Overview of Automotive Chips

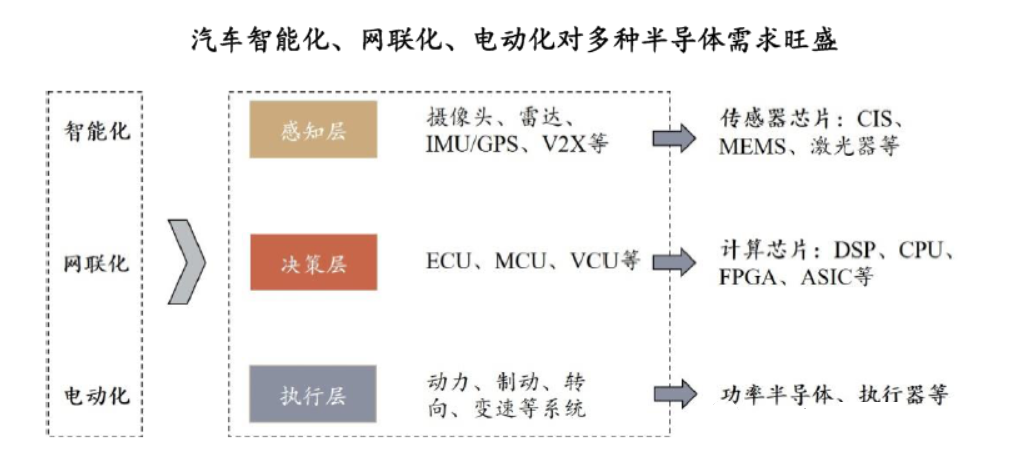

Looking at the different control levels of vehicles, the new device demands brought about by vehicle intelligence and connectivity mainly lie in the perception and decision-making layers, including cameras, radars, IMU/GPS, V2X, ECU, etc., which directly drive the growth of various sensor chips and computing chips. The electrification of vehicles has a more direct impact on the execution layer, which includes power, braking, steering, and transmission systems, resulting in a significant increase in the demand for power semiconductors and actuators compared to traditional fuel vehicles.

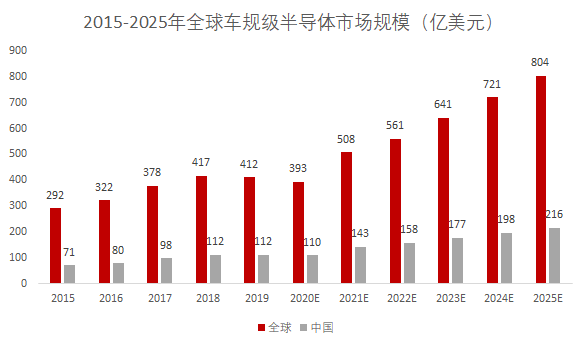

Market Size of Automotive Chips

The booming development of the mobile phone sector has been the main driving force behind the rapid growth of the semiconductor industry over the past decade. The electrification and intelligence of automobiles are expected to become a new growth engine for the semiconductor industry, and the industrial transformation will certainly give rise to new tech companies and industry leaders. In the future, automobiles will become the primary driving force for overall growth in the semiconductor industry, similar to mobile phones and computers, with more advanced autonomous driving as the focus. Intelligent cockpits, in-vehicle Ethernet, and in-vehicle information systems will create new demands for semiconductors.

The number of chips equipped in new energy vehicles is approximately 1.5 times that of traditional fuel vehicles, and it is expected that by 2028, the semiconductor content per vehicle will double compared to 2021. The higher the level of autonomous driving, the greater the number of sensor chips required; L3 autonomous driving typically requires an average of 8 sensor chips, while L5 autonomous driving requires up to 20 sensor chips.

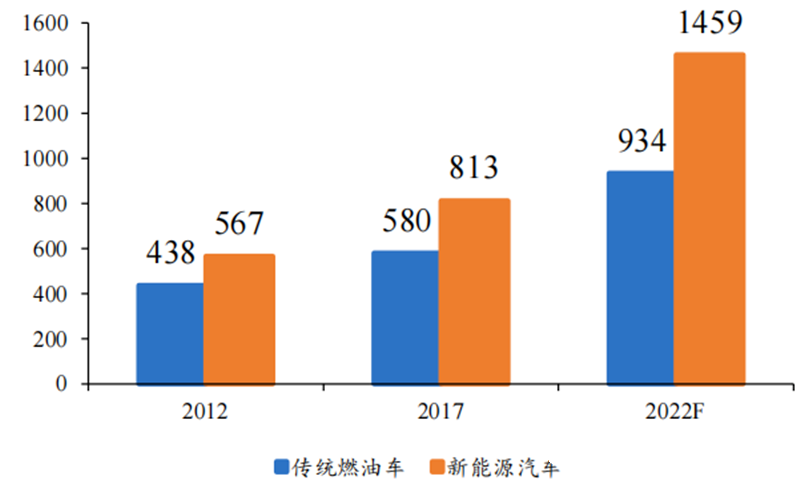

The amount of information that needs to be processed and stored in the same vehicle is positively correlated with the maturity of autonomous driving technology, further increasing the number of control and storage chips equipped. According to statistics, by 2022, the average number of chips equipped in new energy vehicles is approximately 1459, while traditional fuel vehicles have about 934 chips. Strategy Analytics predicts that the average silicon content per vehicle will double from $530/vehicle in 2021 to over $1000 by 2028, with high-end manufactured vehicles potentially exceeding $3000 in silicon content.

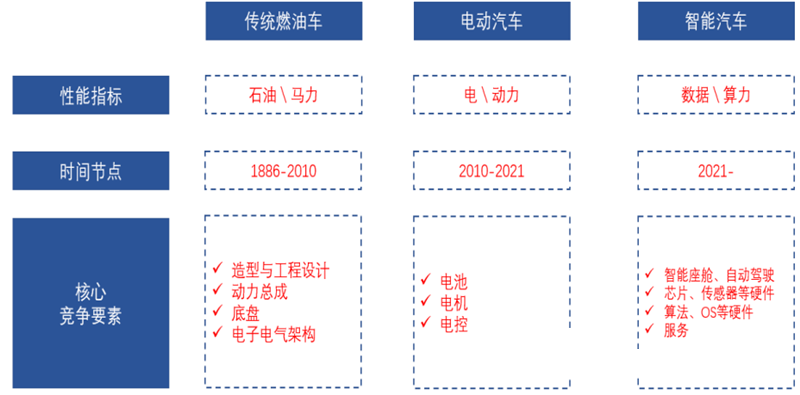

Comparison of Different Types of Vehicles

Number of Chips Equipped in Each Vehicle in China from 2012 to 2022 (Unit: pieces)

Compared to traditional vehicles, automotive-grade chips are semiconductors that meet the specifications and standards for automotive electronic components. The increase in data volume for smart vehicles has significantly raised the demand for high-performance chips. According to statistics from Omdia, the global automotive-grade semiconductor market size was approximately $41.2 billion in 2019 and is expected to reach $80.4 billion by 2025; the automotive-grade semiconductor market size in China was approximately $11.2 billion in 2019, accounting for about 27.2% of the global market, and is expected to reach $21.6 billion by 2025.

Source: Omdia, Gaohe Investment Research Center

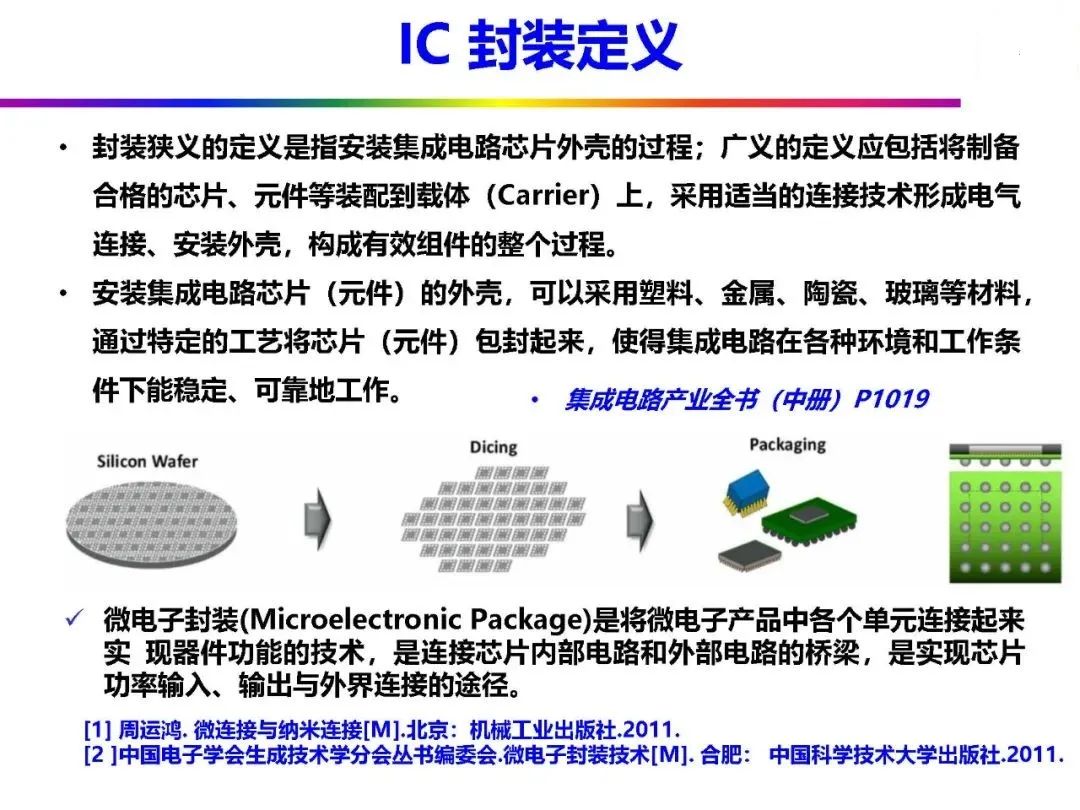

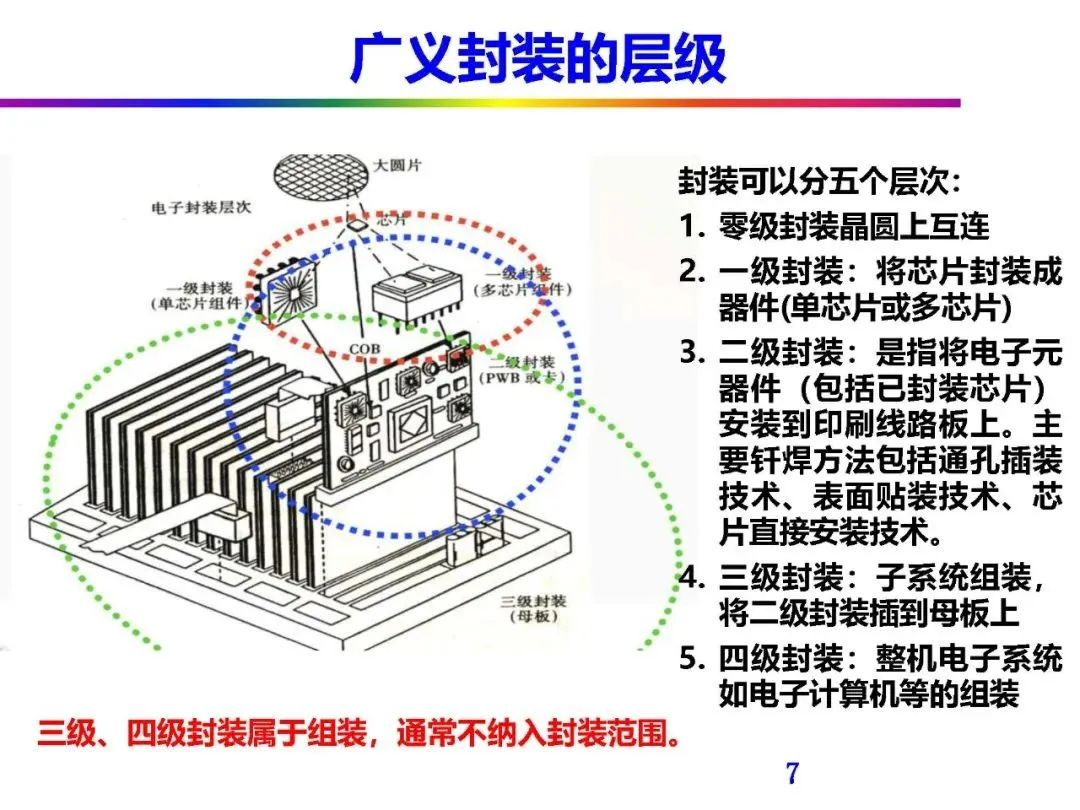

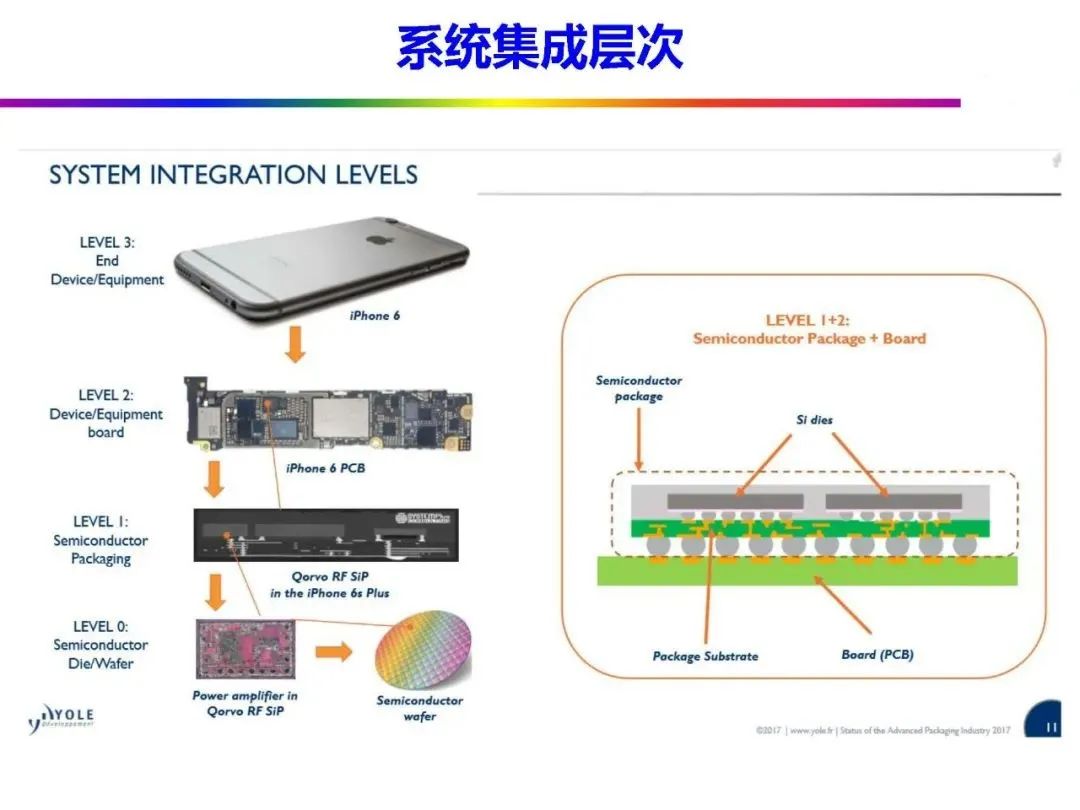

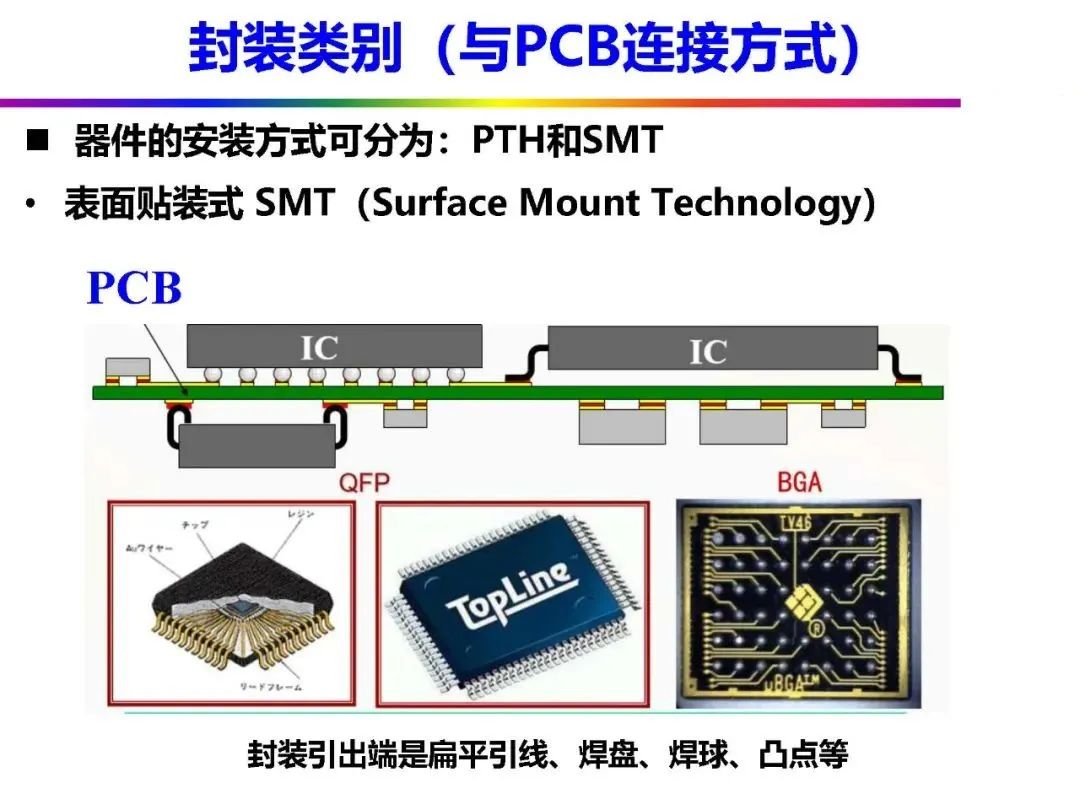

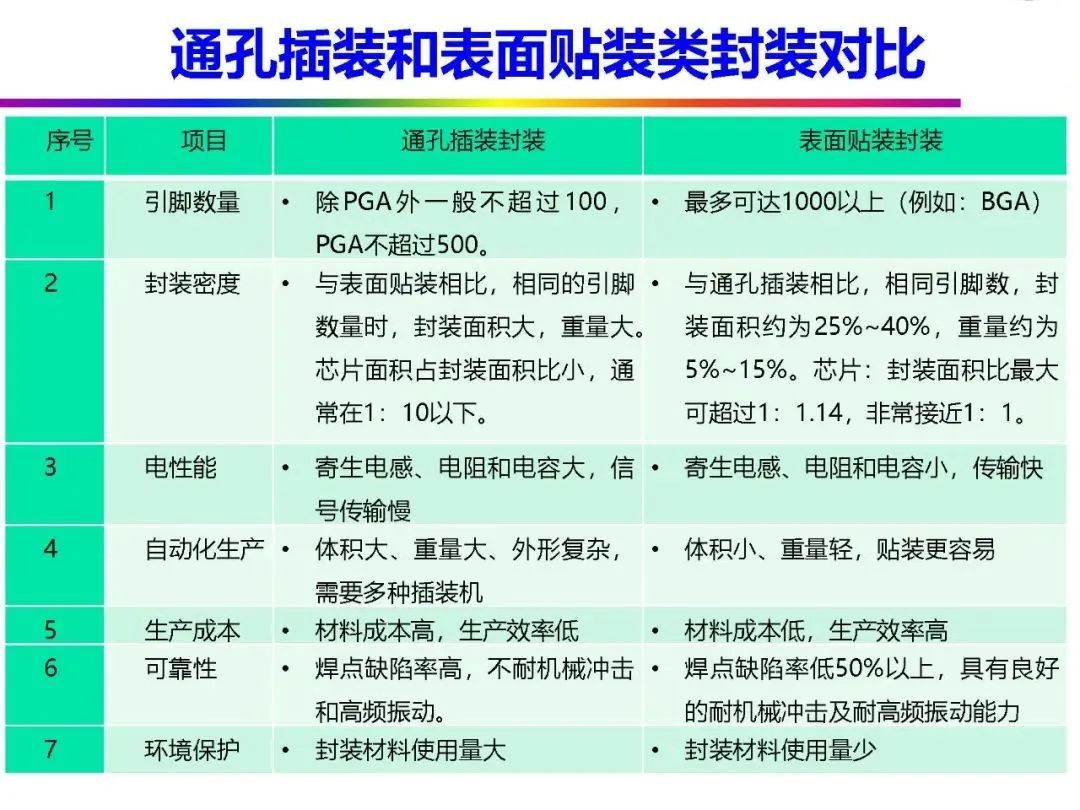

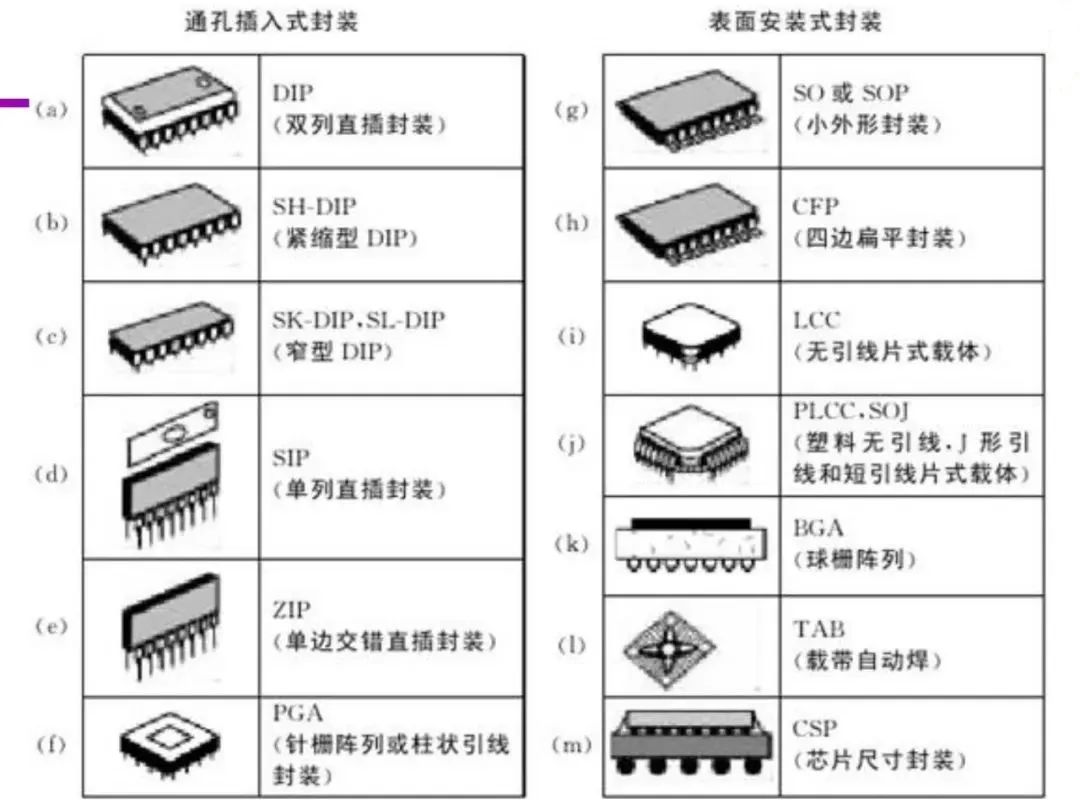

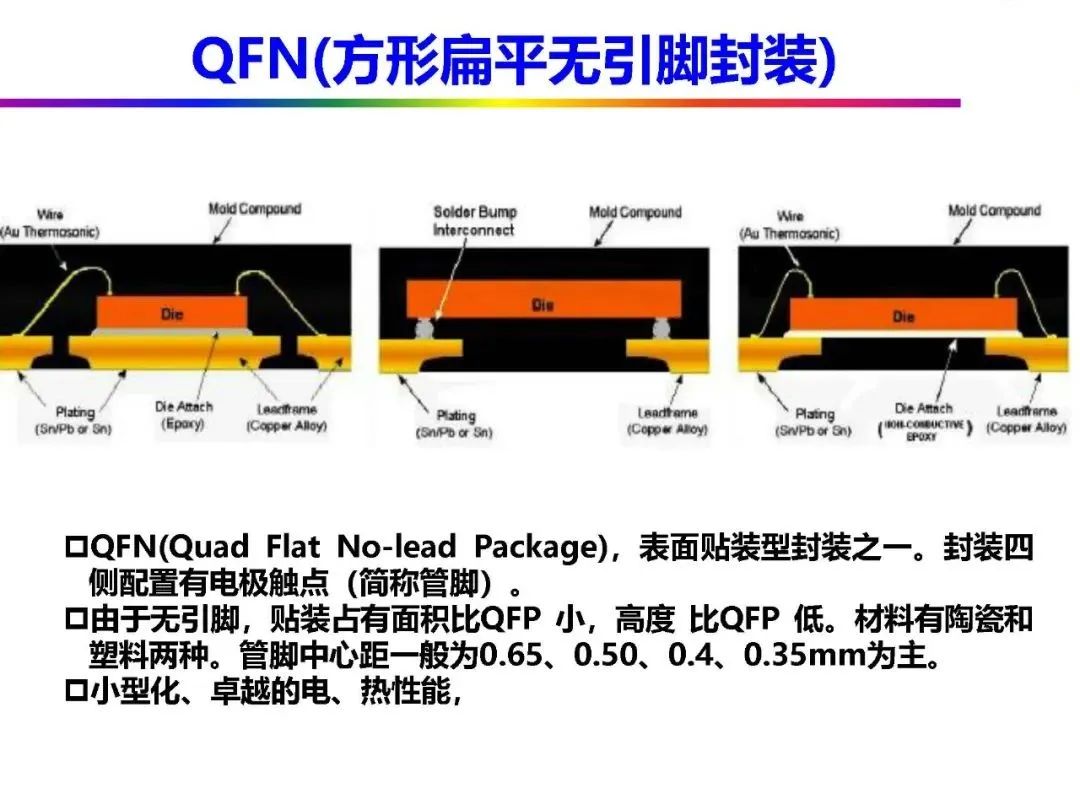

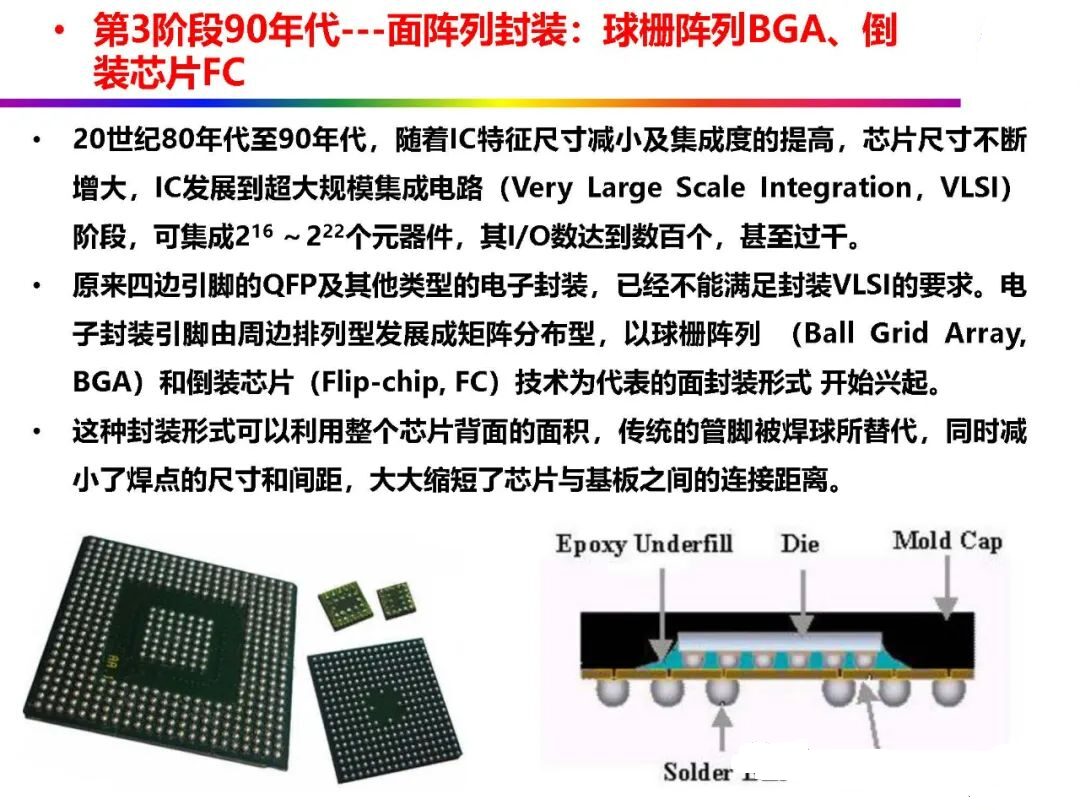

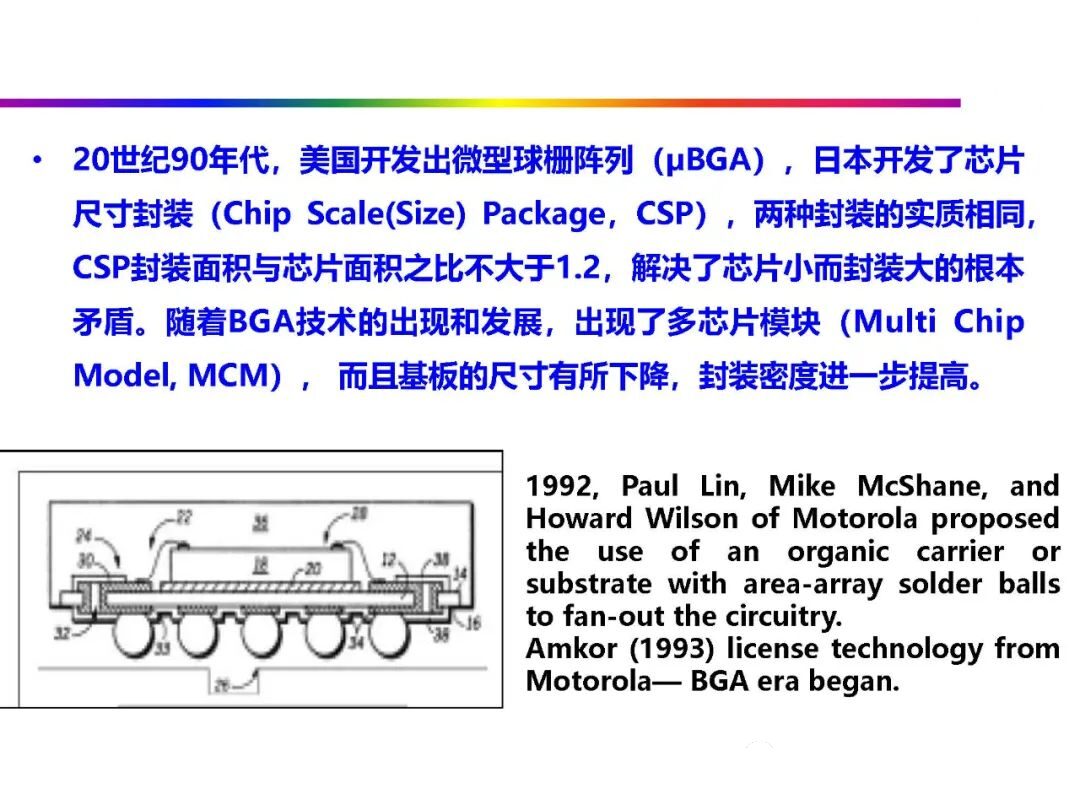

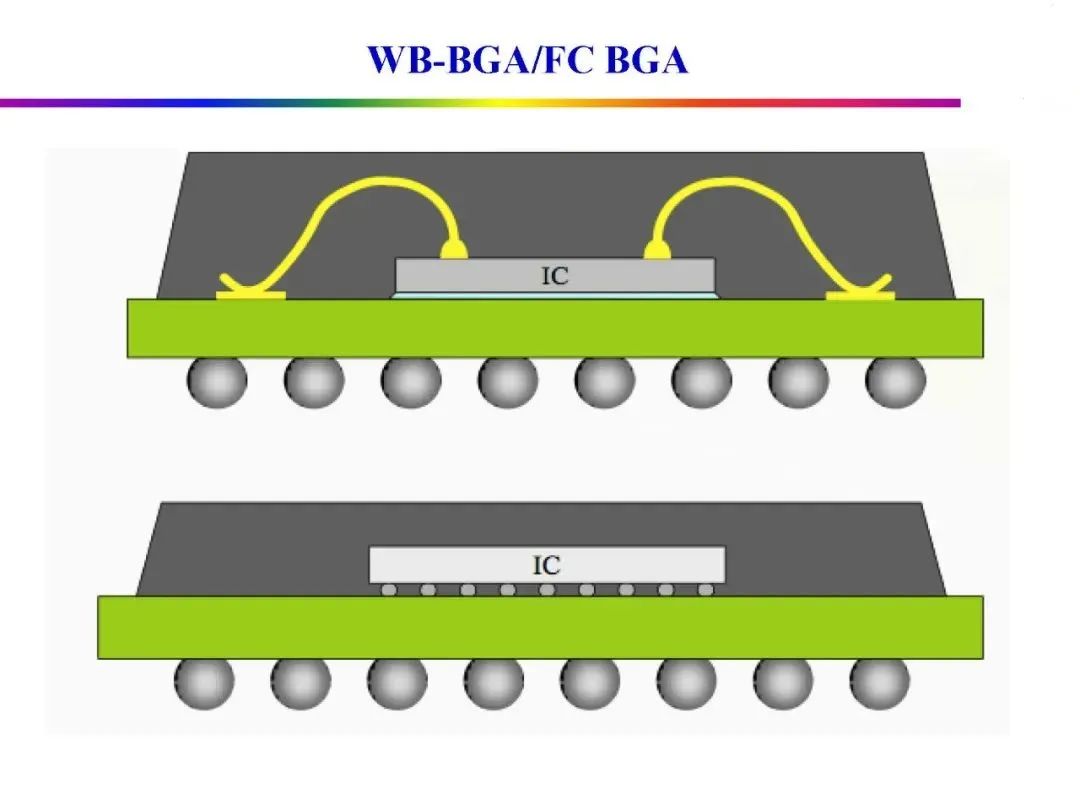

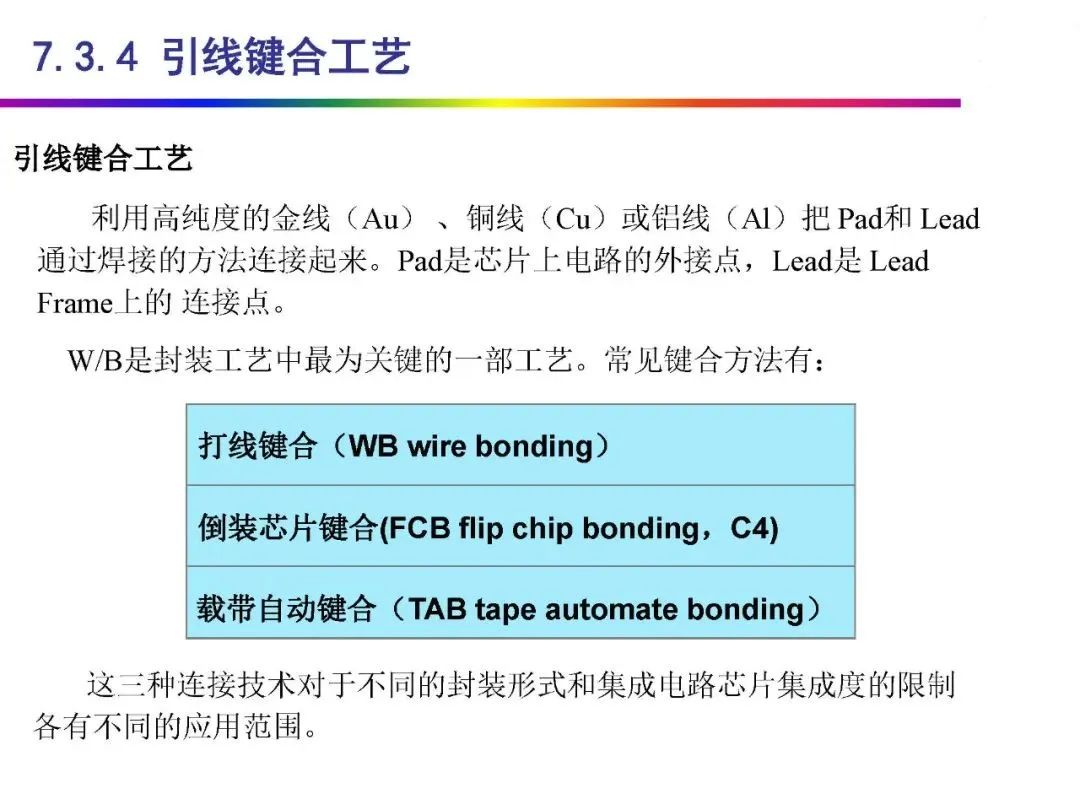

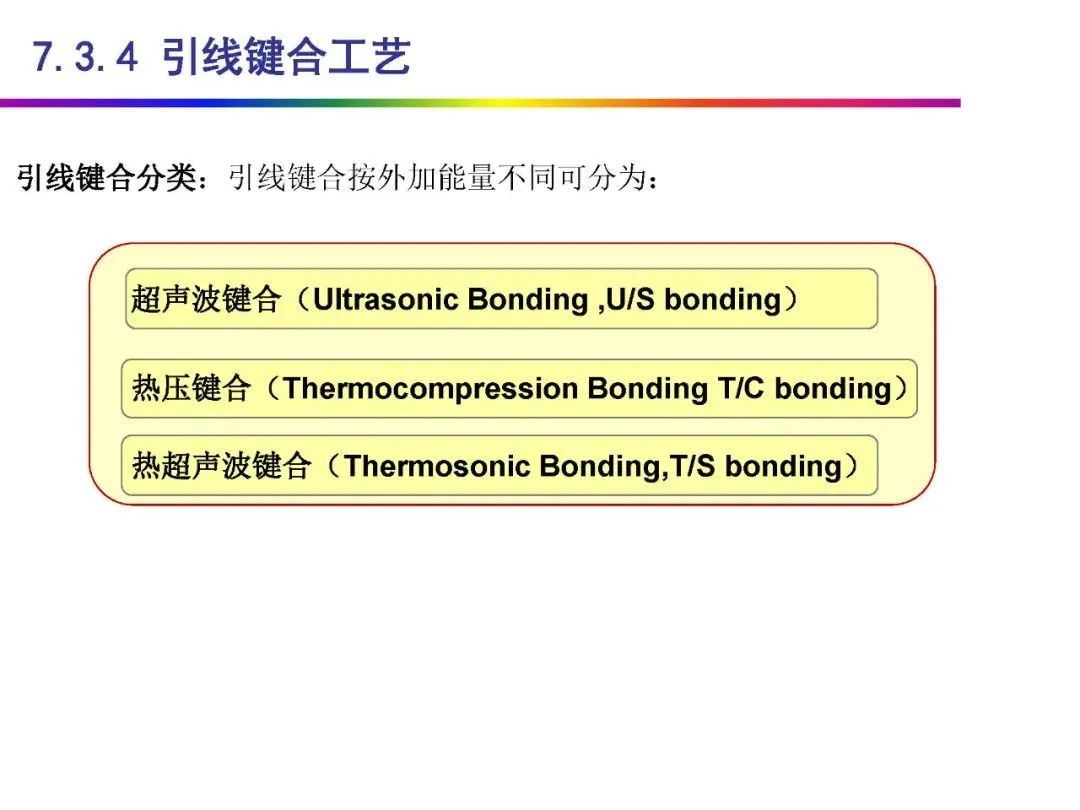

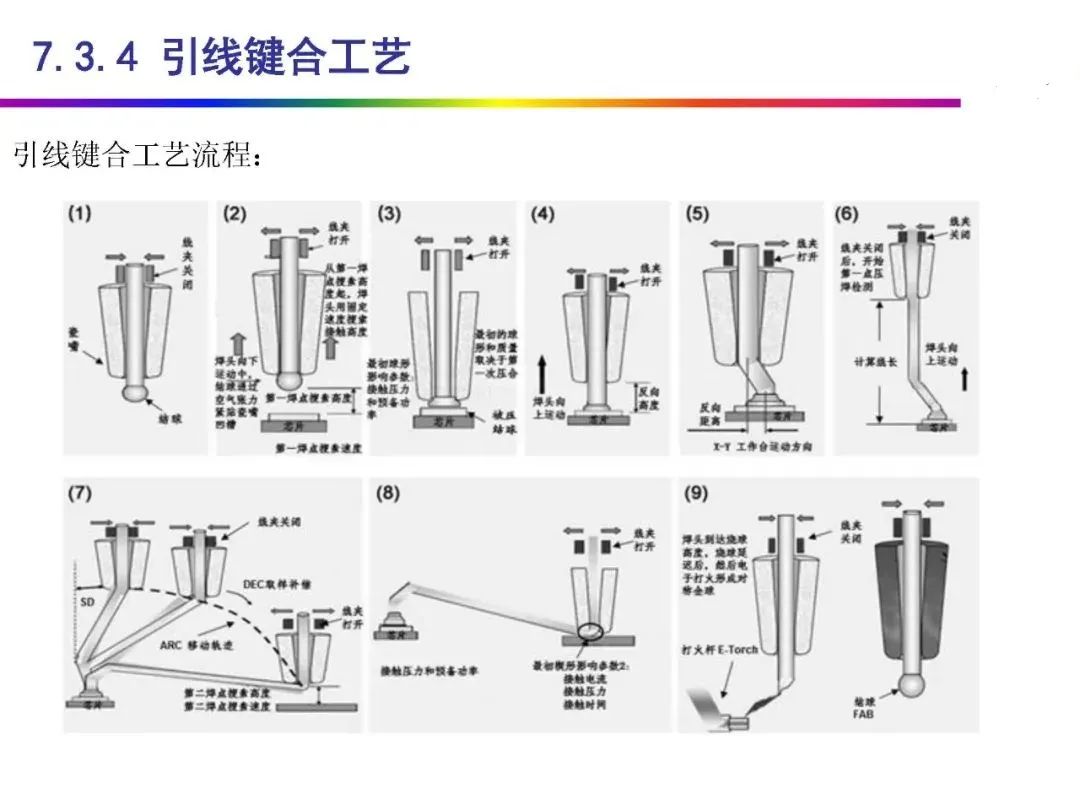

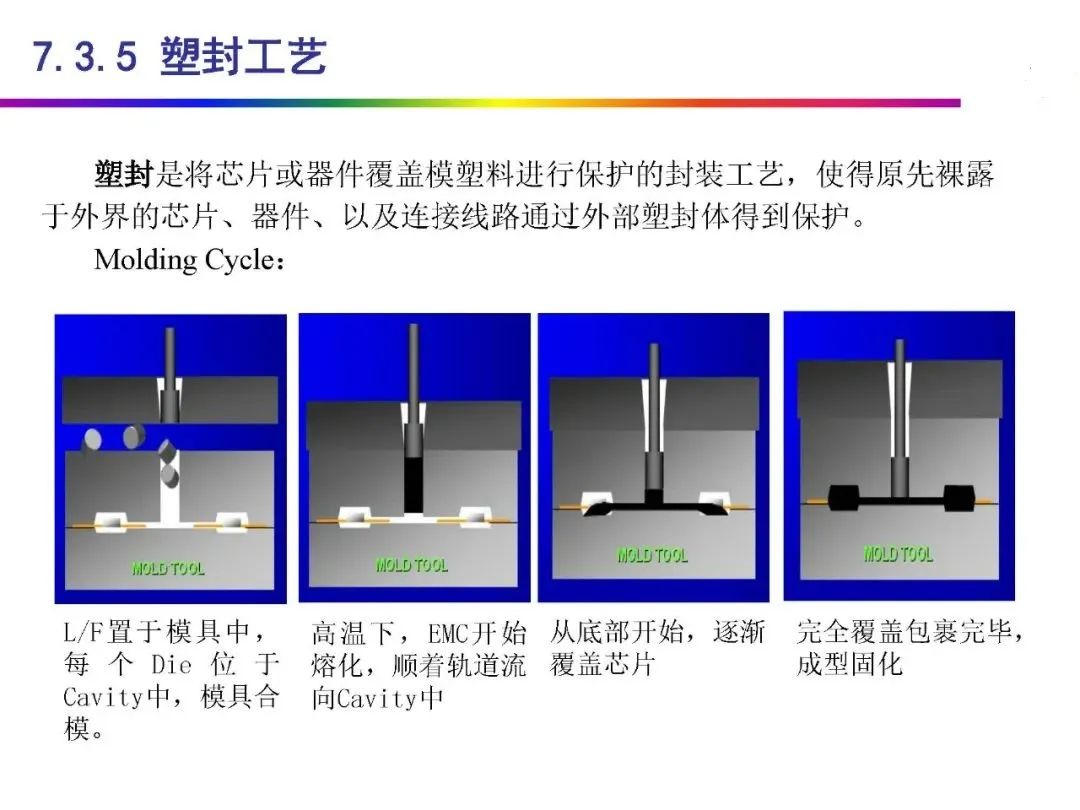

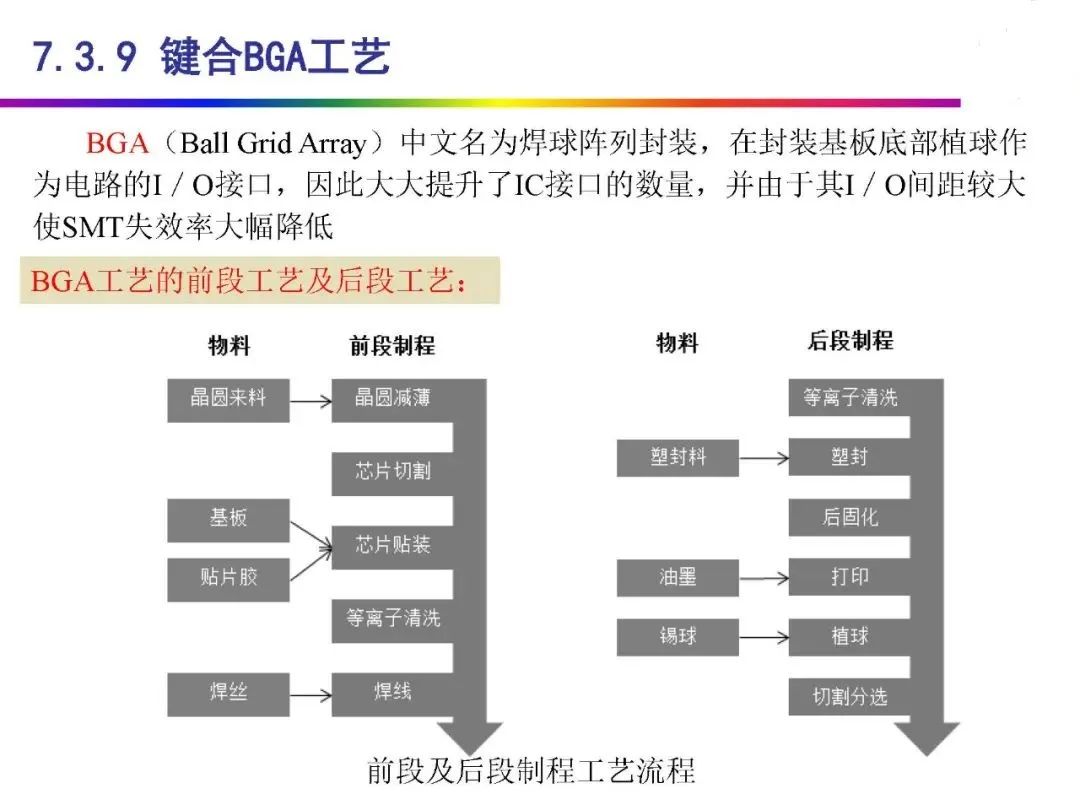

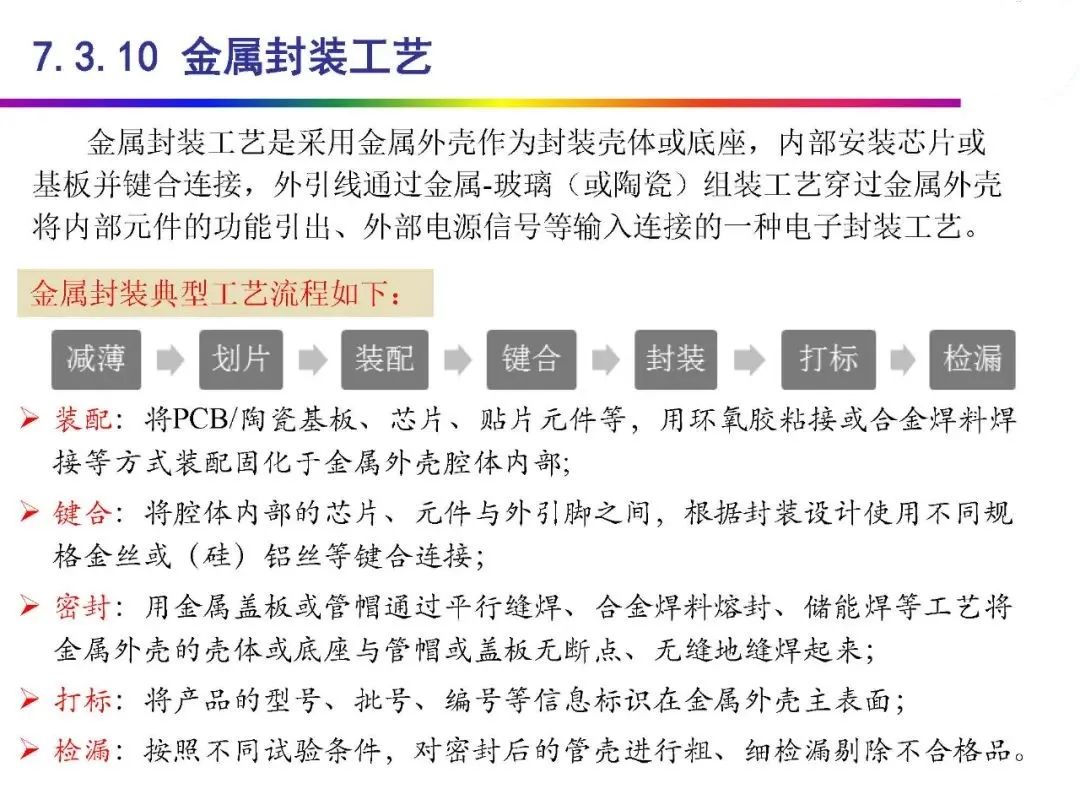

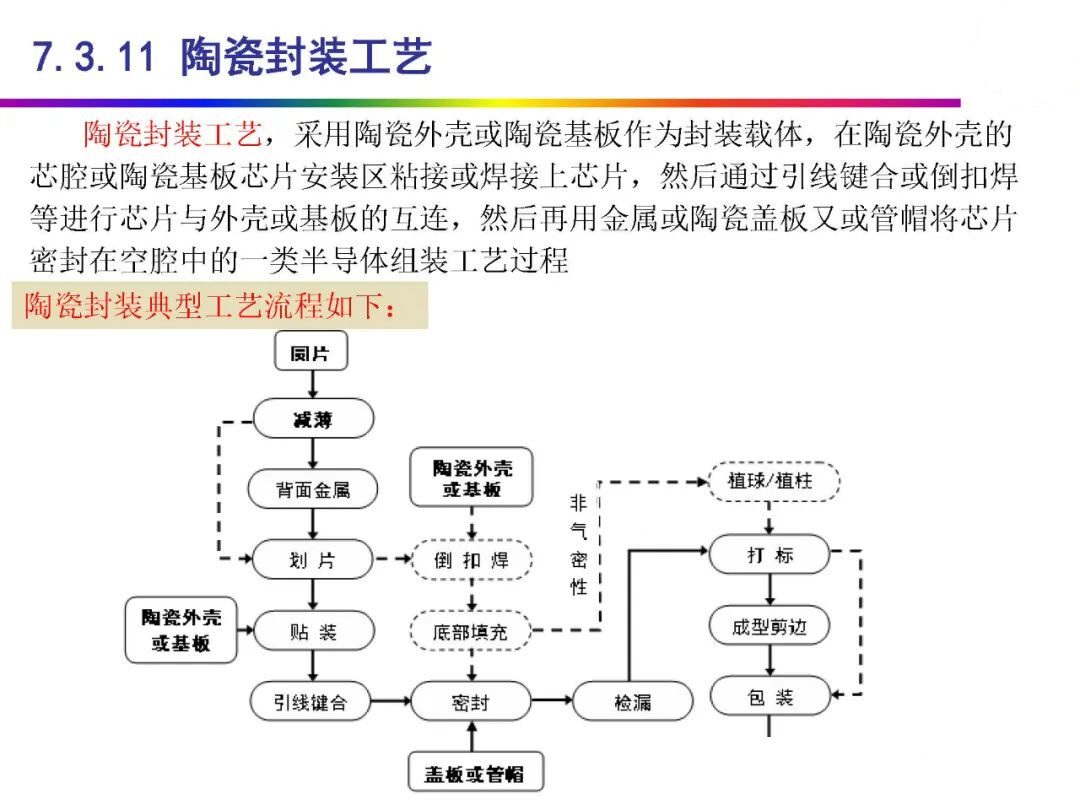

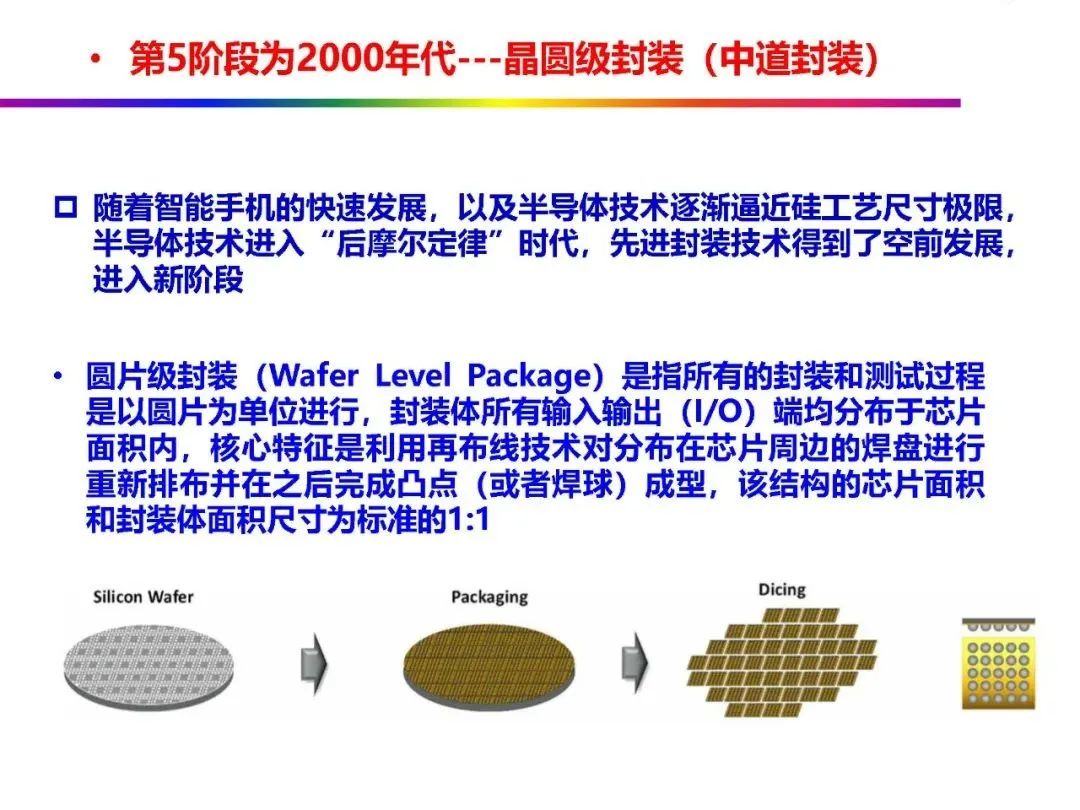

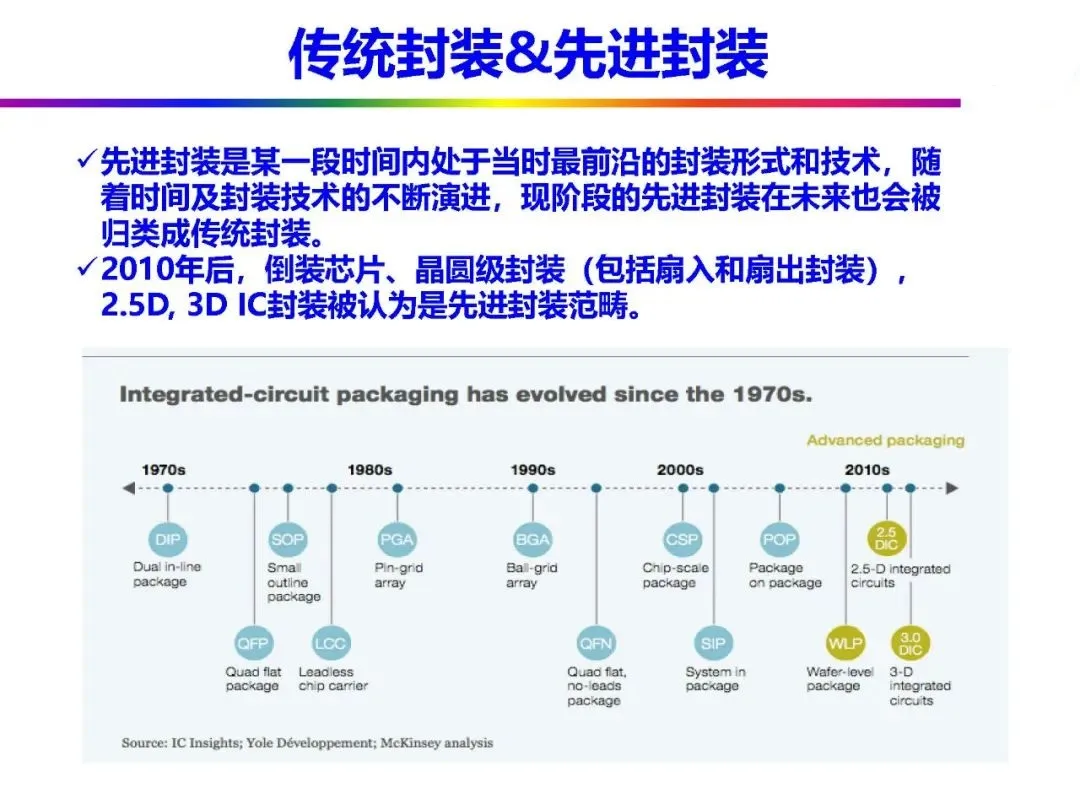

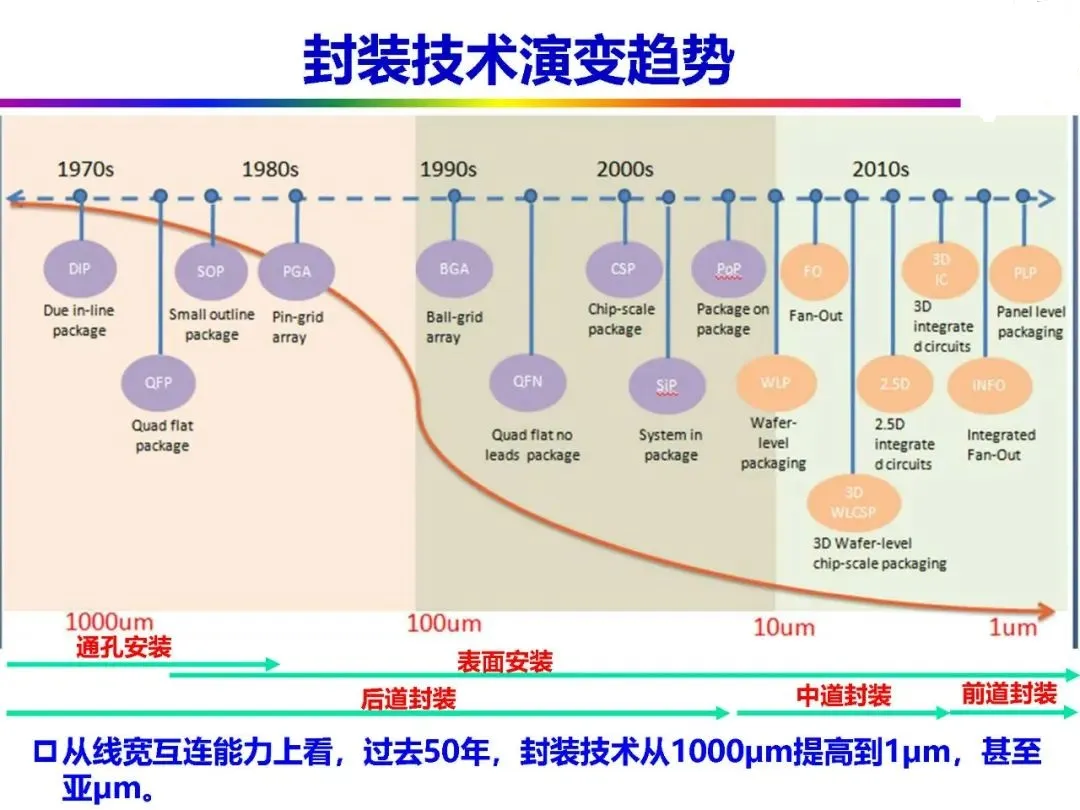

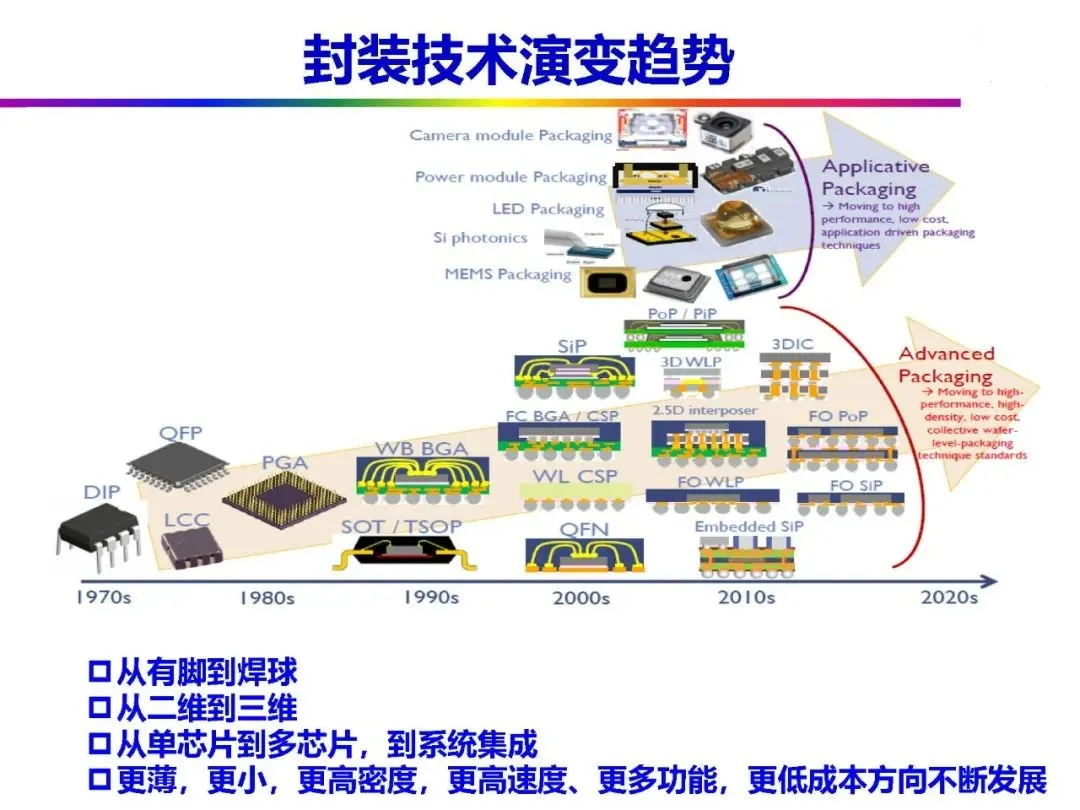

Chip Packaging

Source: SSTARCAR

Welcome to All Automotive Industry Chain (Including Power Battery Industry Chain) Angel Round,ARound Enterprises to Join the Group (Will recommend to over 1000 automotive investors including top institutions); There are communication groups for innovative companies, groups for the automotive industry, automotive semiconductors, key components, new energy vehicles, intelligent connected vehicles, aftermarket, automotive investment, autonomous driving, vehicle networking, and dozens of other groups. To join the group, please scan the administrator’s WeChat (Please indicate your company name)