufacturing technology system, and successfully applying this technology in the field of structural remanufacturing. The company is one of the few enterprises in China that has mastered cold spray additive manufacturing technology and applied it in the aerospace maintenance remanufacturing sector. From 2019 to 2023, the company’s revenue increased from 51 million to 270 million, with a compound growth rate of 51.69%; net profit attributable to the parent company decreased from 10.7128 million to -35.0016 million. In 2023, the company reported revenue of 270 million (year-on-year +93.38%), with a net profit of -35.0016 million (year-on-year -159.64%). In Q1 2024, the company achieved revenue of 86 million (year-on-year +42.90%), realizing a net profit of 17 million (year-on-year -19.82%). Since its establishment, the company has been deeply engaged in the maintenance of airborne equipment for over a decade. Through years of technological accumulation and process innovation, the variety of products served by the company has continuously enriched, and its business structure has been continuously improved.

Angel round and A round enterprises in the automotive industry chain (including the dynamic battery industry chain) are invited to join the groupWe will recommend to over 1000 automotive investors from top institutionsThere are also communication groups for innovative technology companies and dozens of groups related to the automotive industry including complete vehicles, automotive semiconductors, key parts, new energy vehicles, intelligent connected vehicles, aftermarket, automotive investment, autonomous driving, vehicle networking, etc. Please scan the administrator’s WeChat to join the group (please indicate your company name)