Related Articles

-

[Financial Industry ESG] Climate and Environmental Stress Testing Series Article One: Concepts, Regulations, Practices, and Challenges

Introduction

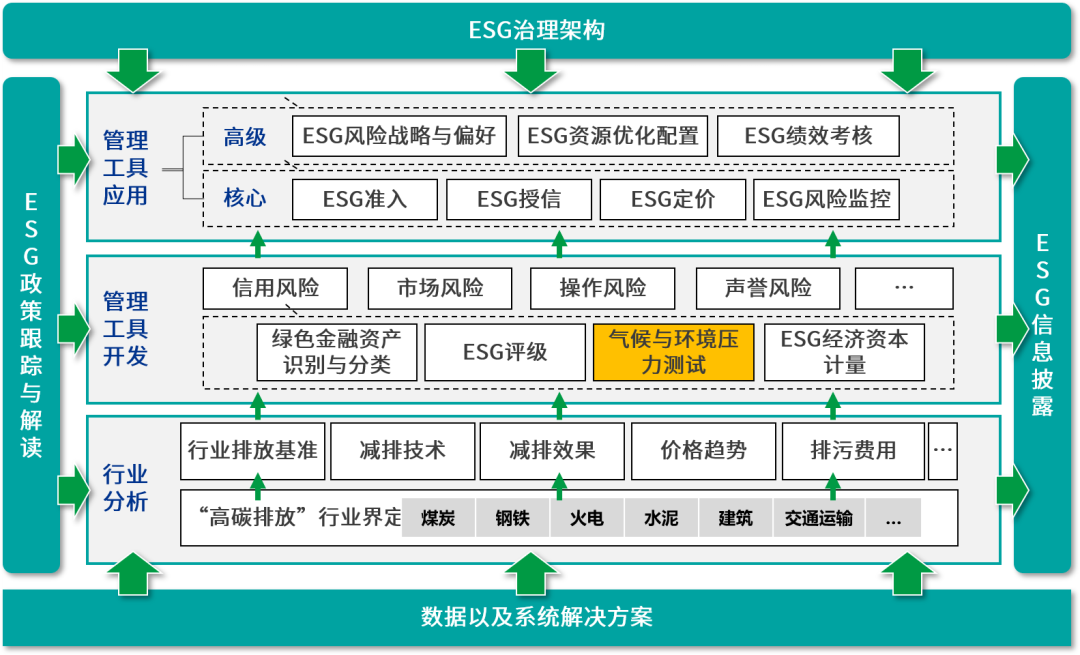

Climate and environmental stress testing is an important component of KPMG’s green finance and ESG (Environmental, Social, and Governance) solutions. In addition to climate and environmental stress testing, we also cover aspects such as industry analysis, green finance asset identification and classification, ESG ratings, and ESG capital measurement, as shown in the figure below. Climate and environmental stress testing is not an isolated module; it is closely linked with other modules in the solutions, including ESG risk strategy and preferences, industry analysis, as well as data and system solutions.

In “Climate and Environmental Stress Testing Article One: Concepts, Regulations, Practices, and Challenges,” we elaborated on the basic concepts of climate and environmental stress testing, regulatory developments, practices of domestic and foreign financial institutions, and future challenges. In this article, we will mainly introduce the framework, models, and applications of climate and environmental stress testing.

Climate and Environmental Stress Testing Framework

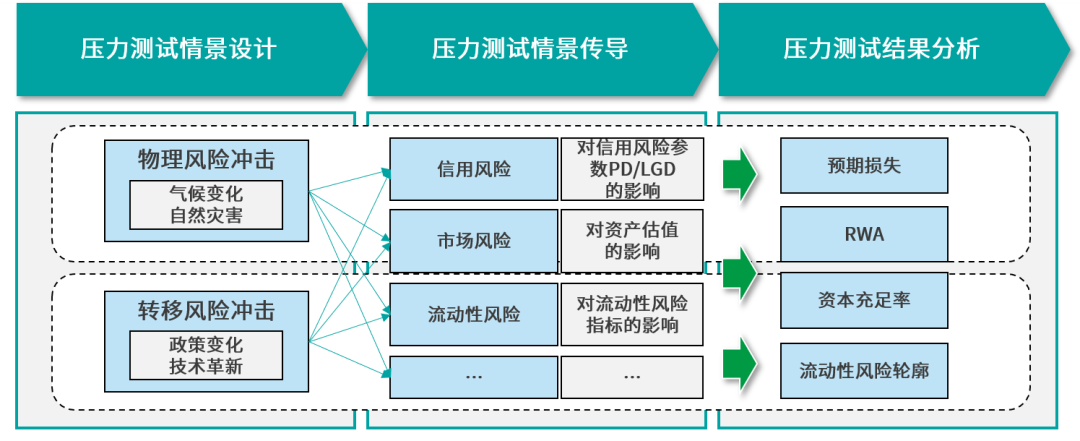

KPMG has assisted several large state-owned banks in implementing climate and environmental risk stress testing. Our methodological framework is shown in the figure above, including basic work modules such as stress testing scenario design, stress testing scenario transmission, and stress testing result analysis.

▶ First, the stress testing scenario design considers physical risks, where stress scenarios mainly consider sea level rise, extreme weather, etc. For transition risks, the focus is primarily on changes in policy and technological innovations under the pressures of environmental degradation and climate change.

▶ Second, the stress testing scenario transmission estimates the impact on various risk categories under the stress scenarios of physical or transition risks. For example, for credit risk, the focus is on the impact on credit risk parameters PD and LGD. For market risk, the focus is on the impact on asset valuation. For liquidity risk, the focus is on the impact on liquidity risk indicators.

▶ Finally, the stress testing result analysis integrates the results of stress testing across various risk categories to comprehensively assess the impact on expected losses, risk-weighted assets (RWA), capital adequacy ratios, and liquidity risk profiles. Furthermore, based on the result analysis, a climate and environmental risk-oriented decision-making mechanism and internal policies are established to mitigate and respond to environmental risks.

Stress Testing Scenario Design

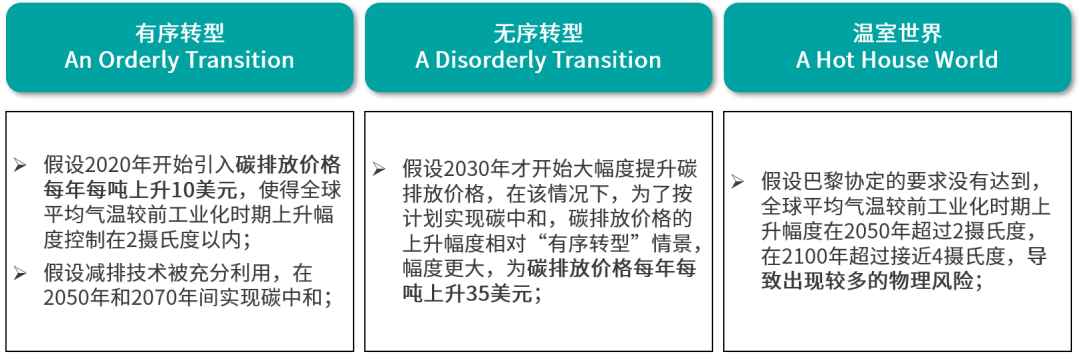

For climate and environmental stress testing, the NGFS (Network for Greening the Financial System) published the “Guide to Climate Scenario Analysis for Central Banks and Supervisors” in June 2020, providing detailed methods for climate and environmental stress testing scenario analysis for central banks and regulators, as shown in the figure above.

In the stress testing scenario design process, it is essential to focus on the sources of risk. The sources of physical risks include various extreme weather events, sea level rise, ecological environmental pollution incidents, and the destruction and depletion of natural resources. Transition risks mainly have two sources: one is policy changes, such as various environmental policies and regulations to curb the consumption of polluting products and financial subsidies for environmentally friendly enterprises and products. The other source is technological advancements, such as innovations in clean energy, energy conservation, clean transportation, and green building.

The NGFS climate and environmental risk scenarios provide a solid foundation for domestic financial institutions to design climate and environmental stress testing scenarios. However, domestic financial institutions still need to pay attention to the following aspects in stress testing scenario design:

▶ Establish a pressure testing scenario library suitable for China, including carbon emission indicators, carbon trading prices, climate change indicators, macroeconomic indicators, etc.;

▶ Stress testing scenarios need to distinguish between mild, moderate, and severe stress levels;

▶ The time span of the forecast period should cover 3 years, 5 years, or even longer periods of 30 years or 40 years.

Stress Testing Scenario Transmission

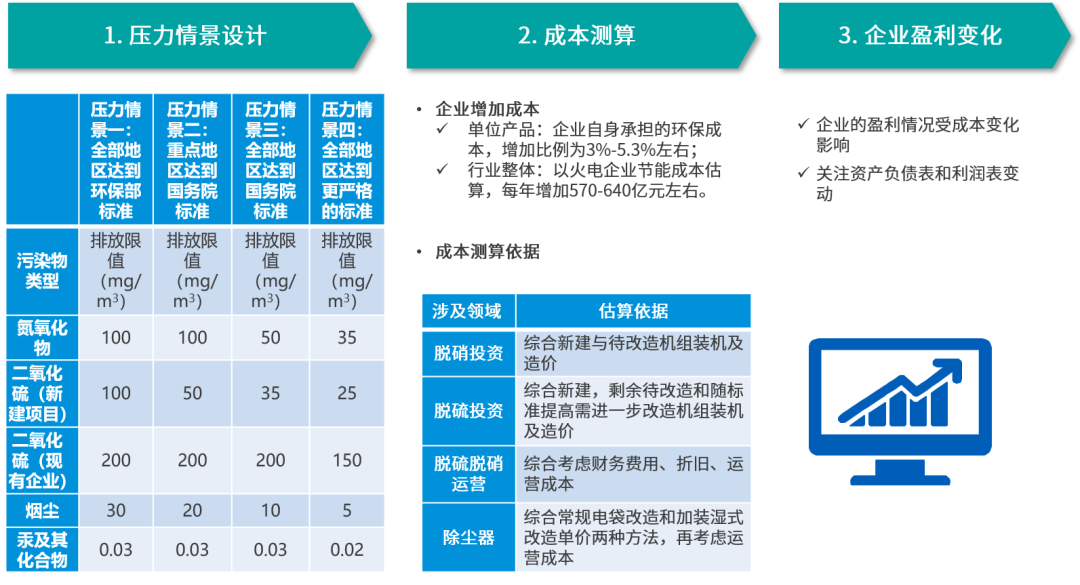

In climate and environmental stress testing, financial institutions are more concerned about transition risks. The above is an example of KPMG’s transition risk pressure transmission model. In this process, the focus is on translating the impacts at the industry and macroeconomic level into the impacts on micro-enterprises, such as reflecting these impacts in the changes of various financial indicators on corporate financial statements.

For physical risks, the key is to establish estimation models for disaster losses. Disasters can lead to direct and indirect losses. Direct losses include damages to physical assets, while indirect losses refer to losses caused by reduced production due to disasters. Estimating disaster losses requires modeling analysis based on the relationship between disaster intensity and disaster losses.

In constructing the pressure transmission model for climate and environmental stress testing, the challenge lies in handling the relationships among economic variables, energy industry parameters, and the impacts on enterprises. Climate and environmental factors do not directly affect the revenues and costs of enterprises but often influence them through impacts on macroeconomics, regional economies, and the supply and pricing of industries. Therefore, before constructing a model to analyze the impacts of climate and environmental risk factors on enterprises, industry analysis theories must be supported, such as assessing the supply and demand changes of various energy types under 1.5 or 2 degrees Celsius, required carbon price changes, and changes in macroeconomic indicators.

Stress Testing Result Analysis

Through climate and environmental stress testing, financial institutions can obtain analyses of the impacts of climate and environmental factors on their various risk categories, thereby obtaining analysis results for the expected losses, risk-weighted assets (RWA), capital adequacy ratios, and liquidity risk profiles at the corporate level of the entire financial institution. Based on these analysis results, the most direct application is that financial institutions can formulate corresponding mitigation measures to reduce their exposure to climate and environmental risks in assets and operations, such as limiting the proportion of holdings in high-carbon assets and optimizing the disclosure and management of environmental risk information.

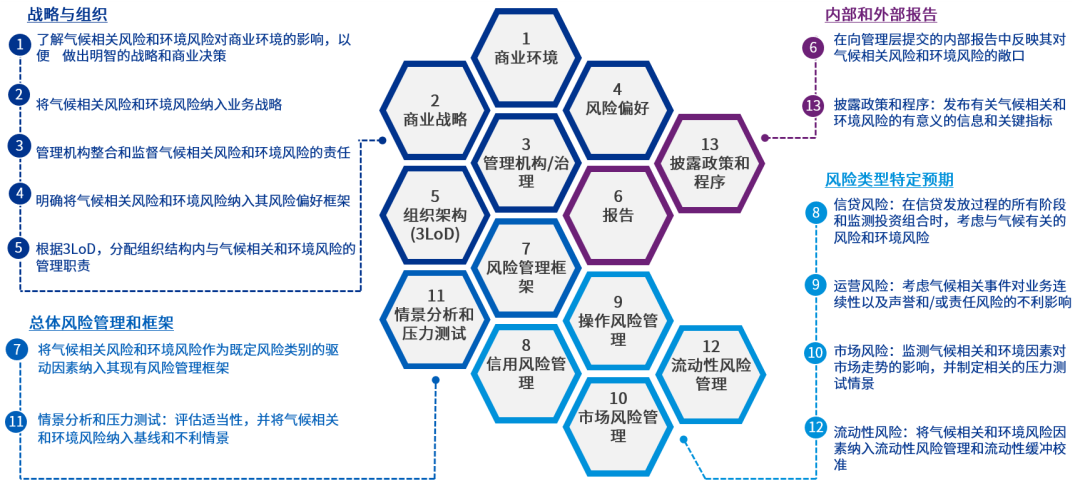

In addition to the direct applications mentioned above, broadly speaking, the applications of climate and environmental stress testing should integrate with various domains of financial institution risk management, including but not limited to the following aspects:

▶ In terms of strategy and organization, incorporate climate and environmental risk factors into the risk strategy and preferences of financial institutions. At the same time, clarify the management responsibilities related to climate and environmental risks;

▶ In terms of overall risk management and framework, climate and environmental risks should be established as a defined risk category;

▶ In specific risk management aspects, such as credit risk, operational risk, market risk, and liquidity risk management, climate and environmental risk factors should be included;

▶ In both internal and external aspects, relevant disclosure information related to climate and environmental risks should be included.

Climate and environmental stress testing is a recent hot topic, and KPMG has accumulated rich case experience in this field. In the third article of the climate and environmental stress testing series, we will introduce KPMG’s classic cases in the field of climate and environmental stress testing, so stay tuned.

Contact Us

Zhang Chudong

Financial IndustryManaging Partner

KPMG China

Cao Jin

Partner in Financial Risk Management Consulting

KPMG China

Zhao Peng Partner in Financial Risk Management Consulting Services

KPMG China

Zhang Xun

Partner in Financial Risk Management Consulting Services

KPMG China

Yang Na

Director of Financial Risk Management Consulting Services

KPMG China

Li Lishu

Director of Financial Risk Management Consulting Services

KPMG China