Under the spotlight of the semiconductor industry, the MCU market has always been a battleground.

Once, Texas Instruments (TI), and STMicroelectronics (ST) held the top positions in the industry due to their first-mover advantage and technological accumulation, pulling the strings of the entire industry. However, amidst the changing tides of the market, these two giants have recently found themselves in trouble.

At the same time, domestic MCU manufacturers are rapidly rising with technological breakthroughs and cost advantages, marking the beginning of an intense industry competition.

01The Giants’ Predicament: TI and ST in Crisis

01The Giants’ Predicament: TI and ST in Crisis

In March of this year, a layoff announcement put TI in the spotlight of industry opinion.

TI conducted a round of layoffs at its Lehi factory to support long-term operational plans.

According to TI’s official website, it has a total of 15 manufacturing plants worldwide, including wafer fabrication plants, packaging and testing plants, and bump processing testing plants. By 2030, the internal manufacturing ratio of TI will reach 90%.

Currently, TI has 8 12-inch wafer fabs, of which 2 are located in Lehi, Utah, USA, namely LFAB1 and LFAB2 (“L” represents Lehi).

LFAB1 produces analog and embedded semiconductors, acquired from Micron Technology’s 12-inch wafer fab in 2021, and went into production in 2022, becoming TI’s fourth 12-inch wafer fab.

LFAB2 produces analog and embedded semiconductors, broke ground in 2023, costing $11 billion, making it the largest economic investment in Utah’s history, creating about 800 additional TI jobs and thousands of indirect jobs, with the earliest production expected in 2026.

Currently, TI has not explained the specific reasons for the layoffs, but industry insiders speculate that the layoff plan is largely due to insufficient capacity utilization at the factory.

Compared to other major companies, TI‘s layoffs are not significant.

In May of last year, TI was reported to have disbanded its MCU R&D team at its Shanghai research center in China, moving the original MCU R&D line to India. This news was confirmed in November.

In addition to layoffs, TI has several indicators that have turned red.

From a performance perspective, TI‘s revenue has shown a significant decline since the fourth quarter of 2022, with a year-on-year decline starting from Q4 2022 (approximately -3%), continuing into 2023 and 2024, lasting nearly two years, until the year-on-year decline in Q4 2024 shrank to -1.7%.

TI‘s inventory levels are also not optimistic. At the end of Q4 2024, the inventory was $4.5 billion, an increase of $231 million from the previous quarter, with inventory days at 241 days, an increase of 10 days quarter-on-quarter. It is expected that the inventory level in Q1 2025 will further increase, possibly exceeding $1 billion, and then stabilize around that level.

TI also stated that supply-demand imbalance still exists. Once an industry giant, is now facing unprecedented challenges.

ST: Large-scale layoffs, even facing split challenges

Coincidentally, ST has also recently announced significant personnel adjustments.

This month, ST CEO Jean-Marc Chery announced that the company expects 5,000 employees to leave in the next three years, including the previously announced layoff plan of 2,800 employees earlier this year. It is reported that about 2,000 will leave due to natural attrition, and with voluntary departures, the total number of departures will reach 5,000.

In November of last year, STMicroelectronics detailed its cost-cutting plan, aiming to save hundreds of millions of euros by 2027, including reducing the workforce through natural attrition and early retirement.

At the same time, according to a report from one of Italy’s largest media outlets, La Stampa, on June 4, the French and Italian governments and relevant shareholders plan to study the possibility of splitting ST.

As the wave of new energy vehicles rises, ST was once one of the “big winners” in the chip market. However, as demand declines, ST is also inevitably falling into a passive position.

Looking at specific performance, in 2024, ST’s revenue and profit fell by 23.24% and 63.03%, with the net profit growth rate in Q1 2025 at -89.08%, marking the lowest quarterly profit growth rate in nearly a decade.

In terms of specific products, automotive-related analog, power discrete devices, MCU, etc., have all seen significant declines. Notably, ST’s financial report highlighted the company’s competition and volatility risks in the analog, MCU, and SiC markets.

In its core revenue-generating MCU products, the market share of general-purpose MCUs in China continues to decline due to the influence of domestic manufacturers such as GigaDevice. Automotive MCUs are also impacted by leading manufacturers like Infineon and the localization efforts of mainland Chinese manufacturers.

So how are domestic MCU companies performing? It is reported that companies such as NXP, GigaDevice, and Giga Semiconductor have successively launched products that compete with TI and ST, beginning to engage in direct competition with international leaders.

02Domestic MCUs: A Hard Clash with International Giants

02Domestic MCUs: A Hard Clash with International Giants

TI C2000 faces numerous challengers

In the journey of MCU localization, real-time control is considered the toughest “hard nut to crack”.

For many years, TI C2000 has dominated the real-time control field. Even giants like Microchip, ST, and Renesas that have made achievements in power and motor control have not been able to shake TI C2000’s position.

In recent years, with the rise of domestic MCU manufacturers, many markets have begun to see the presence of domestic MCU manufacturers. Even the previously seemingly unshakable C2000 is gradually losing ground in motor control, inverters, and servos.

NXP and Giga Semiconductor and other domestic companies have taken the initiative to directly target TI C2000 series products, launching attacks on this technological high ground.

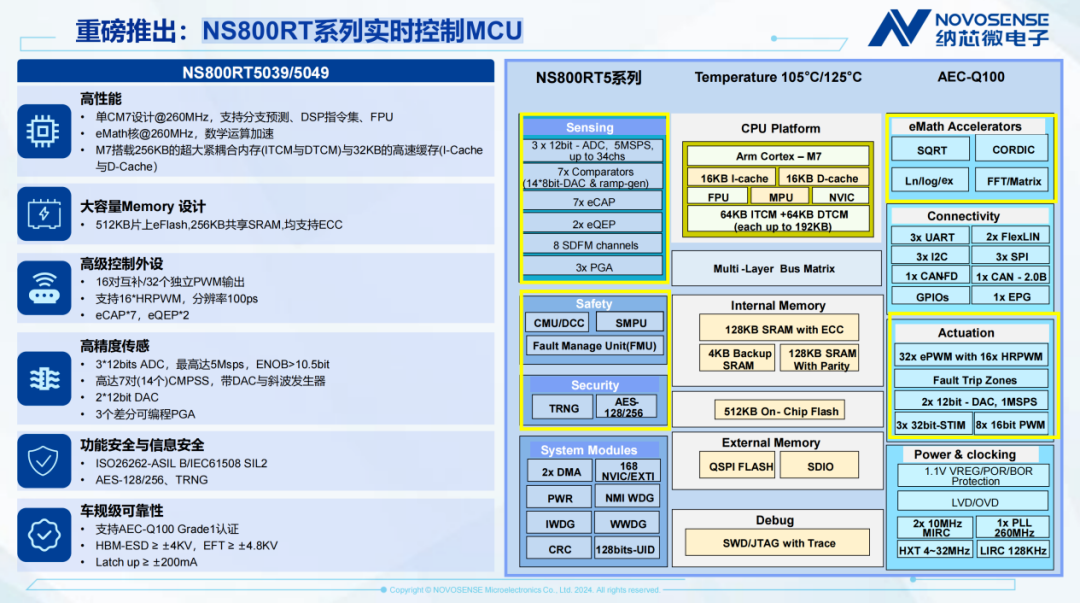

For example, NXP has launched the NS800RT5 and NS800RT3 products, precisely targeting TI C2000 models such as F280039 and F280049.

In terms of technology, users of real-time control systems are most concerned about the core issue. It is well known that C2000 is TI’s proprietary DSP core, while NXP adopts the commonly used Arm Cortex-M7 core and introduces its self-developed eMath mathematical acceleration core, which significantly enhances mathematical computation capabilities compared to the general Arm Cortex-M7 in digital signal processing operations such as trigonometric functions, square roots, exponentials, logarithms, Fourier transforms (FFT), matrix operations, and FIR filtering.

In addition to the improvement in computing power, NXP has also made improvements in the expansion of storage and key real-time peripherals in the NS800RT series.

More quantity without increasing price is also one of NXP’s advantages.

According to NXP’s MCU market director, Song Kunpeng, although it is a direct competition, the product definition stage is not a complete copy, but rather a comprehensive innovation based on customer pain points in terms of real-time performance, scalability, and security, which are clearly key aspects of real-time control MCUs. Of course, considering that both of TI’s products were launched several years ago, it is natural for newcomers to innovate and upgrade.

Recently, Giga Semiconductor officially released the G32R501 real-time control MCU based on the Arm Cortex-M52 dual-core architecture and supporting Arm Helium technology, officially entering the market dominated by TI C2000.

According to reports, the G32R501 real-time control MCU is based on the Arm v8.1-M architecture, featuring a new generation of high-efficiency processors with excellent real-time computing performance, achieving 2.7 times DSP performance and 5.6 times ML performance improvement while maintaining easy migration from Cortex-M4F and Cortex-M33, meeting most real-time control needs, mainly due to the extensions brought by Arm on this architecture—Helium. As a vector extension (MVE) of the Arm Cortex-M processor series, as mentioned above, Helium technology can provide significant performance improvements for machine learning (ML) and digital signal processing (DSP) applications.

Based on the above hardware configuration, and leveraging Giga’s ACI-based CDE (Customer Datapath Extension) interface, it can perfectly integrate Giga’s self-developed Zidian mathematical instruction extension unit with the Cortex-M52 core, enabling support for FFT operations, complex mathematical operations, trigonometric functions, Fourier transforms, and various mathematical acceleration operations at the instruction set level, further enhancing real-time control computing efficiency and significantly reducing CPU access latency.

In addition, this chip also supports TCM and has enhanced real-time control and many other functions.

Although these companies are not yet a threat to the C2000’s throne, it is certain that the C2000 is facing market pressure.

The reasons are twofold: on one hand, some products in the market do not have such high requirements for real-time control; on the other hand, these markets require a bus architecture for interoperability, which is precisely what the C2000 core lacks and what Arm excels at; additionally, pricing and market strategies are also reasons why the C2000 is starting to lose this territory. As NXP’s CEO Wang Shengyang stated, the years of chip shortages have made users realize that “it is very unsafe for such a critical category of products to be solely supplied by one company.”

STM32 is no longer alone

In the general MCU market, competition between domestic MCU brands such as GD32 and STM32 is also becoming increasingly fierce.

GigaDevice’s GD32, as a leader in the Chinese 32-bit general-purpose MCU field, has secured an important position in the market with over 200 million units shipped, more than 10,000 users, and a large lineup of over 300 product models across 20 series. GD32 adopts the Cortex-M3 core, achieving full compatibility with the same models as STM32, making it easy for users to replace, and has a higher clock frequency, successfully replacing STM32 in numerous applications in smart homes, industrial control, and more.

Zhongke Core’s 32-bit MCU products can replace STM32’s F103, F030, F031, and F051 series in bulk. Based on the ARM architecture, it covers eight major series of products with Cortex-M0, M3, and M4 cores, with hardware pin compatibility with STM32 P2P, and software designed for register-level compatibility, allowing programs developed for ST series MCUs to be directly burned into the corresponding models of Zhongke Core’s MCUs without excessive modifications.

Lingdong Microelectronics‘s MM32 series, based on ARM Cortex-M0 and Cortex-M3 cores, includes: MM32F series for general high-performance markets, MM32L series for ultra-low power and secure applications, MM32W series with various wireless connectivity features, MM32SPIN series for motor drive and control, and OTP-type MM32P series, all of which are fully compatible with ST, resulting in low replacement costs.

Giga Semiconductor ‘s general MCU APM32 series is designed based on the ARM Cortex M3 series CPU, featuring a self-designed 32-bit CPU. APM32F030, APM32F103, and APM32F072 can directly replace the corresponding STM32 models.

In addition, many domestic MCU companies such as Yateli, Guomin Technology, Xinhai Technology, and Huada Semiconductor also have products that can directly compete with STM32.

03Waiting for a Breeze: The MCU Market Has Changed

03Waiting for a Breeze: The MCU Market Has Changed

Domestic MCUs are rising, but they are also extremely competitive. This is the current situation.

Faced with the cost advantages of domestic MCUs, imported brands are “losing” in this price war. The impact is not limited to ST and TI.

It is reported that in some product areas, frequent price comparisons have become the norm, and even if a domestic MCU has already been selected, there is always the possibility of switching to a lower-priced alternative.

The price war is the result of multiple factors at play. On one hand, global semiconductor capacity expansion has led to an oversupply in the MCU market; on the other hand, the market demand structure has changed, with consumers increasingly demanding cost-performance ratios, which domestic MCUs happen to meet. In addition, domestic MCU manufacturers are continuously optimizing production processes and supply chain management, further reducing costs and providing solid support for price competition.

The changes in market dynamics are not only reflected in price competition but also in aspects such as foundry cooperation and supply chain adjustments. ST announced that it will entrust the production of 40nm process node MCUs to Huahong Semiconductor, breaking the previous industry pattern. For ST, this move allows it to optimize its capacity layout by leveraging Huahong Semiconductor’s capacity and cost advantages; for Huahong Semiconductor, it is a good opportunity to enhance technology and expand the market.

NXP has also released positive signals, stating that it will establish a dedicated chip supply chain for Chinese customers. Behind this is the increasing importance of the Chinese market and the pressure brought by domestic MCU competition. Establishing a dedicated supply chain will help NXP improve its response speed and service quality in the Chinese market, enhance customer loyalty, and also alleviate the competitive pressure brought by domestic MCUs.

Looking ahead, the changes in the MCU market dynamics will bring new opportunities and challenges. Domestic MCUs are expected to achieve breakthroughs in high-end markets, breaking the monopoly of international giants through technological innovation and product upgrades. At the same time, cooperation between international and domestic manufacturers in technology research and development, market channels, and other aspects may become more frequent, achieving complementary advantages. The future of the domestic MCU industry is worth watching.