The Printed Circuit Board (PCB), known as the “mother of electronic products”, is required in all electronic devices or products. The development level of its industry can reflect the development speed and technological level of the electronic information industry in a certain country or region.

PCBs are mainly composed of two types of materials: insulating substrates and conductors. They are printed boards formed on common substrates according to predetermined design plans, creating connections between points and printed components. Their main function is to connect various electronic components into predetermined circuits, serving as a relay for transmission.

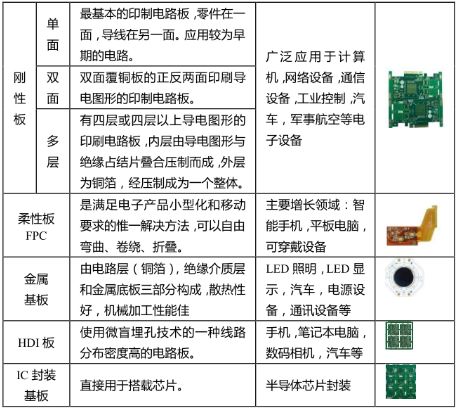

From the perspective of product structure, rigid boards (commonly known as “hard boards”) still dominate the current PCB market. According to Prismark (a professional consulting agency in the electronic information industry), the demand for high-density PCBs in electronic products is expected to become more prominent, with high-tech PCBs such as high-layer boards, flexible boards, HDI boards, and packaging substrates expected to account for 60.58% of the market by 2021.

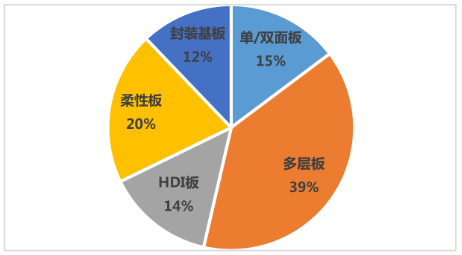

Global PCB Classification Output Value Proportion

Source: Prismark (2016)

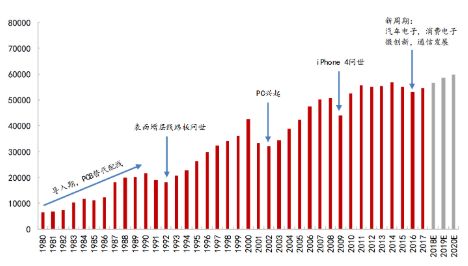

Current Status of the PCB Market

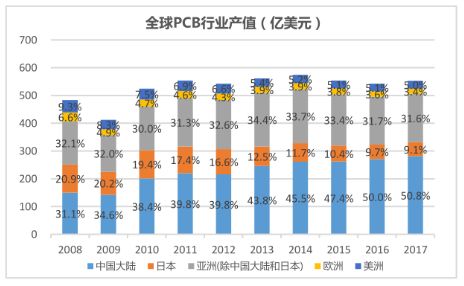

Global PCB Industry Output Value (Million USD)

Source: Prismark, AT&S, Zhiyan Consulting, Caitong Securities Research Institute

From 2000 to 2002, the bursting of the internet bubble led to a global economic contraction, causing a slowdown in demand for downstream electronic terminal products, resulting in a decline in global PCB output value.

From 2003 to mid-2008, benefiting from a strong global economic recovery and continuous innovation in electronic products, the PCB industry output value grew rapidly.

In the second half of 2008 to 2009, the financial crisis led to a winter for the PCB industry.

From 2010 to present, with the economic recovery and the rise of new products like smartphones and tablets, PCB output value has rapidly recovered and shown stable growth. The global PCB market size has reached 50 billion USD.

Source: Prismark

In the past 10 years, the global PCB industry has maintained an average annual compound growth rate of about 4%. In 2017, the global PCB output value was 58.8 billion USD, with a year-on-year growth rate of 8.60%. China’s PCB output value was 29.7 billion USD, with a year-on-year growth rate of 9.70%, higher than the global rate.

In terms of regional distribution of PCB output value, the focus of the PCB industry is continuously shifting towards Asia, with China becoming the most important player in the global PCB market, accounting for over 50% of global PCB output value.

In China, the electronic industry, mainly in telecommunications, computers, consumer electronics, and computer networks, is primarily concentrated in the Yangtze River Delta, Pearl River Delta, and Bohai Rim regions, forming a good electronic industry cluster. The Yangtze River Delta and Pearl River Delta regions account for 90% of the total output value in mainland China.

In recent years, due to rising labor costs and stricter environmental protection requirements in coastal areas, the PCB industry has gradually shifted towards inland provinces, especially in economic industrial belts such as Hunan, Hubei, Jiangxi, and Chongqing, where PCB production capacity has shown rapid growth.

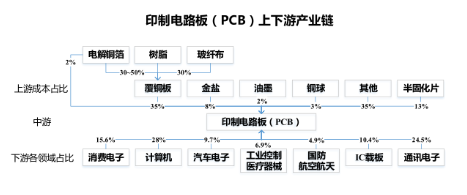

Overview of the PCB Industry Chain

Source: NTInformation, Pacific Securities Research Institute

The upstream of the PCB industry chain consists of various raw materials for PCB production, including copper-clad laminates, copper foils, copper balls, prepregs, gold salts, inks, dry films, and other chemical materials. The main raw materials for flexible circuit boards also include cover films and electromagnetic films.

The midstream consists of PCB manufacturing companies. The downstream applications of PCBs cover a wide range, with computers, communications electronics, and consumer electronics accounting for over 68%, directly impacting the development status of the upstream PCB industry.

The supply situation and price levels of upstream raw materials determine the production costs of PCB companies. Changes in downstream industries will directly affect the demand and price levels of printed circuit boards, driving a recovery in the PCB market.

The demand for lightweight mobile electronic products drives the expansion of the FPC market.

Under the trend of smart and lightweight mobile electronic products, the advantages of FPCs, such as high density, light weight, thin thickness, flexibility, and high-temperature resistance, are widely utilized. Manufacturers like Apple have significantly increased the usage of FPCs in their new smartphones.

Currently, the level of domestic production of FPCs is low, with major production still occupied by manufacturers from the United States, Japan, and Taiwan.

With the advent of 5G, the demand for high-value-added PCBs is driven by high-density small base stations.

According to the announcement from the Ministry of Industry and Information Technology, large-scale trial networking for 5G in China will begin in 2018, with 5G network construction starting in 2019, and commercial services expected to be officially launched in 2020. The high frequency of 5G means smaller coverage radius. According to the China Industry Information Network, the number of 5G base stations is expected to reach 14 million by 2024, thereby driving an increase in PCB demand.

5G imposes higher requirements on the capacity and speed of PCBs. Prismark estimates that China will invest 180 billion USD in 5G infrastructure construction.

The high-end server market is growing rapidly, and the added value of PCBs is increasing.

The new IT era marked by cloud computing and big data is driving changes in server technology and the market, with China’s server market maintaining a double-digit growth rate.

With the continuous development of high-speed, large-capacity, cloud computing, and high-performance servers, the design requirements for PCBs are also continuously upgraded, such as the application of high layer counts, large sizes, high aspect ratios, high density, high-speed materials, and lead-free soldering.

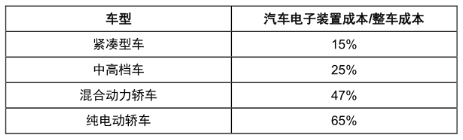

The trend of automotive electronics is evident, with the automotive PCB market scale expected to exceed 100 billion, and new energy vehicles are expected to drive an increase of 10 billion in the PCB market.

With the development of intelligence, the level of electronicization in automobiles is increasing. The number of electronic devices used for driving control, vehicle condition display, and vehicle entertainment systems is increasing, and the proportion of electronic devices in the overall vehicle cost is also growing.

In 2017, China’s automotive electronics market size was 82.6 billion USD, accounting for 36% of the global automotive electronics market share. It is expected that the market size of China’s automotive electronics will reach 110.2 billion USD by 2019.

The acceleration of the ban on fuel vehicles in major countries globally has made it an inevitable trend to replace fuel vehicles with new energy vehicles. As one of the basic components of BMS, PCBs will also benefit from the development of new energy vehicles. According to the Ministry of Industry and Information Technology’s plan, it is roughly estimated that the corresponding PCB market scale for new energy vehicles from 2018 to 2020 will be 2.85 billion, 3.96 billion, and 5.43 billion respectively.

Environmental Regulation and Automation Drive, PCB Industry Concentration Increases

With strengthened environmental inspections and new automation production capacities, outdated domestic PCB capacities will accelerate exit, benefiting leading companies and accelerating industry consolidation, with concentration continuing to increase.

Since 2017, the intensity of environmental regulation has increased, and many companies in the PCB industry chain have received production limits and rectifications. Leading enterprises with environmental indicators are increasing capacity investments. The tightening of environmental regulations accelerates the trend of “large-scale, centralized” in the industry while guiding companies to layout in the central regions.

The overall process requirements for electronic products have increased, and small factories with limited funds find it difficult to improve and upgrade their process technologies.

Large enterprises are actively expanding production, and under the trend of automation, operational advantages are significant, with yield rates, gross margins, and supply chain cost control advantages continuing to widen, while the relatively higher bargaining power in the industry will continue to squeeze the space for small factories.

Source: PCB Industry Engineer Technical Exchange

Disclaimer:The copyright of this article and images belongs to the original author and source. The content reflects the author’s personal views and does not represent the views of this public account or its accuracy. This public account only provides reference and does not constitute any investment or application advice. This public account serves as a platform for personal learning and exchange, and some articles are reprinted and not used for any commercial purposes. If there are any infringements, please notify us in a timely manner, and we will handle it as soon as possible. This public account reserves the final interpretation rights of this statement.