Abstract:

Waveguide solutions can be further subdivided into two mainstream options: array waveguides and diffraction waveguides. In terms of display solutions, LCD and LCoS are mature solutions, but both face issues of low contrast and high energy consumption. Micro OLED and Micro LED are both self-emissive display technologies that do not require backlight modules, allowing them to be lighter and thinner while offering superior display effects and resolutions.With the coordinated development of content and hardware, AR is expected to achieve large-scale deployment in the consumer market.

01

AR:With extensive downstream applications, the rapid development and improvement of each link in the industry chain are expected to accelerate entry into the consumer market and drive the industry to open up upward space

(1) AR has extensive downstream applications, and the rapid development and improvement of each link in the industry chain

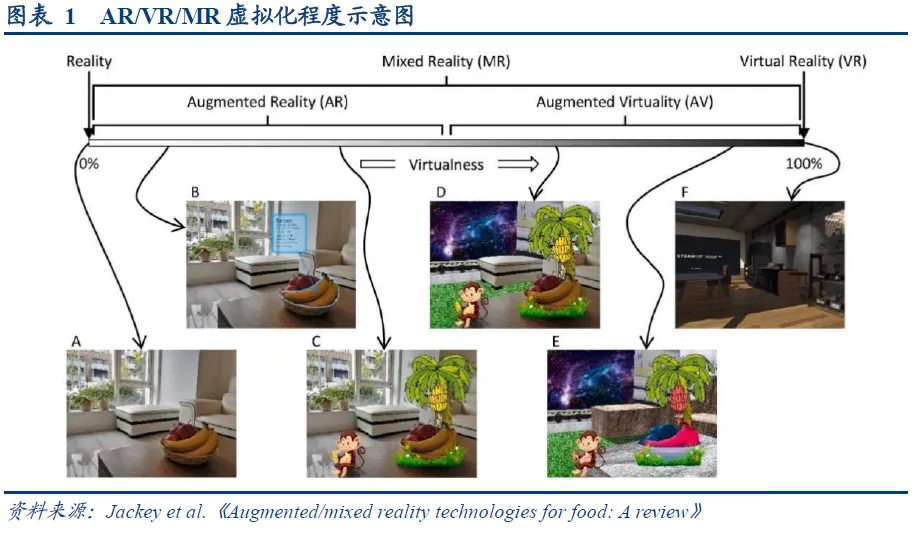

AR, VR, and MR represent different levels of integration between the virtual and real worlds.From a conceptual understanding, AR, or Augmented Reality, can overlay virtual information data onto the real world based on technologies such as sensors and computer vision, presented and perceived by users through devices such as smartphones and head-mounted displays. Similar to AR, VR and MR also provide virtual experience services to users, but their degrees of virtualization differ. VR creates a three-dimensional digital environment that allows users to interact immersively with multiple degrees of freedom, having the highest degree of virtualization.

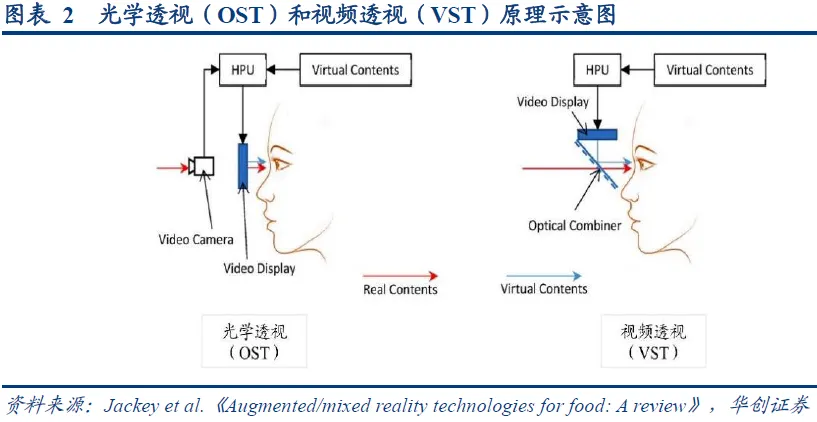

MR merges objectively existing physical objects with computer-generated virtual objects for real-time interaction, which can be understood as “the real world + virtual world + digital information,” with a virtualization degree between VR and AR.In terms of perspective solutions, AR mainly adopts Optical See-Through (OST), while VR primarily uses Video See-Through (VST). Optical see-through provides a more realistic visual effect for everyday consumer-grade AR, with relatively lightweight and power-efficient devices. The hardware display technologies involved include waveguide technology, lightweight optical engine technology, and micro-display technology, which have high technical requirements in optical path design and device mass production.

AR employs OST technology to provide authentic optical see-through, with broad prospects for mobile scene applications.From the perspective of selected solutions, AR mainly uses Optical See-Through (OST), while VR mainly uses Video See-Through (VST). Optical see-through provides a more realistic visual effect for everyday consumer-grade AR, with relatively lightweight and power-efficient devices. The hardware display technologies involved include waveguide technology, lightweight optical engine technology, and micro-display technology, which have high technical requirements in optical path design and device mass production.

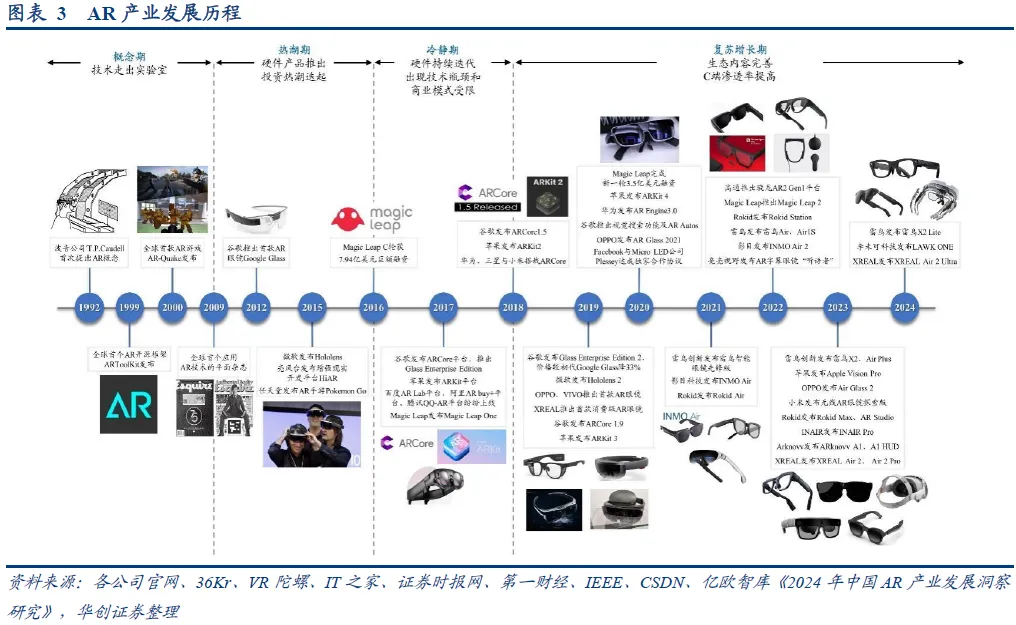

ARIndustry development history can be divided into four periods: the concept period, the boom period, the calm period, and the recovery period. 1) Concept period: In 1992, Boeing researcher T.P. Caudell first proposed the term “Augmented Reality” in a paper about improving aircraft assembly efficiency, discussing the application of head-mounted AR devices in industrial scenarios. In 1999, the AR open-source framework ARToolKit was released, marking the gradual entry of AR technology into the public eye beyond specialized research institutions. 2) Boom period: In 2012, Google Glass was released, reaching a peak in market expectations and investment enthusiasm, with global giants and startups entering the scene.

3) Calm period:Due to bottlenecks in software and hardware technology and application ecosystem construction, market enthusiasm and capital input could not be sustained, leading the industry into a low valley state. Leading manufacturers focused on internal improvements, promoting software and hardware iterations. 4) Recovery growth period: Starting in 2019, Rokid, XREAL, Magic Leap, and Thunderbird have successively launched new products, continuously improving the hardware ecosystem, and the business models of each link in the industry chain have gradually matured. With technological accumulation and the promotion of scenarios such as AI and 5G, the AR industry is expected to usher in broader growth space.

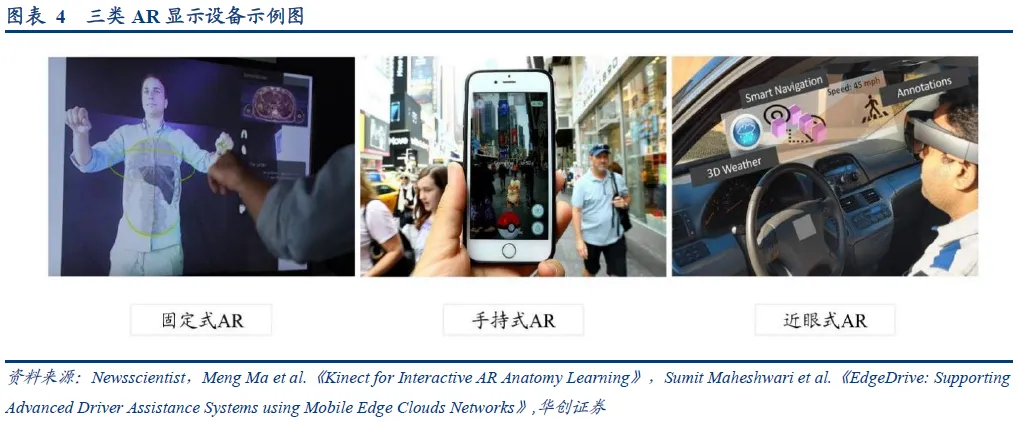

AR display devices can be divided into fixed, handheld, and near-eye types, with near-eye being the main development direction.1) Fixed AR: Generally does not need to meet the application demands of mobile scenarios, usually requiring larger displays or additional projection equipment, and has not yet been widely accepted by the consumer market. 2) Handheld AR: Uses the screens of handheld devices such as smartphones and tablets as display units, leveraging the device’s own computing, processing, and image input capabilities to process virtual information and overlay it onto the real scene. Handheld AR is convenient to utilize existing user cognitive habits and technological foundations, but in the long run, it may impose certain limitations on interaction experience and the construction of an AR-native ecosystem.

3) Near-eye AR: Mainly refers to AR headset devices, which reflect virtual images based on technologies such as OST and transmit external light to provide a visual experience that merges the real and virtual.Near-eye AR opens up broad imaginative spaces beyond fixed and handheld terminals, and the immersive experience and innovative interaction methods will provide a newer and stronger sensory experience, with glasses being the typical wearable form that domestic and international AR hardware manufacturers are currently focusing on in their research and development.

According to product form, near-eye AR devices can be further divided into separate and all-in-one types.Separate AR separates the processor, battery, buttons, etc., from the glasses body, requiring connection to external devices such as smartphones or computers via cables or wireless projection using a host box. This design offloads computational tasks, supports more complex applications, and can leverage existing classic content ecosystems and interaction methods. All-in-one AR glasses integrate computing power, display, and other component units internally, requiring higher independence and portability while balancing or compromising on computing performance, display quality, thermal management, and power consumption within limited volume and weight.

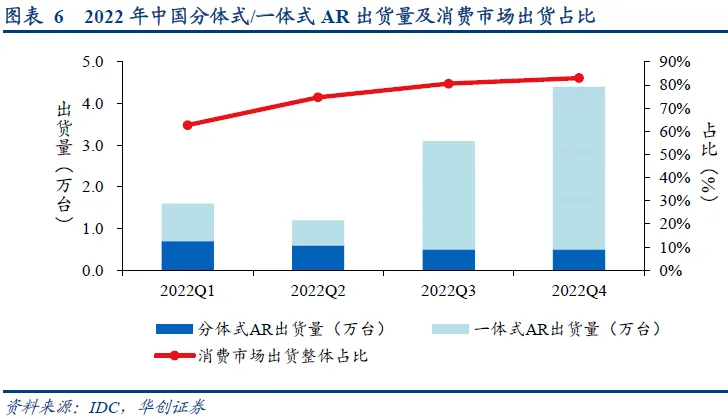

Trends in all-in-one AR layouts are beginning to emerge, which may replace separate AR headsets to achieve a dominant position.According to IDC data, in 2023, the shipment proportion of separate AR in China was about 88%, with separate AR headsets currently dominating the market. All-in-one AR still needs to go through processes including hardware solution research and deployment, gradual content ecosystem development, and industry chain structure layout improvement; compared to separate AR, it is closer to the definition of a spatial computing platform, with broad exploratory space in AR-native content ecosystem development and human-computer interaction sensor innovation.

With the advancement of waveguide technology and the release of AR chips, all-in-one AR is expected to see more layouts and iterations, continuously enhancing the screen experience in mobile scenarios and unlocking an all-day comfortable wearing experience, targeting consumer market demands with lightweight products, consolidating and expanding upward space.

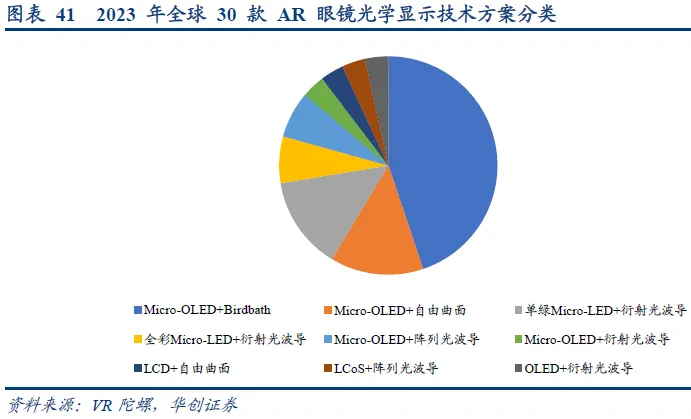

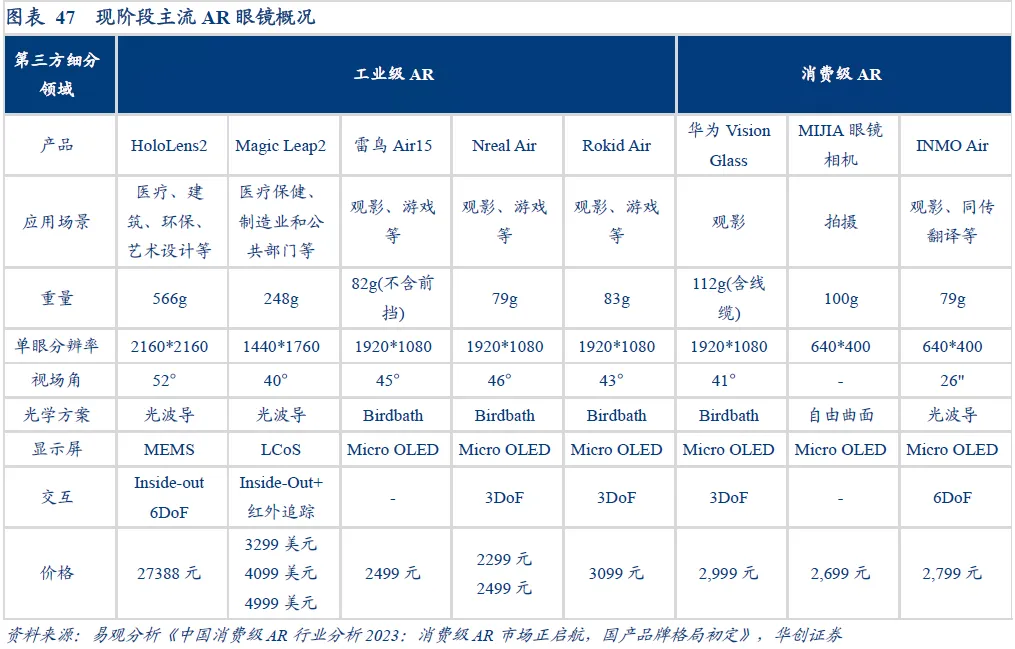

AR headsets have diverse hardware forms and technical paths, with lightweight full-color products targeting the consumer market as new growth points.From the parameters of mainstream AR devices released in recent years, domestic and international manufacturers are steadily enhancing product configurations and performance while keeping product weight at a low level. Domestic brands are more evidently seeking to penetrate the consumer market, building a cost-performance advantage through product upgrades and price reductions, and intensifying efforts in lightweight full-color AR headsets to accelerate penetration and popularization in the consumer market. From a specific optical display technology perspective, Birdbath + Micro OLED is one of the commonly used solutions, which has relatively mature mass production capabilities.

In January 2024, the Thunderbird X2 Lite adopted a Micro LED + diffraction waveguide optical display solution to achieve dual-eye full-color display, equipped with the Snapdragon AR1 Gen1 chip and incorporating the large model voice assistant Rayneo AI to unlock new AI + AR experiences. The development potential of AR products in scenario definition innovation and technology path exploration is evident, with the possibility of continuous iterative breakthroughs, enhancing user experience, and capturing the consumer market dividends.

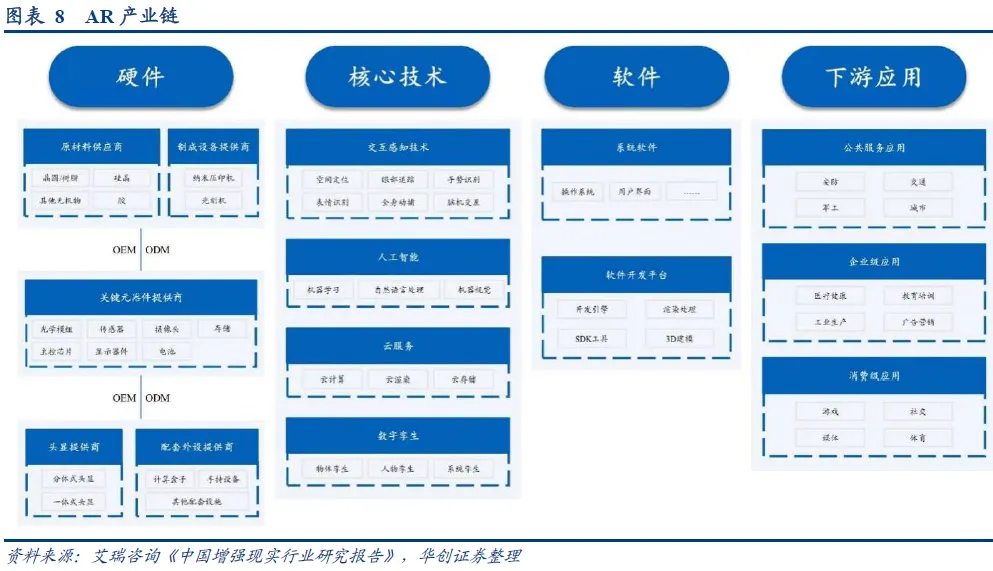

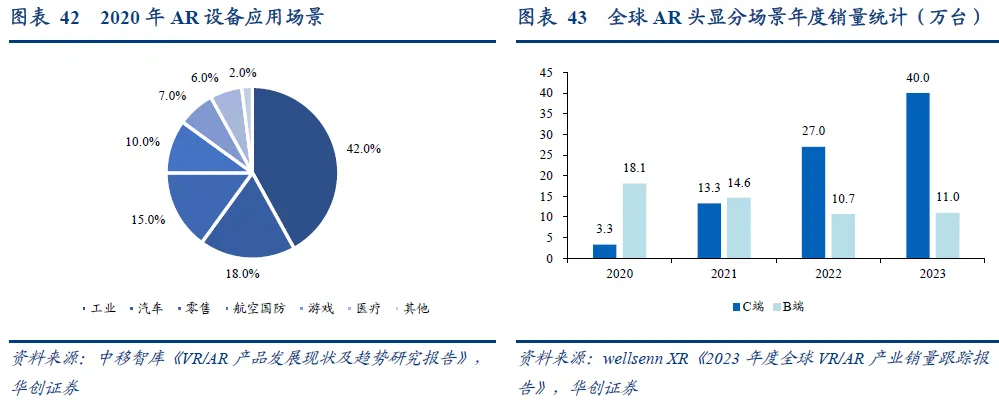

In the AR industry chain, the upstream hardware end is a core link, with extensive downstream application scenarios.The AR industry is in the preliminary development stage, and the industry chain is long, with many participants. The upstream hardware end focuses on optical devices, display devices, and chips, which are the basic support for subsequent applications. This link has a significant impact on the terminal device form and user experience, with a high proportion of value. From the downstream perspective, the AR application field is quite rich, currently dominated by B-end scenarios such as industry and military, while the C-end market’s demand has not yet matured.

In addition to planning and layout by leading companies in the industry, some startups are also beginning to emerge, launching AR products aimed at the consumer market, actively exploring and accumulating content ecosystem construction and user value realization. With the advancement of the industry development process, it is expected that a good supply-demand closed loop and aggregation of the entire industry chain value can be achieved in the future.

(2) Consumer-grade AR glasses are rapidly scaling up, with domestic manufacturers occupying a major share.

The global AR market is experiencing growth in shipments, with the Chinese market performing impressively.According to Wellsenn XR data, in 2023, global AR shipments reached 650,000 units, a 54.8% increase from the previous year, indicating a significant increase in the popularity and acceptance of AR technology worldwide. Against this backdrop of global growth, the growth rate of the Chinese market is remarkable, with AR shipments in China reaching 197,000 units in 2023, a substantial year-on-year increase of 45.93%, reflecting strong demand and market potential in AR in China.

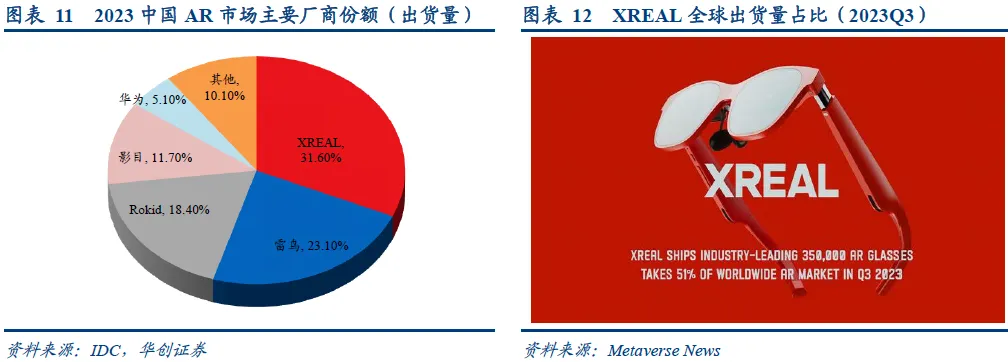

Consumer-grade AR is setting sail, expected to consolidate the growth outlook for AR shipments.Domestic manufacturers such as XREAL, Rokid, and Thunderbird are focusing on the consumer-grade AR glasses market priced below 5,000 RMB, currently holding a mainstream position in shipment volume share in China. From the perspective of global market shipments, domestic manufacturers promoting lightweight consumer-grade AR glasses still occupy the majority of the share. In 2023, XREAL ranked first in global market sales, with its shipments accounting for over half of the total global shipments in Q3 2023, reaching 51%.

Currently, the shipment base for AR remains low, while macroeconomic pressures and tightening business expenditures have a certain suppressive effect on growth.With future economic recovery and the iterative upgrade of AR products’ software and hardware, coupled with the deepening trend of ecological integration between AR and fields such as AI and 5G, consumer-grade AR glasses with superior performance configurations and wearing comfort are expected to accelerate their emergence, leading the industry into a sustained growth and steady realization phase.

(3) Optical display and computing units occupy a large share of hardware costs, and the choice of technical solutions highlights the main differences between products.

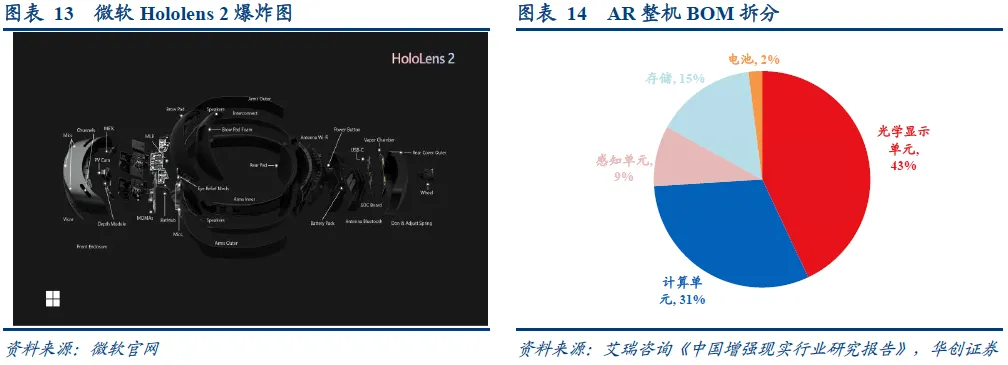

The optical display unit and computing unit are the largest cost components among the main modules of AR glasses.The components of AR devices include micro-displays, chips, cameras, and sensors, which can be further categorized into five functional modules: optical display, computing, perception, storage, and battery. Taking Microsoft’s Hololens as an example for hardware BOM analysis, the optical display unit accounts for about 43% of the total cost, making it the core part of AR glasses, where the optical solutions involved significantly impact the production and promotion of the product. Additionally, the computing unit accounts for approximately 31% of the total cost, making it another major cost component of AR headsets, holding high value in the industry chain.

In terms of optical display, AR headsets primarily utilize near-eye display systems (NED) based on stereoscopic vision simulation for human eyes.Stereoscopic vision is the perception of distance, depth, and volume of surrounding objects by the human eye, with the brain providing a three-dimensional spatial perception by integrating real physical information from physiological cues and visual illusion effects from psychological cues. Currently, the mainstream NED solutions used in AR headsets primarily utilize binocular parallax to allow the brain to adaptively merge images for stereoscopic visual perception, while also incorporating optical mixers to naturally blend virtual images with real scenes, with core modules involved including optical modules, light sources, and optical display devices.

(4) Price declines, enhanced experience, and a rich ecosystem indicate promising growth for AR devices.

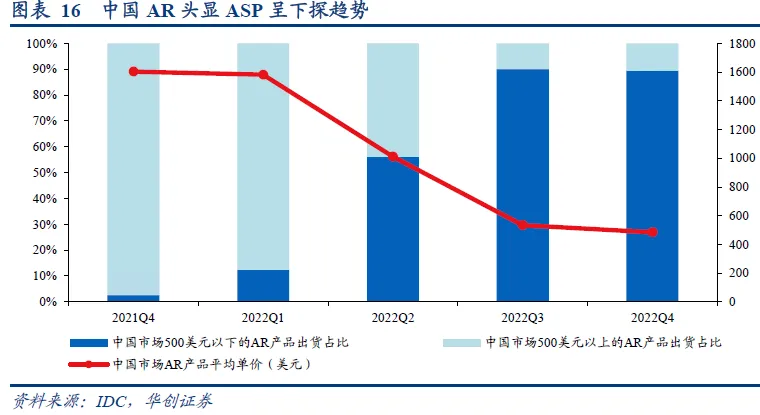

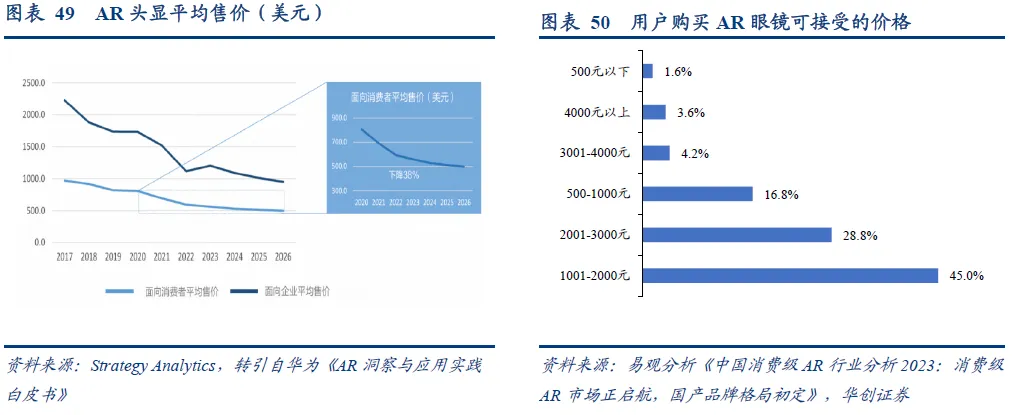

The average price of AR devices is declining, and the improvement in wearing comfort, combined with the gradual enrichment of the content ecosystem, is expected to strengthen the endgame expectations for AR headsets.(1) In terms of device pricing, the average price of AR devices is decreasing, with lightweight consumer-grade AR glasses released by manufacturers like XREAL and Rokid priced lower, while all-in-one AR devices like Hololens also show a price reduction trend due to mass production iterations, indicating a clear downward trend in overall ASP, suggesting that AR devices are likely to gain larger market space. (2) Regarding wearing experience, with technological advancements, the wearing comfort of AR devices has significantly improved, which not only increases user comfort but also enhances the device’s attractiveness, providing possibilities for the popularization and long-term use of AR. (3) In terms of content ecosystem, with the increase in entering manufacturers, the AR content ecosystem is rapidly developing, evolving from early general content consumption to more intelligent virtual content generation and interactive perception experiences. Progress in technologies such as AI and 5G will further highlight the unique features of AR, promoting the richness and diversity of the AR content ecosystem.

AR’s share in XR shipments continues to rise, and future growth can be expected.AR is seen as the ultimate form of XR technology, as its devices are lightweight and portable, allowing users to see the real world while using them, which is different from VR, which feels like looking at a closed screen. These characteristics make AR more capable of meeting users’ needs for long-term wear in daily activities.

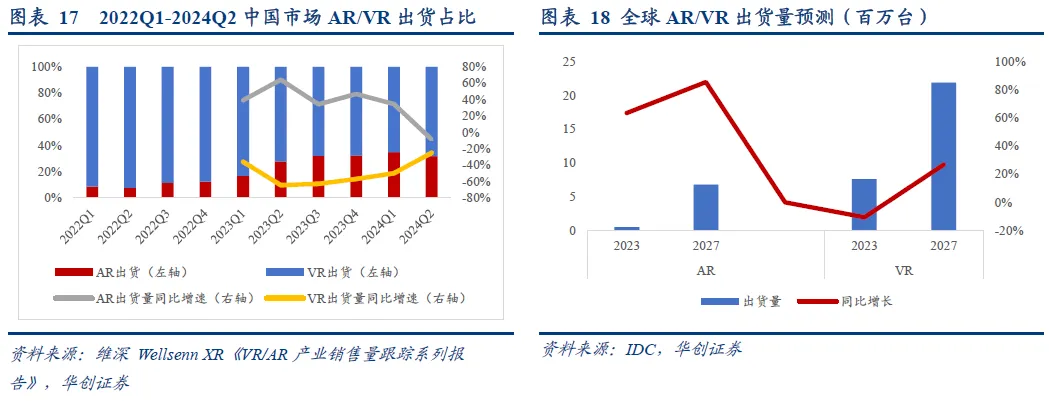

According to Wellsenn XR data, in the second quarter of 2024, the AR shipment volume in the Chinese market reached 42,000 units, with the shipment share of AR products in XR increasing from 8.42% in Q1 2022 to 31.82% in Q2 2024, showing a continuous increase in shipment share. From a global market perspective, AR is expected to see considerable growth. According to IDC’s forecast data at the end of 2023, the compound annual growth rate of global AR shipments from 2023 to 2027 is projected at 96.5%, with shipment growth far exceeding that of VR.

02

Optical display systems: Optical and display solutions are gradually iterating, with waveguides & micro-displays providing excellent effects

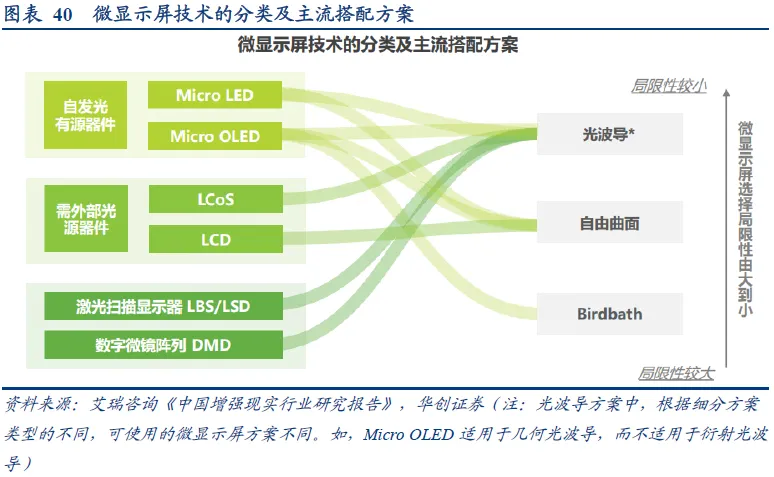

The optical display system of AR terminal devices consists of optical components and displays.Optical AR glasses simultaneously present the virtual and real worlds, imposing high requirements on the display system, which must overlay virtual information without obstructing the real display, comprising (1) the main optical solutions: prism solutions, freeform prism solutions, Birdbath solutions, and waveguide solutions (diffraction waveguides and geometric waveguides); (2) displays: providing display content for the device, including self-emissive active devices (such as Micro-LED, Micro-OLED), LCDs (such as transmissive LCD, reflective LCoS) that require external light sources, and digital micromirror devices (DMD) based on micro-electromechanical systems technology.

(1) Waveguide solutions are lightweight, have high light transmittance, and are comfortable to wear, gradually becoming mainstream.

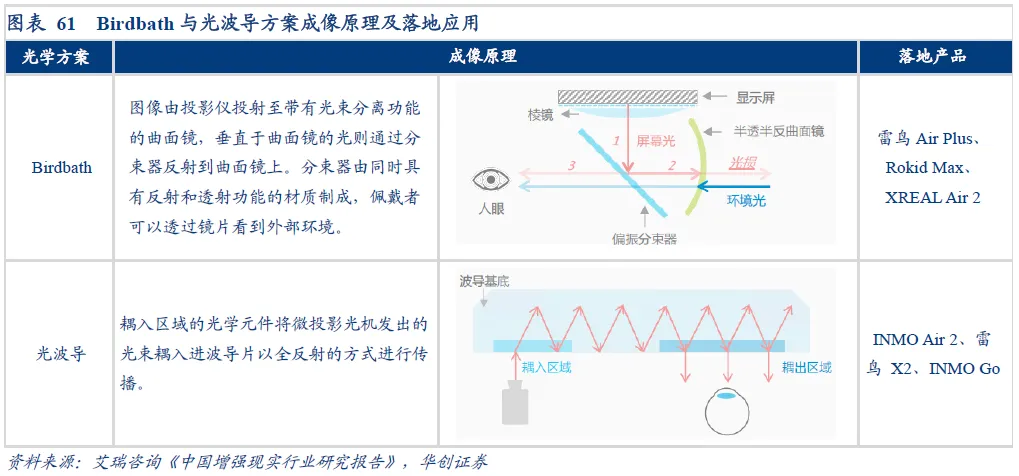

There are various optical solutions on the market, each with its advantages and limitations, suitable for different application scenarios and needs.Optical solutions mainly include prism solutions, freeform solutions, Birdbath solutions, and waveguide solutions, among which freeform solutions and Birdbath have relatively mature mass production capabilities, with higher imaging quality, light efficiency, and color saturation compared to prism solutions, but face contradictions in volume and field of view.

In recent years, waveguide solutions have developed rapidly, addressing this contradiction and achieving 80%-95% light transmittance, while simultaneously providing more realistic three-dimensional images through multi-layer waveguide sheets. However, the cost of waveguides is relatively high compared to other solutions, and the current mass production difficulty is significant; once mass production is achieved, it is expected to become a promising and advantageous optical solution.

1. Prism and freeform: Mature technology, gradually being replaced due to field of view and volume issues.

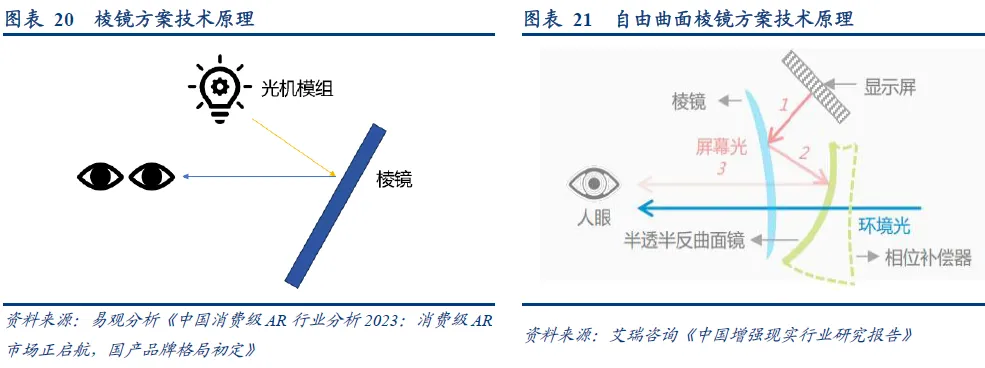

The optical principles of prisms and freeform surfaces each have unique characteristics; prisms mainly rely on refraction and reflection principles, while freeform surfaces primarily rely on double-reflection spectroscopic principles.The optical principle of prisms relies on the refraction and reflection effects of prisms on light. When virtual image light strikes the prism, different faces or curves of the prism produce varying refraction effects on the light, allowing precise control over the light’s propagation direction and focal point, ensuring that virtual image light enters the human eye’s retina. The optical principle of freeform surfaces involves two reflections, using semi-transparent and semi-reflective beamsplitters and concave mirrors to reflect the projected virtual image into the human eye, while the real-world scene enters the eye directly through the curved mirror.

The earliest market entrants, prisms and freeform surfaces, possess maturity and cost advantages but face issues with field of view and volume.Among them, the field of view angle of prism refraction is only 10°-20°, with insufficient brightness and significant image distortion. Increasing the field of view parameters requires increasing the area of odd reflections, which leads to increased lens thickness and, consequently, increased device weight. Compared to the overall image distortion issues of the prism optical solution, the freeform solution has made improvements only through local distortion. Therefore, during the development process, due to the inherent disadvantages of both, they have gradually been replaced by the more mature Birdbath solution.

2. Birdbath: High cost-performance ratio & strong mass production capability, a solution balancing cost and display effects in the short term.

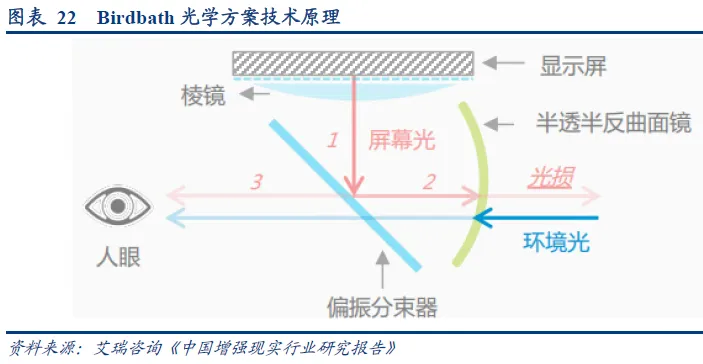

The Birdbath solution leads the market with a broad field of view, economical cost, and excellent experience.The Birdbath solution combines the images from the display screen with the real world through two reflections, using beamsplitters to control light, allowing users to have a synchronized visual experience of digital images and the real world. Specifically, the optical principle of Birdbath involves two reflections, projecting the light source from the display screen onto a 45-degree semi-transparent and semi-reflective beamsplitter, allowing users to see the real world outside of the digital image. After the beamsplitter reflects the light onto a curved mirror, the semi-transparent and semi-reflective curved mirror transmits the light to the human eye. The advantages of the Birdbath solution include a large field of view (40°-60°), high imaging light, high contrast, high resolution, low cost, high mass production degree, and slightly higher overall weight compared to ordinary glasses.

However, the Birdbath solution suffers from significant light loss and needs to be paired with Micro OLED, which leads to a “short board effect.”The Birdbath solution has considerable light loss, often used in conjunction with Micro OLED screens, and the combination of the two will yield better light efficiency than most existing solutions. The corresponding issue is that the AR industry chain has relatively few overlaps with existing smart hardware or VR industry chains, and the high-quality Micro OLED screens that the Birdbath solution is “bundled” with have not achieved large-scale mass production, resulting in a “short board effect.”

3. Waveguide solutions: Lightweight, high light transmittance, and comfortable to wear, expected to become the new mainstream for AR glasses.

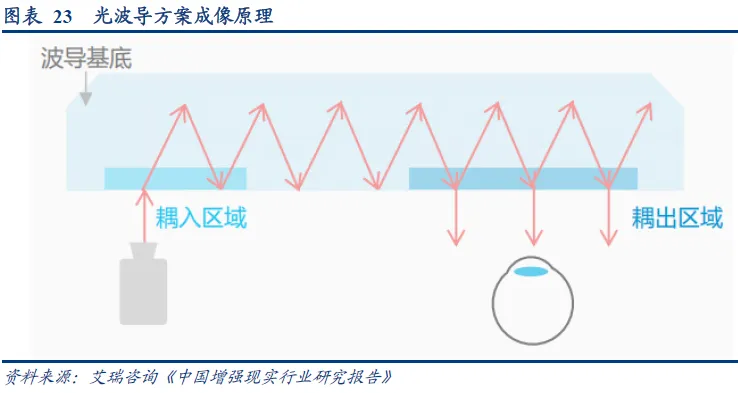

Waveguide solutions mainly consist of micro-projection optical machines, optical waveguide optical devices, and couplers.The light emitted by the micro-display in the optical machine is coupled into the waveguide lens through a lens group, propagating in the waveguide through total internal reflection. When it reaches the coupler, it is coupled out of the waveguide and enters the human eye for imaging. The coupling area can be reflective mirrors, prisms, embossed gratings, and volume holographic gratings. The coupling output area can be semi-transparent and semi-reflective mirrors arranged in arrays, embossed gratings, and volume holographic gratings.

Waveguides are lightweight, have high light transmittance, and are comfortable to wear, but the difficulty of mass production technology is significant.The advantages of waveguide solutions include: 1) Their structural design facilitates head-worn designs and enhances aesthetics, as they can move the display and imaging systems away from the glasses to the forehead or side, significantly reducing the optical system’s obstruction of external vision; 2) They easily enlarge the eye box range, improve mechanical tolerances, and make the weight distribution more ergonomic, thus enhancing the wearing experience of the device; 3) High light transmittance, with the maximum advantage of waveguides being the ability to achieve over 80% light transmittance, providing more realistic three-dimensional images through stacking multiple waveguide sheets. However, the manufacturing process of waveguides is complex, and the cost is high, making mass production difficult. Therefore, this technology still requires time for further development.

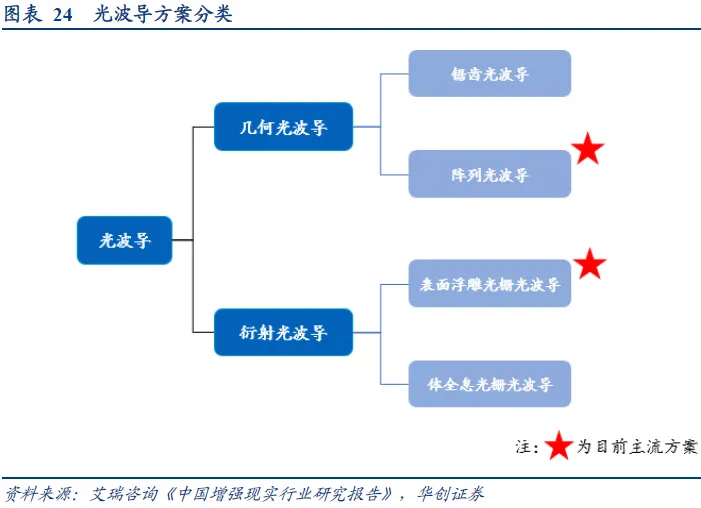

Waveguides can be further divided into geometric waveguides and diffraction waveguides, with array waveguides and surface-embossed grating waveguides being the mainstream solutions.Based on the configuration of optical components in the coupling area, waveguide solutions can be further classified—common optical components for the coupling input area include reflective mirrors, prisms, embossed gratings, and volume holographic gratings, while common optical components for the coupling output area include semi-transparent and semi-reflective mirrors, surface-embossed gratings, and volume holographic gratings. Currently, array waveguides and surface-embossed grating waveguides are the mainstream solutions.

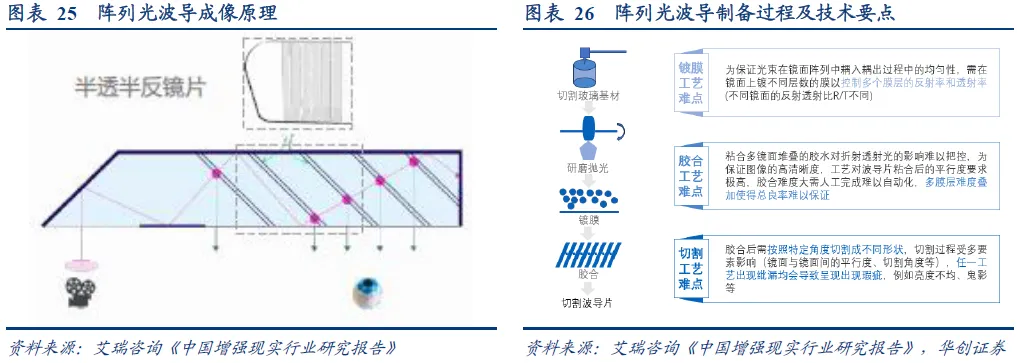

Array waveguides have excellent imaging effects, but optimizing production capacity, yield, and cost control is challenging.Array waveguides are based on traditional geometric optics principles, with most processes being mature cold processing techniques, making the design principles relatively simple; they do not involve micro-nano level structures, achieving high imaging quality, color, and contrast without dispersion issues. The preparation process for array waveguides mainly includes “cutting-polishing-coating-bonding,” which is complicated and requires high precision in each process, posing certain challenges to production capacity, yield, and cost. The main difficulty in preparation lies in the coating and bonding processes, as the coating process requires stacking 5-6 waveguide sheets, and any error in one will lead to scrapping, while the bonding process currently relies mainly on manual operations, limiting production capacity. Currently, various manufacturers are actively laying out molecular bonding technology to replace traditional bonding solutions.

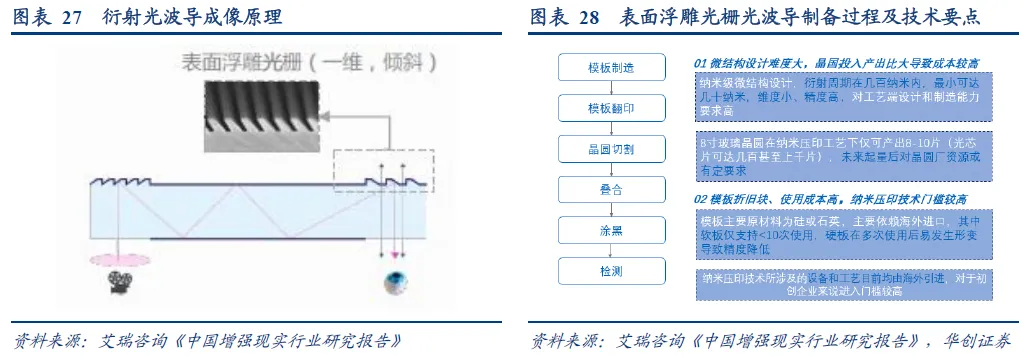

Diffraction waveguides have better mass production capabilities and yields, but template design is challenging, and dispersion issues need to be addressed.Diffraction waveguide technology allows for great freedom in grating design, and the preparation process is relatively simple; after coating on a glass substrate, it can be processed directly, avoiding glass slicing and bonding processes, which can easily enhance yield and mass production capabilities. The challenge in mass production lies in the difficulty of master design, which involves semiconductor micro-nano level processing techniques, requiring electronic beam exposure and ion etching to create the master on silicon substrates. Furthermore, due to physical principles, diffraction elements’ inherent selectivity for angle and wavelength leads to a “rainbow effect,” where dispersion causes uneven RGB light distribution ratios.

Waveguide technology has not yet determined its final path, but continuous iterative development is expected to enhance penetration rates.Currently, various waveguide solutions are in the development stage, each with its advantages and disadvantages, and the final technical path has not yet been determined. Among them, geometric waveguides combined with surface-embossed grating waveguides are already in small-scale mass production, while volume holographic waveguides have not yet achieved mass production. In the future, with the continuous development and iteration of waveguide technology, its display effects, yields, and mass production performance are expected to improve further, increasing the penetration of waveguide technology in AR glasses.

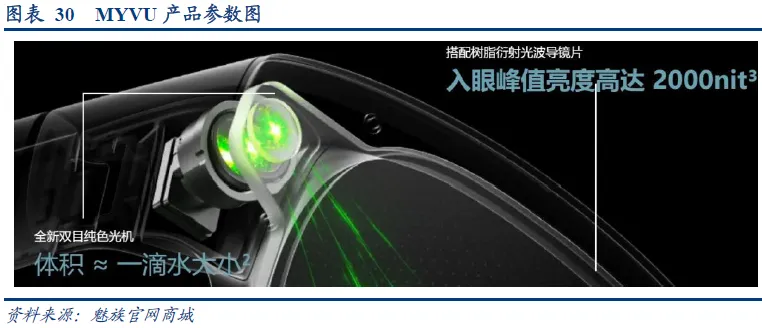

The introduction of waveguide technology has enabled AR glasses and other wearable devices to break free from heavy and complex structures, achieving a lighter and more portable design.Compared to Birdbath, freeform, and off-axis reflection optical solutions, waveguides can achieve a lighter volume, higher light transmittance, and larger eye-box by using micro-nano processing technologies like nano-imprinting to create waveguide sheets resembling ordinary glasses. Additionally, when paired with Micro-LED micro-displays, they can achieve higher brightness entering the eye and smaller optical machine volumes. For example, the latest AR glasses product MYVU released by Starry Sky Meizu reportedly has a dual-eye pure-color optical machine volume the size of a drop of water.

(2) With advantages in image quality and volume, Micro-OLED and Micro-LED are future application trends.

Multiple display panels coexist in AR to adapt to different light loss and structural optical solutions.Users’ needs when using AR glasses reflect on the display panel level, mainly in terms of sensitivity to brightness, display effects, battery life, and overall device weight. Therefore, different optical solutions have varying degrees of light loss, with brightness being a key consideration for panel selection, requiring sufficient brightness for HMDs to clearly display images even in ambient light. Commonly seen display panels on the market include LCD, LCOS, Micro-OLED, and Micro-LED, with the latter two being inorganic self-emissive and Micro-LED having absolute advantages in various parameters, recognized as the next-generation mainstream display technology solution in the industry, although it is still in the research and development stage and faces several technical challenges before achieving large-scale mass production.

1. LCD and LCoS technologies are relatively mature but face challenges of low contrast and high energy consumption.

The LCD panel structure includes a backlight, lower polarizer, TFT Glass, CF Glass, and upper polarizer.LCD utilizes an external light source; under the action of an electric field, liquid crystals deflect and change the polarization direction of light, passing through the color filter and polarizer to produce the color of individual pixels. In other words, the white light emitted from the backlight is reflected onto the polarizer, converting natural light into polarized light, which then enters the liquid crystal layer controlled by voltage to change the deflection direction, controlling the amount of light that passes through, finally projecting colored light through the color filter.

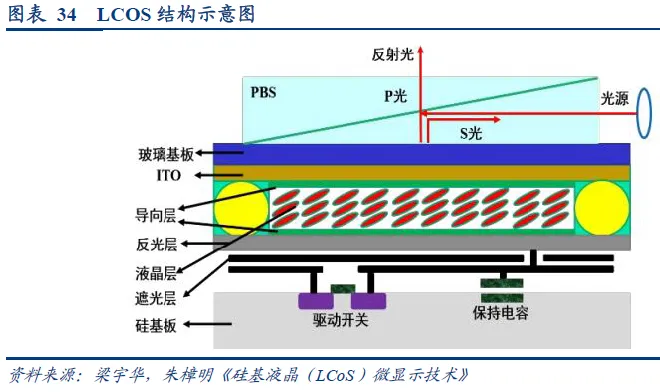

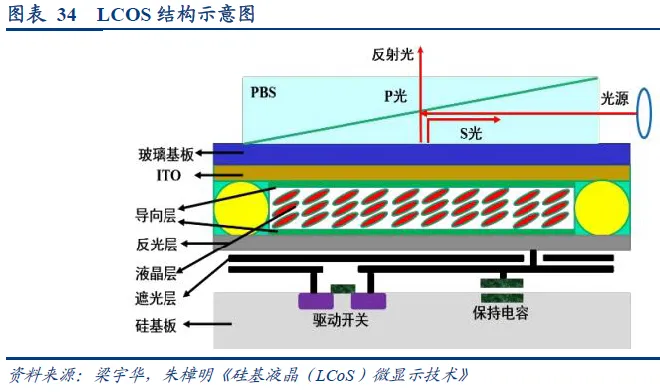

LCoS is a reflective display device based on liquid crystal materials (Liquid Crystal) combined with silicon-based integrated circuit technology.LCoS technology manufactures the driving panel on silicon wafers and combines it with glass substrates, injecting liquid crystals for packaging. Its display principle is to adjust voltage to control liquid crystal molecules, changing the light’s passage to display images. Simply put, when the voltage is zero, light does not enter the projection light path, and the pixel appears dark; when voltage is applied, light passes through and images are displayed, making the pixel appear bright.

LCD and LCoS technologies face challenges of low contrast and high energy consumption.Both LCD and LCoS have issues with relatively insufficient contrast and high energy consumption, especially LCD, which requires continuous backlight support, while LCoS, despite high light utilization, still has room for improvement in overall power consumption control. Additionally, the module size is relatively large, which is not conducive to lightweight design, and performance is limited in low-temperature environments.

2. Micro-OLED and Micro-LED display panels excel in display effects and are the new trend for AR.

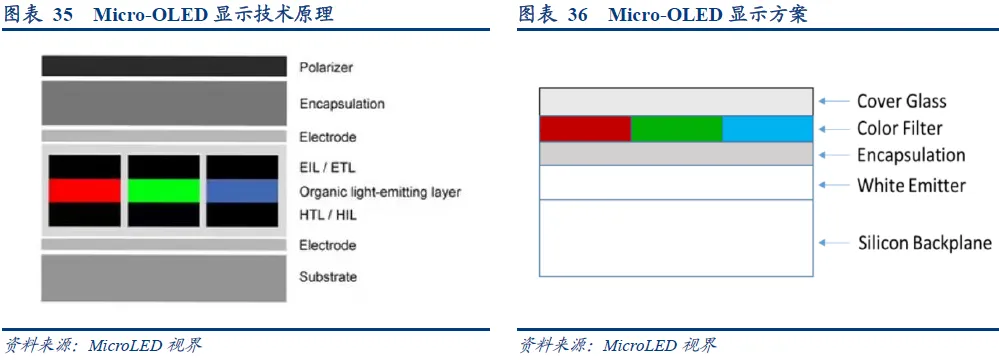

Micro-OLED absorbs diverse technological elements, uniquely possessing advantages of small size and high pixel density.Micro-OLED is based on organic light-emitting diode technology, where each pixel can emit light independently, offering extremely high contrast, a wide color gamut, and microsecond-level response speed. Thanks to the close integration of CMOS technology and OLED technology, Micro-OLED no longer uses traditional glass substrates but utilizes single-crystal silicon substrates, integrating the drive circuit directly onto the substrate, significantly reducing the overall size and weight of the screen. By employing semiconductor technology, using chip-making techniques for screens, and highly integrating inorganic and organic semiconductor materials, the pixel spacing of Micro-OLED can be controlled at the micrometer level, enhancing pixel density within a small-sized micro-display.

Micro-OLED is lightweight, with superior image quality and response speed, but the lifespan of organic materials is relatively short.Micro-OLED has significant advantages over LCD and LCoS, but its high cost and difficulty in mass production remain challenges. Its advantages include: 1) Strong lightweight properties, as Micro-OLED is a self-emissive display technology that does not require backlight modules, allowing for thinner, lighter, and more energy-efficient designs; 2) Higher pixel density, exceeding 3000 ppi, providing clearer and more detailed images; 3) Faster response speed, suitable for high frame rate applications such as AR/VR; 4) Smaller size, enabling higher pixel density and resolution; 5) No need for complex packaging technology, reducing costs and thickness. However, its drawback lies in the short lifespan of organic materials (several thousand hours), leading to potential burn-in issues.

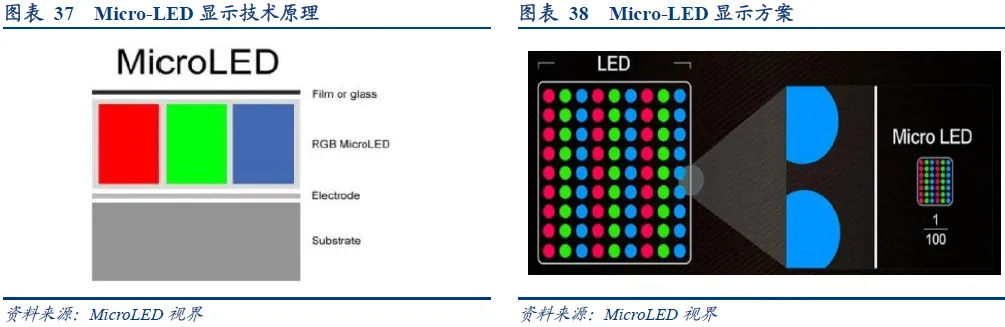

Micro-LED generates various colors and achieves high resolution by combining sub-pixels.Micro-LED refers to the miniaturized LED technology, with the core being micro light-emitting diodes (LEDs) smaller than 100 micrometers. These micro LEDs are made from inorganic materials, primarily gallium nitride (GaN), known for their excellent light-emitting characteristics and high thermal stability. Each Micro-LED consists of three sub-pixels (red, green, and blue) that can emit light independently. By combining these sub-pixels, Micro-LED displays can produce various colors and achieve high resolutions.

MicroLED technology stands out in the display field due to its excellent image quality.Based on LED micro-display technology, MicroLED achieves independent light emission for each pixel, especially in high-density configurations (such as applications in AR/VR fields, with PPI exceeding 2000, and LED particle sizes as small as 1-10μm), significantly enhancing brightness to an outstanding level of 2000-4000 cd/m², while ensuring high image quality, achieving superb high contrast and HDR effects. For example, VU Discovery utilizes a full-color Micro-LED light engine based on a color-matching scheme with an extremely compressed volume of only 0.4 cubic centimeters.

(3) Micro-OLED + Birdbath are mainstream solutions, and improved mass production of Micro-LED is expected to drive long-term penetration.

Micro-OLED, paired with various optical solutions, is currently the mainstream solution.Due to its high pixel density, lightweight, low power consumption, and other significant advantages, Micro-OLED is widely regarded as a mature display technology solution in the VR and AR fields. In terms of product parameters, Micro-OLED display devices typically possess high clarity, high contrast, wide color gamut, and high-speed responsiveness. The combination of Micro-OLED + Birdbath or geometric waveguides is currently a mature technical combination. Micro-OLED is not suitable for diffraction waveguides because it relies on self-emissive characteristics, while the Birdbath optical solution can effectively combine with Micro-OLED to provide high-quality image output.

Micro-OLED + Birdbath has become a mature solution, and improved mass production of Micro-LED is expected to drive long-term penetration.According to statistics of 30 AR glasses optical display technology solutions globally in 2023, Micro-OLED + Birdbath is the primary AR glasses display technology, followed by Micro-LED + freeform/diffraction waveguides. Micro-LED is regarded as a strong candidate for next-generation display technology in the consumer electronics field due to its high brightness, low power consumption, and long lifespan, but it still faces technical challenges in chip, massive transfer, and full-colorization, preventing large-scale mass production. As technology and yield continue to improve, Micro-LED and waveguide solutions will continue to penetrate.

03

The coordinated development of content and hardware is expected to lead to large-scale deployment of AR in the consumer market

(1) The consumer market is dominated by gaming and viewing, with continuous landing of C-end scenarios expected to drive long-term growth in the AR market.

The B-end market leads early development, while the C-end market drives long-term growth.At present, AR devices are concentrated in the B-end, with many mature cases in industrial and training scenarios, forming a preliminary market scale. The development of the C-end market is slightly delayed, with manufacturers mostly entering the market through viewing and entertainment scenarios, which has not yet promoted actual penetration. In 2023, global AR headset sales for the C-end reached 400,000 units, while B-end market sales were 110,000 units, with C-end sales of AR headsets exceeding B-end sales since 2022. In the long run, as technology continues to iterate, B-end scenarios will increasingly become specialized, while C-end scenarios may further subdivide, and the rapid growth and scaling of the AR market will still rely on the promotion and explosion of the C-end market.

The downstream application scenarios of AR are mainly divided into consumer-grade application markets (To C) and enterprise-grade application markets (To B).Currently, the C-end application scenarios mainly involve gaming, viewing, information prompts, shopping, navigation, and office tasks, with gaming and viewing scenarios developing the fastest, with several mass-produced products already entering the market. The AR mobile game “Pokémon GO,” launched in July 2016, quickly became a global phenomenon with record-breaking revenues and download counts within just over a month of its release.

AR’s application scenarios in the B-end mainly cover critical fields such as military, industry, medical, education, and security, with the industrial sector being a hotspot for AR technology applications in China.The third-generation industrial-grade AR smart glasses HiAR H100 by Liangfengtai, along with the “AR Smart Operation and Maintenance System” jointly developed by Liangfengtai and Baowu Group, has opened up a new inspection approach for maintenance personnel, serving as a model for domestic AR smart terminal applications.

The consumer-grade market is dominated by viewing and gaming, while the enterprise-grade application market is relatively balanced.According to statistics from the Yiou Research Institute, in the AR enterprise application service market in 2023, the market scale proportions of various fields are relatively balanced, with the top three application scenarios being education and training, industrial manufacturing, and medical, accounting for 24.7%, 16.8%, and 16.2% of the market scale respectively. In the consumer-grade application service market, the entertainment attributes of viewing and gaming account for 87.6% of the total scale.

(2) The B-end market has a strong demand for specialized applications, while the C-end market penetration still requires multi-faceted iterative upgrades.

In terms of hardware, B-end customers are more concerned with whether products can meet core needs for efficiency improvements, with lower requirements for weight and user experience.Compared to consumer-grade AR products, industrial-grade AR products generally exhibit higher resolution, color display quality, horizontal and vertical FOV angles, image cleanliness, and rendering speeds for eye-tracking, providing real-time information and highly restoring scenes to assist with complex operations and training, meeting clear application needs in B-end markets, especially in fields like military and aerospace. However, industrial-grade AR products also face issues of increased weight, leading to subpar user experiences.

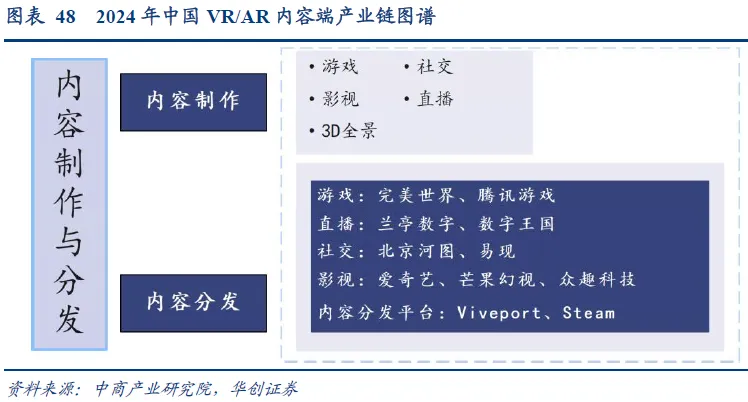

In terms of content, there are significant differences in the professionalization requirements of AR products and content ecosystem needs between B-end and C-end markets.The B-end scene demands functionality-oriented products with high levels of specialization, but with lower requirements for the richness of the AR content ecosystem. From an industry layout perspective, current VR/AR content manufacturers mainly focus on the C-end consumer market, covering entertainment scenarios such as gaming and film, as well as social, live streaming, and daily life scenarios.

In terms of pricing, the B-end market is less sensitive to price compared to the C-end.Due to the non-essential nature of existing application scenarios and the maturity of alternative solutions, along with the still immature AR technology, consumer demand for AR devices appears somewhat fatigued, facing challenges in commercial monetization growth in the short term. Currently, specialized AR headsets are mainly aimed at the enterprise market, with Strategy Analytics estimating that the average price of AR devices will gradually decline over time, predicting that by 2026, 62% of consumer-grade AR device shipments will be at the $500 price point, aligning with the psychological pricing expectations of most C-end consumers for consumer-grade AR devices.

(3) The coordinated development of content and hardware is expected to lead to large-scale deployment of AR in the consumer market.

1. Content side: The value of hardware needs to be reflected through content, and “open-source + AI” is expected to enhance content richness.

The market development potential of hardware products relies more on their content ecosystem, as the quantity and quality of platform applications determine the product’s market scale.For instance, in the case of smartphones, the launch of app stores in 2008, along with the proliferation of convenient applications like Alipay, WeChat, and entertainment applications such as Fruit Ninja and Temple Run, optimized the interactive experience and further promoted the penetration rate of smartphones, leading to a golden period of rapid development for smartphones. Currently, startup hardware manufacturers lack the financial strength to build developer platforms and create application ecosystems, while leading companies represented by smartphone manufacturers prioritize hardware deployment in the AR market, with investments in content ecosystems remaining cautious. The development of downstream content application ecosystems is inadequate, and terminal products lack sufficient consumer-grade AR application content support, making it difficult for hardware products to attract consumer purchases, resulting in limited shipment volumes.

Meta’s launch of the open-source operating system Meta Horizon OS is expected to enrich the content ecosystem.Meta has publicly announced the launch of the next-generation spatial computing operating system, Meta Horizon OS, which will be open to third-party hardware manufacturers. Currently, Lenovo, Microsoft, and ASUS are the first partners. At the same time, Meta has developed a new spatial application framework to help mobile developers create mixed reality experiences, allowing developers to use familiar tools to port mobile applications to Meta Horizon OS or create new mixed reality applications. The open-sourcing of Meta’s operating system is expected to promote the establishment of a more complete AR content ecosystem, catalyzing more excellent content and driving the AR industry into a positive development cycle of “hardware, software, and content spiraling together,” thereby enhancing shipment volumes.

2. Hardware side: Pursuing lightweight device innovations and optimizing appearance to fit daily use scenarios.

“Material innovation + technological breakthroughs” continuously drive the reduction of overall weight.Reducing device weight is a significant challenge for AR optical solutions and manufacturers. In 2024, among the new AR glasses released by various manufacturers, “lightweight” is a major promotional highlight. XREAL Air 2 introduces magnesium alloy beams, ultra-light plastic particles for the shell, and other new materials, with a body weight of only 72g, a 10% reduction compared to the previous generation. The Thunderbird X2 Lite adopts a new ID design, achieving breakthroughs in optical machine miniaturization, waveguide design, and material innovation, with an overall weight of approximately 60g, nearly a 50% reduction from the previous generation.

In terms of wearing comfort, advanced optical solutions are expected to balance the weight distribution of AR devices.Currently, the mainstream AR optical solutions targeting the consumer market are mainly Birdbath and waveguide solutions. In waveguide solutions, the waveguide transmits light to the front of the eyes through the principle of “total internal reflection” and releases it. This allows the display screen and imaging system to be relocated away from the glasses to the forehead or side, significantly reducing the optical system’s obstruction of external vision and making the weight distribution more ergonomic. The Birdbath solution places a micro-display in front of the glasses, transmitting images to the user’s eyes through mirrors, allowing the display components and optical elements to be positioned at the upper or middle parts of the glasses, thus transferring some of the weight to the temples, achieving balanced weight distribution.

In terms of appearance, optimizing design to fit real-life usage scenarios.In 2012, Google launched the first AR glasses, Google Glass, and it has been over a decade since then. In recent years, the appearance of AR glasses has undergone significant changes; the products released by mainstream manufacturers now closely resemble ordinary glasses, incorporating stylish designs that better fit consumers’ real-life scenarios, making users appear less conspicuous during daily use.

In terms of pricing, terminal manufacturers are gradually lowering prices to accelerate penetration into the C-end market.Taking four mainstream consumer-grade AR terminal manufacturers, XREAL, Rokid, INMO, and XREAL, as examples, it can be observed that the new AR glasses released by each manufacturer in 2023 are mostly priced in the 2000-3000 RMB range, roughly maintaining or slightly reducing the prices compared to previous-generation products, with the Thunderbird Air 2 priced 800 RMB lower than the Thunderbird Air.

As current AR products have not yet reached sufficient maturity and widespread acceptance in the market, these products have not become necessities in daily life for most consumers. To attract users and encourage them to pay for these products, even leading companies in the AR field are continuously adjusting their pricing strategies to promote the penetration of AR products in the C-end market.

04

Representative Enterprises

1. GoerTek

The resumption of smart acoustics assembly business has driven the improvement of operating rates, and the company’s profitability has significantly recovered.In the first half of 2024, the smart acoustics assembly business achieved operating revenue of 12.789 billion RMB (YoY +38.19%), with a gross profit margin of 9.83% (an increase of 5.78 percentage points compared to the same period last year). This is mainly due to the gradual decline of the adverse impact from the decrease in project share through the company’s efforts to consolidate relationships with major clients, improving operating rates and shipment volumes, thus restoring the company’s smart acoustics assembly revenue and profitability. Looking ahead, according to Bloomberg reporter Mark Gurman’s news, Apple is expected to launch two new fourth-generation AirPods models in September-October 2024, which may further drive growth in the smart acoustics assembly business.

2. Luxshare Precision

Deeply cultivating overseas large customers, the market share continues to grow.The company has achieved breakthroughs in the assembly business of major clients for smart mobile terminals, health wearables, and acoustic wearables, as well as in core components and module products such as smart terminal display modules, system packaging, and voice coil motors, consistently receiving high praise and recognition from core customers, resulting in an annual increase in market share across various product lines. In terms of new products and new businesses, the company acknowledges the future development space of human-computer interaction, virtual reality, and other industries in various fields such as industry, transportation, medical, and entertainment, actively laying out and collaborating with top clients to plan and implement the golden development opportunities for the next five years. Faced with highly complex new product interfaces, the company continues to transform complex structures into multiple mature process flows through in-depth process analysis and technical breakdown, empowering customers through technologies such as sound, light, electricity, and magnetism to assist in product development and implementation.

3. Crystal Optoelectronics

Crystal Optoelectronics started with optical coating and optical cold processing technology research and development, adhering to innovative development in the optical track, and is a leading domestic optical enterprise.The company has now built five business segments: optical components, thin film optical panels, semiconductor optics, automotive electronics (AR+), and reflective materials, transitioning from a manufacturing enterprise to a technology platform enterprise, dedicated to providing one-stop professional services from core components to modules and solutions. Its products are widely distributed in downstream industries, including smartphones, cameras, smart wearable devices, smart home, security monitoring, automotive optics, and metaverse AR/VR, etc. (Source: Huachuang Securities)